Optimal Entry Points With Engulfing Patterns

In this article, we discuss the different options for entry points after the appearance of an engulfing pattern.

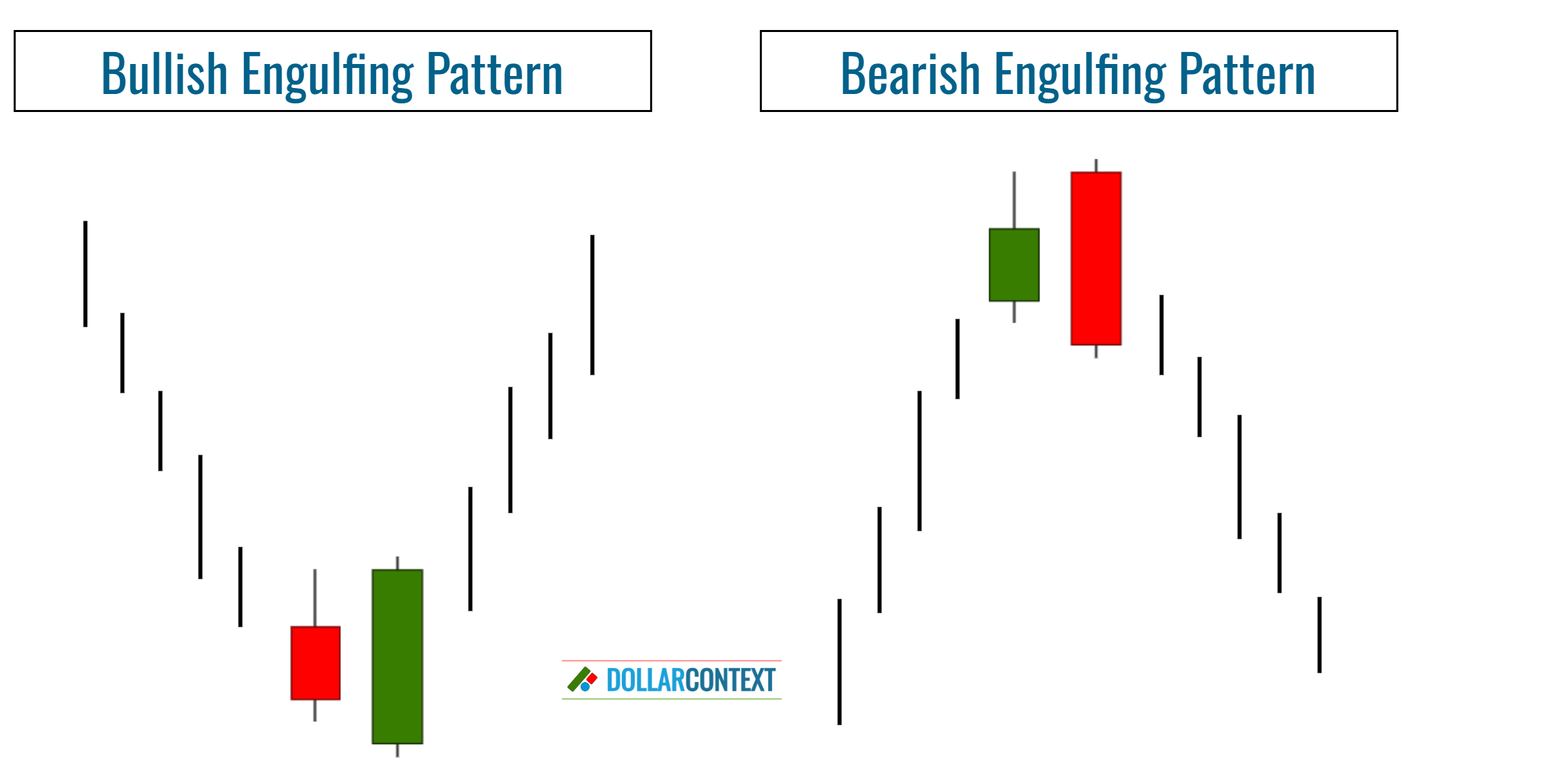

An engulfing pattern is a major candlestick pattern used in Japanese candlestick analysis. It suggests a potential trend reversal in the market. This formation consists of two candlesticks:

- Bullish Engulfing: The first is usually a small bearish (red or black) candle, followed by a larger bullish (green or white) body that engulfs the entirety of the first real body, indicating a potential upward reversal.

- Bearish Engulfing: The first is typically a small bullish (green or white) body, followed by a larger bearish (red or black) real body that engulfs the entirety of the first candle, indicating a potential downward reversal.

The pattern is most significant when it appears after a clear trend.

Here are different entry point strategies following the emergence of an engulfing pattern:

