Doji Candlestick: How to Set Your Stop-Loss

In this post, we'll explore effective methods to set a stop-loss when leveraging a doji candle to initiate a market position.

In candlestick analysis, setting a stop-loss level is crucial in trading, especially when implementing a doji strategy. A doji session is characterized by its open and close prices being virtually the same. It reflects indecision in the market.

In this post, we'll explore effective methods to set a stop-loss when leveraging a doji candle to initiate a market position.

1. Correct Identification

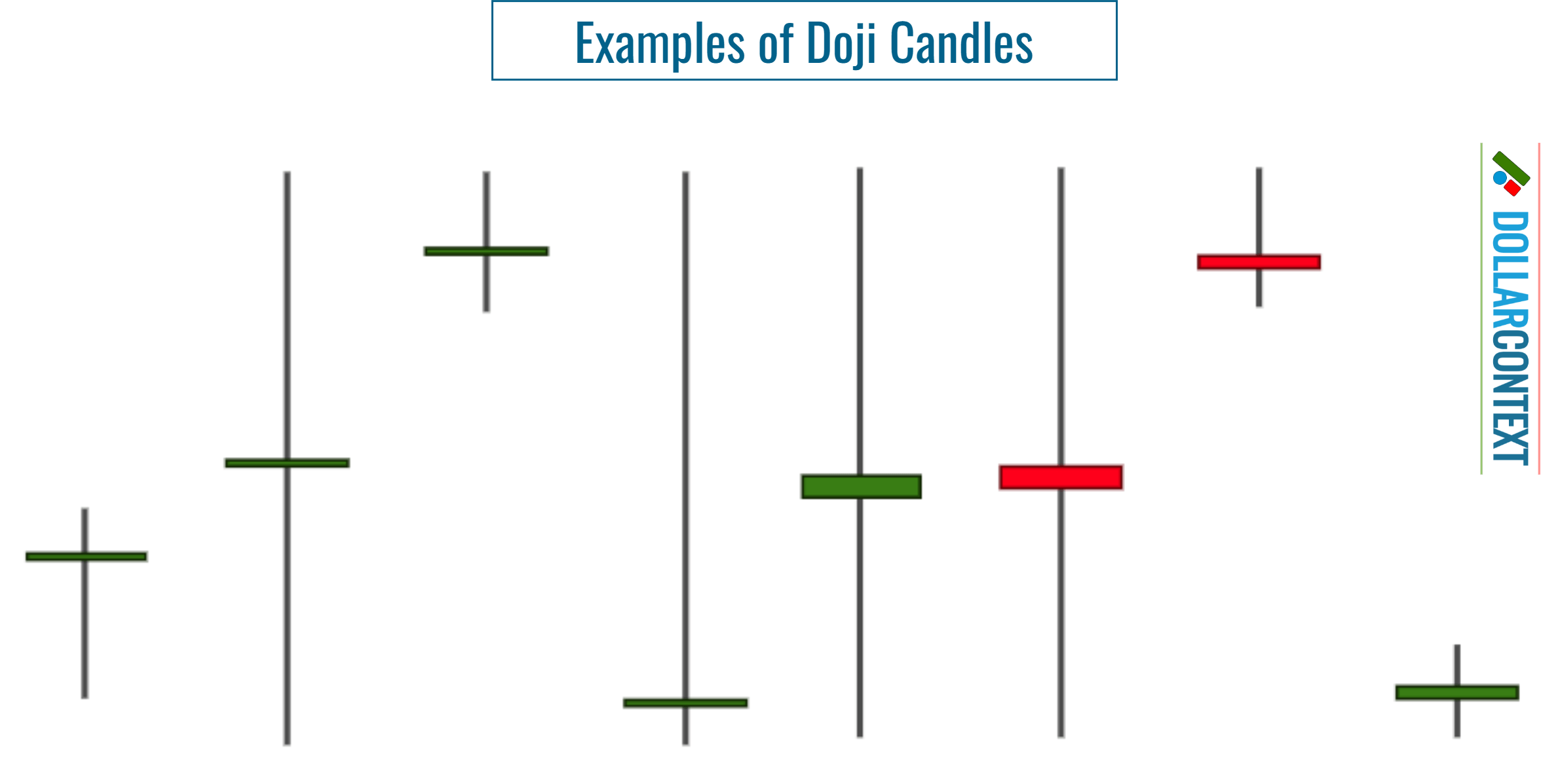

Make sure you accurately identify the doji session on your chart. A doji is a candlestick with identical (or almost identical) opening and closing prices, resulting in a horizontal line rather than a distinct body on the chart.

