Checklist for an Engulfing Pattern

Three conditions must be met for a pattern to be classified as an engulfing pattern: trending market, engulfing, and opposite colors.

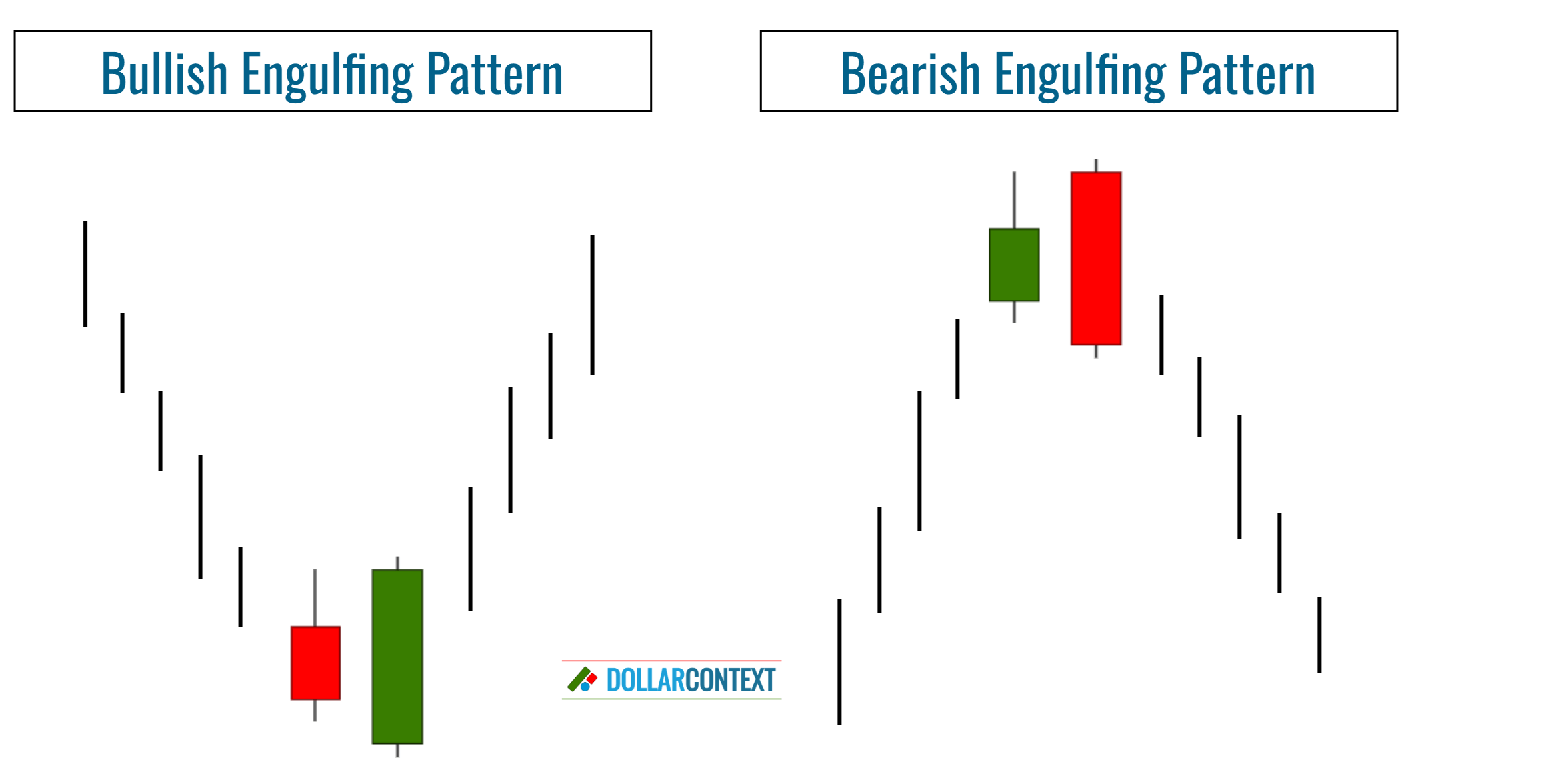

An engulfing pattern is a two-candle formation that may signal a market reversal. There are two basic types of engulfing patterns:

- Bullish Engulfing Pattern

- Bearish Engulfing Pattern

Basic Criteria

Three conditions must be met for a pattern to be classified as an engulfing pattern:

- Trending Market: The market must be in a clear uptrend or downtrend, even if that trend is short-term.

- Engulfing: The engulfing pattern consists of two candlesticks, where the second one's real body must envelop the first one's real body, although it doesn't have to cover the shadows.

