CANDLESTICK

Types of Engulfing Patterns

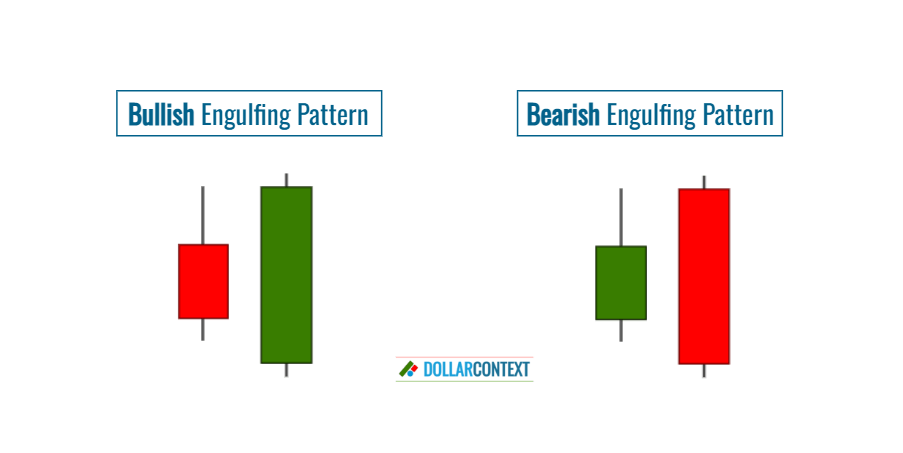

We can distinguish two primary types of engulfing patterns, each with its own set of subcategories or subtypes.

CANDLESTICK

We can distinguish two primary types of engulfing patterns, each with its own set of subcategories or subtypes.

