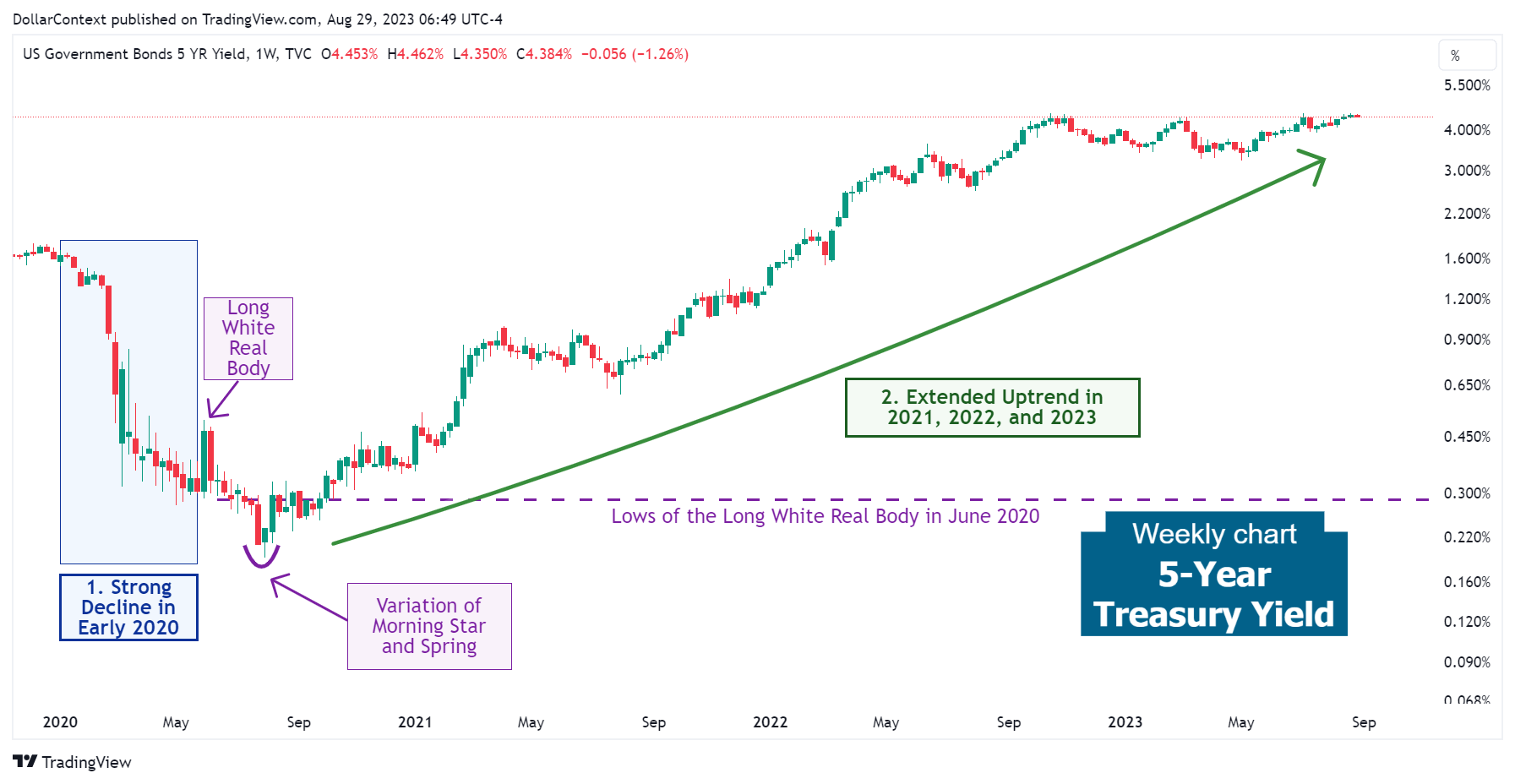

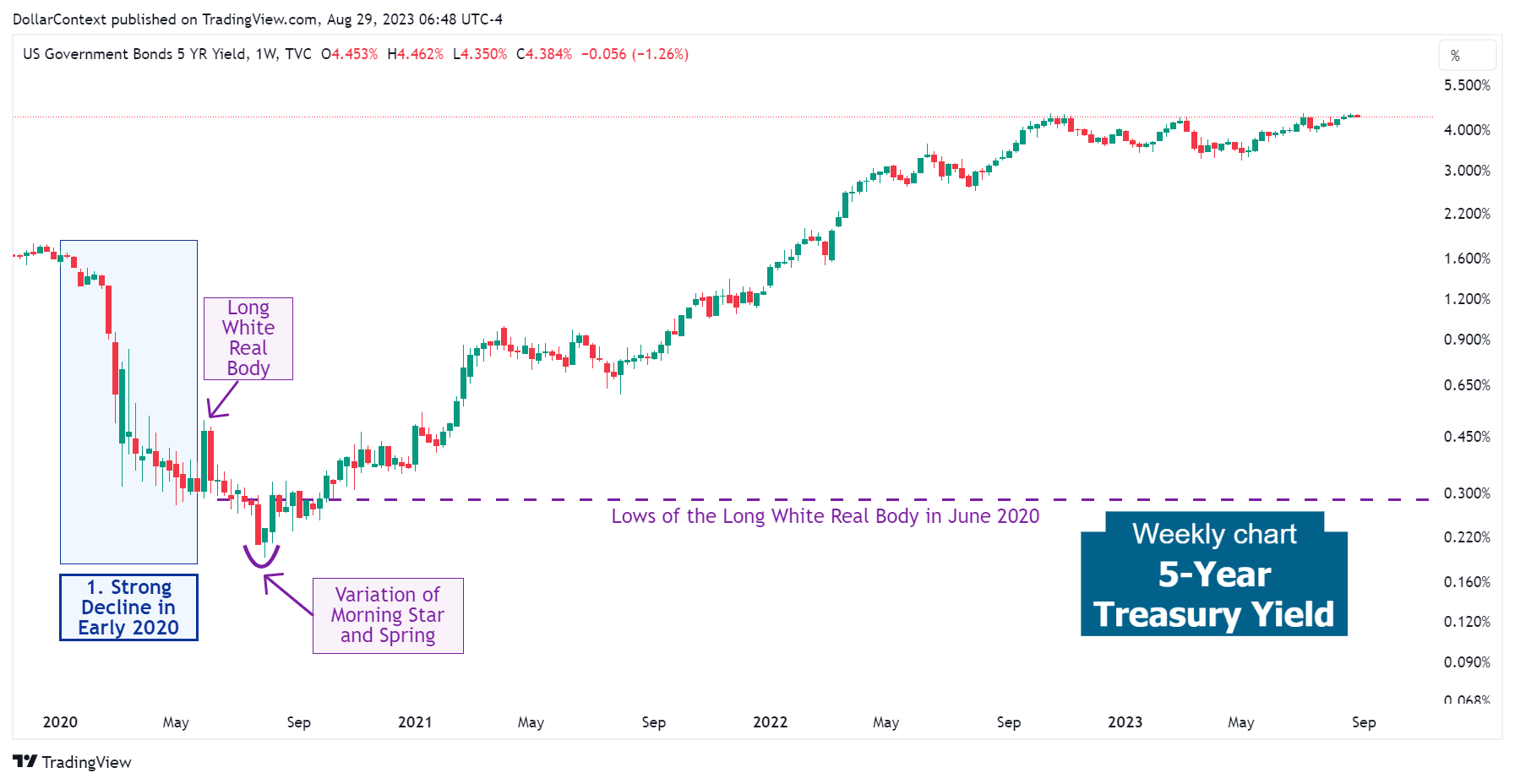

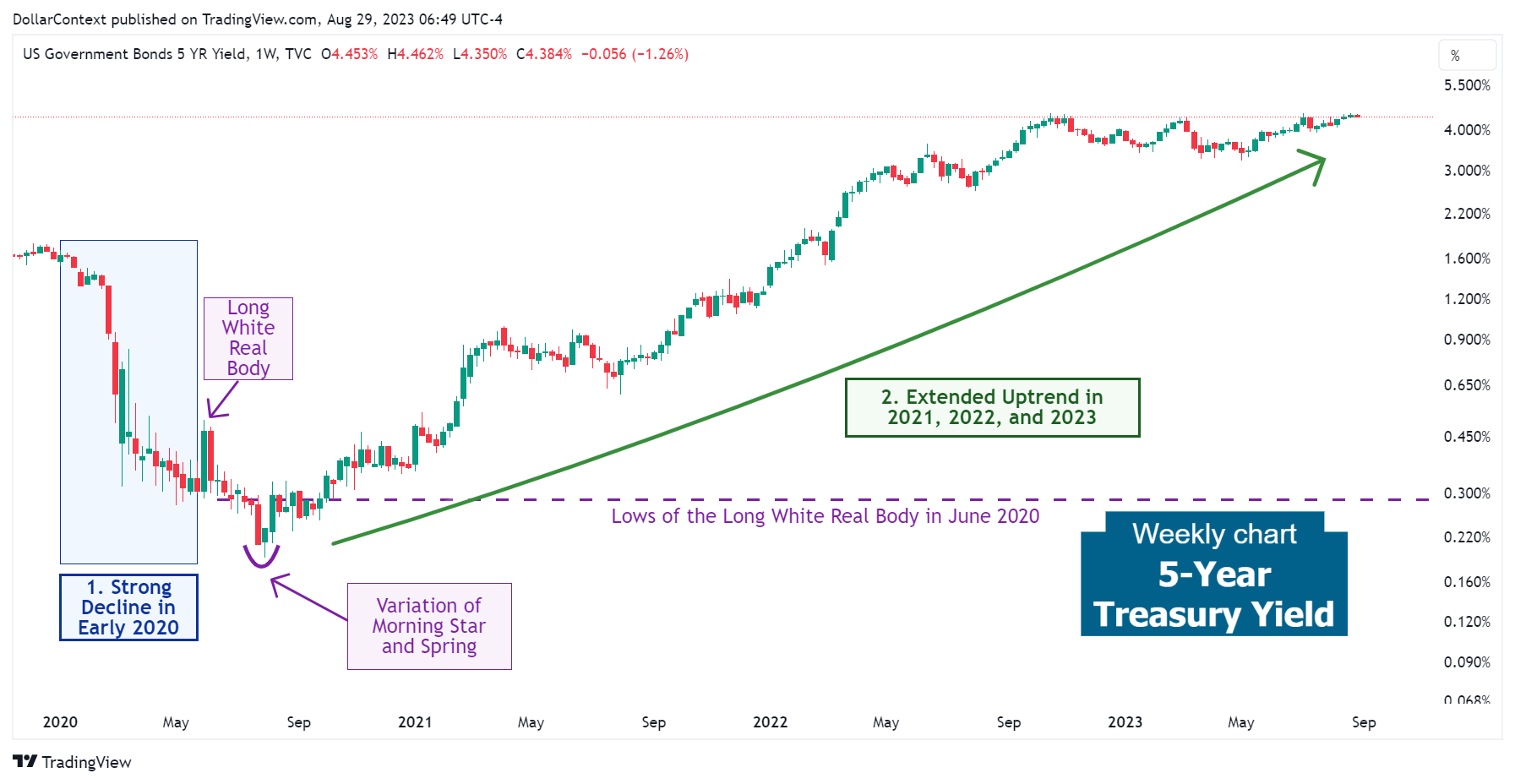

5-Year Treasury Yield: Evolution and Outlook

We discuss the trends that have shaped the movement of the 5-year Treasury yield since 2020 and provide our insights on potential dynamics affecting this market.

