Energy Prices: Evolution and Outlook

We'll explore the drastic fluctuations in energy prices and provide our insights into potential future changes in this market.

The energy sector has always been a pulsating realm of dynamic shifts, but the years since 2020 have been particularly tumultuous.

In this article, we'll explore the drastic fluctuations in the prices of major energy commodities, encompassing West Texas Intermediate (WTI), Brent Crude, natural gas, and gasoline. In conclusion, we'll provide our insights into potential future changes in this market.

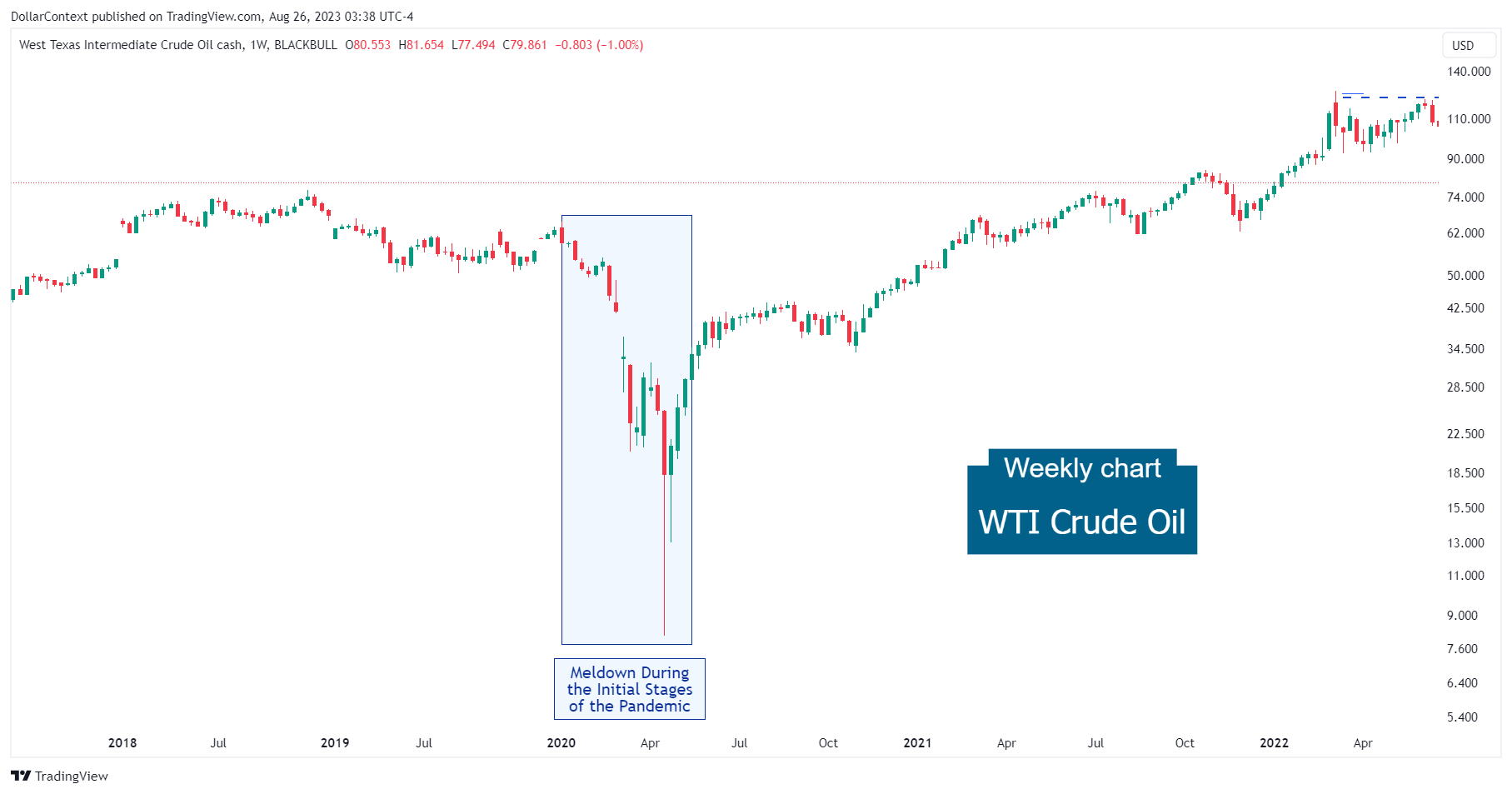

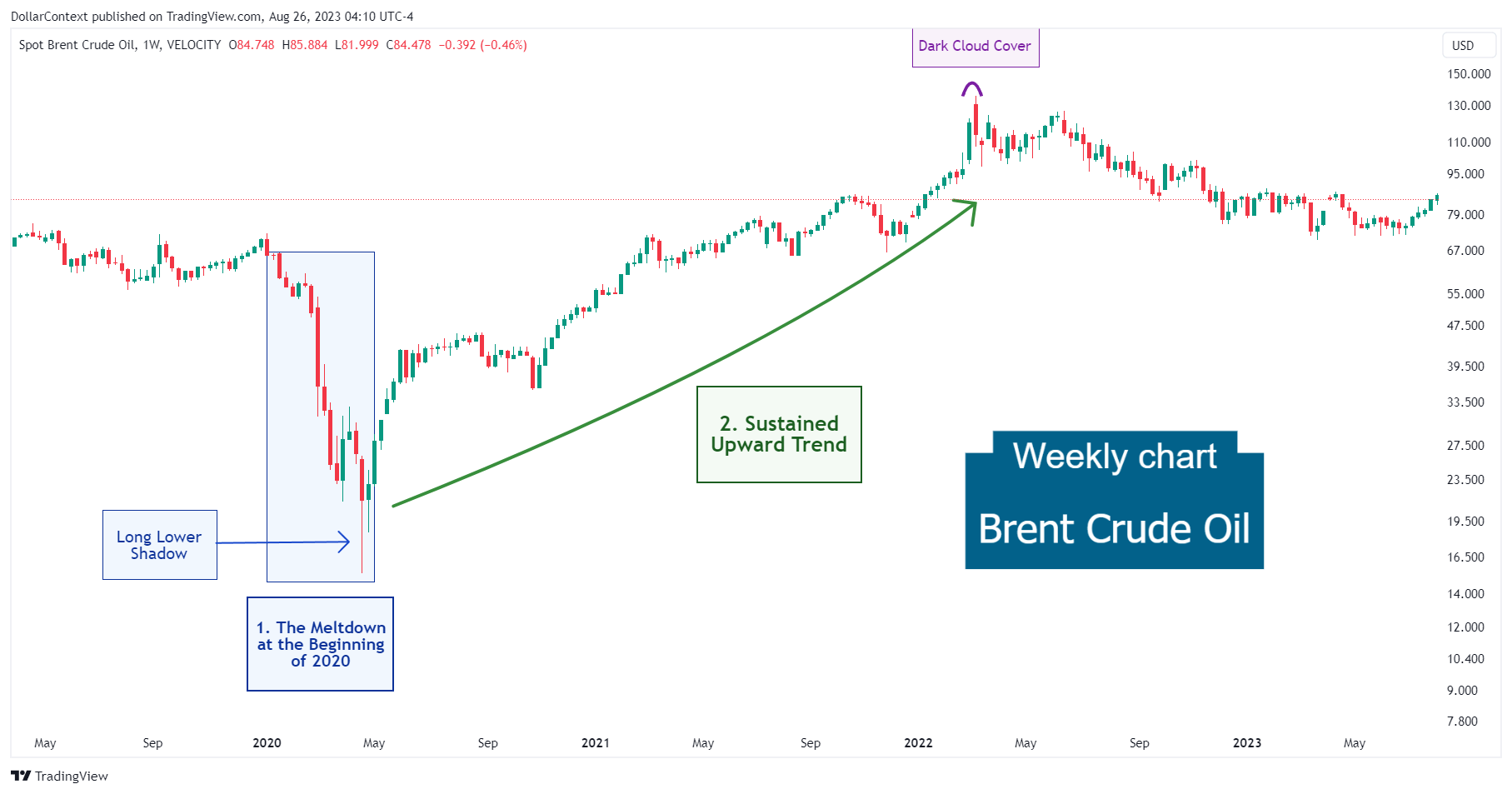

1. First Half of 2020: The Pandemic's Meltdown

