30-Year Treasury Yield: Evolution and Outlook

We discuss the intricacies and dynamics that have affected the 30-year Treasury yield since 2020 and provide our insights on the future of this market.

This analysis reflects market conditions and information available at the time of publication (September 2023). It is provided for educational and historical context.

In this piece, we'll discuss the intricacies and dynamics that have affected the 30-year Treasury yield beginning in 2020. We'll conclude with our insights on potential elements that could sway this market in the future.

1. January 2020–July 2020: The Meltdown of Treasury Yields in the Pandemic

In early 2020, the bond market went through considerable fluctuations, primarily because of the unexpected repercussions of the COVID-19 pandemic. Several factors played a crucial role in shaping the alterations seen in the 30-year Treasury yield during this period:

- Pandemic Crisis: The swift proliferation of the virus resulted in widespread global lockdowns and major economic challenges. Amidst rising uncertainties, investors leaned towards U.S. Treasury securities, notably the 30-year Treasury bonds, elevating their prices and consequently pulling down their yields.

- Aggressive Central Bank Measures: As a reaction to the pandemic, the Federal Reserve dramatically cut interest rates to near zero in March 2020, leading to a significant decline in Treasury yields.

- Shaky Economic Outlook: Emerging data revealed immense economic distress—from soaring unemployment rates to sharp declines in various economic metrics. These adverse macroeconomic circumstances took a toll on the 30-year Treasury yield.

- Risk Aversion: Similar to other safe-haven assets, the market's prevailing risk sentiment typically sways the 30-year Treasury yield. In periods characterized by heightened uncertainty or gloom, investors flock to these assets, resulting in a dip in yields.

- Fiscal Stimulus Measures: The introduction and execution of significant economic relief packages during the pandemic contributed to the recovery of the 30-year Treasury yield by the close of 2020.

