STOCKS

U.S. Equity Markets: Evolution and Outlook

We'll explore the dynamics that have shaped the course of the major U.S. equity indices and provide insights about the potential future of this market.

Stock Market

STOCKS

We'll explore the dynamics that have shaped the course of the major U.S. equity indices and provide insights about the potential future of this market.

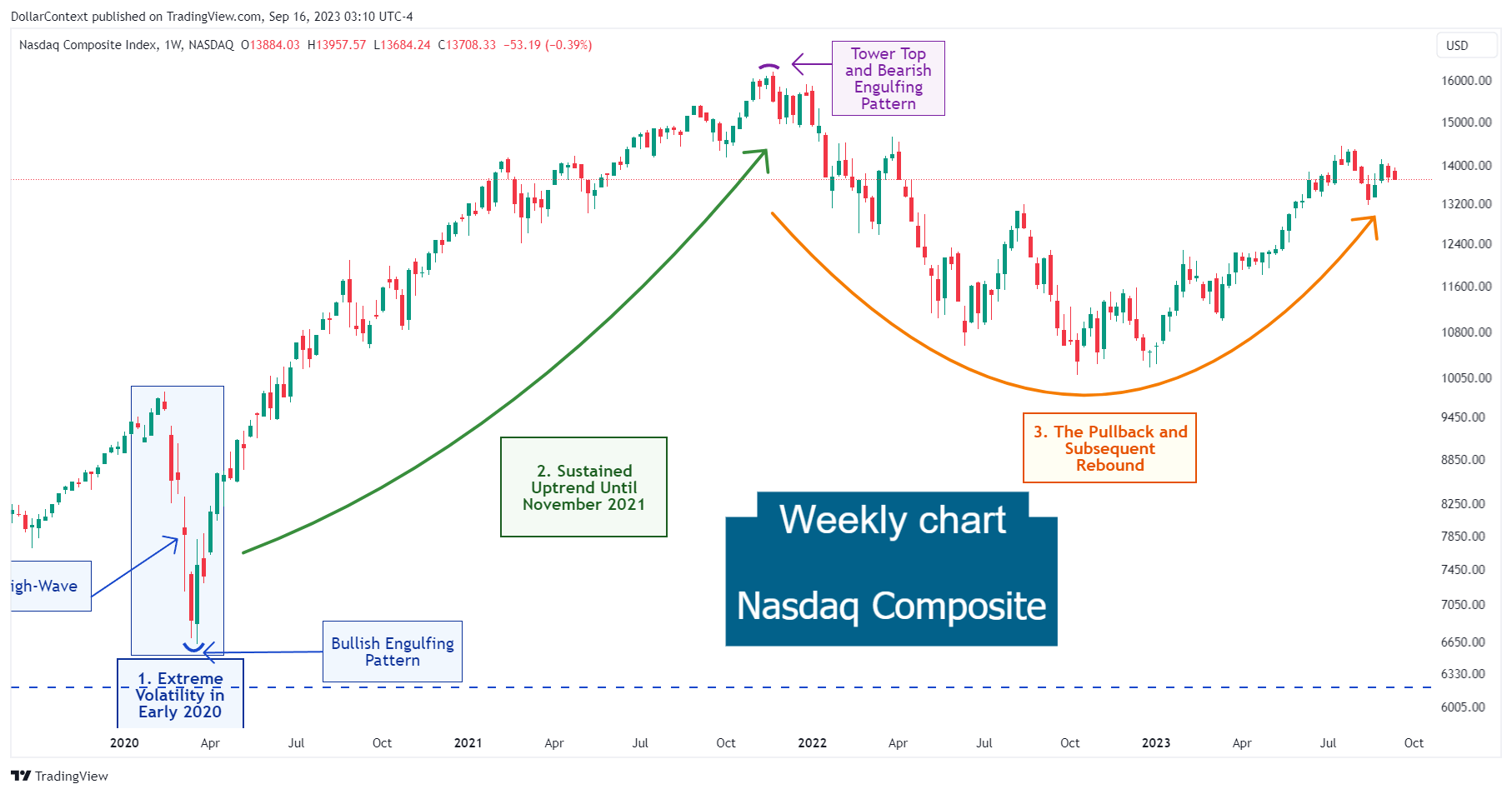

NASDAQ

We discuss the drivers that shaped the course of the Nasdaq Composite post-2020. We'll wrap up by examining potential factors that might determine the market's direction in the future.

