Case Study 0013: Various Long Lower Shadows Herald a Bottom (Natural Gas)

In this article, we will examine the performance of the natural gas market after the emergence of a series of long lower shadows.

Data Sheet

- Reference: CS0013

- Security: Natural Gas

- Timeframe: Hourly Chart (October 20, 2023)

- Patterns:

- Long Lower Shadow

- Hammer

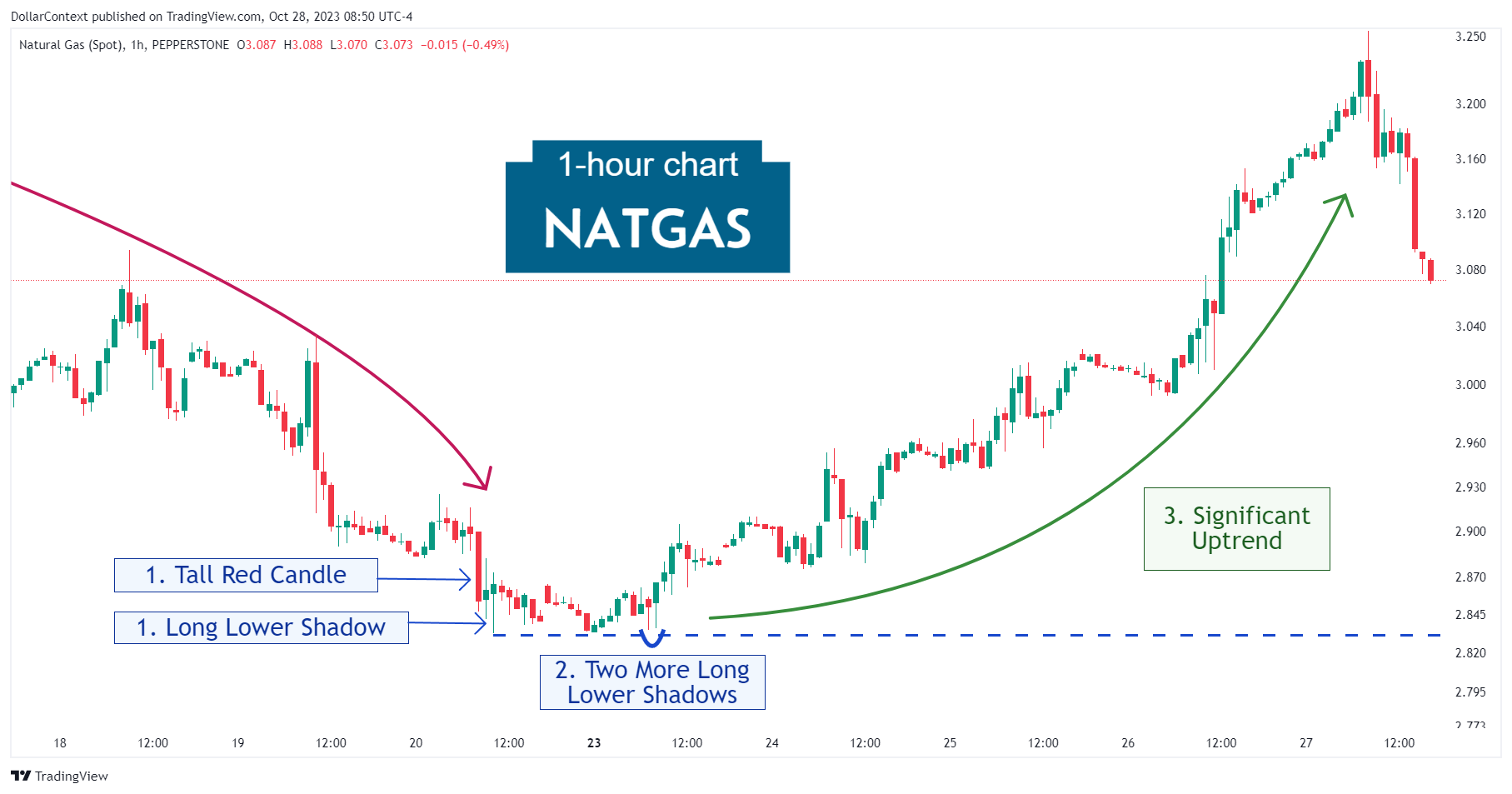

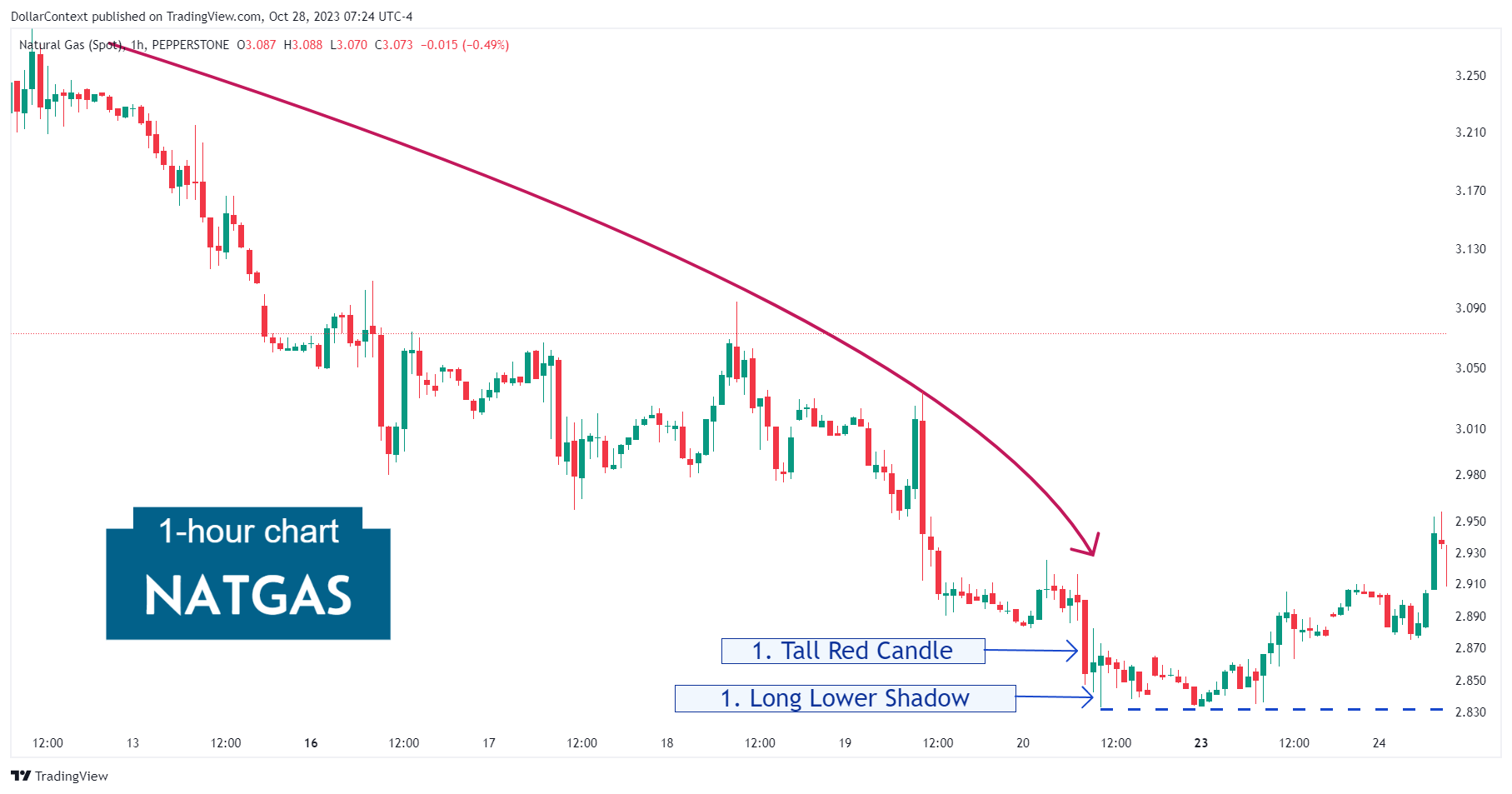

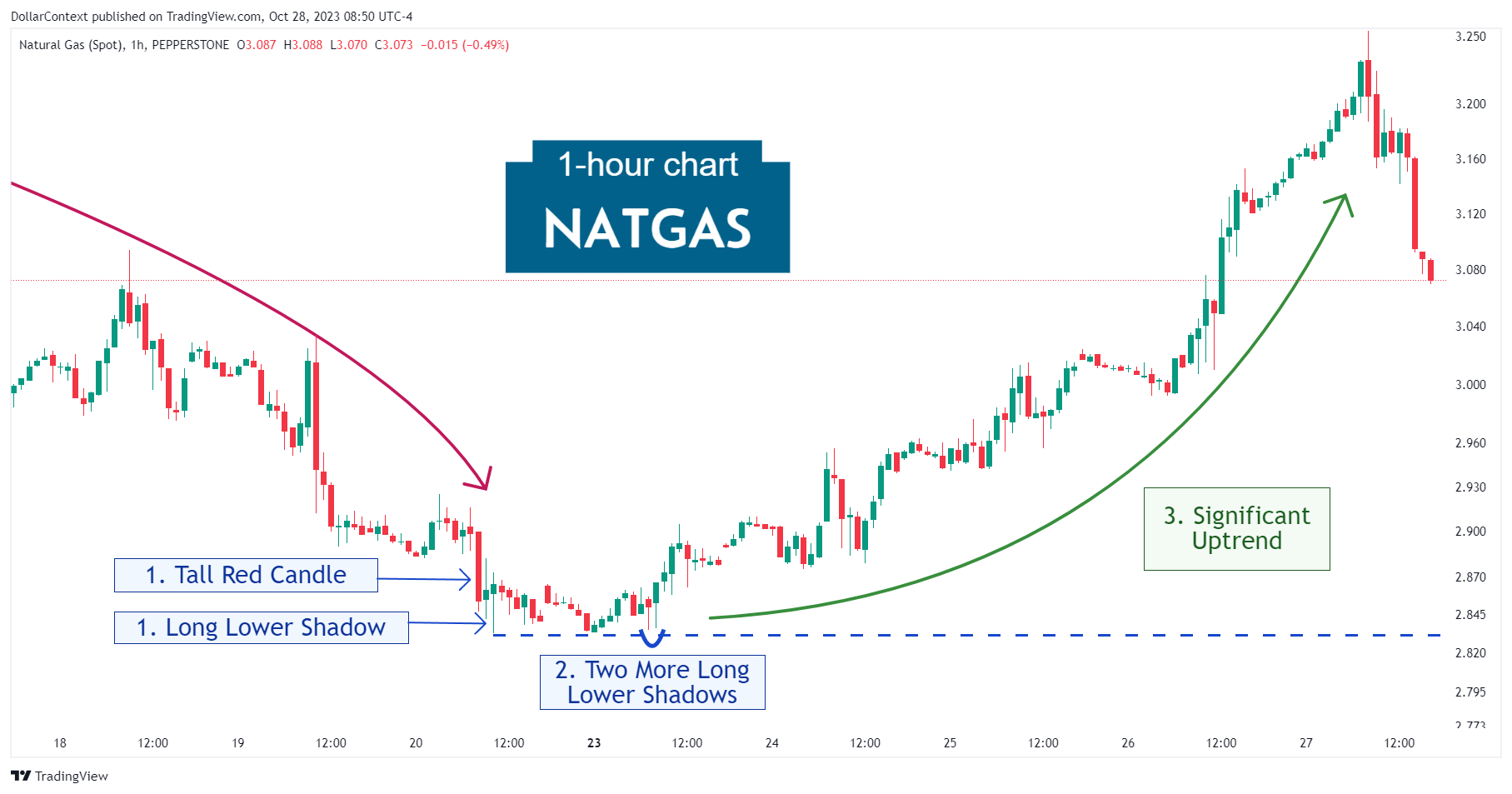

1. Signal Formation

After a sustained downtrend, the natural gas market displayed a long lower shadow session preceded by a tall red candlestick. Because the small body of the session is near the upper end, the long lower shadow can also be viewed as a variation of the hammer pattern.

