Shaping the Future of Silver Prices

Evidently, this particular scenario may not come to fruition. Nevertheless, we deem it a likely outcome. Episodes of profound collapses and panic, similar to the one observed in 2020, frequently precede commodity supercycles.

Before projecting the future evolution of silver prices, we'll examine the underlying forces and dynamics that have been driving the silver market throughout the past three years.

1. March 2020: The Meltdown

The COVID-19 pandemic outbreak and the ensuing global economic contraction set in motion:

- Disruptions to the supply chain and a decrease in economic activity.

- Low Demand: The market experienced a strong decline in silver demand from sectors such as electronics and solar panels.

- Flight to Liquidity and Dollar Appreciation: The surge in uncertainty triggered a flight to liquidity, as well as the appreciation of the dollar as a safe-haven currency.

This led to the price of silver plunging to a low near $11.6 an ounce.

Take note that on a broader timescale, the meltdown appears to be a false breakout from a range that was stable from 2015 to 2020.

2. March 2020–August 2020: The Skyrocketing Jump

From March to August 2020, the silver price skyrocketed in an impressive vertical move. The jump stalled:

- At the 100% projection of the previous lateral move.

- After displaying a double top (conventional technical analysis)

- Via a shooting star (candlestick analysis)

3. August 2020–August 2022: The Correction

Silver prices confirmed the double top pattern by dropping below the "neckline" or support level (at around $21.5). Yet, before reaching the full projection target, the price rebounds, returning to the previous range and exhibiting ascending highs and lows.

4. From August 2023 Onward

Beginning in 2020, the global commodity market, including silver, might have embarked on a supercycle stage. These supercycles typically last for more than 8 years and result in considerable price surges. If this hypothesis holds, then silver would have been undergoing a correction phase since June 2022, and now it might be set to resume its ascending trend over a longer duration.

However, given our forecast of an economic slowdown sometime in 2024, we may witness a sharp correction, which could result in a major adjustment in silver prices at some point.

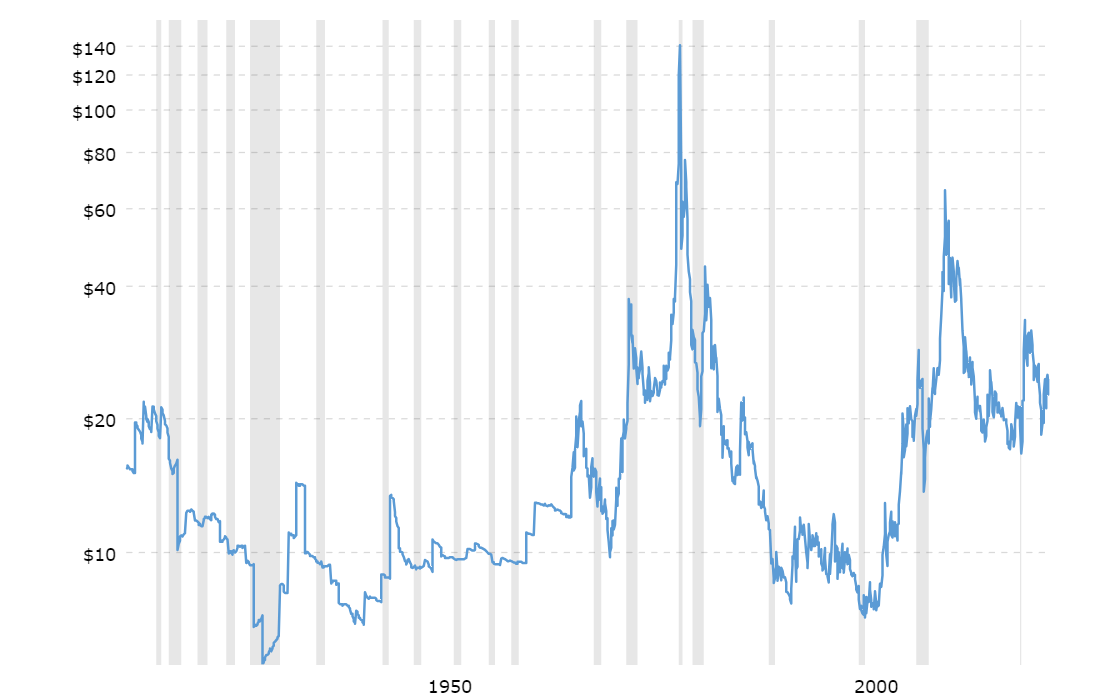

Note the pattern of silver experiencing substantial declines during times of economic recession, as illustrated by the gray-shaded regions in the following chart.

Source: Macrotrends

Evidently, this particular scenario may not come to fruition. Nevertheless, we deem it a likely outcome. Episodes of profound collapses and panic, similar to the one observed in 2020, frequently precede commodity supercycles.