Doji: Similarities and Differences With Other Candlestick Patterns

The configuration of a doji candle has resemblances to other candlestick patterns, including spinning tops, stars, and hammers.

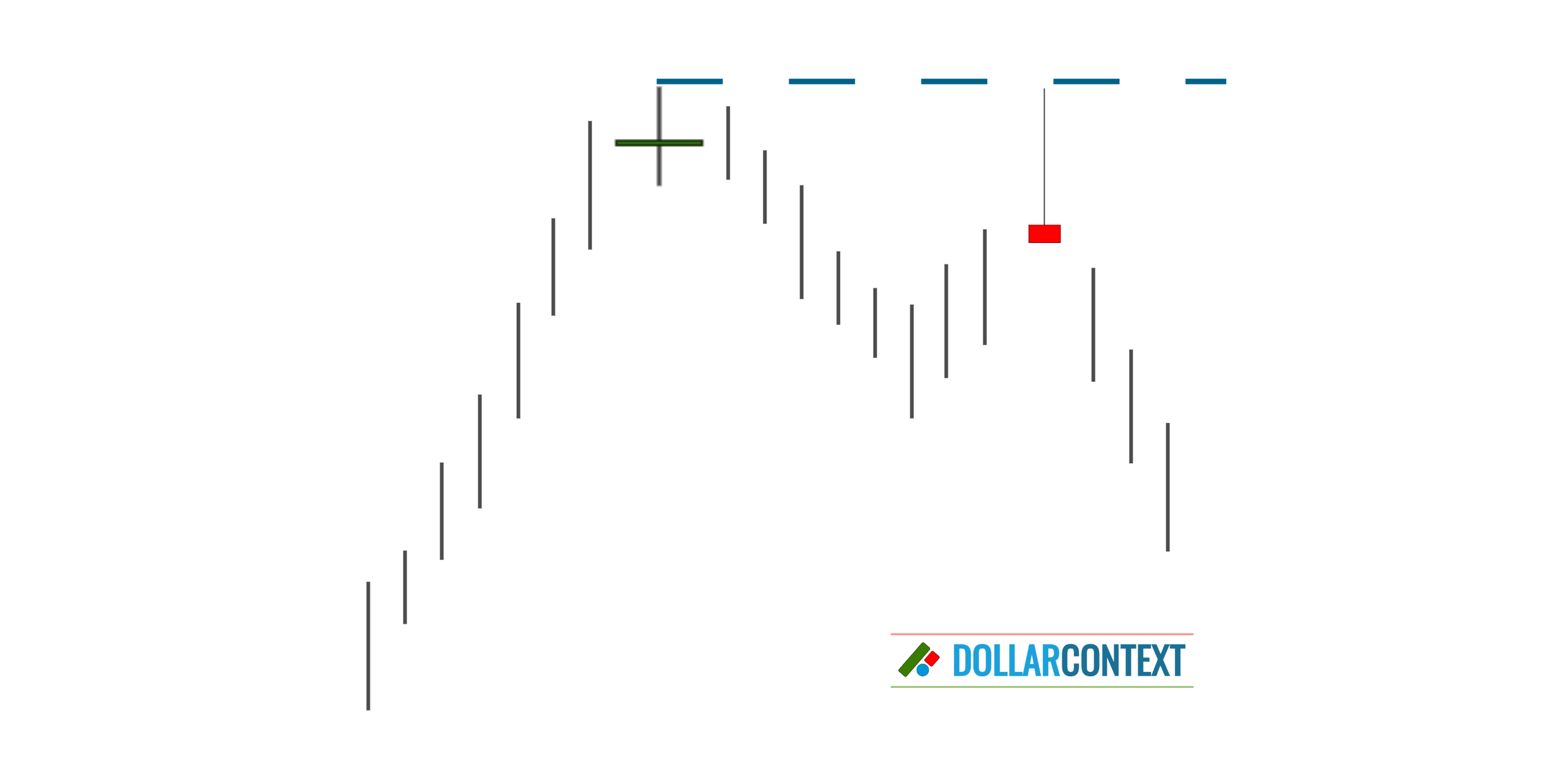

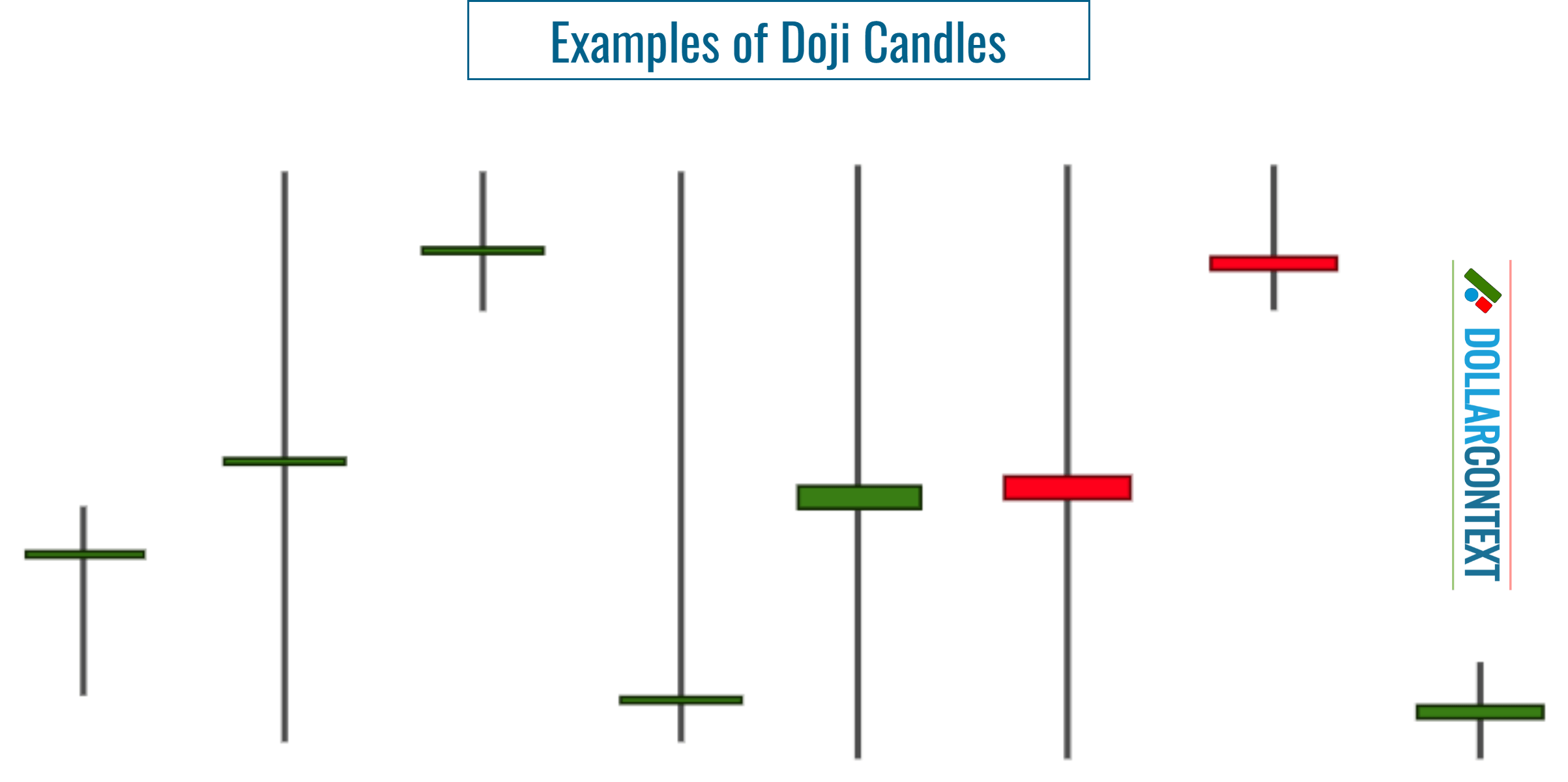

A doji is a candlestick pattern where the opening and closing prices are nearly identical, resulting in a minimal or non-existent body. The shadows (lines above and below the body) can vary in length. The primary interpretation of a doji is indecision and a potential market reversal after a trending market.

As a reversal indicator, however, the doji has its own limitations, especially if it is not confirmed by other technical signs.

