Types of Doji Candles

Five basic types of doji sessions are commonly identified: standard doji, dragonfly, gravestone, long-legged doji, and doji star.

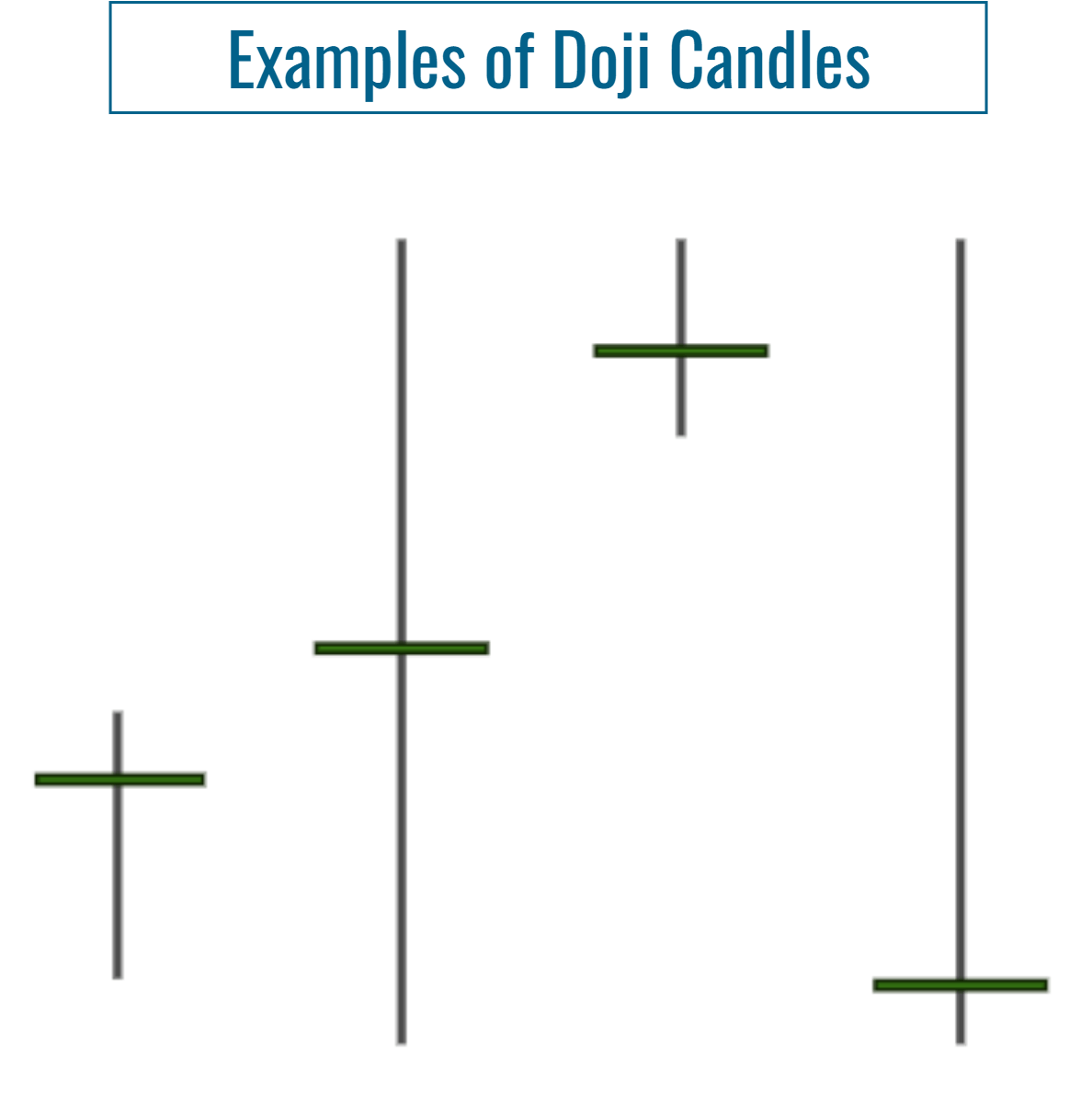

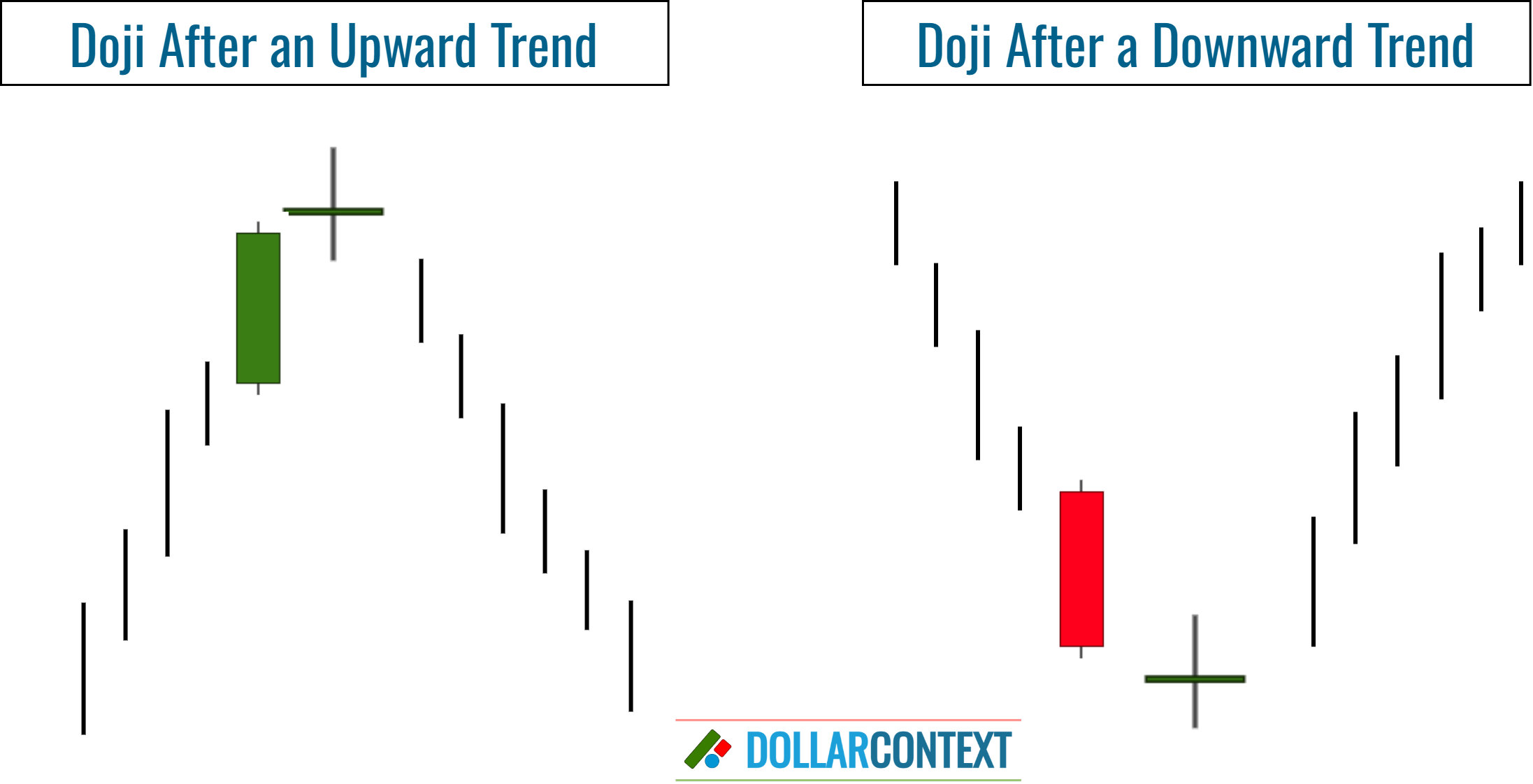

A doji is a candlestick that signifies indecision in the market. It occurs when the opening and closing prices of an asset are virtually identical. The result is a candle with a very thin body, resembling a cross or plus sign. The shape of a doji reflects a balance between buying and selling forces, suggesting that a change in market direction could be imminent.

