U.S. Equity Markets: Evolution and Outlook

We'll explore the dynamics that have shaped the course of the major U.S. equity indices and provide insights about the potential future of this market.

In this post, we'll explore the intricacies and dynamics that have shaped the course of the major U.S. equity indices, including the Dow Jones Industrial Average, Dow Jones Transportation Average, S&P 500, Russell 2000, Nasdaq 100, and Nasdaq Composite, since 2020. We'll conclude by offering insights into the anticipated factors that may influence these markets going forward.

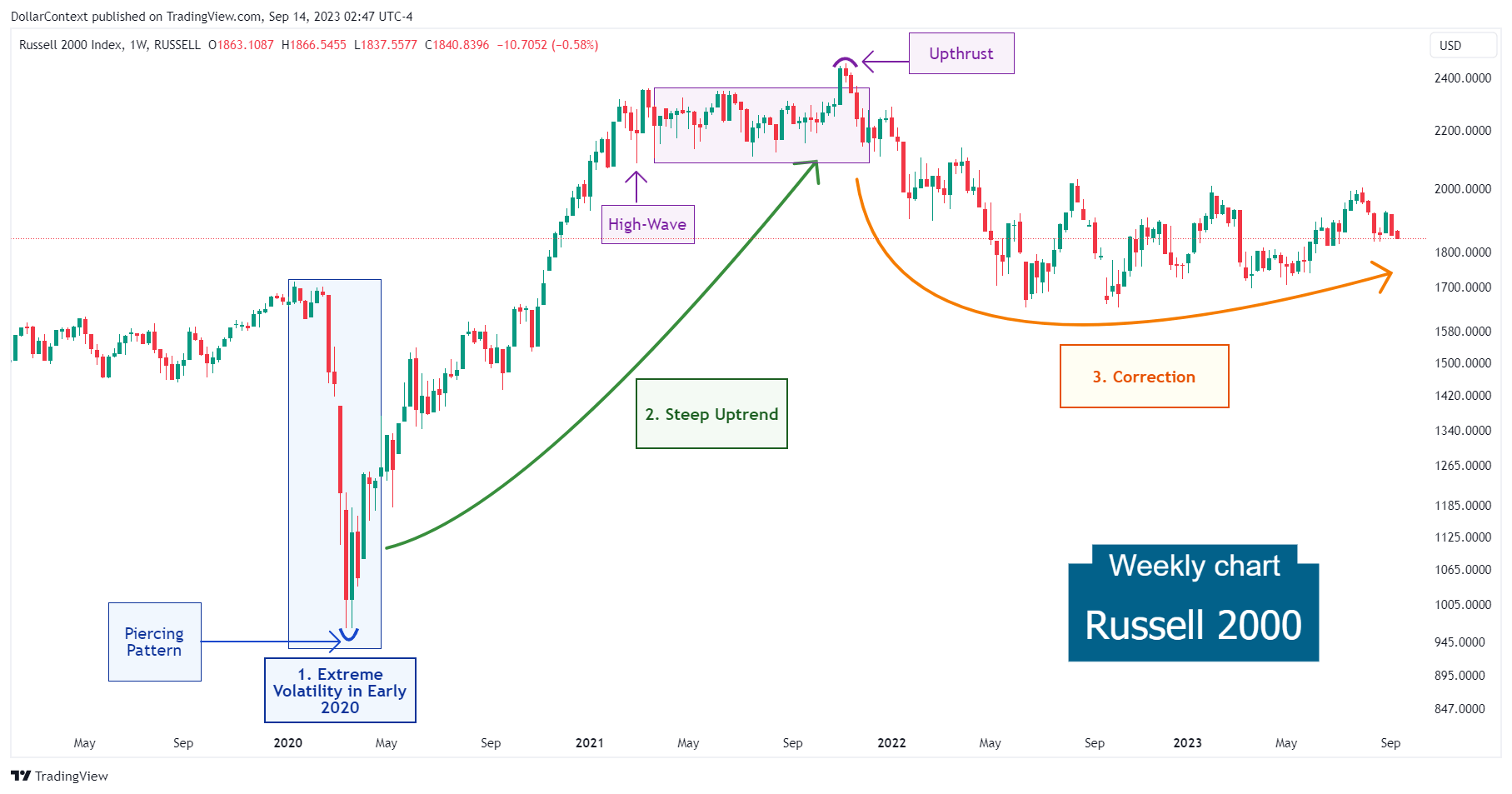

1. First Half of 2020: Wild Moves in the Stock Market

At the onset of 2020, U.S. equity markets underwent notable turbulence, largely attributed to the unexpected ramifications of the COVID-19 pandemic. Throughout this phase, several elements crucially shaped this market:

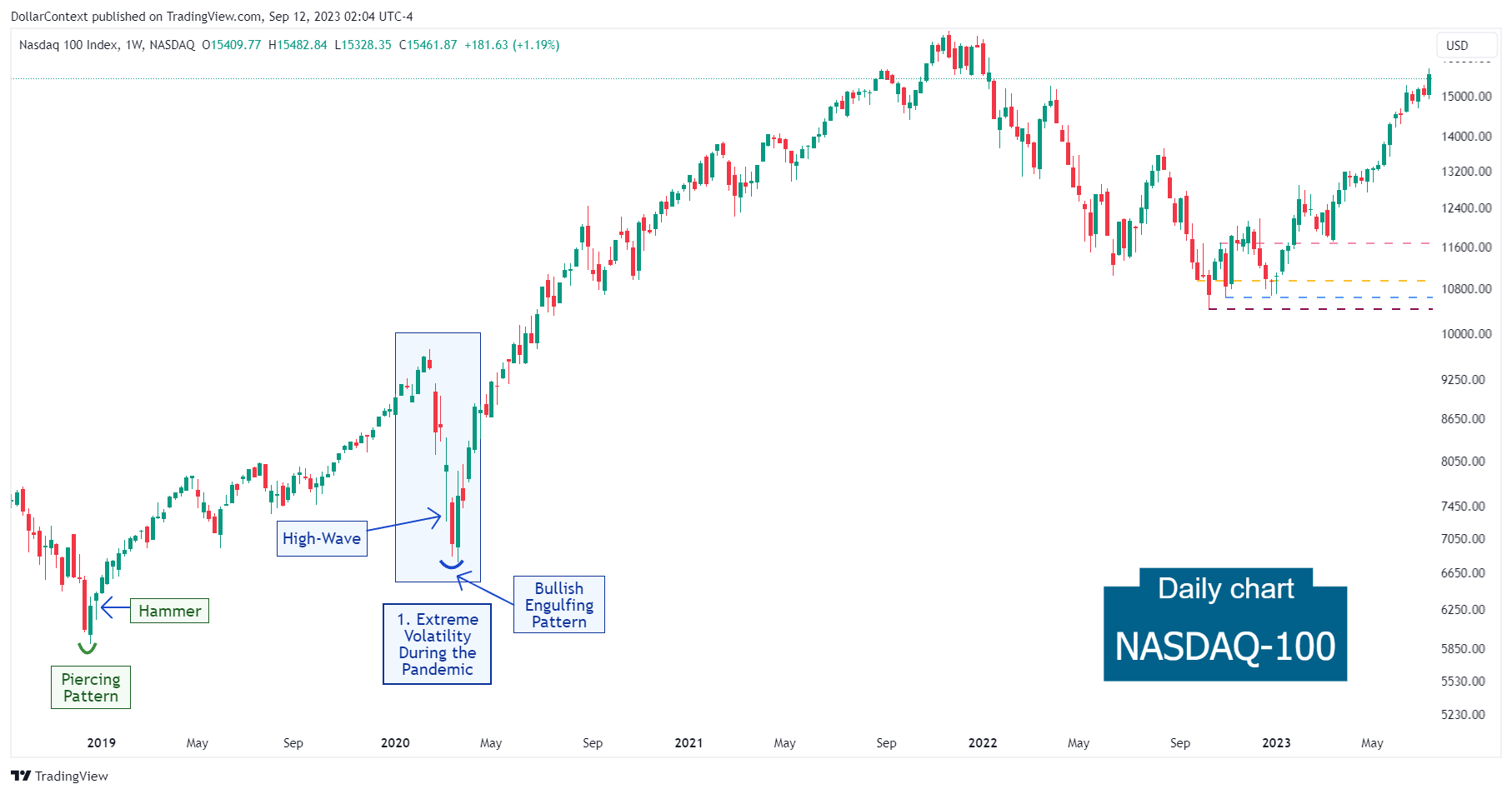

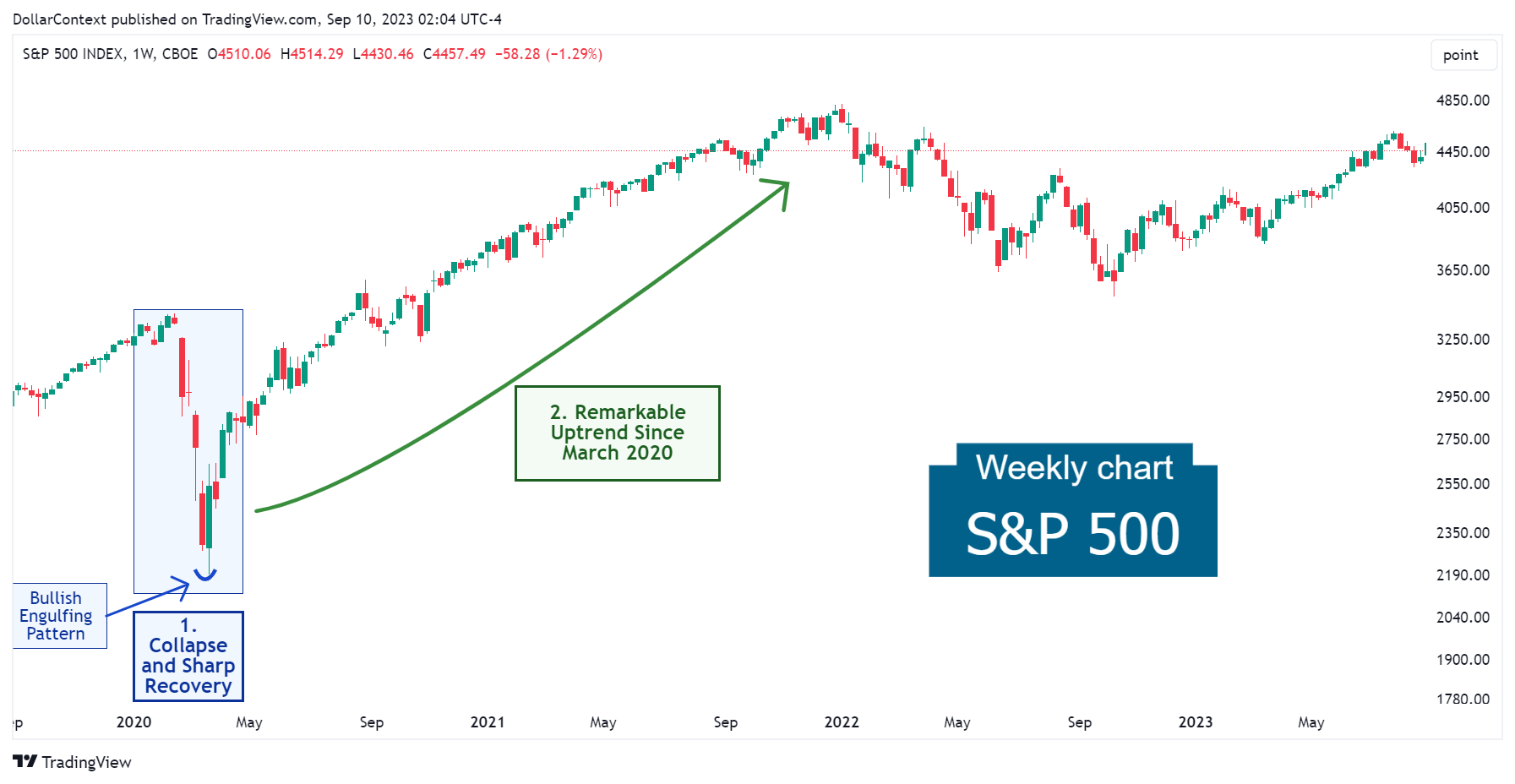

- COVID-19 Pandemic: The most significant factor, the emergence of the COVID-19 pandemic in early 2020 and its rapid global spread, led to unparalleled market volatility. As the severity of the virus became apparent, concerns about its impact on the global economy prompted massive sell-offs in February and March.

- Economic Shutdowns: To combat the spread of the virus, large portions of the U.S. economy were shut down, leading to business closures and significant economic contraction.

- Unemployment: The shutdowns resulted in a dramatic surge in unemployment, with millions of Americans filing for unemployment benefits, reaching levels not seen since the Great Depression.

- Government and Federal Reserve Response: In response to the crisis, the U.S. government passed significant fiscal stimulus packages, including the CARES Act. Additionally, the Federal Reserve implemented various measures to support the economy, such as slashing interest rates to near zero and launching extensive bond-buying programs.

- Recovery and Tech Rally: Despite the dramatic downturn in February and March, the U.S. stock market experienced a swift recovery in the subsequent months, largely led by the technology sector. Big tech companies, like Apple, Amazon, Microsoft, and Alphabet, saw their stock prices rise significantly as they were perceived to be beneficiaries of the "stay-at-home" and "work-from-home" economy.

- Uncertainty: The overall sentiment in H1 2020 was dominated by uncertainty. Not just about the trajectory of the virus, but also about the efficacy of government responses, the potential for further economic disruptions, and geopolitical tensions, including U.S.-China relations.

- Sector Rotation: While tech stocks soared, many traditional sectors like travel, hospitality, and certain retail sectors were severely affected due to the pandemic. On the other hand, sectors like healthcare, technology, and consumer staples were more resilient.

This period will be remembered for its swift market downturn followed by an equally rapid recovery, led initially by the technology sector.

