Nickel Prices: Evolution and Outlook

We discuss the drivers that have shaped the nickel market since 2016, and we share our perspective on possible upcoming trends in this market.

This analysis reflects market conditions and information available at the time of publication (August 2023). It is provided for educational and historical context.

In this post, we'll discuss the drivers and fluctuations that have shaped the nickel market since 2016. In the conclusion, we will share our perspective on possible upcoming trends in this market.

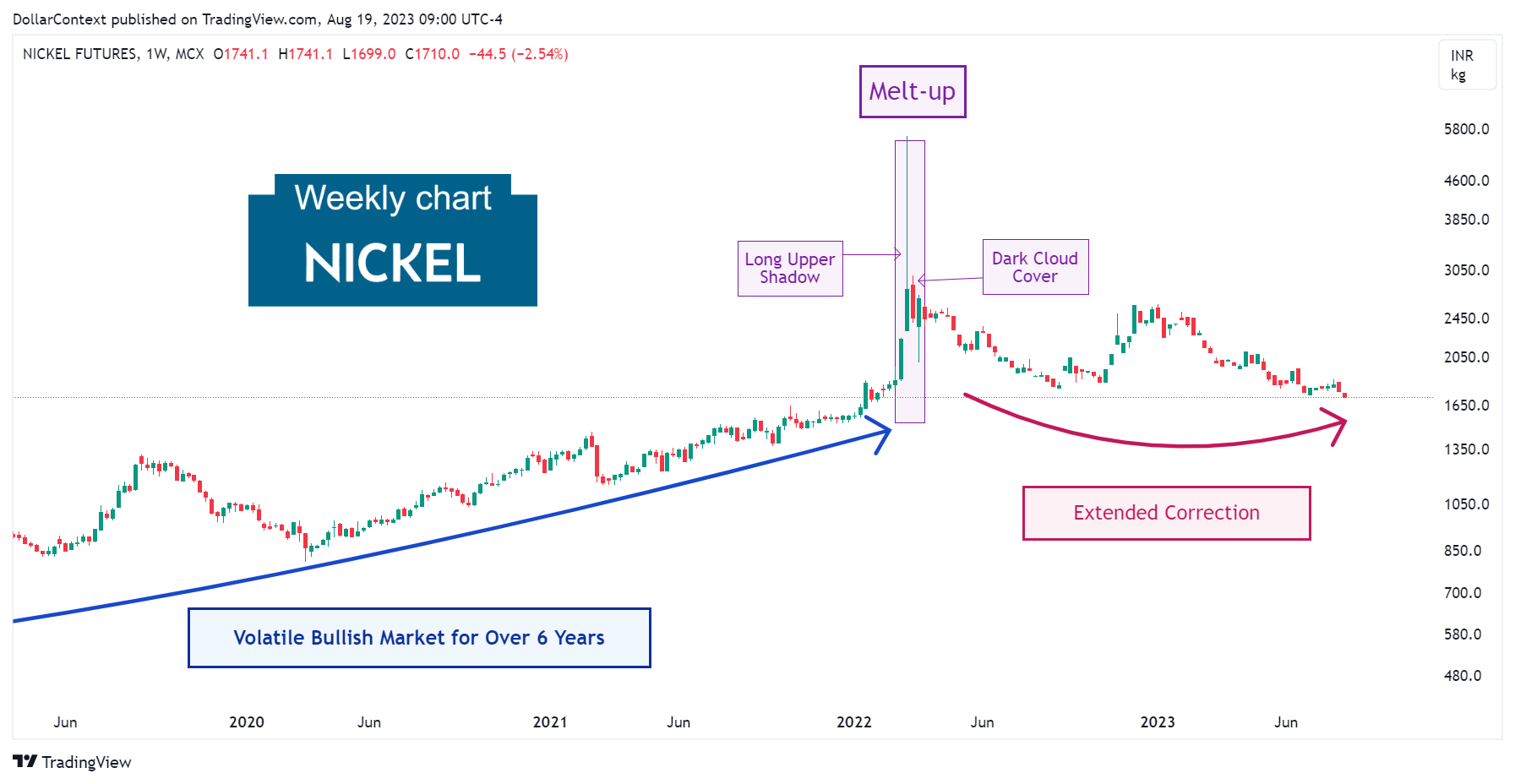

1. January 2016—February 2022: The Volatile Upward Trend of Nickel Prices

In early 2016, the nickel market, along with a broad array of other commodity assets, reached a historic low, marking the beginning of a new long-term bullish trend. However, the rising nickel price landscape experienced sudden and significant corrections until February 2022. These are the main factors contributing to this volatility:

- Supply Constraints: During this period, two of the most significant producers of nickel, Indonesia and the Philippines, implemented and modified several policies related to nickel production and exports.

- Chinese Demand: China remained a major consumer of nickel, primarily for its stainless steel production. China’s economic health and construction activity were critical drivers of nickel demand.

- Electric Vehicle Batteries: The rise of electric vehicles and the increasing demand for batteries, in which nickel is a key component, emerged as a significant new source of nickel demand during this period. As EV adoption accelerated globally, market participants increasingly factored this into nickel price projections.

- Dollar Value Fluctuations: The US Dollar remained the currency in which nickel (and other commodities) are priced. Therefore, fluctuations in the value of the US dollar continued to have an inverse impact on nickel prices.

- The COVID-19 Pandemic: The global economic slowdown in 2020 due to the COVID-19 pandemic created unprecedented disruptions in the supply and demand for many commodities, including nickel. Lockdowns and other restrictions impacted both mining operations and demand from key end-use sectors.

2. March 2022: The Dramatic Spike in Nickle Prices

Since early 2022, the nickel market had been experiencing low liquidity. On March 8, in response to concerns over potential disruptions to nickel supplies resulting from Russia's invasion of Ukraine, nickel prices surged by more than 250%. In 2021, Russia accounted for over 200,000 tonnes of nickel output, making it the third-largest global producer and contributing 7.5% of the world’s nickel production. Following the dramatic price increase, the London Metal Exchange (LME) suspended trading in nickel.

The dramatic price surge was attributed to short-covering by Tsingshan, a major nickel producer in China owned by Chinese tycoon Xiang Guangda. Tsingshan held substantial short positions, and its aggressive buying activity played a significant role in fueling the explosive increase in nickel prices.

The spike in the nickel market revealed a long upper shadow candle and an incomplete dark cloud cover formation.

3. From April 2022 Onward: The Lengthy Market Correction

Much like other commodity markets, nickel prices initiated a prolonged correction in the first half of 2022. While the pullback has not been, so far, as severe as in other industrial metals, it remains currently active.

4. Outlook for Nickel in 2023 and 2024

The following perspective reflects expectations based on information and policy signals available at the time of writing.

When forecasting the nickel price trend for 2023 and 2024, we deem the following scenarios to be critical for consideration:

- The Supercycle Hypothesis: Beginning with the 2016-2020 timeframe, the commodity market may have embarked on what is known as a supercycle. These cycles typically span more than eight years and are characterized by significant surges in global commodity prices. If this theory proves accurate, nickle prices could be poised for a prolonged upward climb in the coming years.

- The Economic Downturn Scenario: Considering the Federal Reserve's decisive stance on increasing interest rates, coupled with alarming signals from key indicators such as the inverted yield curve, the probability of an economic downturn around 2024 is increasing. In the early stages of a global recession, most commodities—including nickle—are typically subject to downward price pressures.