COMMODITIES

Past and Future of Agricultural Commodity Prices

We discuss the technical aspects of a range of agricultural commodity assets and offer our insights on the potential future direction of this market.

Commodity Assets

COMMODITIES

We discuss the technical aspects of a range of agricultural commodity assets and offer our insights on the potential future direction of this market.

RICE

We discuss the patterns that have shaped the course of rice prices since 2020 and provide our perspectives regarding the future of this market.

SUGAR

We discuss the patterns that have shaped the trajectory of sugar prices since 2020 and provide our perspectives regarding the future of this market.

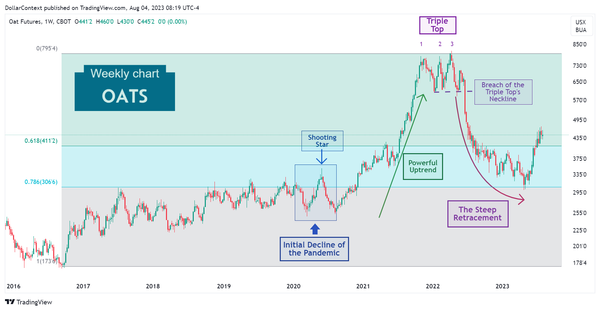

OATS

We cover the trends that have shaped the course of oat prices and provide our view regarding the likely future progression of this market.

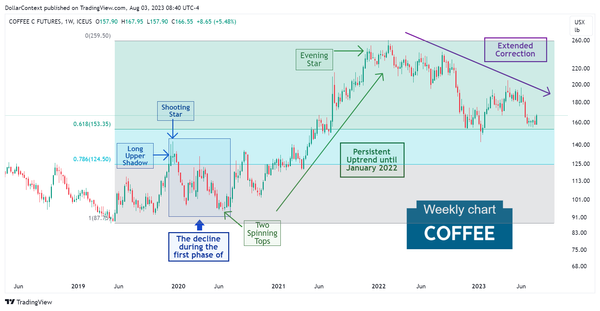

COFFEE

We'll discuss the trends and factors that have shaped the course of coffee prices from 2020 onwards. As we wrap up, we'll offer our insights on the probable future direction of this market.

COCOA

After covering the key factors that have driven cocoa prices since 2020, we'll provide our perspectives on the future path of this commodity.

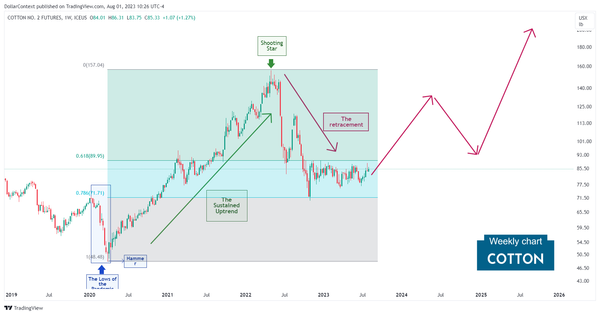

COTTON

In this post, we're going to explore the trends and influences that have molded the trajectory of cotton prices starting from 2020. As we reach the end, we'll share our insights on the potential future direction of this market.

CORN

We'll delve into the trends that have shaped the path of corn prices since 2020. Then, we'll provide our perspectives on the potential future course of this market.

SOYBEAN

From 2020 onwards, the commodity market, encompassing soybeans and other agricultural products, might have embarked on a supercycle period.

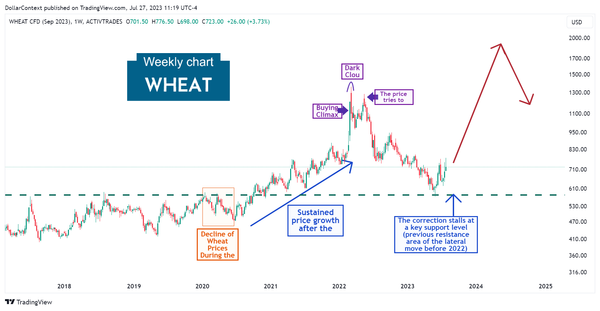

WHEAT

We delve into the key driving forces that have been shaping the wheat market since 2020. Then, we speculate on the potential trajectory this market might take.

SILVER

Evidently, this particular scenario may not come to fruition. Nevertheless, we deem it a likely outcome. Episodes of profound collapses and panic, similar to the one observed in 2020, frequently precede commodity supercycles.

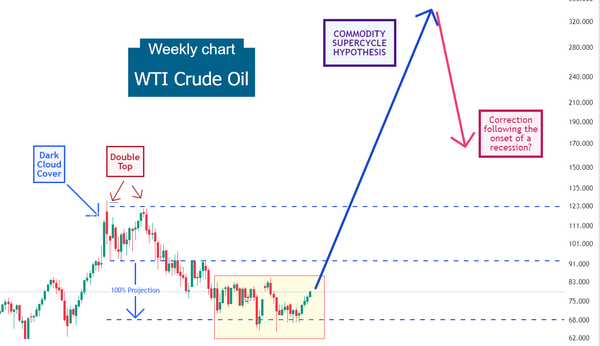

CRUDE OIL

Starting in 2020, the commodity market may have entered a supercycle phase. Such supercycles usually extend beyond 8 years and lead to substantial price escalations.