CANDLESTICK

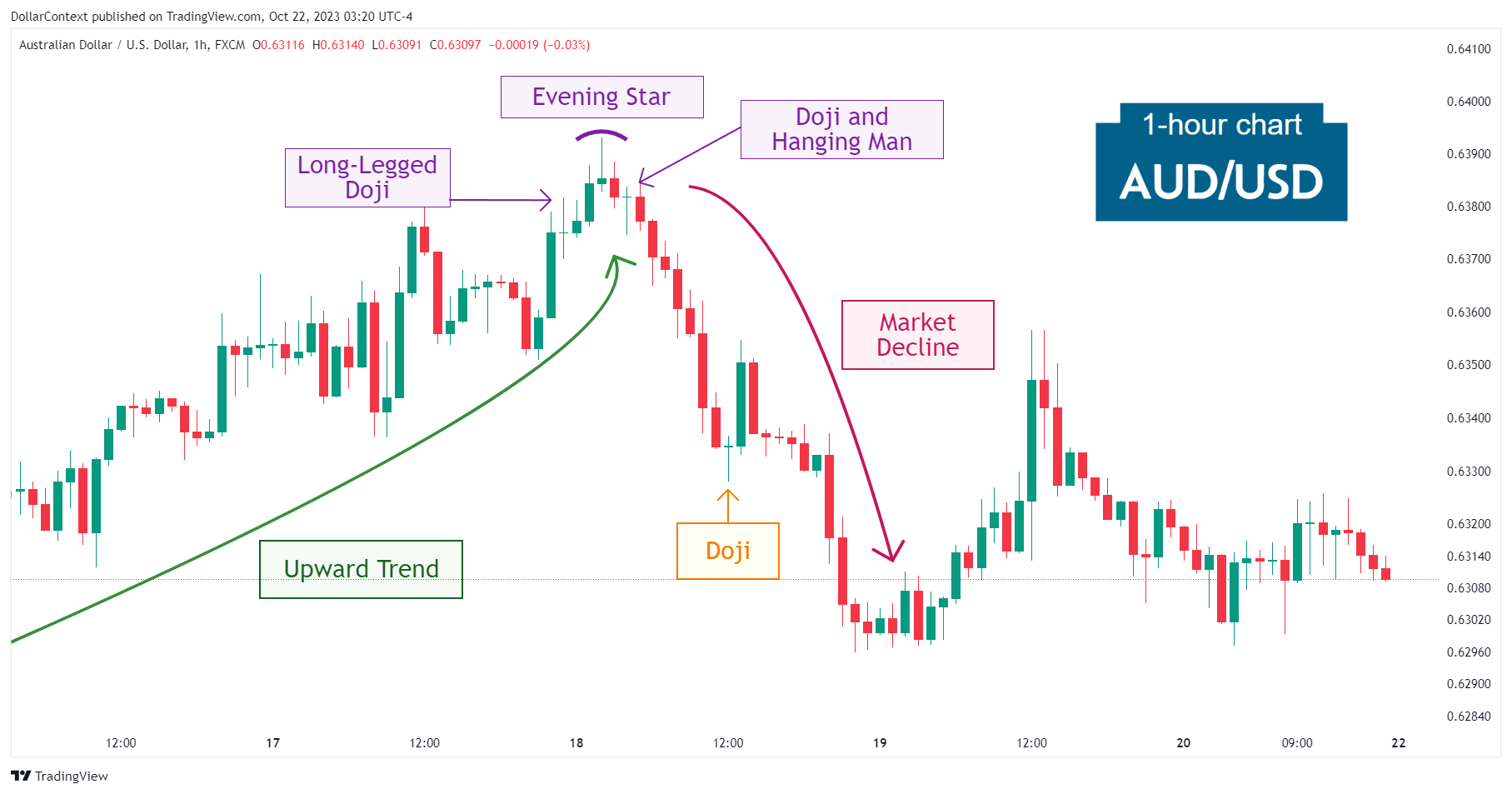

Case Study 0010: Evening Star and Shooting Star Patterns Yield Immediate Results (AUD/USD)

In this article, we will cover the performance of the AUD/USD market after the appearance of an evening star and shooting star pattern.