2. Verify the Previous trend

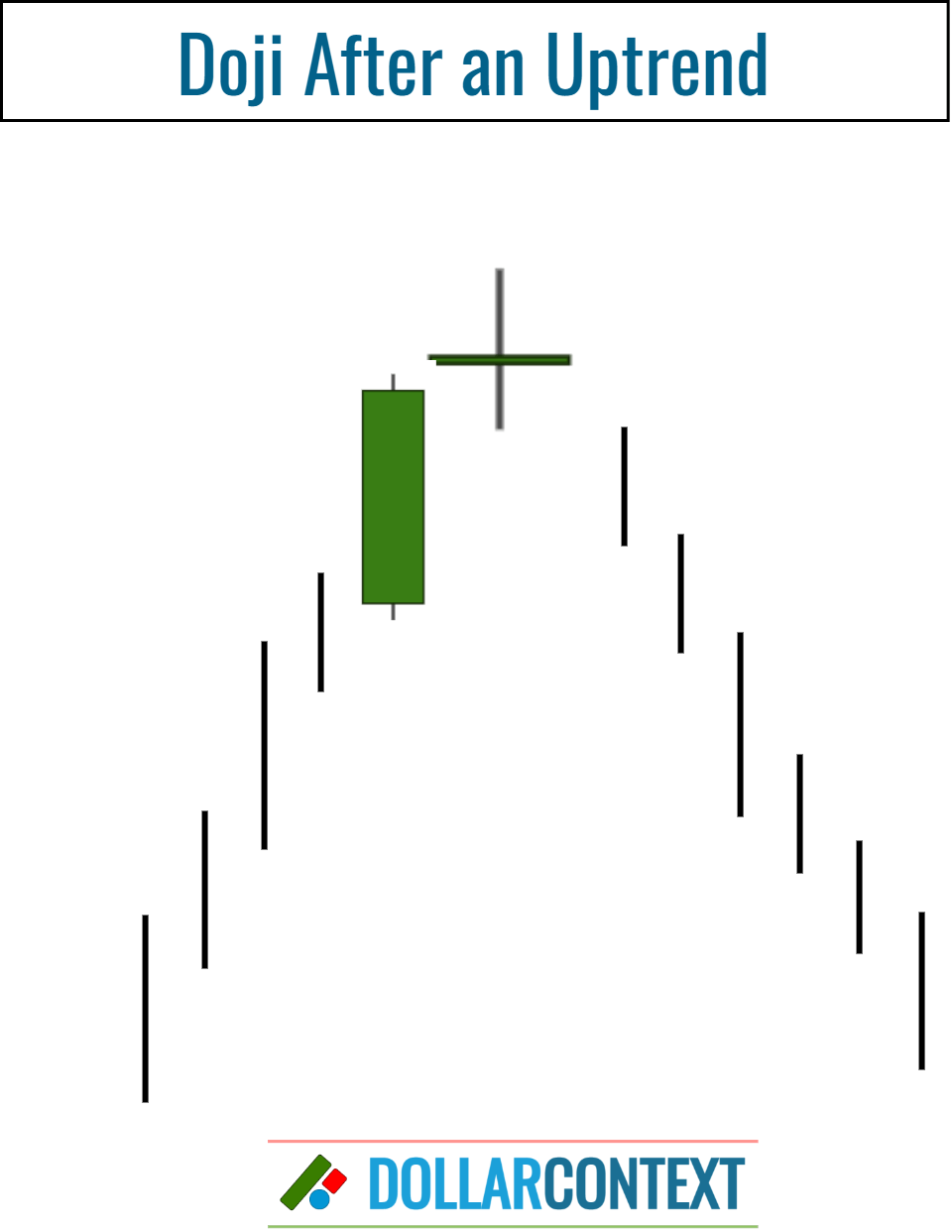

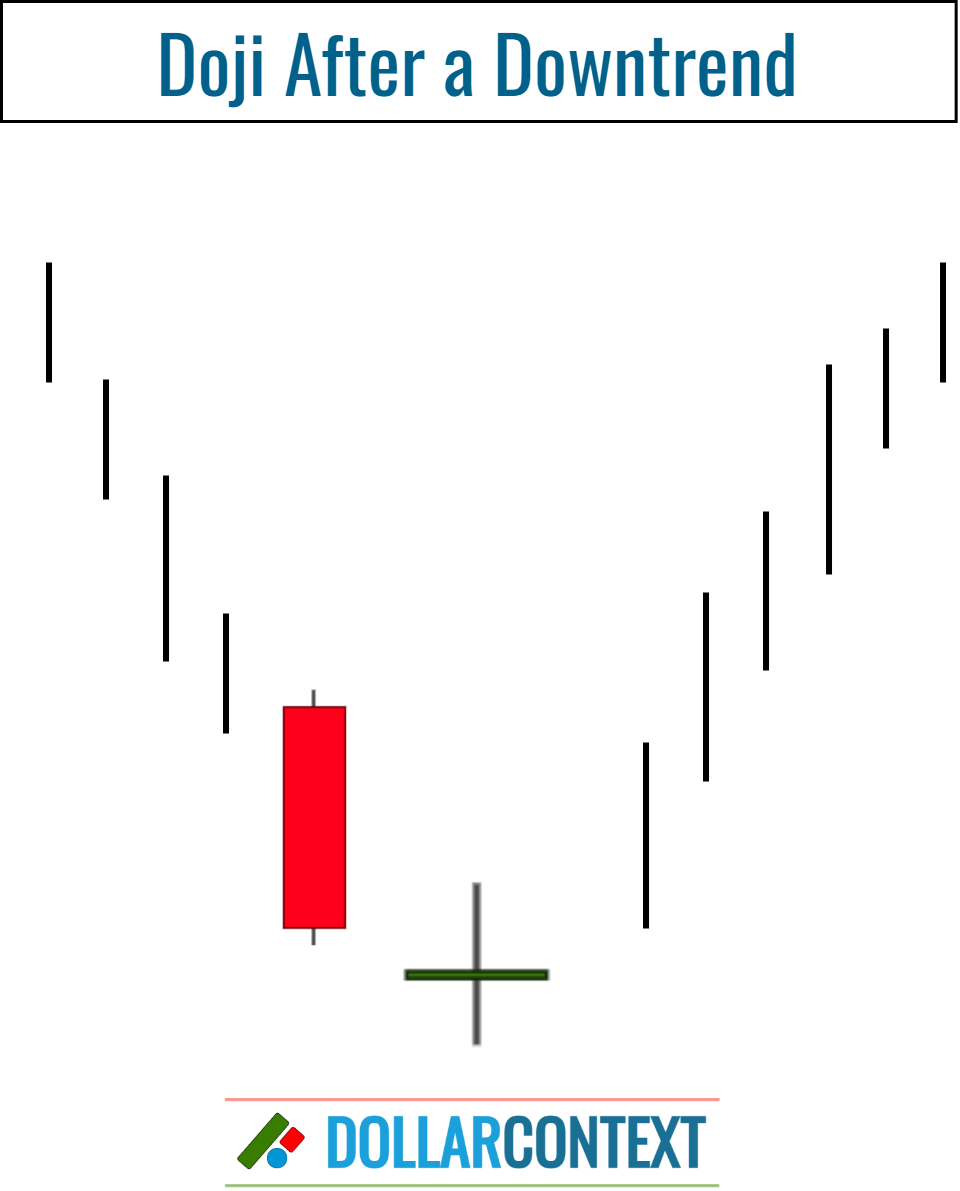

Psychologically, a doji candle indicates a market equilibrium, hinting at a possible sentiment change and a potential trend reversal. Yet, for this reversal to materialize, there should be a clear upward or downward trend before the doji session.

