AUD/USD: Evolution and Outlook

We'll examine the drivers that have shaped the AUD/USD since 2020 and wrap up by discussing the pair's future movements.

In this article, we'll examine the key drivers that have shaped the direction of the AUD/USD pair since 2020. We'll wrap up by discussing factors that could influence the pair's future movements.

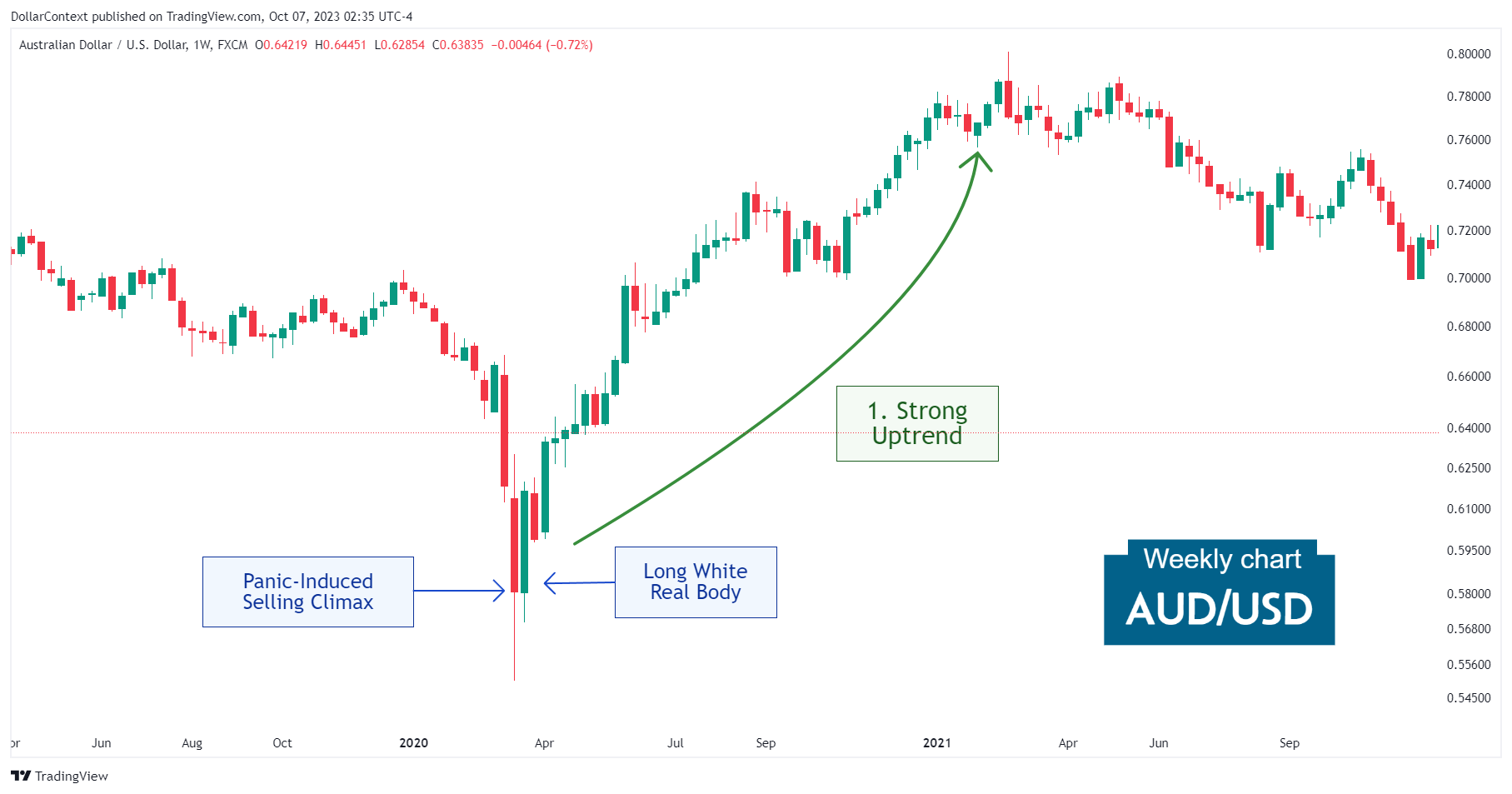

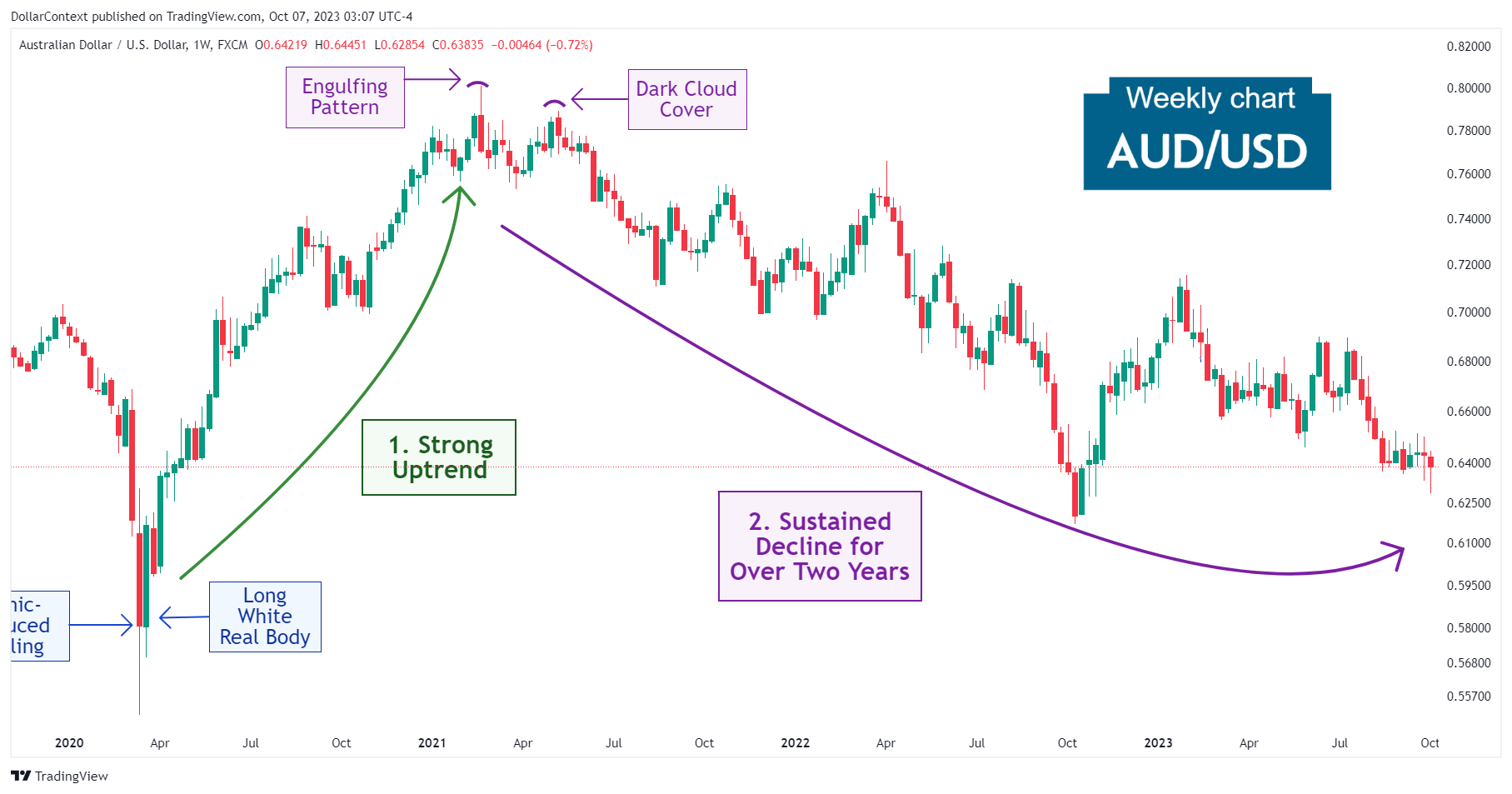

1. January 2020–February 2021: Strong Uptrend Following the Pandemic's Volatile Phase

During the early stages of 2020, when the pandemic began to spread, market uncertainty led to a surge in demand for safe-haven assets such as the U.S. dollar. This resulted in considerable fluctuations in the AUD/USD exchange rate.

Following the initial decline, the AUD/USD pair quickly showed a lengthy white real body by the end of March 2020. Note how the next session displayed a pullback which stopped at the midpoint of this large white or green body before resuming the pair's upward trajectory.

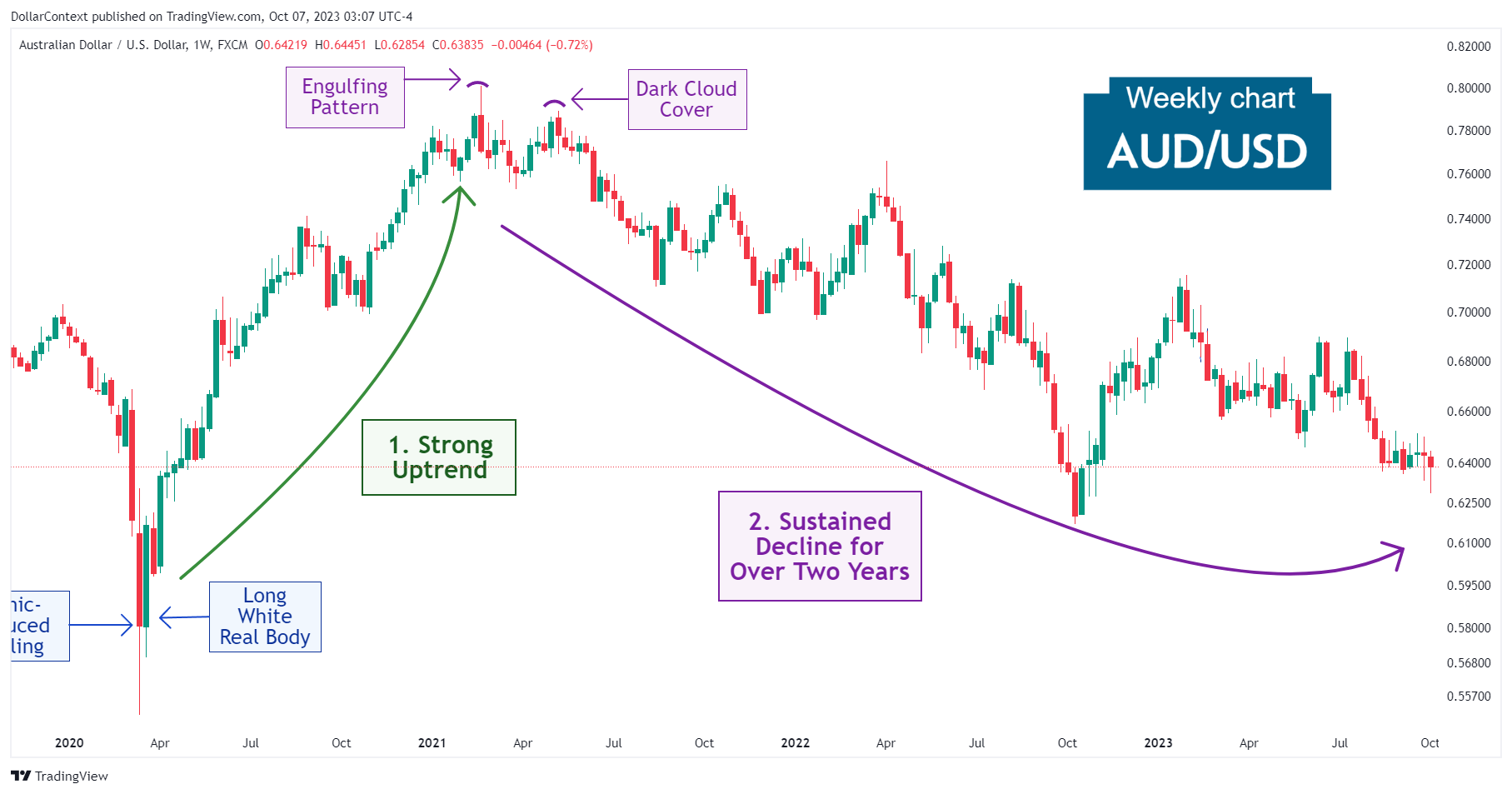

2. March 2021–September 2023: The Peak and the Ensuing Downturn

The AUD/USD gave its first sign of a potential peak with a bearish engulfing pattern in the last week of February 2021. The price range associated with this pattern established a resistance zone, which was successfully tested via a dark cloud cover in May 2021.

Fueled by the decline in commodity prices and the Federal Reserve's hiking cycle, the pair exhibited an extended decline for over two years.

3. Outlook for Late 2023 and Throughout 2024

While the short-term direction of the AUD/USD pair remains uncertain, several critical elements could shape its future path:

- Impact of Artificial Intelligence on Market Sentiment: Advances in AI technology have the potential to shift market sentiment, possibly making safer assets like the U.S. dollar less appealing.

- Concerns Over Economic Downturn: The aggressive rate hikes by the Federal Reserve, along with red flags such as an inverted yield curve and other leading economic indicators, suggest the possibility of a global economic slowdown in 2024. In times of global uncertainty or geopolitical tensions, investors often turn to the U.S. dollar as a "safe-haven" asset.

- Growing National Debt: A notable rise in the federal budget deficit is raising alarms about mounting public debt, which could influence the value of the USD in the near term.