Engulfing Pattern: Limitations and Criticisms

Though the engulfing pattern can serve as a useful instrument for traders, it's important to be aware of its limitations and the skepticism that surrounds it.

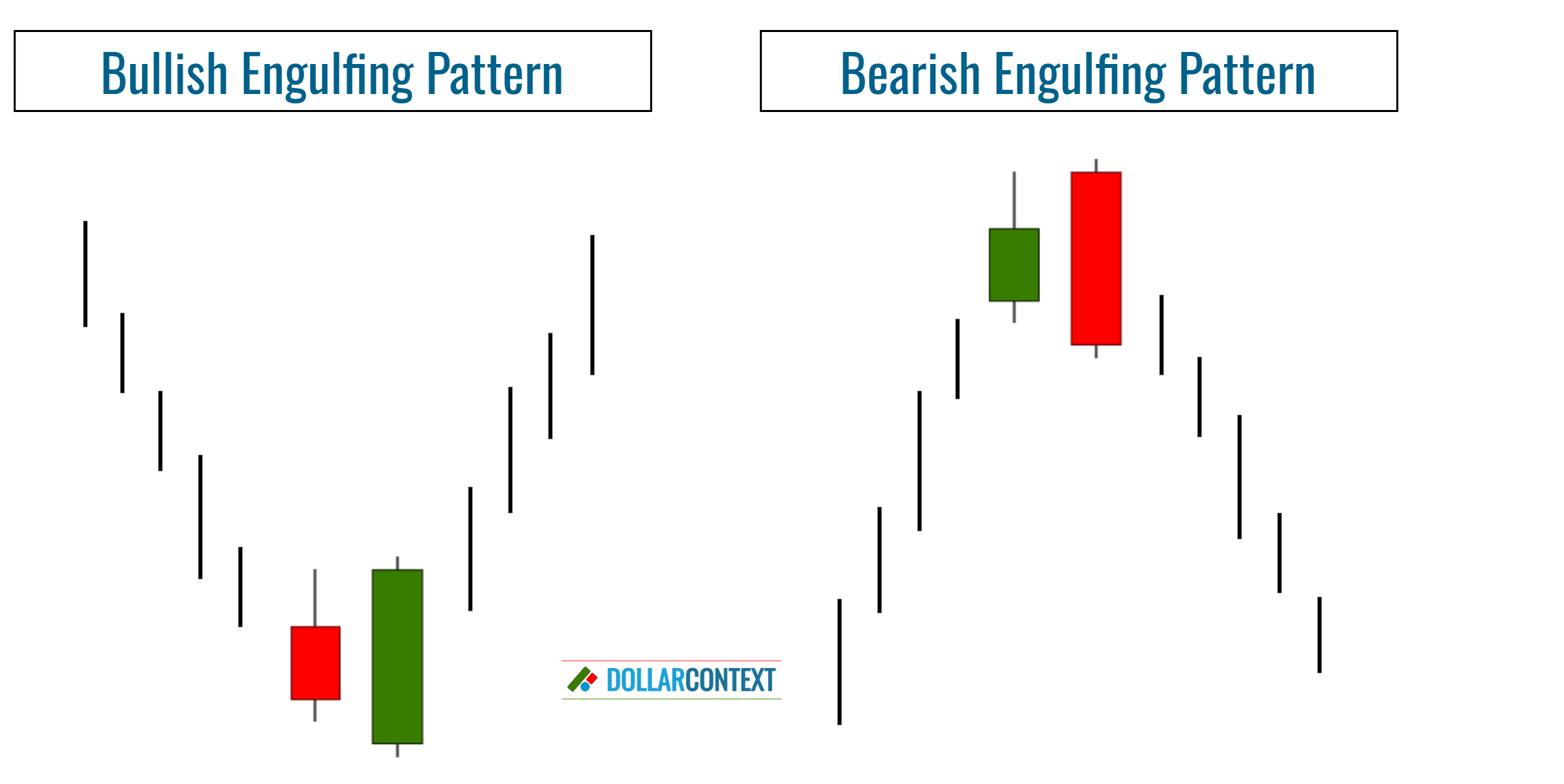

In the realm of candlestick charting, the engulfing pattern stands out as one of the most identifiable and commonly used configurations. An engulfing pattern is a two-candle formation that suggests a potential shift in market direction. We can differentiate two types of engulfing patterns:

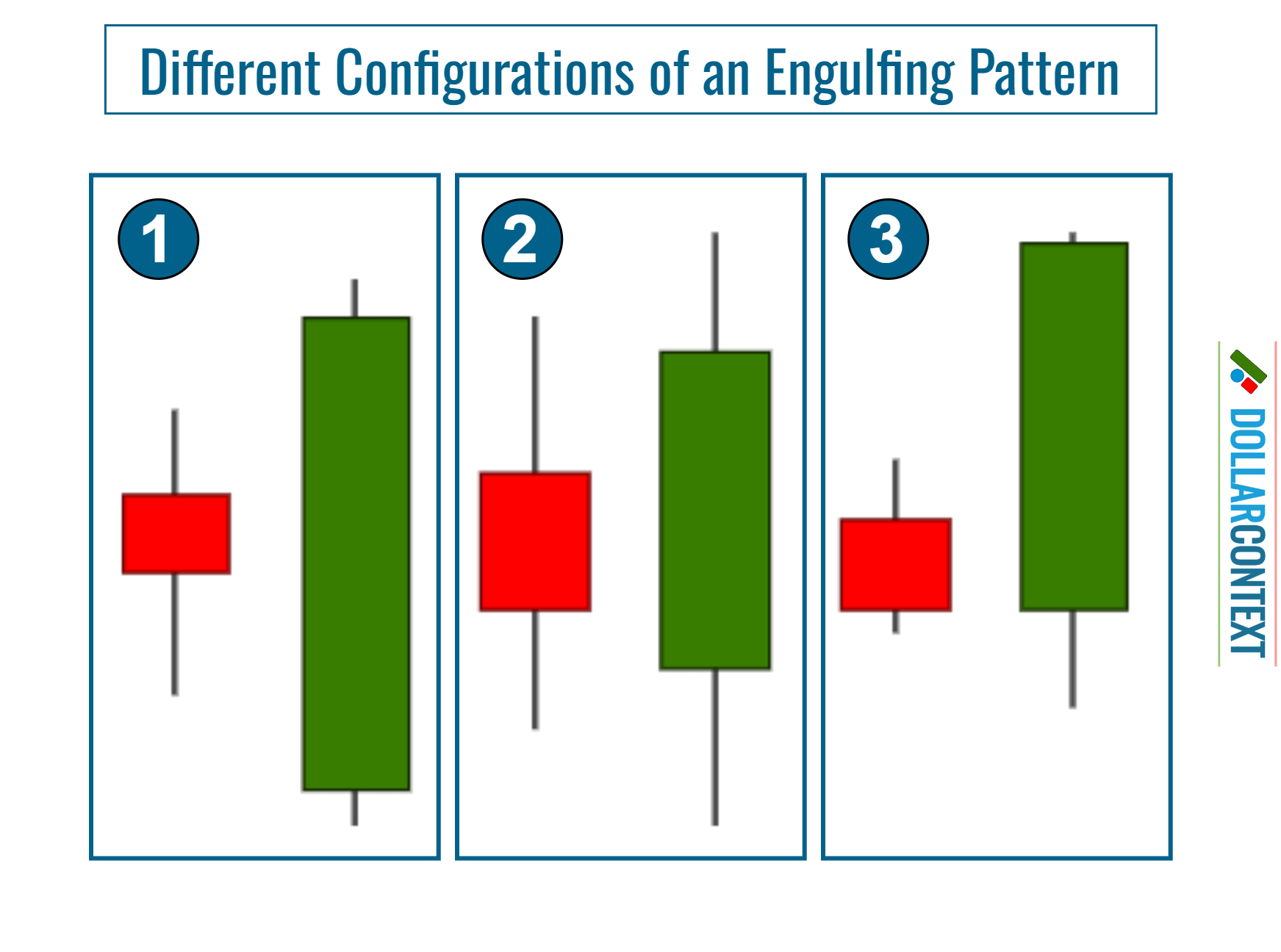

- Bullish Engulfing Pattern: Starts with a short red (or black) candle, which represents a price decline. This is followed by a long green (or white) candle that completely "engulfs" the preceding red candle, indicating a potential upward shift in price.

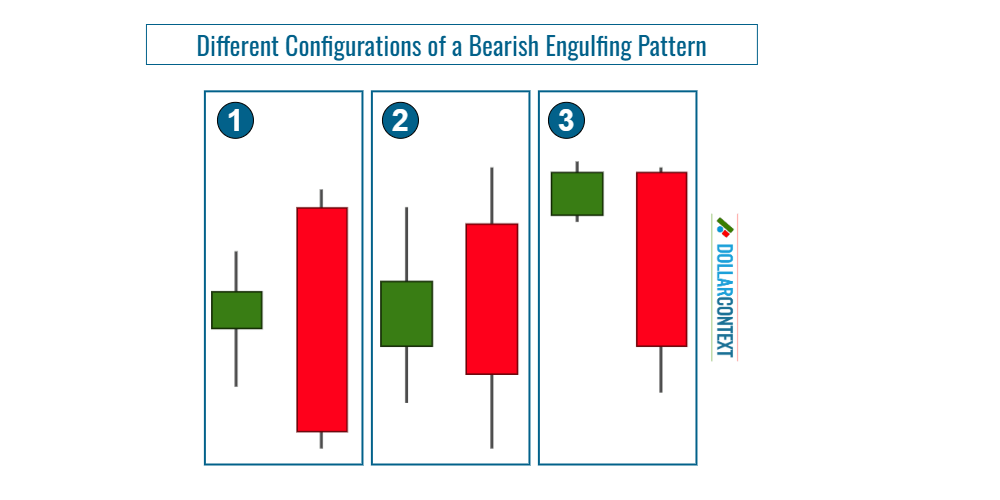

- Bearish Engulfing Pattern: Begins with a short green (or white) candle, representing a price rise. A long red (or black) candle follows, engulfing the previous green candle and signaling a possible downward turn in price.

Here are the most important limitations and criticisms of the engulfing pattern.

1. Subjectivity

The identification of engulfing patterns can be subjective and may differ from trader to trader.

Indeed, not every engulfing pattern carries the same weight. The significance of these patterns is influenced by factors such as the dimensions of the real bodies, the relationship between the shadows, and other contextual elements that often involve a degree of subjectivity.

- An ideal engulfing pattern would feature a small first candle, followed by a considerably larger second one. In this perfect scenario, the body of the second candle would entirely encase not just the body but also the shadows of the first candle, as illustrated by the engulfing pattern labeled "1" in the image below.

- The next strictest definition would involve the second candle's shadows exceeding those of the first. In this case, the market on the second day of the engulfing pattern would record both a higher high and a lower low, as depicted by the pattern labeled "2" in the image below.

- In markets with low volatility or when examining shorter timeframes, such as minutes or hours, a more lenient criterion is often advisable for identifying an engulfing pattern. Specifically, many traders regard it as an engulfing pattern if the second session opens at the same price where the first candle closed. In these cases, it's wise to look for supplementary confirmation indicators to substantiate the likelihood of a trend reversal.

The expression "variation of an engulfing pattern" is generally used to describe forms of this pattern that don't perfectly meet the ideal criteria.

