The Past and Future of Cotton Prices

In this post, we're going to explore the trends and influences that have molded the trajectory of cotton prices starting from 2020. As we reach the end, we'll share our insights on the potential future direction of this market.

In this piece, we're going to explore the trends and influences that have molded the trajectory of cotton prices starting from 2020. As we reach the end, we'll share our insights on the potential future direction of this market.

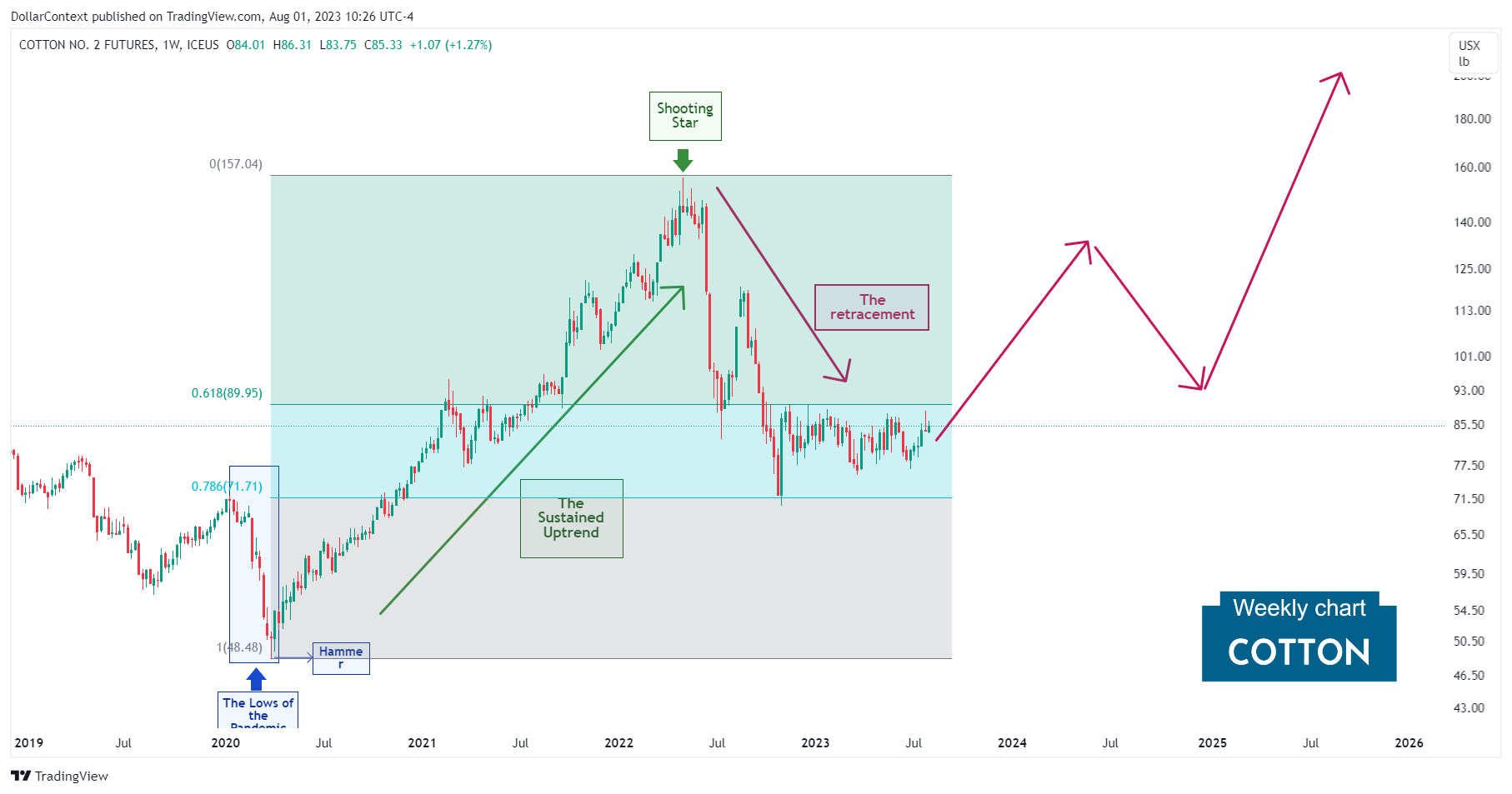

1. January 2020–March 2020: The Lows of the Pandemic

A number of factors contributed to a significant downturn in the cotton market during the initial three months of 2020:

- COVID-19 Pandemic: This unprecedented health crisis led to a slowdown in global economic activity as countries implemented lockdowns and restrictions. This situation significantly reduced the demand for cotton and led to a decline in prices. The pandemic also disrupted the supply chains, causing further uncertainties in the market.

