The Past and Future of the Cocoa Market

After covering the key factors that have driven cocoa prices since 2020, we'll provide our perspectives on the future path of this commodity.

This analysis reflects market conditions and information available at the time of publication (August 2023). It is provided for educational and historical context.

In this article, we'll cover the patterns and driving factors that have shaped the course of cocoa prices since 2020. Then, we'll provide our perspectives on the likely future path of this commodity.

1. January 2020–March 2020: The Decline of the Pandemic

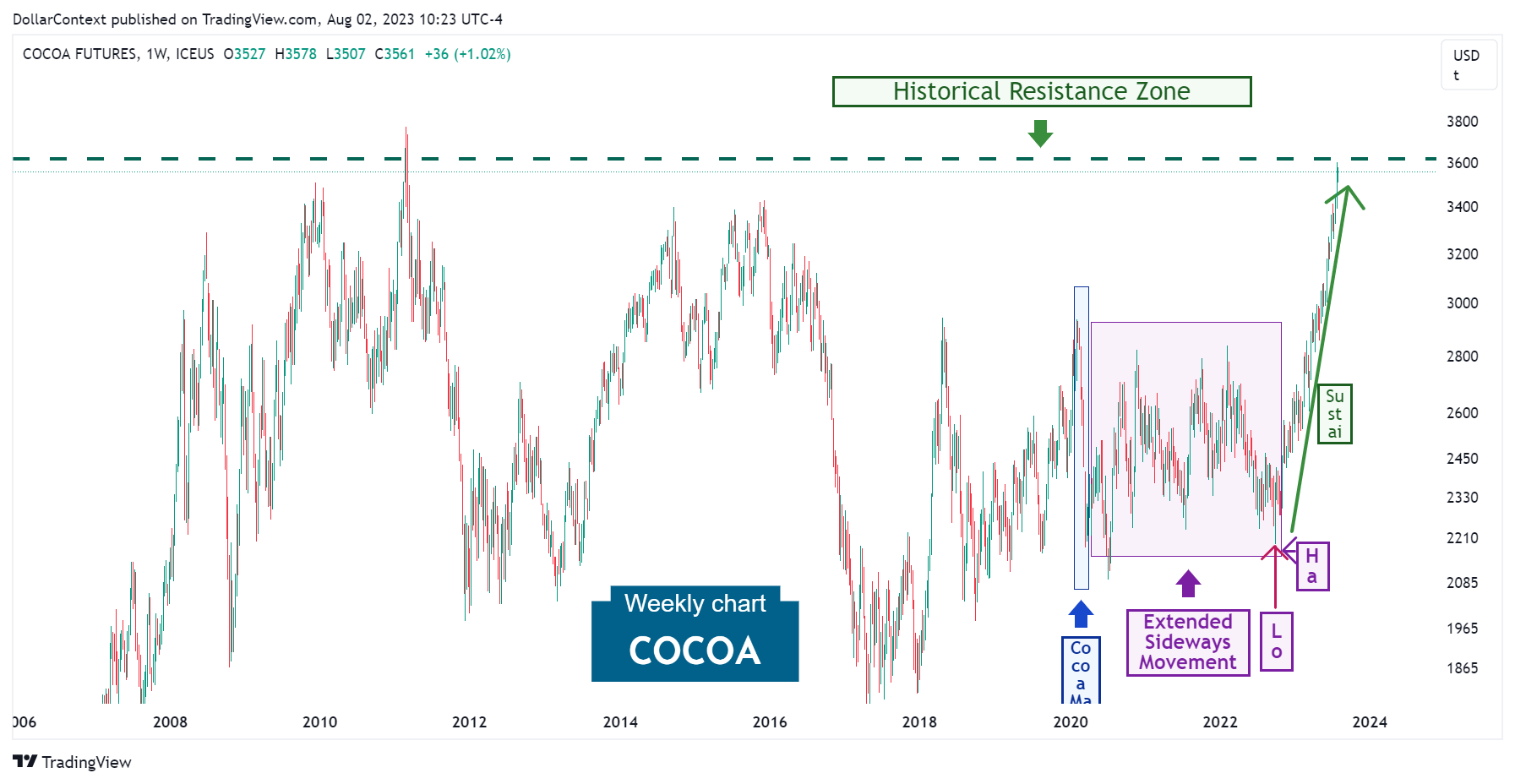

The cocoa market witnessed a substantial drop in the early stages of the pandemic. Yet, in contrast with many other commodity assets, the fall wasn't as severe, and the price successfully remained within the wide fluctuation boundaries set in 2018.

2. April 2020–October 2022: The Extensive Lateral Range

For more than two years, the cocoa market persisted within the wide horizontal range established back in 2018. Note that in the final week of September 2022, the price showcased a long white real body, according to the Japanese candlestick analysis. This formation was indicative of a possible bullish trend for cocoa prices.

3. Since October 2022: The Solid Uptrend

Following the above-mentioned long white real body in September 2022, the cocoa market embarked on a remarkable upward trend that has continued until now. Note that this substantial surge has occurred without any major pullbacks.

4. Outlook for Late 2023 to 2024

The following perspective reflects expectations based on information and policy signals available at the time of writing.

After such an impressive rally, predicting the future of cocoa prices might be challenging. In our view, these are the critical elements to consider:

- Risks of an Economic Downturn: Aggressive hiking cycle from the Federal Reserve and leading indicators, such as the yield curve and the PMI, suggest that an economic downturn in the next few months is quite likely. The initial phases of an economic contraction usually exert downward pressure on commodity prices.

- Market Overbought: As previously noted, the cocoa market has experienced an extended period of rising trends without significant retracements.

- Historical Resistance Zone: As depicted in the following chart, the cocoa market has arrived at a significant resistance area.