2. Dependence on Context

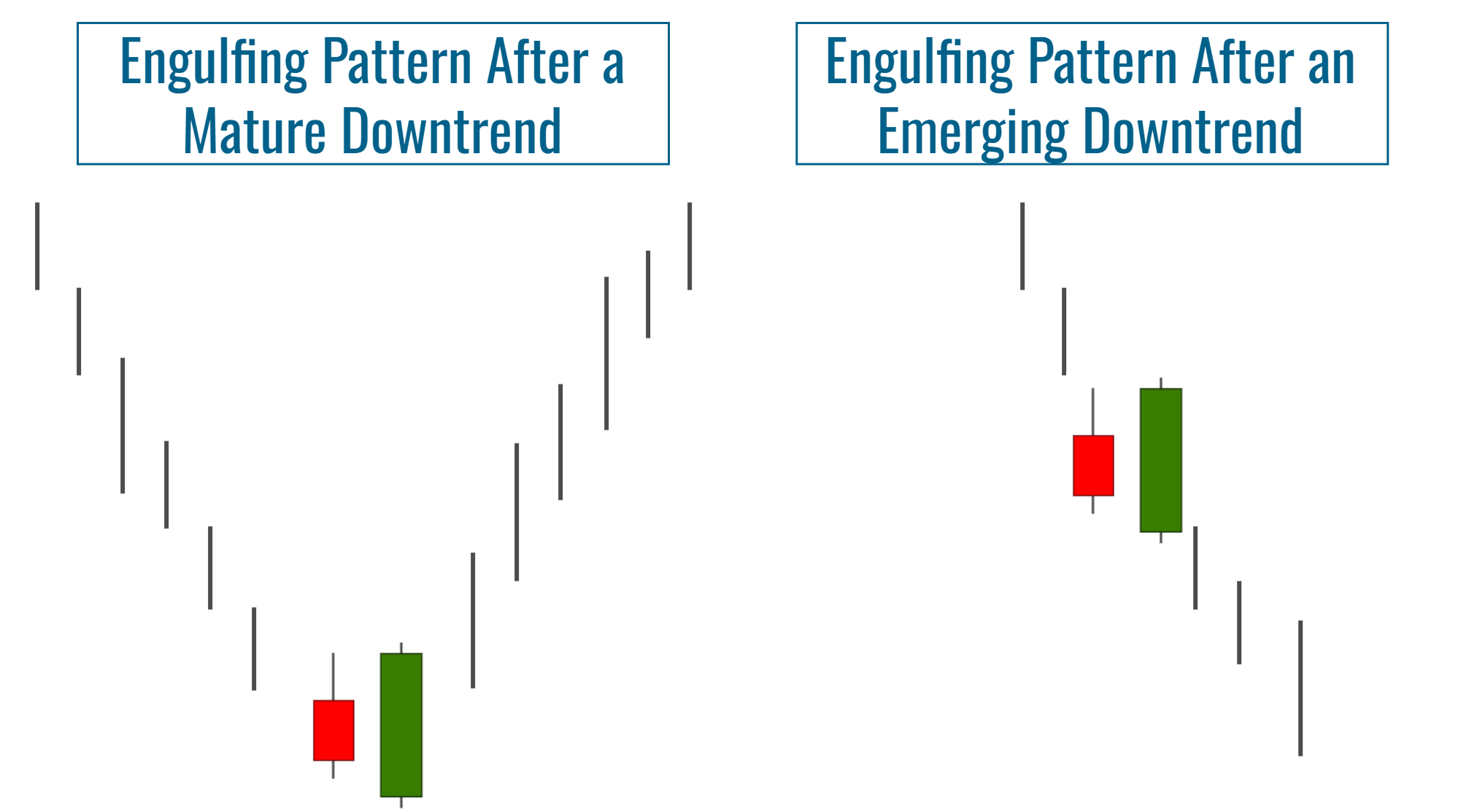

The efficacy of an engulfing pattern as an indicator for trend reversal is significantly influenced by the trend that precedes it.

- After an extended uptrend, a bearish engulfing pattern may signal a bearish reversal.

- Following a lengthy downtrend, a bullish engulfing pattern could imply a bullish reversal.