CANDLESTICK

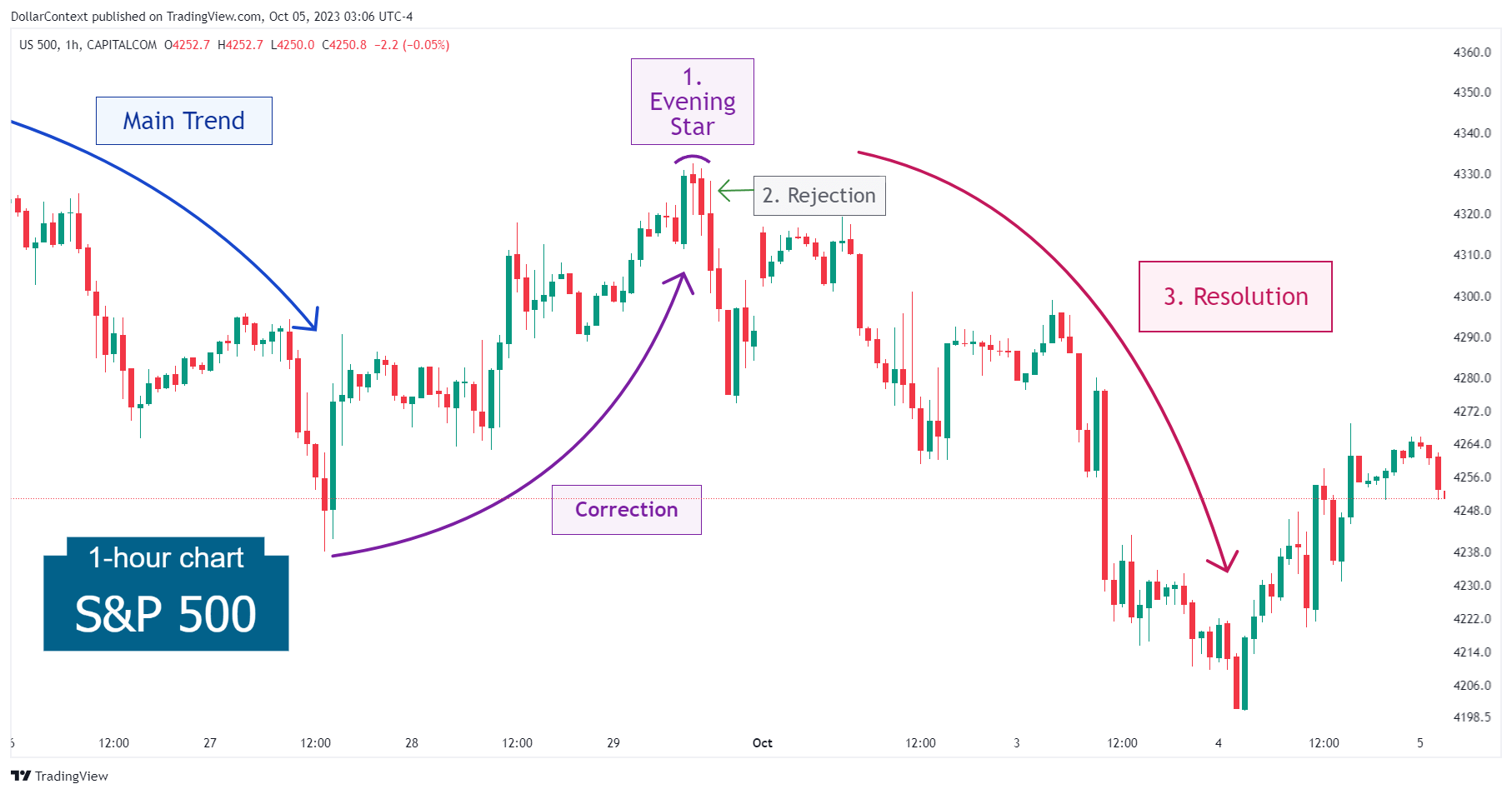

In this article, we will discuss the performance of the S&P 500 after the appearance of an evening star.

CANDLESTICK

Though the engulfing pattern can serve as a useful instrument for traders, it's important to be aware of its limitations and the skepticism that surrounds it.

CANDLESTICK

We discuss the significance of an engulfing pattern in different market scenarios, such as uptrends, downtrends, and trading ranges.