One should take particular notice when a doji follows a tall white (or green) candle, especially if that white candle comes after a notable uptrend.

Following a pronounced downtrend, a doji emerging after a lengthy black (or red) candle often signals a possible reversal.

In a market that's confined to a narrow range or showing a moderate trend, a doji session usually holds no significance.

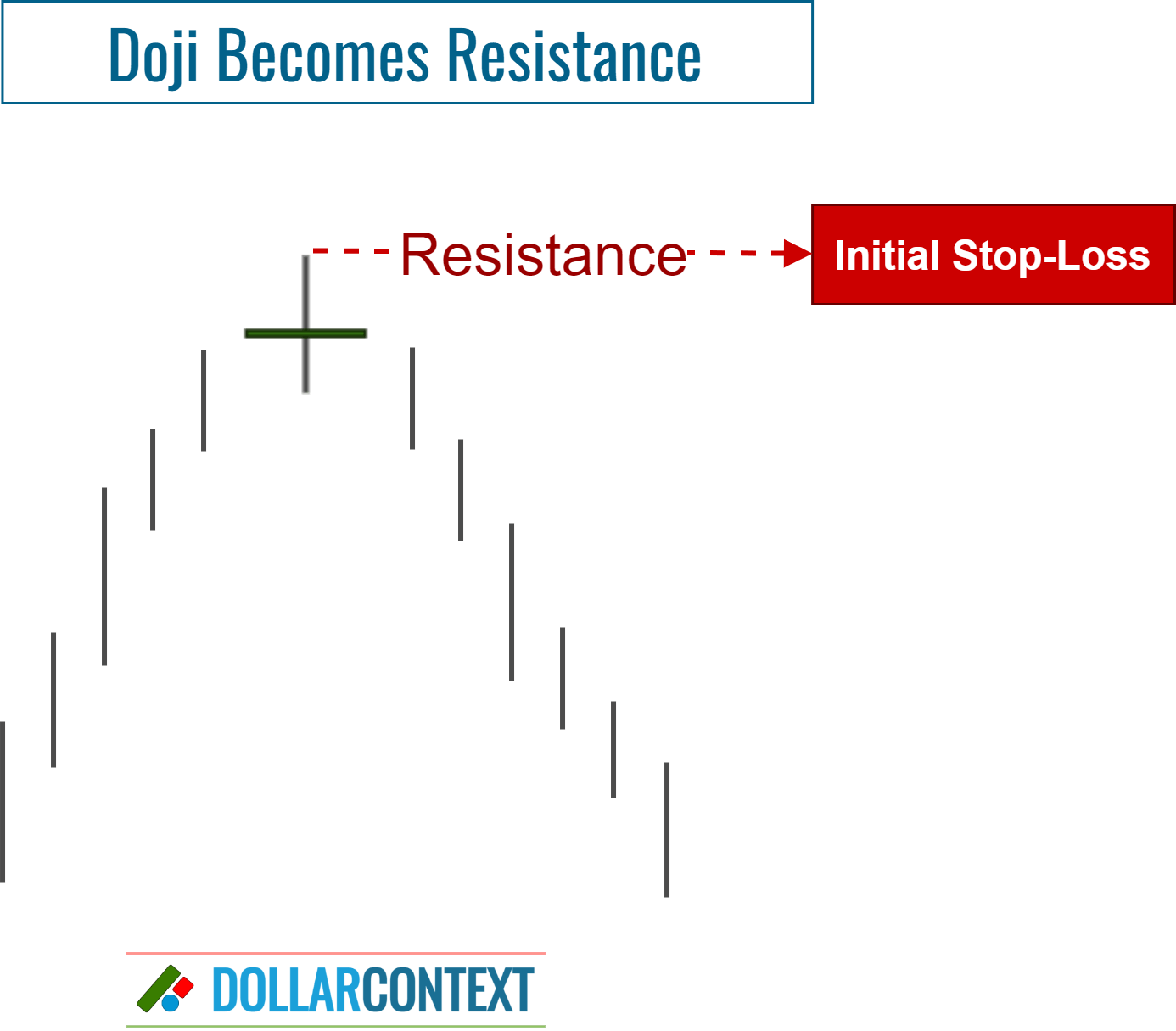

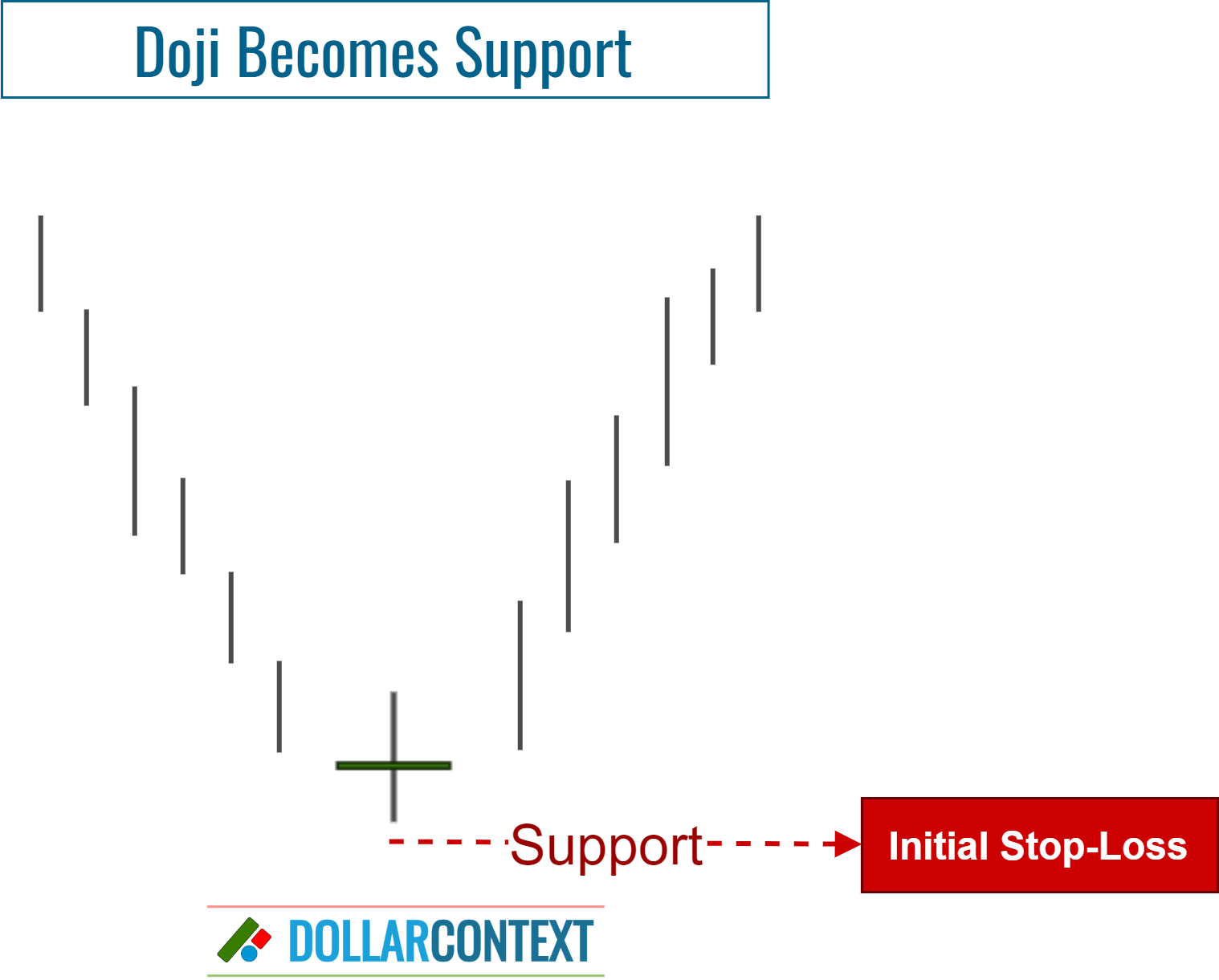

3. Identify the Support or Resistance Zone