In the early months of 2020, the energy sector witnessed significant price fluctuations, largely attributed to the pandemic and its subsequent impact on the global economy. These factors primarily precipitated the initial downturn in the pricing of many of these commodities:

- COVID-19 Pandemic: In the initial months of 2020, the rapid worldwide spread of COVID-19 led to unprecedented lockdown measures. Leading economies imposed travel restrictions, placed large populations under quarantine, and shut down major parts of their business sectors. As a result, demand for crude oil, gasoline, and natural gas plummeted, particularly in sectors like transportation, aviation, and industry.

- OPEC Price War: The cost of crude oil saw considerable fluctuations in 2020. Early in the year, tensions rose between oil powerhouses Saudi Arabia and Russia. By March, OPEC and its associates failed to agree on oil production cuts. Reacting to this stalemate, Saudi Arabia announced notable price cuts and plans to increase production. This potential flood in the market, combined with waning demand, further amplified the price decline.

- Storage Constraints: During the 2020 COVID-19 pandemic, the substantial decline in demand occasionally led to storage capacity challenges, which in turn impacted prices.

- Economic Uncertainties: The long-term economic outlook seemed grim due to the possible lasting impacts of the pandemic. This decline in economic activity further diminished the prospects for a recovery in energy demand.

As an example, the WTI chart below illustrates this unparalleled plunge in prices.

