Metal Commodities: Evolution and Outlook

We explore the trends that have molded metal prices since 2016 and offer our perspective on possible upcoming shifts in these markets.

In this article, we'll explore the influences and trends that have molded metal prices since 2016. After covering a range of these assets, including gold, copper, palladium, zinc, nickel, lead, silver, and platinum, we'll offer our perspective on possible upcoming shifts in this market.

1. January 2016–December 2019: The Genesis of a Robust Uptrend

Metal commodities experienced a significant low around the end of 2015 and the beginning of 2016, but then started an upward trend. Several factors contributed to these market dynamics:

- Dollar Stabilization: Between April 2011 and March 2015, the dollar index appreciated by roughly 37%. It wasn't until early 2016 that the dollar began to exhibit signs of stabilization.

- Reduced Investment: The end of the previous commodity boom led to reduced investment in new mines, which eventually created a lagged supply deficit.

- Chinese Economic Measures: In 2015 and 2016, the Chinese government introduced several economic measures to stabilize and stimulate its economy. These measures boosted metal demand.

- Central Bank Policies: The Federal Reserve and other primary central banks maintained a near-zero interest policy to stimulate economic activity, which indirectly boosted the demand for commodities.

- Increased Infrastructure Spending: Many countries increased infrastructure spending to stimulate their economies, which raised demand for metals.

- The booming Battery Market: The rise of technologies, especially in the battery sectors, drove the demand for metals such as lithium, nickel, and cobalt to produce, for example, electric vehicles.

Following the initial rise, most precious and base commodities underwent a correction, showing varied patterns. Gold, copper, palladium, zinc, nickel, and lead didn't return to their 2015 lows. Meanwhile, silver prices retested the 2015 lows before picking up the upward trajectory again, and platinum reached new lows before aligning with the general upward trend.