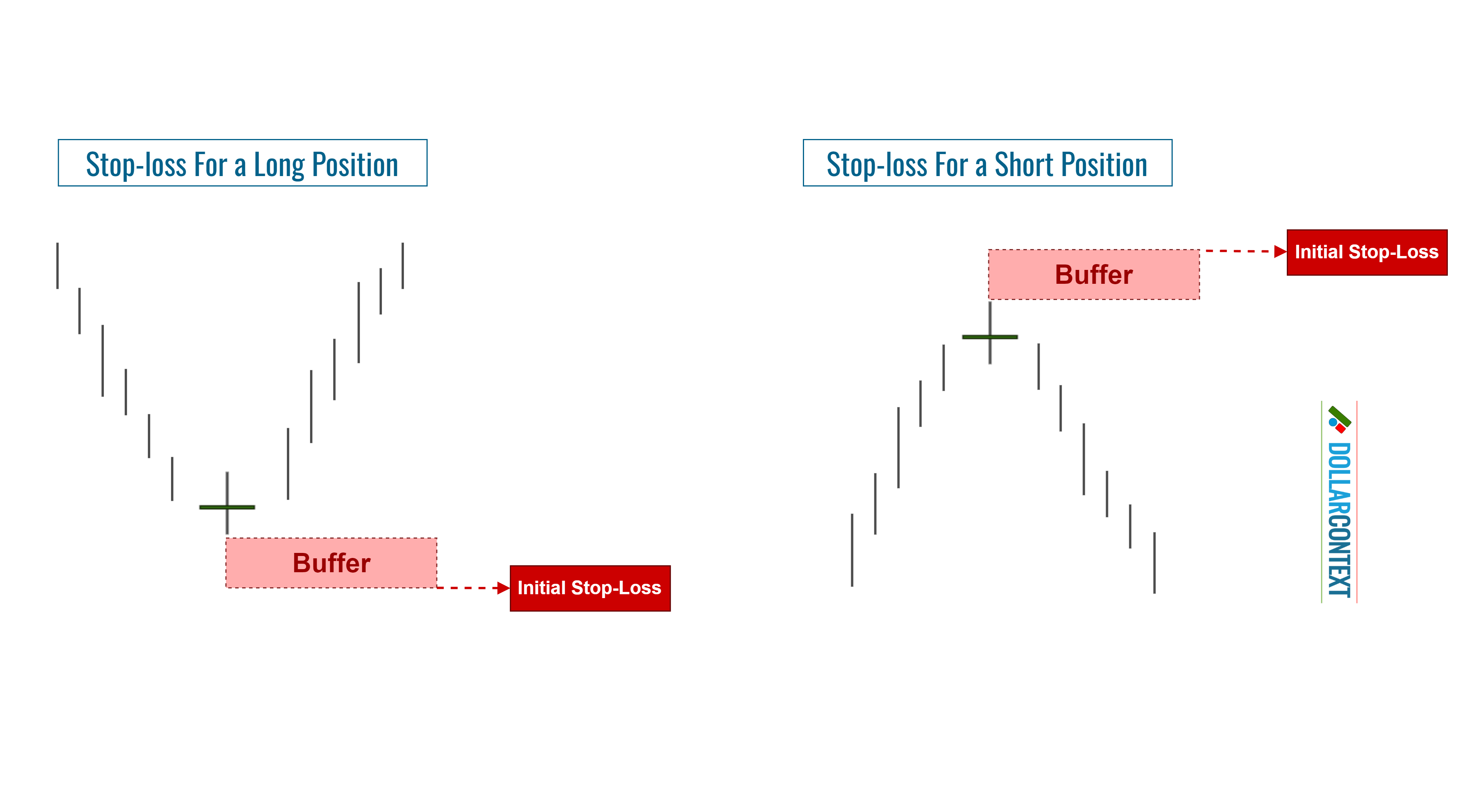

Following an uptrend, the price range of a doji often becomes resistance. The peaks of this range can serve as a reference for setting your initial stop-loss when entering a short position.

