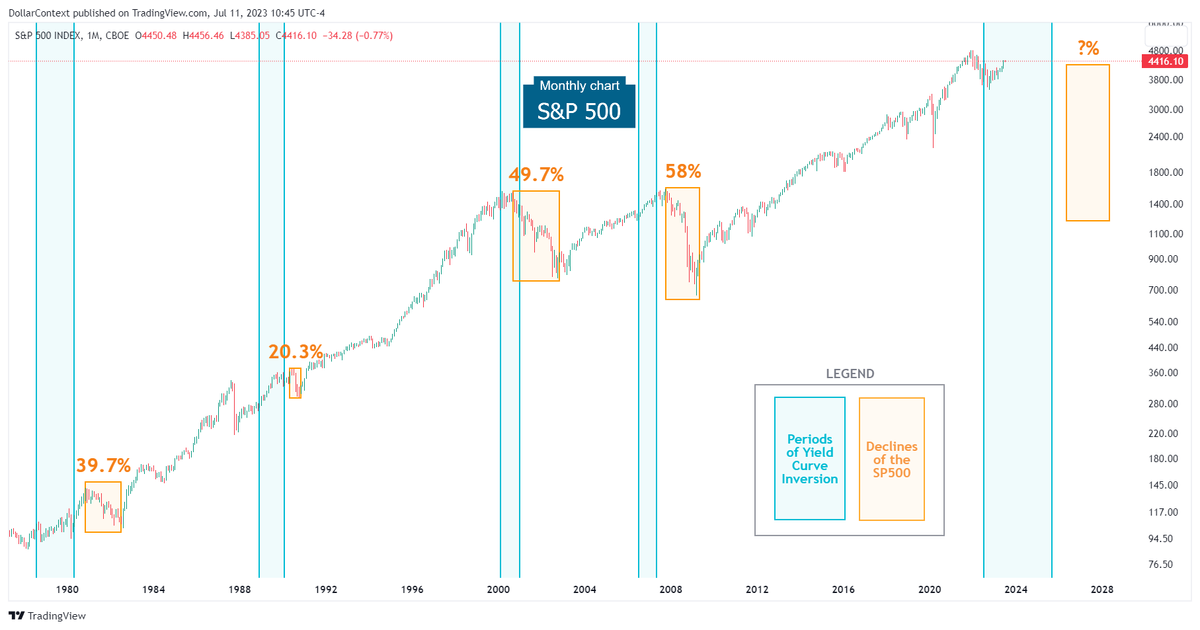

S&P 500 Performance After Yield Curve Inversions

The SP500 typically experiences a decline within a range of 6 to 18 months after reaching the low point of the yield curve. The magnitude of these declines range approximately from 20% to 60%.

The yield curve has been an accurate indicator to predict recessions. In addition, there has always been a strong correlation between recessions and S&P 500 downtrends. Not surprisingly, there should be a significant connection between yield curve inversions and stock market performance as well.