To be meaningful as a reversal indicator, the doji should appear after an uptrend or a downtrend. A doji within a lateral range usually holds no significance.

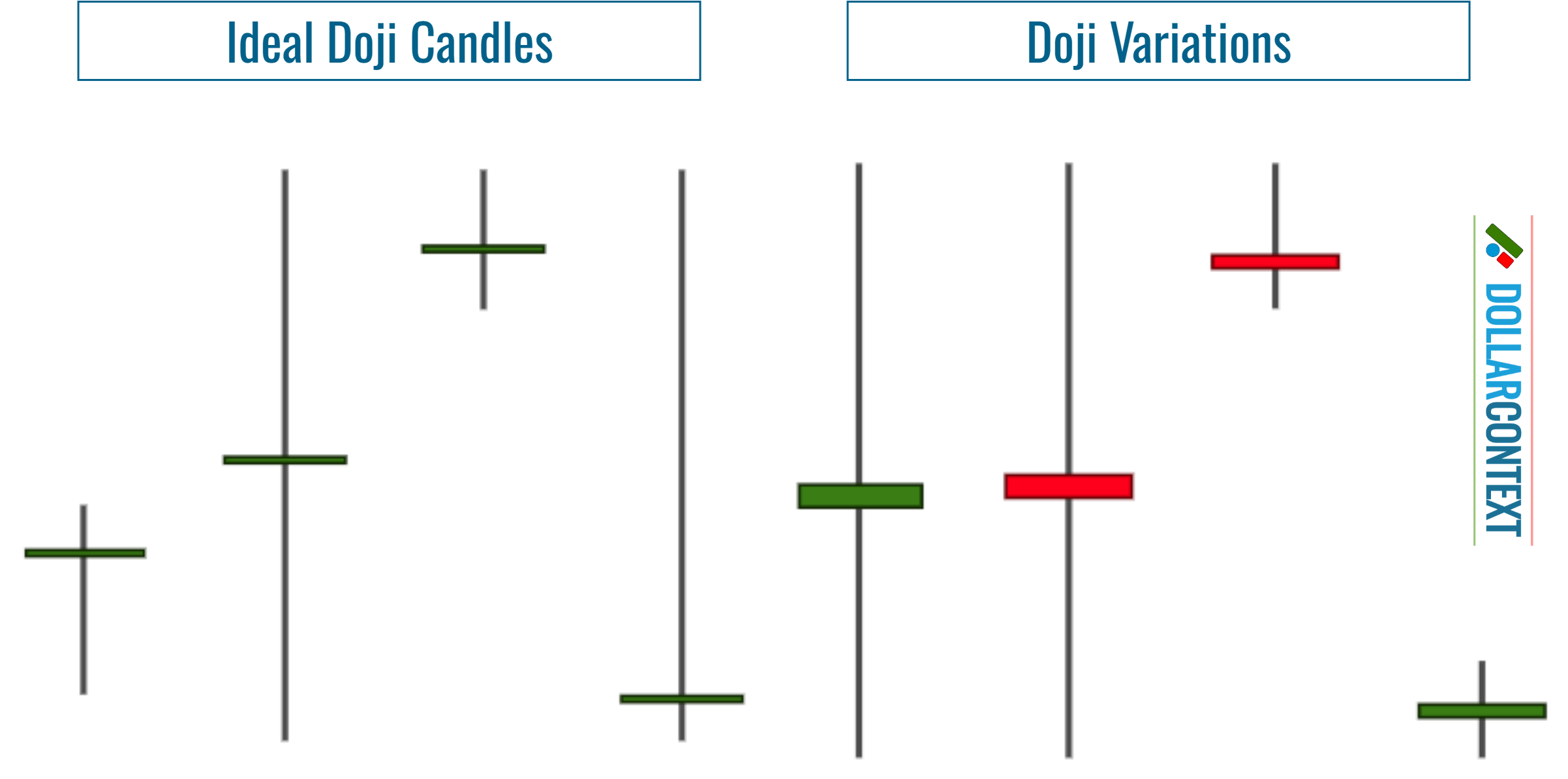

Doji Types vs. Doji Variations

While the common definition indicates that a doji requires the open and close prices to be identical, some analysts consider slight-bodied sessions as valid doji candles under certain market conditions. These are called doji variations.