Differences and Similarities With Other Patterns

The configuration of a doji candle has resemblances to other candlestick patterns, primarily:

- Spinning Top

- Hammer

- Inverted Hammer

- Shooting Star

- Hanging Man

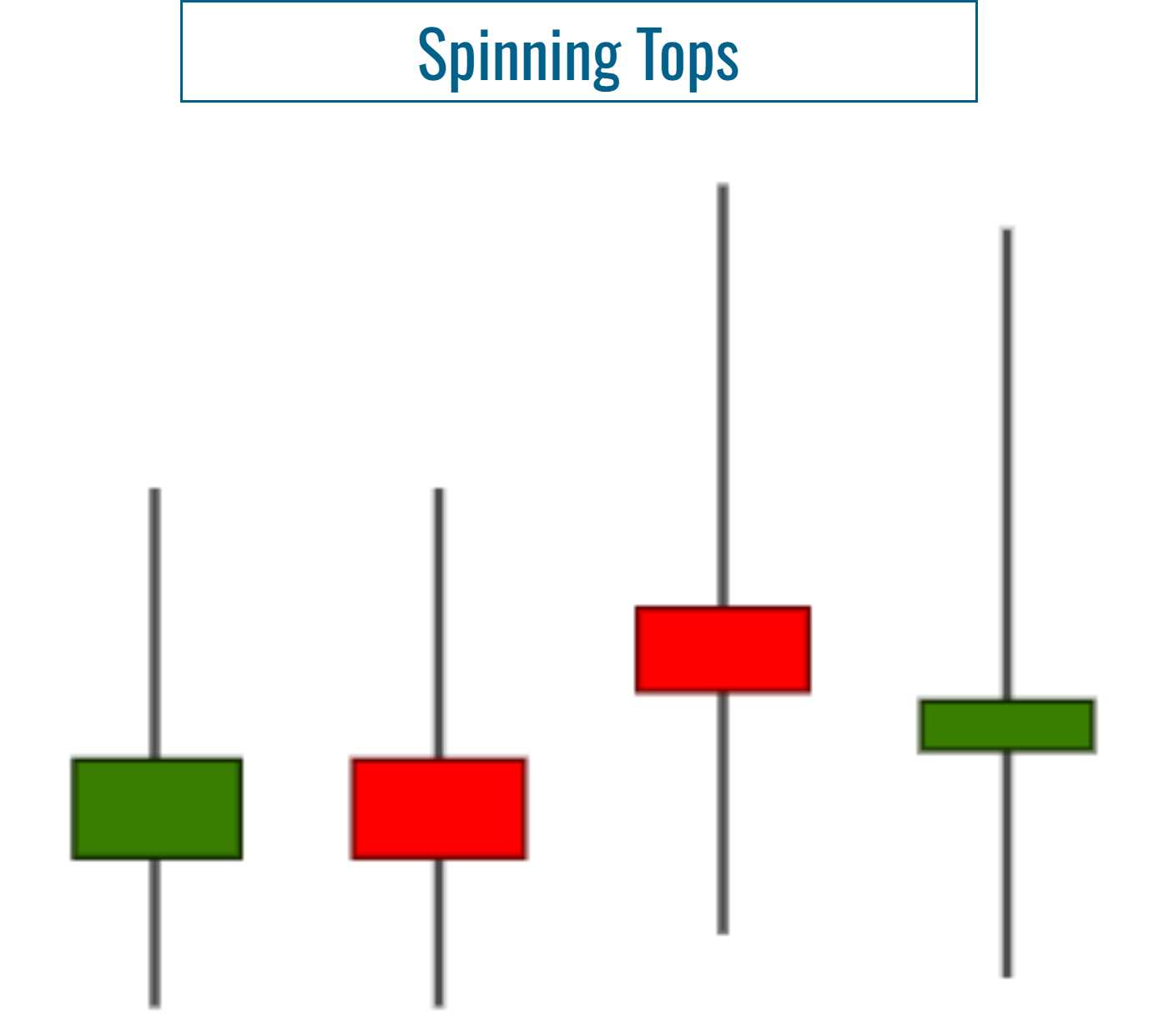

1. Doji vs. Spinning Top

Resembling the doji, a spinning top has a small real body but differs with its slightly larger body, denoting a bit more directionality in the market.

Similarities: Both doji sessions and spinning tops denote market indecision, albeit to varying degrees.

Differences: The doji, with its almost non-existent body, often signifies stronger indecision than a spinning top.