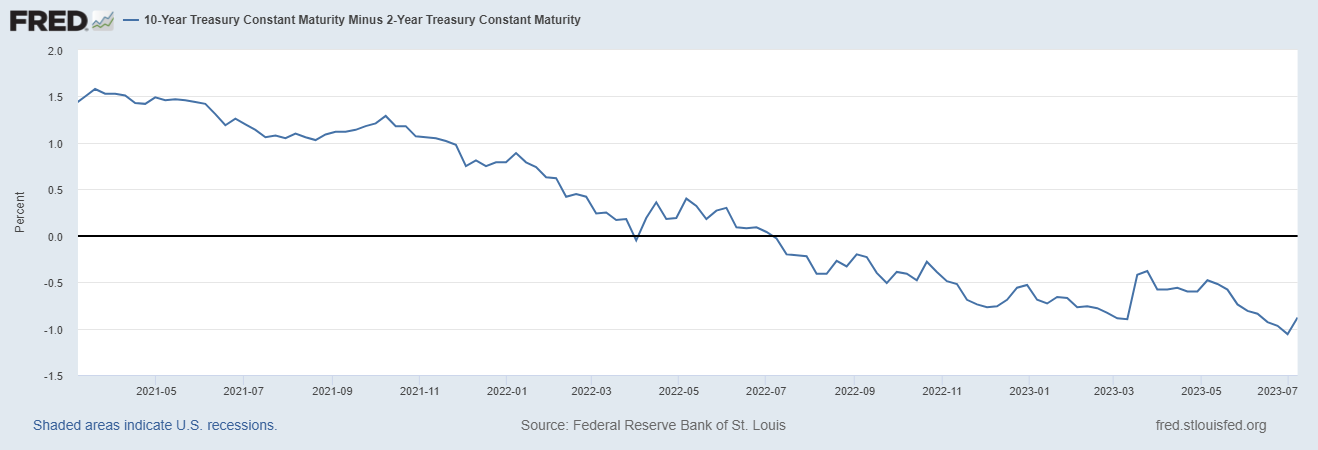

Today we’re going to discuss different timing strategies to buy or sell the S&P 500 when the bond market, specifically the 10-2 year treasury yield spread, displays an inversion.

Overview

We’ll examine the S&P 500's performance during the past five instances of yield curve inversion by presenting the following two charts for each period:

- S&P 500 chart where the periods of inversion are indicated by blue shaded areas while subsequent market downtrends are represented by orange shaded areas.

- 10-2 Year Treasury Yield Spread

Historically, the stock market has shown strong performance either during the first half or throughout the entire duration of a yield curve inversion.

The S&P 500 typically experiences a decline after a period spanning from 6 to 18 months from the lowest point of the yield curve. The magnitude of these declines ranges approximately from 20% to 60%.

