Doji Variations: Spotting a Near-Doji Candle

How can one determine if a near-doji session, where the opening and closing prices are similar but not the same, qualifies as a genuine doji?

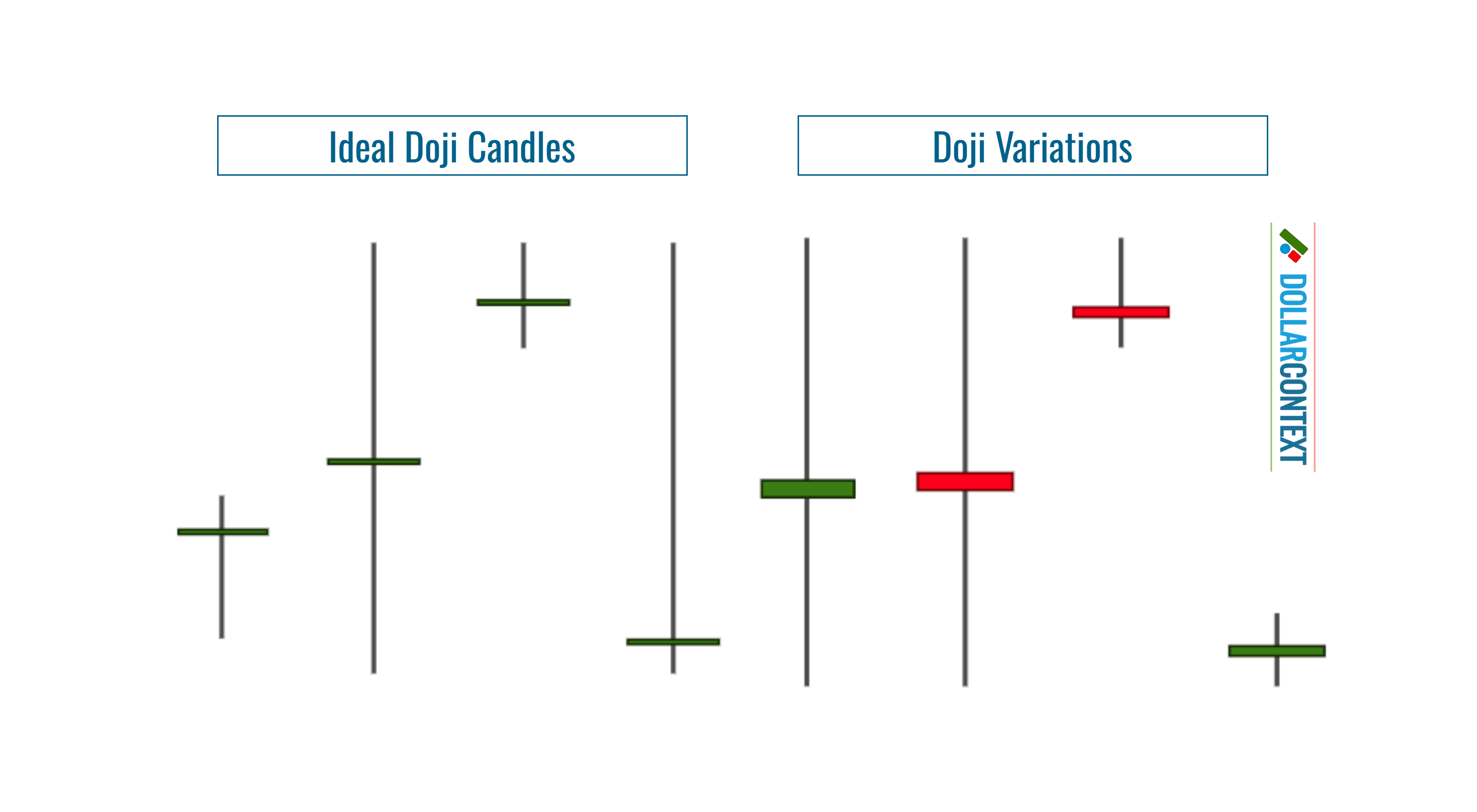

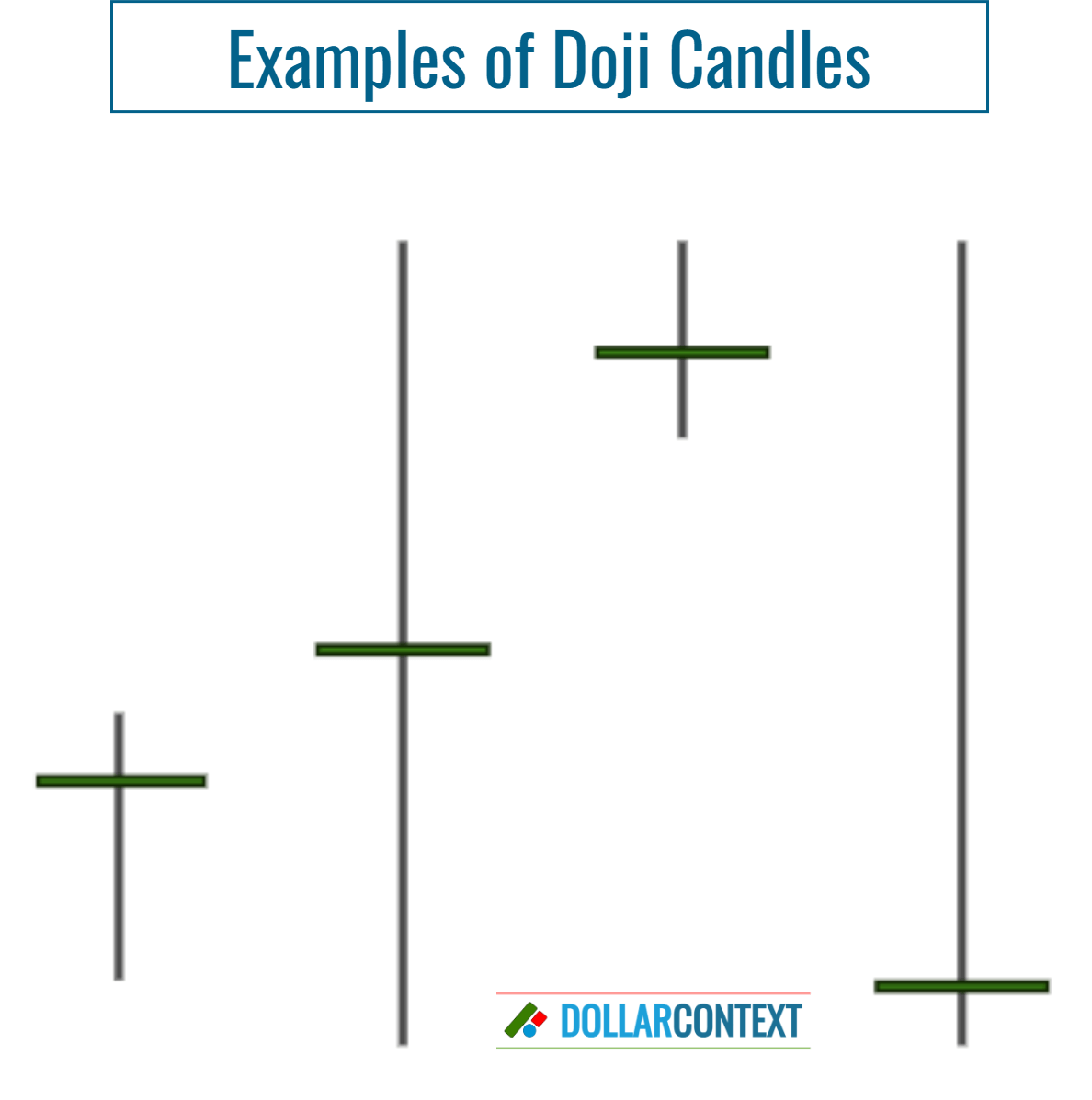

Within the sphere of Japanese candlestick analysis, a doji candle stands out as one of the most important candle lines. As illustrated below, the shape of an ideal doji presents a horizontal line. This formation arises when the session's opening and closing prices match.

What Is a Doji Variation?