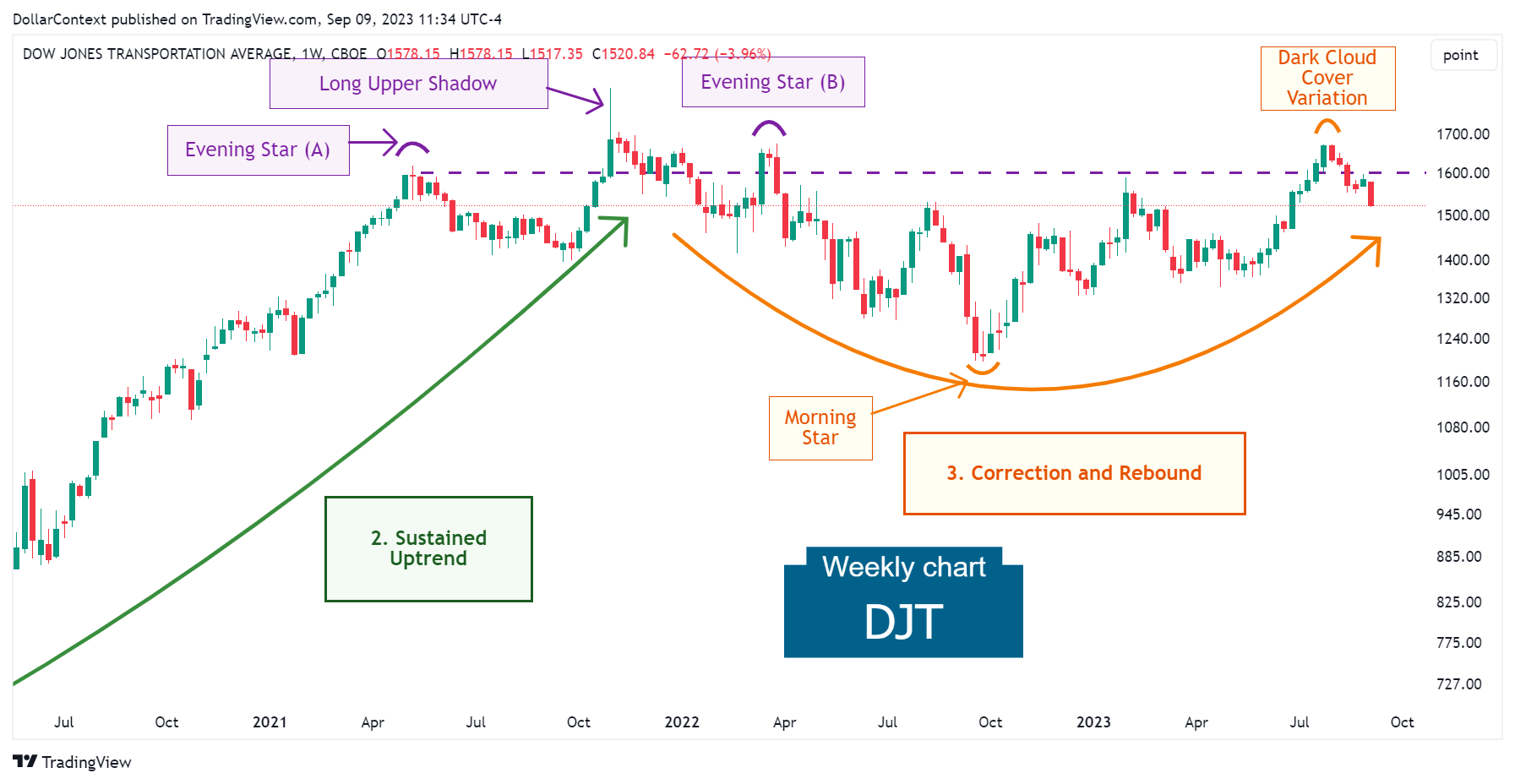

2. Mid-2020 to Late 2021: The Resilient Bull Run

As 2020 progressed, a glimmer of hope shone through when the market began to stabilize, paving the way for a solid upward trend. Several key elements fueled this bullish trajectory:

- Surge in Tech Stocks: The pandemic took a toll on numerous sectors, but tech giants like Apple and Microsoft flourished. The rise of remote work trends and e-commerce growth played pivotal roles in this boost.

- Anticipation Around Vaccines: As 2020 neared its close, encouraging news about the progress and potential authorization of COVID-19 vaccines uplifted market spirits. The possibility of resuming normal activities with vaccine distributions bolstered market optimism.

- Central Bank Interventions and Fiscal Stimulus: In the second half of 2020, the Federal Reserve implemented significant liquidity measures. This involved buying government and mortgage-backed securities, funneling fresh funds into the markets. The overarching goal was to foster market resilience, promote lending, and cushion the pandemic's economic repercussions. Through these liquidity provisions, the Federal Reserve aimed to keep financial institutions operational to aid the economic rebound.

As the global economy showed signs of steadying and inching towards recovery in 2021, most equity assets maintained its ascendant course.