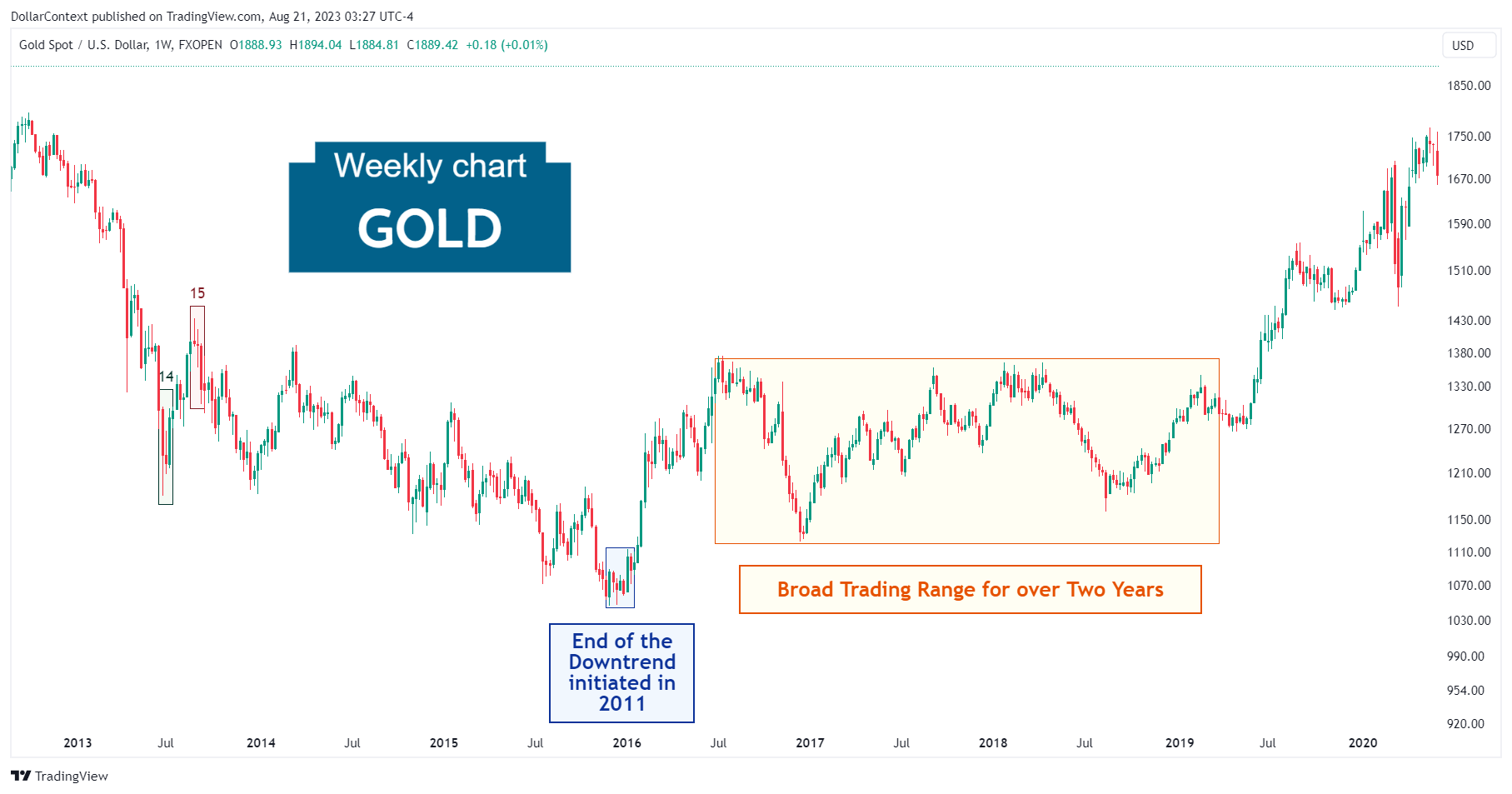

With the exception of palladium, lead, and nickel, the majority of these markets stayed within a broad trading range up to 2019. This lateral price movement was likely tied to the Federal Reserve's rate hikes during the second half of this period and shifts in the dollar's value. The gold market chart serves as an illustration of this kind of price movement.

2. First Quarter of 2020: The First Wave of Pandemic Instability

The first stages of the pandemic created a period of enormous uncertainty, economic slowdown, and disruptions in both demand and supply of metal assets.

Following an initial drop in prices, the majority of metal markets rebounded swiftly to continue their prior ascending trajectory. The infusion of liquidity and stimulus actions by major central banks played a pivotal role in shifting the mindset within the metal market. Variations in the dollar's value also had a notable impact during this span.