CANDLESTICK

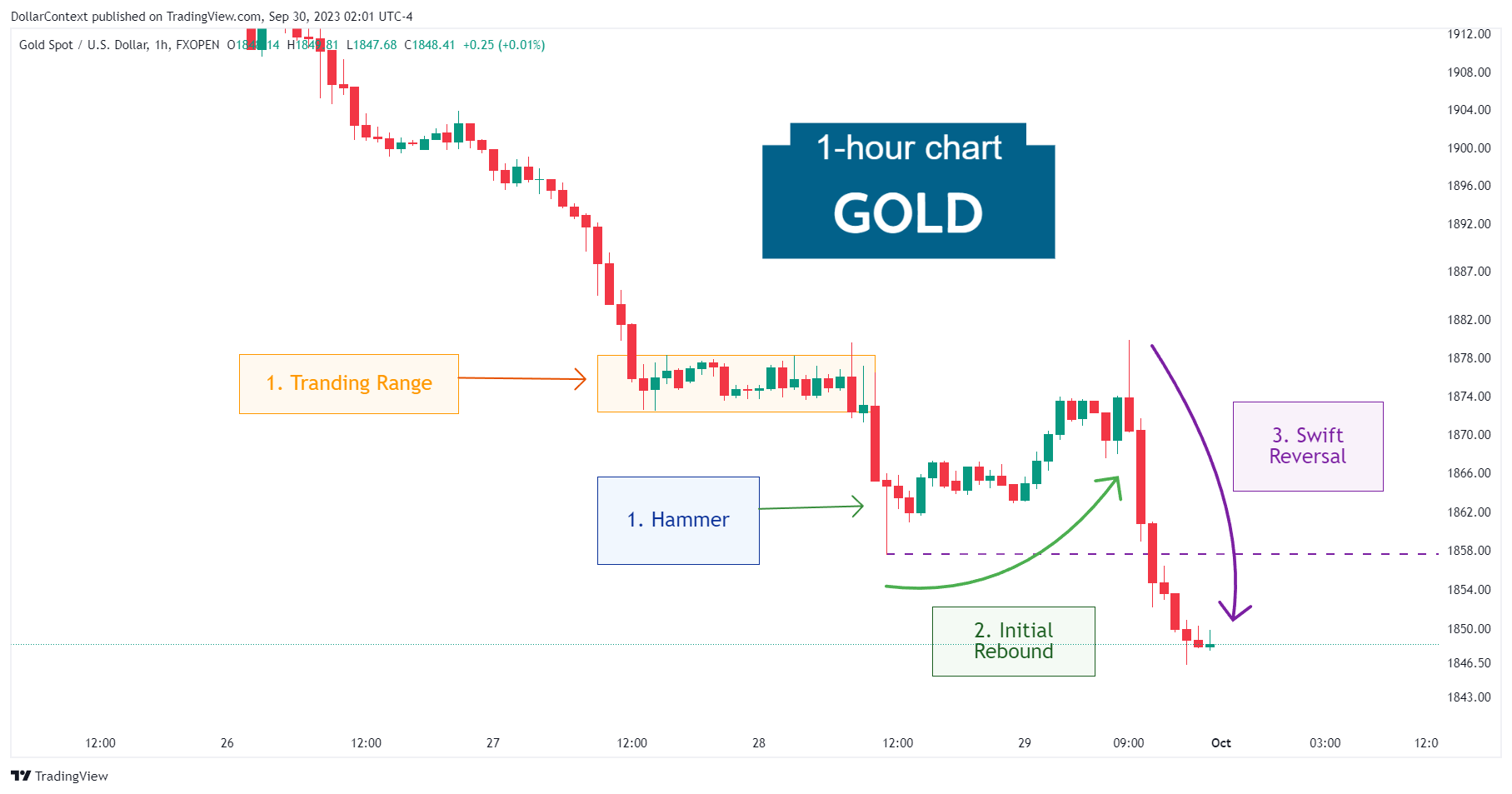

In this article, we will discuss the performance of the gold market after the appearance of a hammer pattern.

CANDLESTICK

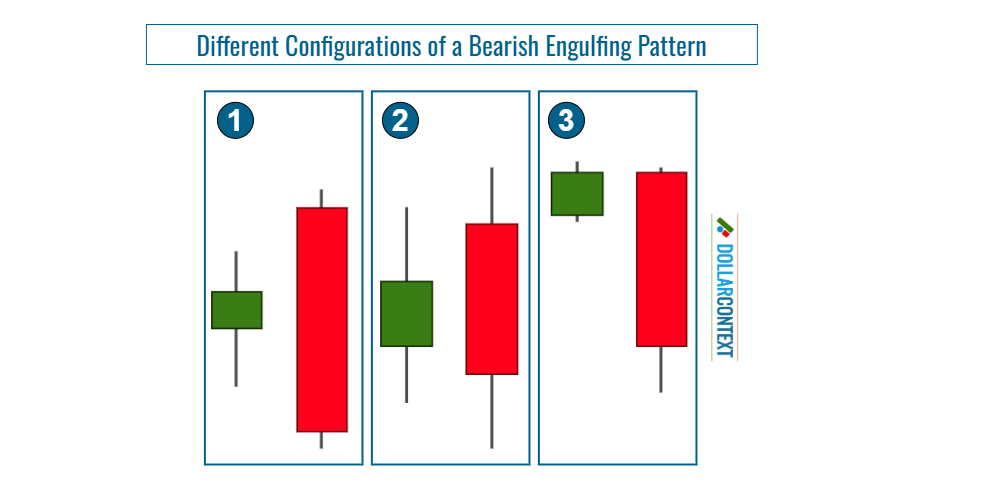

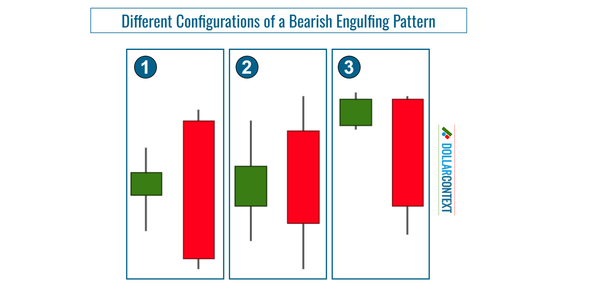

Not all engulfing patterns are equally relevant. They can be presented in different configurations or variations.

