USD/CAD: Evolution and Outlook

We'll examine the drivers that have shaped the USD/CAD since 2020 and conclude by discussing the pair's future movements.

This analysis reflects market conditions and information available at the time of publication (October 2023). It is provided for educational and historical context.

In this article, we will explore the major elements that have influenced the trajectory of the USD/CAD pair since 2020. We'll conclude by looking at factors that could impact the pair's movements going forward.

1. January 2020–May 2021: Strong Decline Following the Pandemic's Volatile Period

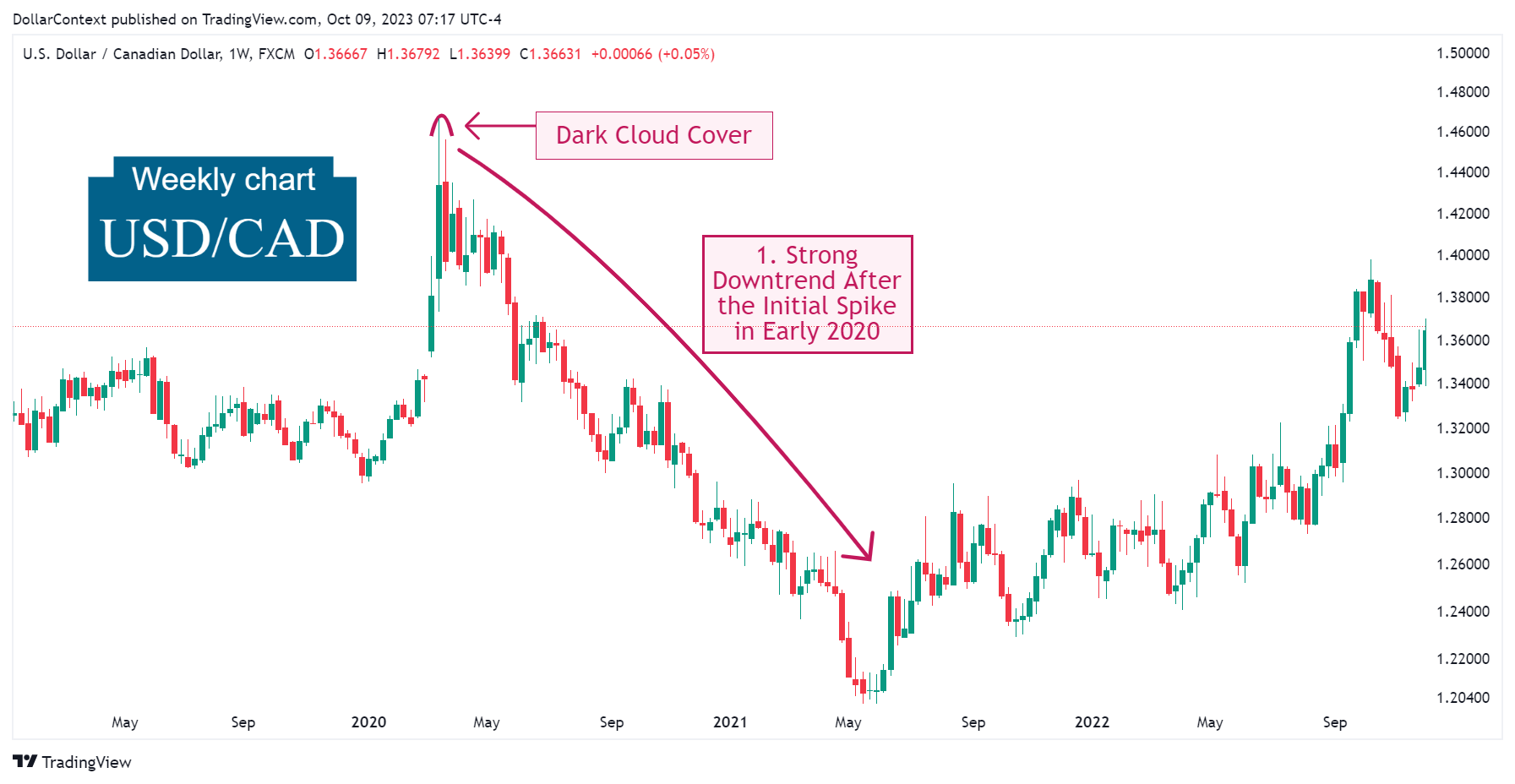

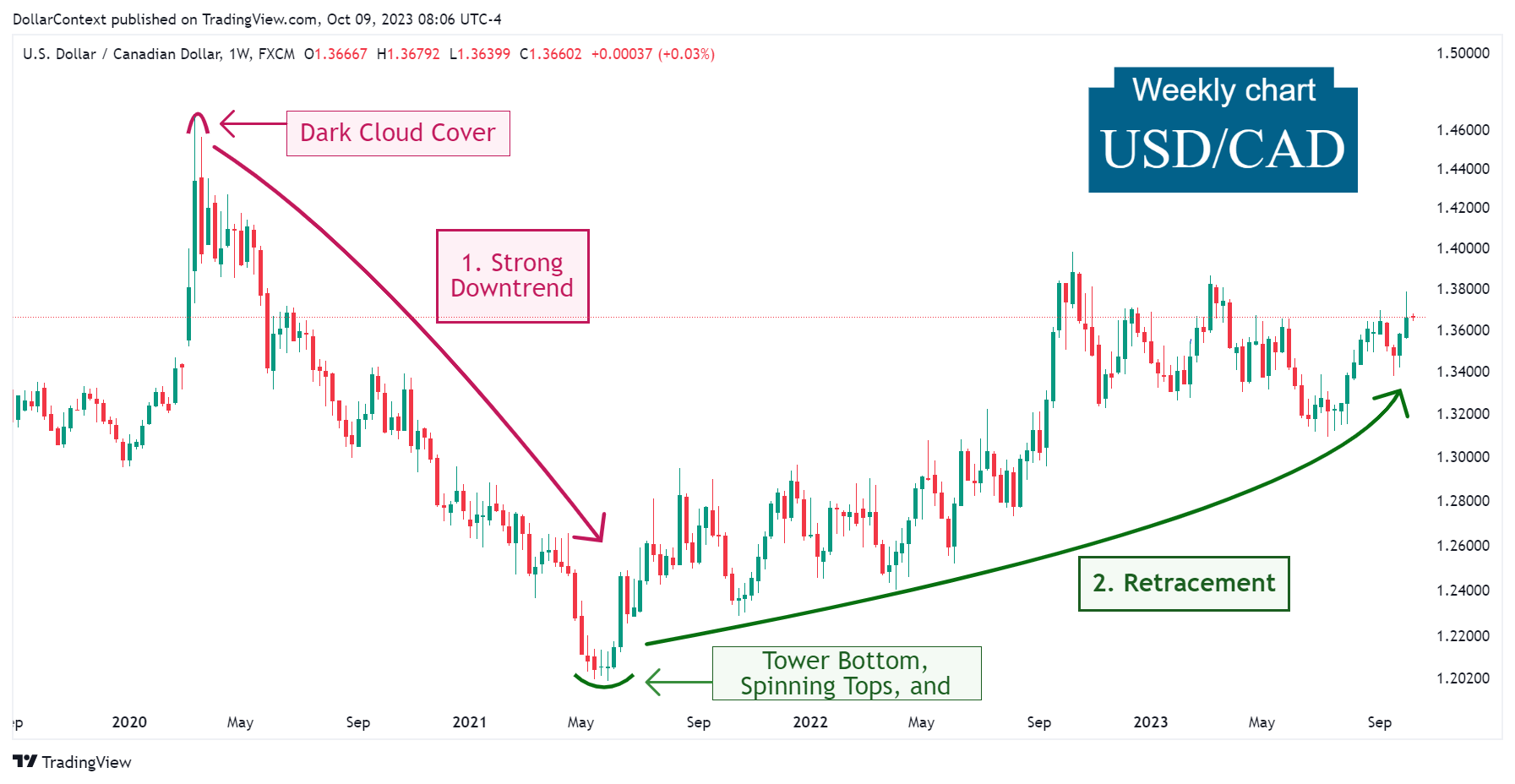

In the initial months of 2020, as the pandemic started to unfold, the demand for safe-haven assets like the U.S. dollar soared due to market uncertainty. This led to significant volatility in the USD/CAD exchange rate, culminating in a sharp price increase in March 2020.

Note the lofty dark cloud cover that marked the end of the spike in price, paving the way for the extended downtrend that followed.

