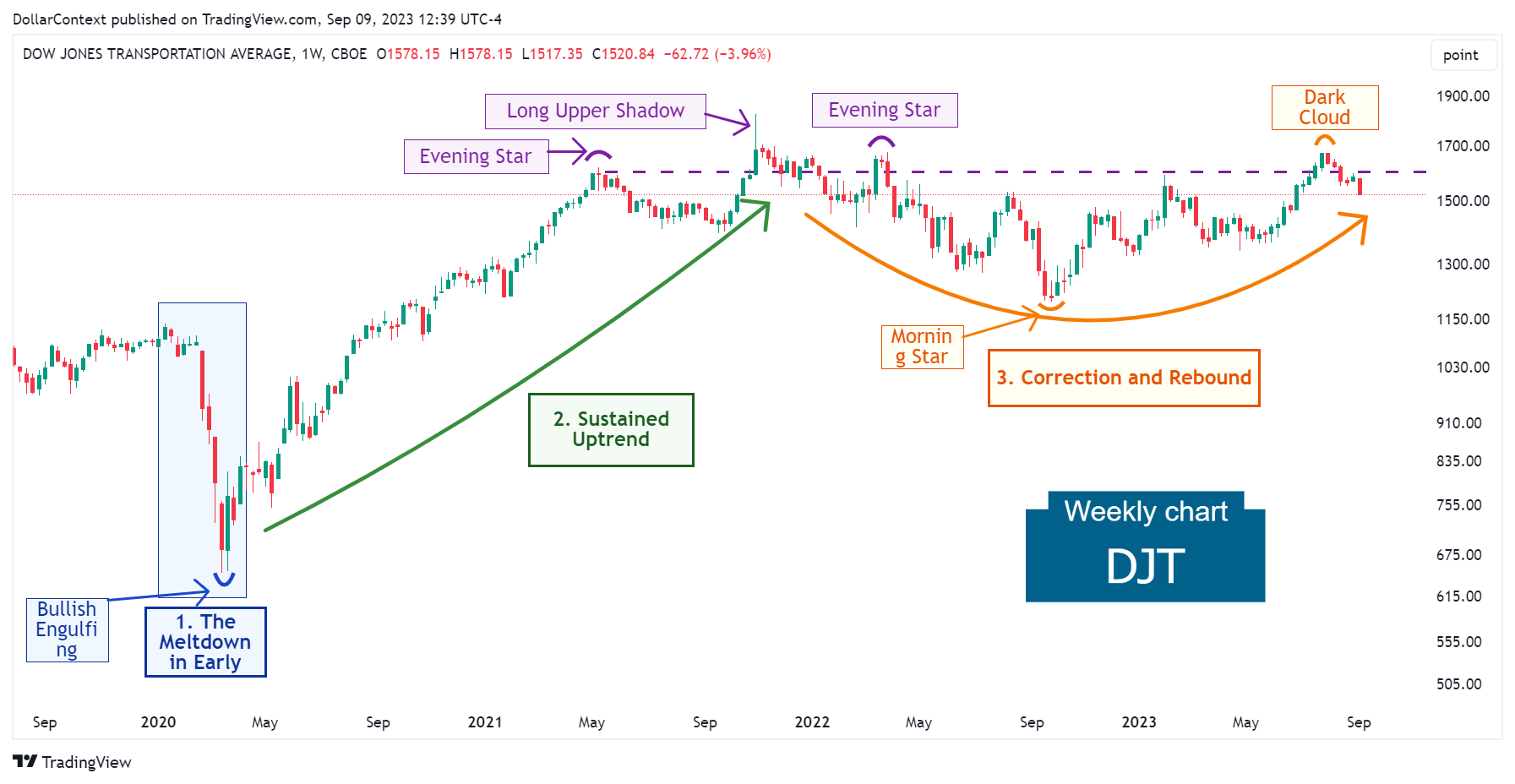

Dow Transports (DJT): Evolution and Outlook

We explore the forces that have shaped the course of the DJT since 2020 and provide our view on the potential drivers that might influence this market moving forward.

