DOJI

How to Recognize a Doji Candle

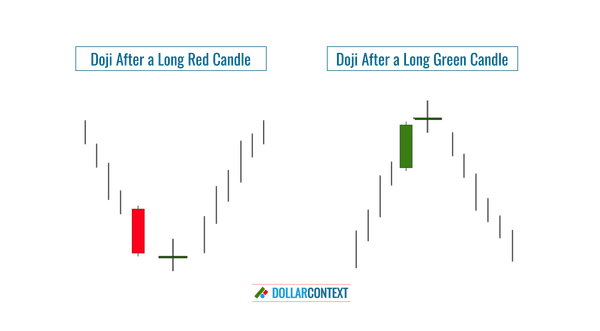

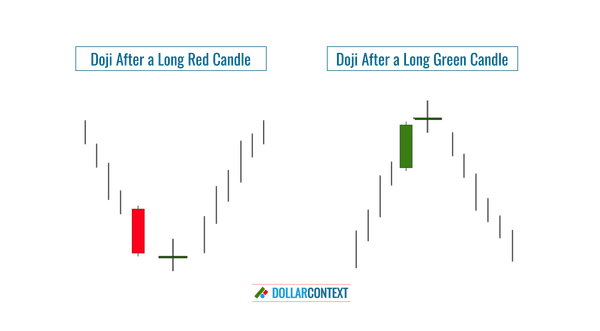

A doji is a candlestick where the opening and closing prices are the same. That is, a doji session displays a horizontal line instead of a real body.

DOJI

A doji is a candlestick where the opening and closing prices are the same. That is, a doji session displays a horizontal line instead of a real body.

CANDLESTICK

Today we're exploring an important indicator of Japanese candlestick charting: the piercing pattern.

CANDLESTICK

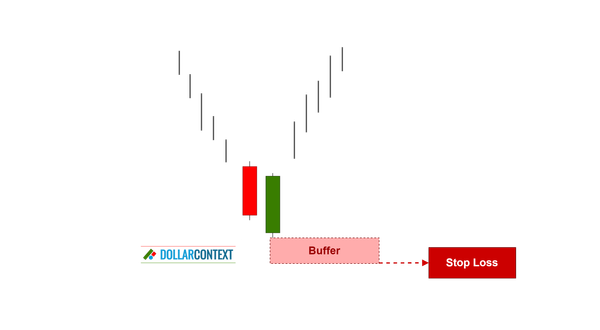

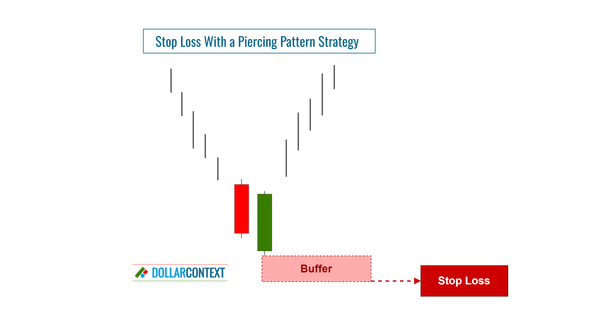

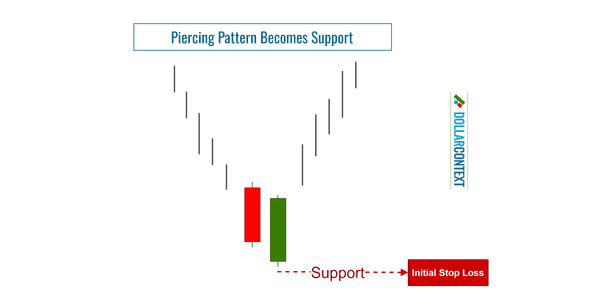

Set the stop-loss level below the low of the piercing pattern to protect you against potential downside risk.

CANDLESTICK

The price range associated with a piercing pattern frequently evolves into a support area.

