CANDLESTICK

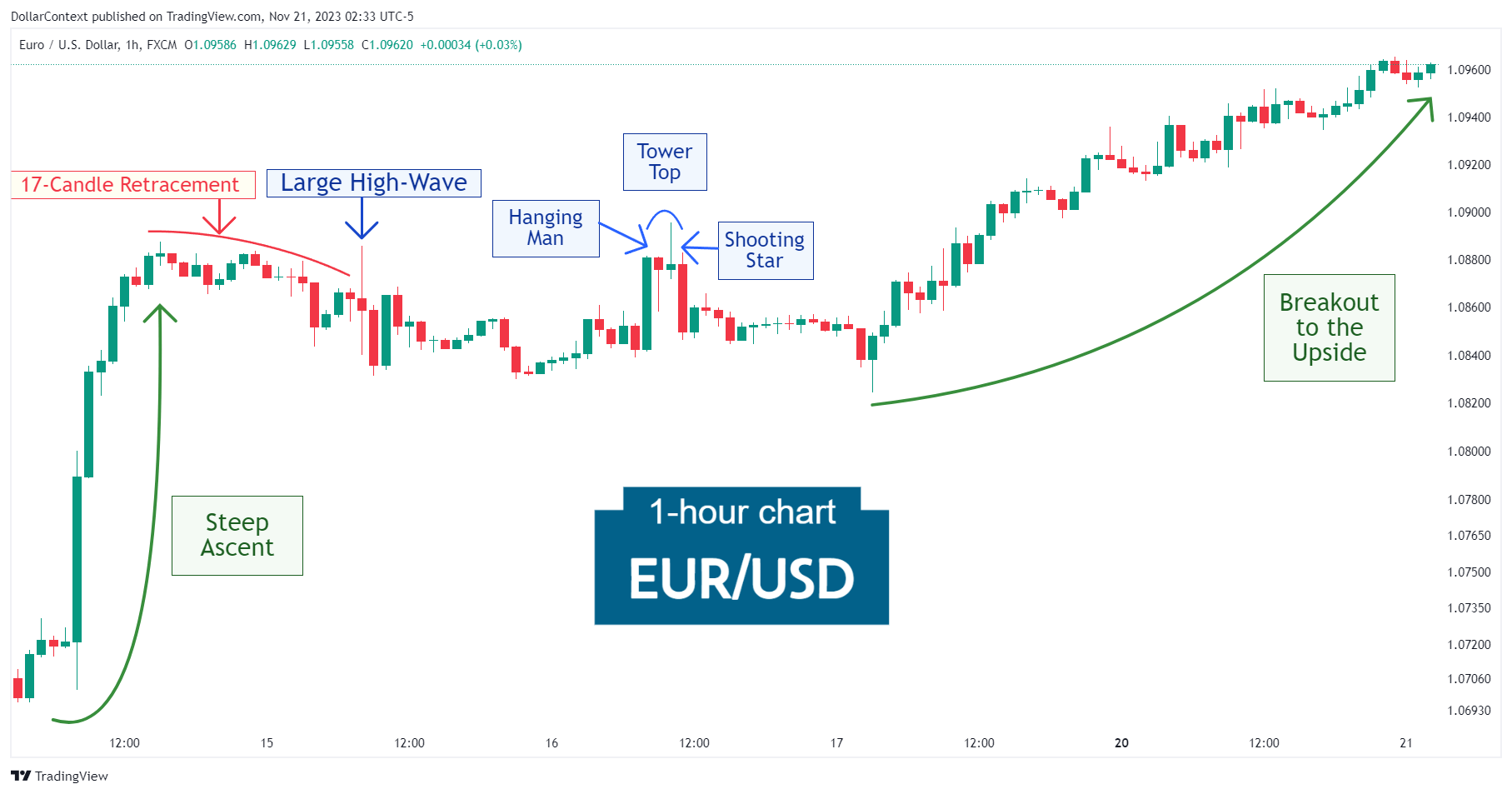

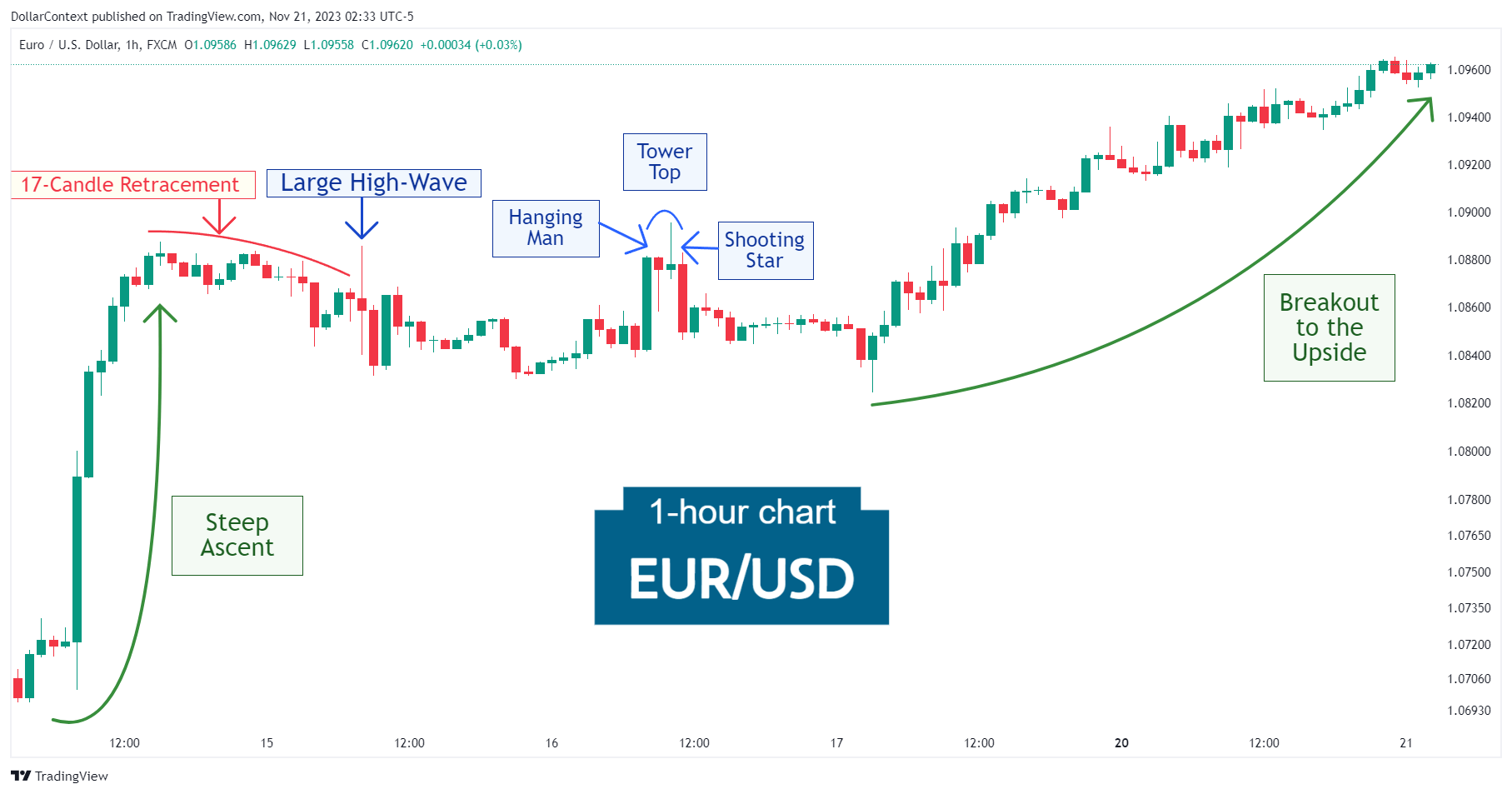

Case Study 0026: High-Wave and Tower Top in a Consolidation Phase (EUR/USD)

In this article, we will discuss the performance of the EUR/USD after the emergence of a high-wave candle in a consolidation phase.

CANDLESTICK

