CANDLESTICK

Shooting Star Strategy: A Comprehensive Tutorial

Today, we're going to explore a crucial component in the realm of Japanese candlestick analysis: the shooting star.

CANDLESTICK

Today, we're going to explore a crucial component in the realm of Japanese candlestick analysis: the shooting star.

CANDLESTICK

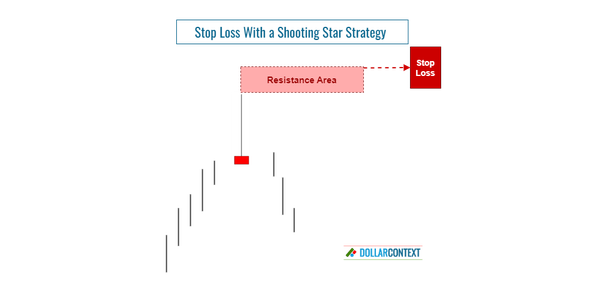

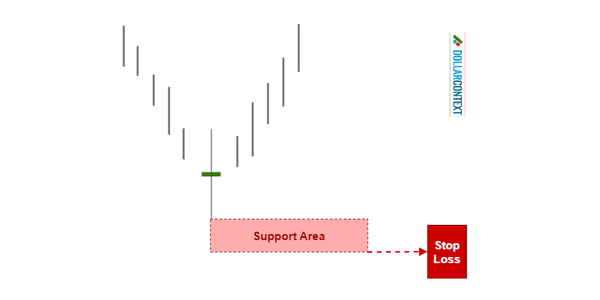

The peak price of a shooting star establishes a resistance level, which functions as your initial stop loss point.

CANDLESTICK

The price range of a shooting star tends to become resistance. In particular, the peak price of this candle line either establishes or reinforces a resistance level.

CANDLESTICK

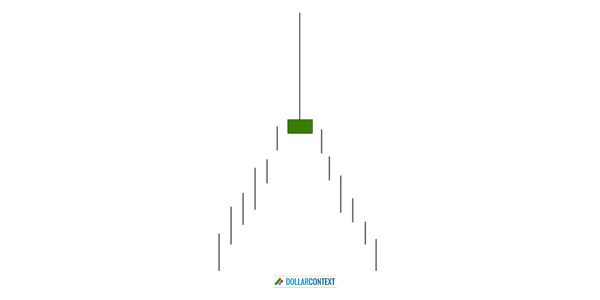

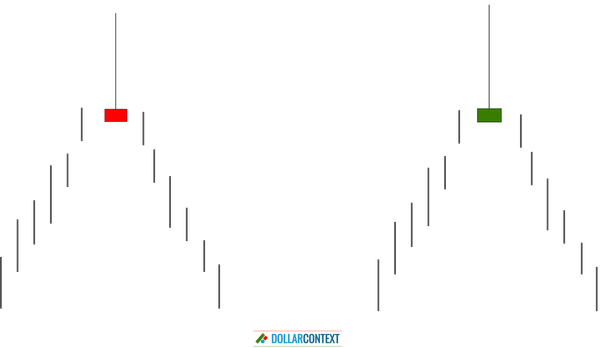

A shooting star symbolizes a psychological battle between bulls and bears and the inability of the buyers to sustain the high prices.

CANDLESTICK

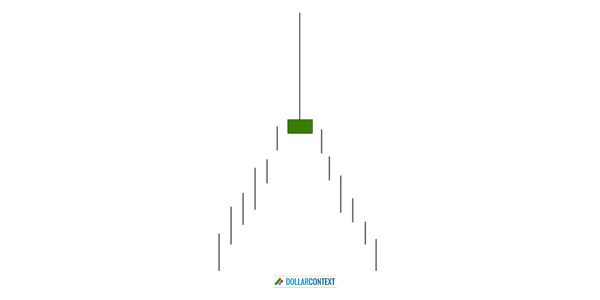

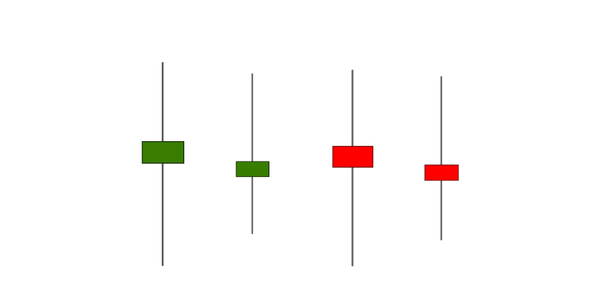

The shooting star pattern consists of a candle with a small real body at the lower end of the candle and a long upper shadow.

CANDLESTICK

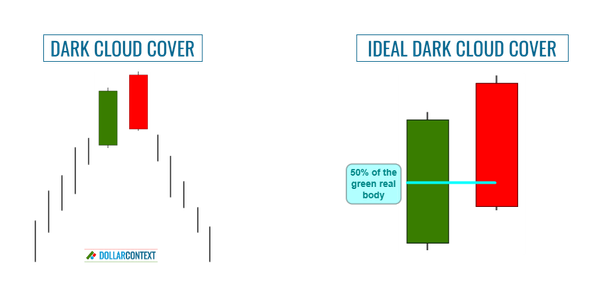

After either a mature or a sharp uptrend, a dark cloud cover can act as an indicator of reversal. This presents a potential opportunity for traders to establish short positions in the market.

CANDLESTICK

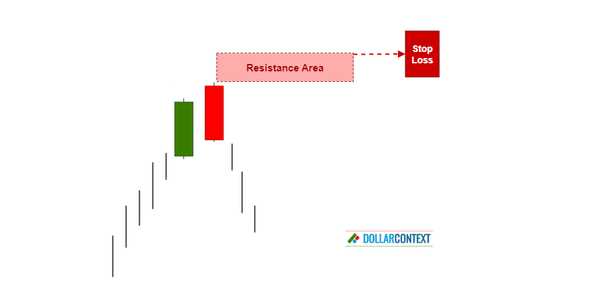

The highs of a dark cloud cover usually becomes resistance. This level acts as a ceiling that price struggles to break through.

CANDLESTICK

The highs of the dark cloud cover creates a resistance area. This resistance level represents your initial stop loss.

CANDLESTICK

This sudden reversal surprises those participants who had been expecting the upward trend to continue.

CANDLESTICK

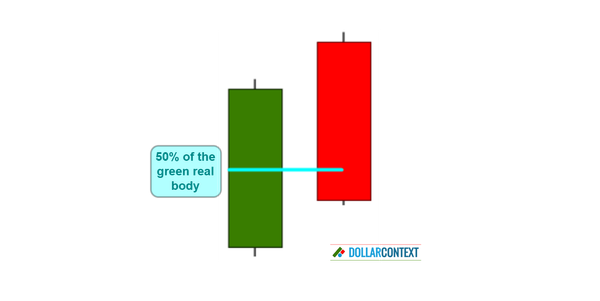

For an optimal dark cloud cover, the second session should ideally conclude below the midpoint of the preceding white/green candle.

HIGH-WAVE

The high-wave candle is characterized by its distinct long upper and lower shadows, which are significantly longer than the candle's real body.

HIGH-WAVE

After a downtrend, the lowest price reached during the high-wave’s session sets up a support level.