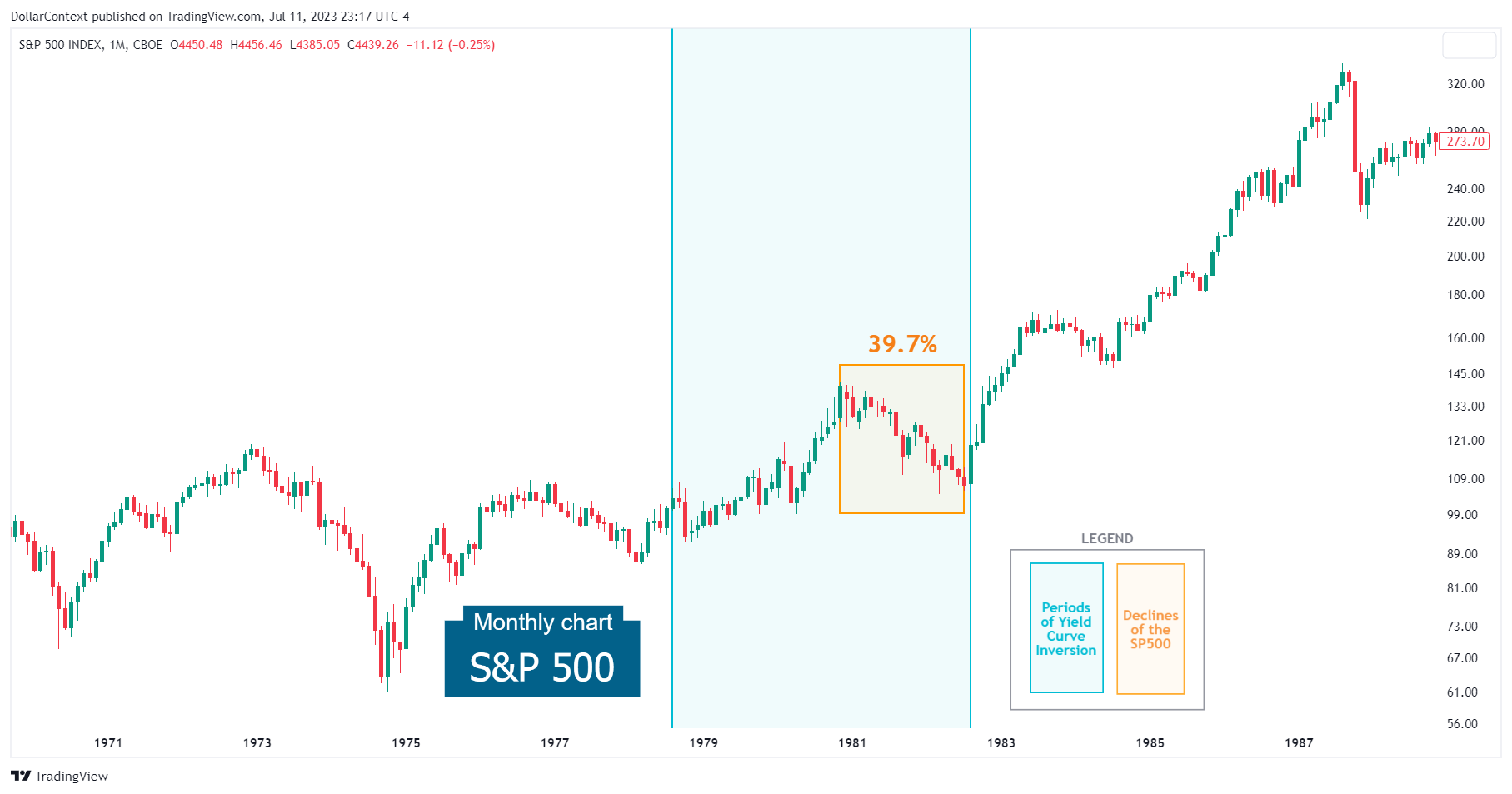

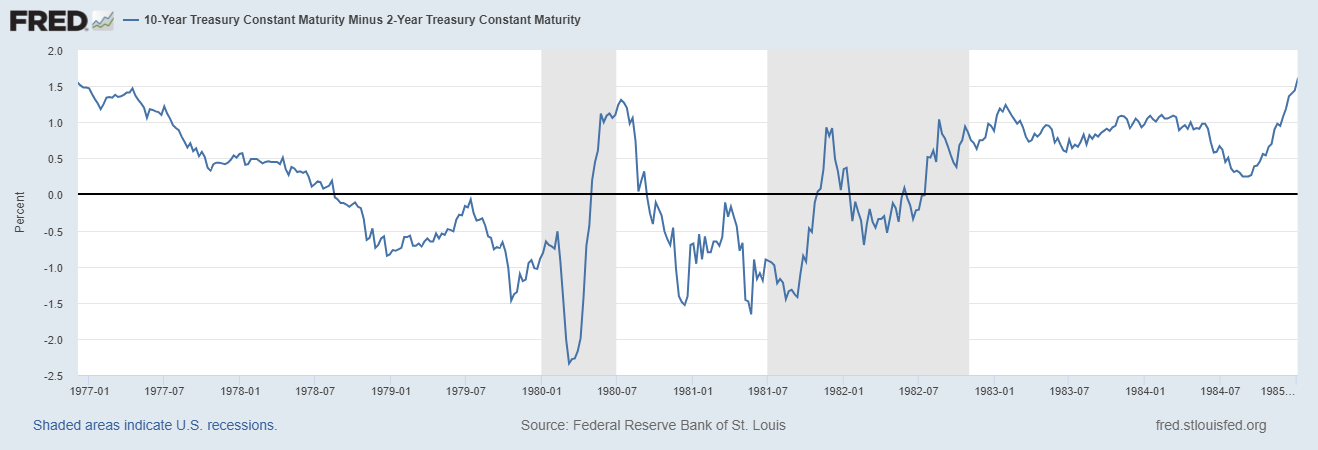

August 1978–July 1982

- The inversion begins in August 1978

- Yield curve bottomed in April 1980

- S&P 500 decline begins in November 1980

- Bottom of the inversion to the onset of the S&P 500 downtrend: 7 months

- S&P 500 decline: 39.7%