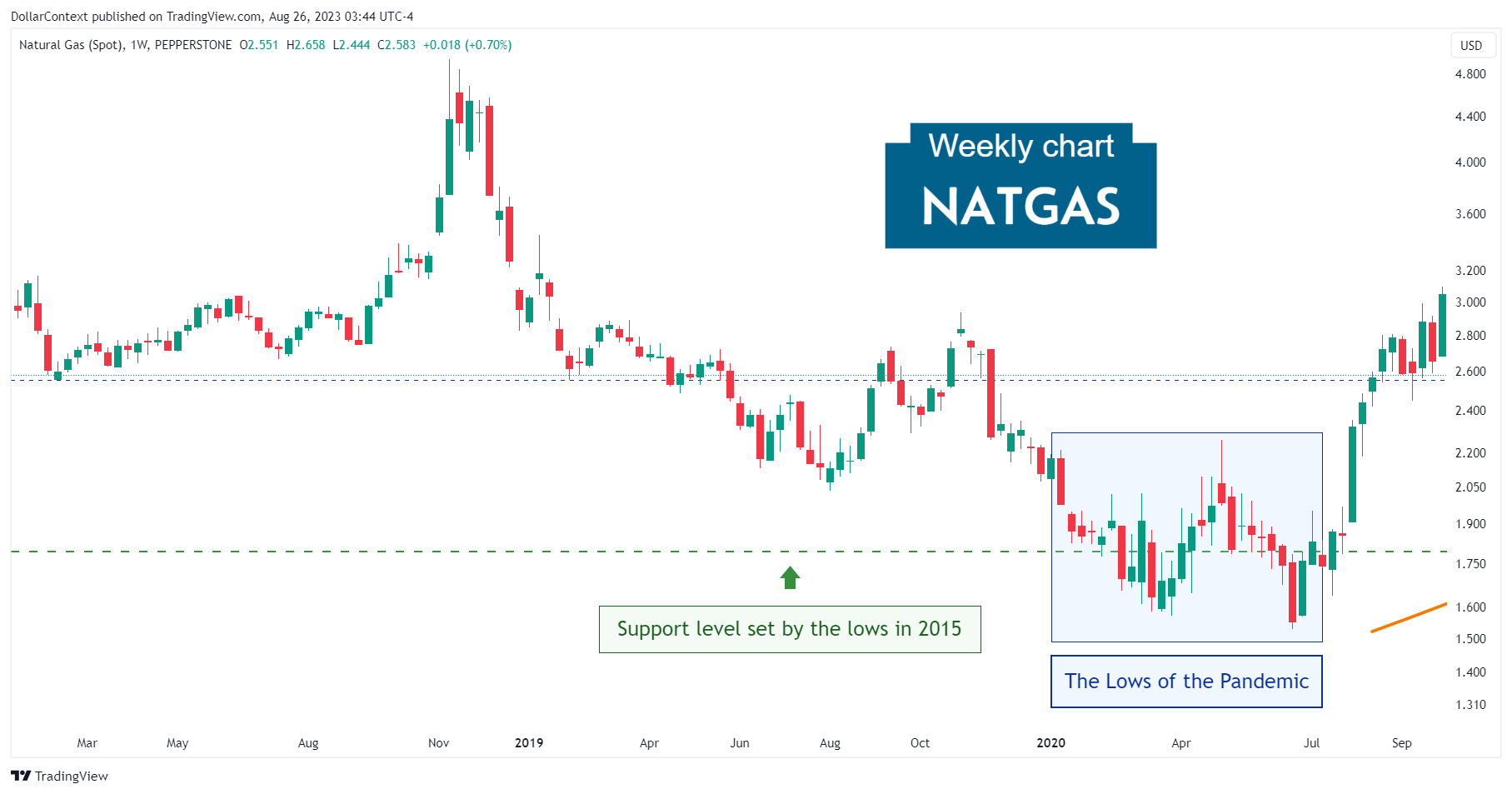

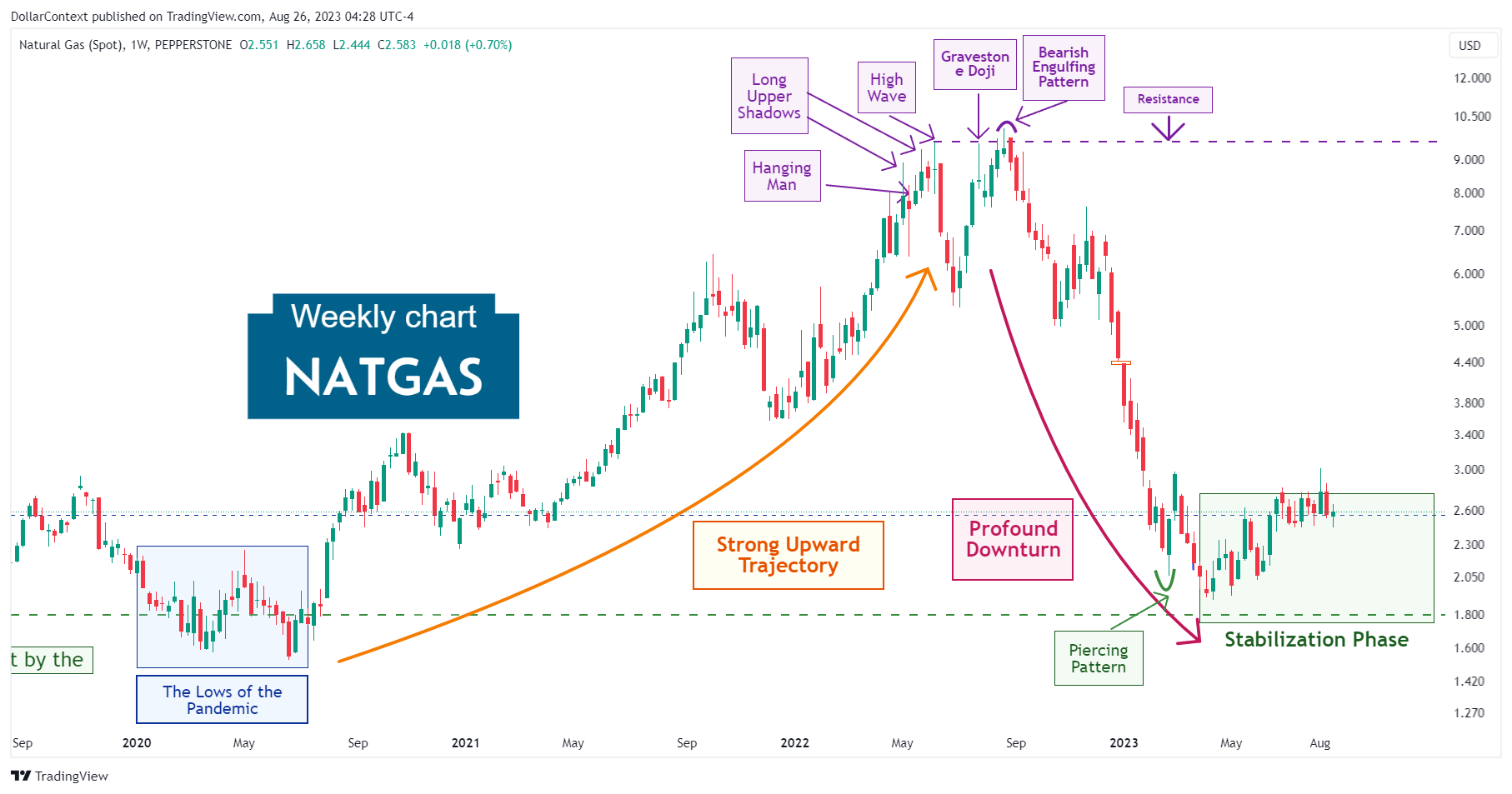

Although natural gas prices showed a noticeable decrease, the decline wasn't as pronounced as in other energy markets.

2. July 2020–June 2022: The Persistent Upward Momentum

Following an initial decline in prices, the majority of energy markets rebounded swiftly to initiate a strong and sustained uptrend. The following factors contributed to triggering a shift in market sentiment:

- The Injection of Liquidity and Stimulus Measures Promoted by Leading Central Banks.