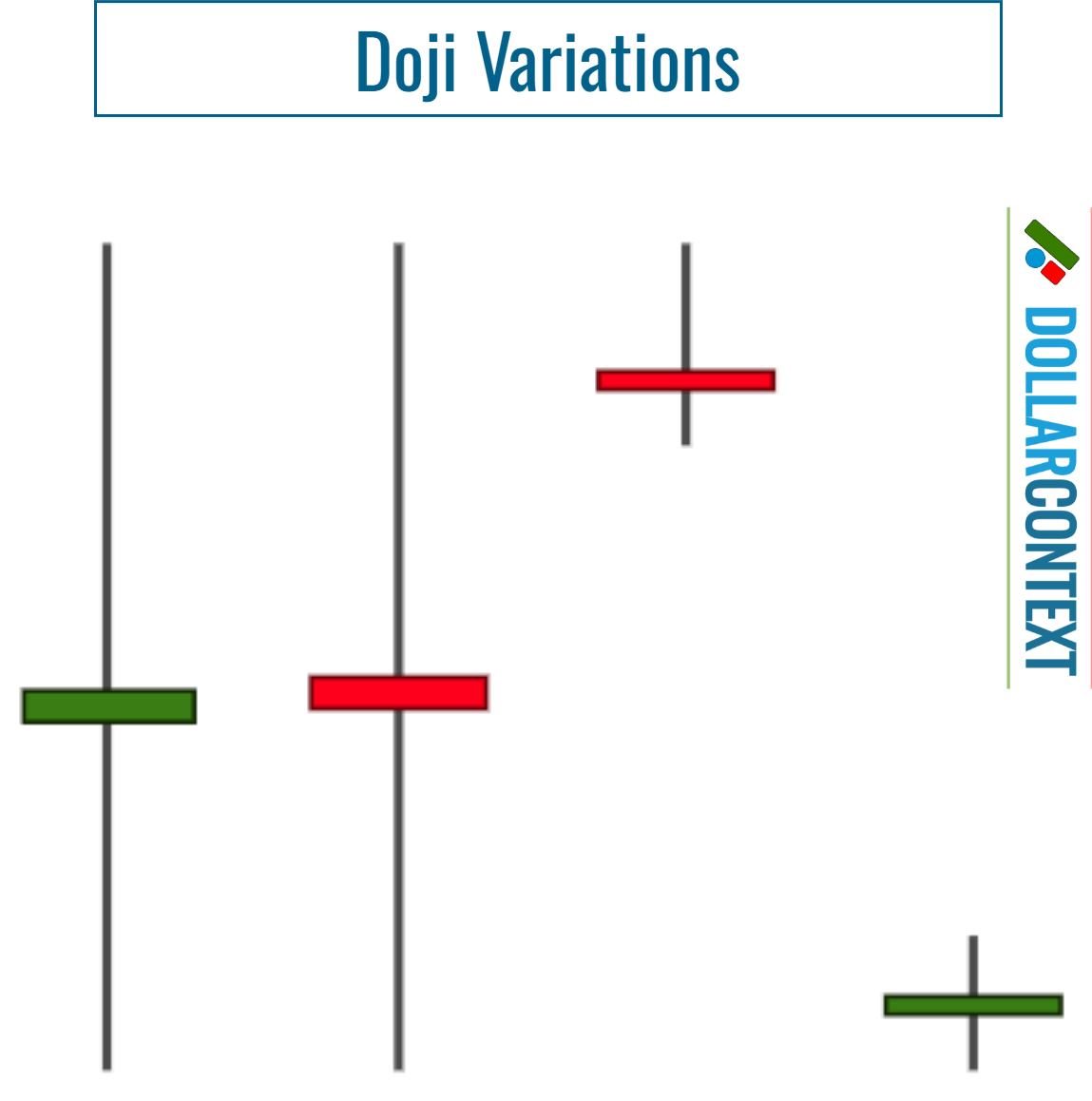

While an ideal doji session has identical opening and closing prices, there's some leeway with this definition. If the opening and closing prices are only a few ticks apart, it can still be considered a doji. For clarity, we sometimes refer to the standard version as a "doji" and any slight deviation from this as a "variation of a doji".

The philosophy behind a doji is that this candle reflects indecision, and a near-doji session can reflect this sentiment in the market.

"Doji Variations" vs. "Ideal Doji"

After a mature or pronounced trend, a doji candlestick can serve as an alert, suggesting a possible upcoming market reversal.

How can one determine if a near-doji session, where the opening and closing prices are similar but not the same, qualifies as a genuine doji? Although the response is somewhat subjective and doesn't adhere to rigid rules, experience has shown us that a doji variation requires additional confirmation, or corroborating signs, to be considered a valid reversal indicator.

Methods to Validate a Doji Variation

The following indicators and strategic approaches can help validate a near-doji candle as a reversal signal.

- Prior Bodies: One way is by comparing it to recent market action. If there's a sequence of minor real bodies preceding the doji-like session, this candle might not be that significant.

- Doji Frequency: The doji stands out as a specific indicator of trend shifts. Doji sessions hold weight in markets with sparse occurrences of doji candles. We are referring to doji frequency across a chart rather than near the doji-like session. When a chart already showcases numerous doji sessions, the introduction of another should not be perceived as a significant change in that market.

- Market Juncture: If the market is at a crucial intersection or in the mature phase of a bullish (or bearish) movement, a near-doji can be regarded as a legitimate doji.

- Additional Candlestick Patterns: When supplementary candlestick patterns arise before or after the near-doji session, the probability of a market reversal increases. In this case, the near-doji session should be taken seriously as an indicator of change.

