CANDLESTICK

Understanding the Psychology of a Dark Cloud Cover

This sudden reversal surprises those participants who had been expecting the upward trend to continue.

CANDLESTICK

This sudden reversal surprises those participants who had been expecting the upward trend to continue.

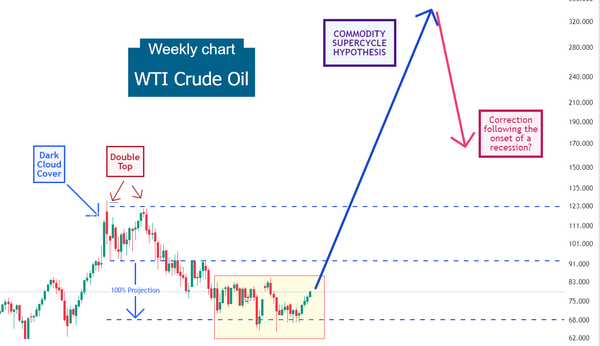

CRUDE OIL

Starting in 2020, the commodity market may have entered a supercycle phase. Such supercycles usually extend beyond 8 years and lead to substantial price escalations.

CANDLESTICK

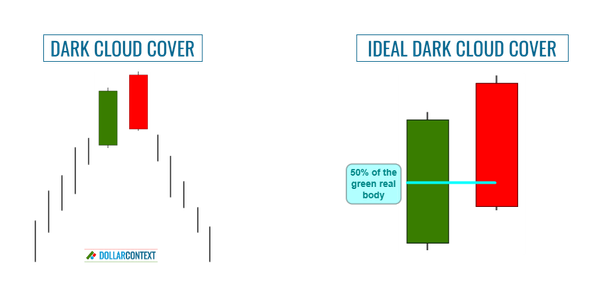

For an optimal dark cloud cover, the second session should ideally conclude below the midpoint of the preceding white/green candle.

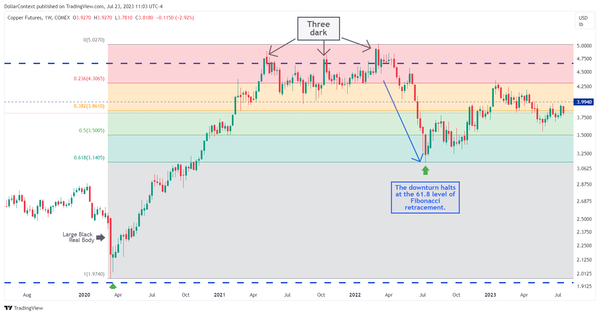

COPPER

Scenario 1. Since 2020, the commodity market might have been going through a supercycle. Scenario 2. Copper could be undergoing a brief correction phase before retesting the lows of 2022. The catalyst for this scenario might be a recession expected to materialize in 2024.

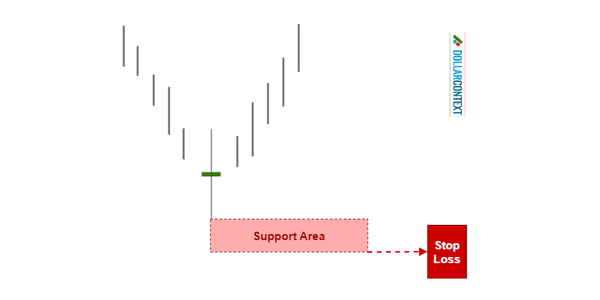

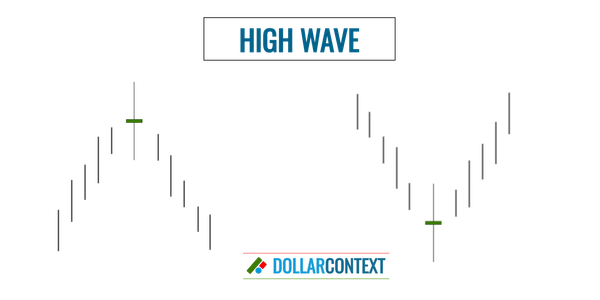

HIGH-WAVE

The high-wave candle is characterized by its distinct long upper and lower shadows, which are significantly longer than the candle's real body.

AI

Artificial intelligence (AI) is revolutionizing the economy by substantially enhancing efficiency and productivity. That is, we are witnessing the early phases of what could very well become a transformative era in our history.

HIGH-WAVE

After a downtrend, the lowest price reached during the high-wave’s session sets up a support level.

GDP

Instead of a soft landing, a "hard landing" scenario will come to fruition at some point. When? While the timing is uncertain, the collapse may be delayed until somewhere next year.

CANDLESTICK

A high-wave candle reflects equilibrium, indecision, and volatility: a tug of war between buyers and sellers signaling a reversal or transition.

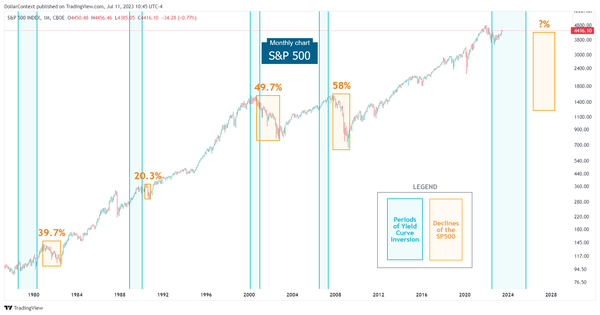

SP500

While we expect a recession, probably at some point next year, we believe that the market will continue to rise for the next few months.

CANDLESTICK

High-wave candles are reversal patterns that appear at the end of a strong trend. They have long upper and lower shadows, and their real bodies are frequently small.

SP500

The SP500 typically experiences a decline within a range of 6 to 18 months after reaching the low point of the yield curve. The magnitude of these declines range approximately from 20% to 60%.