- Dollar Appreciation: In this timeframe, the strengthening of the dollar played a role in driving down global commodity prices, as these assets are denominated in the U.S. currency.

Following a dip to the cotton market's lowest price point since 2009, the descent halted after a hammer pattern (candlestick analysis), signaling the beginning of a potential reversal.

2. April 2020–April 2022: The Remarkable Upswing

The cotton market witnessed an impressive surge from April 2020 to April 2022. Essentially, prices experienced a threefold increase during this timeframe. In the aftermath of the COVID-19 pandemic, a variety of elements played a role in driving this upward trend:

- Stimulus Measures: Governments worldwide introduced various stimulus measures to revitalize their economies.

- Economic Recovery: As global economies began to recover and restrictions eased, industries like textiles and apparel experienced an increase in demand, which would have positively influenced cotton prices.

- Reduced Surplus: The surplus inventory caused by reduced demand during the initial stages of the pandemic might have begun to decrease as consumption increased with recovery, further supporting price growth.

- USD Depreciation: During this period, the U.S. dollar experienced a decline in value.

Interestingly, the uptrend halted via a shooting star

3. Since May 2022: The retracement

Following the shooting star pattern, cotton prices along with a host of other commodities have undergone an extended correction period since May 2022, a trend that persists today. The dollar's appreciation has been a significant driving force behind this development.

Notice how the retracement has stalled at the 0.786 Fibonacci retracement level.

4. Outlook for Late 2023 to 2024

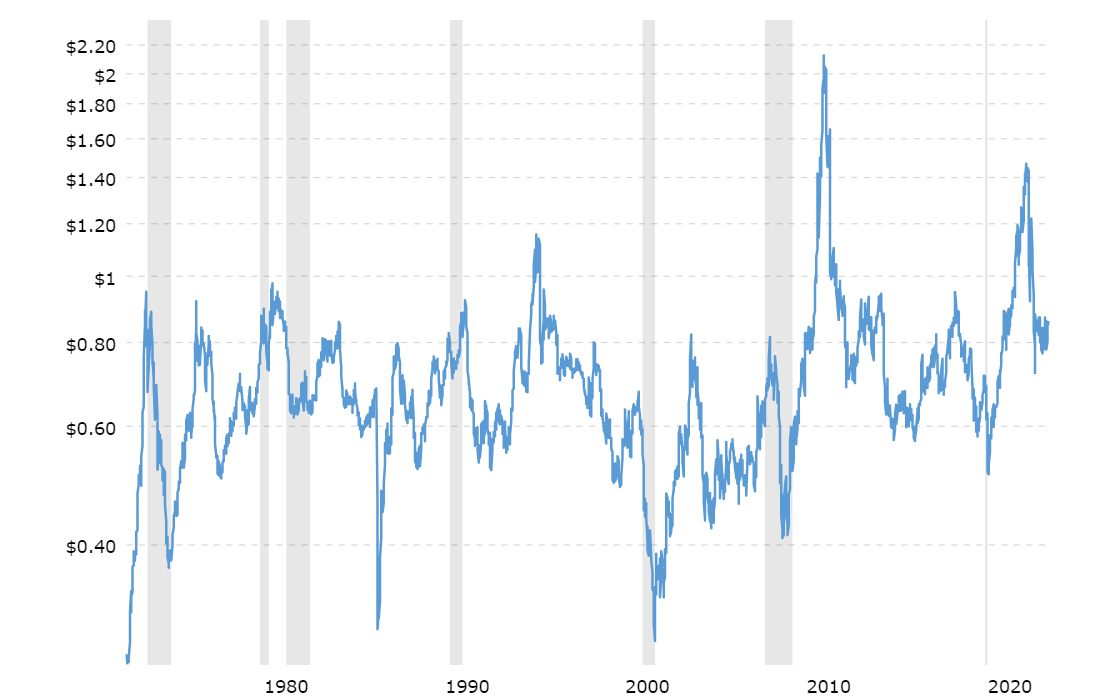

Due to the aggressive rate increase actions undertaken by the Federal Reserve to control inflation, we foresee a recession potentially occurring in 2024. Generally, commodity prices, with cotton being no exception, tend to underperform during the initial phases of a recession. This pattern is evident in the below chart of cotton prices, where periods of recession are highlighted in gray.

Source: Macrotrends

That said, from a long-term viewpoint, we postulate that starting from 2020, the commodity market may have embarked on a supercycle phase. These supercycles often span more than 8 years and carry extensive repercussions, influencing a wide range of commodity assets rather than just a handful.

If the supercycle hypothesis is validated, we could witness a prolonged uptrend in the aftermath of a potential recession, where the cotton market could possibly reach new highs.