CANDLESTICK

Case Study 0028: Hammer and Long Lower Shadows (Natural Gas)

In this article, we will examine the performance of the natural gas market after the emergence of a hammer and two long lower shadows.

CANDLESTICK

In this article, we will examine the performance of the natural gas market after the emergence of a hammer and two long lower shadows.

CANDLESTICK

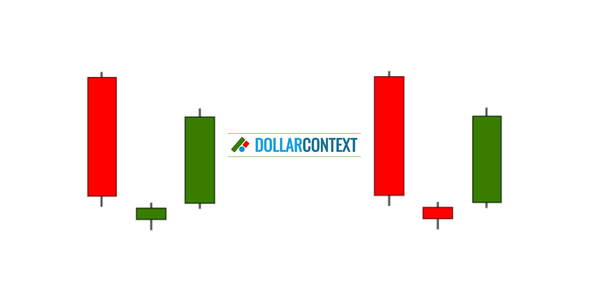

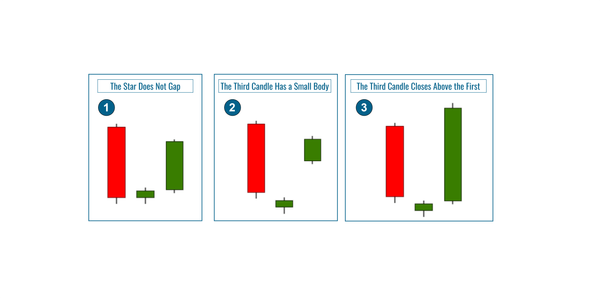

The configuration of the morning star has resemblances to other candlestick patterns, including the hammer, the tower bottom, and the doji.

CANDLESTICK

In this article, we will discuss the performance of the Dollar Index after an evening star and engulfing pattern.

CANDLESTICK

We can distinguish three primary types of morning stars: standard morning star, morning doji star, and abandoned baby bottom.