Engulfing Pattern-Based Entry Techniques

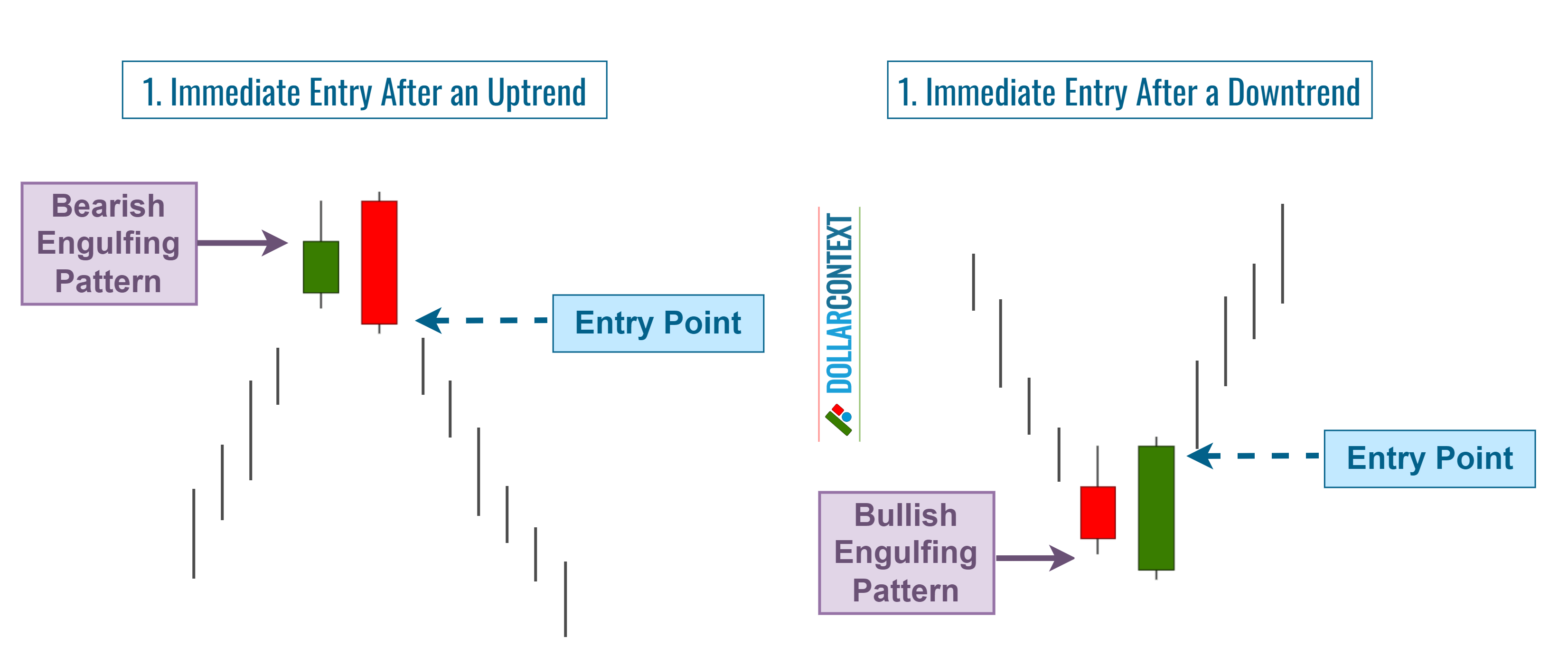

1. Immediate Entry

When a bearish engulfing pattern emerges after a clear uptrend, you can consider opening a short position. Similarly, if a bullish engulfing pattern appears after a defined downtrend, it may be an opportunity to open a long position.

This strategy is more aggressive and can be used when expecting an outright reversal.

- Advantages: You won't miss the trading chance.

- Disadvantages: Since not all engulfing patterns are equally important, many of them do not anticipate a direct reversal.