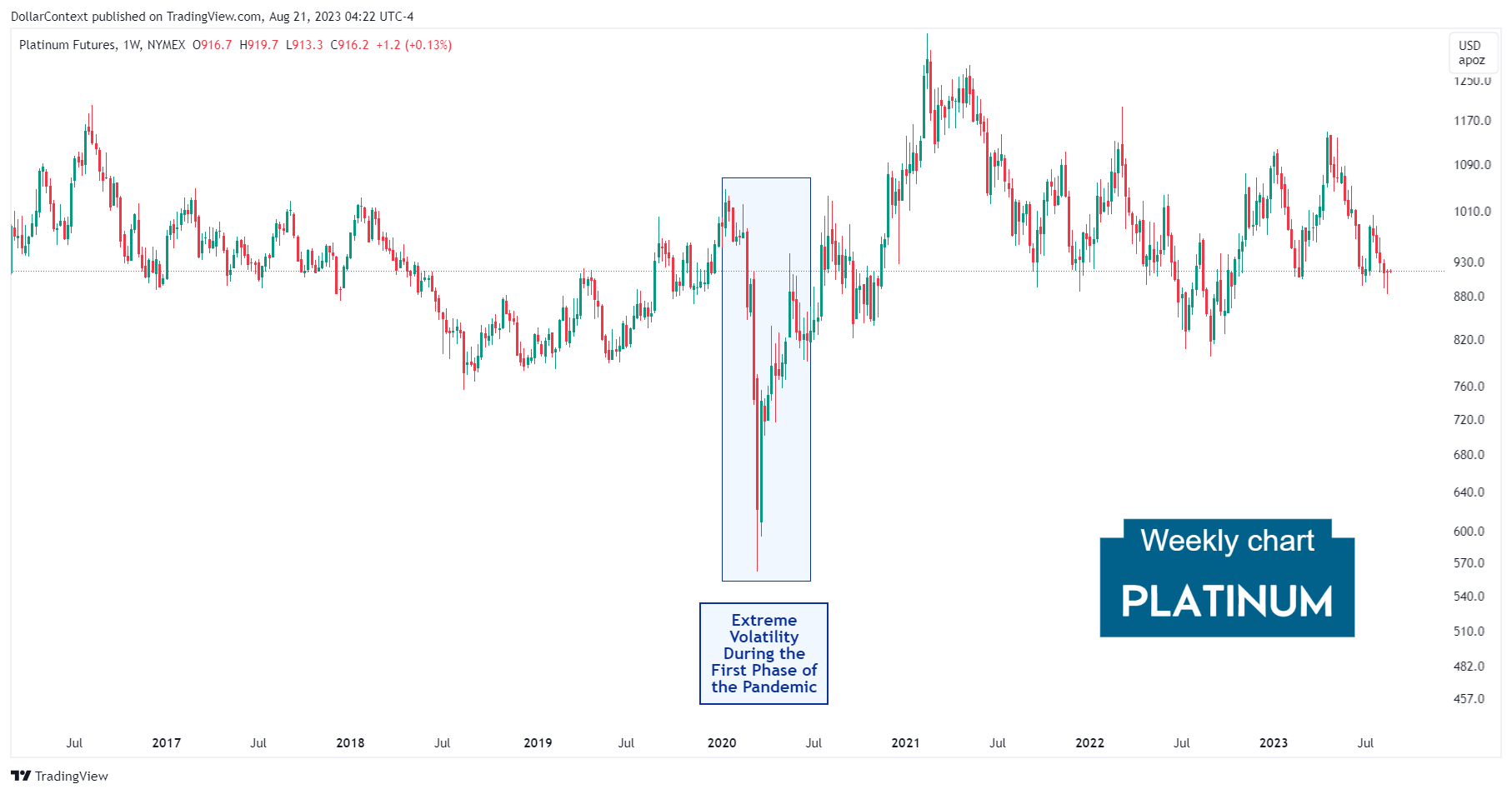

The platinum market stands out as a prime example of this intense volatility:

3. April 2020–March 2022 The Last Notable Climb Before the Top

The stimulus measures endorsed by the Federal Reserve, combined with disruptions in supply chains, propelled precious and base metals to new highs during this period.

