Is the S&P 500 Poised for a Melt-up?

While we expect a recession, probably at some point next year, we believe that the market will continue to rise for the next few months.

Since October 2022, the S&P 500 has been edging higher in the context of a general market pessimism and concerns about a potential recession. Those fears have been driven by a number of factors, including:

- The aggressive hiking cycle from the Fed.

- Deterioration of a wide range of leading indicators, such as PMI, consumer confidence, or commodity prices.

- Deep and extended inversion of the yield curve.

- A series of Regional Bank failures in the first half of 2023.

In contrast with this negative environment, the stock market has been gradually rising. Thus, at the time of writing, the S&P 500 is making progress towards its all-time highs (near $4800.)

Can the S&P 500 Rally Continue or Even Transition into a Melt-up?

There are several factors that lead us to believe that the rally will persist or even gather momentum in the upcoming weeks or months.

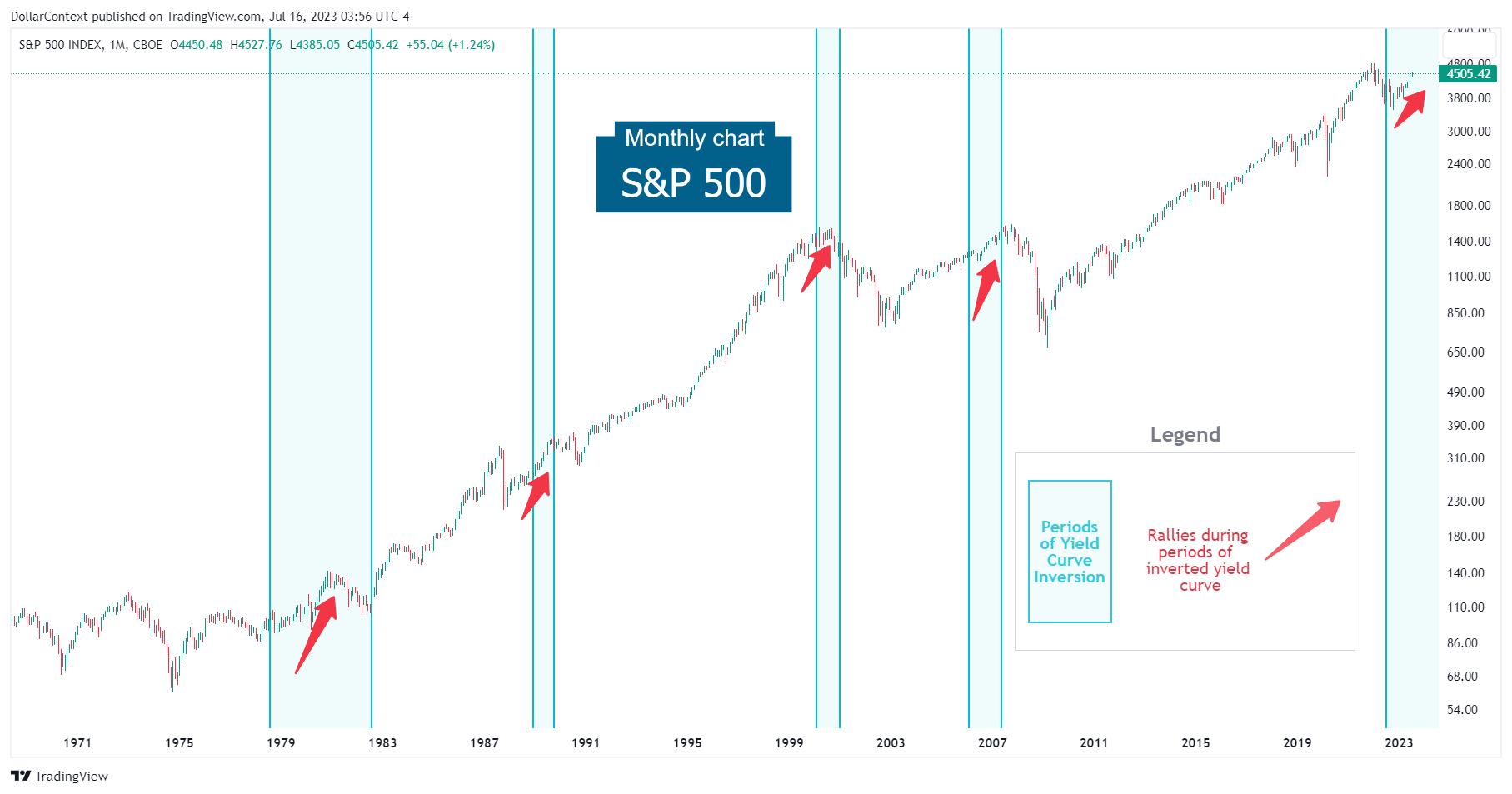

- Historical data shows a substantial correlation between stock market appreciation and yield curve inversion.

- Inflation data is plummeting.

- Market sentiment is pessimistic, and therefore short-term bullish for stocks.

- The stock market continues to be driven by the artificial intelligence boom.

1. Correlation Between Market Rallies and an Inverted Yield Curve