In this article, we will discuss the performance of the EUR/USD after the emergence of a high-wave candle in a consolidation phase.

CANDLESTICK

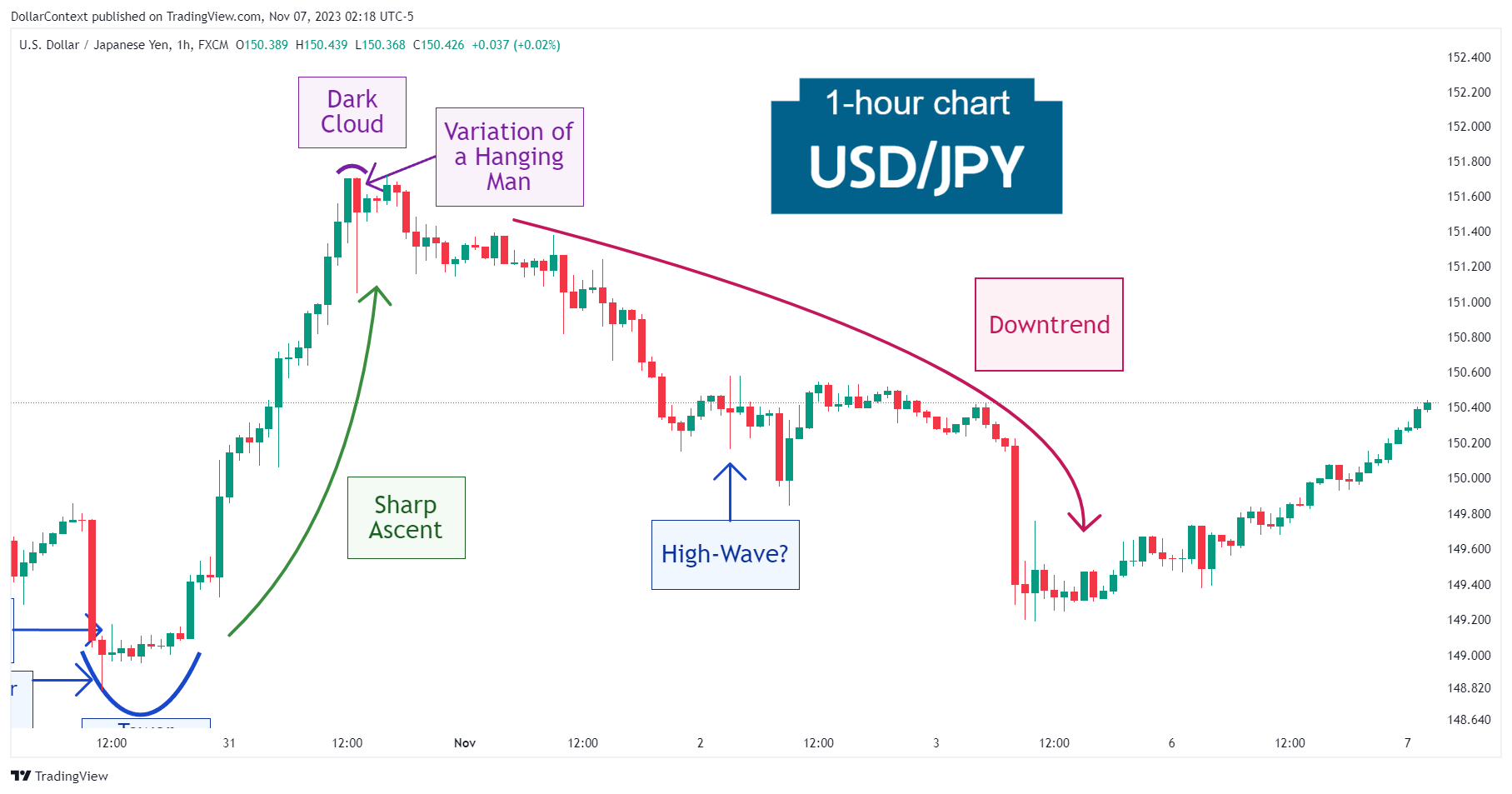

After a sharp rise of approximately 1.8 percent within an 18-hour timeframe, the USD/JPY presented a dark cloud cover and a hanging man candle line.