Similarly, following a downtrend, the initial stop-loss for a doji should be placed at its lowest point.

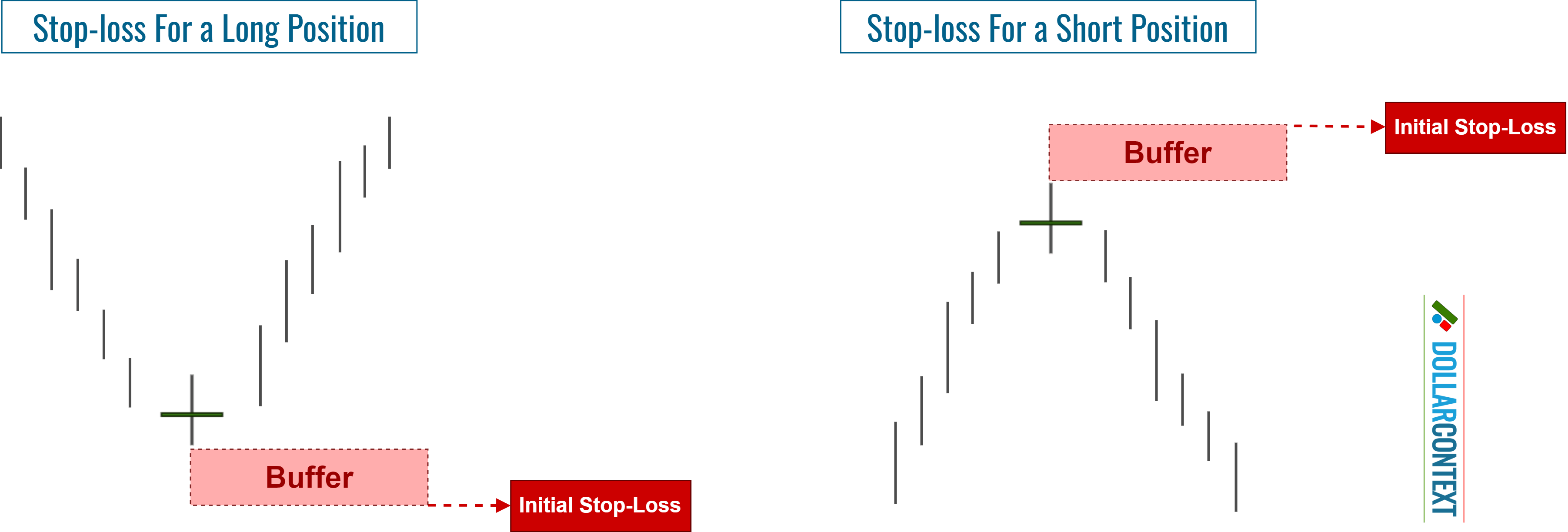

4. Consider Adding a Safety Margin

After regarding factors like market volatility and risk management, it might be prudent to add a cushion to your initial stop-loss. This extra safeguard can effectively protect you from the pitfalls of false breakouts.

5. Decide Whether Your Stop-loss Is Based on a Close

A stop triggered upon closing is activated when the closing price of a trading session exceeds the stop-loss limit, instead of just depending on intraday price movements.

In candlestick charting, it's often recommended to set a stop at the closing point, especially when using a doji candle to initiate your position.

6. Monitor the Trade

Regularly assess the market and your position to ensure they are in sync with your doji strategy, specifically:

- Adjust your stop-loss point when needed. Markets constantly evolve, and new candlestick patterns may appear as your trade unfolds. If such changes occur, consider refining your stop-loss to adapt to the changing landscape. For instance, if a new candlestick pattern emerges around the same level as the doji, reinforcing the reversal hypothesis, it's wise to realign your stop accordingly.

- As the price moves in your favor, think about implementing a trailing stop-loss to safeguard profits and manage risk effectively.

- Maintain discipline. Refrain from making emotion-driven decisions, regardless of market shifts.