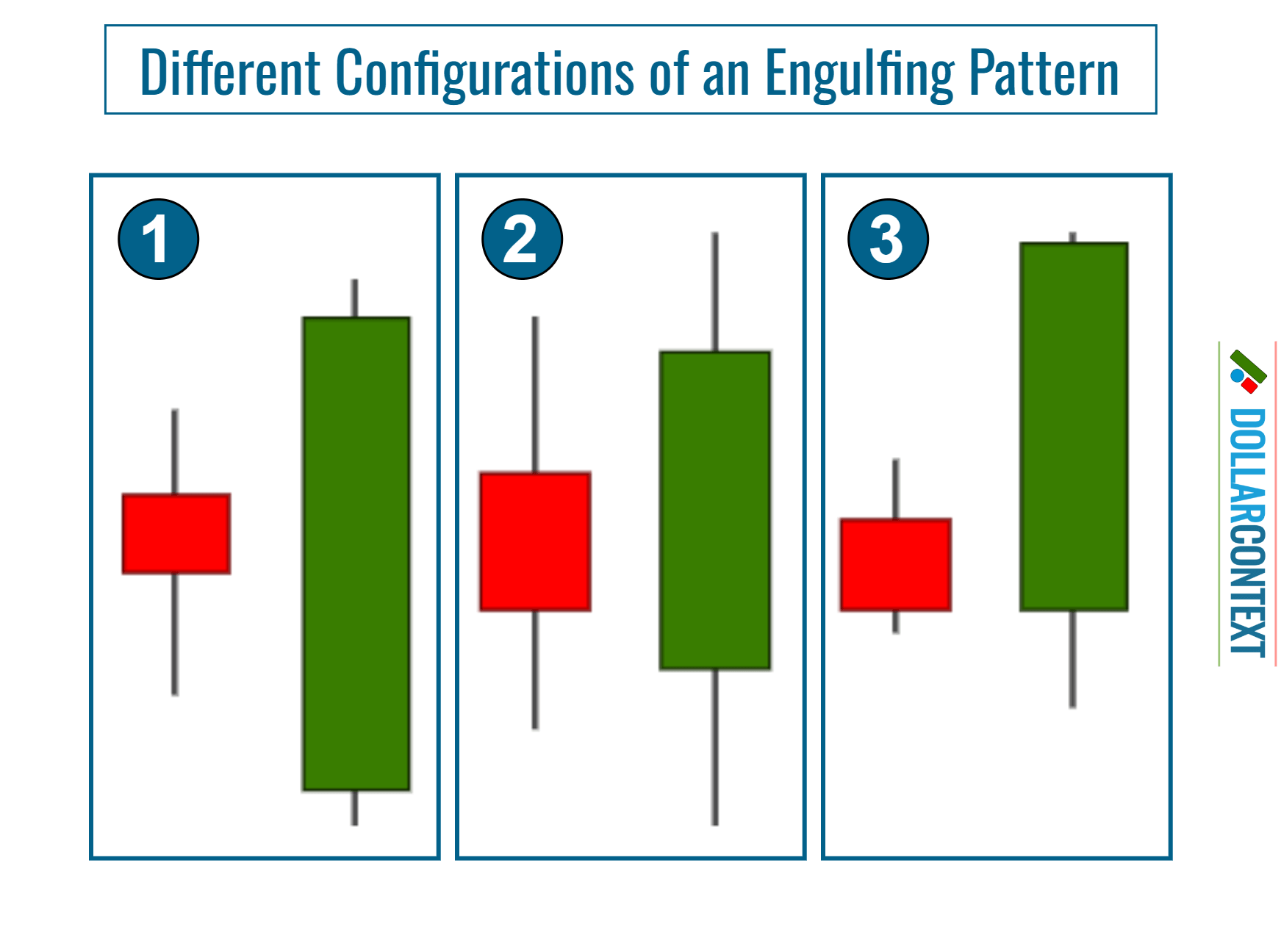

We recommend adopting this strategy only when the first candle is petite, with the second one substantially larger. The ideal scenario is when the body of the second candle wholly covers the first candle, including its shadows—see engulfing pattern labeled as "1" in the image below.

