Oat Prices: A Look Back and Ahead

We cover the trends that have shaped the course of oat prices and provide our view regarding the likely future progression of this market.

In this post, we'll cover the trends and factors that have determined the trajectory of oat prices since 2020. Before concluding, we will provide our perspectives regarding the likely future progression of this market.

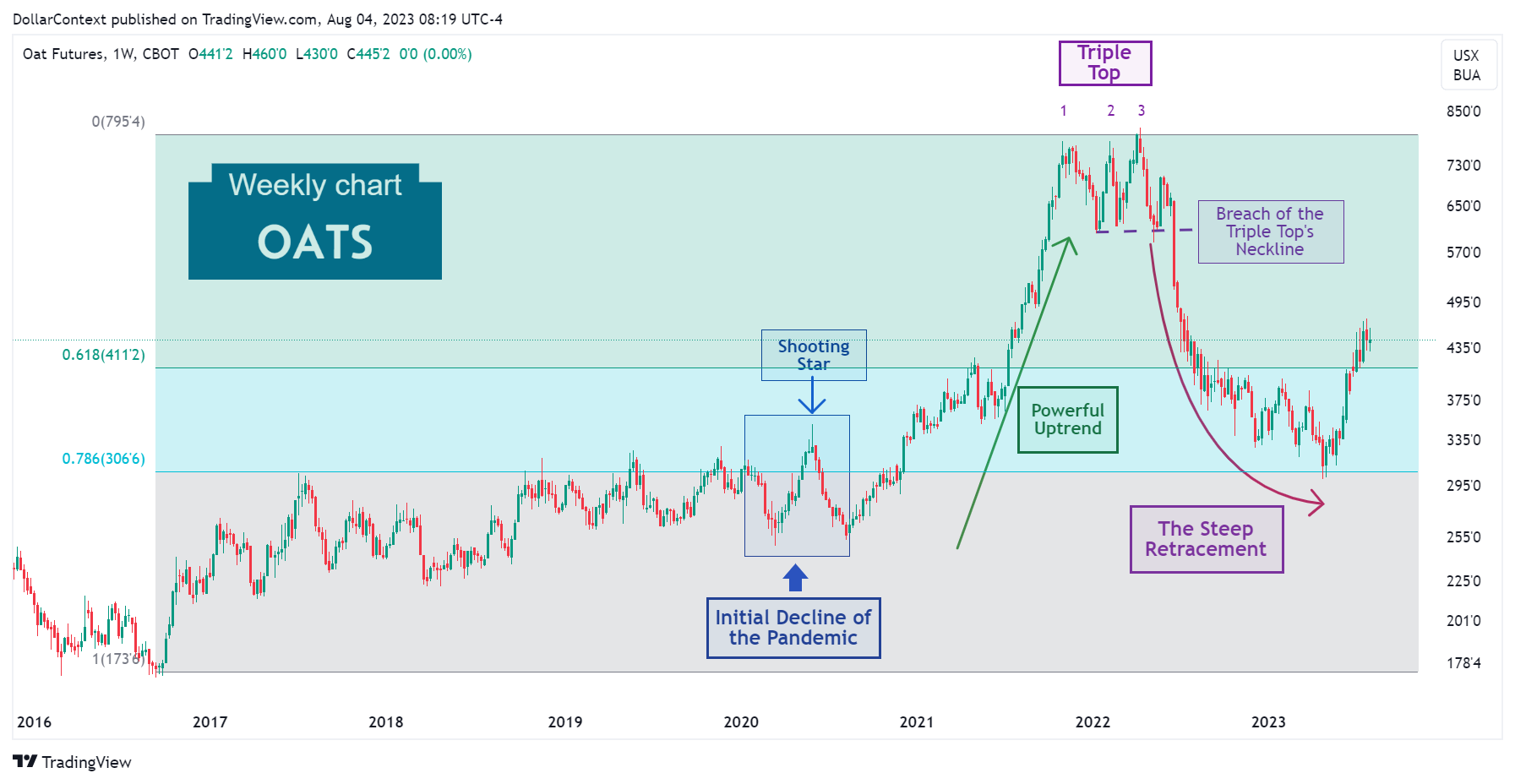

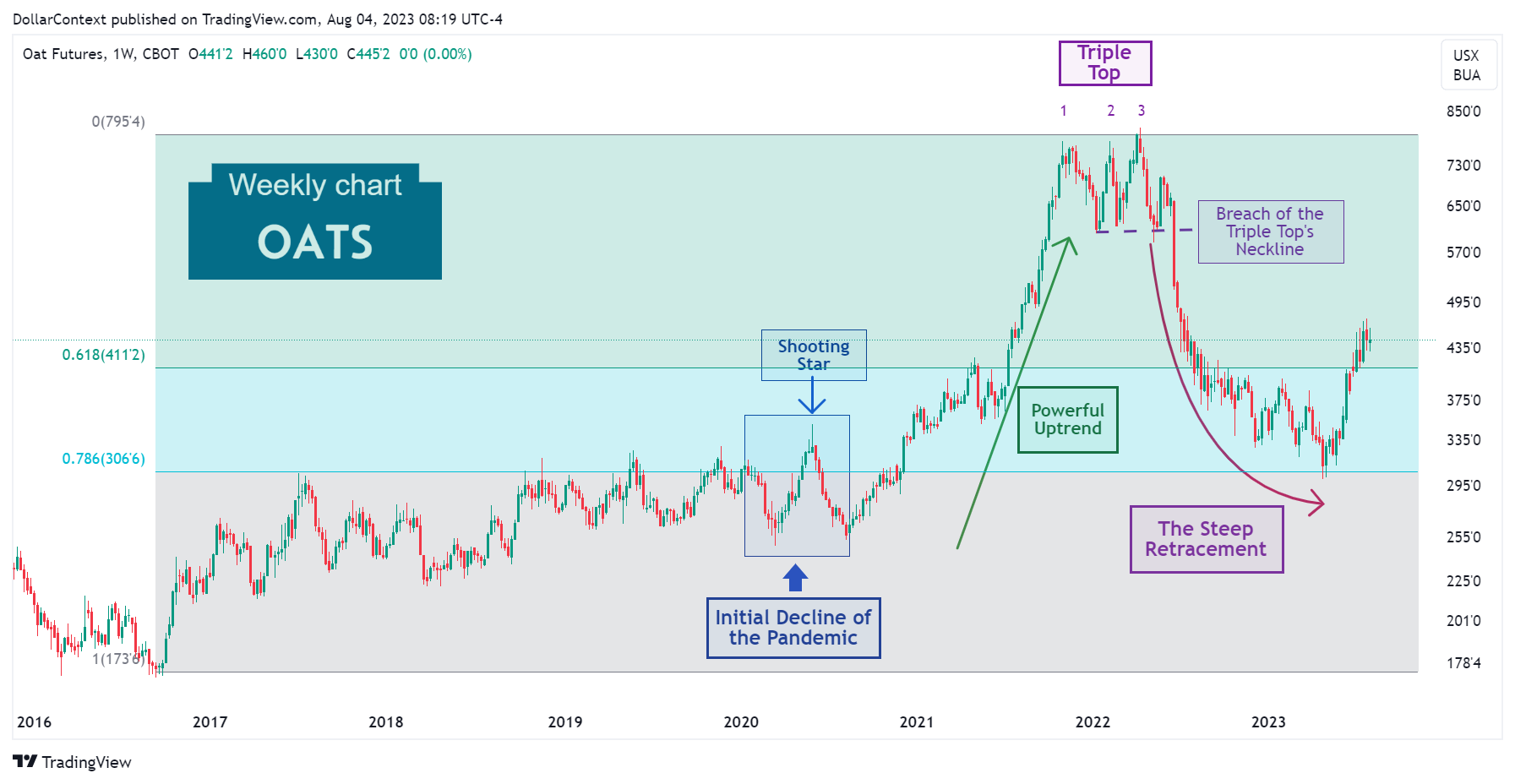

1. January 2020–August 2020: The Range During the Pandemic

During the first half of 2020, oat prices presented a mixed picture. At first, the market experienced a significant downturn, but it swiftly bounced back only to decline once more, revisiting the initial lows. However, unlike many other non-agricultural commodity assets, the price largely succeeded in staying within the confines of a sideways range that was established in 2018.

Notice the emergence of a shooting star pattern, signaling the onset of the second downturn.