A doji type refers to a pre-defined form in which a doji can be presented or found. In Japanese candlestick analysis, five basic types of doji sessions are commonly identified:

- 1. Standard Doji

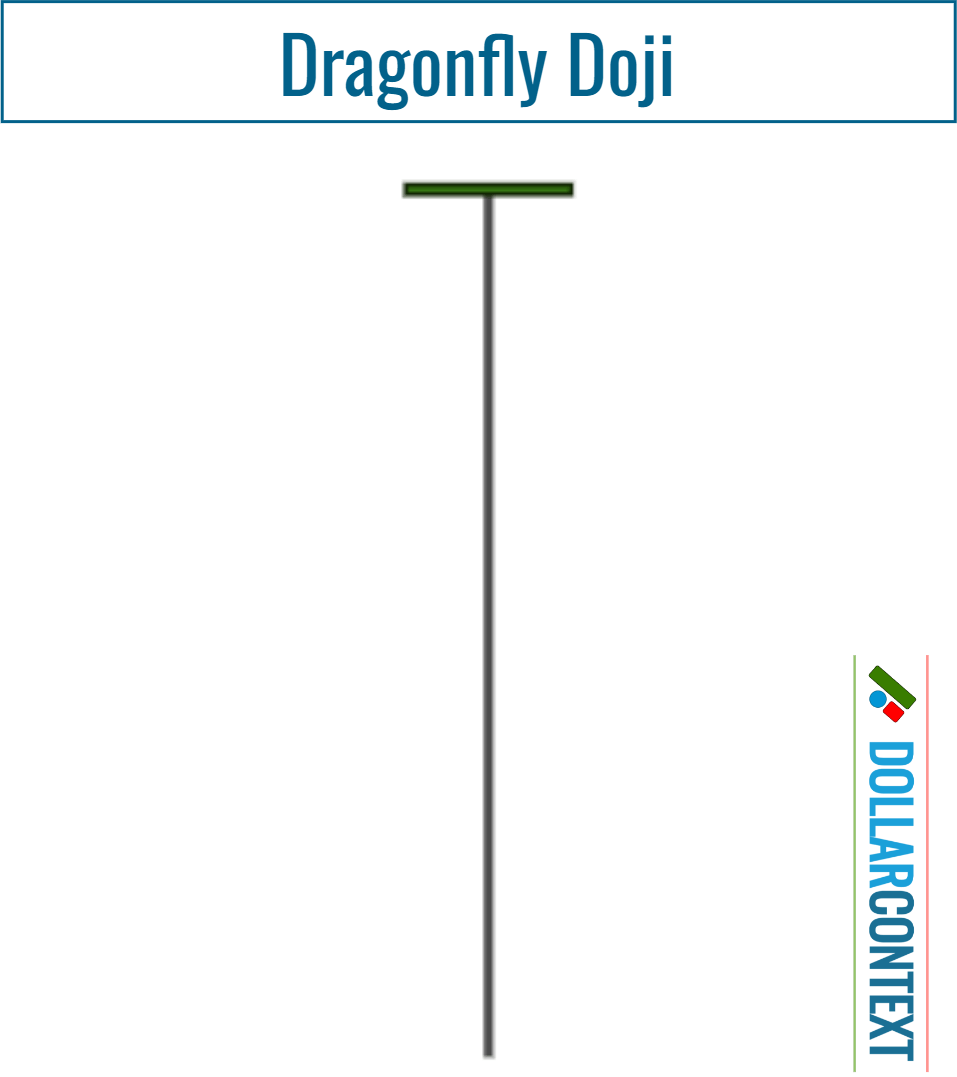

- 2. Dragonfly Doji

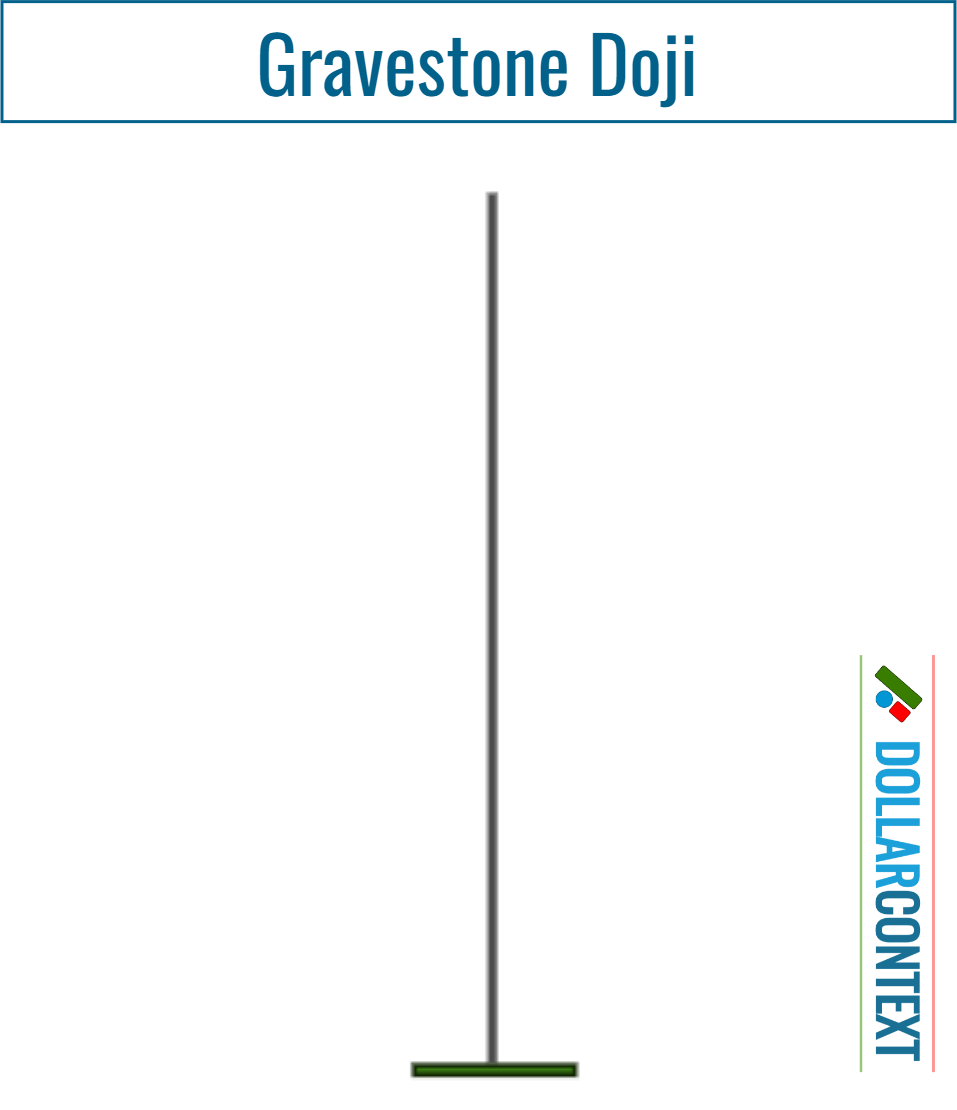

- 3. Gravestone Doji

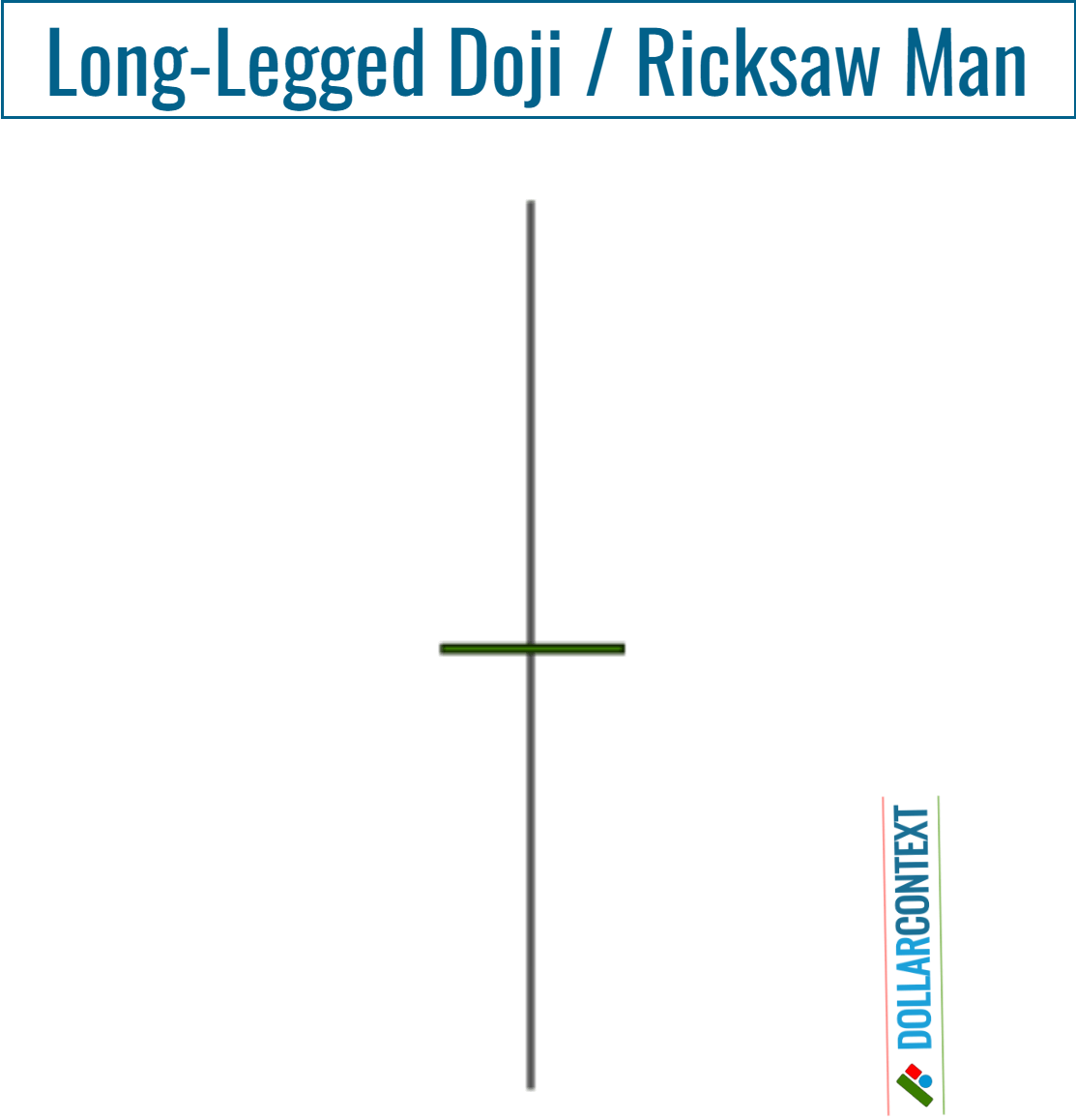

- 4. Long-Legged Doji and Rickshaw Man

- 5. Doji Star

1. Standard Doji

This is the classic doji where the open and close are the same, or very close to the same.

A standard doji in an uptrend or downtrend can signal a potential reversal, given that neither the bulls nor the bears could gain an advantage.

2. Dragonfly Doji

This doji appears when the opening, closing, and high prices are all the same (or very close), and there is a long lower shadow. A dragonfly doji at the bottom of a downtrend can be a bullish reversal signal, indicating that the asset’s price may start moving upward.

Dragonfly doji candlesticks can also be considered a subtype of the hammer pattern.

3. Gravestone Doji

This is the opposite of the dragonfly. The opening, closing, and low prices are almost the same with a long upper shadow. When found at the top of an uptrend, a gravestone doji can signify a bearish reversal, suggesting a potential downward movement in price.

Gravestone doji candles can also be considered a subtype of the shooting star pattern.

4. Long-legged Doji and Rickshaw Man

Also known as a "high-wave doji", a long-legged doji has long upper and lower shadows. It represents a large trading range during the period but still closes near its opening price, suggesting significant indecision and potential volatility.