In this post, we'll discuss the intricacies and dynamics that have shaped the movement of the 5-year Treasury yield from 2020 onwards. The discussion will end by offering our perspectives on potential factors influencing this market.

1. January 2020–September 2020: The Steep Decline in the Pandemic

In the initial nine months of 2020, the worldwide financial scenario underwent substantial upheaval, primarily attributed to the unexpected repercussions of the COVID-19 pandemic. Several factors played a crucial role in guiding the fluctuations witnessed in the 5-year Treasury market throughout this period:

- Global Health Crisis Effects: The swift proliferation of the virus resulted in widespread lockdowns and substantial economic downturns worldwide. As uncertainty escalated, investors sought refuge in U.S. Treasuries, such as 5-year Treasury bonds, causing prices to rise and consequently exerting downward pressure on yields.

- Loose Monetary Policy of Central Banks: Reacting to the pandemic, the Federal Reserve reduced interest rates to nearly zero in March 2020, leading to a decline in Treasury yields.

- Unpredictable Economic Landscape: As data emerged, revealing the magnitude of economic harm—ranging from soaring unemployment rates to sharp declines in retail sales—Treasury yields, including the 5-year yield, were adversely impacted by these negative macroeconomic conditions.

- Overall Risk-Averse Sentiment: Similar to other safe-haven assets, the 5-year Treasury yield is shaped by the prevailing risk sentiment in the market. In periods characterized by heightened uncertainty or negativity, investors typically increase their holdings of such assets, which subsequently exerts downward pressure on yields.

- Fiscal Stimulus Measures: The declaration and execution of sizable fiscal stimulus plans during the pandemic contributed to the resurgence of the 5-year Treasury yield by the conclusion of 2020.

When analyzing candlestick formations, the emergence of a long white real body in May provided a hint that the downward trend might be approaching its end. The low point of this candle was temporarily breached by a spring (false breakout). Finally, a variation of the morning star pattern indicated the market lows.

2. October 2020–August 2023: The Extended and Solid Uptrend

During nearly three years, the 5-year Treasury yield has been experiencing a continuous ascent. This steady upward trajectory has been fueled by a range of factors:

- Expected Inflationary Trends: The substantial infusion of fiscal and monetary stimulus sparked apprehensions among certain investors regarding potential inflation in the future, which in turn impacted Treasury yields.

- Elevated Price Increase Metrics: Over time, anticipated inflation became noticeably tangible, reaching levels not witnessed since the 1980s.

- Aggressive Rate Hikes by the Federal Reserve: The Federal Reserve's robust cycle of interest rate hikes aimed at curbing inflation, lifting rates from approximately 0% to over 5% in a span of fewer than 15 (from March 2022 to June 2023), may have exerted a significant influence on the 5-year Treasury market.

- Recovery of the Economy After the Pandemic: As the global economy began recovering from the significant shocks of the pandemic, several factors paved the way for rising Treasury yields, including the return of consumer confidence.

Take note of how the 5-year Treasury yield began to exhibit a deceleration phase towards the close of 2022.

3. Outlook for the Second Half of 2023 and 2024

Over the medium term, the trajectory of the government bonds, including the 5-year Treasury, is likely to be shaped by these emerging factors:

- Economic Downturn Threats: The Federal Reserve's vigorous interest rate increases, coupled with the deterioration of crucial metrics such as the inverted yield curve and PMI, suggest the possibility of an economic downturn, potentially occurring in 2024. During periods of recession, central banks often decrease interest rates, and market participants tend to avoid riskier assets and favor bond acquisitions, resulting in a decline in yields.

- How Markets Respond to Inverted Yield Curves: Based on historical data, it is evident that the demand for high-risk assets tends to stay robust either at the onset or throughout the course of a yield curve inversion. Consequently, the move towards safer assets and the ensuing decline in Treasury yields typically occur at a later stage.

- The Impact of AI on Productivity: The onset of the artificial intelligence (AI) era, accompanied by its potential to enhance efficiency and productivity, currently seems to be a significant driver behind this growing inclination toward risk.