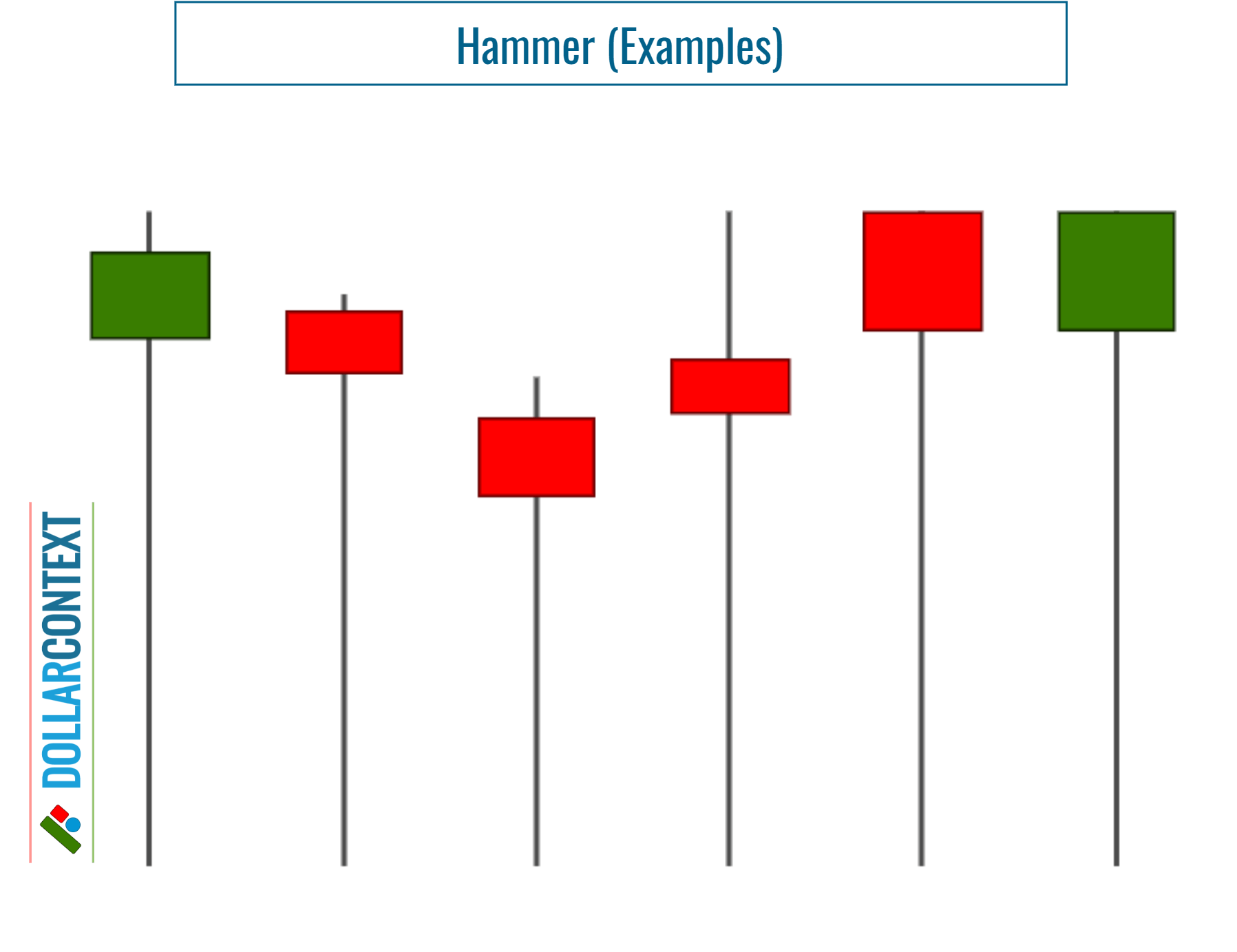

2. Doji vs. Hammer

The hammer pattern exhibits a small body at the upper end with a long lower shadow, indicating potential bullish reversals after a decline.

Similarities: The significance of a hammer and a doji is enhanced when viewed within the context of preceding price action. For instance, a doji (or hammer) after an extended downtrend may indicate a potential bullish reversal.

Differences: While the doji primarily indicates indecision, the hammer signals potential bullish reversals. In addition, regarding the shape of these candlesticks, the doji can have varying shadow lengths and placements. By contrast, the hammer candlestick pattern has its body specifically positioned at the upper end, with a long shadow or wick extending downward.

