Optimal Entry Points With Doji Candles

Here are different options for entry points after the appearance of a doji.

This article is part of the Doji candlestick tutorial series. For the complete guide, see the Doji Candlestick Pattern — Complete Guide.

A doji is a popular pattern in candlestick analysis and represents a session where the opening and closing prices are virtually the same. It indicates indecision in the market.

For a doji to be considered a valid reversal signal, there should be a clear preceding trend. In other words, a bullish trend should be present before a bearish doji reversal, and a bearish trend should be there before a bullish doji reversal.

Here are different options for entry points after the appearance of a doji:

Entry Point Strategies with a Doji

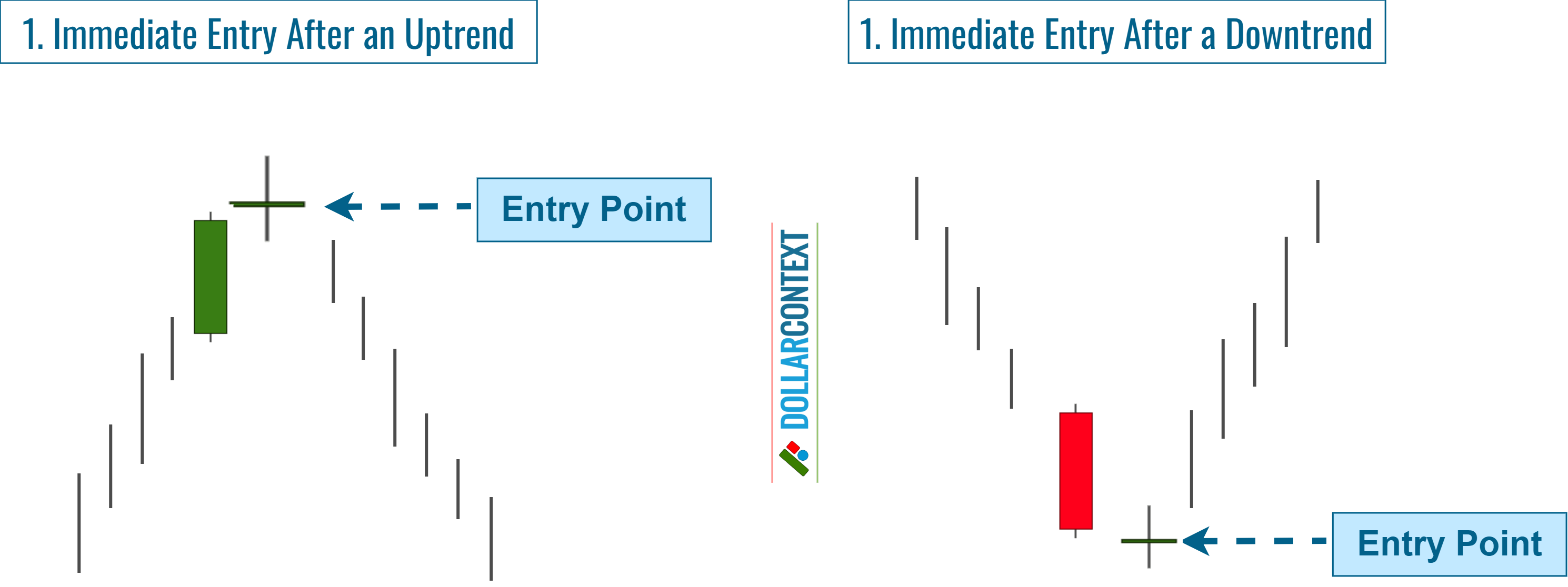

1. Immediate Entry

Once a doji appears following a distinct uptrend or downtrend, you can consider taking a position in the opposite direction. This approach is more aggressive and is based on expecting a reversal.

- Advantages: You won't miss the trading opportunity.

- Disadvantages: You're taking a position without further confirmation. It's important to keep in mind that doji-like candles are fairly common in some markets, and in many situations, they do not anticipate a trend reversal.

We recommend using this strategy only if the previous trend is clear, and the doji session is preceded by a long white candle after an uptrend—or a long black candle after a downtrend.