CANDLESTICK

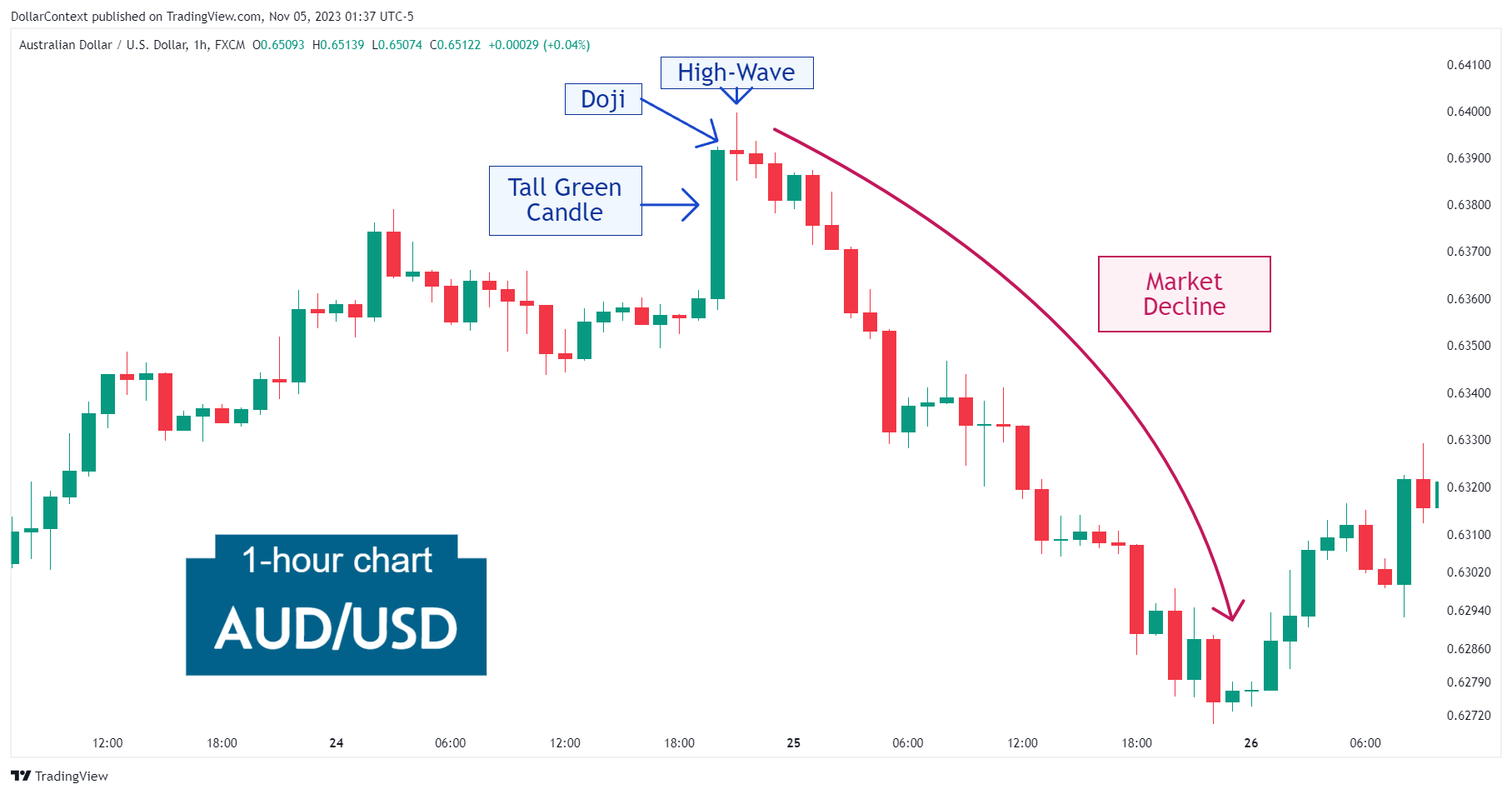

In this article, we will cover the performance of the AUD/USD after the emergence of a high-wave pattern.