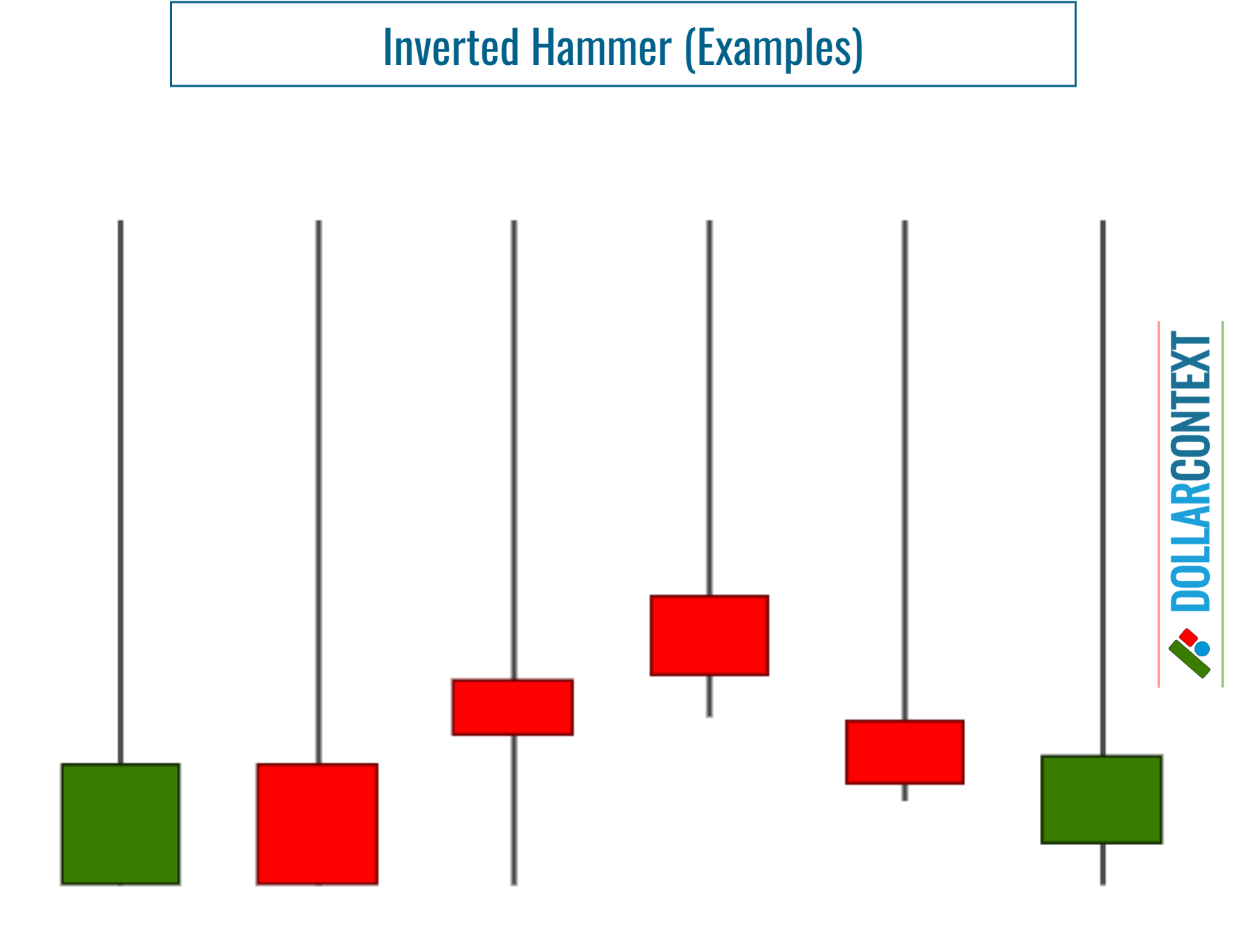

3. Doji vs. Inverted Hammer

The inverted hammer exhibits a small body at the lower end with a long upper shadow, resembling an upside-down hammer, signaling potential bullish reversals after a decline.

Similarities: Both patterns hold significance in trending markets, but often lack relevance in lateral ones.

Differences: In contrast to the inverted hammer, a doji's primary connotation is market indecision. Additionally, the inverted hammer has its body specifically positioned at the lower end of the session.