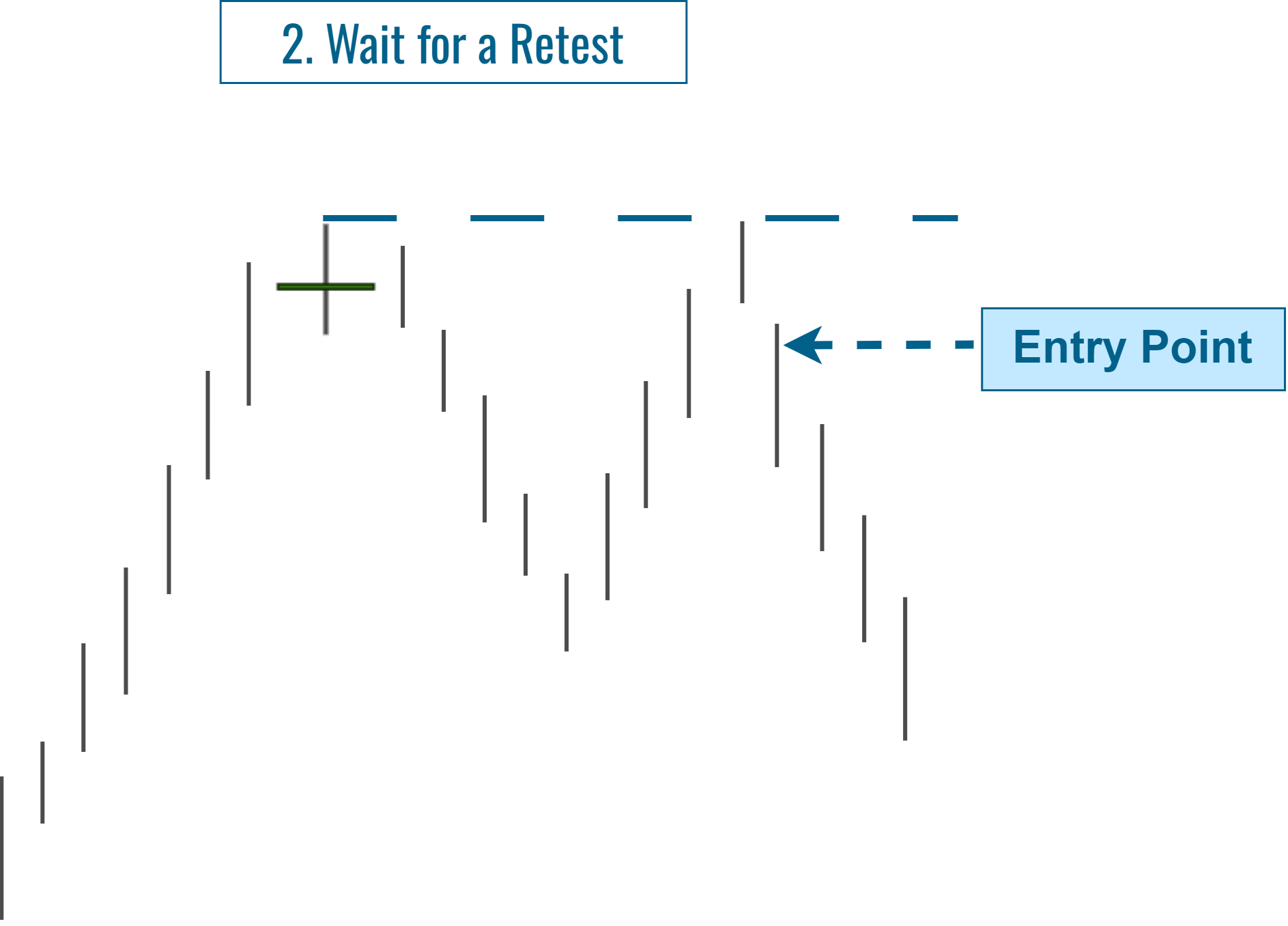

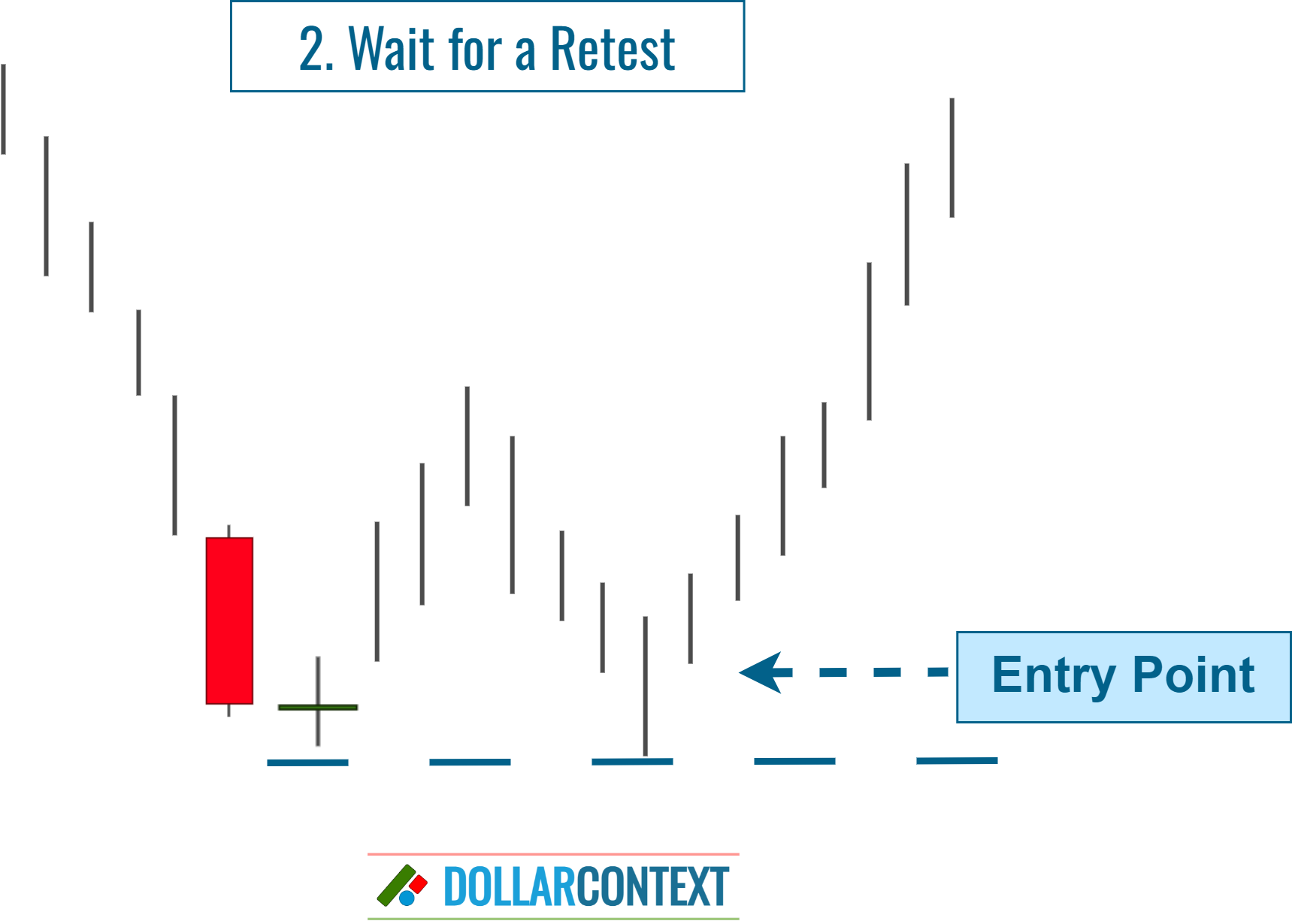

2. Wait for a Retest

Following a robust uptrend, when a doji emerges and the market starts going down, residual buying pressure often persists. This might cause the market to retest the highs of the doji candle before potentially transitioning into a definitive downtrend.

Some traders prefer to wait for the price to revisit the doji candle's highs before making an entry. Remember, after an upward trend, a doji candle becomes resistance. This strategy verifies that the resistance level, marked by the high of the doji, holds. You can also apply this as the stop-loss for your doji strategy.

The same works in reverse. After a downtrend, you can wait for a successful retest of the support area established by the doji to validate your strategy.

- Advantages: If the upper and/or lower shadows of the doji are long, the profit-to-risk ratio may improve notably. In addition, a successful re-evaluation of the support/resistance established by the doji candle strengthens its potential as a reversal indicator.

- Disadvantages: Given that there are instances where the doji's lows or highs aren't revisited, you might miss the trading opportunity.