CANDLESTICK

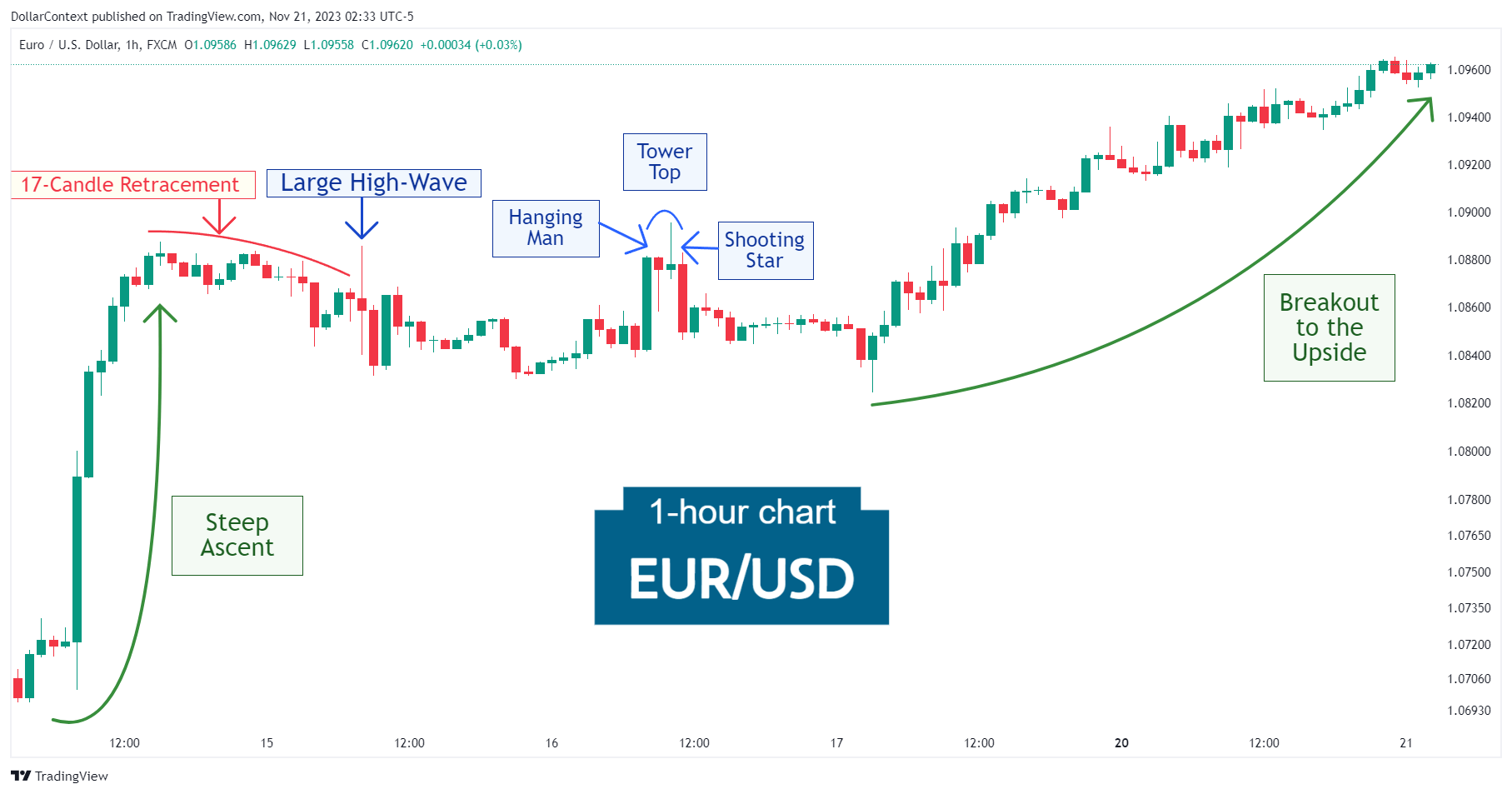

In this article, we will discuss the performance of the EUR/USD after the emergence of a high-wave candle in a consolidation phase.

CANDLESTICK

While the morning star can serve as a useful instrument for traders, it's important to keep in mind its limitations and the skepticism that surrounds this pattern.

