STOP-LOSS

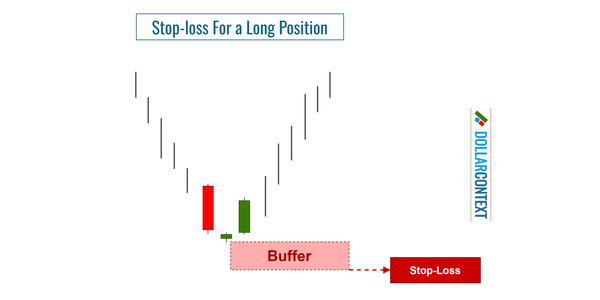

Morning Star: How to Set Your Stop-Loss

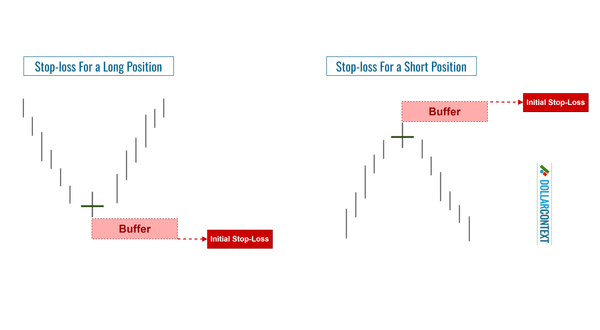

In this post, we'll explore effective strategies to set a stop-loss when using a morning star pattern to initiate a long position.

STOP-LOSS

In this post, we'll explore effective strategies to set a stop-loss when using a morning star pattern to initiate a long position.

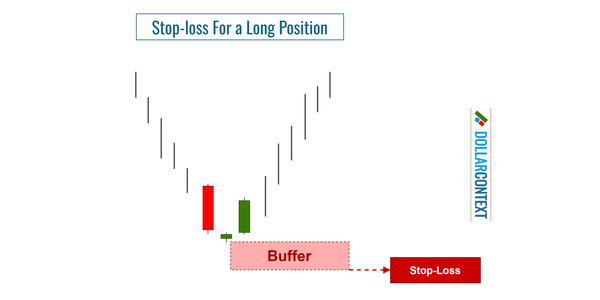

STOP-LOSS

In this post, we'll explore effective strategies to set a stop-loss when using an evening star pattern to initiate a short position.