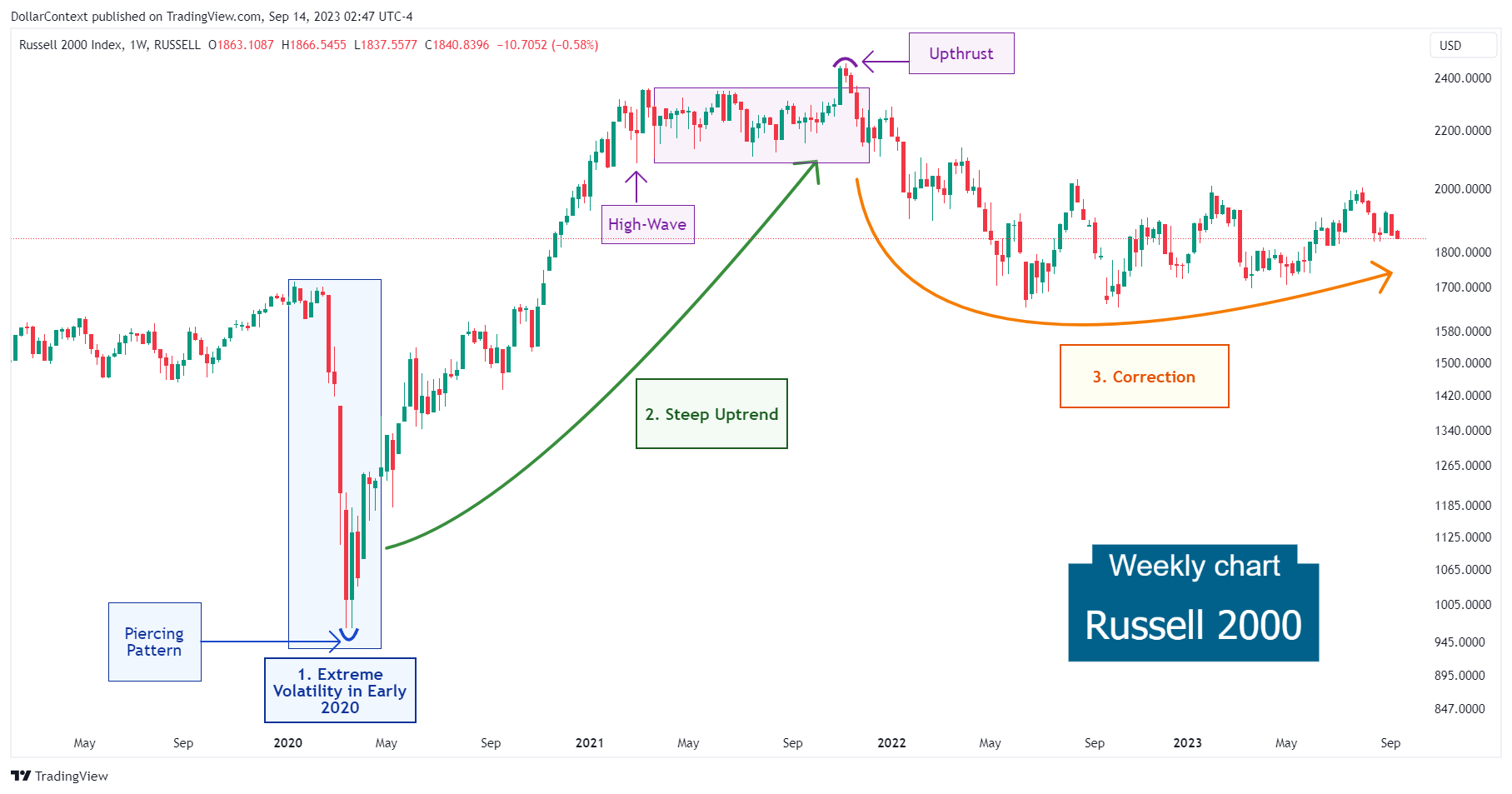

RUSSELL 2000

We examine the main factors shaping the Russell 2000 since 2020 and speculate on its future trajectory.