- In the absence of a distinct trend, however, this indicator holds no significance.

Such dependency on trend context leads to two pertinent questions:

- What duration must a trend have to be regarded as long-lasting or mature enough?

- What magnitude of price fluctuation is necessary for a trend to be classified as extended?

3. Need for Confirmation

Some traders overly emphasize the presence of a single pattern, neglecting the larger market landscape. Such a focus can result in hasty or misguided trading choices.

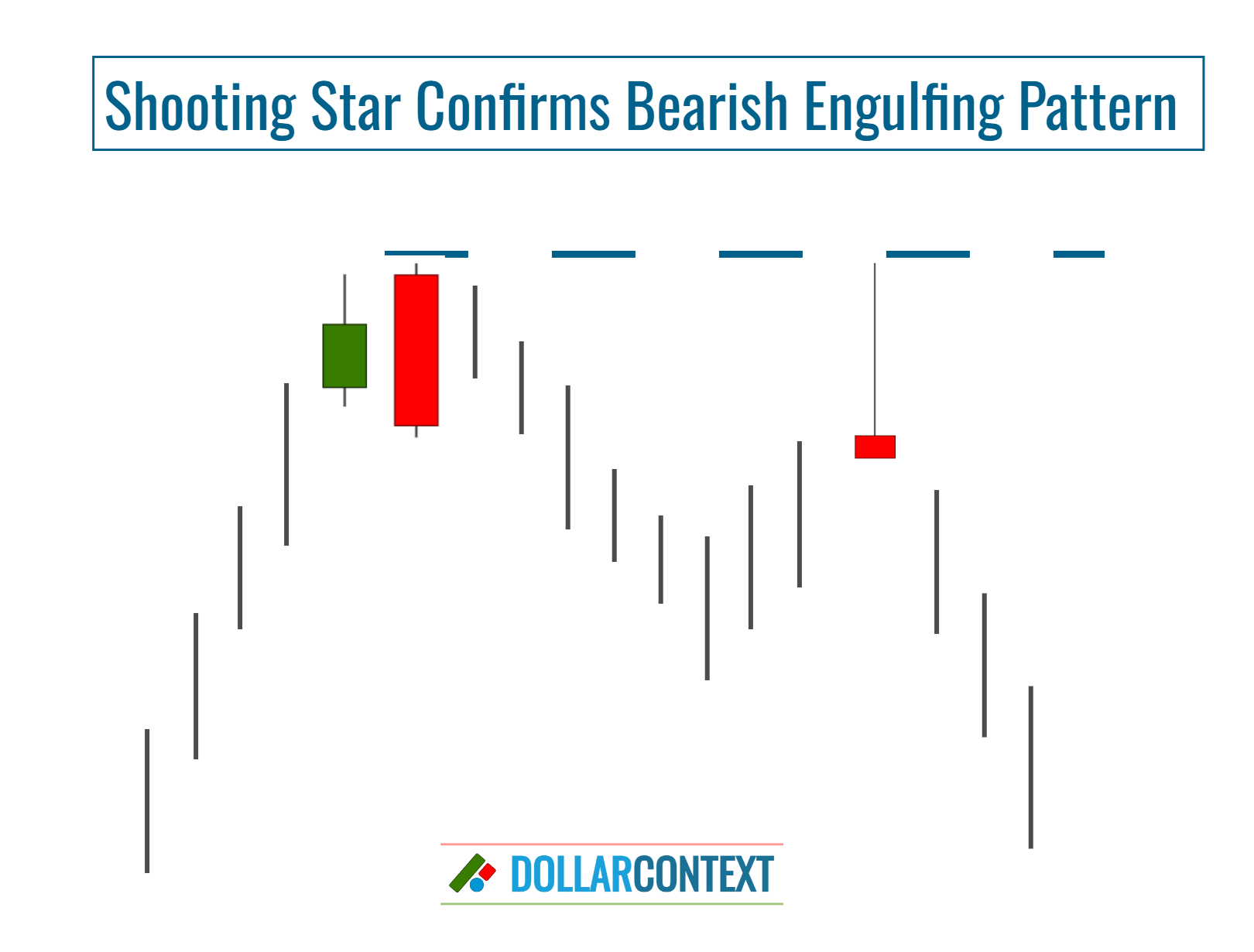

An engulfing pattern does not guarantee a reversal. Experienced traders commonly seek extra validation through subsequent candle patterns or additional technical indicators before initiating a position.