CANDLESTICK

In this article, we will cover the performance of the AUD/USD market after the appearance of an evening star and shooting star pattern.

CANDLESTICK

After an uptrend, the price range associated with an evening star becomes resistance.

CANDLESTICK

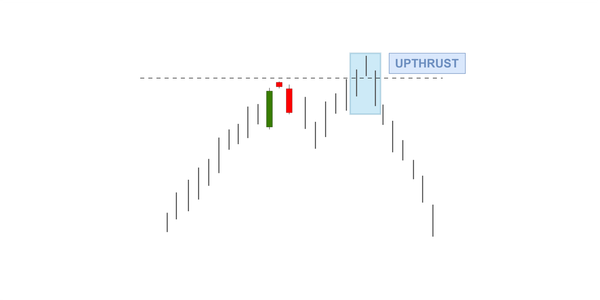

In this article, we will cover the performance of the WTI market after the emergence of a high-wave and an engulfing pattern.

CANDLESTICK

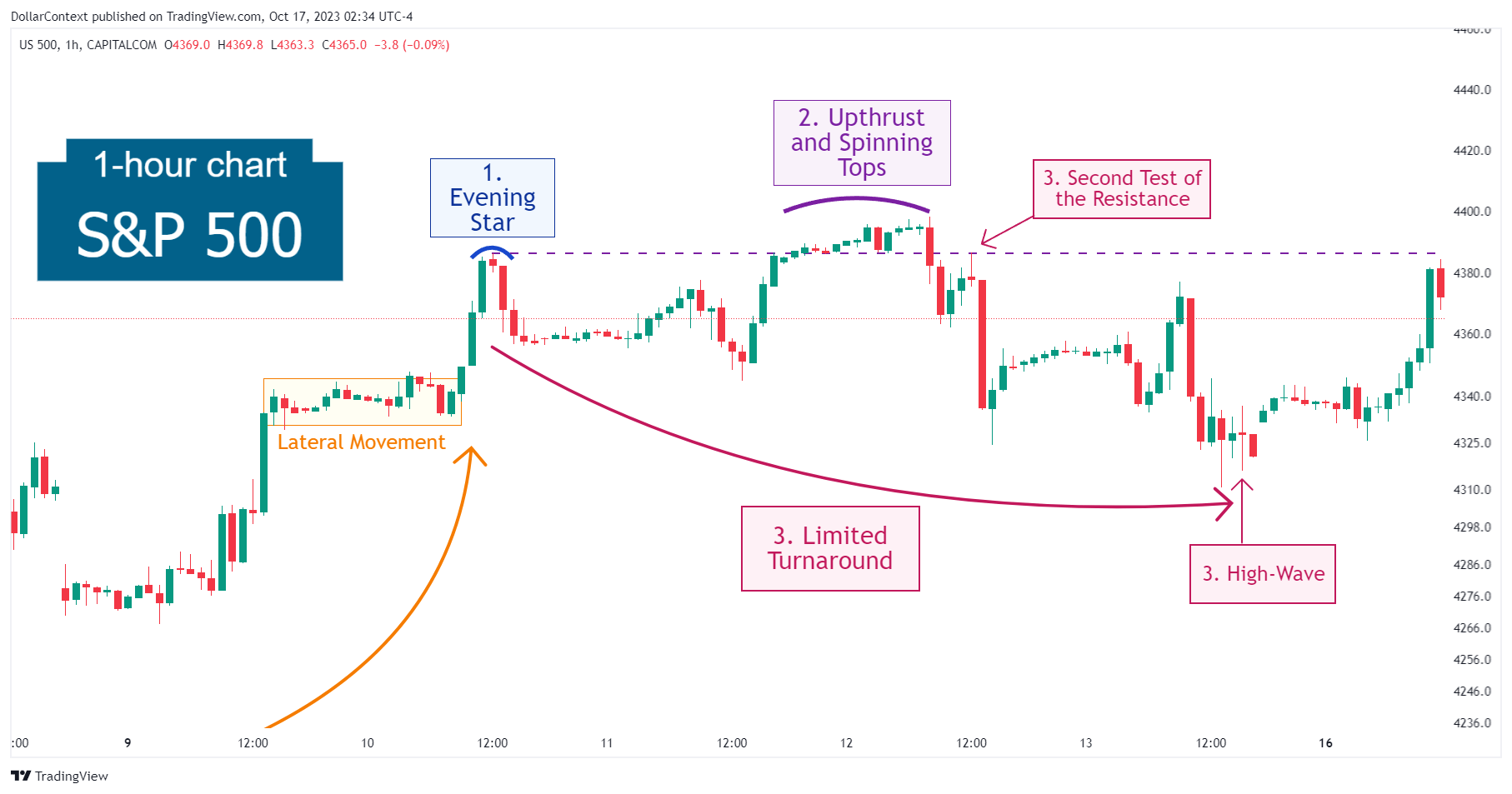

In this article, we will discuss the performance of the S&P 500 after the appearance of an evening star.