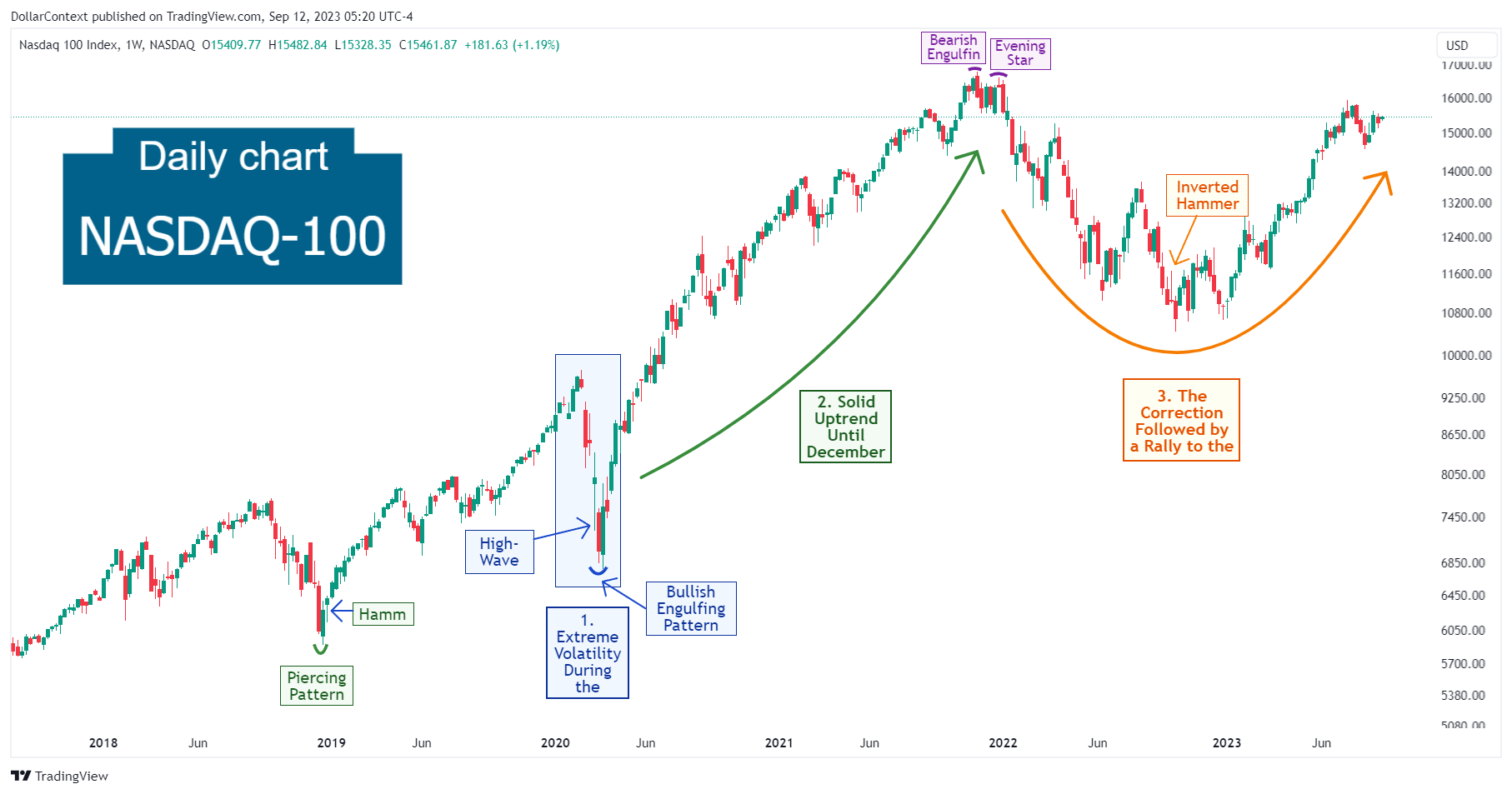

NASDAQ

We examine the main factors shaping the Nasdaq-100 since 2020 and speculate on its future trajectory.

