Brent Prices: Evolution and Outlook

We delve into the core dynamics shaping the direction of Brent crude prices since 2020 and discuss possible future developments in this market.

In this article, we'll delve into the technical factors and core dynamics shaping the direction of the Brent crude oil market since 2020. We'll also discuss possible future developments in this market.

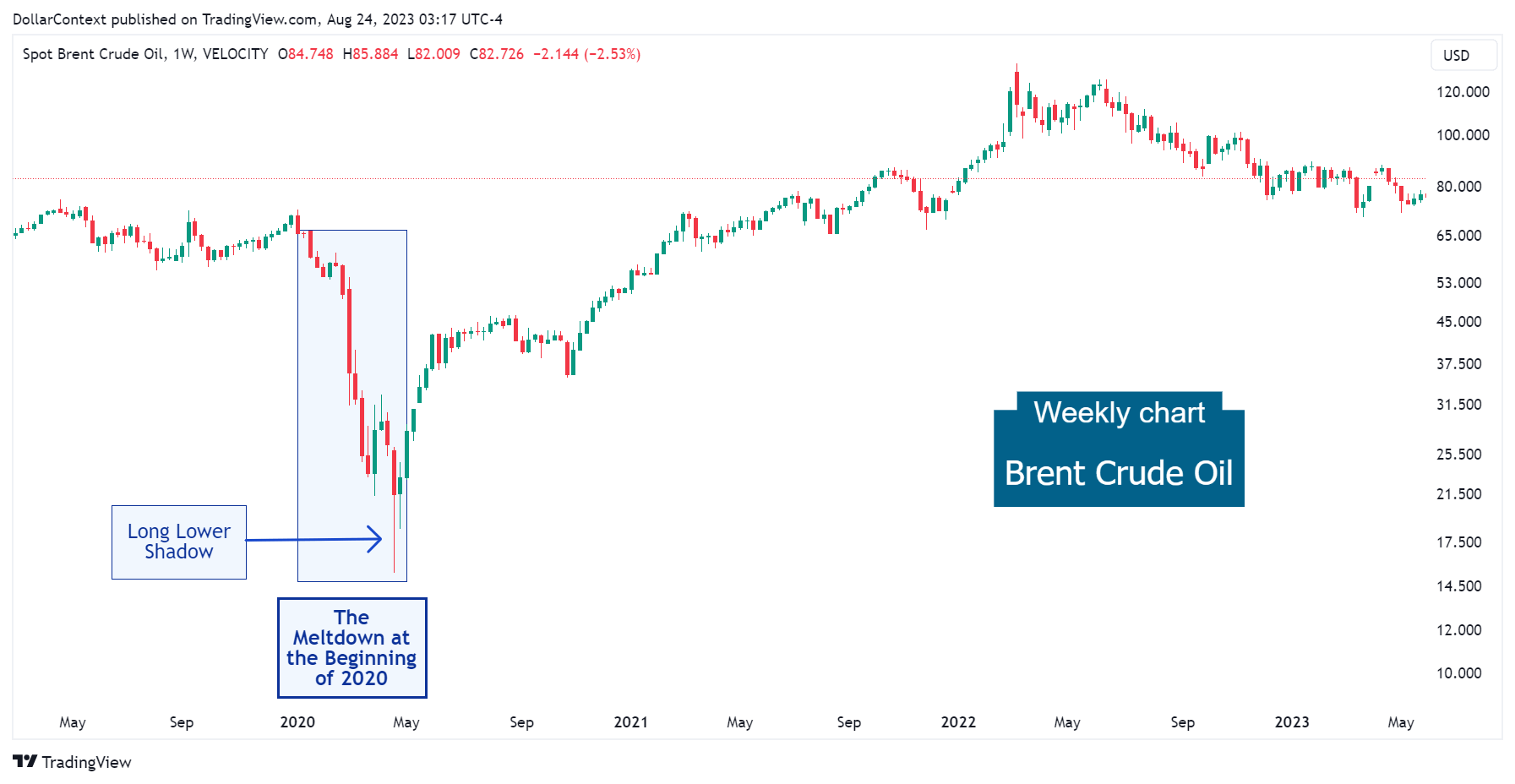

1. January 2020–April 2020: The Collapse

Between January and April 2020, Brent prices saw a significant drop, with a sharp plunge occurring in April 2020 when the market took a nosedive. Several factors converged to cause a stark drop in demand coupled with a supply surplus. Here are four major drivers of this extraordinary situation:

- COVID-19 Pandemic and Demand Destruction: The rapid spread of the COVID-19 virus across the globe in early 2020 resulted in unprecedented lockdown measures. Many countries, including major economies, imposed travel restrictions, quarantined large populations, and shut down significant portions of their economies. This led to a massive drop in demand for oil, particularly in sectors like aviation, transportation, and industry.