CANDLESTICK

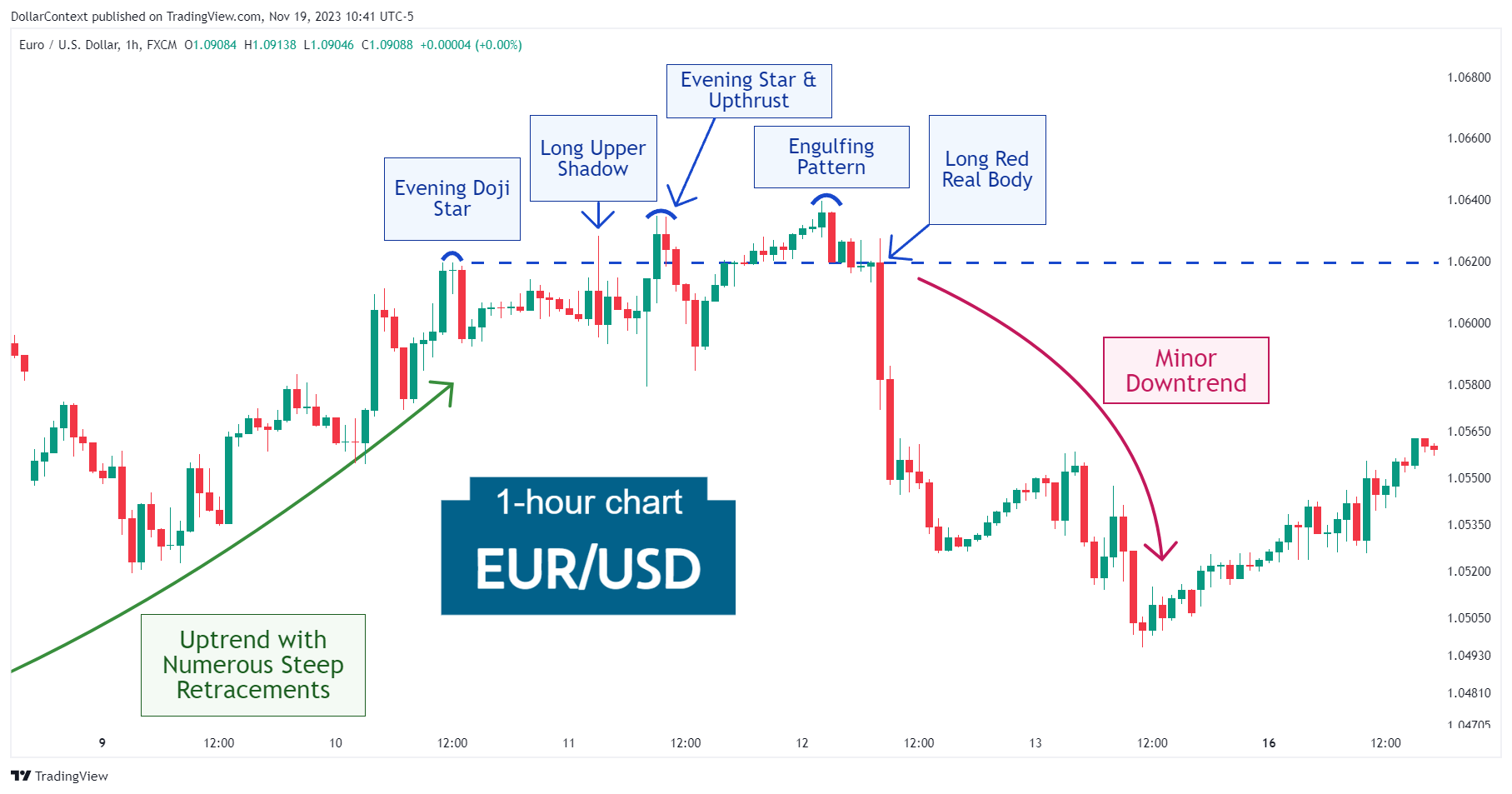

In this article, we will discuss the performance of the EUR/USD after the emergence of a series of bearish patterns.

CANDLESTICK

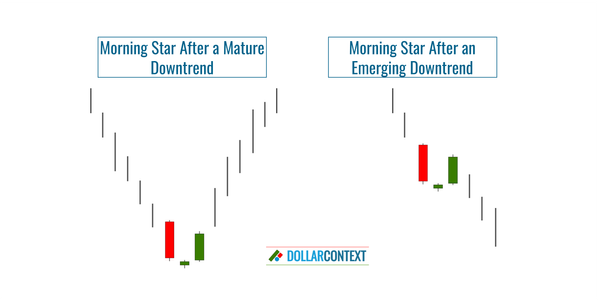

We discuss the implications of the morning star pattern in different market scenarios, including downtrends and lateral movements.