4. False Signals

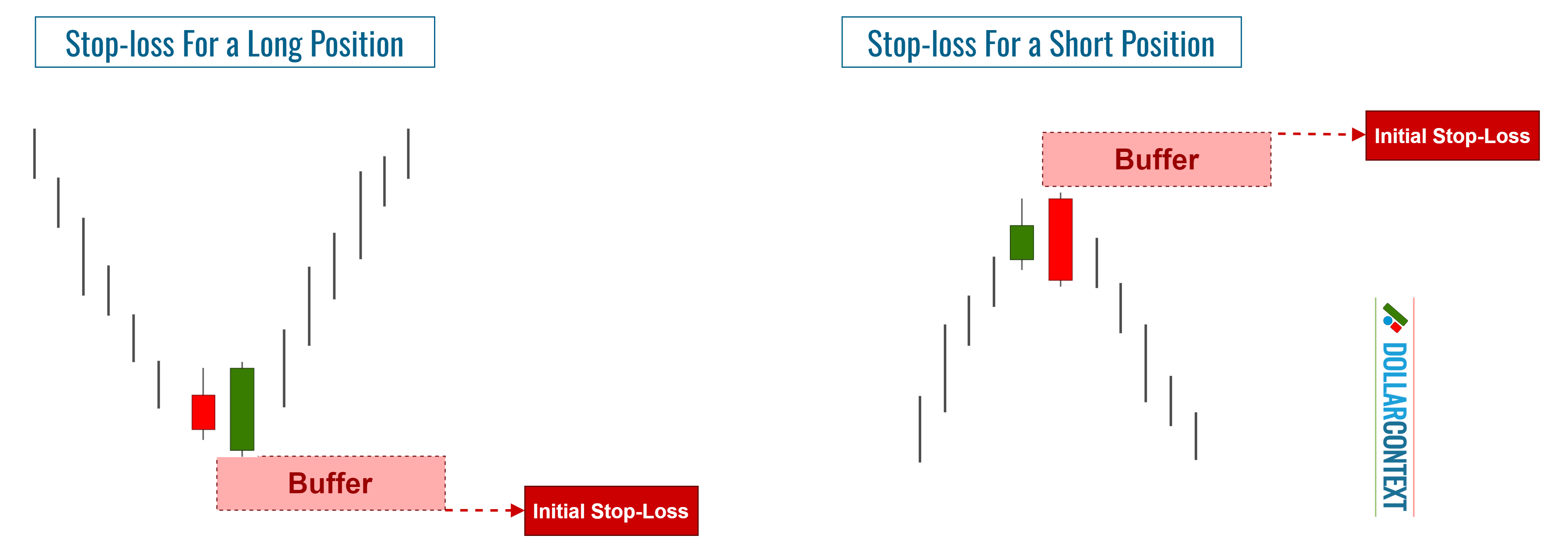

As with any technical indicator, engulfing patterns are not immune to generating misleading signals. If used without adequate risk management, exclusive reliance on these indicators can lead to substantial financial setbacks.