CANDLESTICK

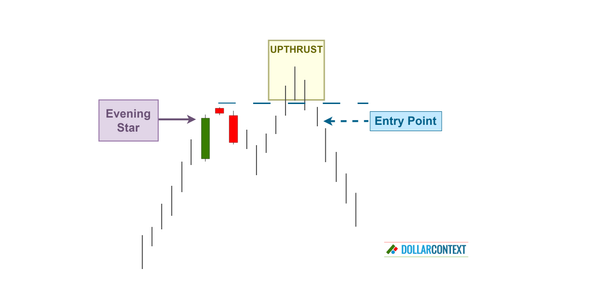

In this article, we'll discuss the different options for entry points after the emergence of an evening star pattern.

CANDLESTICK

The psychology behind an evening star pattern reveals a shift in market sentiment from bullish to bearish, usually occurring after an uptrend.

CANDLESTICK

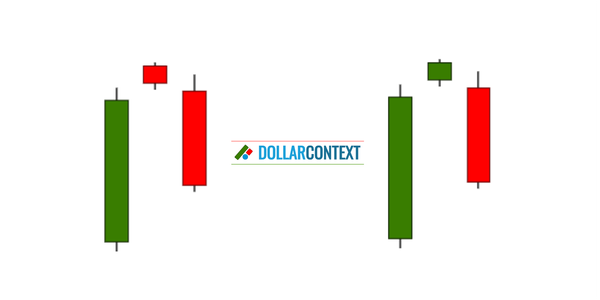

In this article, we'll explore the layout of an evening star pattern in Japanese candlestick analysis and how to identify this reversal indicator.