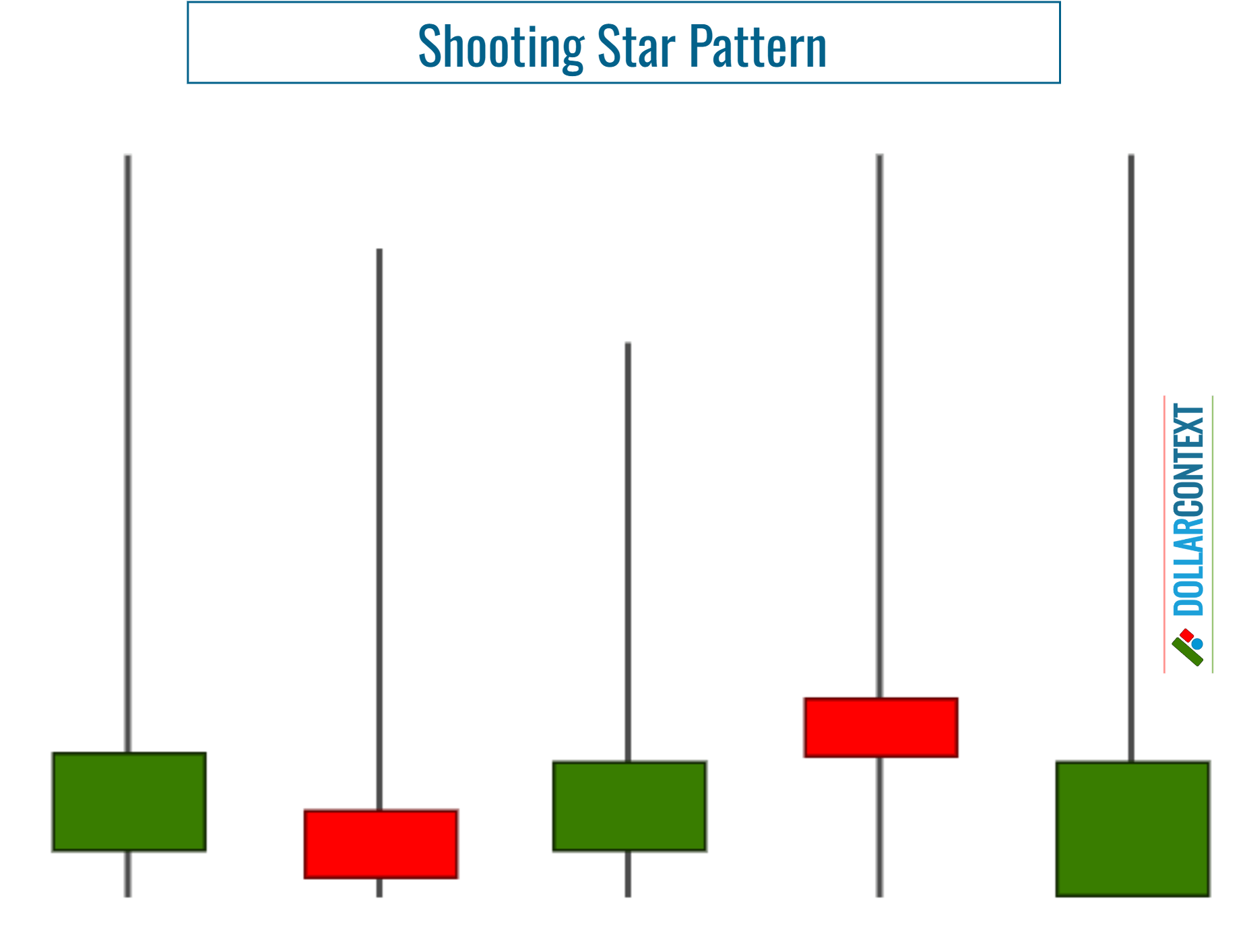

4. Doji vs. Shooting Star

A shooting star has the same shape as an inverted hammer, but the shooting star pattern should emerge following a downtrend.

Similarities: Both patterns are pertinent in trending markets, yet typically inconsequential in sideways movements.

Differences: Contrary to a doji, the placement of the body within the candle is crucial for shooting stars.