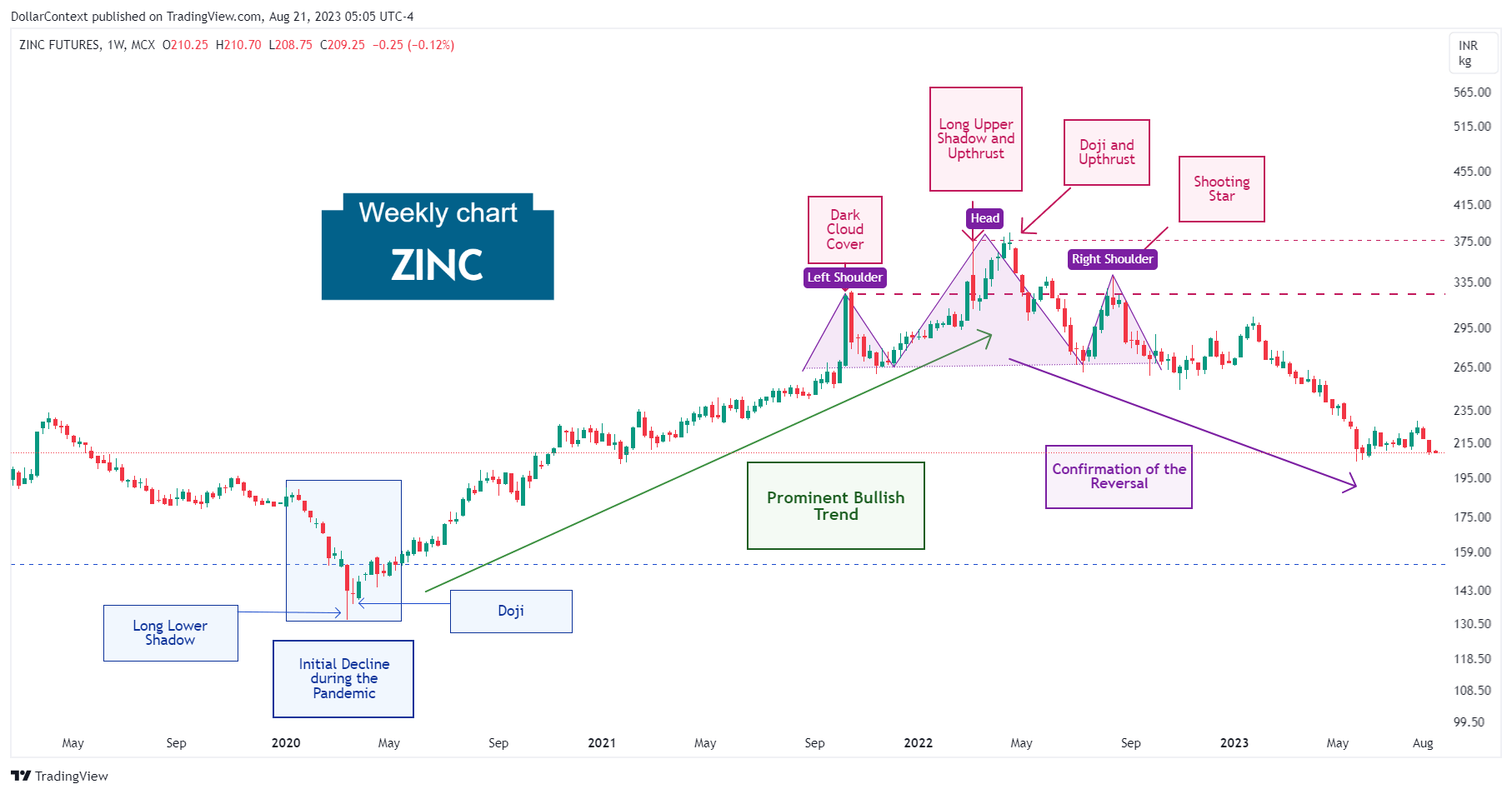

However, in March 2022, the Federal Reserve adopted a new policy stance. The central bank initiated a vigorous series of rate hikes to counteract inflation. Consequently, the dollar strengthened, and many metal commodities peaked around this time. As an example, observe the head and shoulders pattern displayed by the zinc market before printing a significant correction.

4. From April 2022 Onward: The Correction

The revised strategy adopted by many central banks to curb inflation and temper economic activity triggered a widespread correction in the majority of metal markets. The price correction painted a varied landscape. Assets such as gold, copper, palladium, zinc, nickel, and lead momentarily approached or even exceeded their recent peaks before declining. In contrast, silver and platinum maintained their descending trajectory.