CANDLESTICK

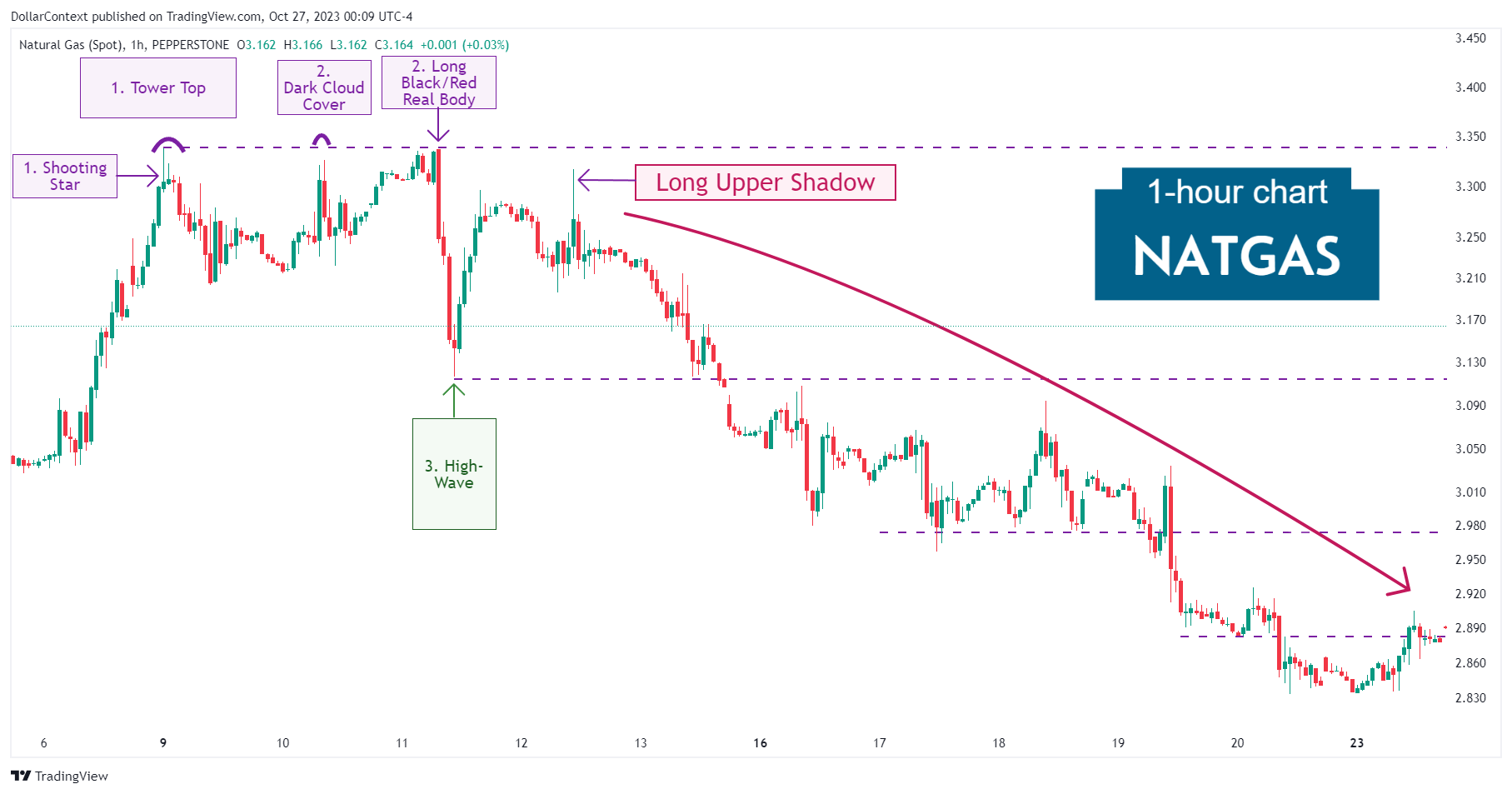

In this article, we will examine the performance of the natural gas market after the emergence of a tower top.