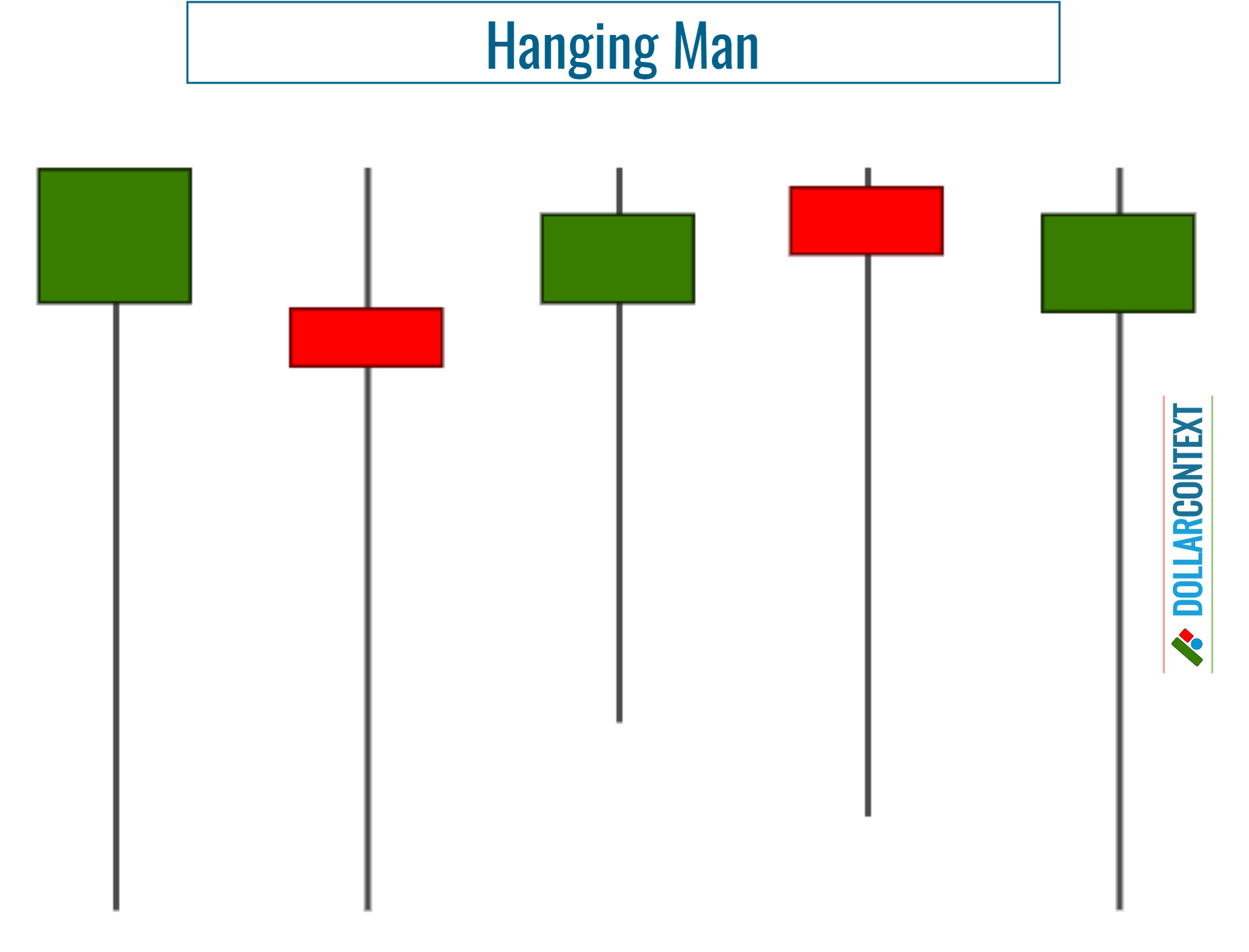

5. Doji vs. Hanging Man

The hanging man is a bearish candlestick pattern with a small upper body and a long lower shadow, often signaling a potential top or reversal following an uptrend.

Similarities:Generally, both the doji and the hanging man are not robust signals. They frequently need further confirmation to serve as reliable reversal indicators after a defined trend.

Differences: Unlike the doji, the position of the body within the candle is vital for a hanging man.