CANDLESTICK

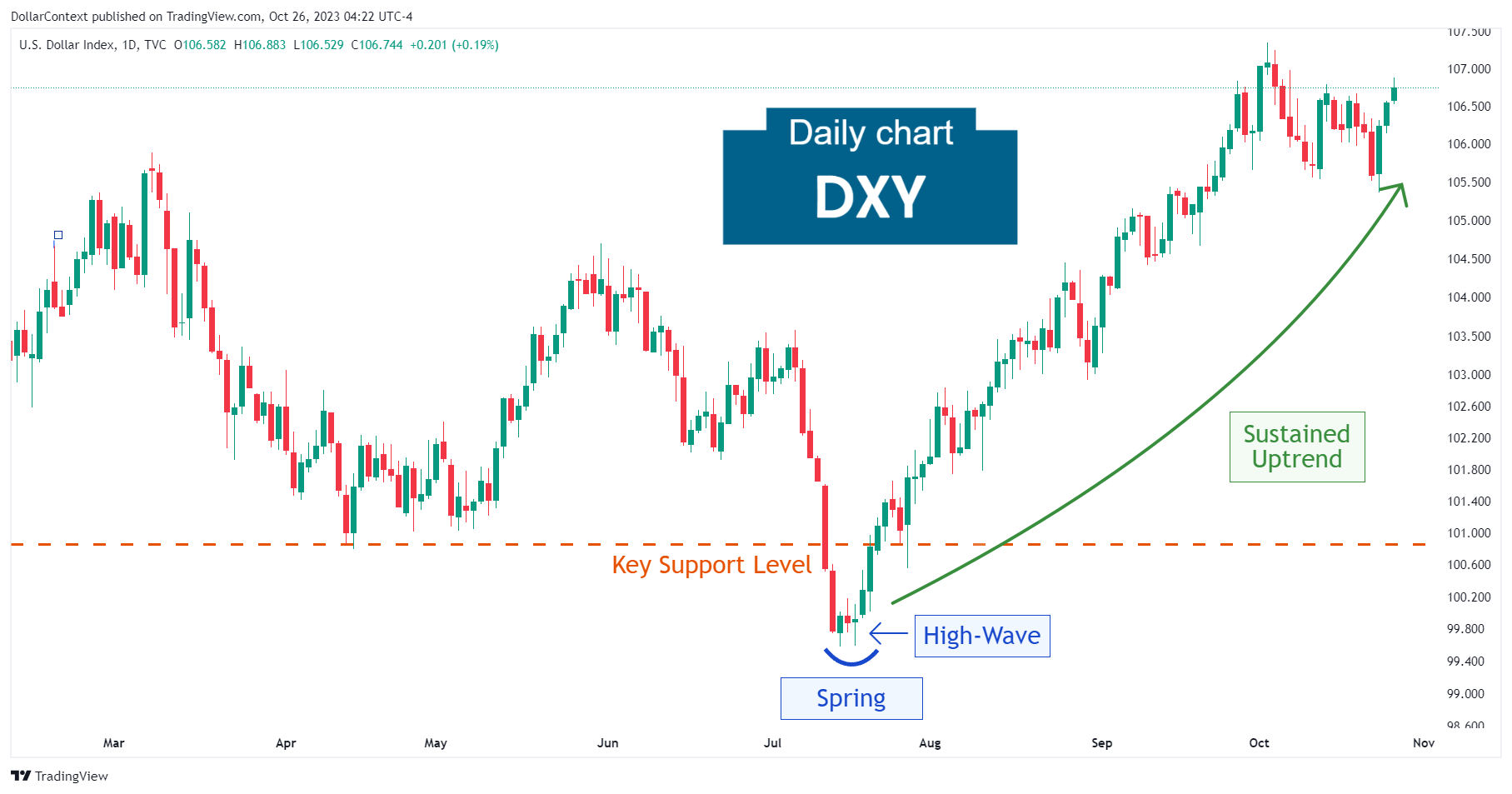

In this article, we will discuss the performance of the DXY after the market plunge in mid-July 2023.

