Is a Soft Landing Possible?

Instead of a soft landing, a "hard landing" scenario will come to fruition at some point. When? While the timing is uncertain, the collapse may be delayed until somewhere next year.

Influencing investors’ decisions and actions, the prevailing narrative of an upcoming recession has had an impact on market sentiment. This rhetoric is primarily based on three pillars.

- Aggressive hiking cycle from the Fed, increasing rates from 0% to over 5% in less than 15 months—from March 2022 until June 2023.

- Deeply inverted yield curve since July 2022.

- Significant deterioration of leading indicators, such as PMI and consumer confidence.

This narrative, however, has recently been toned down by a new variation of it: the soft landing scenario. A number of factors have contributed to embracing this new version of the story:

- The US labor market continues to demonstrate resilience.

- The Federal Reserve has been successfully taming inflation, at least for now.

- The stock market keeps edging higher.

Is This Time Different?

Historically, the three signals mentioned above (hiking cycle, deterioration of leading indicators, and inverted yield curve) have always signaled a severe recession.

Each time a yield curve inverts while other market indicators present conflicting signals, the phrase "this time is different" gains popularity among journalists, analysts, and market players. Despite the lessons of the past, each generation seems to believe that their era holds unique circumstances.

The Bull Market in Equities

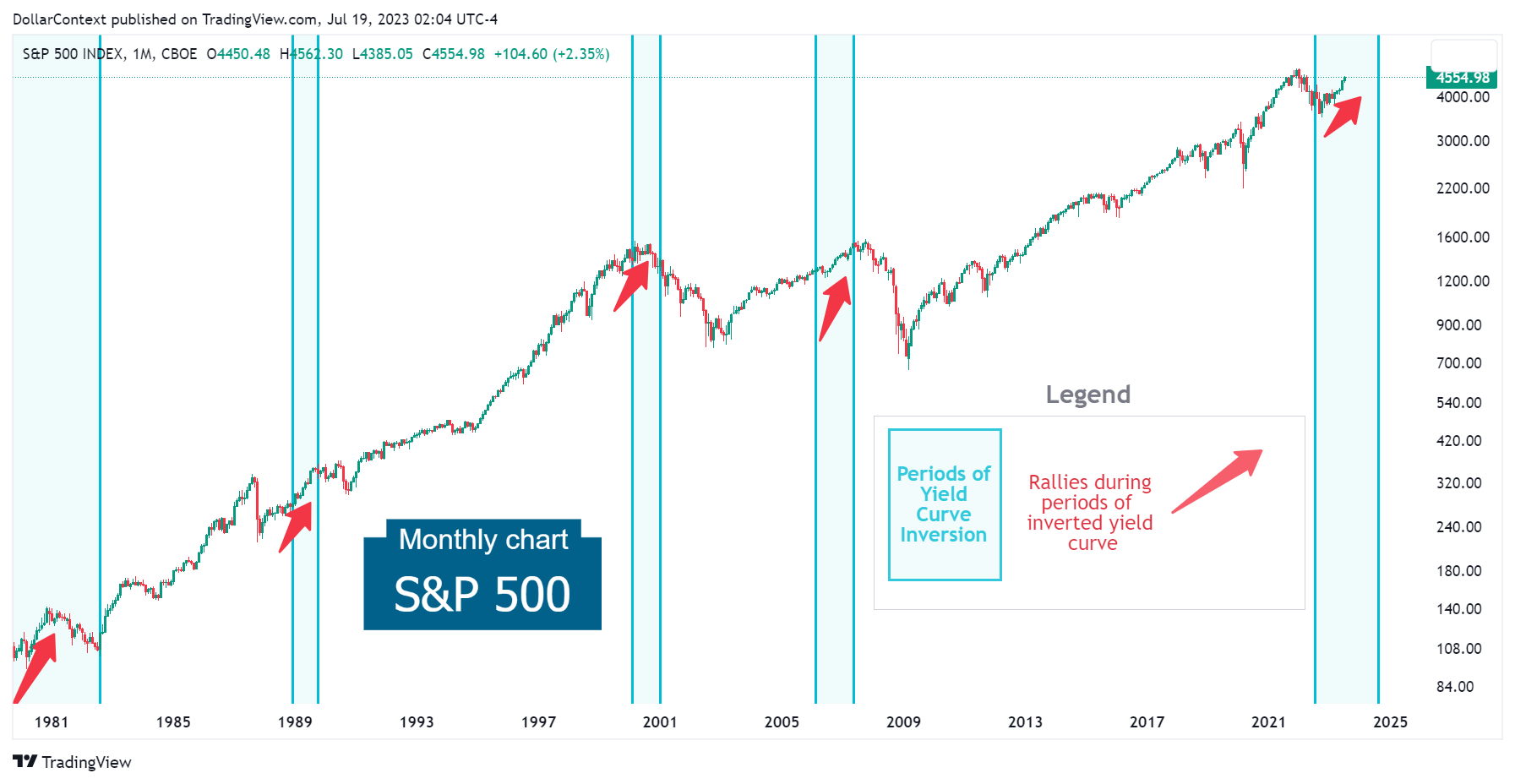

As you can see below, during either the first half or the whole period of a yield curve inversion, the stock market tends to go higher.

Employment

When considering the US job market, it's essential to remember that the effects of a hiking cycle take time to spread throughout the real economy. In other words, employment market indicators are lagging indicators, providing information in retrospect but lacking the ability to forecast recessions. Similarly, they shouldn’t be used to invalidate predictions of economic downturns.

The Timing (Not This Time) Is Different

In our opinion, instead of a soft landing scenario, a "hard landing" scenario will come to fruition at some point. When? While the timing is uncertain, the collapse may be delayed until somewhere next year.

The surge in AI enthusiasm appears to be a key catalyst that could propel the current equity rally to new all-time highs. It is important, nevertheless, to remain cautious. A significant economic downturn may be on the horizon, eventually affecting both the general economy and the stock market.