- Upthrusts and Springs: After an uptrend, the highs of a doji candle become resistance. An upthrust is basically a false breakout of a resistance area. This price action traps traders who bought after the breakout, expecting the price to continue its upward trend. The inability of the price to sustain above the resistance set by the doji indicates that the bullish momentum lacks the strength to push prices upward, hinting at potential vulnerabilities in the market. The same thing works in reverse. After a downtrend, a false breakout of a support level (also known as a spring) increases the likelihood of a successful reversal after the emergence of a doji or doji-like session.

- Other Technical Indicators: Outside the candlestick domain, other technical metrics can also be used to validate a near-doji candle as a reversal signal. These indicators might be based on chart patterns, Fibonacci levels, Elliott Wave theory, etc.

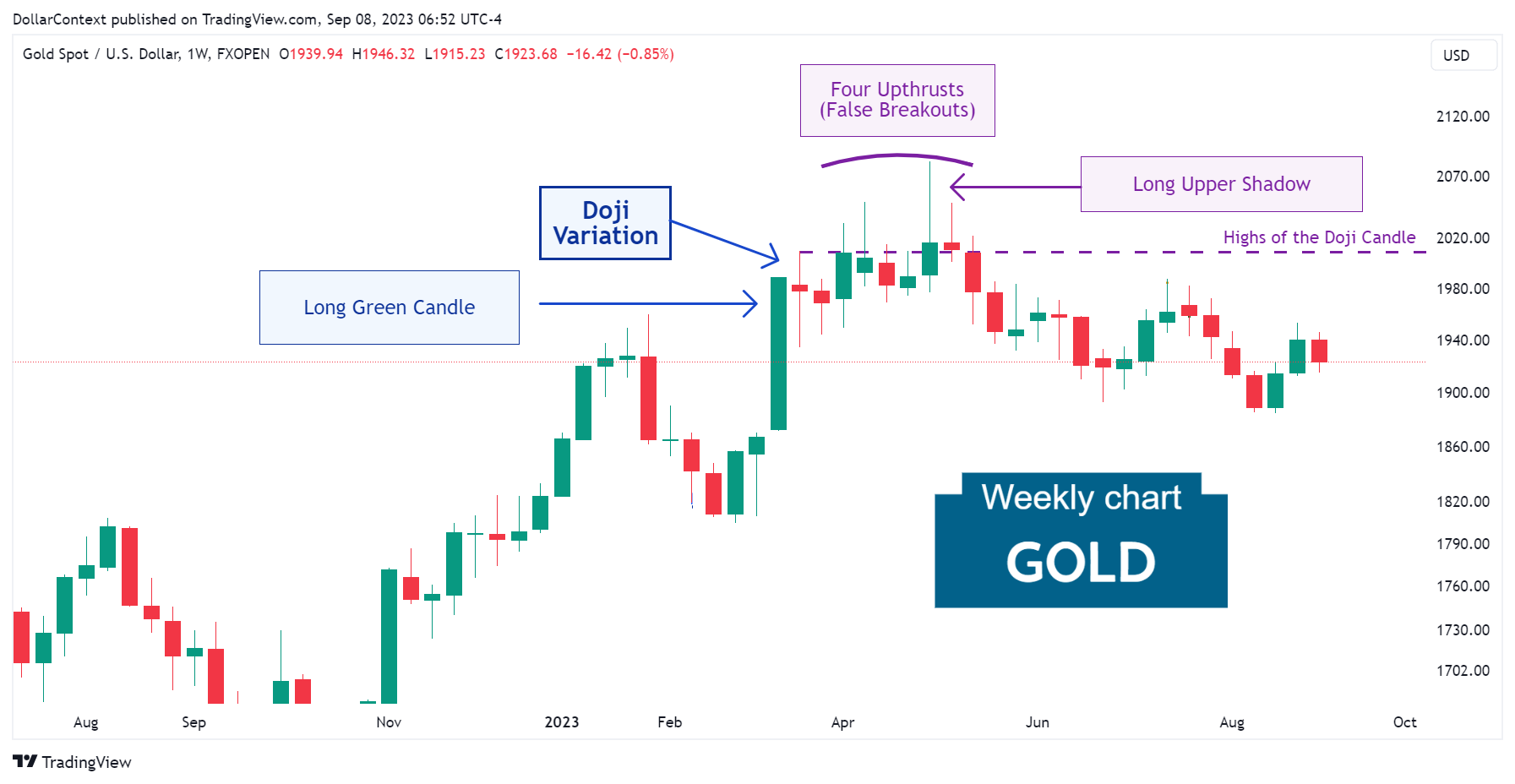

Example

In March 2023, the gold market displayed a doji-like candle following a tall white candle. Notice how a series of upthrusts unsuccessfully challenged the resistance level set by the doji variation. These false breakouts further underscored the credibility of the doji variation as a reversal indicator.