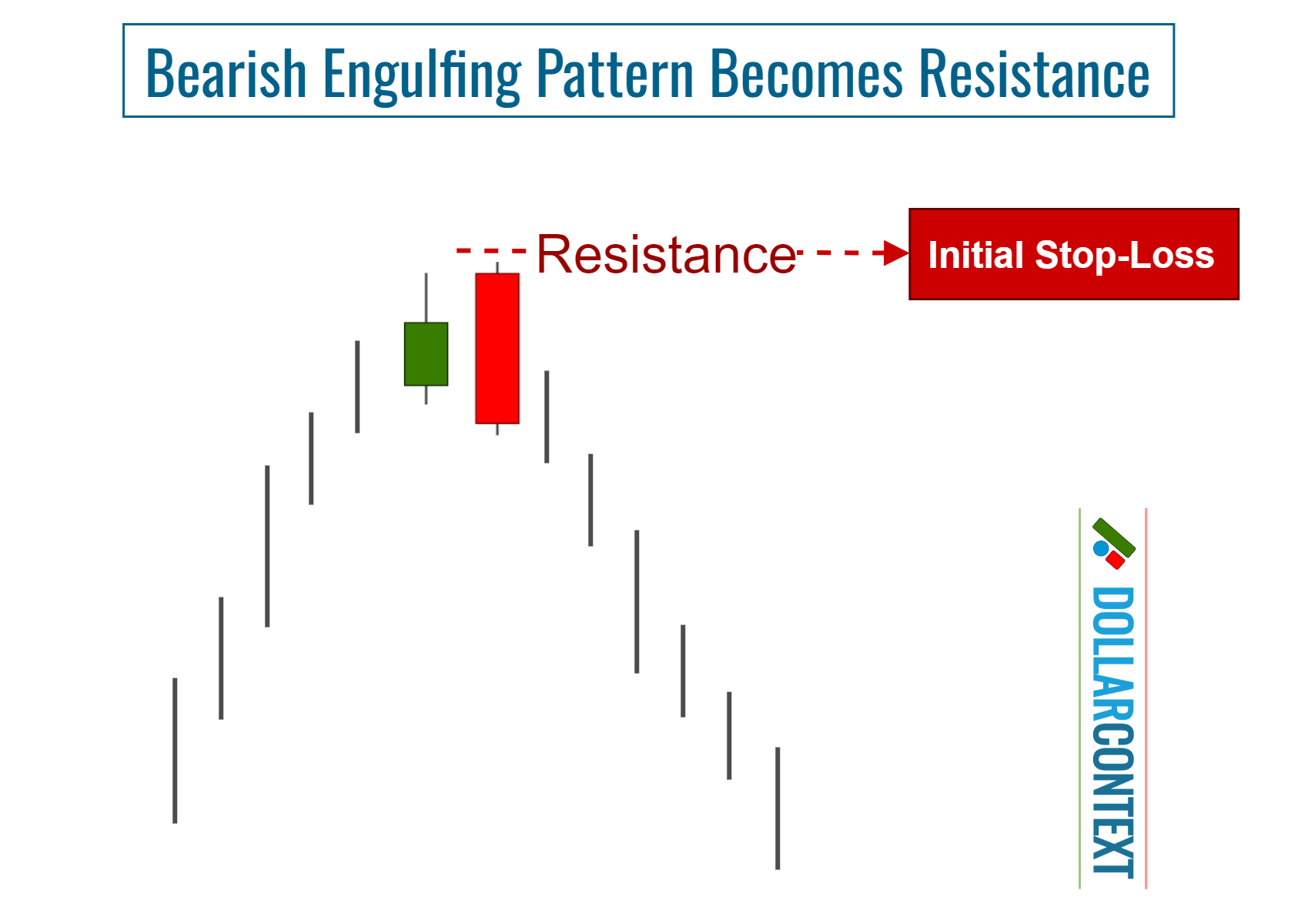

It's crucial to use a stop-loss point when using a strategy based on an engulfing pattern. After an uptrend, the highest level of a bearish engulfing pattern becomes resistance. This point can be used to place your initial stop-loss. Follow the same strategy with a bullish engulfing pattern after a downtrend.