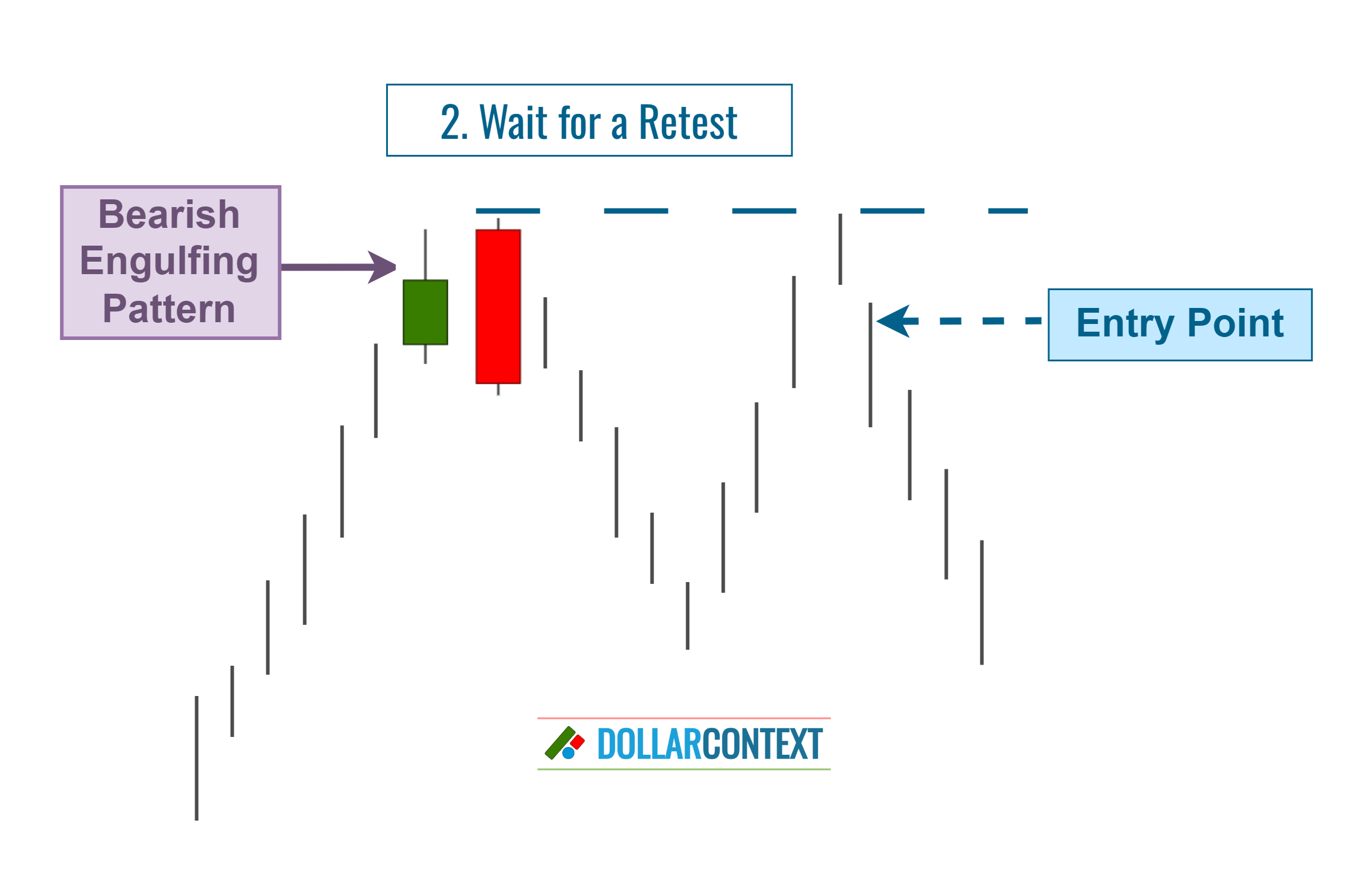

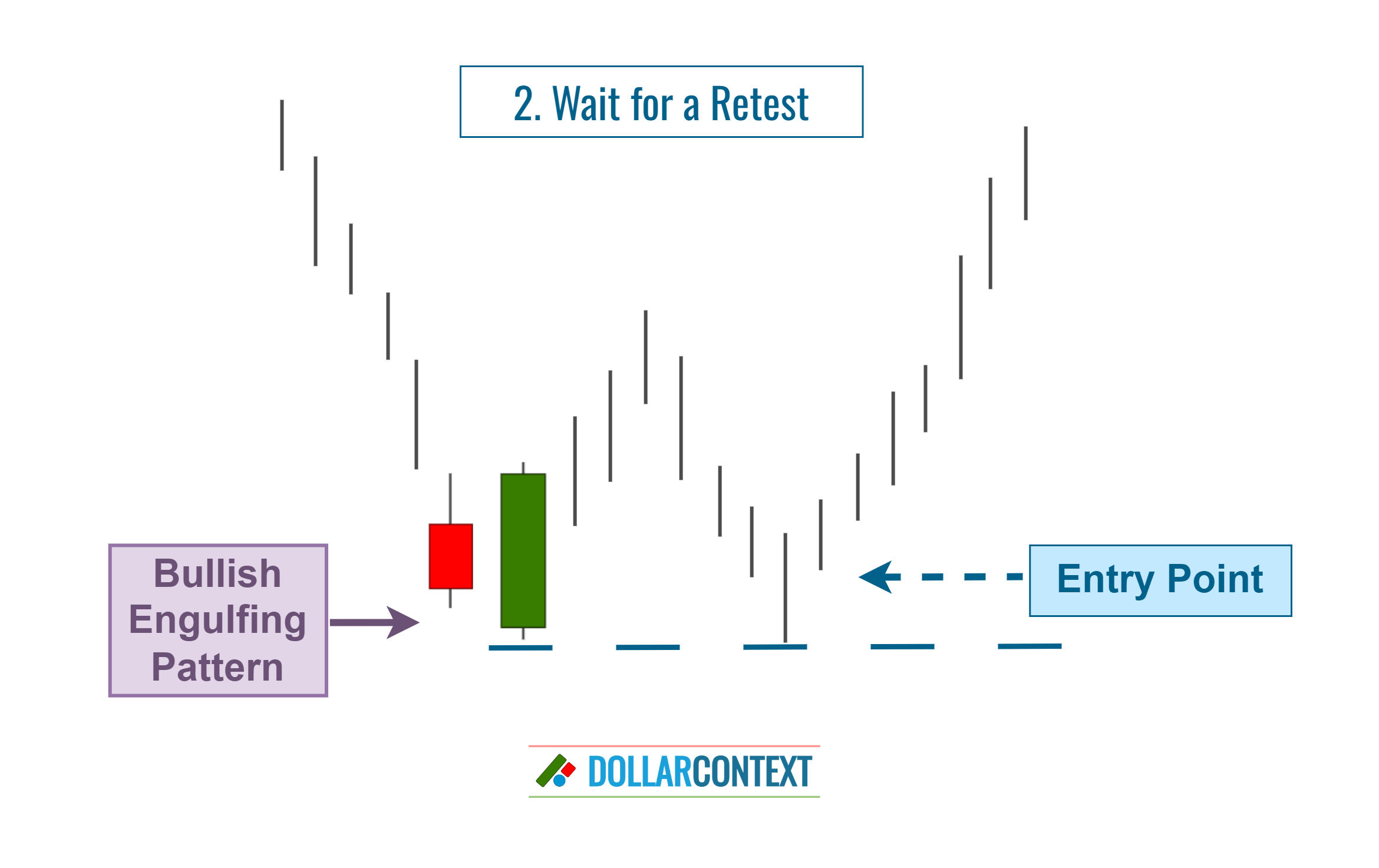

2. Wait for a Retest

After a strong uptrend, if a bearish engulfing pattern appears and the market begins to decline, lingering buying pressure can still remain. This could lead the market to revisit the highs set by the engulfing pattern before possibly shifting into a clear downtrend.

Some traders prefer to wait for the price to revisit the engulfing pattern's highs before opening a short position. Be aware that after an uptrend, the bearish engulfing pattern becomes resistance. Thus, our strategy corroborates that the resistance level, marked by the high of the bearish engulfing pattern, holds. This level can be used to determine your stop-loss for your engulfing pattern strategy.

Follow the same logic after a downtrend. Wait for a successful retest of the support zone established by the lows of the bullish engulfing pattern to validate your buying strategy.

- Advantages: A successful reassessment of the support/resistance set by the engulfing pattern provides added confirmation and enhances the reliability of this pattern as a reversal signal.

- Disadvantages: Considering that there are times when the lows or highs of the engulfing pattern aren't retraced, you could overlook a trading opportunity.