CANDLESTICK

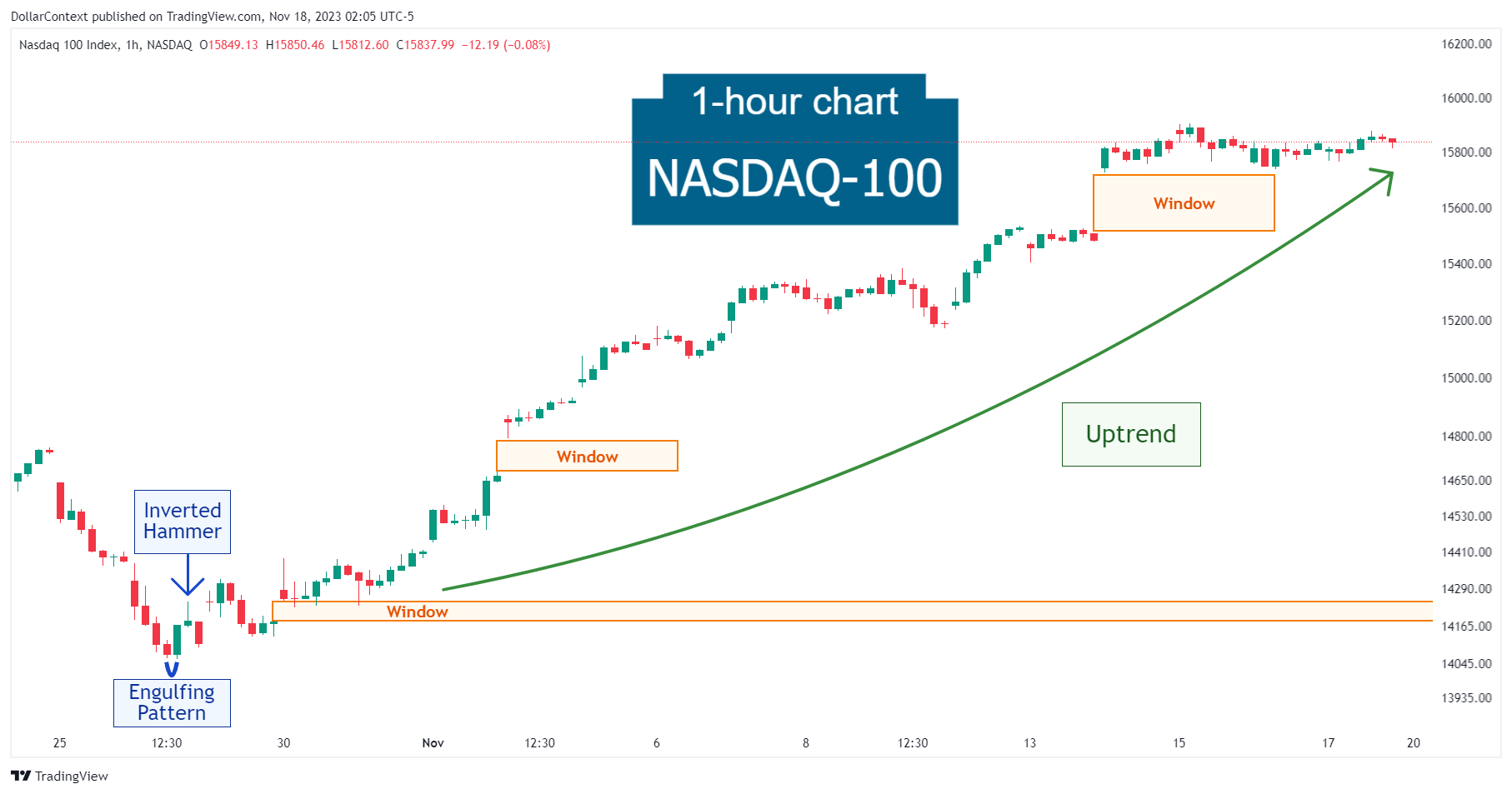

In this article, we will examine the performance of the Nasdaq-100 market after the emergence of an engulfing pattern, an inverted hammer, and a rising window.

CANDLESTICK

Variations of the morning star pattern that may not perfectly align with the ideal form can still be valid, given certain market conditions.