5. False Breakouts

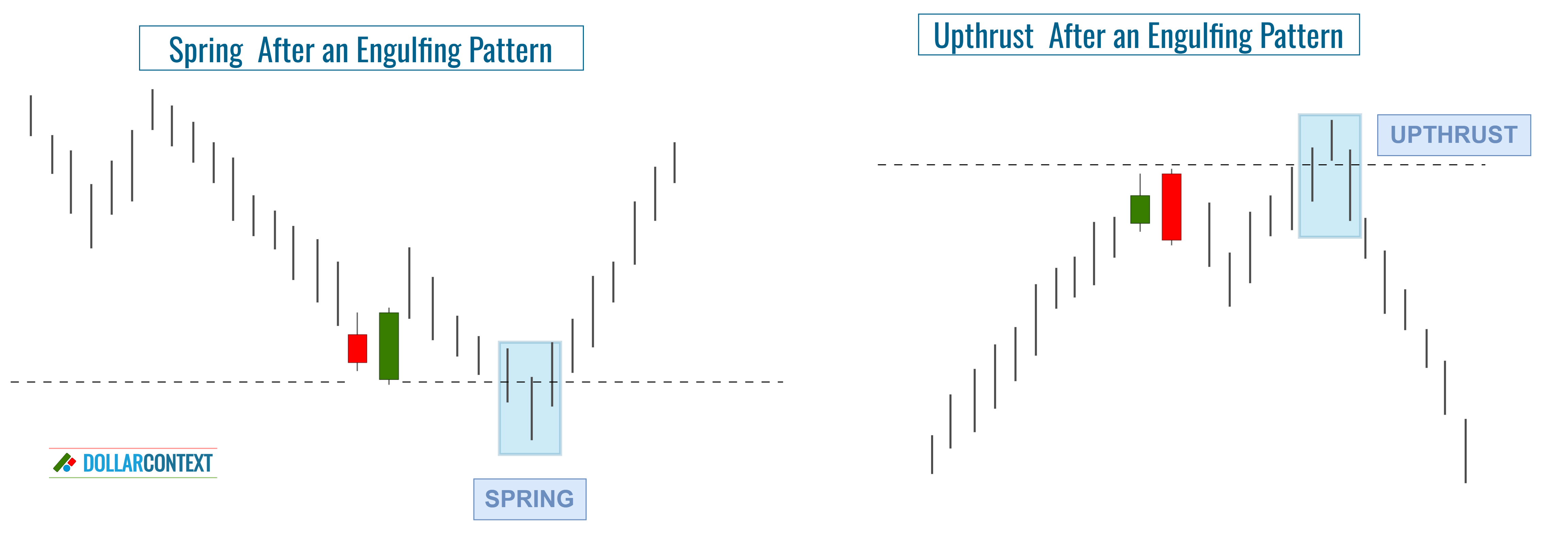

A false breakout refers to a situation where the market briefly crosses a support or resistance level, only to quickly reverse course and move in the opposite direction.

Upthrusts refer to false breakouts that occur to the upside, while springs describe those that happen to the downside. Due to their common occurrence after an engulfing pattern emerges, these false breakouts can confuse traders and lead to unwarranted stop-outs.

To guard against false breakouts, adding a buffer to the initial stop-loss may be beneficial.

6. Engulfing Pattern Frequency

The engulfing pattern may appear frequently in some markets, and it does not always precede a significant price change, making it inconsistent as a standalone indicator.

7. Overemphasis

There's a tendency for traders, especially beginners, to place too much emphasis on individual patterns like the engulfing pattern, neglecting other important aspects of trading such as risk management.

8. Undefined Magnitude of the Result

While engulfing patterns can signal trend reversals and possible entry points, they alone don't offer guidelines for profit-taking levels. For that, other techniques like traditional chart patterns, Fibonacci tools, or moving averages can be employed.

Conclusion

Though the engulfing pattern can serve as a useful instrument for traders, it's important to be aware of its limitations and the skepticism that surrounds it. Instead of using it as a standalone indicator, it should be employed alongside other technical and fundamental methods.

By adopting this integrated approach, traders can optimize the advantages of identifying engulfing patterns while reducing the risks tied to an overdependence on them.