When the opening and closing are situated at the center of the session's range, the line is referred to as a rickshaw man.

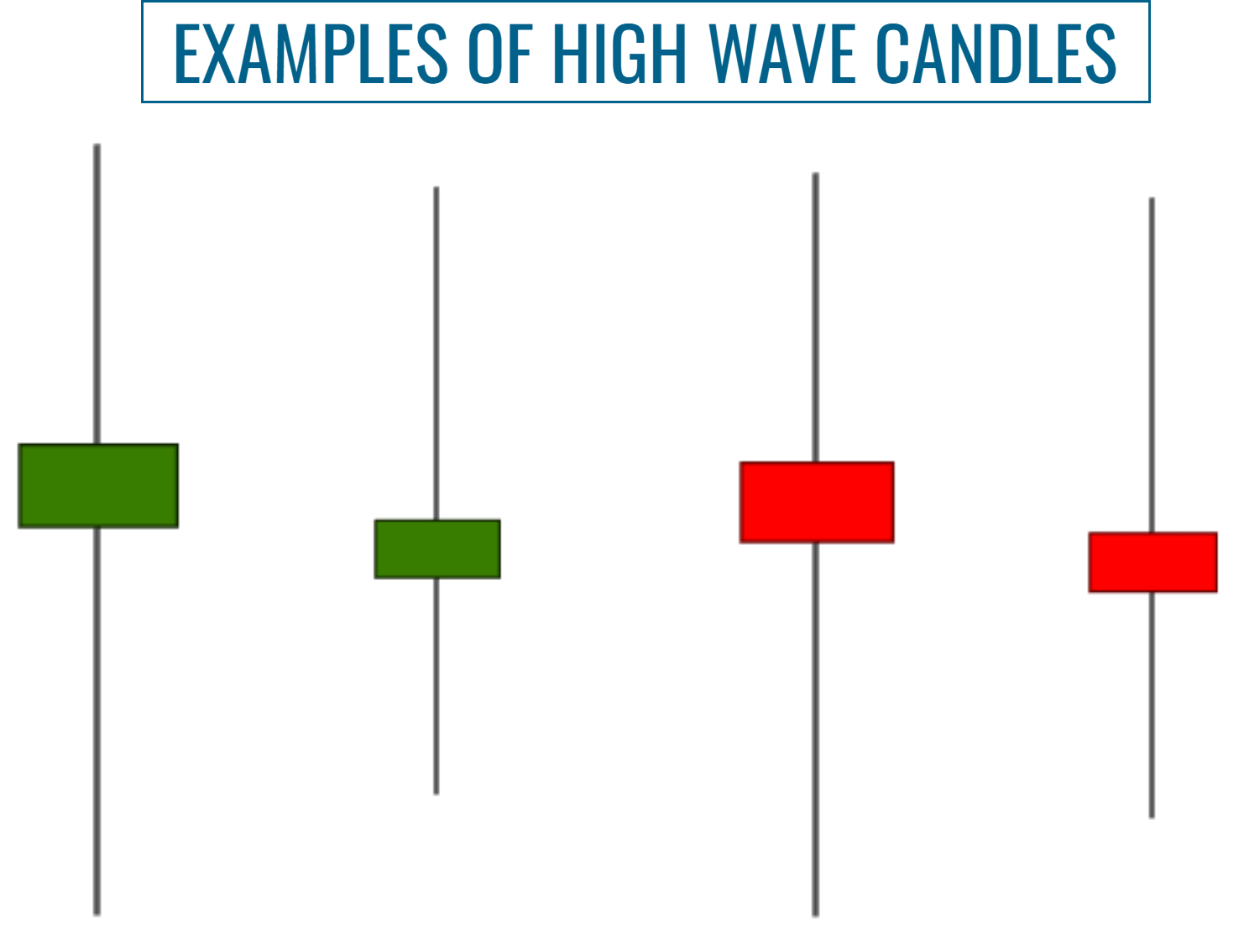

When a session, not a doji, has a notably long upper and lower shadows with a small real body, it's termed a high-wave.