CANDLESTICK

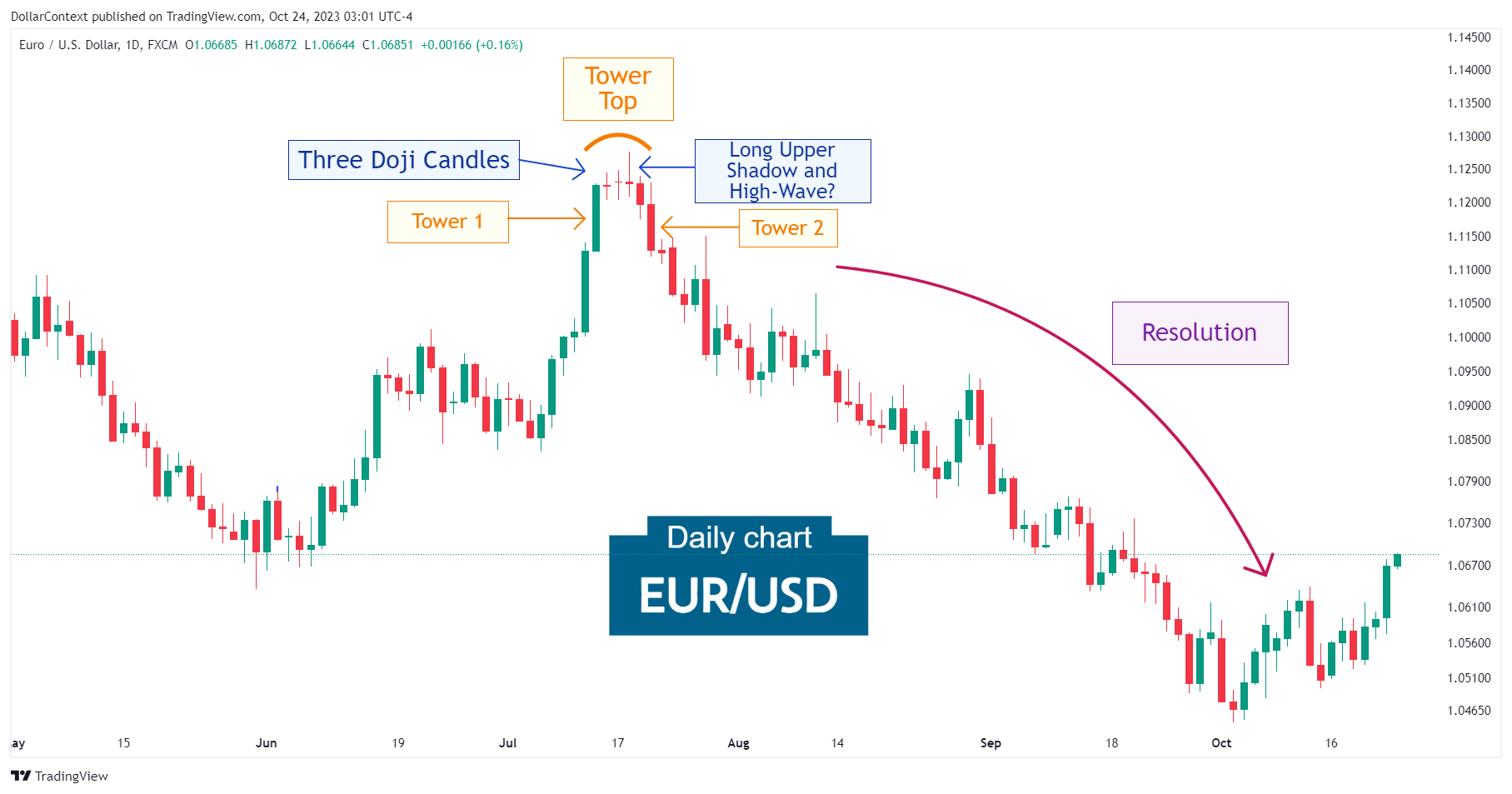

In this article, we will discuss the performance of the EUR/USD after the emergence of a series of doji sessions and a tower top.

CANDLESTICK

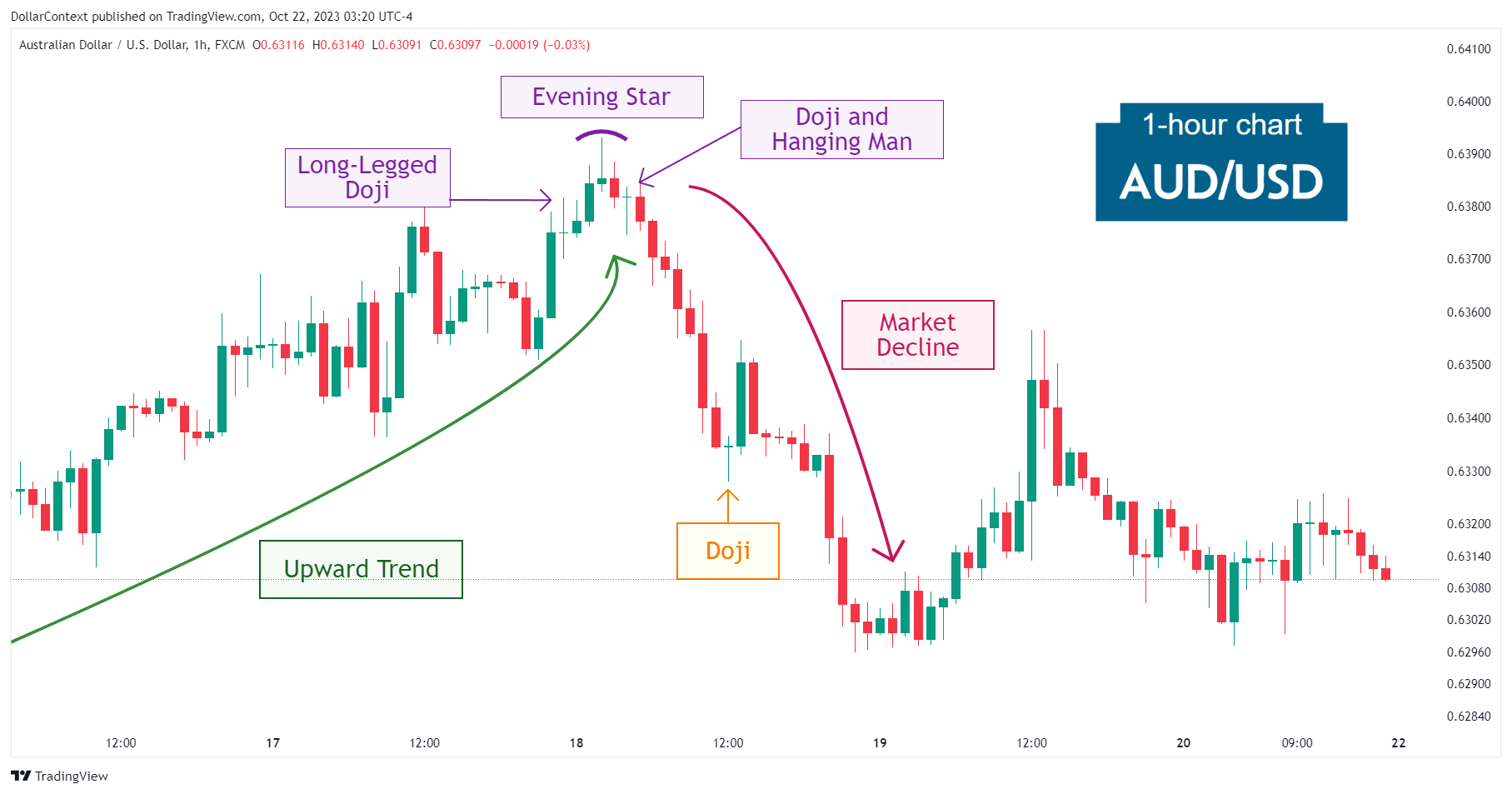

In this article, we will cover the performance of the AUD/USD market after the appearance of an evening star and shooting star pattern.

