Doji Candles: Limitations and Criticisms

While doji candles can be a valuable tool in a trader's arsenal, it's crucial to understand their limitations and the criticisms surrounding them.

This article is part of the Doji candlestick tutorial series. For the complete guide, see the Doji Candlestick Pattern — Complete Guide.

In candlestick charting, one of the most recognized and widely used patterns is the doji. A doji is a candlestick candle where the opening and closing prices are nearly the same, resulting in a non-existent or tiny body.

Psychologically, a doji indicates indecision in the market and a potential change in direction. Depending on the preceding price action and future confirmation, a doji can be interpreted as a sign of a market reversal.

Here are the most important limitations and criticisms of the doji candlestick.

1. Subjectivity

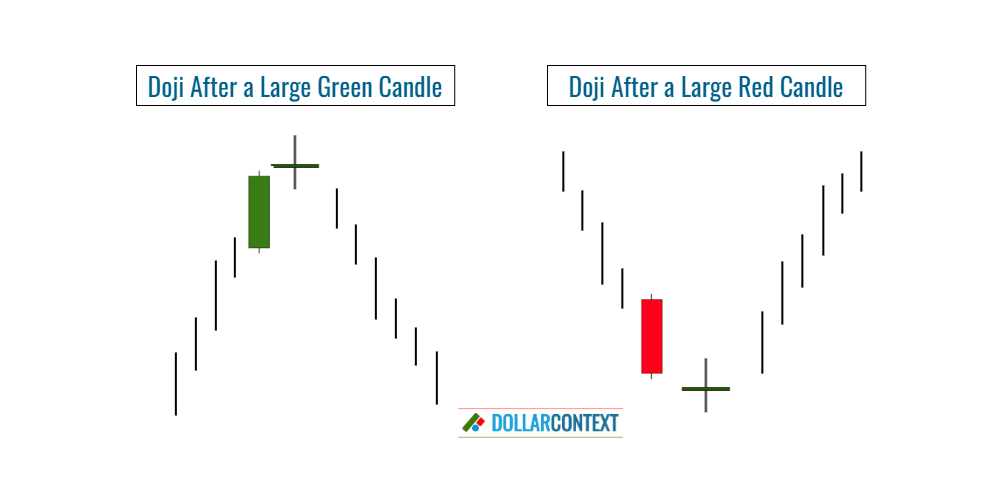

The definition of a doji is somewhat subjective. While the classic definition calls for the open and close to be exactly the same, some traders accept small bodies as doji sessions. This can lead to varying interpretations of the same chart.

For clarity's sake, we often label the ideal version as a "doji" and any minor deviation from it as a "doji variation".