Different Types of Doji

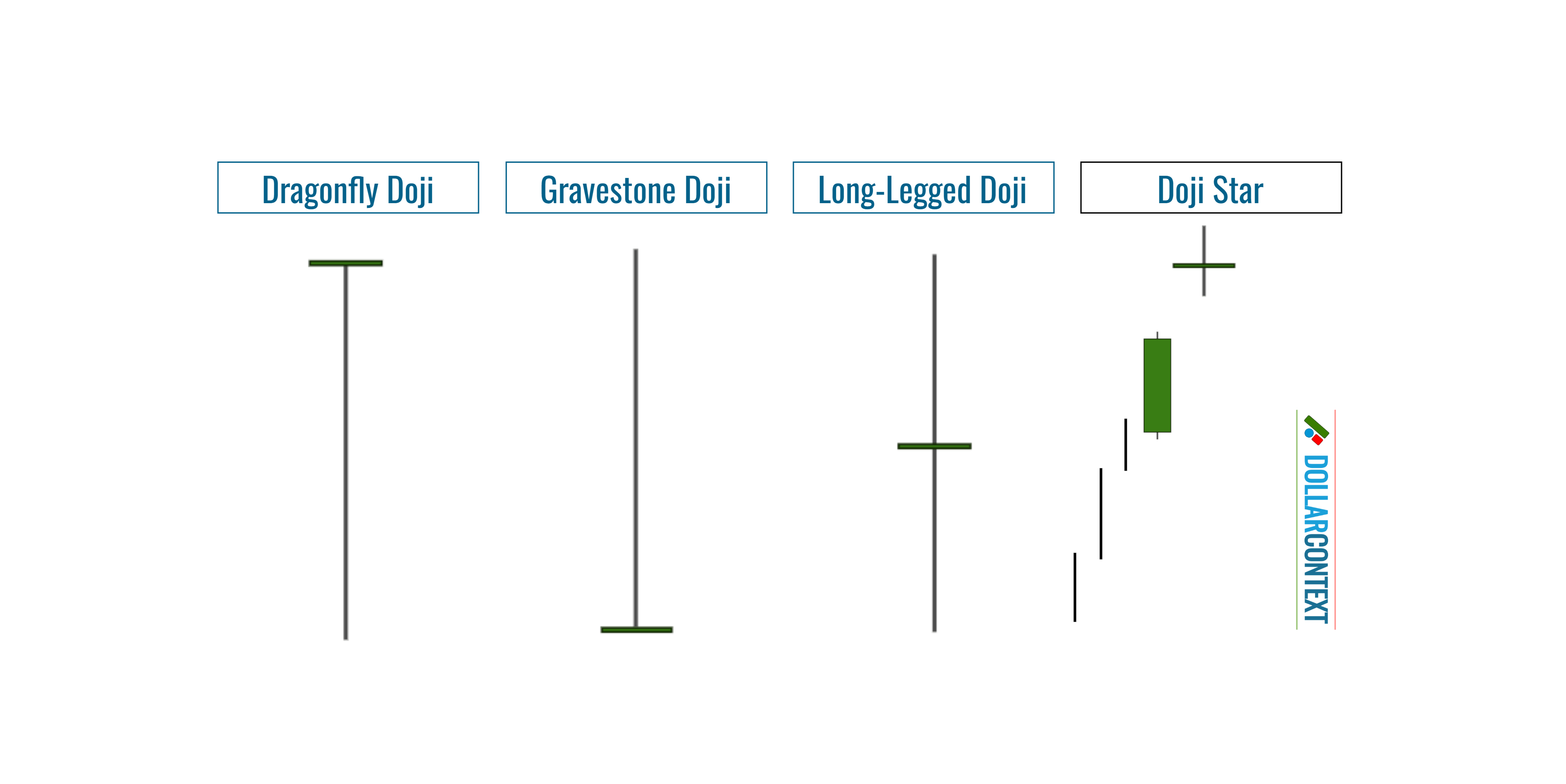

Based on the position of a doji's horizontal line and the market context, we can differentiate the following types of doji.

- Standard Doji: This is the conventional doji where the open and close of the candle are the same, or very close to the same.

- Long-legged Doji: Features long shadows on both sides, signaling increased volatility and greater indecision.

- Dragonfly Doji: The opening, closing, and high prices are nearly the same with a long lower shadow, indicating buying pressure.

- Gravestone Doji: The opening, closing, and low prices are nearly the same with a long upper shadow, indicating selling pressure.

- Doji Star: A star has a small real body that forms a gap away from the preceding real body. When the star presents as a doji rather than a small real body, it's termed a doji star.