CANDLESTICK

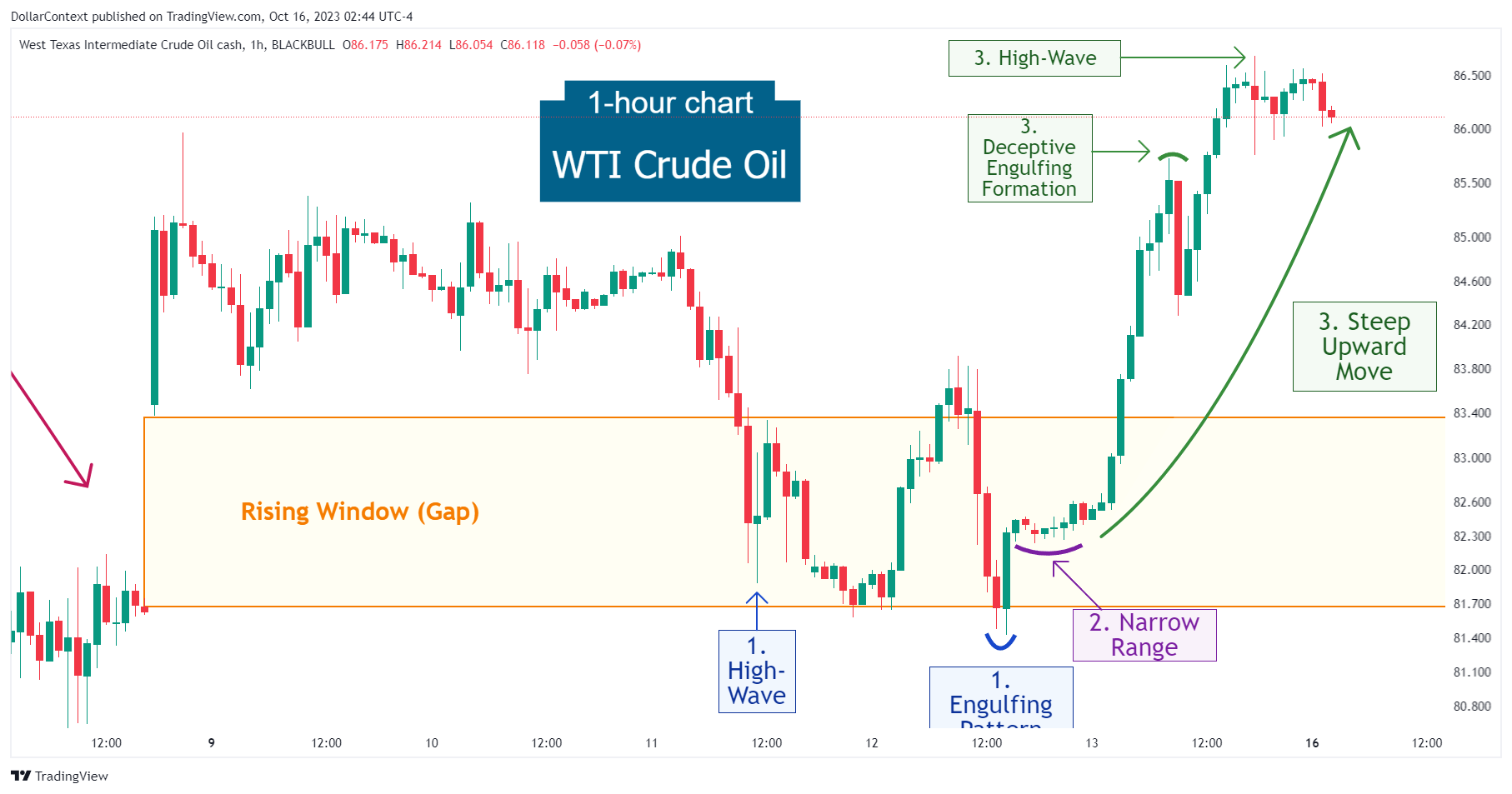

In this article, we will cover the performance of the WTI market after the emergence of a high-wave and an engulfing pattern.