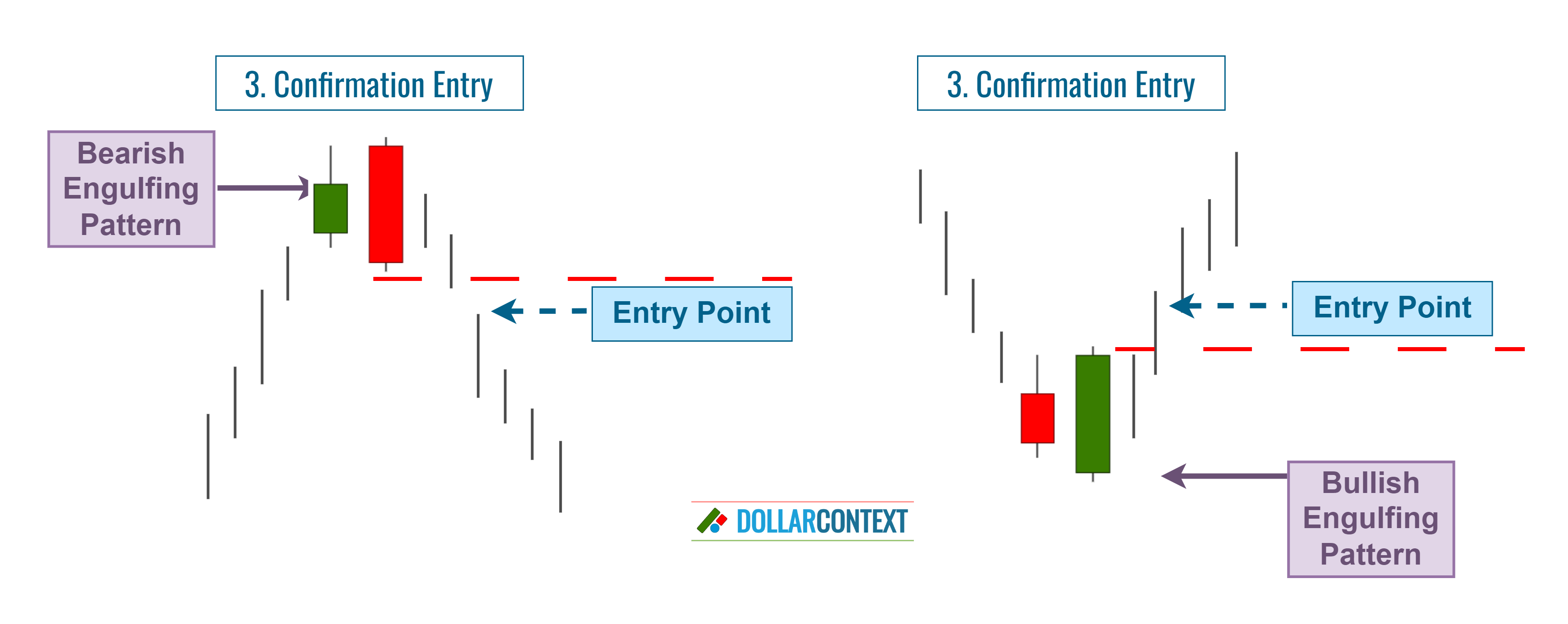

3. Confirmation Entry

This is the traditional approach. To implement it, just await the next candle to validate the market's direction after the engulfing pattern:

- Following a bearish engulfing candle, think about going short if the subsequent session is bearish and closes beneath the lows set by the engulfing pattern.

- Following a bullish engulfing candle, consider opening a long position if the subsequent session is bullish and closes above the highs set by the engulfing pattern.

- Advantages: This approach helps corroborate the direction of the market after the engulfing pattern.

- Disadvantages: The risk-to-reward ratio worsens.

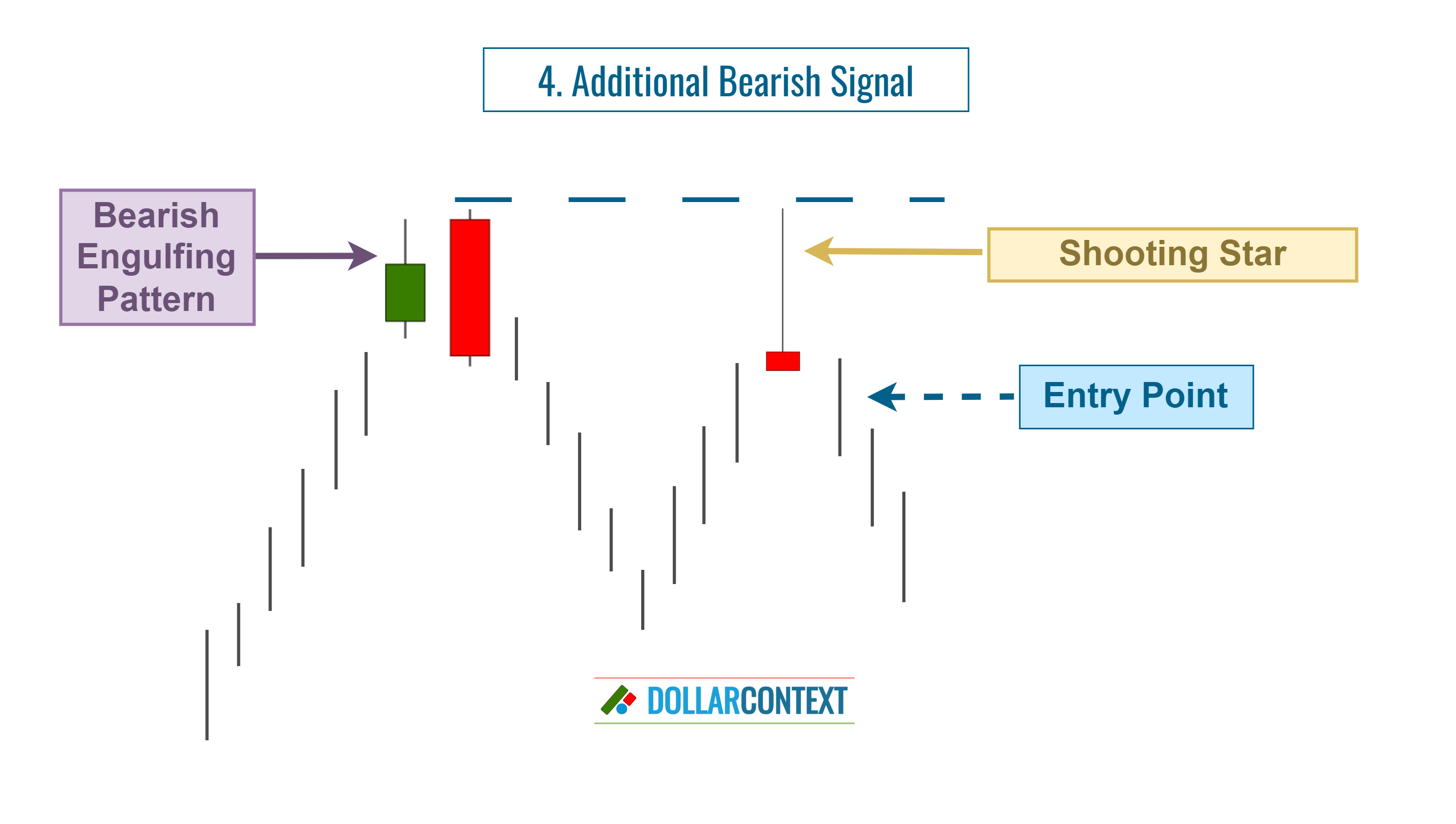

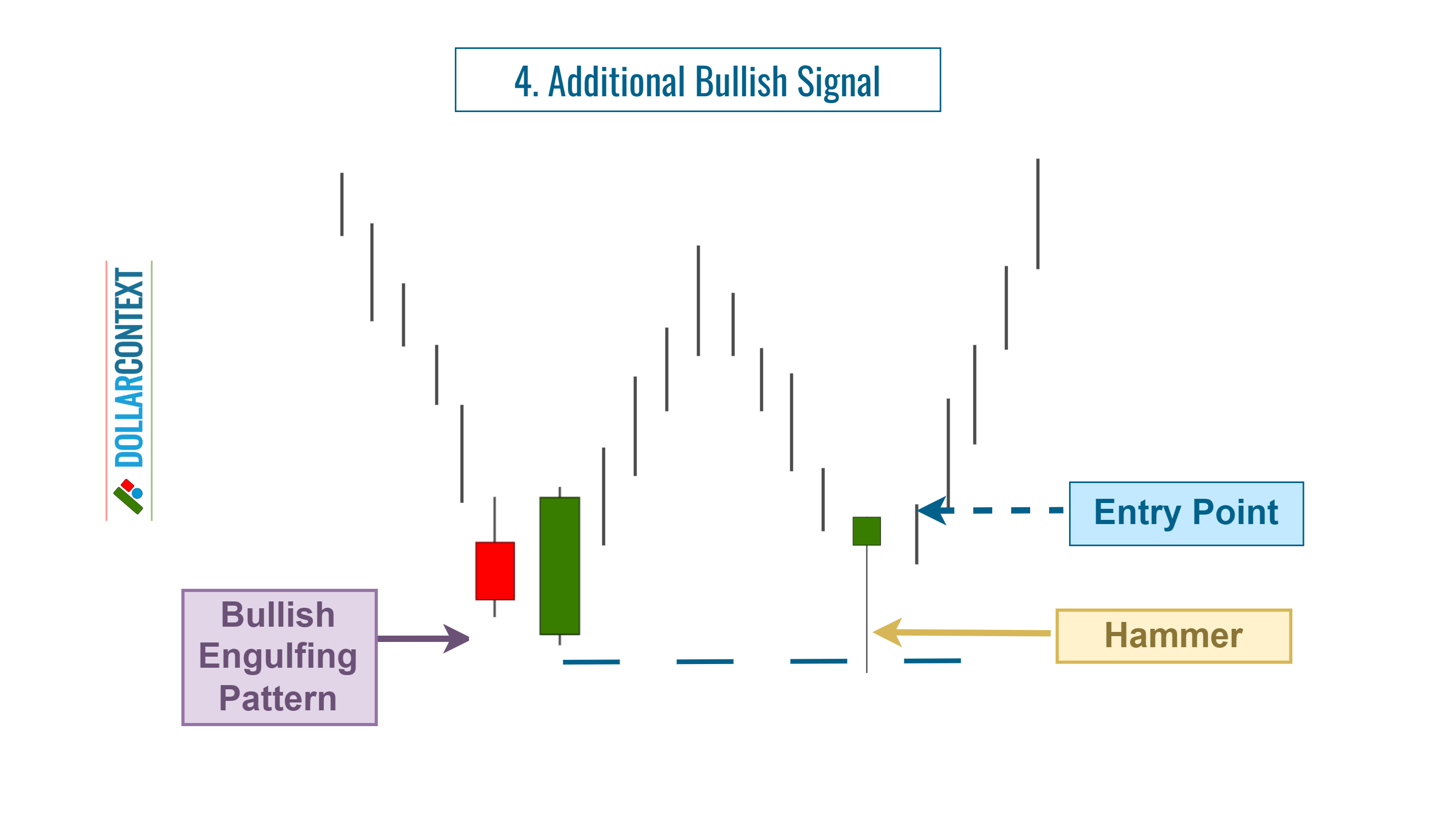

4. On an Additional Reversal Signal

Should a bearish engulfing pattern emerge following an uptrend, await further bearish indications before initiating a short position. These might take the shape of a shooting star, a dark cloud cover, an evening star, or another bearish indicator.

Similarly, but in the opposite direction, wait for additional bullish signals to open a long position after a bullish engulfing pattern.

Keep in mind that those confirming signals may also precede the engulfing pattern.

- Advantages: A reversal pattern that precedes or follows the engulfing pattern reinforces its potential as a reversal indicator.

- Disadvantages: If other candlestick patterns don't manifest within the engulfing pattern's price range, you could miss out on the trading opportunity.

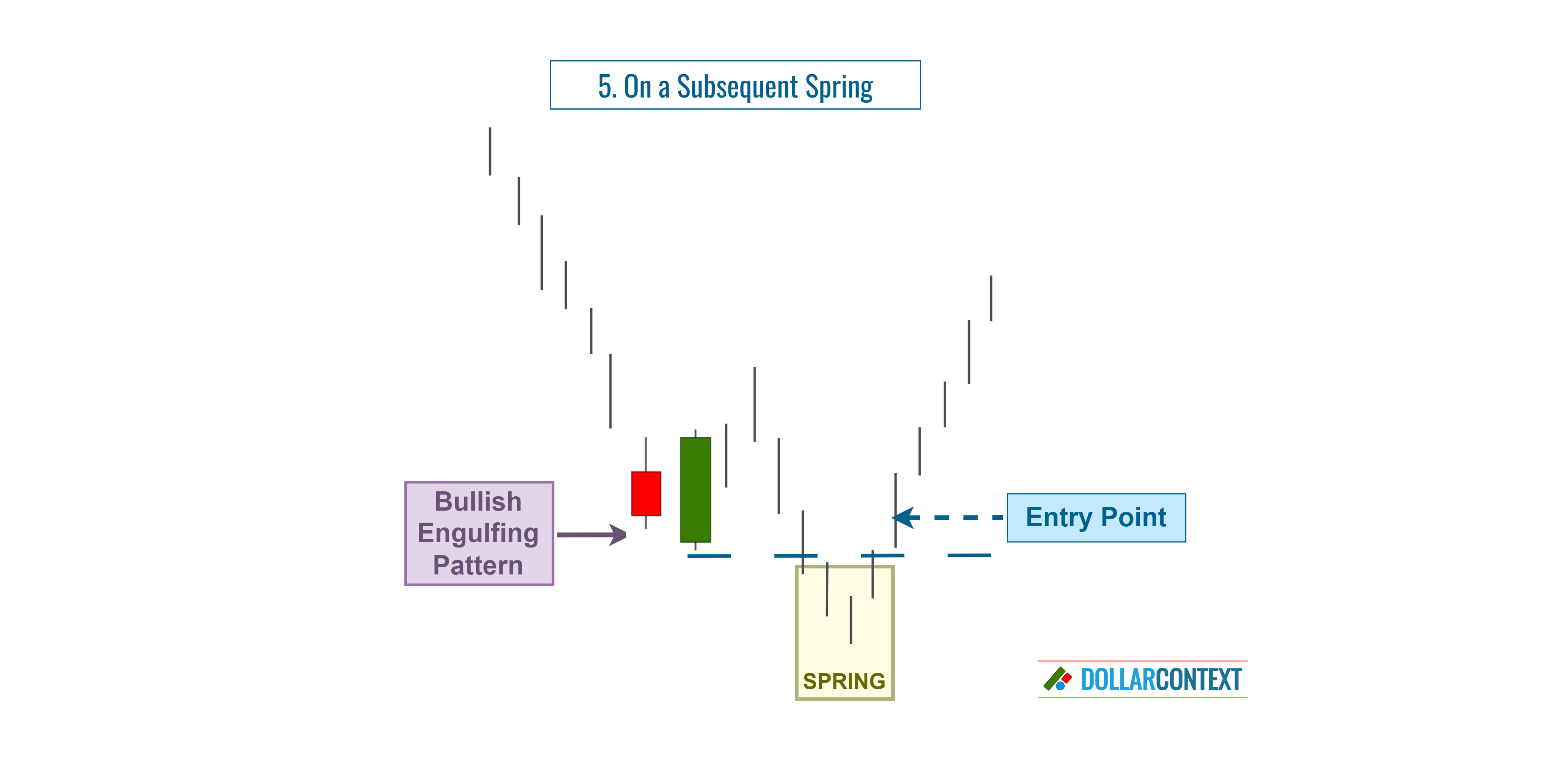

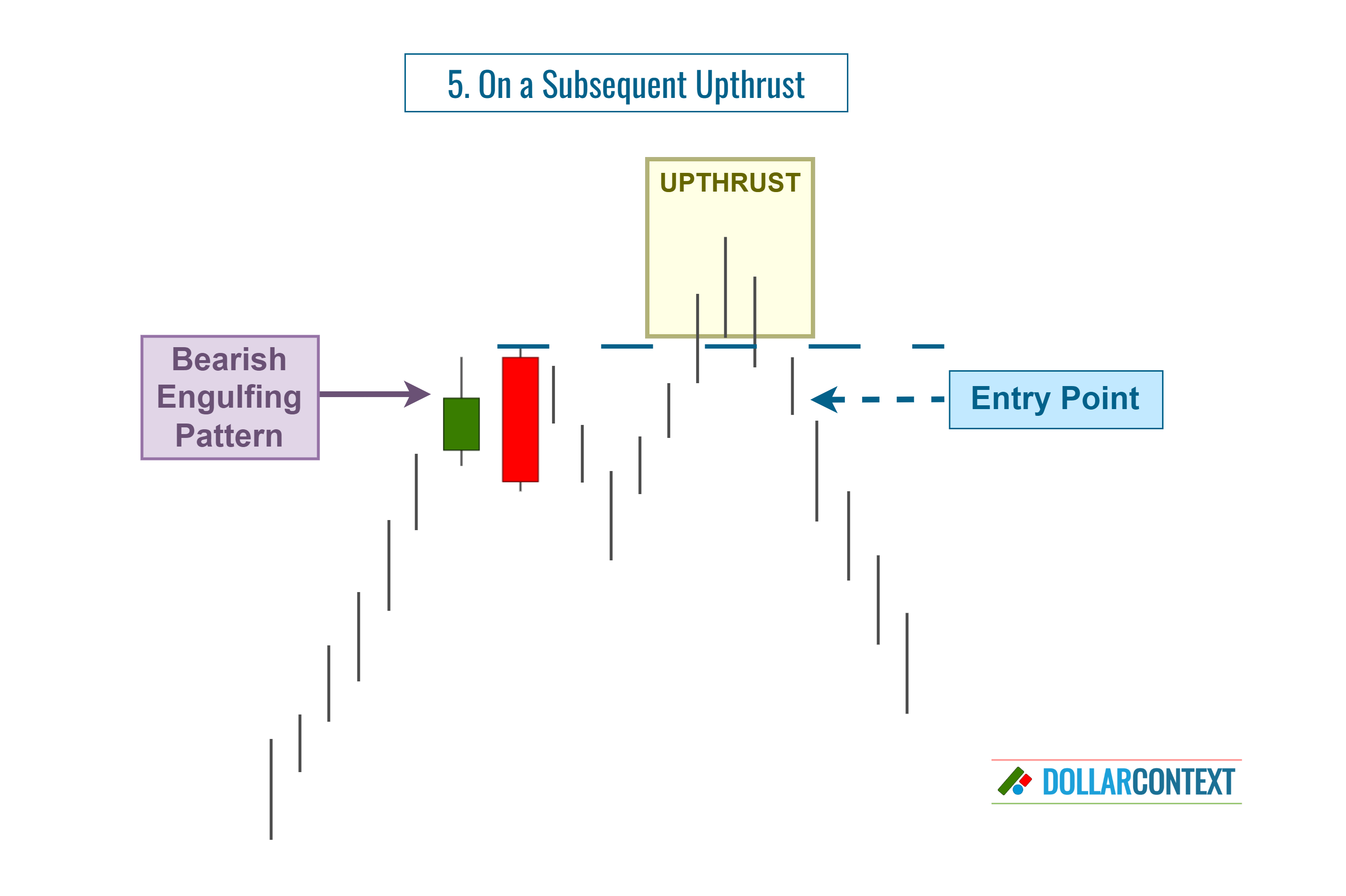

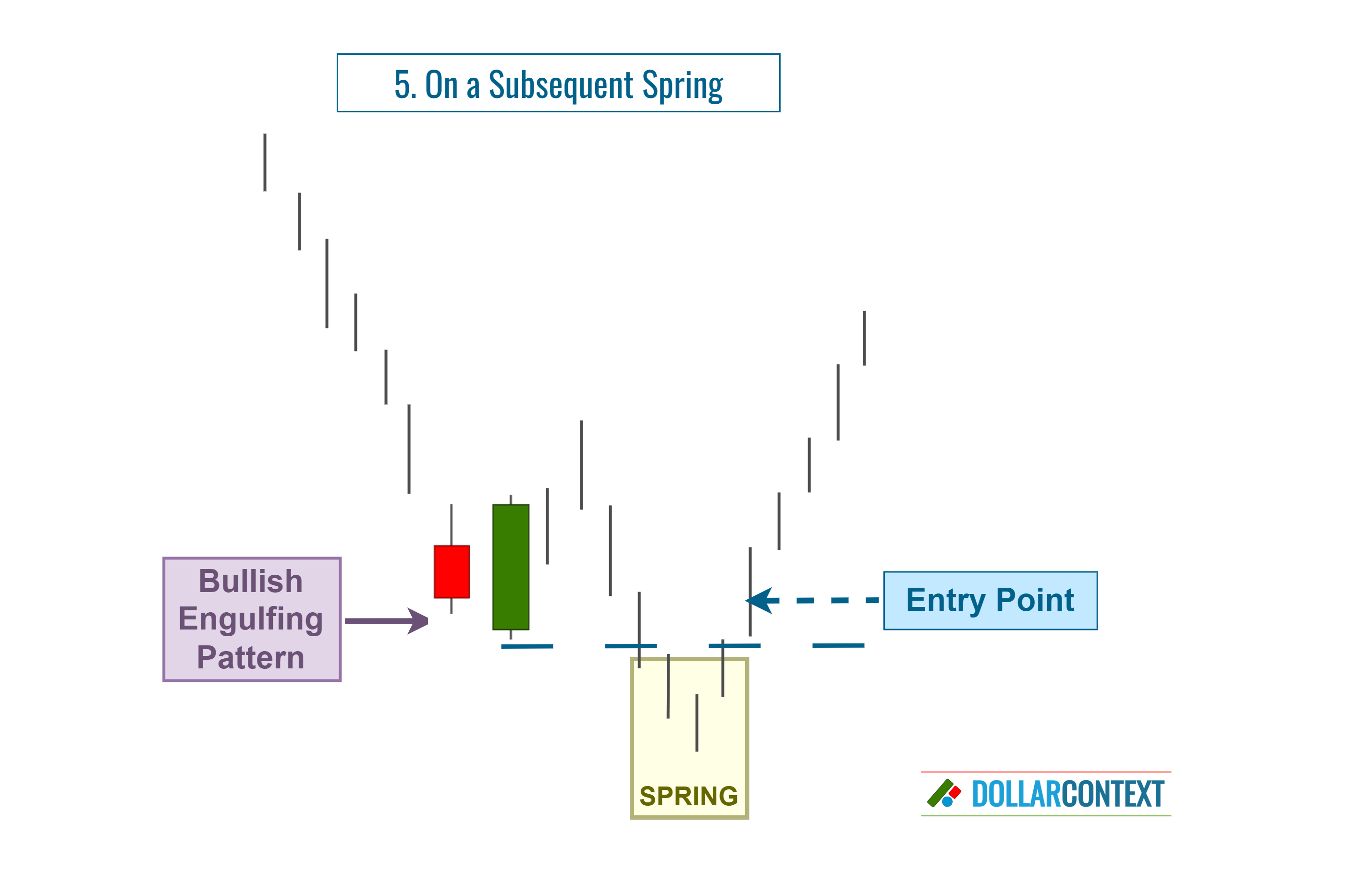

5. After an Upthrust/Spring

An upthrust occurs when the market momentarily surpasses a resistance level but swiftly reverses and heads in the opposite direction. In essence, it represents a deceptive breakout to the upside and a reversal signal.

Upthrusts are common in markets and can be used to both confirm the reversal indicated by a bearish engulfing pattern and to establish a stop-loss above the pinnacle of the upthrust.

Similarly, a spring occurs when the market momentarily descends below a support level but swiftly bounces back, moving in the opposite direction. In essence, it signifies a false breakout that reinforces the likelihood of a bullish reversal.

- Advantages: Following an upthrust or spring, the odds of a trend reversal significantly increase.

- Disadvantages: The revised stop-loss should be set based on the peaks of the upthrust (or the troughs of the spring), placing it at a greater distance from the entry point.

While springs and upthrusts aren't guaranteed to occur, when they do appear, implementing the engulfing strategy with a stop at the upthrust's high, or the spring's low, is often a reliable approach.