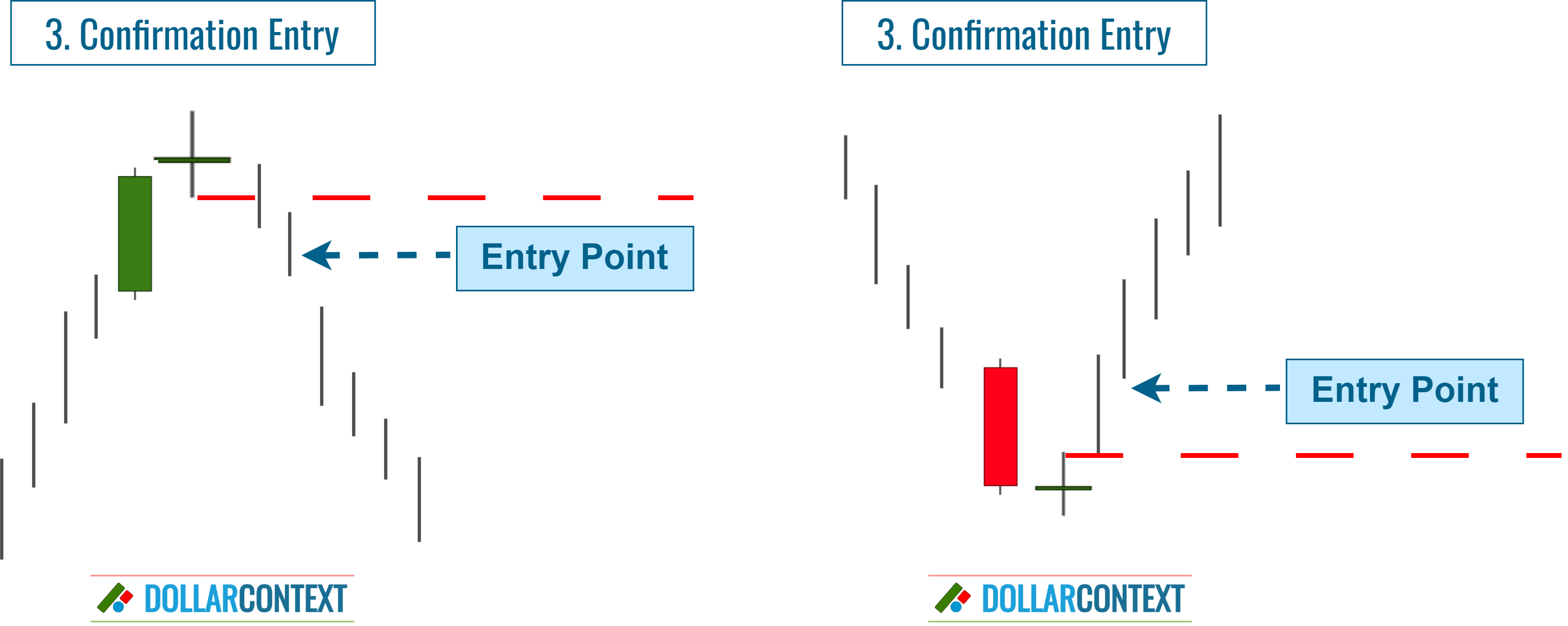

3. Confirmation Entry

This is the most conventional method. To implement it, simply wait for a subsequent candle to confirm the direction before taking a position. For instance:

- If the doji forms after an uptrend and the subsequent candle closes bearish (below the Doji's low), consider a short entry.

- If the doji appears after a downtrend and the next candle closes bullish (above the Doji's high), consider a long entry.

- Advantages: This approach helps corroborate the reliability of the doji candle as a reversal indicator. That is, it reduces the probability of being misled by a false signal.

- Disadvantages: The risk/reward ratio deteriorates.