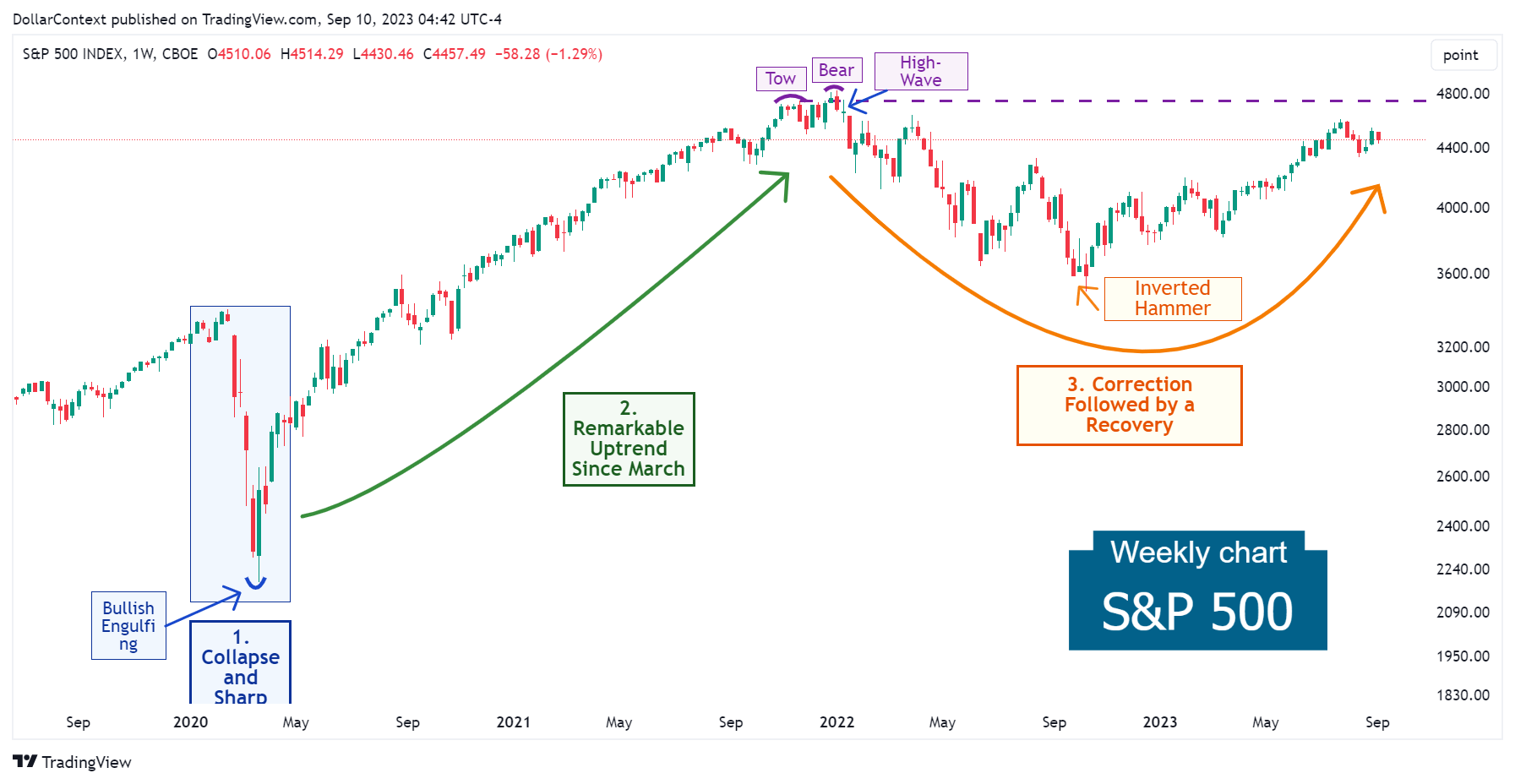

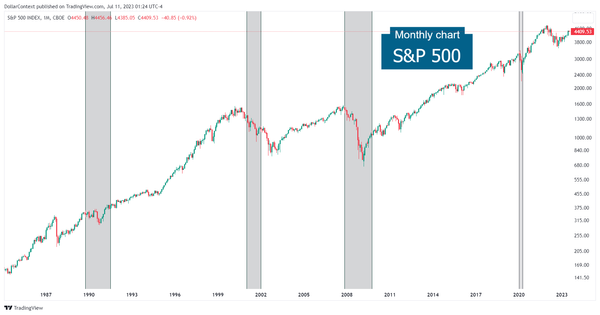

SPX

We discuss the dynamics that have shaped the trajectory of the S&P 500 since 2020 and provide insights on the potential drivers that might influence this market.

