The Evolution and Outlook of Coffee Prices

We'll discuss the trends and factors that have shaped the course of coffee prices from 2020 onwards. As we wrap up, we'll offer our insights on the probable future direction of this market.

In this post, we'll discuss the trends and factors that have shaped the course of coffee prices from 2020 onwards. As we wrap up, we'll offer our insights on the probable future direction of this market.

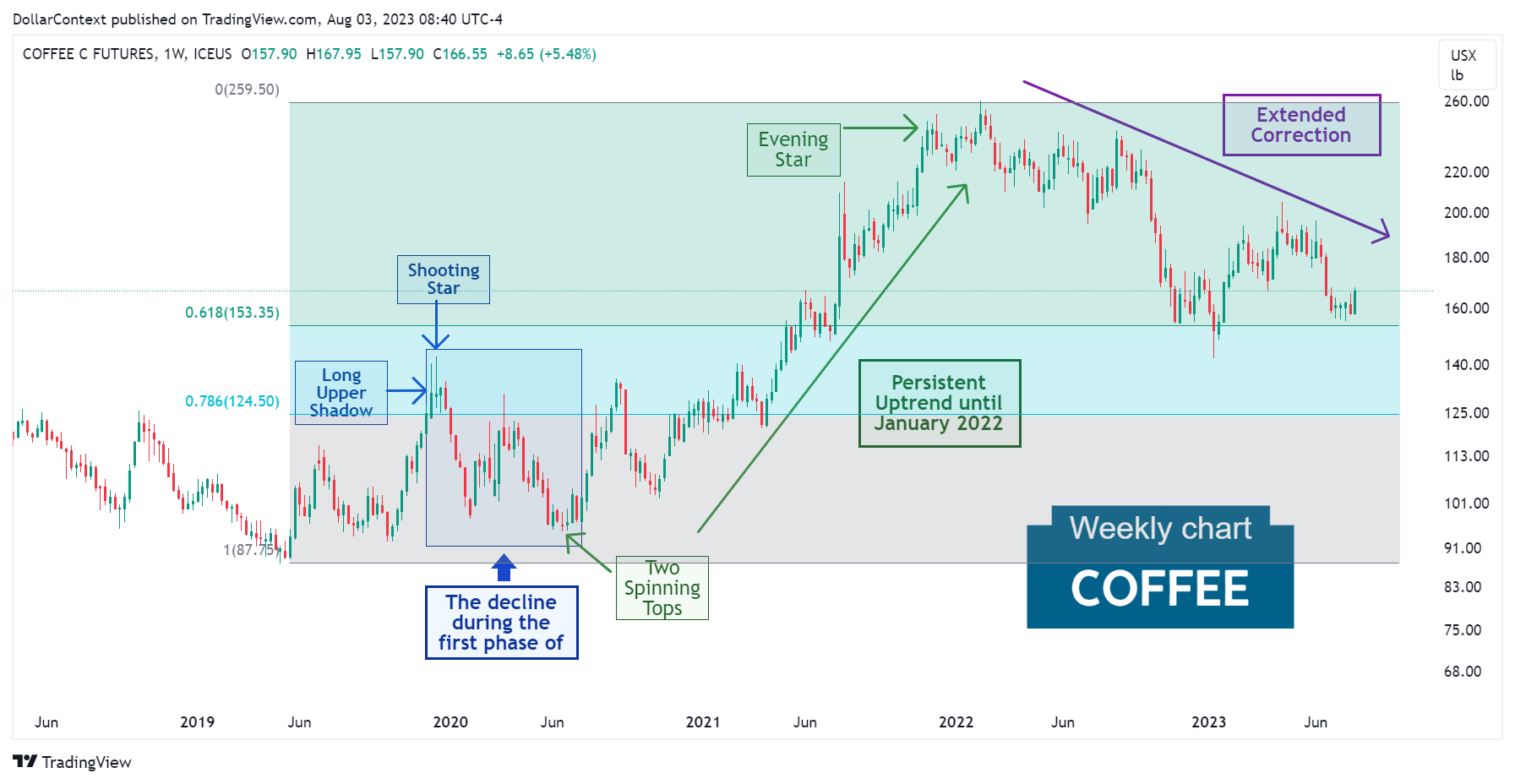

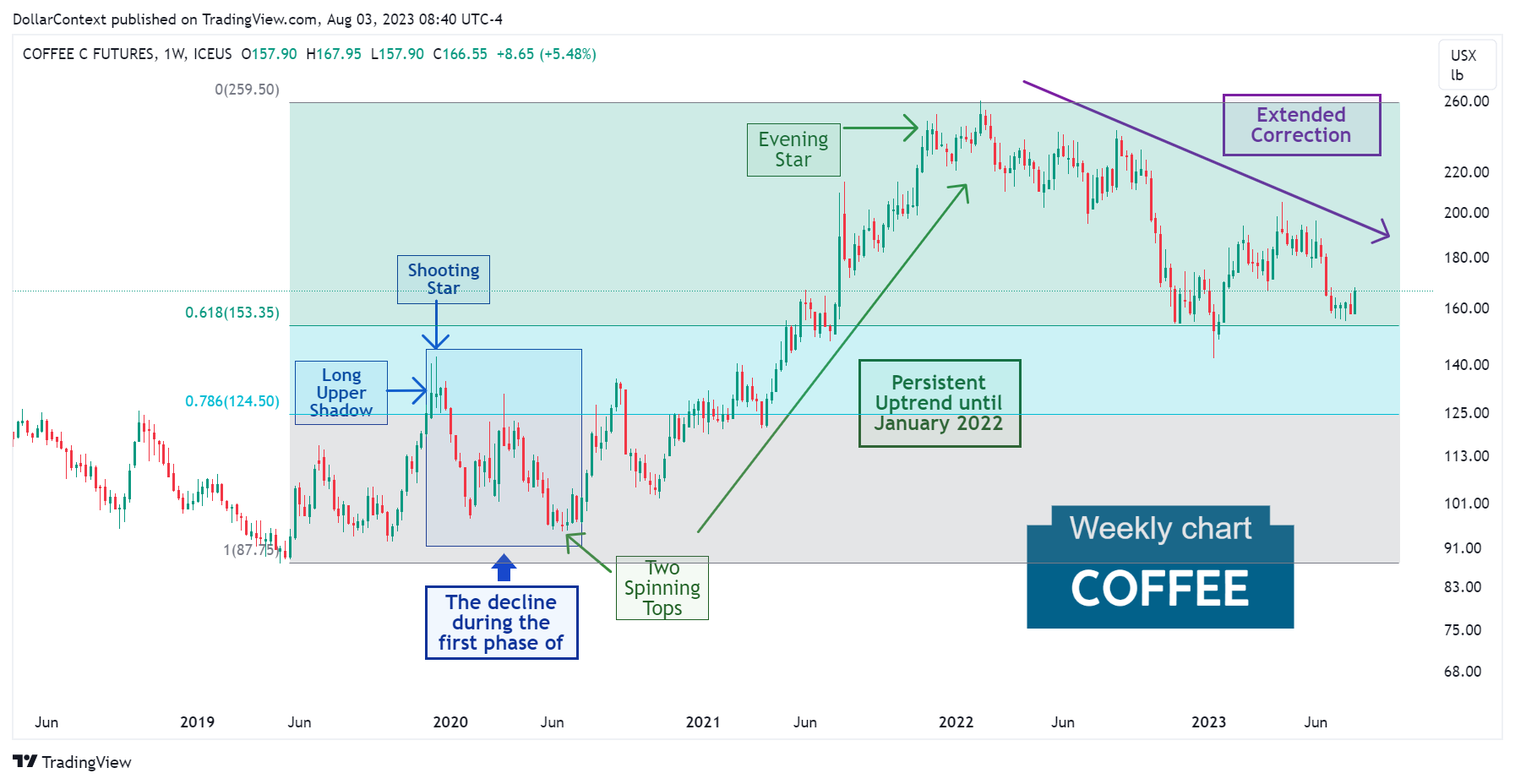

1. January 2020–June 2020: The Decline of the Pandemic

During the first six months of the pandemic, the coffee market experienced a notable decline, triggered initially by a long upper shadow candle, which was then followed by a shooting star pattern. However, unlike many other commodity assets, the downturn wasn't as drastic, and the price didn't breach the lows recorded in May 2019.