2. Dependence on Context

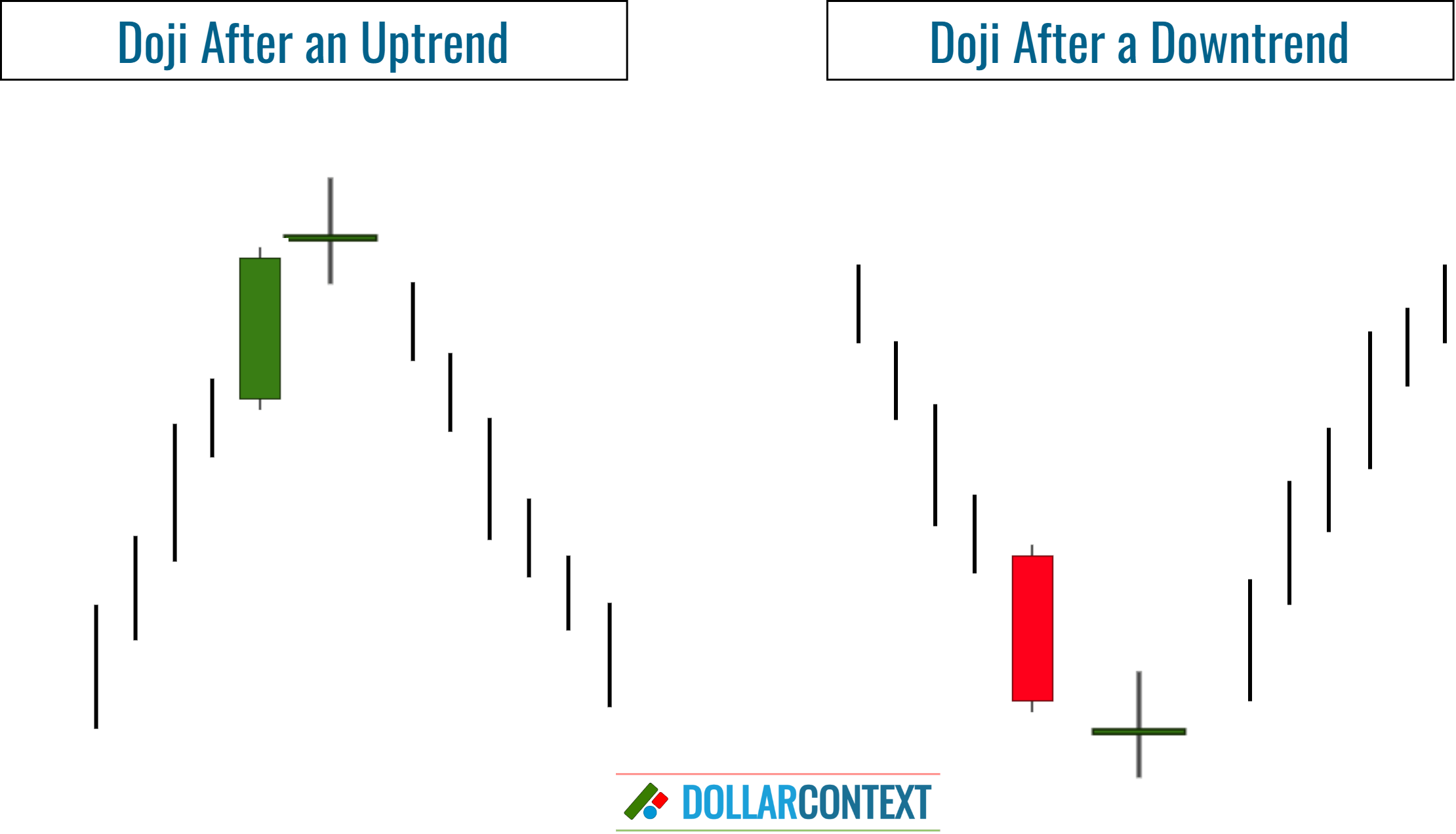

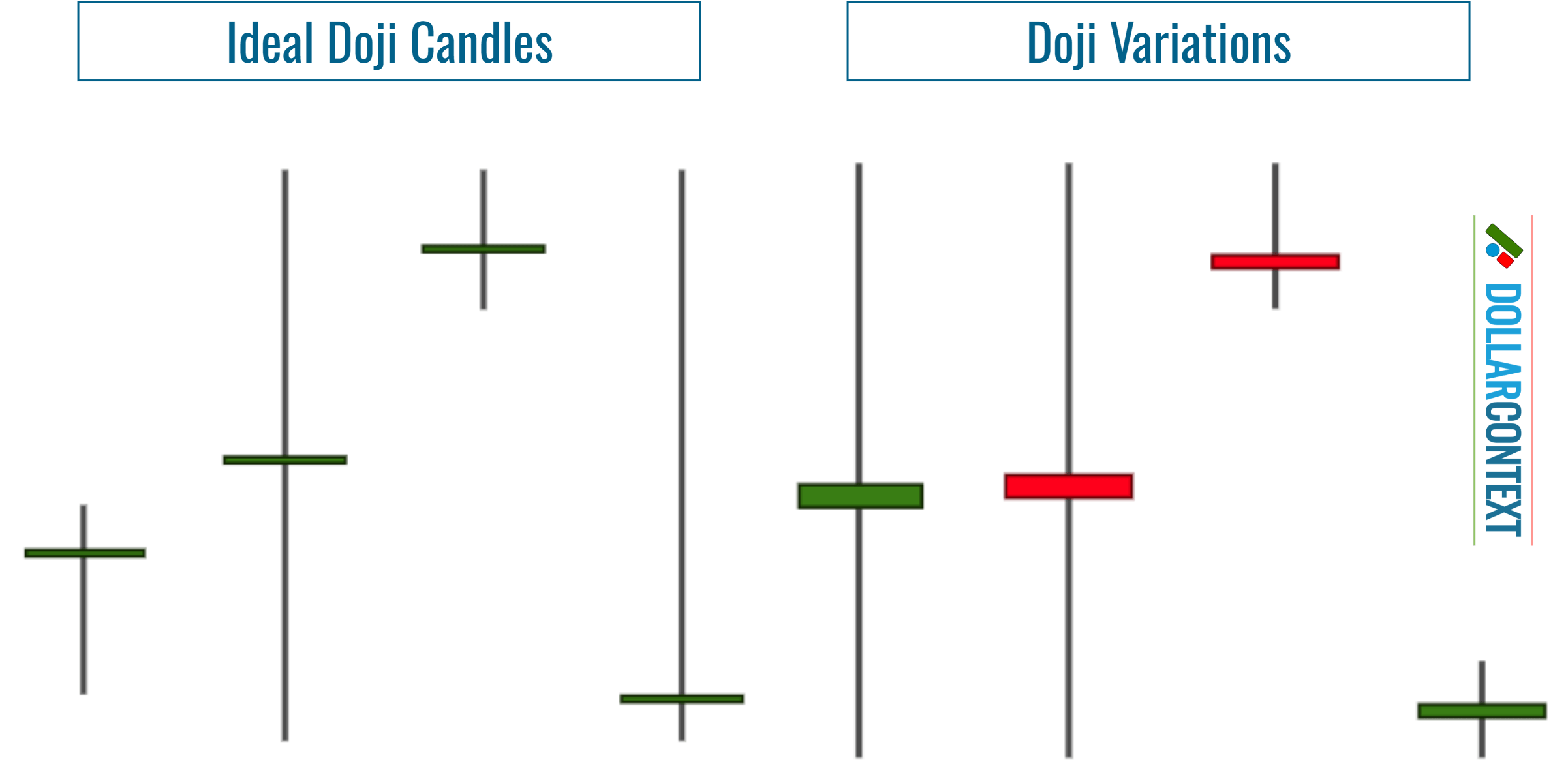

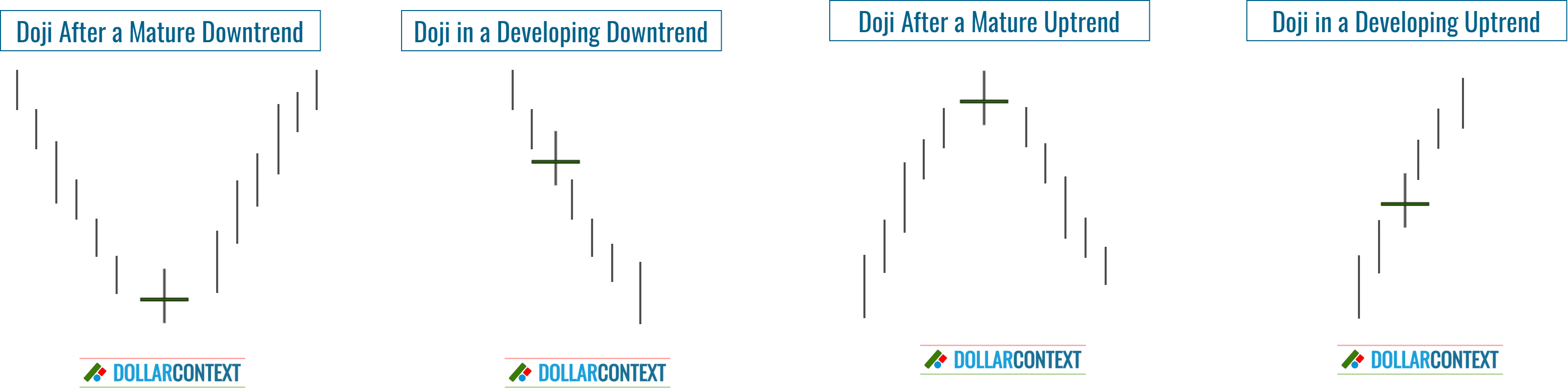

The effectiveness of a doji as a reversal signal largely depends on the preceding price trend. A doji after a prolonged uptrend might indicate a bearish reversal, while one after a prolonged downtrend might suggest a bullish reversal. However, without a clear trend, the significance of a doji diminishes.

This trend dependence raises two questions:

- How much time is required for a trend to be considered long or mature enough?

- How significant a price movement is needed for an asset's trend to be deemed extended or prolonged?

It's crucial not to be misled by incorrect interpretations. To determine if an uptrend or downtrend is sufficiently mature, some traders form their judgment only after observing a reversal. However, this reasoning should be reversed. To implement a doji strategy, one should assess the maturity of the previous trend before the market transitions into a reversal or continuation.

3. Need for Confirmation

Some traders put too much weight on the appearance of a doji, ignoring the broader market context. This can lead to premature or incorrect trading decisions.