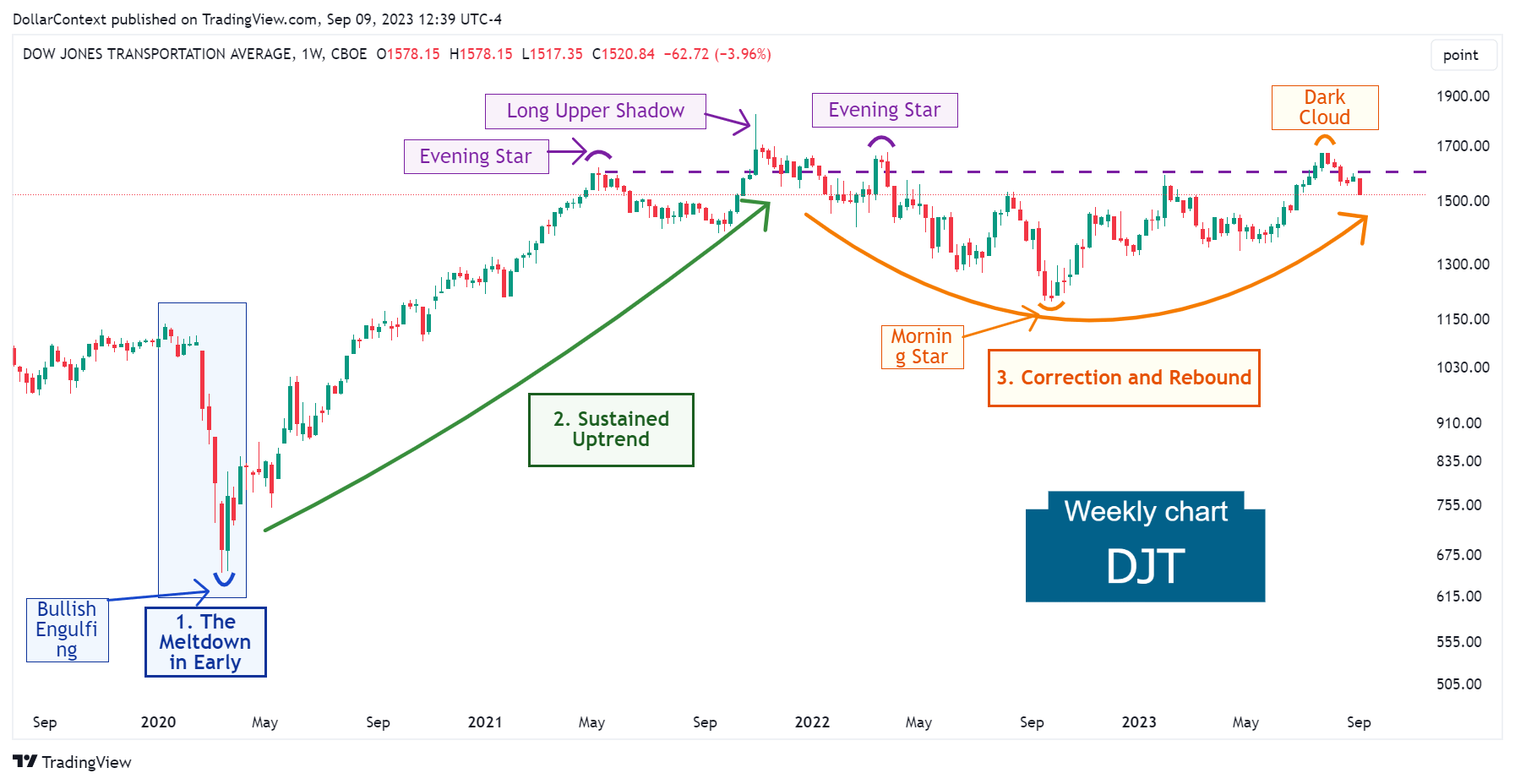

DJT

We explore the forces that have shaped the course of the DJT since 2020 and provide our view on the potential drivers that might influence this market moving forward.

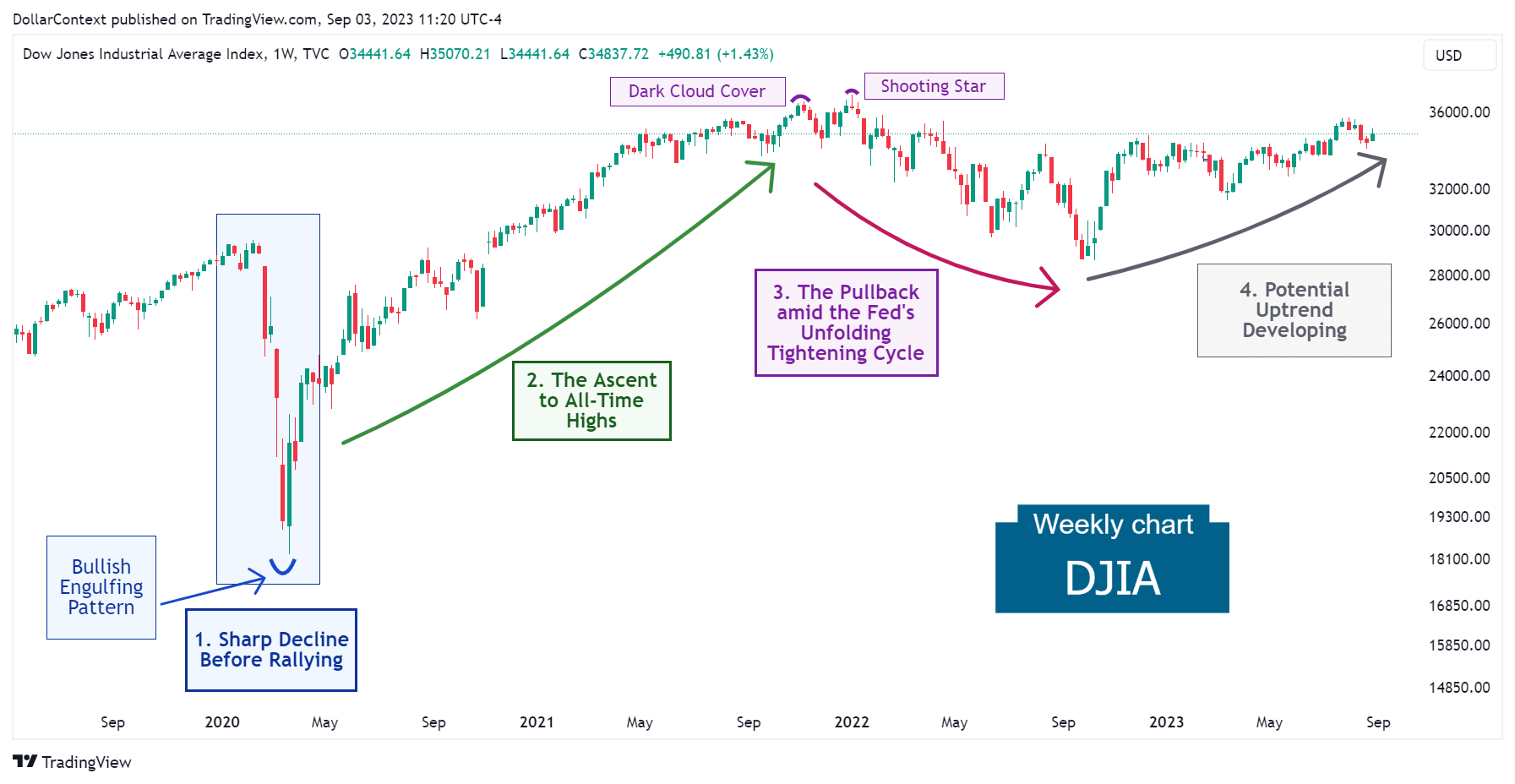

DJIA

We explore the drivers that have shaped the trajectory of the DJIA since 2020 and provide our insights on the potential factors that might influence this market moving forward.

AI

Artificial intelligence (AI) is revolutionizing the economy by substantially enhancing efficiency and productivity. That is, we are witnessing the early phases of what could very well become a transformative era in our history.

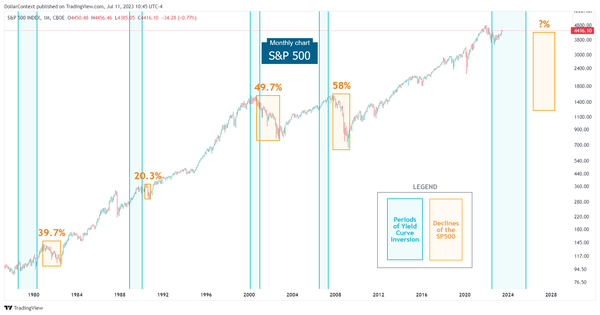

SP500

While we expect a recession, probably at some point next year, we believe that the market will continue to rise for the next few months.

SP500

The SP500 typically experiences a decline within a range of 6 to 18 months after reaching the low point of the yield curve. The magnitude of these declines range approximately from 20% to 60%.

SP500

Typically, the SP500 tends to initiate a downtrend concurrently or slightly ahead of the onset of an economic downturn.