- Opposite colors: The second real body in the engulfing pattern should be a different color from the first one, unless the first real body is so small that it is nearly a doji, or actually is a doji. A bullish engulfing pattern (a red session followed by a green candlestick) should emerge after a downtrend. The reverse holds after an uptrend.

Grading the Importance of an Engulfing Pattern

The fundamental criteria for an engulfing pattern stipulate that the second real body should completely envelop a real body of the opposite color. Yet, not all engulfing patterns are equally important.

The significance of an engulfing pattern hinges on:

- The relative size of the bodies

- The correlation between the respective shadows

- Whether the second day of the engulfing pattern engulfs the real bodies of more than one previous session.

- The strength and duration of the previous trend

- Other contextual factors

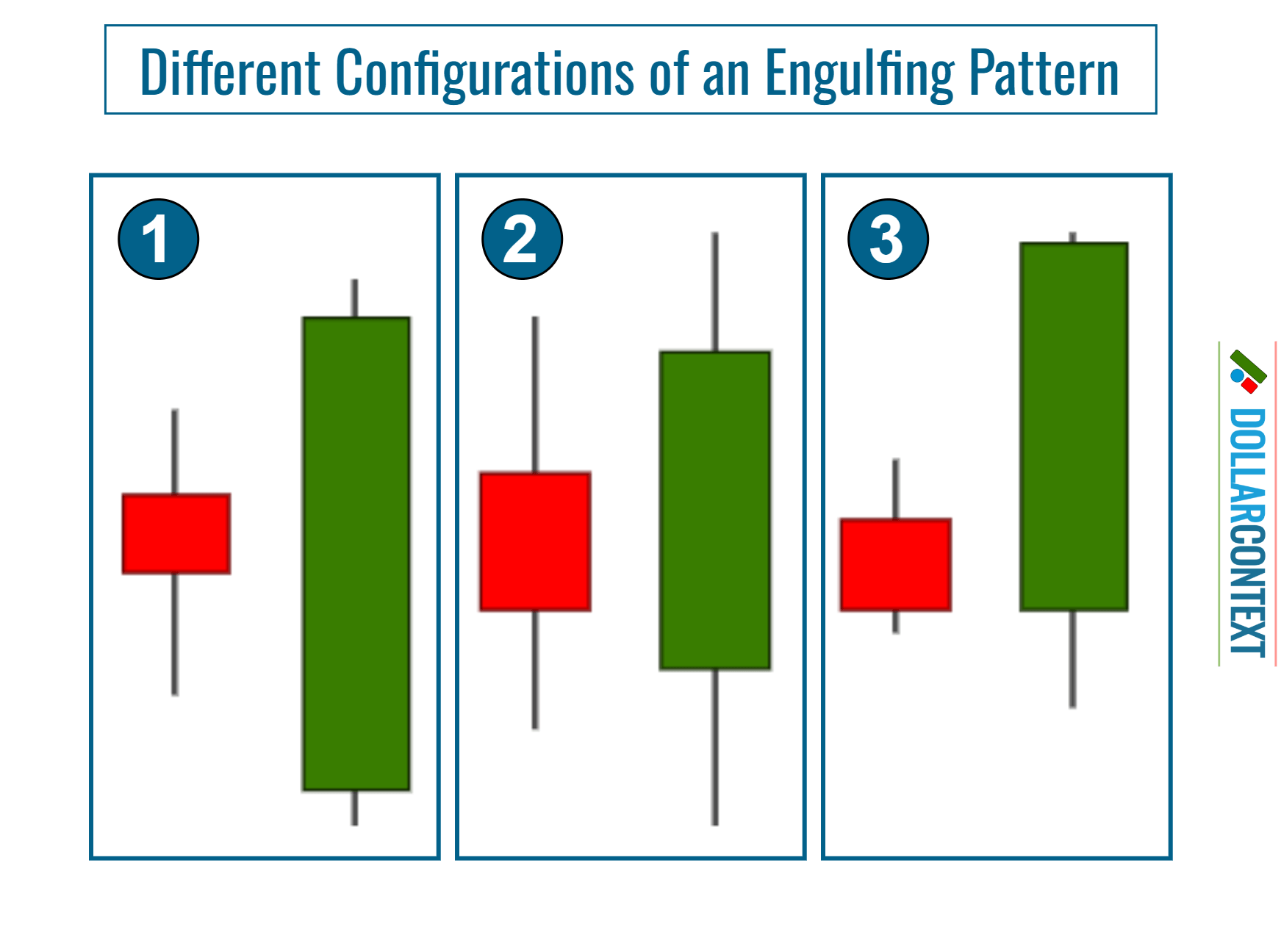

Thus, we can distinguish three degrees of importance:

- An ideal engulfing pattern features a small first candle that is entirely enveloped—shadows included—by a substantially larger second candle. See the pattern labeled as "1" in the image below for reference.