- OPEC Price War: Concurrently, a disagreement arose between two of the world's largest oil producers, Saudi Arabia and Russia. In early March 2020, OPEC and its allies failed to come to an agreement on oil production cuts. This disagreement led Saudi Arabia to announce substantial discounts in oil prices and plans to increase production. The prospect of an oversupplied market in the face of declining demand exacerbated the decline in prices.

- Storage Concerns: As the oil supply began to outpace demand, storage facilities worldwide started to fill up. By April, concerns grew about the world running out of storage space for oil, especially in the U.S. This situation was most starkly illustrated when the U.S. oil benchmark, WTI (West Texas Intermediate), plunged into negative territory for the first time in history on April 20, 2020, due to these storage concerns.

- Economic Concerns: The broader economic outlook was grim due to the potential long-term impacts of the pandemic. This diminished economic activity further dampened the prospects for an oil demand recovery.

Note how the sharp decline culminated in a remarkable long lower shadow candle (candlestick analysis).

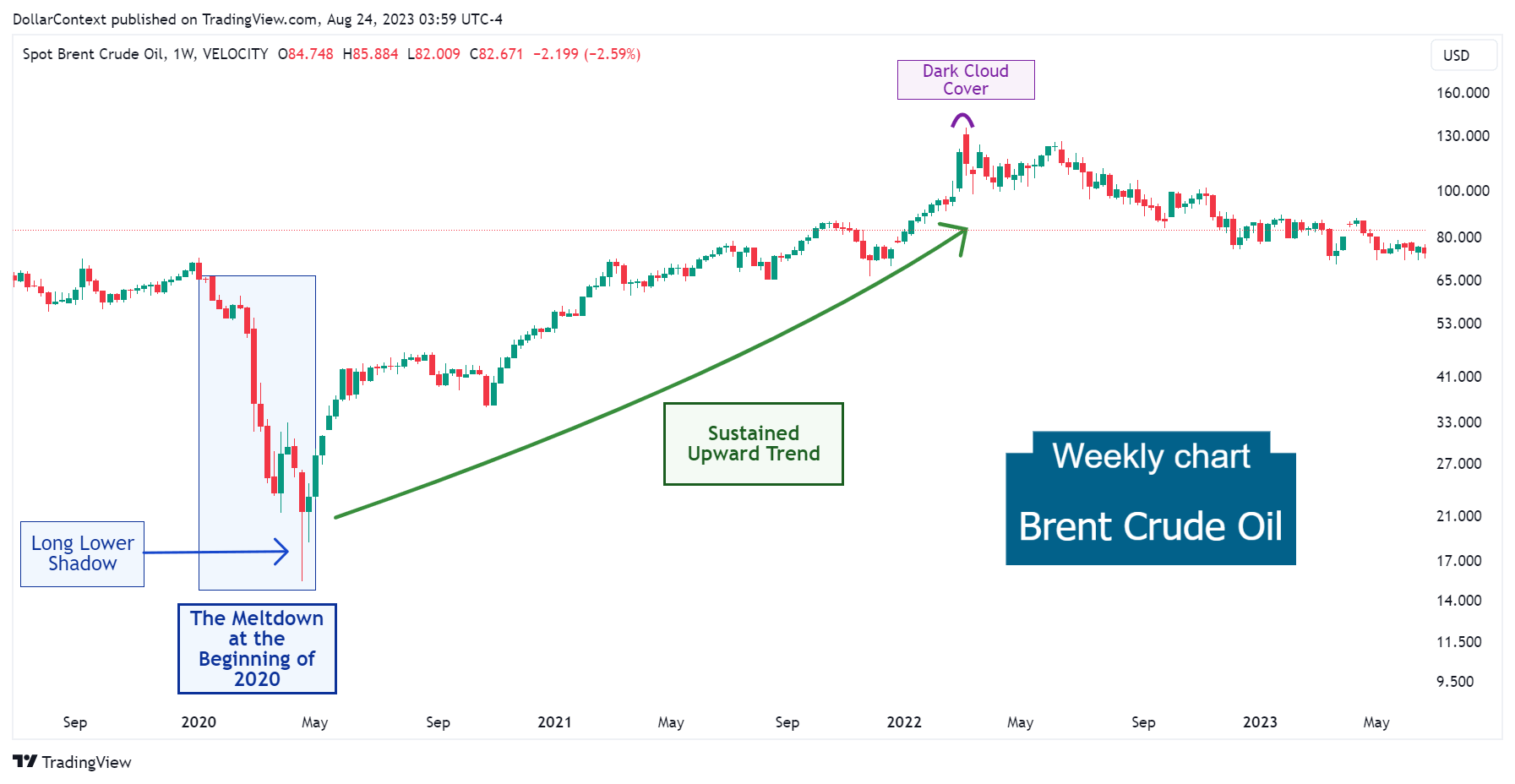

2. May 2020–March 2022: The Recovery

From May 2020 to March 2022, the Brent market staged a robust upward trend after the initial phases of the pandemic. The progressive economic recovery, the stimulus programs promoted by the Federal Reserve and other major central banks, and the depreciation of the dollar have been major drivers of this rally.