CANDLESTICK

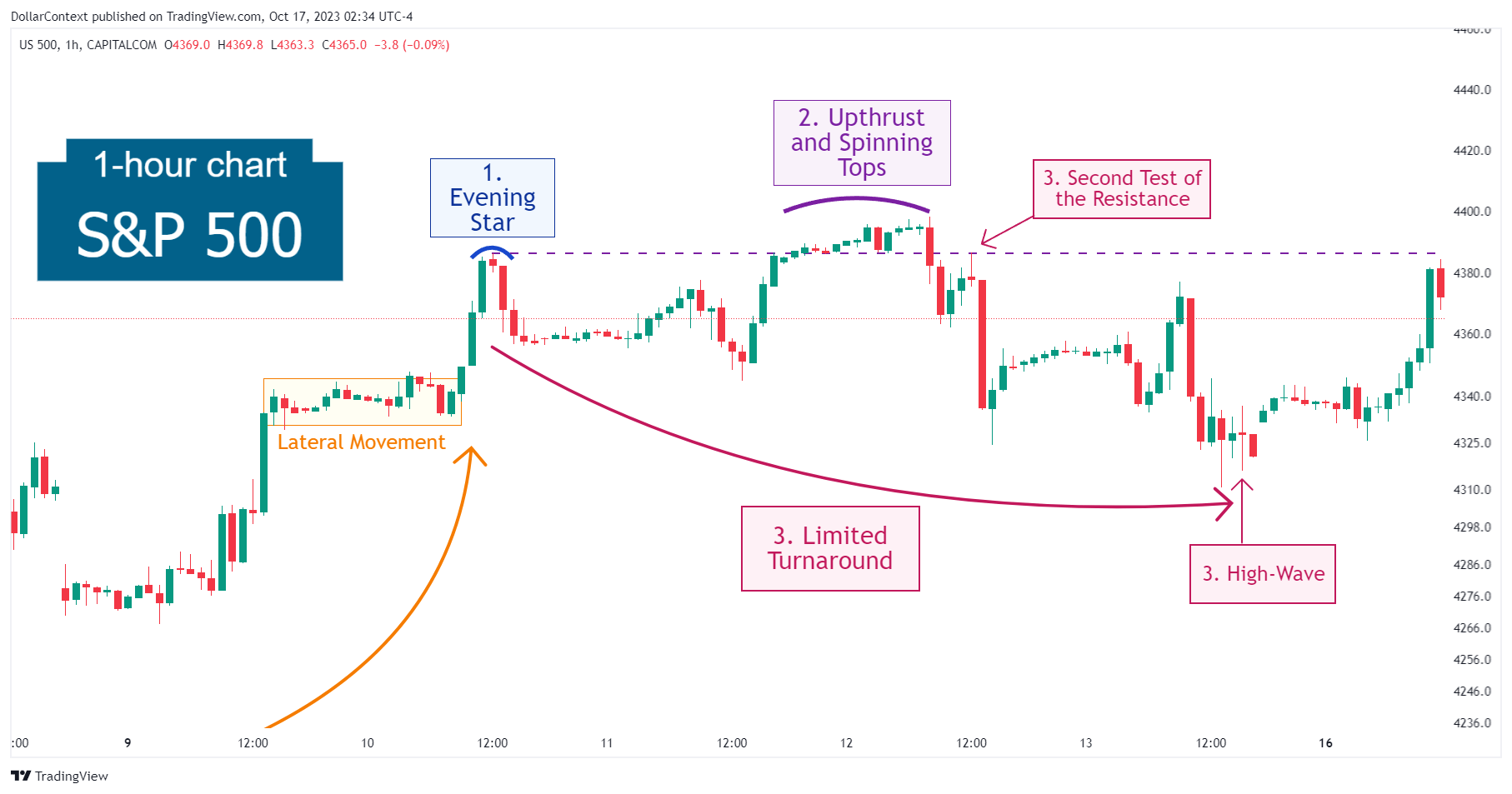

In this article, we will discuss the performance of the S&P 500 after the appearance of an evening star.

CANDLESTICK

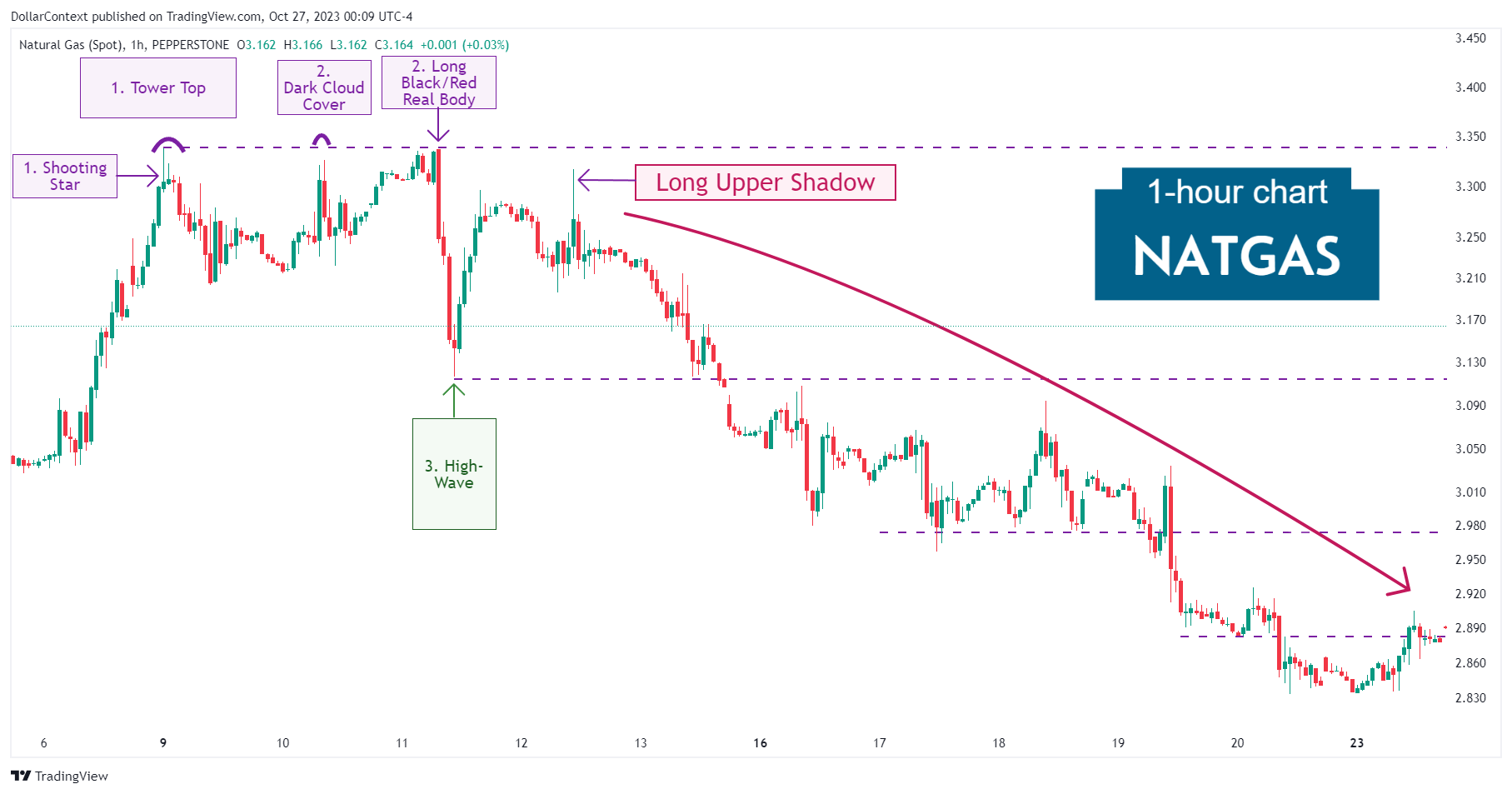

In this article, we will examine the performance of the natural gas market after the emergence of a tower top.