2. September 2020–October 2021: The Powerful Uptrend

A number of factors contributed to the escalation of oat prices during the latter half of 2020 and the majority of 2021:

- Disruptions in the Supply Chain: The COVID-19 pandemic led to significant disruptions in global supply chains, which in turn propelled commodity prices upward.

- Implementation of Government Stimulus Measures: In light of the economic consequences of the pandemic, numerous governments launched substantial stimulus measures. These initiatives bolstered buying capacity and increased demand for commodities, including oats.

- Recovery of the Global Economy: With nations worldwide starting their recovery from the pandemic's initial blow, the demand for goods and services, including agricultural commodities, began to rejuvenate.

In this timeframe, the price of oats increased to more than three times its original value.

3. November 2021–May 2022: The Triple Top

Over the course of six months, the oat market displayed a triple top formation, which was confirmed following the breach of the neckline in June 2022.

4. June 2022–April 2023: The Dramatic Retracement

Like numerous other commodities, the market embarked on a notable correction phase beginning in June 2022. Pay attention to how, in the case of oats, this correction stalled approximately at the 0.786 Fibonacci retracement level, assuming the 2016 lows as the base.

5. Outlook for Late 2023 and 2024

In our viewpoint, two major forces are likely to shape the course of oat prices during 2023 and 2024:

- Supercycle Theory: From 2020 onwards, the commodity market could potentially have initiated a supercycle period. Commodity supercycles usually extend for more than eight years and stimulate substantial price surges across worldwide commodity assets. If this theory turns out to be accurate, then the oat market would have entered a correction phase starting in June 2022, poised to resume its ascent at a certain juncture.

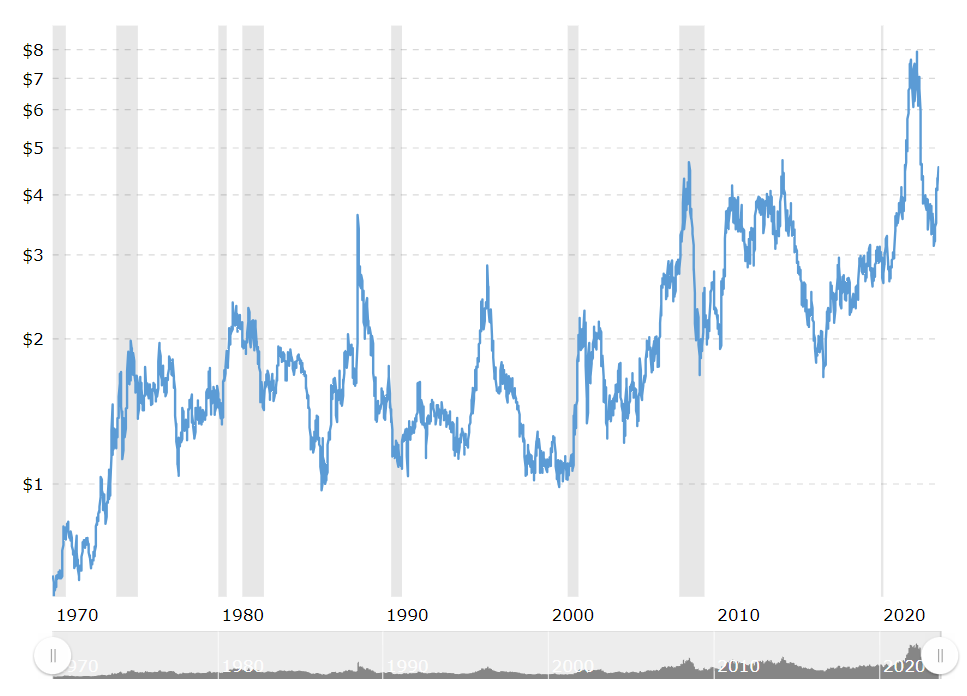

- Risks of an Economic Downturn: The aggressive cycle of rate increases by the Federal Reserve, coupled with the interpretation of leading indicators such as the yield curve and the PMI, suggest a significant probability of an economic slump, potentially materializing in 2024. As depicted in the chart below, the initial stage of an economic contraction (indicated by gray-shaded areas) almost always applies a downward force on oat prices.

Source: Macrotrends