CANDLESTICK

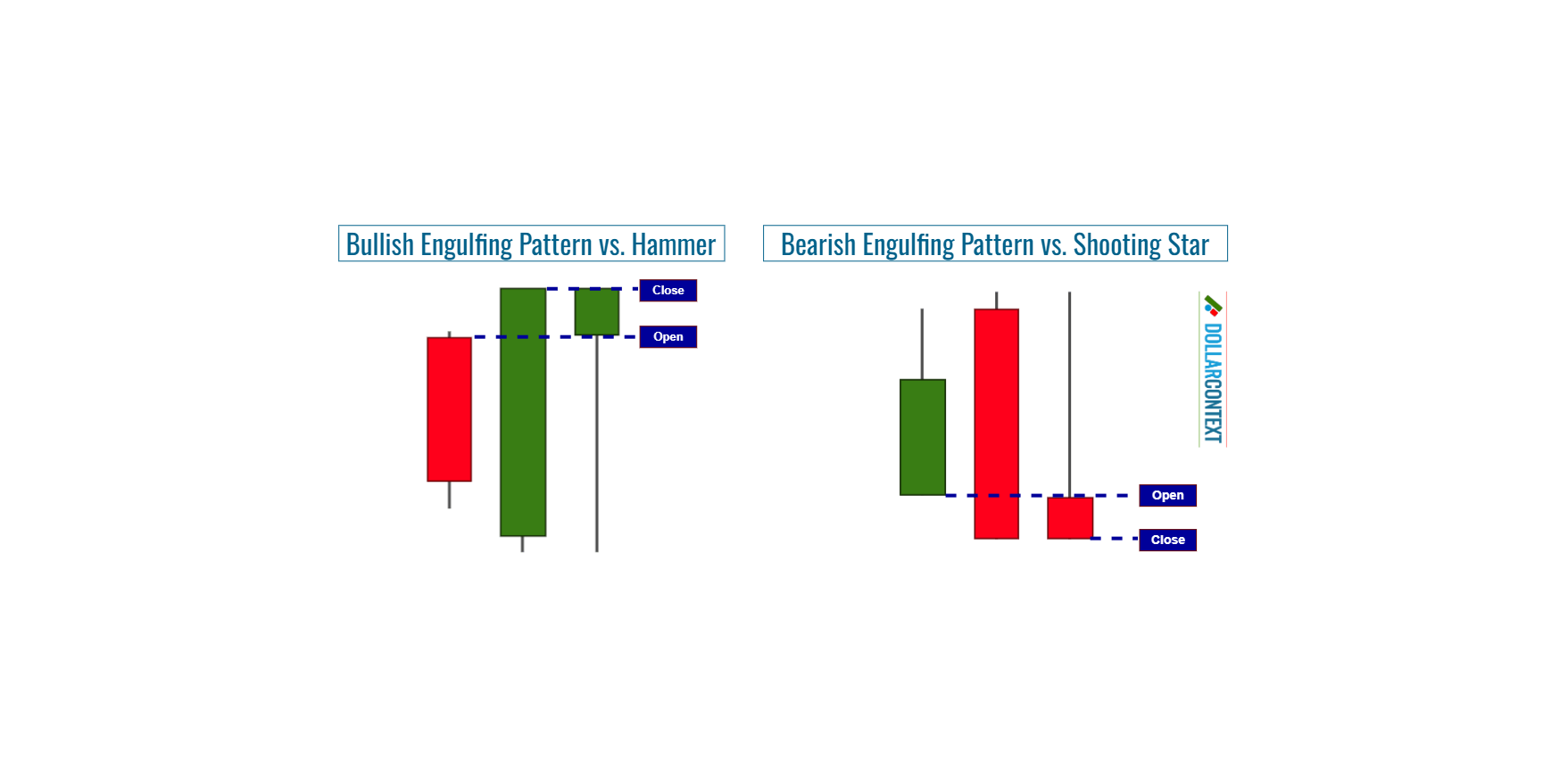

We'll delve into a major indicator of Japanese candlestick charting: the engulfing pattern.

CANDLESTICK

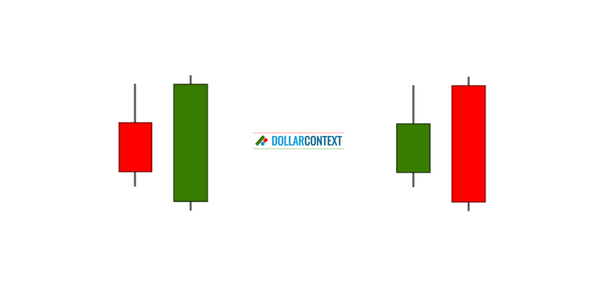

Three conditions must be met for a pattern to be classified as an engulfing pattern: trending market, engulfing, and opposite colors.