CANDLESTICK

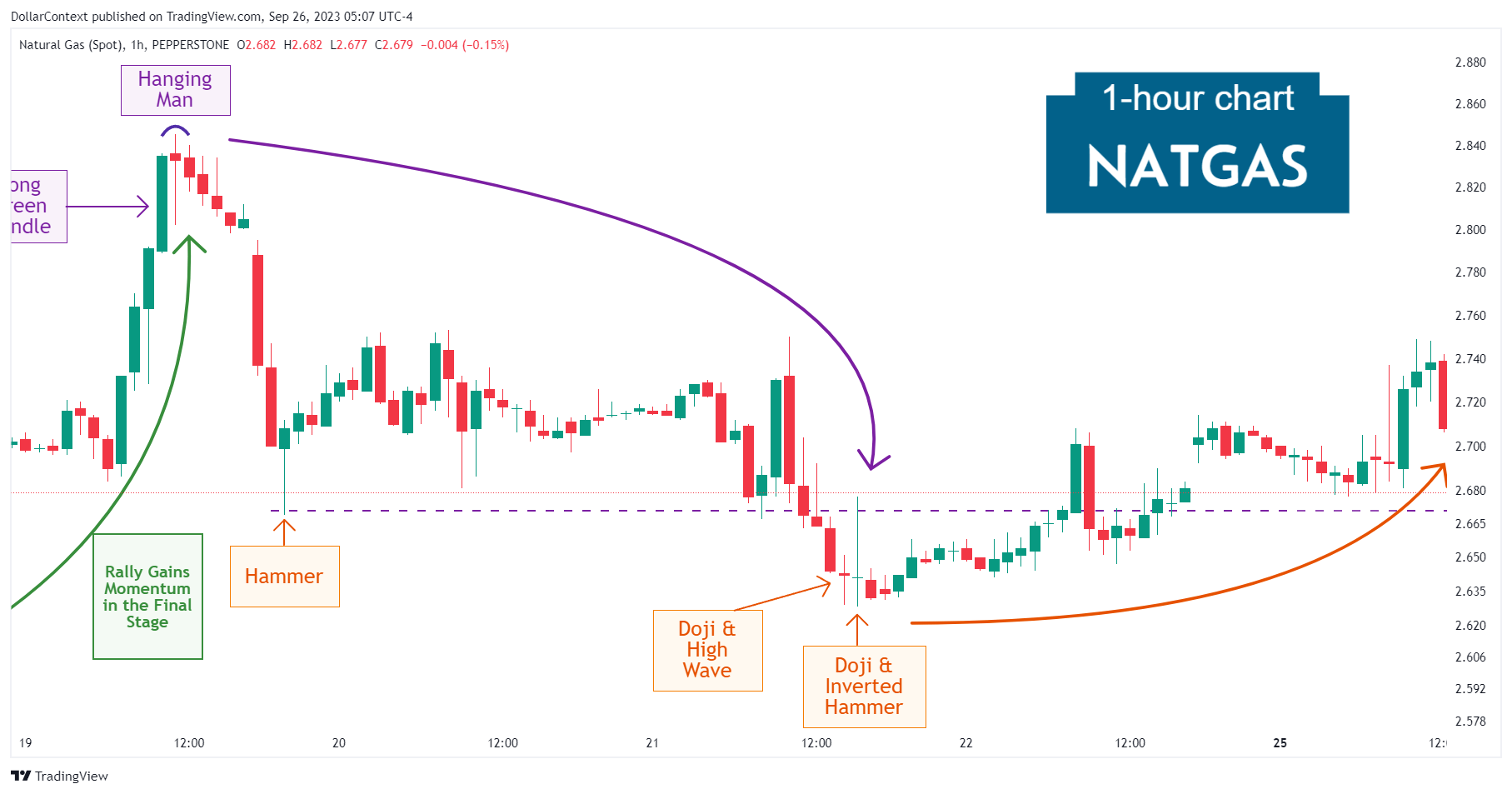

In this article, we will discuss the performance of a highly volatile market in which specific candlestick patterns effectively signaled price tops and bottoms.

HIGH-WAVE

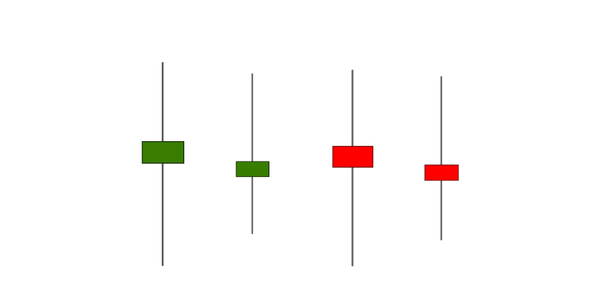

The high-wave candle is characterized by its distinct long upper and lower shadows, which are significantly longer than the candle's real body.

HIGH-WAVE

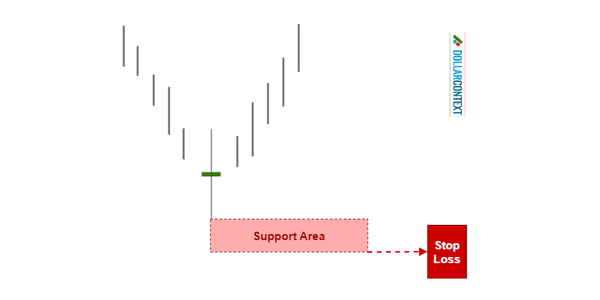

After a downtrend, the lowest price reached during the high-wave’s session sets up a support level.