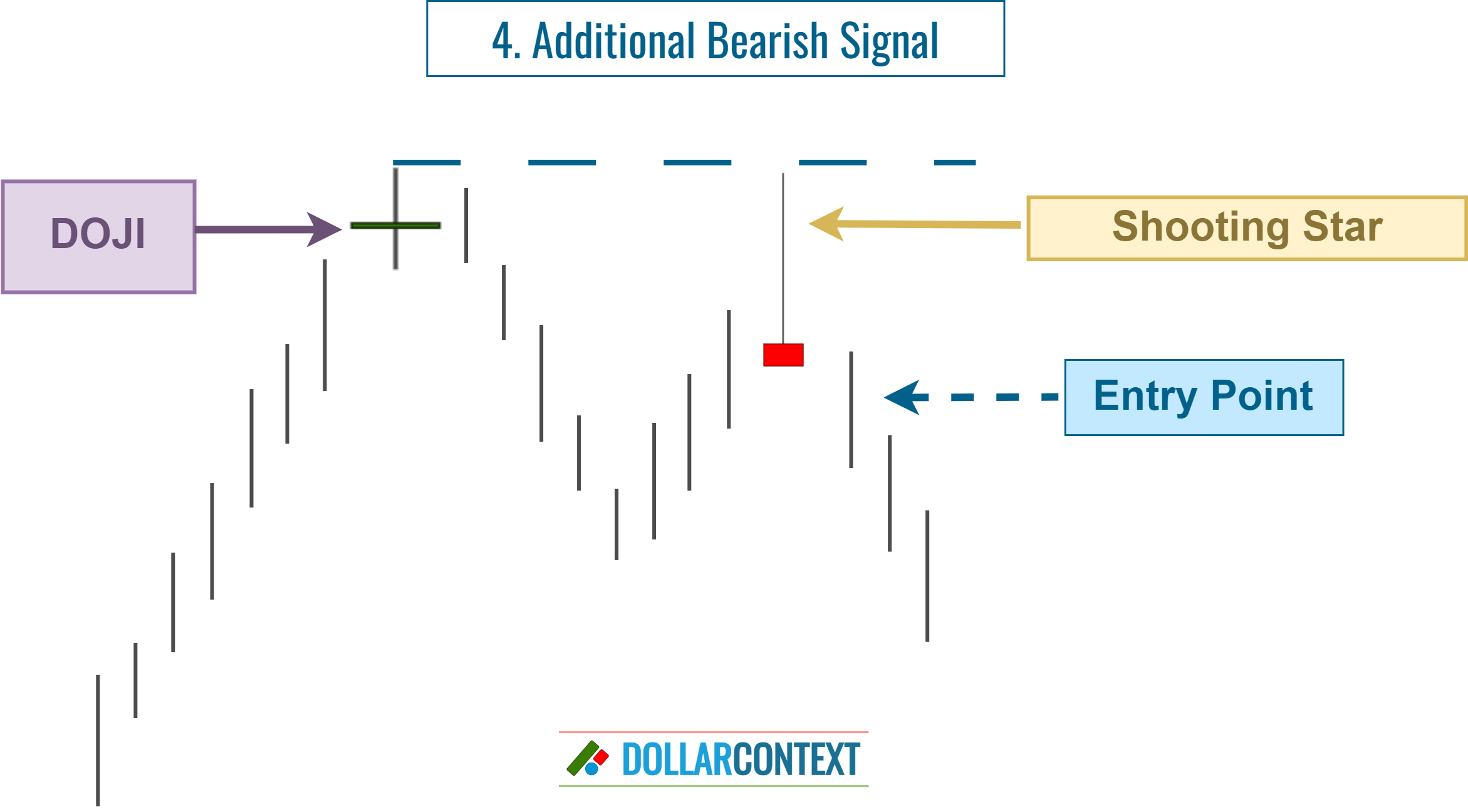

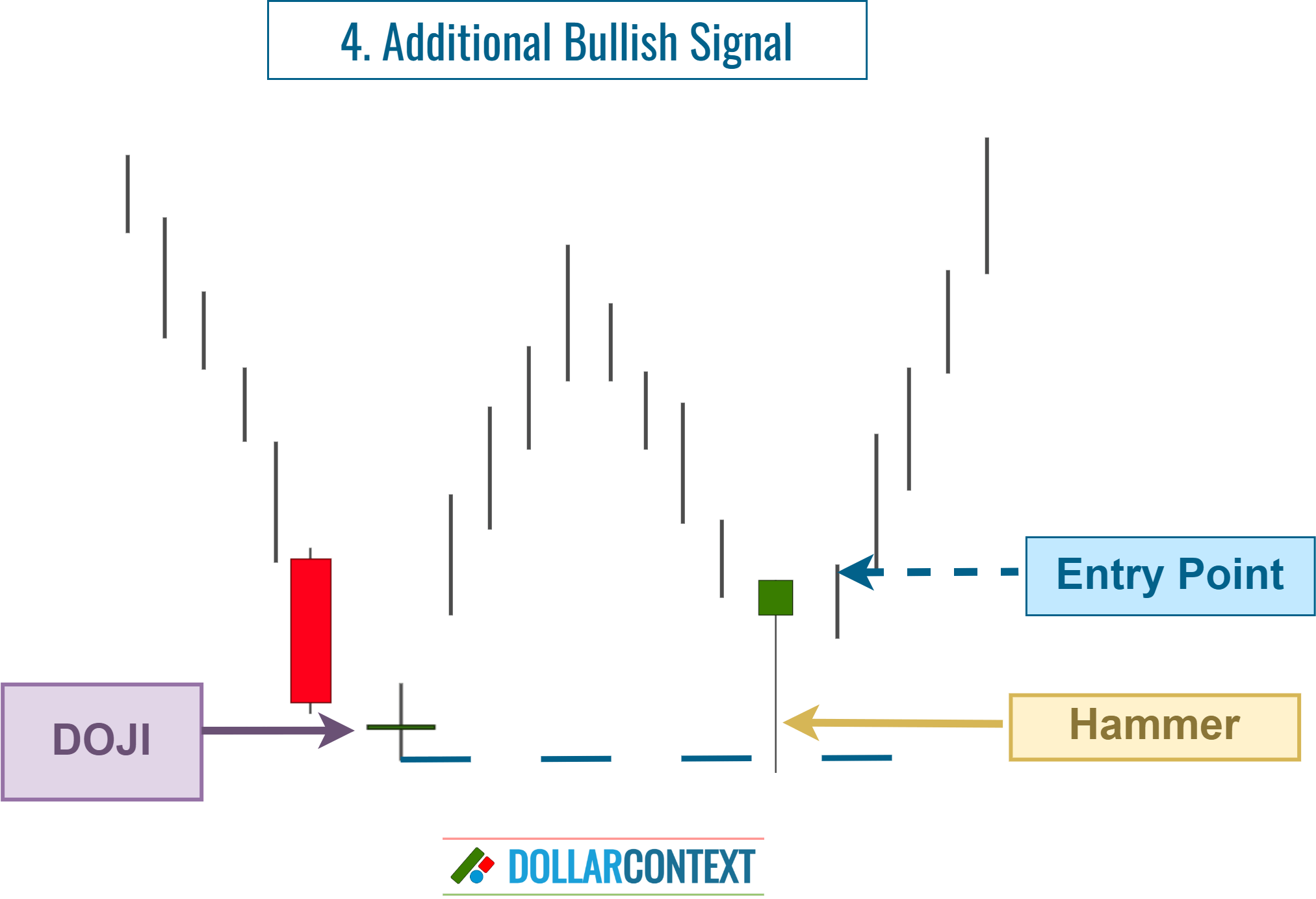

4. On an Additional Reversal Signal

If a doji appears after an uptrend, wait for additional bearish signals to open a short position. This could be a shooting star, a long black real body, an evening star, or another bearish indicator.

The opposite holds true; i.e., wait for additional bullish signals to open a long position after a mature downtrend.

Keep in mind that those confirming signals may also appear before the doji candle.

- Advantages: A reversal pattern that precedes or follows the doji session strengthens its potential as a reversal indicator.

- Disadvantages: Since other candlestick patterns might not appear within the doji candle's price range, you risk missing the trading opportunity.