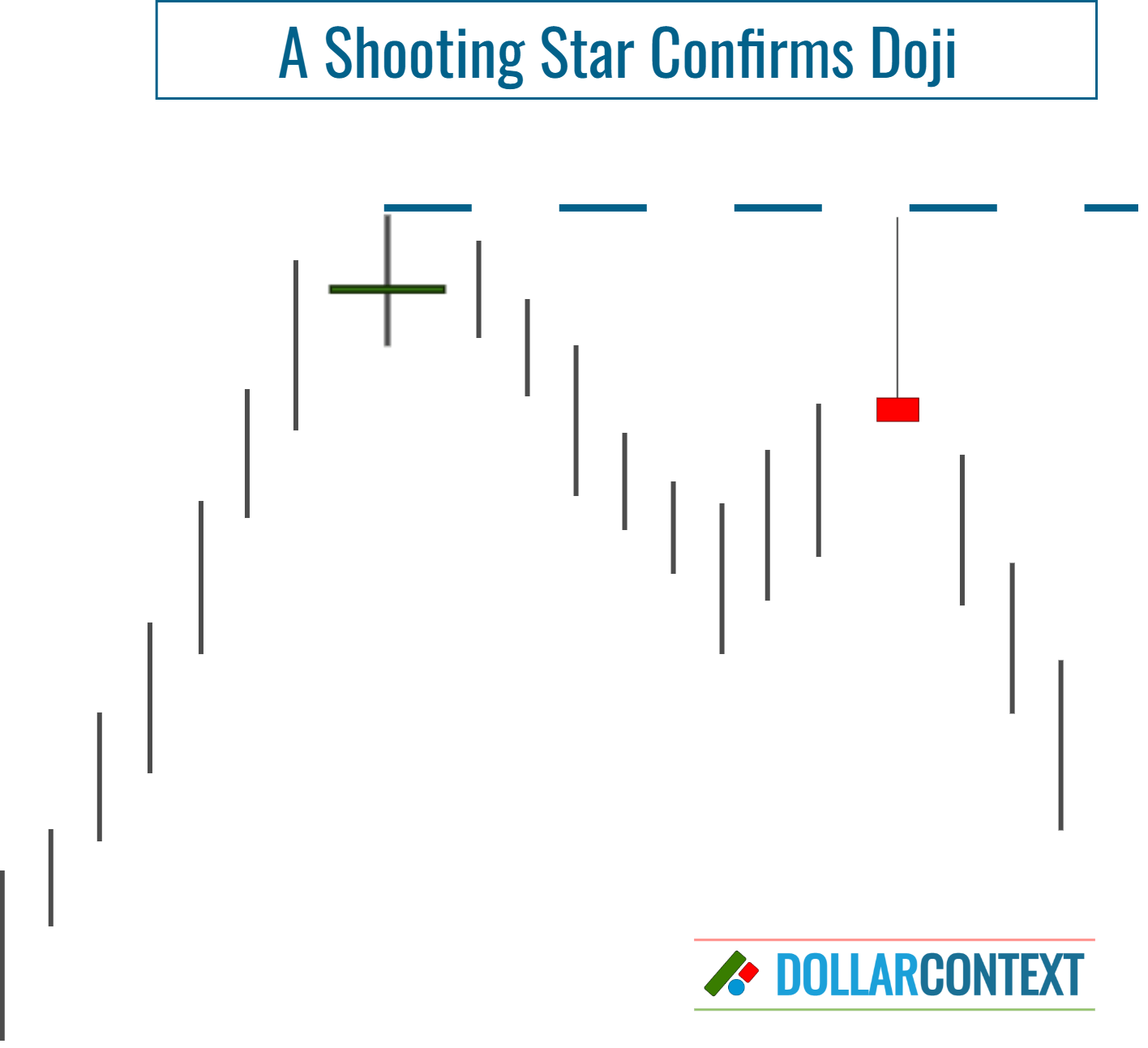

A single doji candle does not guarantee a reversal. Experienced traders often wait for further confirmation through additional candle patterns or other technical indicators before making a decision.

4. False Signals

Like all technical indicators, doji candles can and do produce false signals. Without proper risk management, relying solely on doji candles can result in significant losses.

