GASOLINE

Gasoline Prices: Evolution and Outlook

In this article, we'll explore the fundamental and technical dynamics shaping the trajectory of gasoline prices since 2020. In conclusion, we'll discuss potential trends in this market.

GASOLINE

In this article, we'll explore the fundamental and technical dynamics shaping the trajectory of gasoline prices since 2020. In conclusion, we'll discuss potential trends in this market.

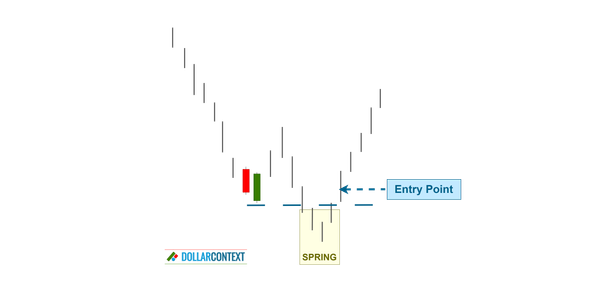

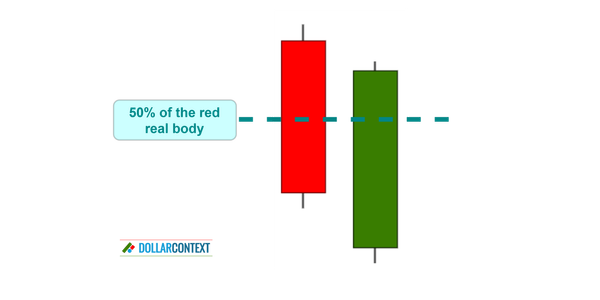

CANDLESTICK

When a piercing pattern emerges, it signals a potential bullish reversal. Here are different options for entry points after this pattern.

BRENT

We delve into the core dynamics shaping the direction of Brent crude prices since 2020 and discuss possible future developments in this market.

NATGAS

We explore the factors that have impacted natural gas prices since 2020, and detail our view on future trends in this market.

CANDLESTICK

Understanding the psychology behind the piercing pattern requires dissecting its two-candle formation and the investor sentiment driving each candlestick.

CANDLESTICK

A piercing pattern is a two-candle combination that occurs at the end of a downtrend, signaling a potential bullish reversal.

COMMODITIES

We explore the trends that have molded metal prices since 2016 and offer our perspective on possible upcoming shifts in these markets.

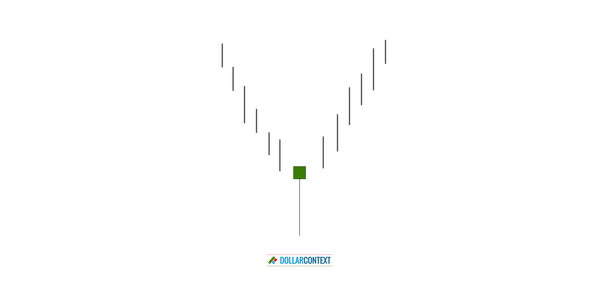

HAMMER

Today, we're going to explore a crucial pattern in the realm of Japanese candlestick analysis: the hammer.

LEAD

We cover the factors and changes influencing lead prices post-2015. We'll wrap up with our insights on potential future trends in this market.

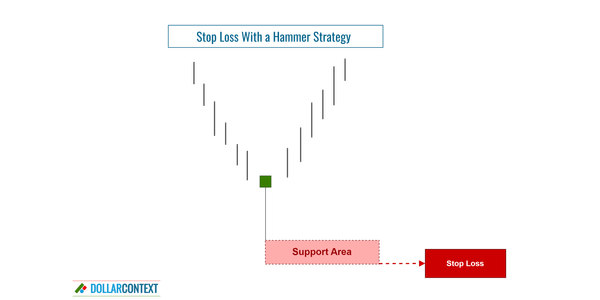

HAMMER

Set the stop-loss level below the low of the hammer pattern to protect against potential downside risk.

NICKEL

We discuss the drivers that have shaped the nickel market since 2016, and we share our perspective on possible upcoming trends in this market.

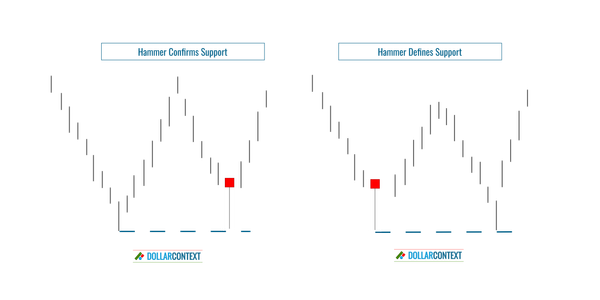

HAMMER

A hammer creates a support area or confirms the credibility of a previously identified support zone.