CANDLESTICK

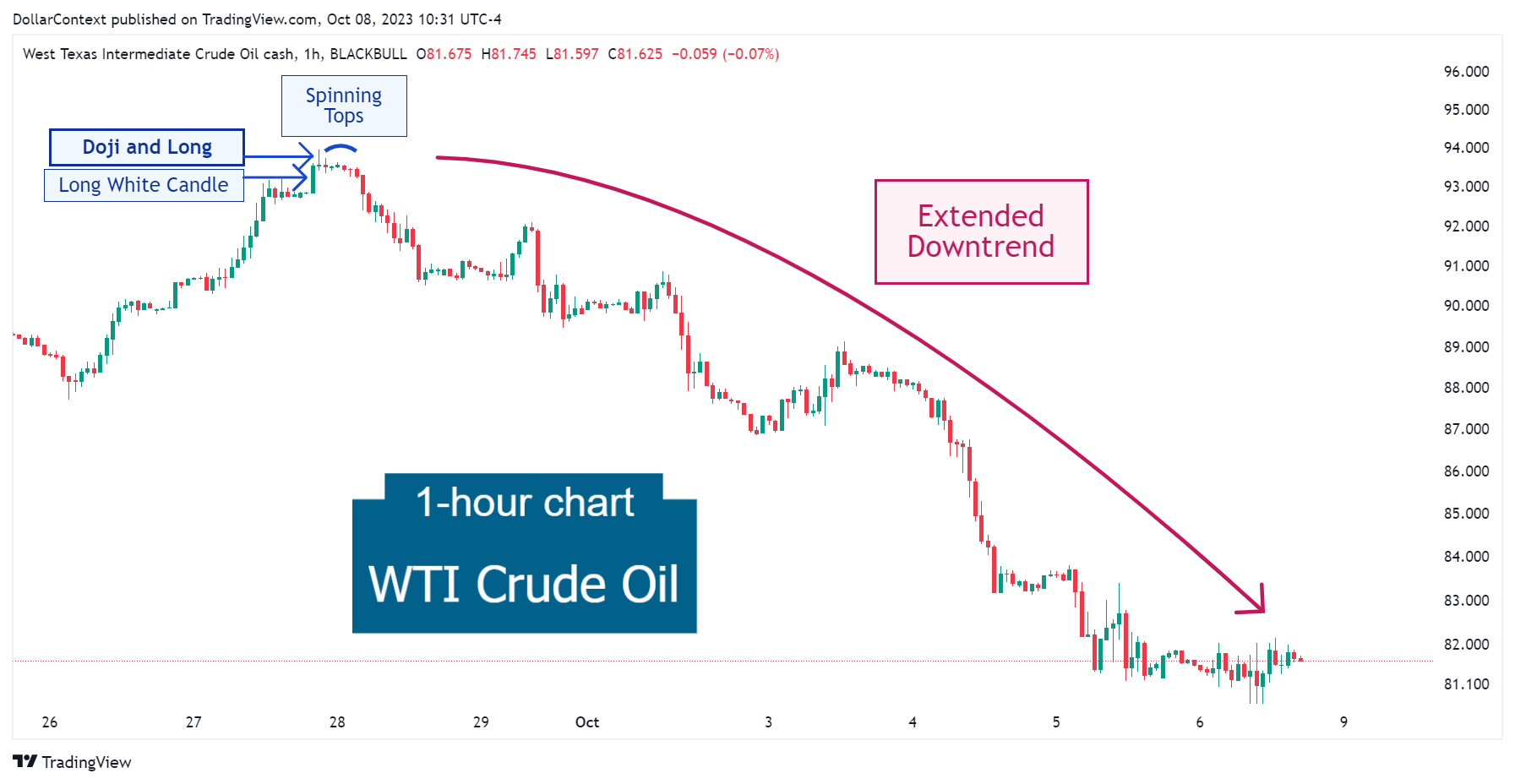

In this article, we will examine the performance of the WTI market after the emergence of a doji pattern.

CANDLESTICK

The configuration of an engulfing pattern has resemblances to other candlestick patterns, including the hammer, shooting star, and harami.