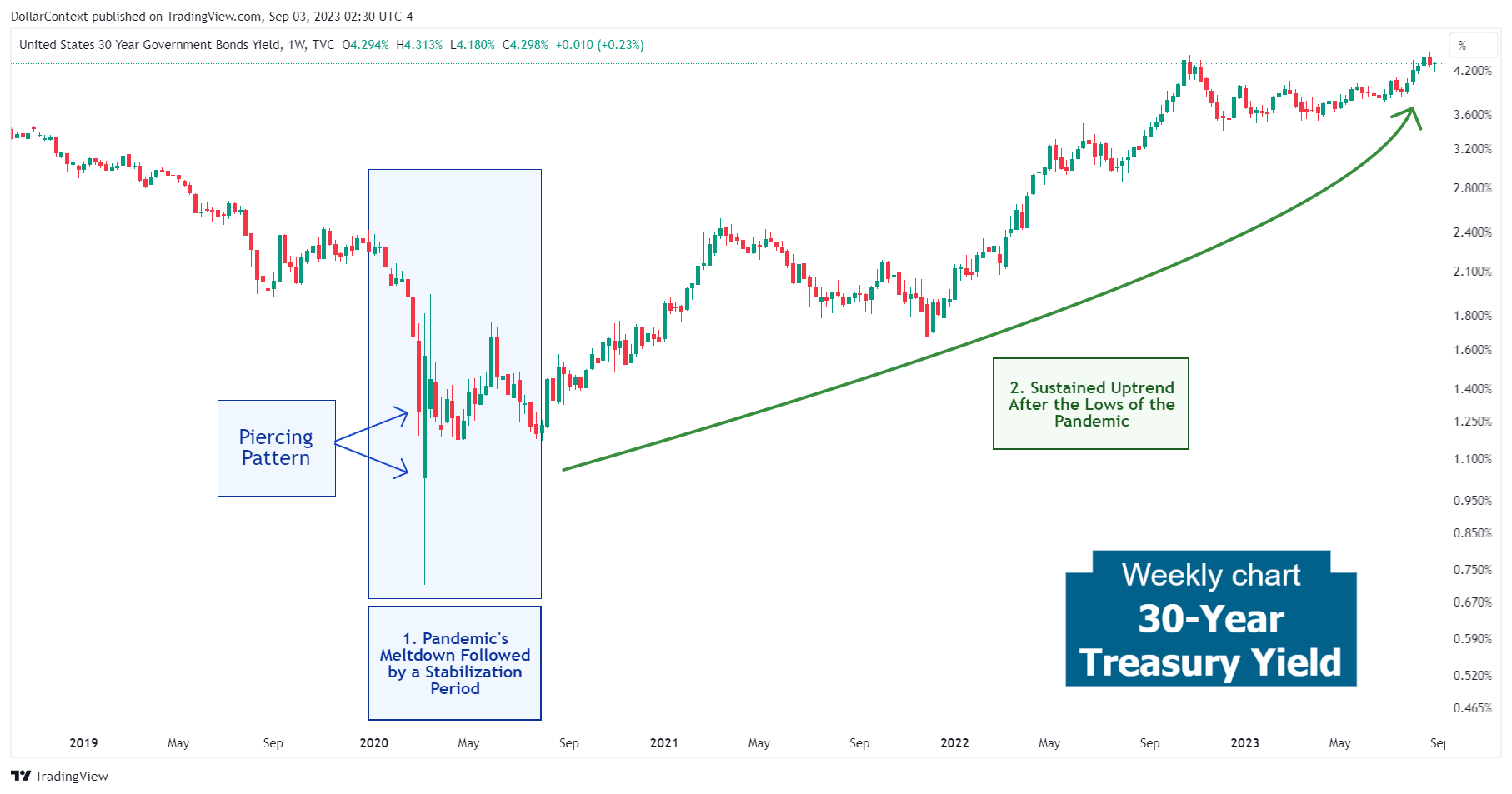

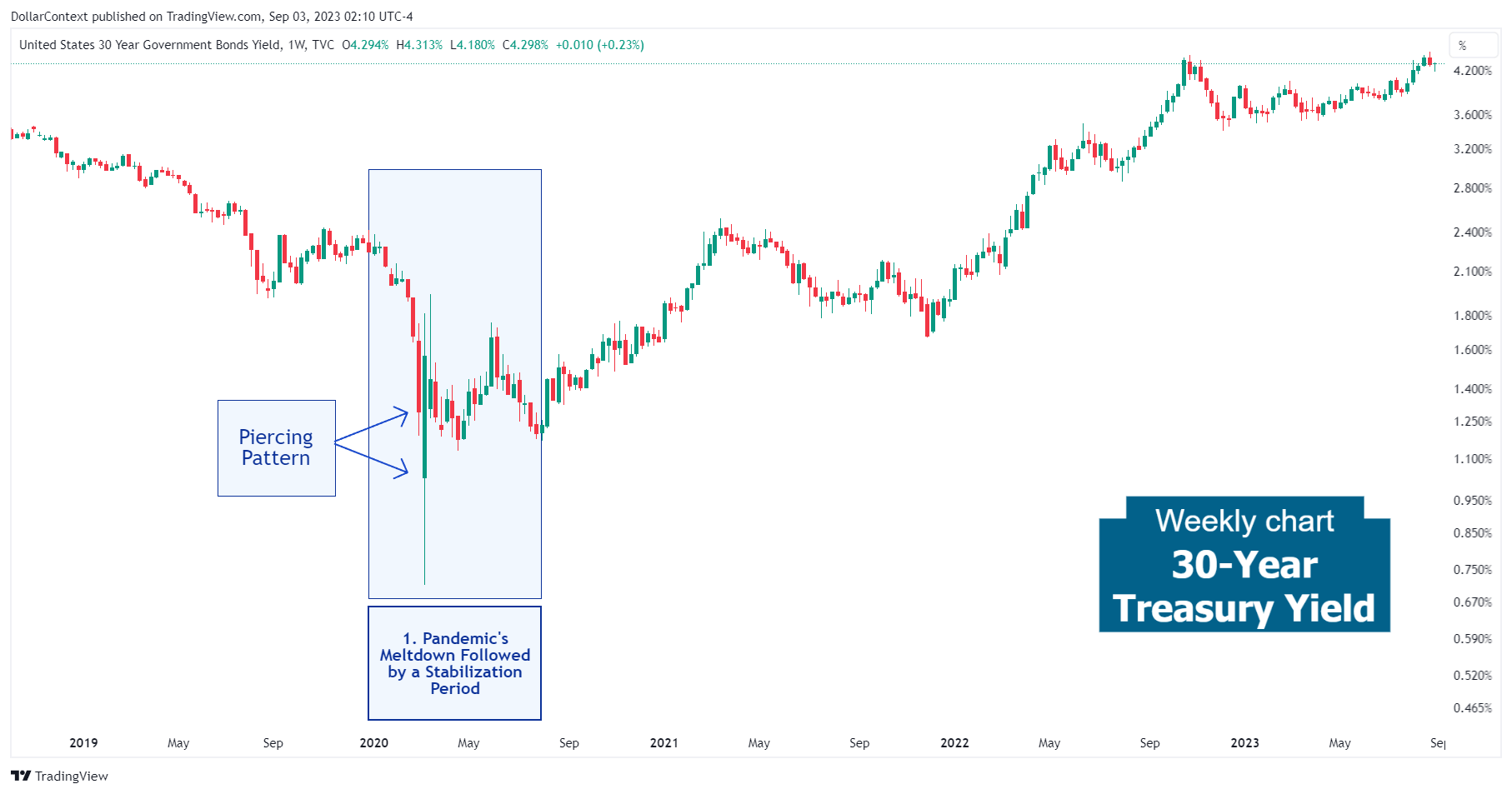

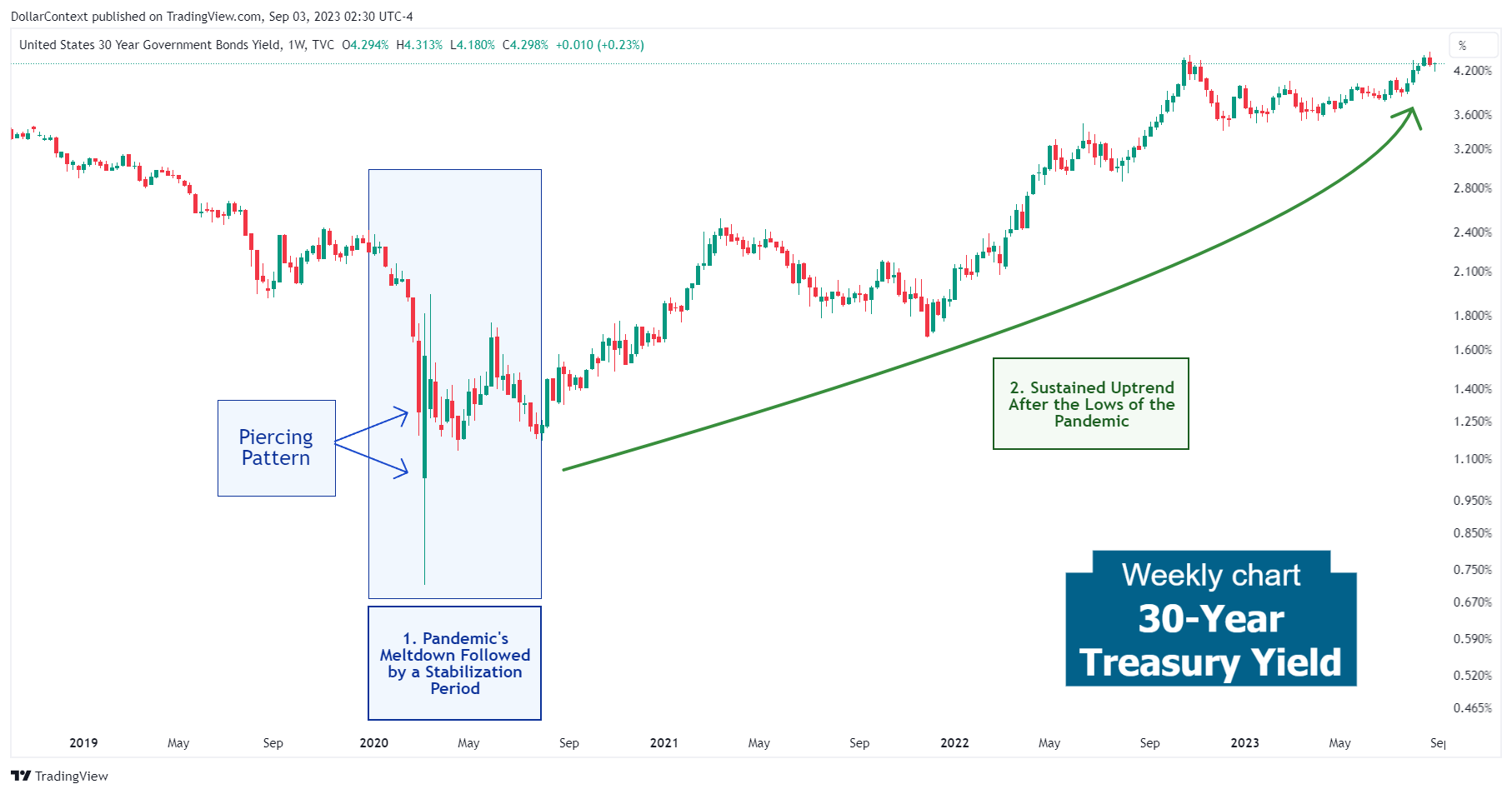

From the viewpoint of candlestick analysis, the March 2000 downturn culminated in a piercing pattern. Following that, the 30-year Treasury market began a phase of stabilization ahead of the ensuing upward trend.

2. August 2020–August 2023: The Prolonged and Robust Uptrend

For more than three years, the 30-year Treasury yield has been increasing steadily. Several factors have driven this continuous ascent:

- Anticipations of Rising Inflation and Subsequent Confirmation: The considerable influx of fiscal and monetary stimuli sparked worries among investors regarding potential inflation, impacting Treasury yields in turn. As time passed, these inflationary predictions manifested more clearly, reaching peaks not seen since the 1980s.