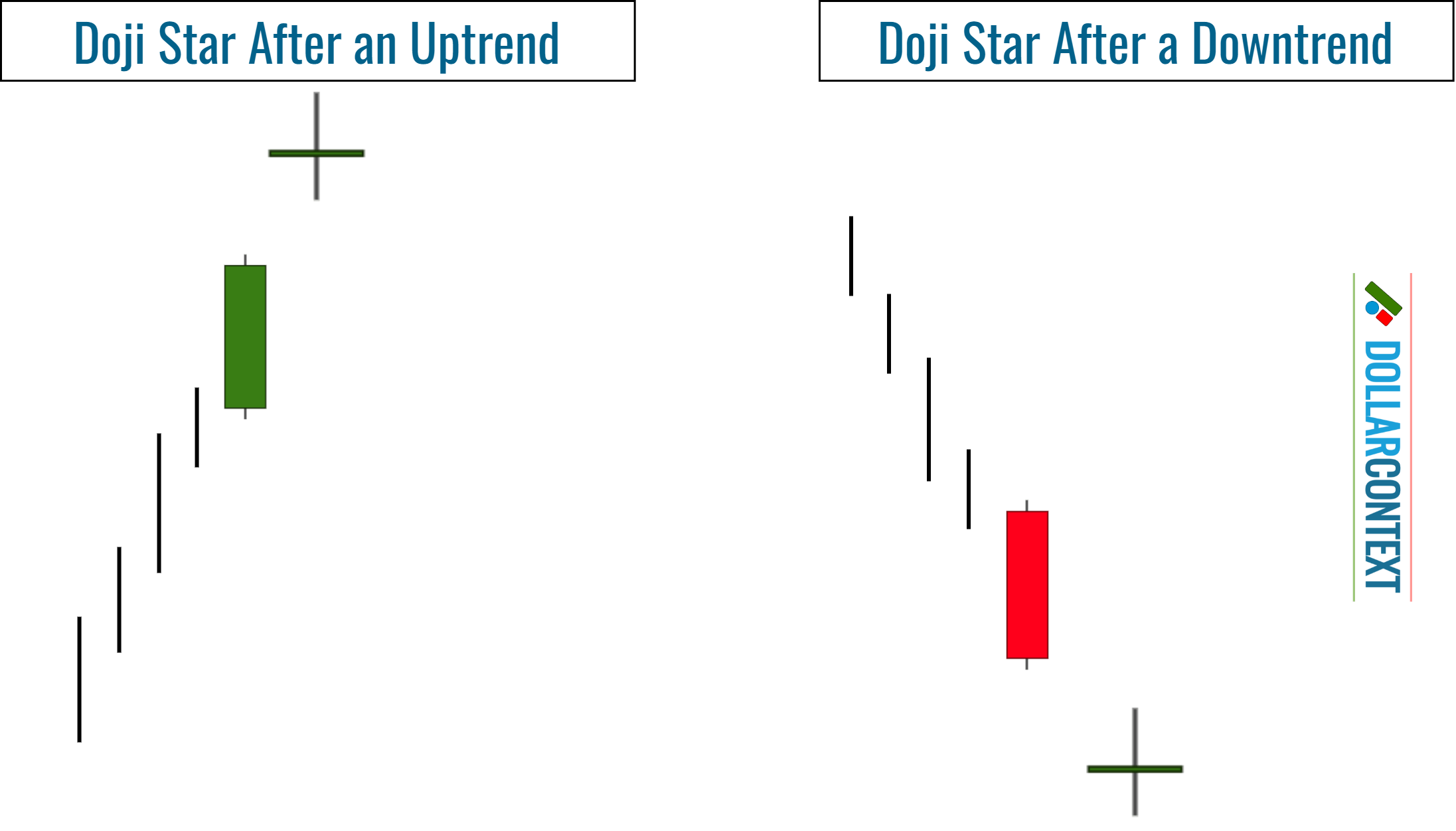

5. Doji Star

A star features a tiny real body that creates a gap from the extensive real body that comes before it. The formation remains a star as long as its real body doesn't overlap with the preceding real body. Stars can emerge at tops or bottoms.

If the star is a doji instead of a small real body, it is called a doji star. The star, particularly the doji star, is a warning that the prior trend may be concluding.