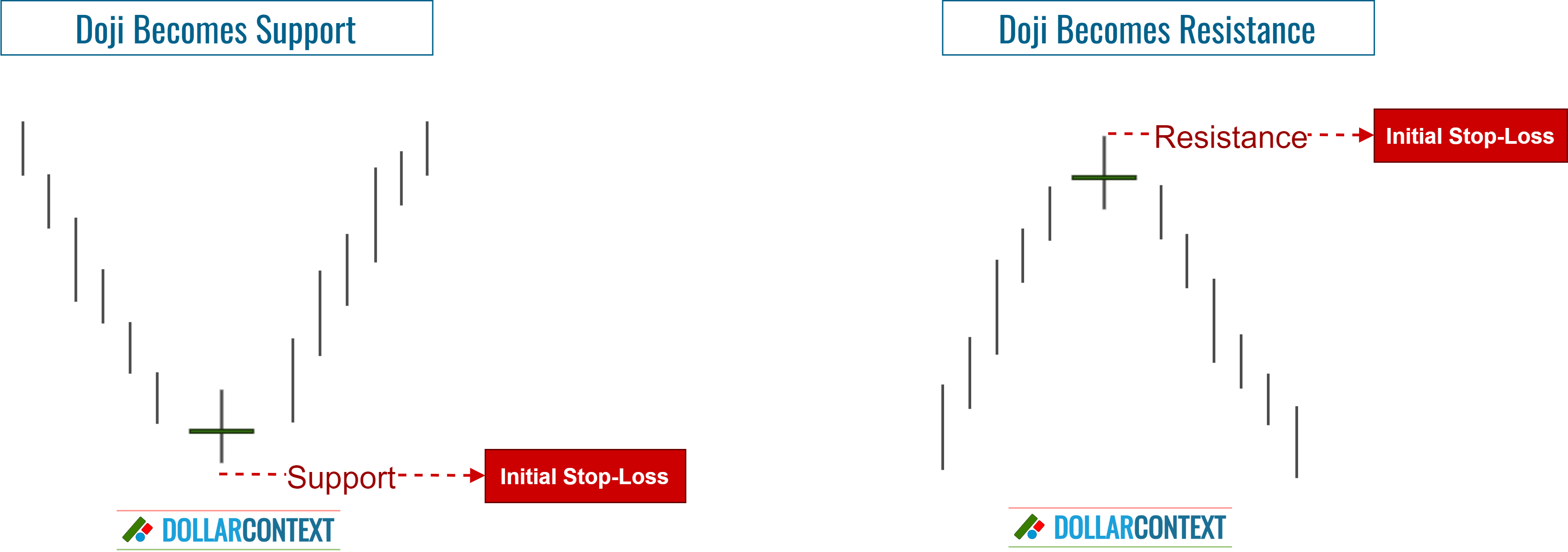

It's essential to use a stop-loss point with doji strategies. After an uptrend, the highest point of the doji becomes resistance. This level can be used to place your initial stop-loss based on the doji. This is also true in the opposite direction.

5. False Breakouts

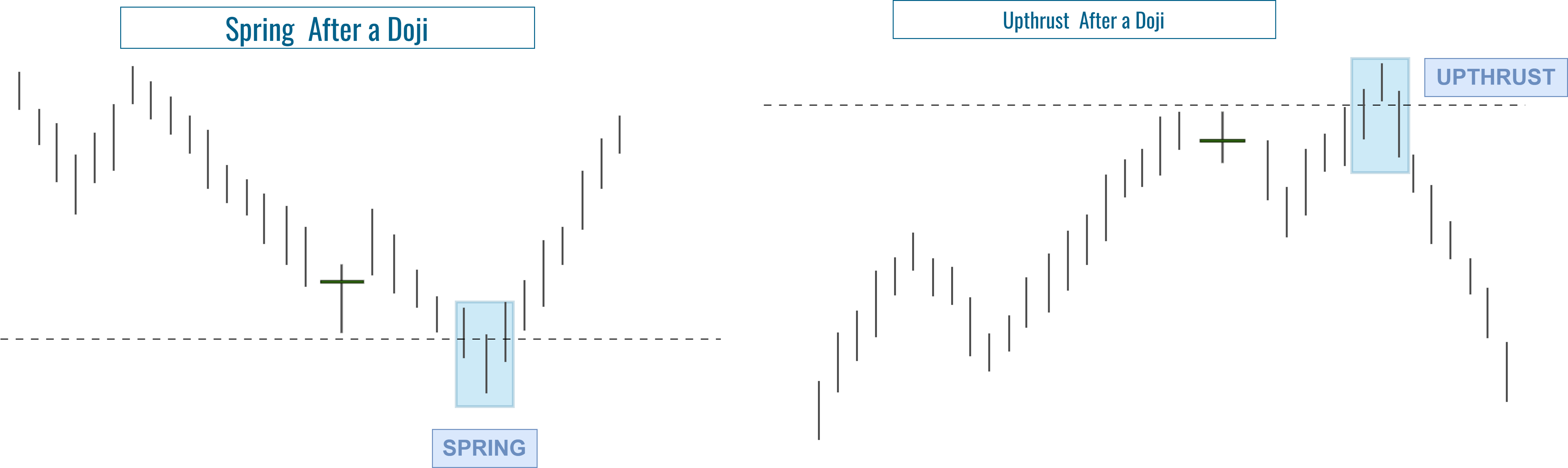

A false breakout describes a price shift where the market momentarily surpasses a support or resistance threshold, only to swiftly revert and head in the counter direction.

False breakouts to the upside are termed upthrusts, while those to the downside are called springs. Given their relative frequency following the appearance of a doji candle, they can perplex traders and result in unnecessary stop-outs.