STOP-LOSS

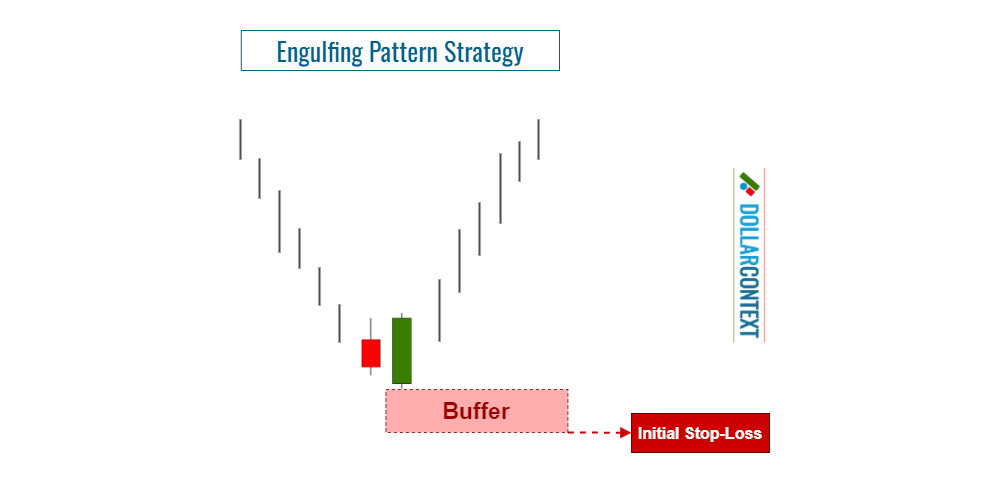

In this post, we'll explore effective strategies to set a stop-loss when using an engulfing pattern to open a market position.