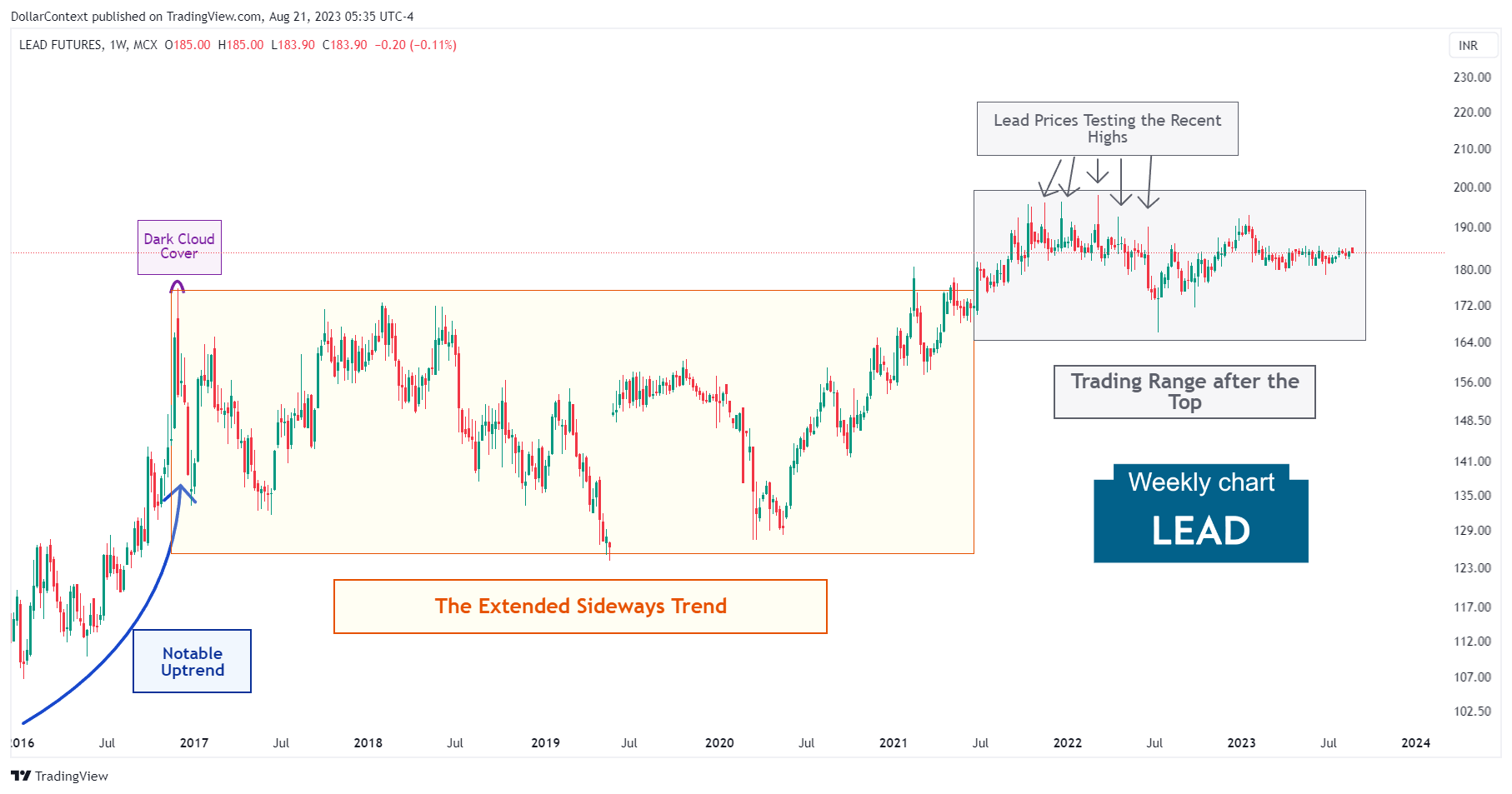

For instance, the lead market consistently approached its peak prices, with values largely staying close to the top for more than a year.