Over a span of almost two years, the Brent market consistently showed an upward trajectory. This rise was marked by:

- A period of sustained upward movement, with only minor pullbacks along the way.

- The absence of significant corrections, which suggests a robust and consistent demand for the asset while reflecting investor confidence.

Observe how the upward trend concludes with a variation of a dark cloud cover pattern (candlestick analysis)

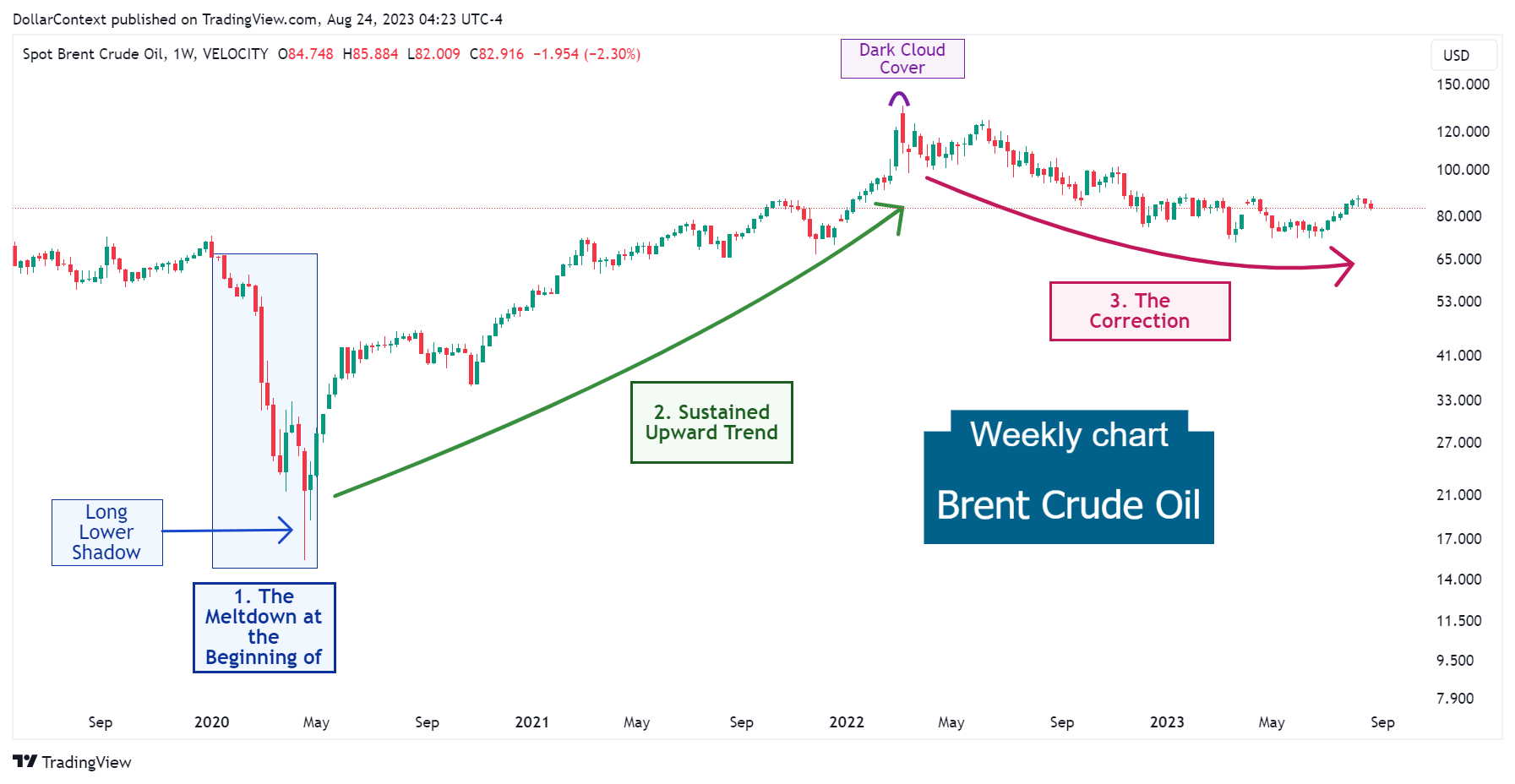

3. The Correction from April 2022 Onward

Following the dark cloud cover pattern, Brent prices initiated a prolonged correction. The Fed's initiation of a tightening cycle to address inflation boosted the value of the dollar and led to a shift in energy market sentiment.

4. Outlook for the second half of 2023 and 2024

Beginning in 2020, it's possible that the commodity market might have entered a supercycle stage. These supercycles typically last for over 8 years, resulting in significant price surges. If this hypothesis holds true, then the Brent market would have undergone a correction phase since April 2022, positioning itself for a sustained upward trajectory in the future.

Having said that, and given our expectation of an economic slowdown in the upcoming year, there could be a marked correction in 2024, which in turn might lead to a considerable adjustment in oil prices.