- Dollar Depreciation

- The World's Economic Recovery Journey after the Pandemic

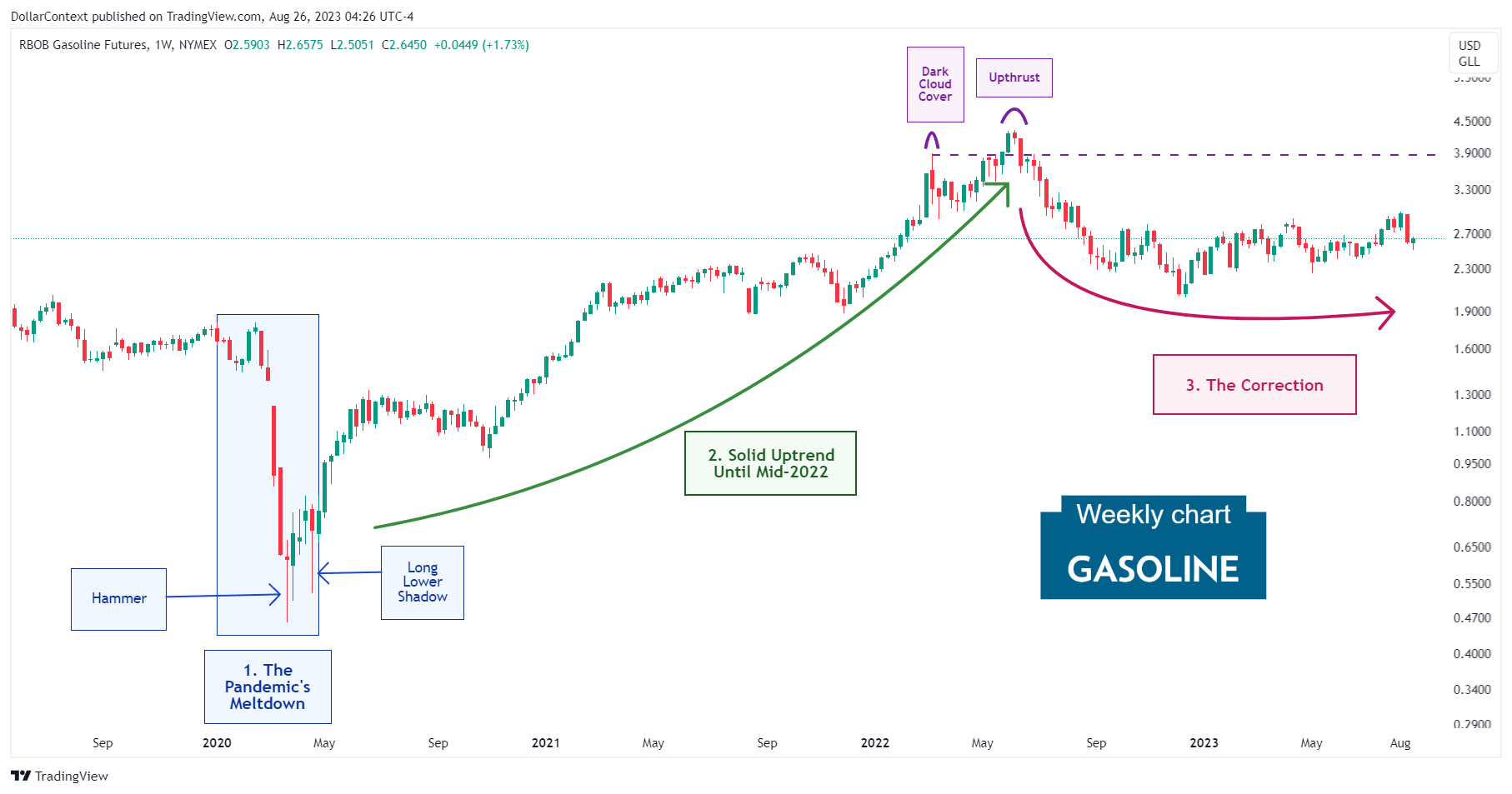

3. From Mid-2022 Onward: The Correction

Prompted by major central banks' stricter policies to address inflation and stabilize the economy, coupled with the subsequent rise of the dollar, the energy market began a significant correction that continues to date.

Considering the significant extent of the prior upward trend, gasoline, WTI, and Brent Crude Oil have, to date, shown only a modest correction.

By contrast, natural gas has undergone a remarkably deep correction.

4. Outlook for the Energy Market in 2023 and 2024

When projecting metal prices for the upcoming two years, we believe it's essential to take into account the following elements:

- The Supercycle Hypothesis: Beginning in 2020, the commodity market may have entered a phase often referred to as a supercycle. Such cycles usually span over eight years and feature pronounced rises in global commodity prices. If this perspective holds true, energy prices might see a steady ascent in the medium term.

- The Economic Downturn Scenario: Given the Federal Reserve's aggressive approach to raising interest rates, along with concerning signs from pivotal indicators like the inverted yield curve, the likelihood of an economic slump by 2024 appears to be on the rise. Historically, as a global recession begins, the energy market experiences price pressures.