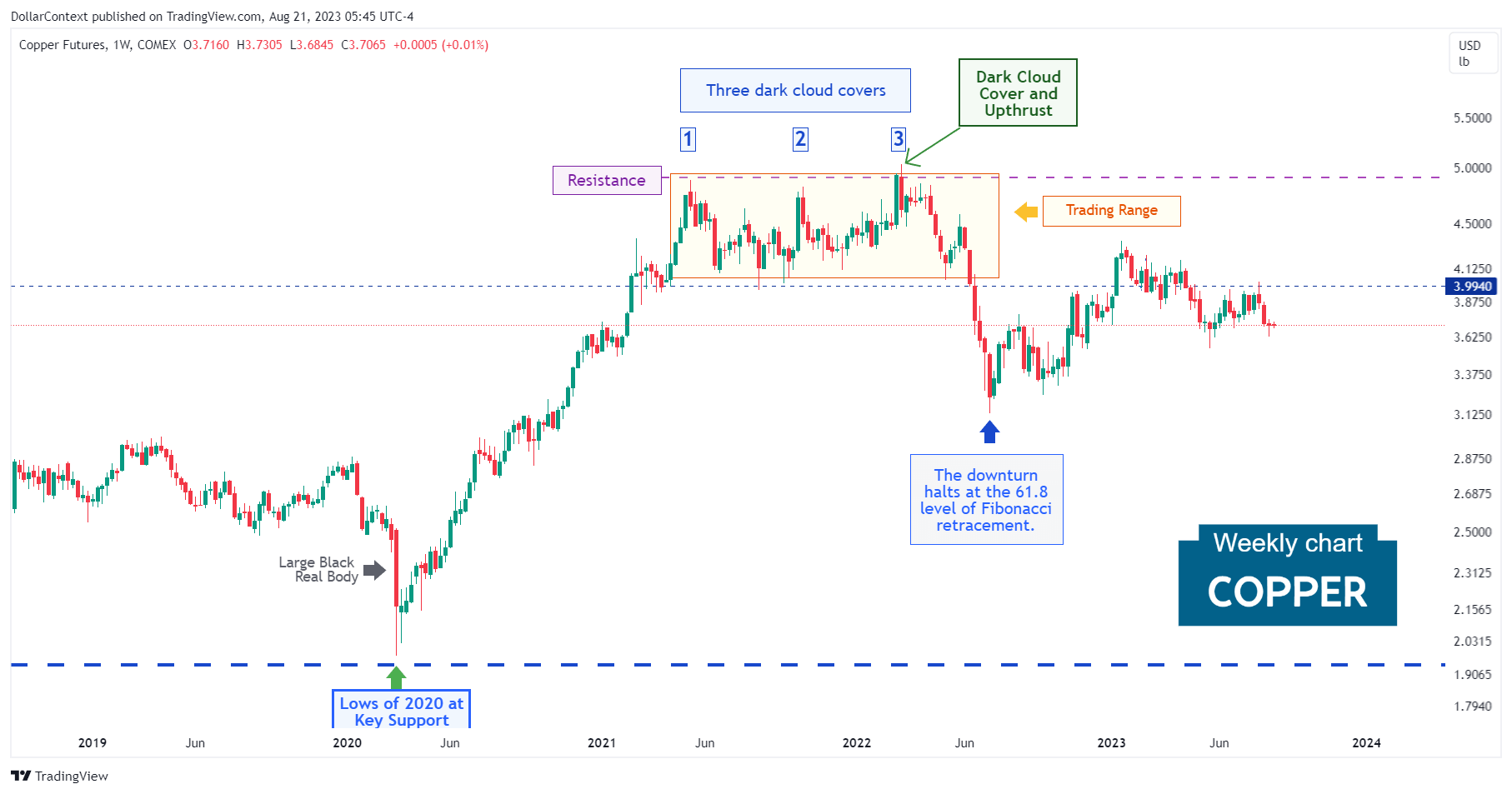

By contrast, copper prices witnessed a significant drop following their peak in March 2022.

4. Outlook for Metal Commodities in 2023 and 2024

When forecasting the trajectory of metal prices for the next two years, we deem it crucial to factor in the following considerations:

- The Supercycle Proposition: Starting in 2016, the commodity market might have embarked on what's known as a supercycle. These cycles typically last more than eight years and are characterized by significant surges in global commodity prices. Should this viewpoint prove accurate, metal prices could be on track for a consistent upward climb in the medium term.

- The Recession Scenario: Considering the Federal Reserve's proactive stance on hiking interest rates, coupled with alarming signals from key indicators such as the inverted yield curve, the prospects of an economic downturn by 2024 seem to be increasing. Typically, at the onset of a global recession, the prices of most commodities, including metals, tend to experience a decline.