Source: Federal Reserve Bank of St. Louis

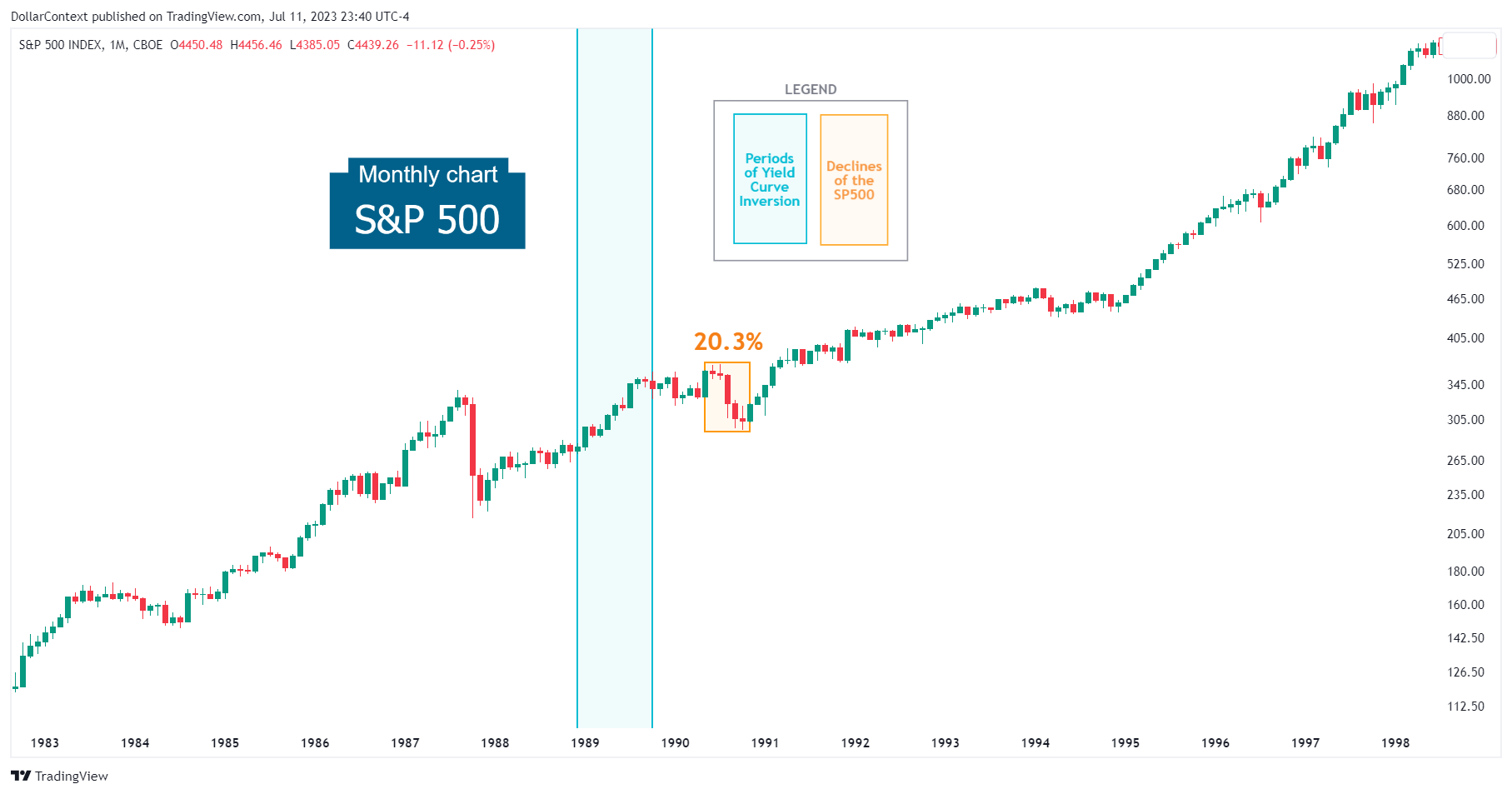

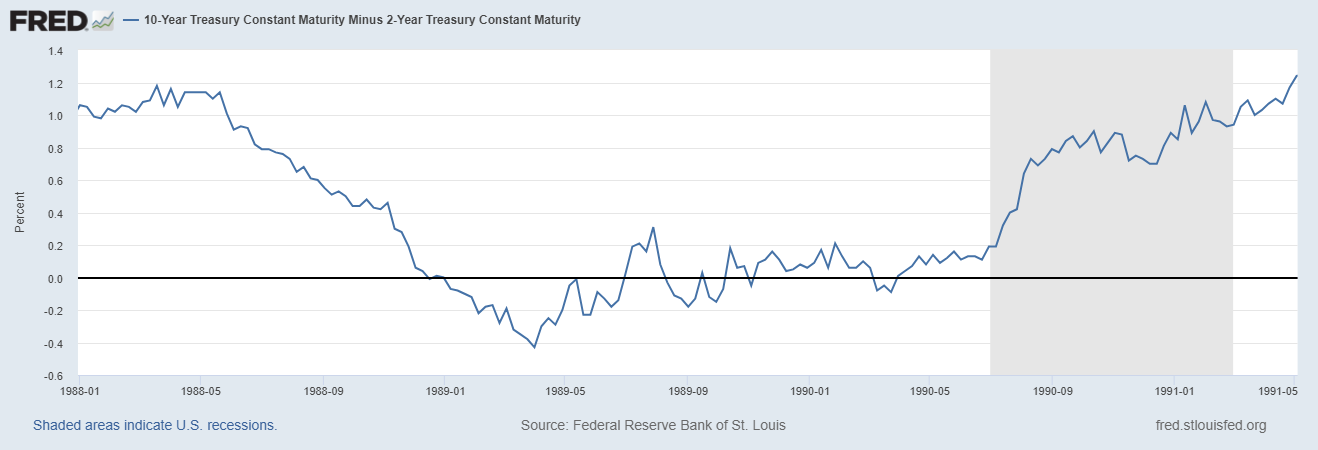

December 1988–October 1989

- The inversion begins in December 1988

- Yield curve bottomed in April 1989

- S&P 500 decline begins in May 1990

- Bottom of the inversion to the onset of the S&P 500 downtrend: 14 months

- S&P 500 decline: 20.3%

Source: Federal Reserve Bank of St. Louis

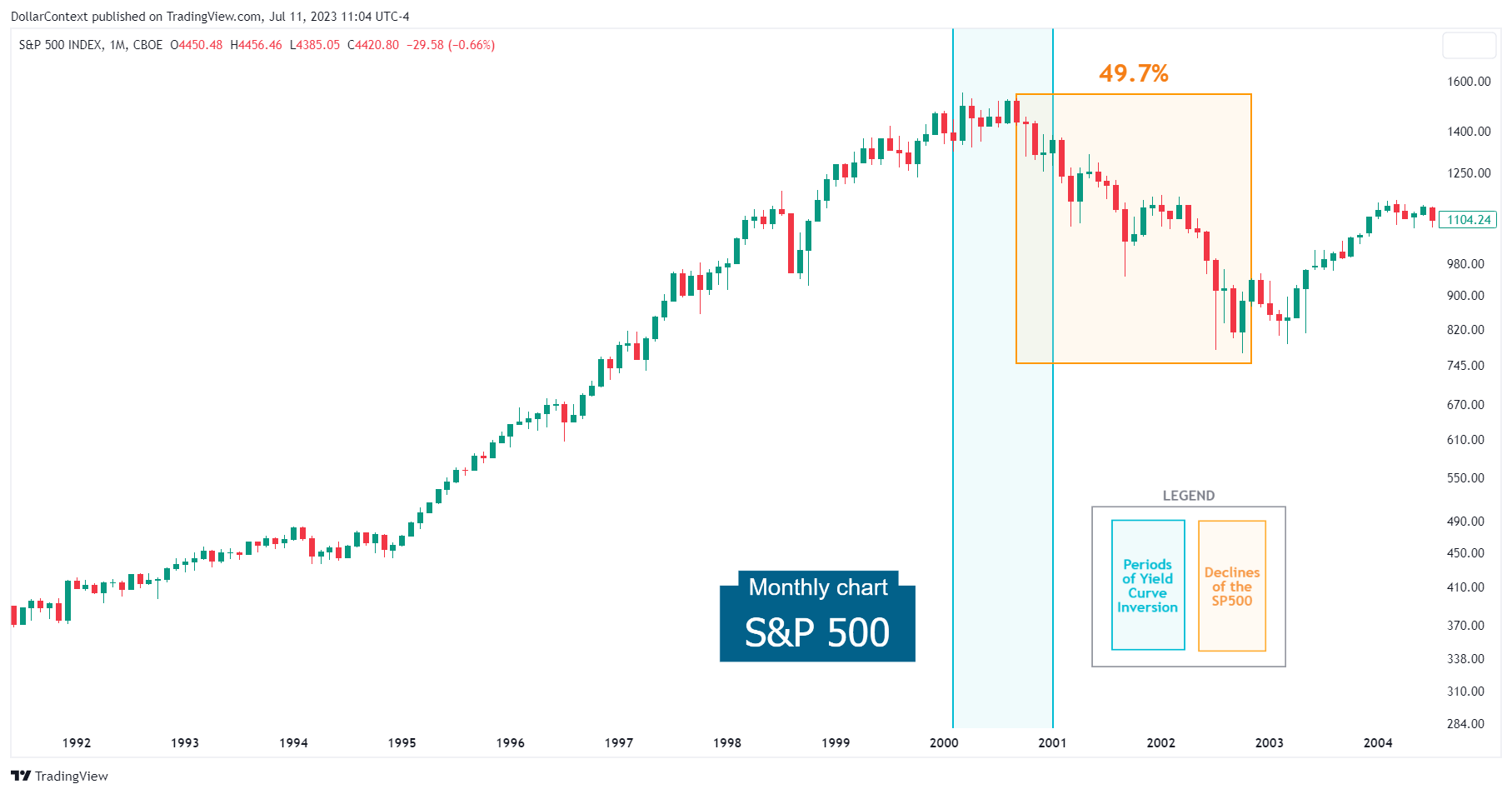

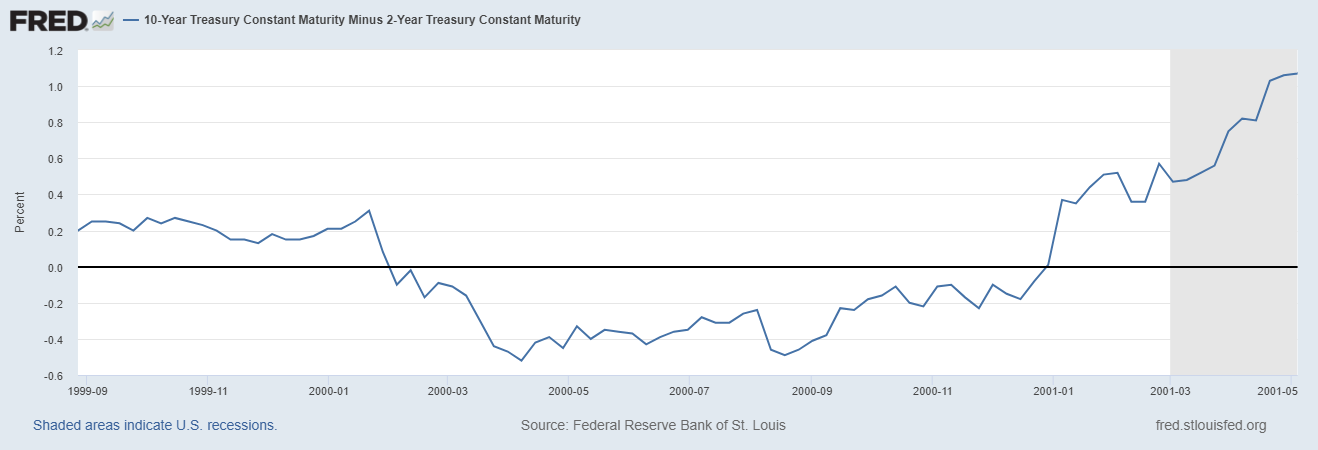

February 2000–December 2000

- The inversion begins in February 2000

- Yield curve bottomed in April 2000