The Dow Jones Transportation Average (DJT) has several major companies representing railroads, airlines, trucking, and shipping. This index is often used as a barometer for the health of the broader economy since transportation companies tend to be sensitive to economic conditions.

We'll discuss the forces and factors that have influenced the direction of the Dow Jones Transportation Average since 2020. We'll conclude with our perspectives on the possible elements that could impact this market in the future.

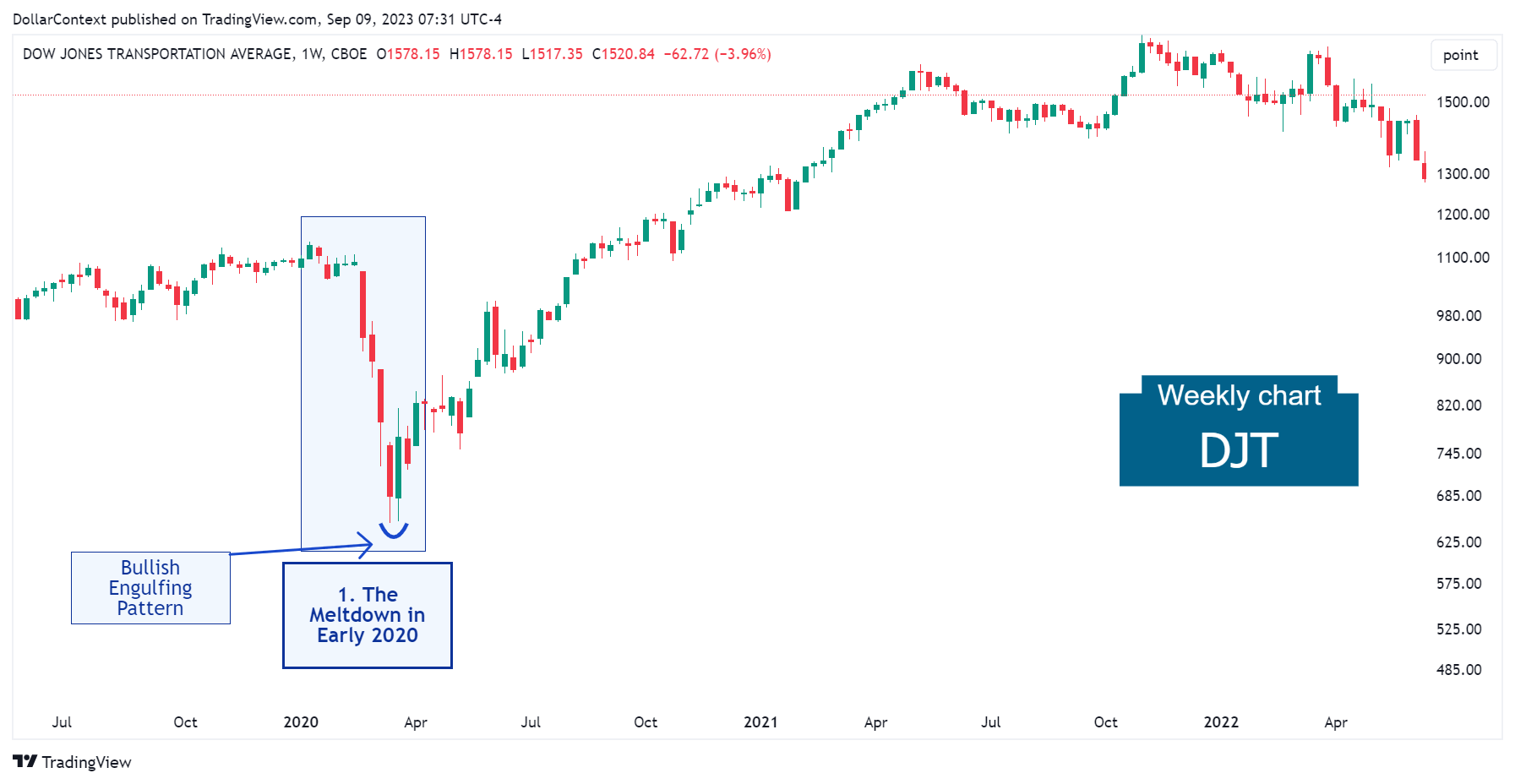

1. January 2020–March 2020: The Pandemic's Chaotic Period

In the early months of 2020, the DJT underwent significant fluctuations. The market initially plummeted, but then began a swift rebound towards the close of the first quarter. Various elements steered the course of the DJT during this timeframe:

- COVID-19 Pandemic: The onset of the COVID-19 pandemic severely impacted global travel and trade, causing major disruptions to airlines, railroads, and shipping companies. The lockdowns and travel bans greatly affected demand.

- Oil Prices: In early 2020, there was a significant decline in oil prices, partly due to a price war between major producers and the reduced demand stemming from the pandemic. This had a complex effect on transportation companies. While lower fuel prices can benefit transportation companies by reducing costs, the broader economic implications and reduced travel hindered potential benefits.

- Economic Slowdown: Concerns about a global recession were growing even before the pandemic due to various factors. The pandemic exacerbated these fears, leading to decreased consumer demand and business activities, which directly impacted transportation.

- Supply Chain Disruptions: Global supply chains were severely affected by the pandemic. Factory shutdowns, especially in major manufacturing hubs like China, impacted the volume of goods being transported.

- Consumer Behavior: As more people started working from home and reduced their travel, there was a drop in demand for certain transportation services, especially airlines. On the other hand, there was a surge in e-commerce, which boosted some logistics and delivery companies.

Based on candlestick analysis, the subsequent chart demonstrates that the sharp decline at the end of March 2000 culminated in a bullish engulfing pattern. This candle configuration also marked the beginning of a robust uptrend.

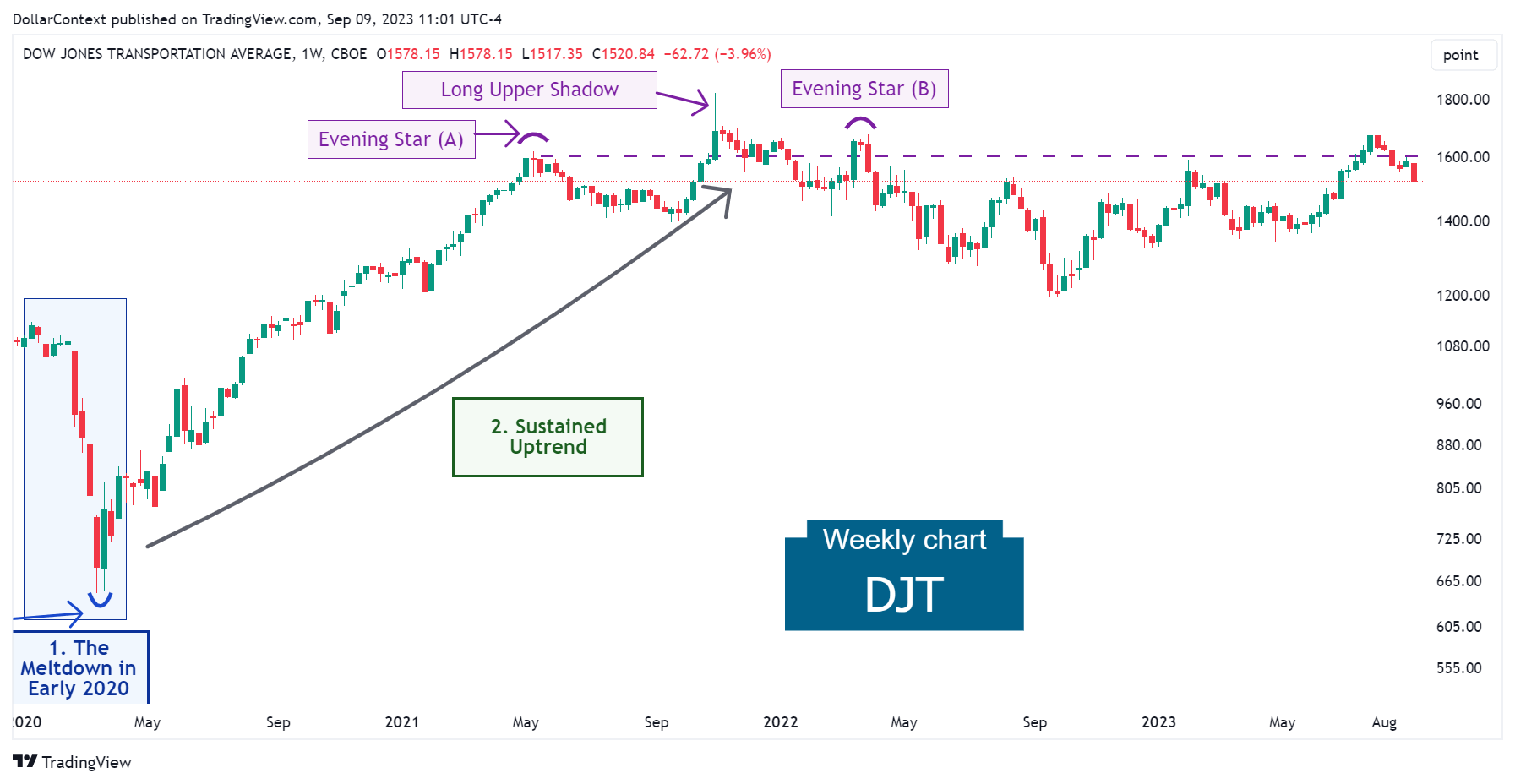

2. April 2020–March 2022: Climbing to Unprecedented Peaks

In the closing months of 2020, a glimmer of hope surfaced as the market regained its footing and the Dow Jones Transportation Average index embarked on a swift rebound that extended until early 2022. Several elements fueled this ascending trajectory:

- Government Stimulus and Interventions: Governments around the world introduced various fiscal stimulus measures to combat the economic slowdown. These measures had implications for different sectors, including transportation.

- Vaccine Optimism: As 2020 drew to a close, encouraging updates about the progress and imminent approval of COVID-19 vaccines infused hope. The anticipation of a gradual return to normalcy, driven by vaccine distributions, bolstered market confidence.

- Economic Recovery: Following the initial shockwaves of the pandemic, the economy began to exhibit signs of a progressive recovery. Consequently, the travel and transportation sectors, pivotal to the movement of goods, also witnessed a rebound.

As the global economy showed signs of stabilizing and steadily recovering in 2021, the DJT maintained its ascending trajectory.

Technically speaking, the rally beginning in the second quarter of 2020 gave its first sign of peaking with the evening star labeled as "A" in May 2021. An upthrust via a long upper shadow tested the highs of evening star "A" in November. Finally, another evening star in March 2022 confirmed the top before the correction.