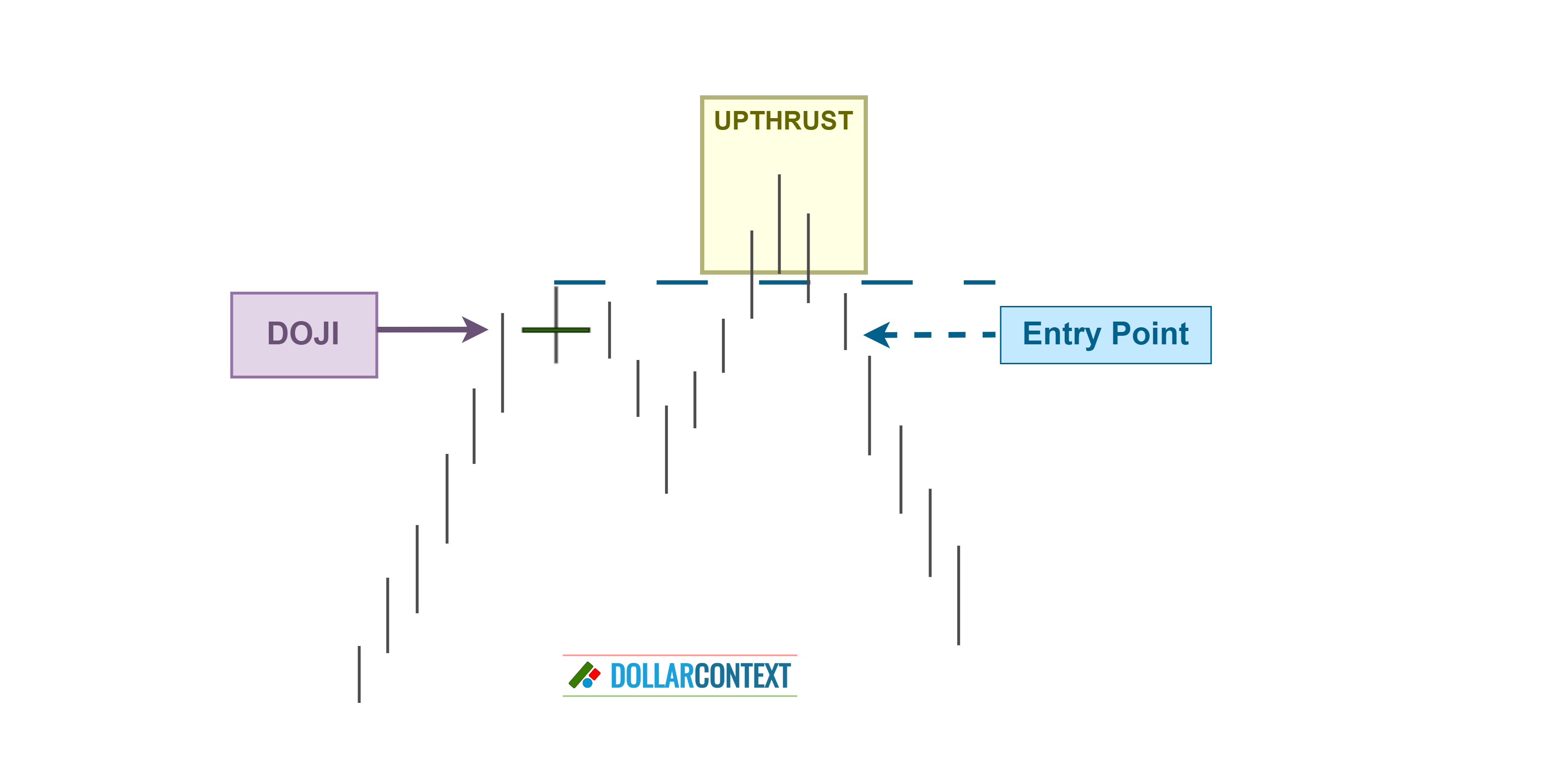

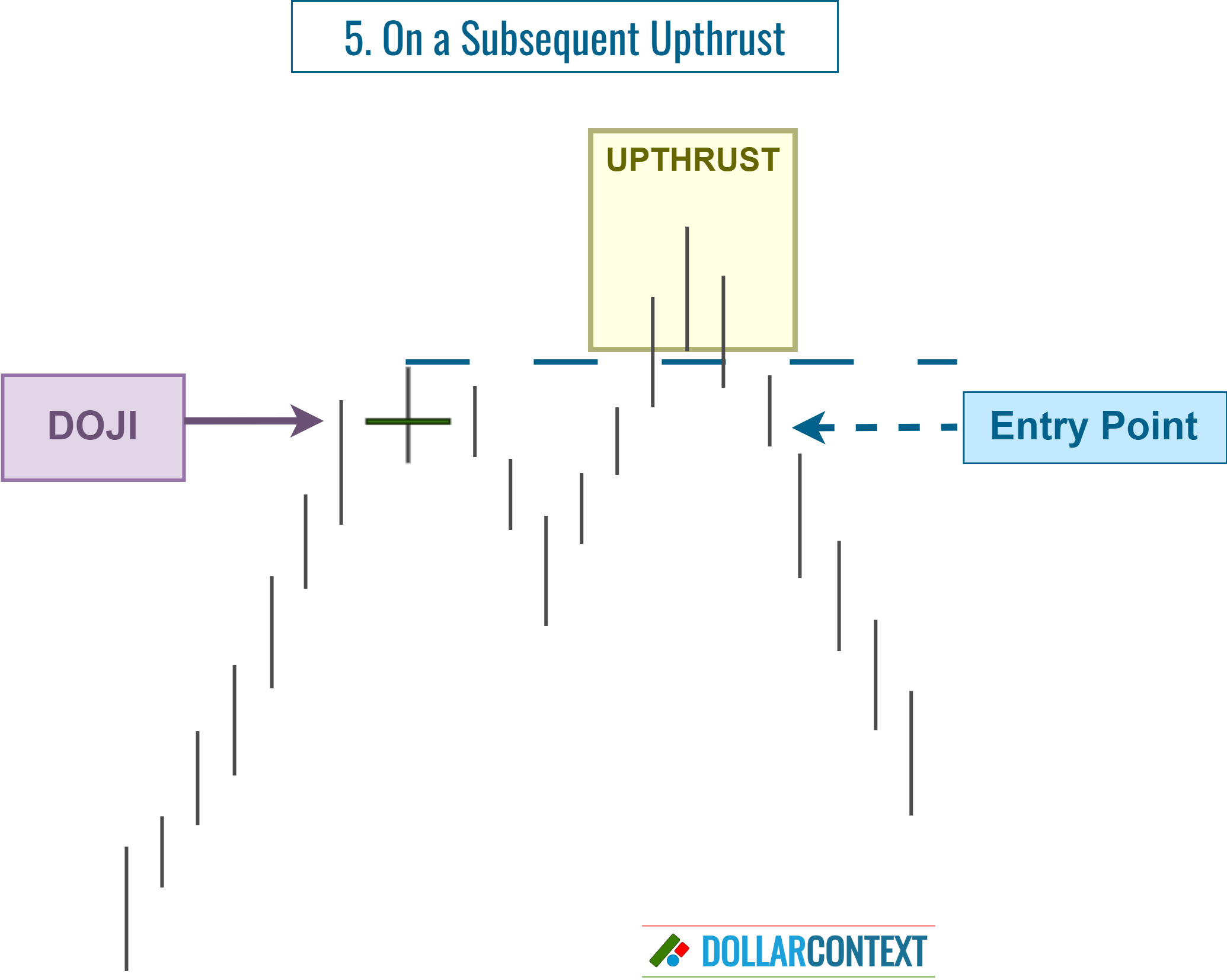

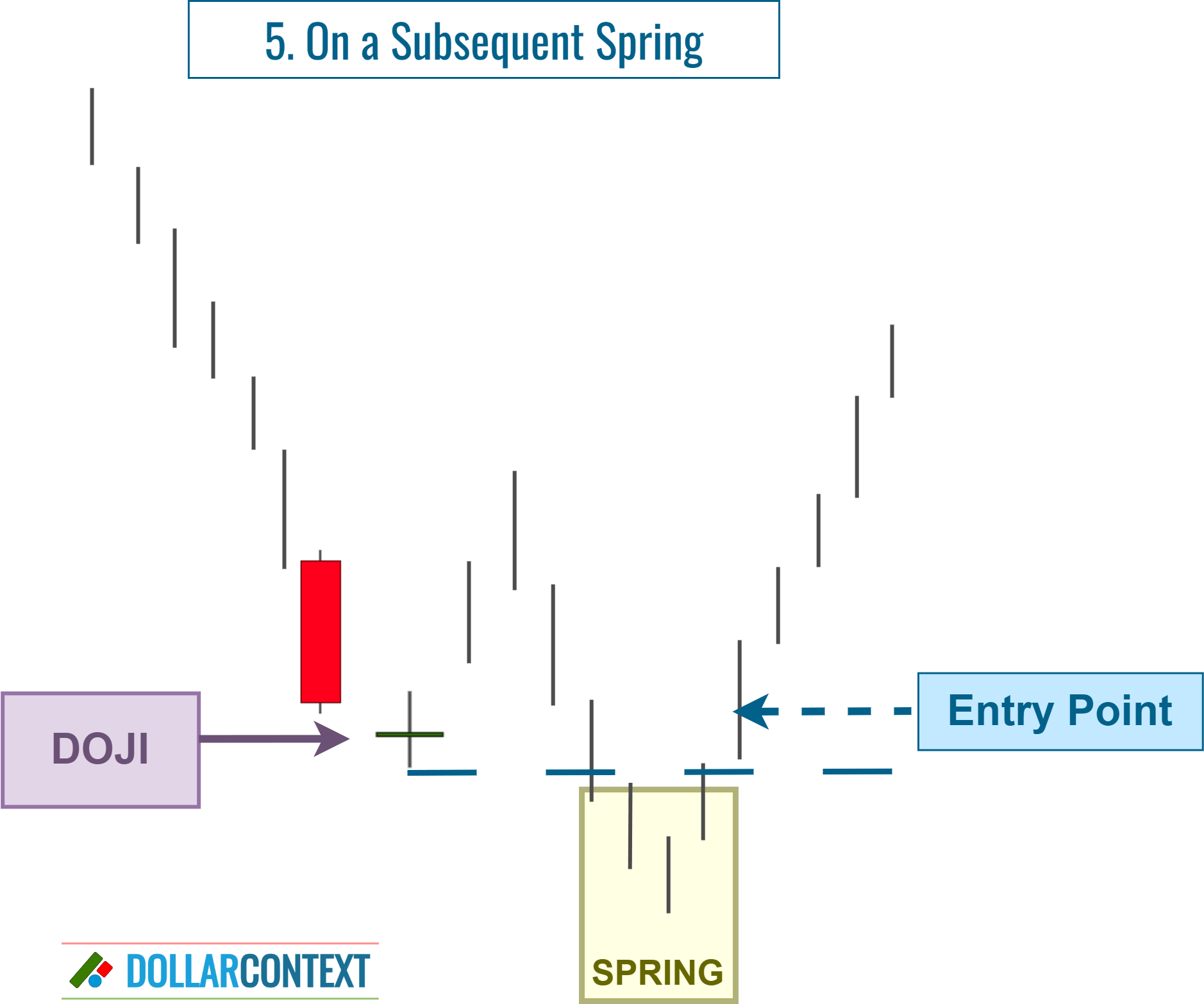

5. After an Upthrust/Spring

An upthrust is a price action where the market briefly rises above a resistance level, only to quickly turn and move in the opposite direction. Essentially, it's a false breakout to the upside.

Upthrusts frequently occur in markets and can be employed both to validate the reversal suggested by the doji and to set a stop-loss above the upthrust's peak.

Similarly, a spring is a price movement where the market briefly drops below a support level, only to quickly rebound and move in the opposite direction. Essentially, it represents a deceptive breakout to the downside.

- Advantages: After an upthrust or spring, the likelihood of a trend reversal rises substantially.

- Disadvantages: The new stop-loss should be based on the highs of the upthrust (or the lows of the spring), making it further from the entry point. Also, keep in mind that springs and upthrusts don't always manifest. However, when one does emerge, using the doji strategy with a stop at the high of an upthrust (or the low of a spring) is typically a reliable method.