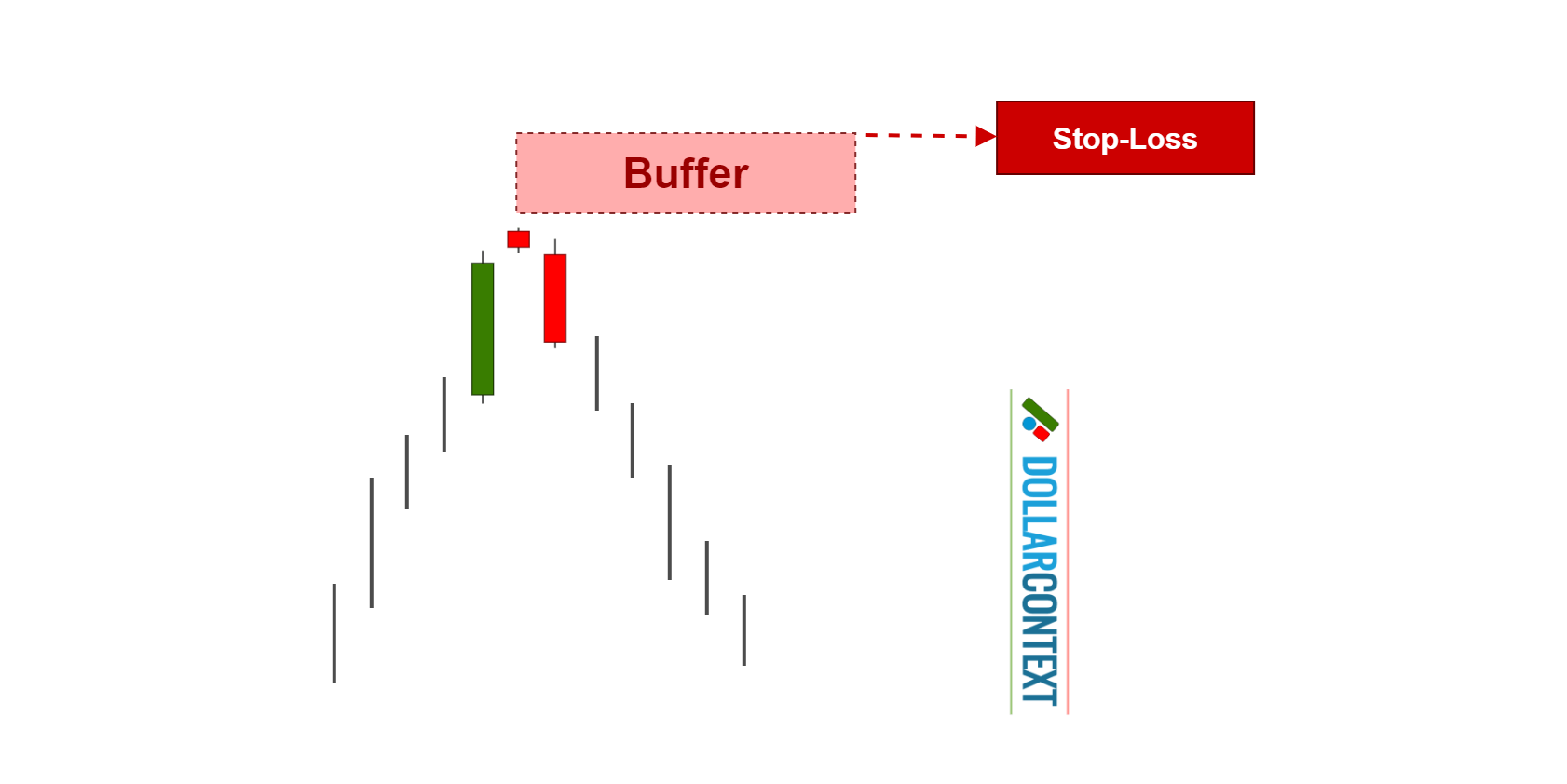

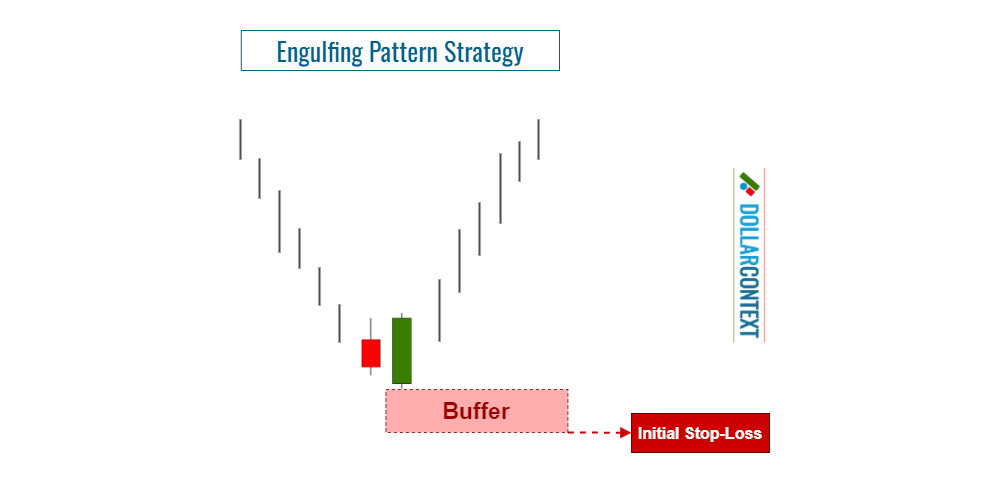

STOP-LOSS

In this post, we'll explore effective strategies to set a stop-loss when using an engulfing pattern to open a market position.