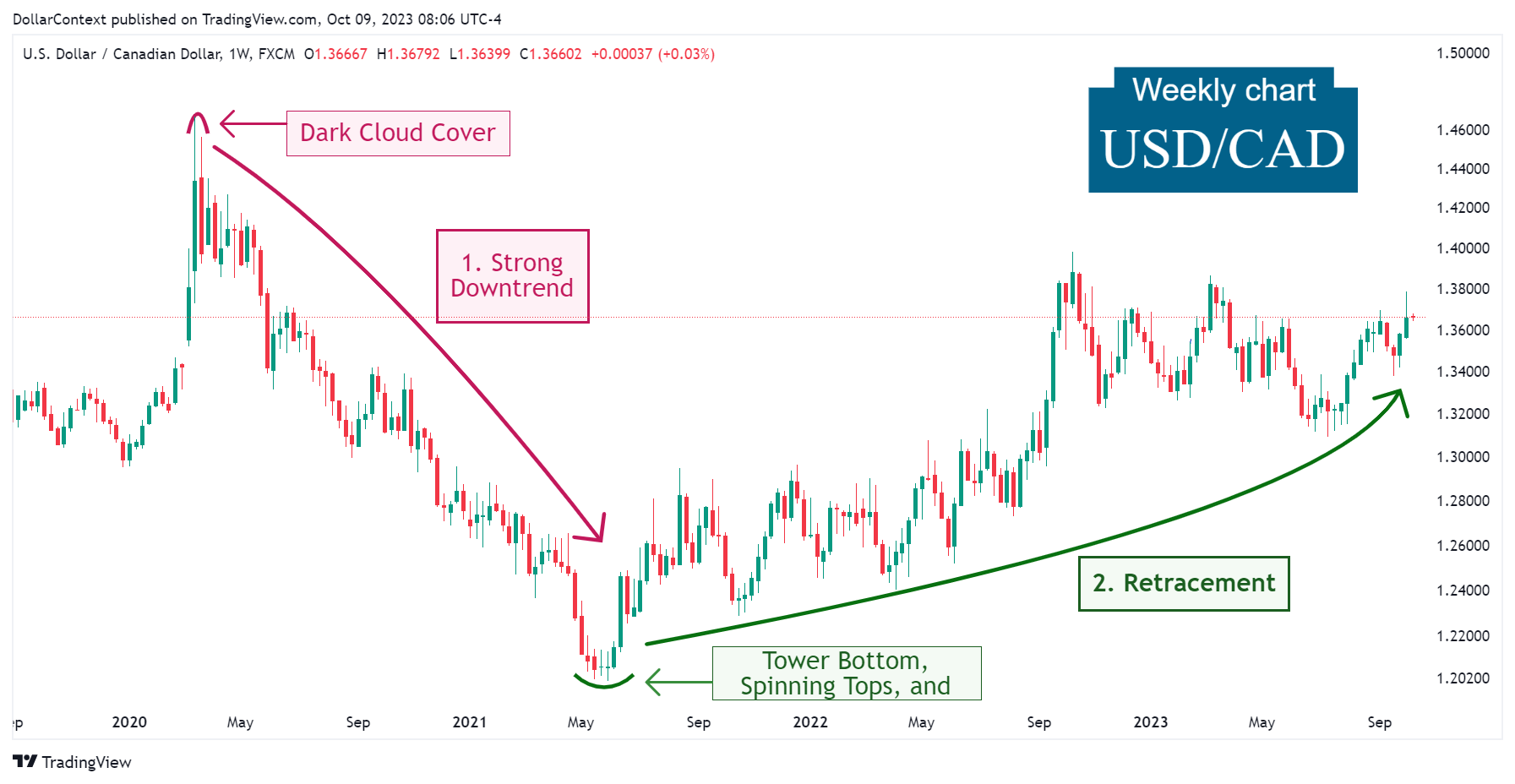

2. June 2021–September 2023: The Bottom and the Ensuing Upturn

Between April and June 2021, the USD/CAD displayed a tower bottom. A series of doji and spinning top sessions within this period reinforced the probability of a bullish reversal. This is what unfolded in Summer 2021 when the pair initiated a significant uptrend.

The Federal Reserve's hiking cycle initiated in April 2022 and the subsequent decline in commodity prices contributed to sustain the upward momentum of the USD/CAD.

3. Outlook for Late 2023 and Throughout 2024

The following perspective reflects expectations based on information and policy signals available at the time of writing.

While the immediate trajectory of the USD/CAD pair is unclear, there are several key factors that could influence its future direction:

- AI's Influence on Market Mood: Technological advancements in Artificial Intelligence could affect market sentiment, potentially making the U.S. dollar, a riskier asset, less attractive.

- Economic Slowdown Worries: Factors like the Federal Reserve's assertive rate increases and warning signs like an inverted yield curve hint at the potential for a global economic downturn in 2024. In such volatile conditions, investors often gravitate towards the U.S. dollar as a "safe-haven."

- Escalating National Debt: Rising concerns about the expanding federal budget deficit could have implications for the USD's value in the short and medium term.