CANDLESTICK

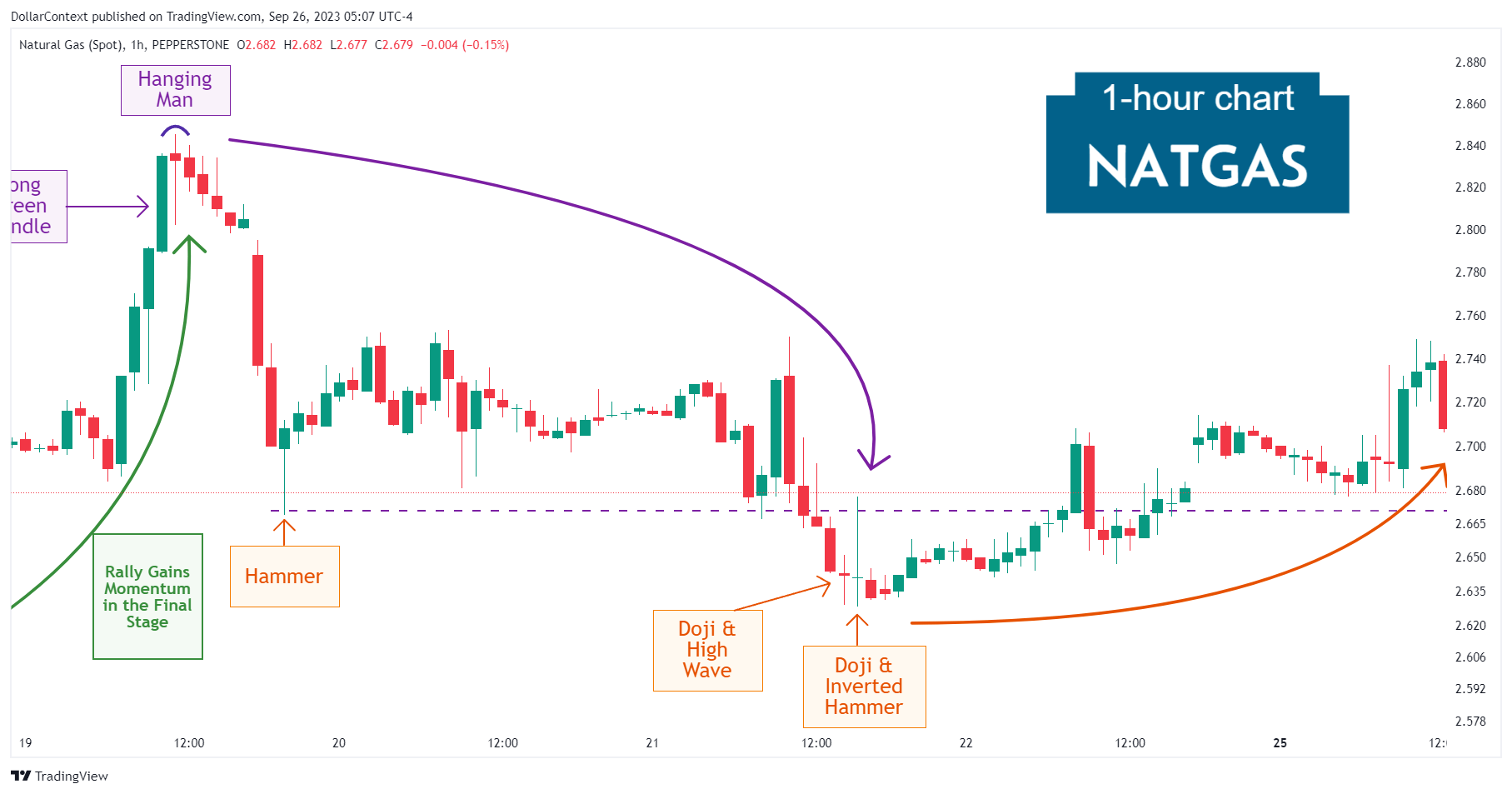

In this article, we will discuss the performance of a highly volatile market in which specific candlestick patterns effectively signaled price tops and bottoms.

CANDLESTICK

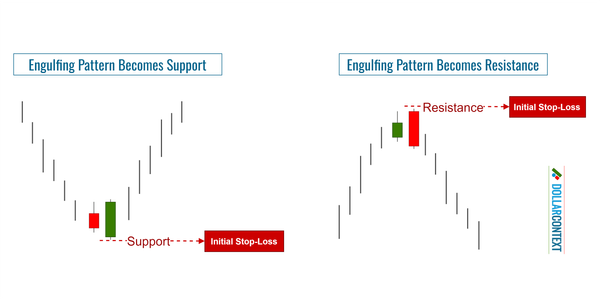

After an uptrend, the price range associated with a bearish engulfing pattern becomes resistance. The same applies in reverse.

CANDLESTICK

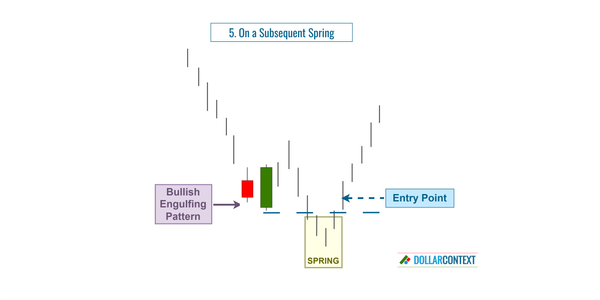

In this article, we discuss the different options for entry points after the appearance of an engulfing pattern.