- The next ideal shape occurs when the second candle's shadows extend beyond those of the first candle, indicating that the market hits both a higher high and a lower low on the second day of the engulfing pattern. Refer to the pattern labeled "2" below for an example.

- A more lenient interpretation can be applied in low volatile markets or when analyzing shorter timeframes, like minutes or hours. Specifically, many traders deem it an engulfing pattern if the second session opens at the same price level as the first candle's close. In those cases, it's wise to look for supplementary confirmation signals to substantiate the likelihood of a market reversal.

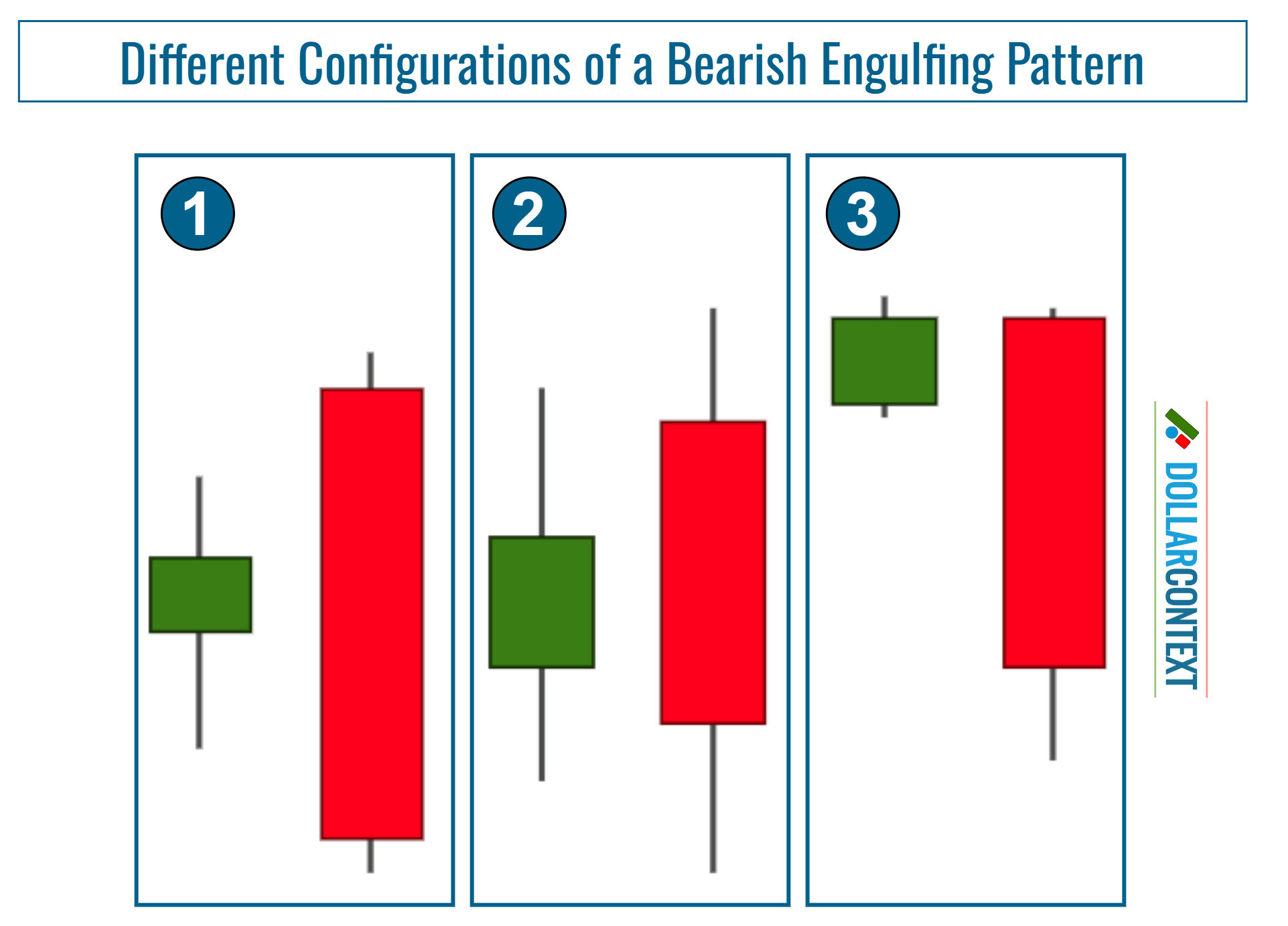

The image below showcases the equivalent configurations for a bearish engulfing pattern: