GBP/USD: Evolution and Outlook

We'll explore the factors that have shaped the GBP/USD pair since 2020 and wrap up by discussing the pair's future movements.

This analysis reflects market conditions and information available at the time of publication (October 2023). It is provided for educational and historical context.

In this article, we'll explore the primary factors that have influenced the trajectory of the GBP/USD pair starting from 2020. We'll conclude by highlighting the elements that could steer the pair's subsequent trends.

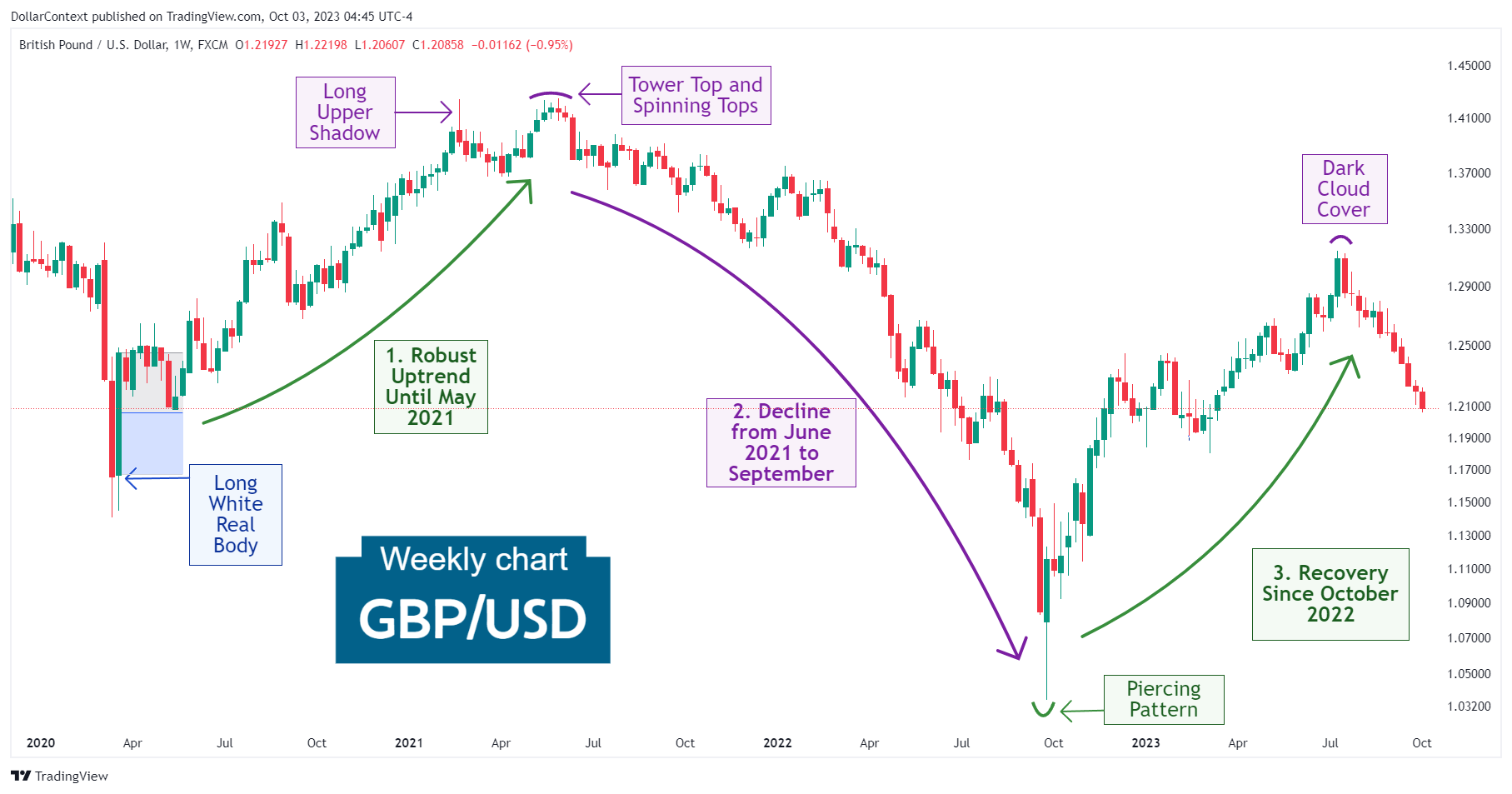

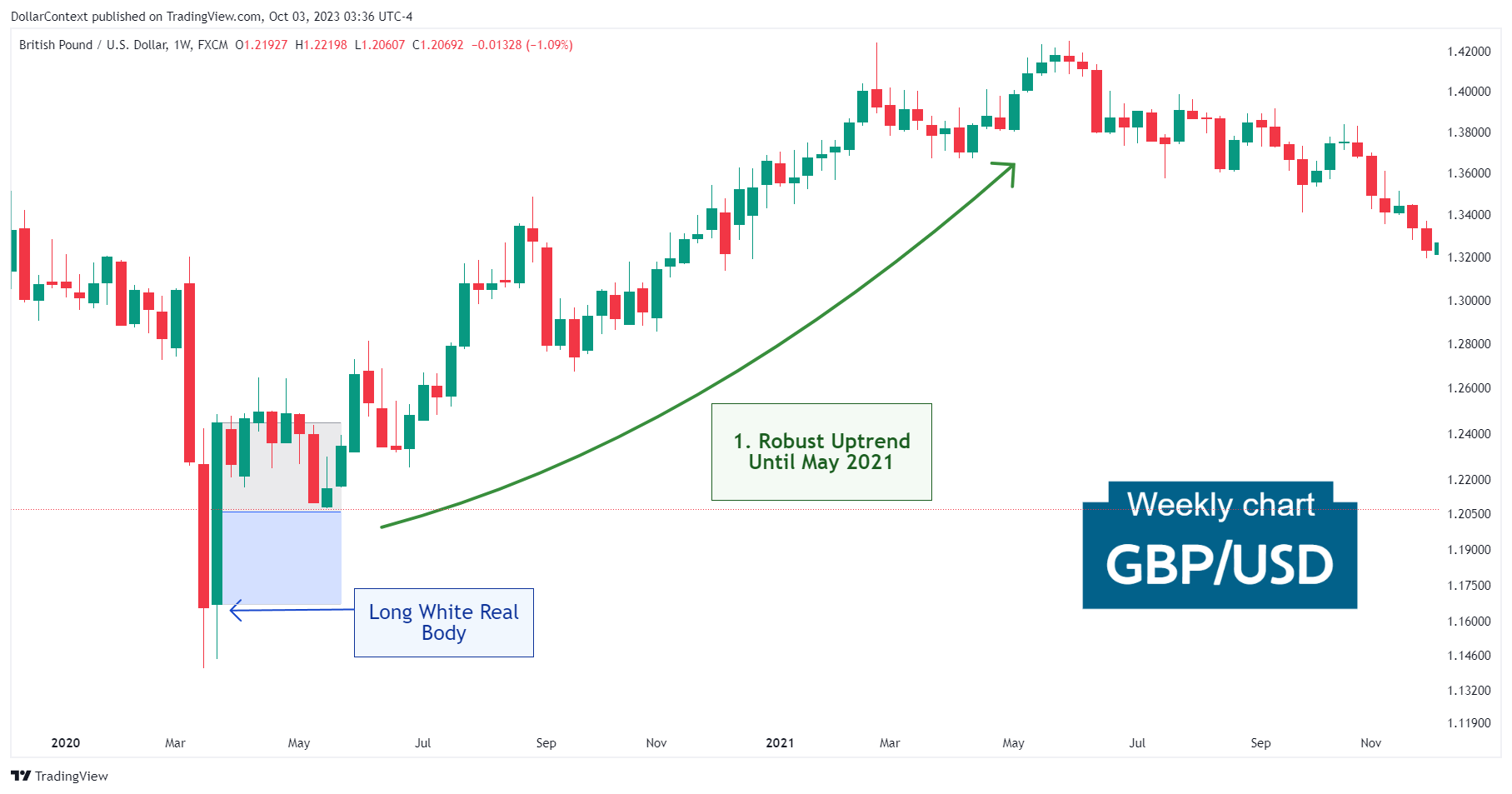

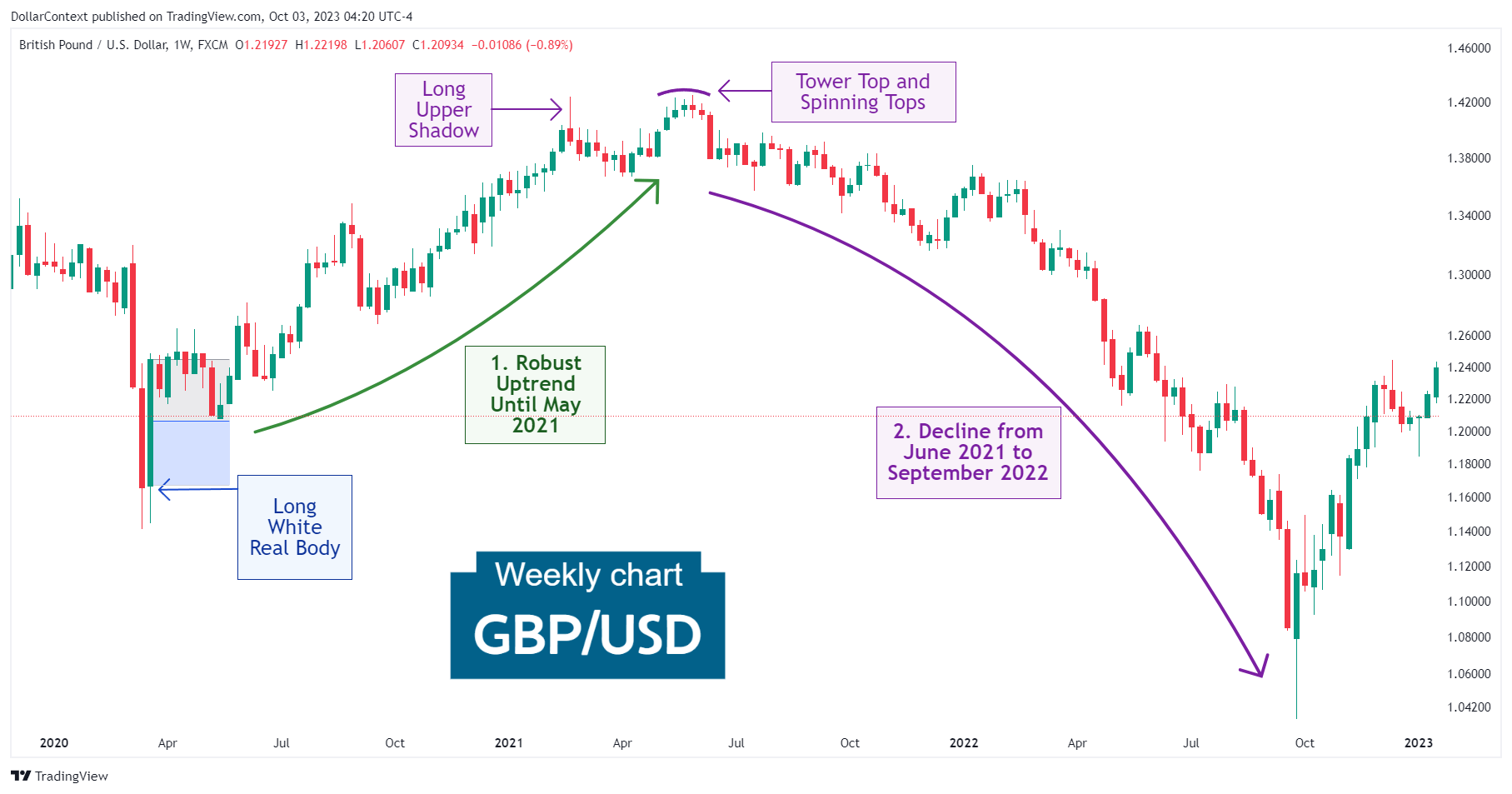

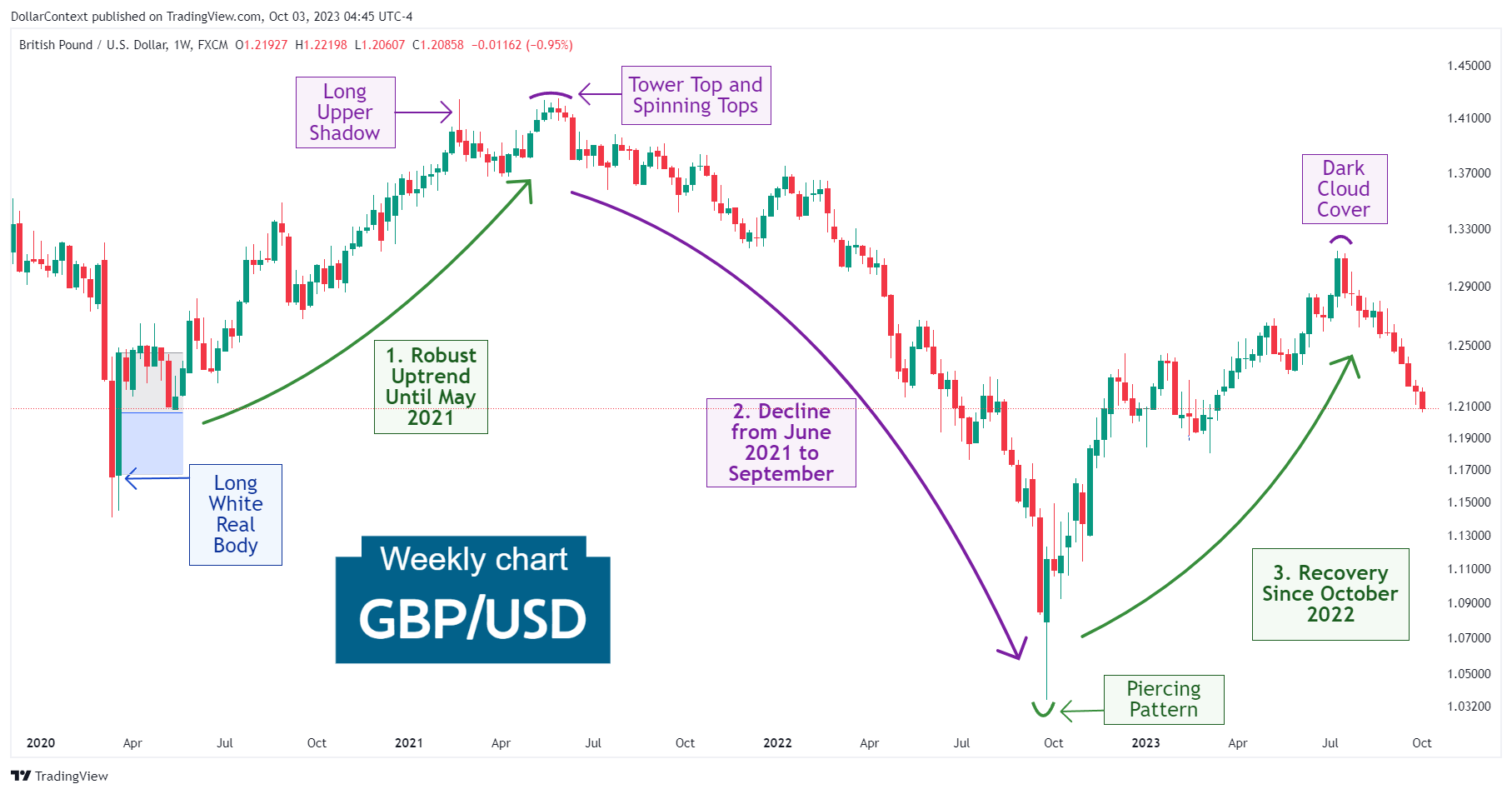

1. January 2020–May 2021: Robust Uptrend After the Pandemic's Volatile Period

In the initial months of 2020, as the pandemic took hold, a rush towards safe-haven assets along with prevailing market anxieties caused significant volatility in the GBP/USD market.

After the initial drop, the pair swiftly displayed a long white real body by the end of March 2020. Observe how a subsequent pullback halted at the midpoint of the substantial white/green body.

2. June 2021–September 2022: The Top and the Subsequent Decline

The GBP/USD pair gave its first sign of a potential top with a long upper shadow in February 2021. A few weeks later, the appearance of a tower top, which includes a series of spinning tops, reinforced the likelihood of a reversal.

3. October 2022–August 2023: Substantial Recovery

The extended decline halted in September 2022 via a piercing pattern which, given the extremely oversold conditions of the market, signaled the bottom and the subsequent reversal.

A dark cloud cover in July 2023 marked the beginning of a pullback of the upward trend.

4. Outlook for Late 2023 and Throughout 2024

The following perspective reflects expectations based on information and policy signals available at the time of writing.

Although the near-term direction of the GBP/USD pair is still unclear, various key factors have the potential to influence its upcoming trajectory:

- Influence of AI on Market Mood: The advent of artificial intelligence could tilt market sentiment, possibly favoring riskier assets like the GBP/USD.

- Worries About Economic Contraction: The Federal Reserve's aggressive rate-increase strategy, coupled with worrisome signs such as an inverted yield curve and other predictive economic indicators, points to the possibility of a global economic downturn in 2024. The U.S. dollar is commonly viewed as a "safe-haven" currency. During periods of global instability or geopolitical strife, investors may flock to the dollar.

- Rising National Debt: A significant increase in the federal budget deficit is fueling concerns about escalating public debt, which could impact the valuation of the USD in the near future.