- S&P 500 decline begins in September 2000

- Bottom of the inversion to the onset of the S&P 500 downtrend: 6 months

- S&P 500 decline: 49.7%

Source: Federal Reserve Bank of St. Louis

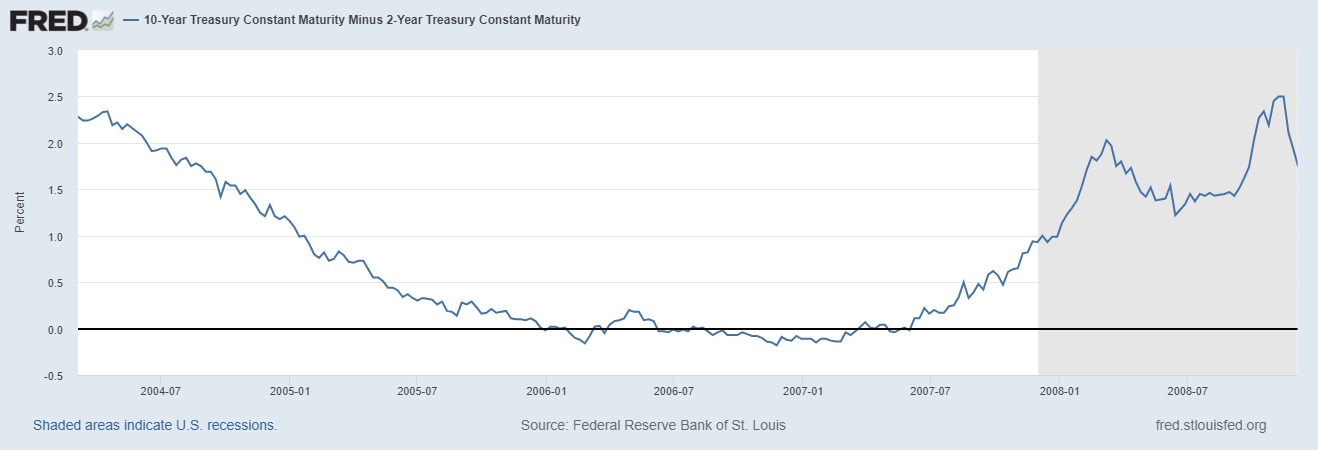

February 2006–April 2007

- The inversion begins in February 2006

- Yield curve bottomed in December 2006

- S&P 500 decline begins in October 2007

- Bottom of the inversion to the onset of the S&P 500 downtrend: 11 months

- SS&P 500 decline: 58%

Source: Federal Reserve Bank of St. Louis

Since July 2022

- The inversion begins in July 2022

- Yield curve bottomed in June 2023?

Source: Federal Reserve Bank of St. Louis