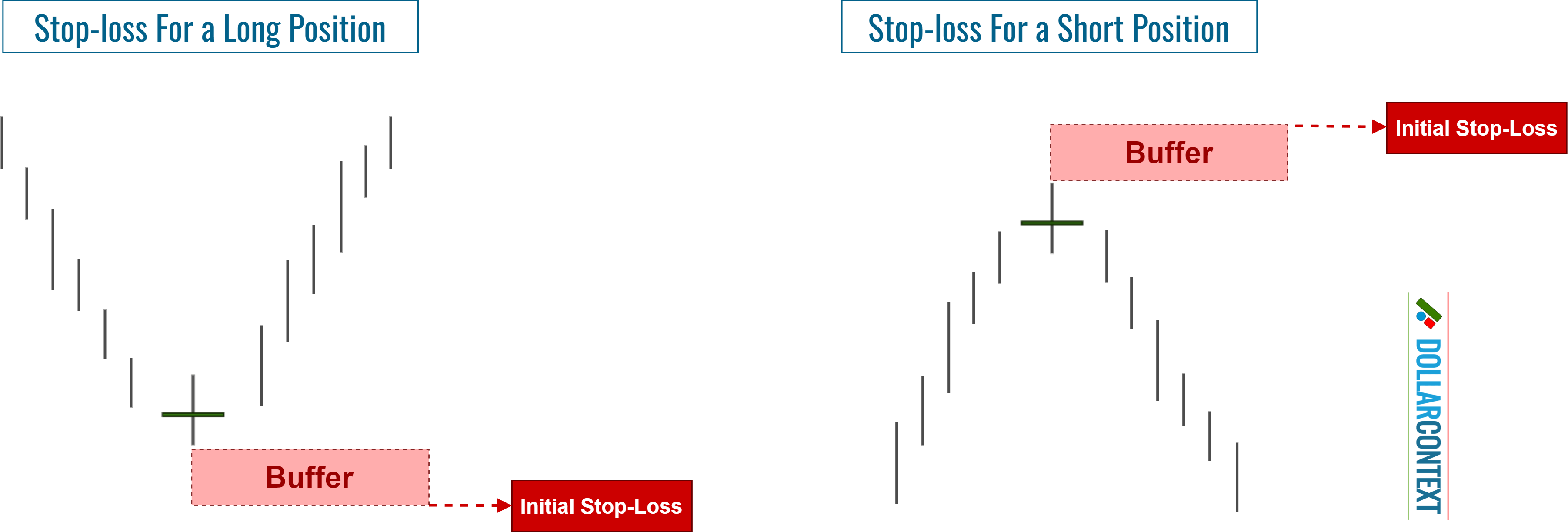

To protect against false breakouts, it may be useful to add a buffer to the initial stop-loss.

6. Doji Frequency

Doji candles hold significance mainly in markets with few doji occurrences. If a chart displays numerous doji, the appearance of a new doji in that specific market shouldn't be considered a notable development. Be aware that we're referring to the total number of doji lines on the chart, not those near the doji session.

More importantly, doji strategies should not be implemented with very illiquid markets since many of the sessions tend to become doji or doji-like candles.

In general, the less active a market is and the shorter the timeframe used, the more likely a doji session becomes irrelevant.

7. Lack of Predictive Power

Some critics argue that while the doji may highlight market indecision, it doesn't have significant predictive power on its own. Market dynamics are influenced by a myriad of factors, and no single candlestick pattern can account for all these influences.

The example below shows how, following a mature trend, two doji sessions appeared, yet the upward trend immediately continued its ascent.

While a doji represents indecision, it doesn't always indicate the direction of the potential reversal. In many situations, the doji by itself can't provide enough information to make an informed trading decision.

8. Undefined Magnitude of the Result

Although candlestick patterns can indicate trend reversals and potential entry opportunities, doji candles don't inherently provide profit-taking levels. To determine these, you need to use other methods such as Fibonacci instruments, conventional chart patterns, or moving averages.

Conclusion

While doji candles can be a valuable tool in a trader's arsenal, it's crucial to understand their limitations and the criticisms surrounding them. They should not be used in isolation but rather in conjunction with other technical and fundamental tools. By doing so, traders can maximize the potential benefits of recognizing doji patterns while minimizing the risks associated with over-relying on them.