- Aggressive Rate Hikes by the Federal Reserve and Leading Central Banks: Between March 2022 and June 2023, the Federal Reserve embarked on a robust tightening journey to counteract inflation. With rate increases from nearly 0% to over 5%, the 30-year Treasury market experienced substantial strain.

- Post-Pandemic Economic Resurgence: As the world economy began its recovery from the deep-seated effects of the pandemic, various metrics, including consumer optimism, displayed positive momentum

The following chart depicts the notable upward trajectory of the 30-year yield over this timeframe:

3. Perspective for the Latter Half of 2023 and 2024

The following perspective reflects expectations based on information and policy signals available at the time of writing.

In the medium term, these evolving elements are anticipated to shape the trajectory of government bonds, notably the 30-year Treasury:

- Risks of Economic Downturn: The Federal Reserve's aggressive rate increases, coupled with alarming signs such as the inverted yield curve, suggest a possible economic downturn in 2024. During economic recessions, central banks usually reduce interest rates. Moreover, investors often transition from high-risk assets to bond acquisitions, resulting in decreased yields.

- Market Reactions During an Inverted Yield Curve: Past records indicate that the demand for high-risk assets typically stays robust either at the onset or throughout a yield curve inversion. Consequently, the movement towards more secure assets and the ensuing decline in bond yields generally materialize in subsequent phases.

- AI's Contribution to Boosted Productivity: As we usher in the era of artificial intelligence (AI), its potential to elevate efficiency and productivity is seemingly a significant driver behind the growing inclination towards risk.