Historical data indicates that the stock market has almost always exhibited robust performance either during the first half or throughout the whole inversion period.

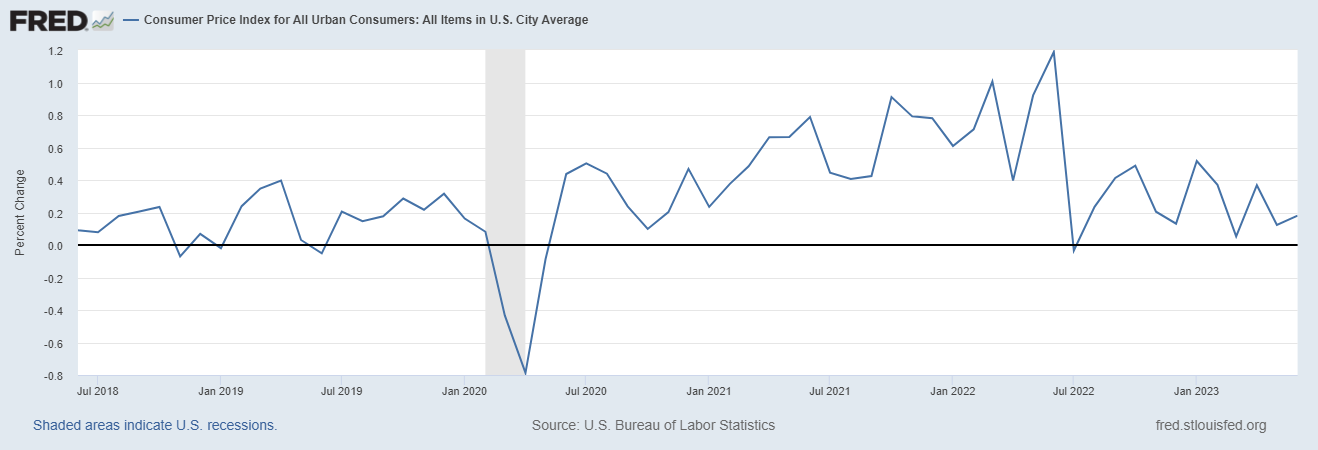

2. Inflation is being controlled

The Fed is maintaining an aggressive stance in their rhetoric. However, the recent data on CPI and PPI suggests that the Fed's hiking cycle may be approaching its conclusion.

Source: Federal Reserve Bank of St. Louis

3. Market Sentiment

While the market has continued its upward trajectory, the inverted yield curve and hawkish tone of the Fed have raised concerns among investors and fund managers. Since we are still far from reaching the point of excessive optimism or euphoria, the likelihood of a bullish scenario is very high.

4. Artificial Intelligence driving the stock market

Many investors and analysts argue that all the gains in the S&P 500 this year can be attributed to AI. However, it's important to keep in mind that such innovation trends and productivity enhancements typically have a spillover effect on other areas of the market over time.

Conclusion

While we expect a recession, probably at some point next year, we believe that the market will continue to rise for the next few months.

It remains uncertain whether the stock market can gain enough momentum to stage a melt-up this summer. However, based on the situation described above, the most likely scenario is that we will continue to witness higher highs and higher lows in the upcoming months.