CANDLESTICK

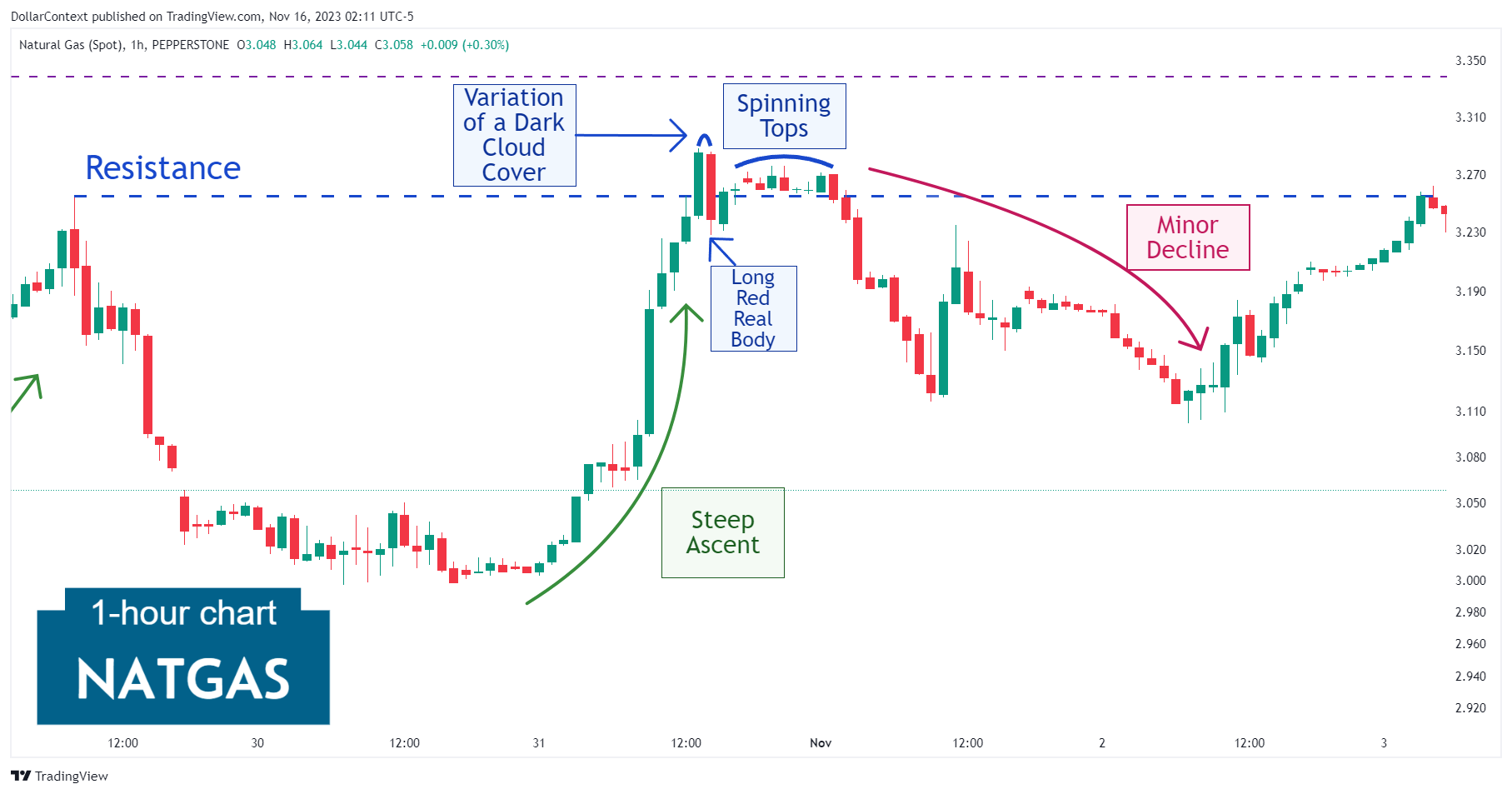

In this article, we will examine the performance of the natural gas market after the emergence of a dark cloud cover and a long black real body.

STOP-LOSS

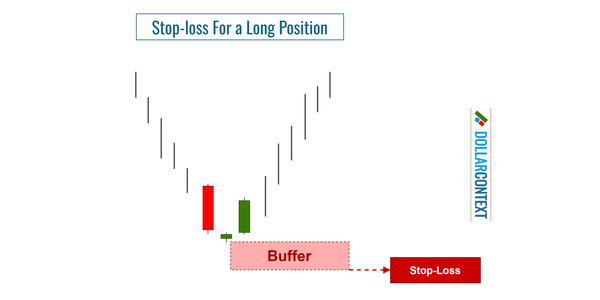

In this post, we'll explore effective strategies to set a stop-loss when using a morning star pattern to initiate a long position.