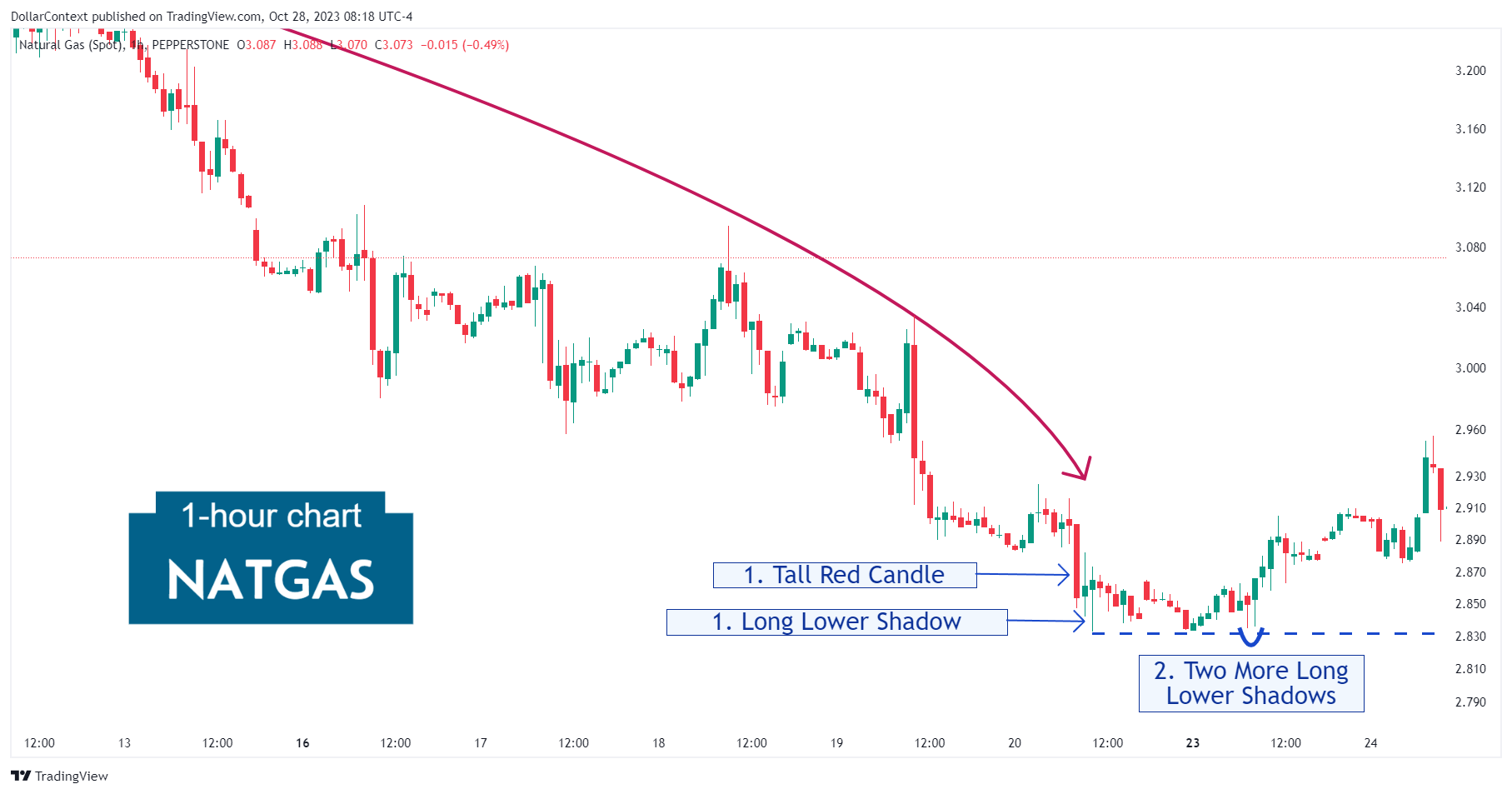

2. Early Market Transition

The long lower shadow candle marked the beginning of a relatively brief sideways period where natural gas tested three times the support level set by this candlestick. Finally, the market displayed two more long lower shadows and the onset of a bottom reversal.

3. Resolution

The last pair of long lower shadows signaled the start of a week-long bullish trend.

4. Conclusion and Subjective Review

Technically, the long lower shadow is not a candlestick pattern per se, but rather a specific type of candle line. Under specific circumstances, however, it can serve to identify buying interest at lower prices and potentially signal a reversal bottom.

For natural gas in October 2023, the following market conditions reinforced the validity of the long lower shadow:

- The prior downtrend was extended.

- The long lower shadow was preceded by a long red candle, signaling a potential selling climax.

- The support level set by the lowest point of the long lower shadow was successfully respected on three occasions.

- A second and third long lower shadow helped corroborate the potential floor set near the 2.83 mark.