2. July 2020–January 2022: The Persistent Escalation

After displaying two spinning tops in June 2020, the coffee market experienced a sustained advancement for over 18 months. The upward trend hit a pause following a modestly sized evening star, which was further tested before the confirmation of the trend's reversal.

3. From February 2022 Onwards: The Prolonged Retracement Phase

The peak in February 2022 gave way to a change in market sentiment, leading to a sustained period of price correction. Note that the downward trend paused around the 61.8% Fibonacci retracement level—a mark traced from the low point of May 2019.

4. Outlook for Late 2023 and 2024

From our perspective, two major forces are likely to influence the course of coffee prices over the next two years:

- Supercycle Hypothesis: Starting in 2020, the commodity market might have embarked on a supercycle period. Commodity supercycles typically span over 8 years and trigger significant price increases across global commodity assets. If this premise holds true, then the coffee market would have begun a correction period since February 2022, ready to resume its upward trend at some point.

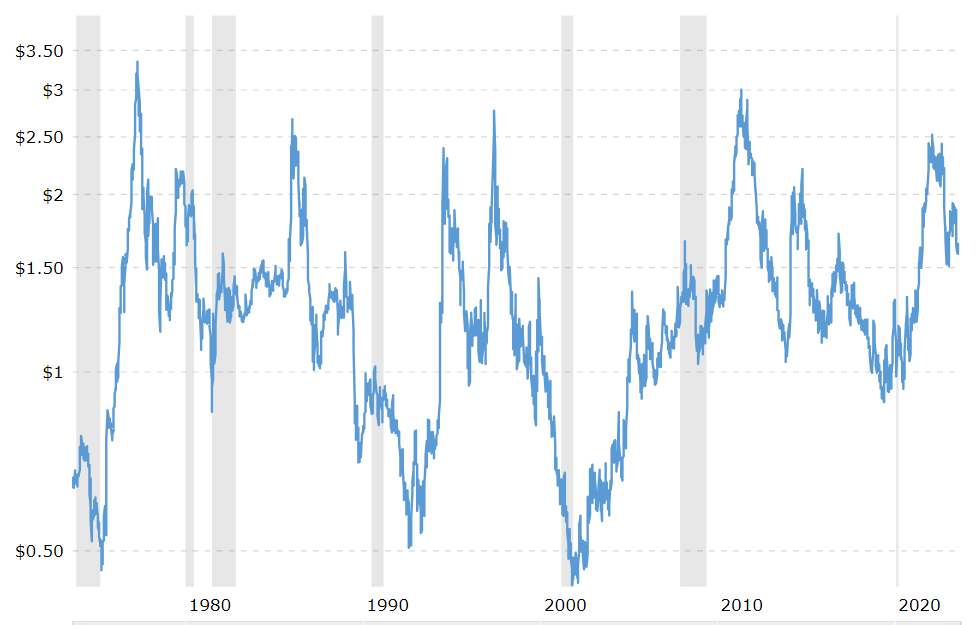

- Dangers of an Economic Slump: The Federal Reserve's assertive cycle of rate hikes, along with the reading of leading indicators like the yield curve and the PMI, indicate a considerable likelihood of an upcoming economic downturn, potentially occurring in 2024. As you can see on the chart below, the initial phase of an economic contraction (indicated by gray-shaded areas) usually exerts downward pressure on coffee prices.

Source: Macrotrends