CANDLESTICK

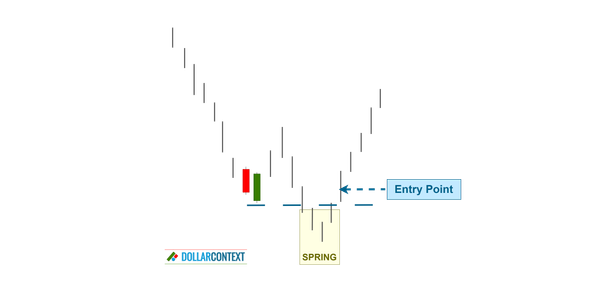

When a piercing pattern emerges, it signals a potential bullish reversal. Here are different options for entry points after this pattern.

CANDLESTICK

Understanding the psychology behind the piercing pattern requires dissecting its two-candle formation and the investor sentiment driving each candlestick.

CANDLESTICK

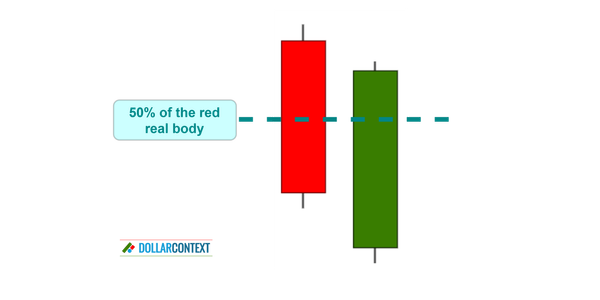

A piercing pattern is a two-candle combination that occurs at the end of a downtrend, signaling a potential bullish reversal.

HAMMER

Today, we're going to explore a crucial pattern in the realm of Japanese candlestick analysis: the hammer.

HAMMER

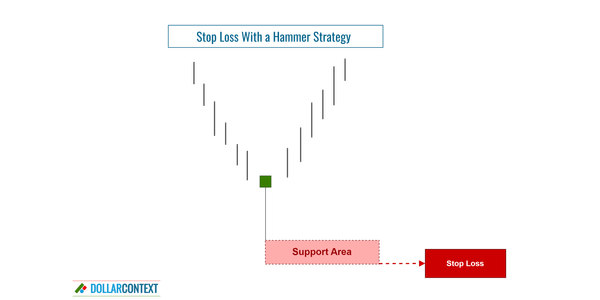

Set the stop-loss level below the low of the hammer pattern to protect against potential downside risk.

HAMMER

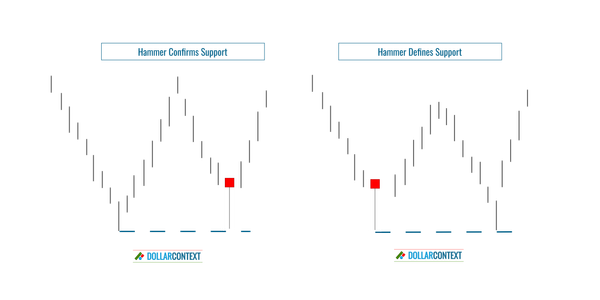

A hammer creates a support area or confirms the credibility of a previously identified support zone.

HAMMER

In this post we cover the psychological implications of a hammer pattern within the domain of Japanese candlestick charts.

HAMMER

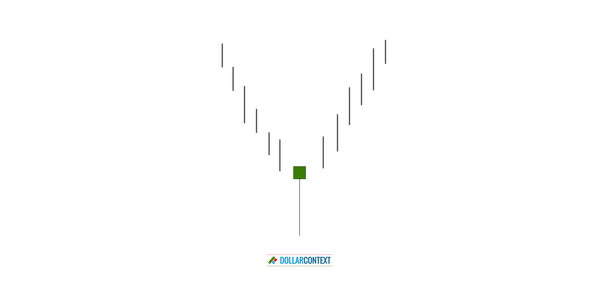

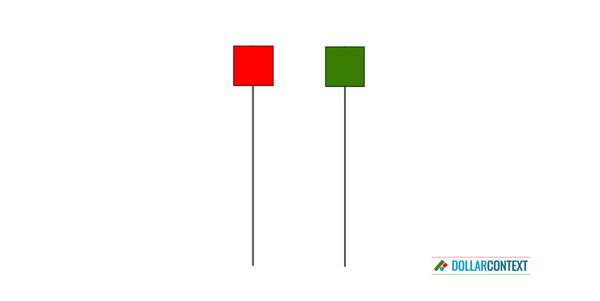

The hammer pattern consists of a candle with a small real body at the upper end of the session and a long lower shadow.