3. January 2022–August 2023: The Retreat and Subsequent Return to the Highs

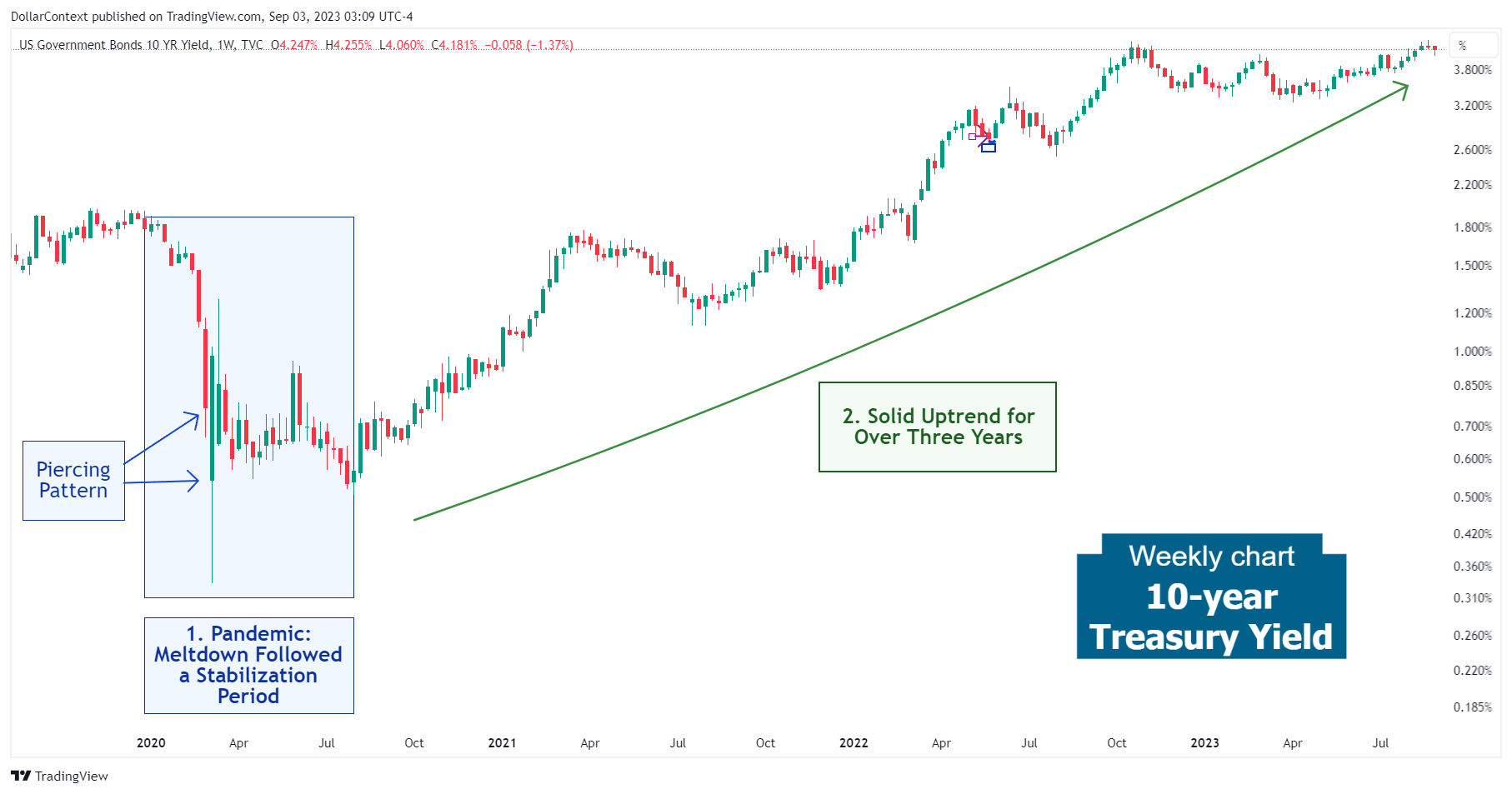

Rising inflation metrics prompted the Federal Reserve to initiate a robust series of interest rate increases, targeting inflation control and tempering economic expansion.

This move towards tighter monetary policies by central banks introduced a wave of uncertainty in the equity market, which was evident in major U.S. indices.

In an environment dominated by intense bearish sentiment, the majority of U.S. indices rallied, approaching their former peaks. This rebound was, in part, fueled by the onset of the artificial intelligence (AI) era and the firms active within this domain.

The Russell 2000 stood as an exception to this rally towards previous peaks. This index predominantly remained near the correction's lows for a prolonged duration.

4. A Glimpse into Late 2023 and 2024's Prospects

Several elements may play a pivotal role in shaping the direction of equity markets in the medium term:

- Risk of Economic Downturn: The Federal Reserve's assertive stance on rate hikes, alongside alarming indicators like the inverted yield curve, suggests potential economic challenges in 2024. In recessionary times, investors often shift their portfolios from equities to more secure assets.

- Equity Market's Response to Yield Curve Inversion: Historical trends show that the appetite for equities tends to stay solid either when a yield curve inverts or during its inversion. A move to more dependable assets and the subsequent equity offload generally occur later on.

- AI's Role in Boosting Efficiency: The dawn of the artificial intelligence (AI) age, and its capacity to significantly uplift efficiency and productivity, could foster a sustained preference for equities.