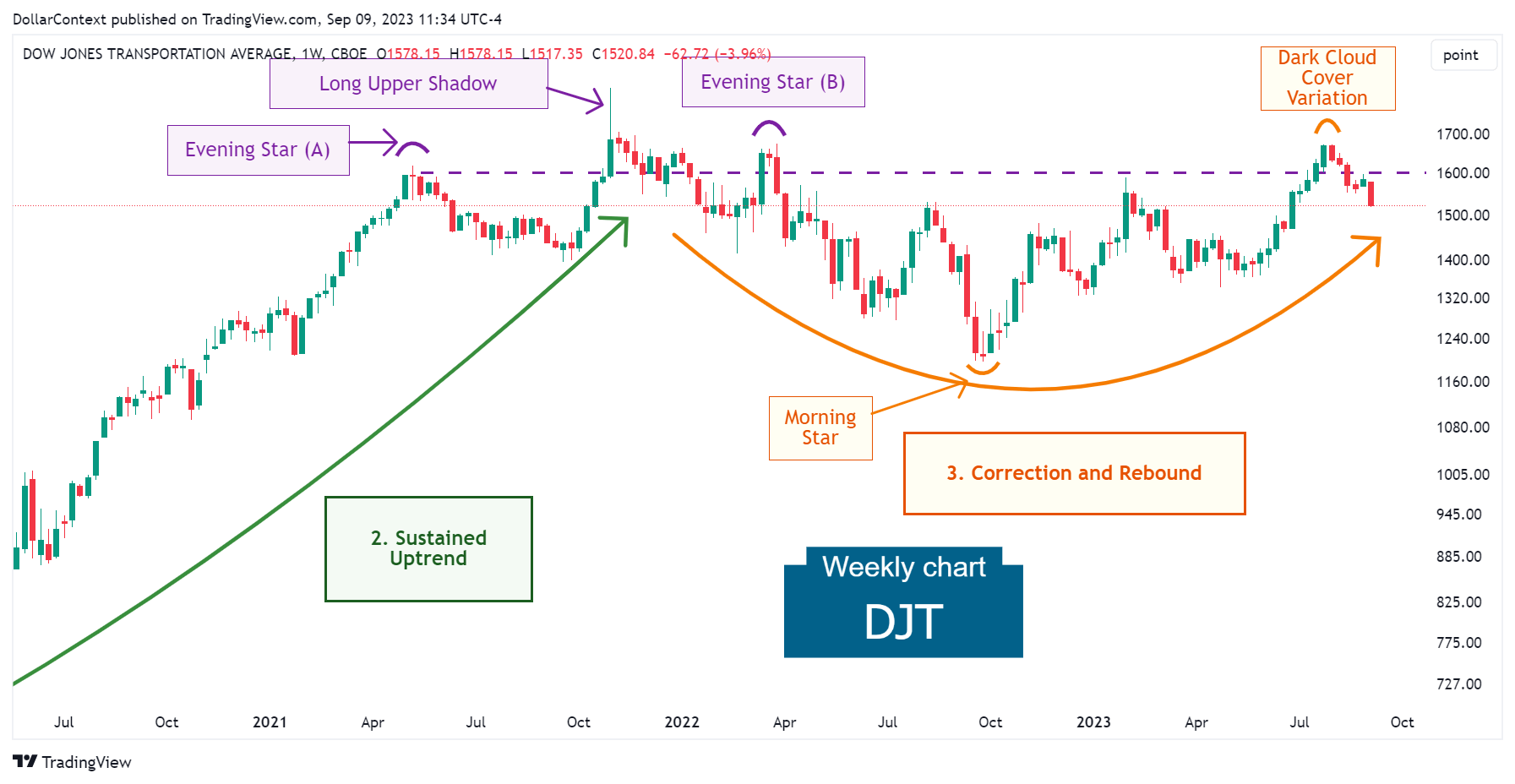

3. April 2022–August 2023: The Adjustment and Subsequent Return to the Highs

Rising inflation signals prompted the Federal Reserve to initiate a robust series of interest rate increases, designed to combat inflation and moderate economic growth.

The central banks' move towards tighter policies resulted in a bearish sentiment in the equity market. This mood was reflected in a notable downturn in the Dow Jones Transportation Average index.

In a climate dominated by heightened bearish market sentiment, the DJT's correction culminated with a morning star pattern in October 2022. This was followed by a surge to previous peaks, which was then interrupted by a variant of the dark cloud cover pattern, halting the rally at a crucial resistance point previously established by evening stars "A" and "B".

4. Outlook for Late 2023 and Throughout 2024

While the immediate outlook is still unclear, several key considerations should be noted as we move ahead:

- Risks of an Economic Slowdown: The Federal Reserve's aggressive interest rate increases, along with worrisome signs such as the inverted yield curve, suggest a possible economic slump in 2024. As mentioned before, transportation companies are especially vulnerable to economic downturns.

- Market Reactions to Yield Curve Inversion: Past trends indicate that the demand for high-risk assets, such as equities, often stays robust either at the onset or during a yield curve inversion. The move to more secure assets and the ensuing drop in equities typically materialize in the latter stages, often when the curve initiates or finalizes a "reinversion".

- AI's Role in Boosting Productivity: In the era of artificial intelligence (AI), its potential to elevate efficiency and bolster productivity is becoming a significant motivator for the rising inclination towards equities and equity indexes, such as the DJT.