DOJI

In this post, we'll explore effective methods to set a stop-loss when leveraging a doji candle to initiate a market position.

CANDLESTICK

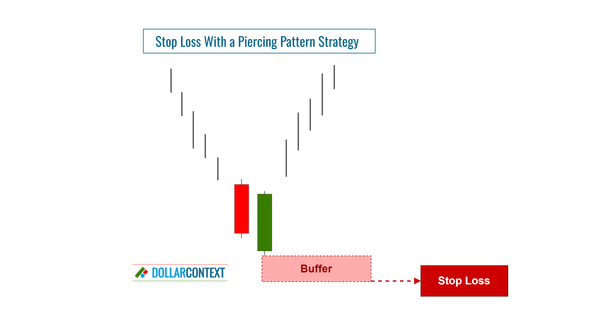

Set the stop-loss level below the low of the piercing pattern to protect you against potential downside risk.

HAMMER

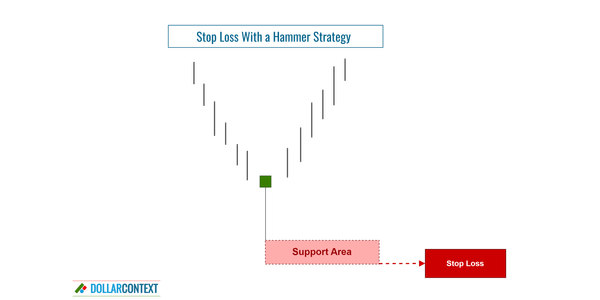

Set the stop-loss level below the low of the hammer pattern to protect against potential downside risk.

CANDLESTICK

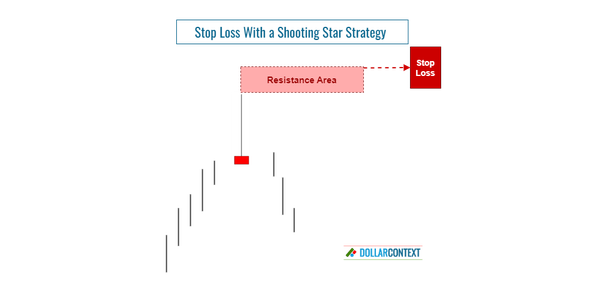

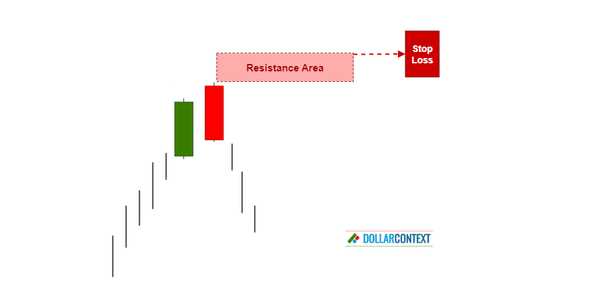

The peak price of a shooting star establishes a resistance level, which functions as your initial stop loss point.

CANDLESTICK

The highs of the dark cloud cover creates a resistance area. This resistance level represents your initial stop loss.

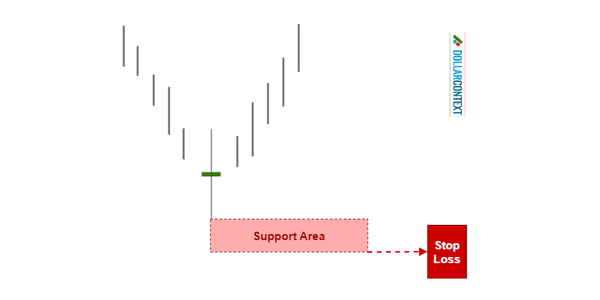

HIGH-WAVE

After a downtrend, the lowest price reached during the high-wave’s session sets up a support level.