CANDLESTICK

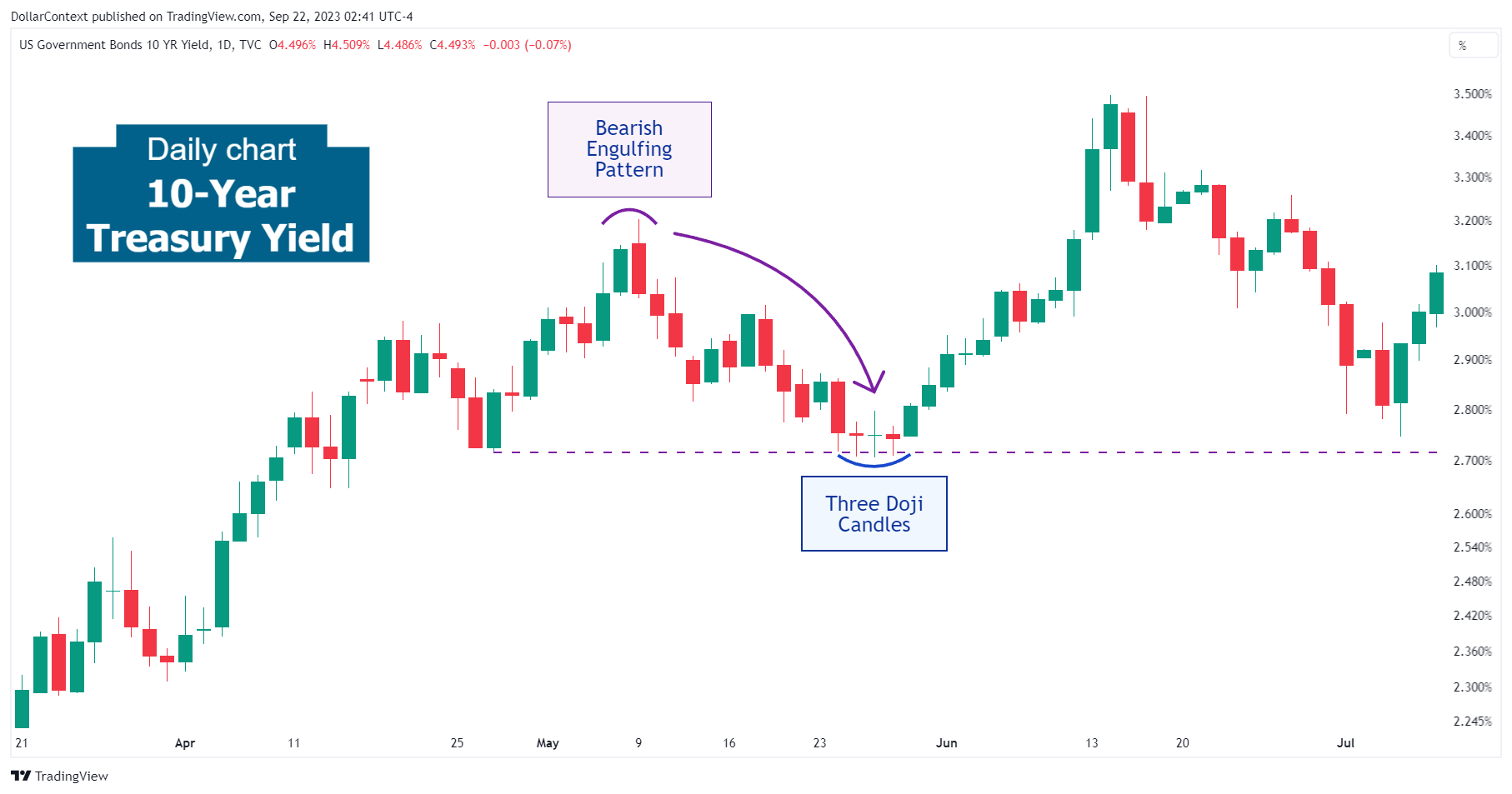

Following the appearance of the bearish engulfing pattern, there was a high likelihood of either a sideways trading range or a minor retracement.

CANDLESTICK

By understanding these psychological aspects, traders can better anticipate the potential market's response to an engulfing pattern and adjust their strategies accordingly.