The Psychology Behind an Engulfing Pattern

By understanding these psychological aspects, traders can better anticipate the potential market's response to an engulfing pattern and adjust their strategies accordingly.

This article is part of the Engulfing Pattern tutorial series. For the complete guide, see the Engulfing Pattern — Complete Guide.

The engulfing pattern is a relevant two-candle formation in Japanese candlestick analysis, signaling potential trend shifts.

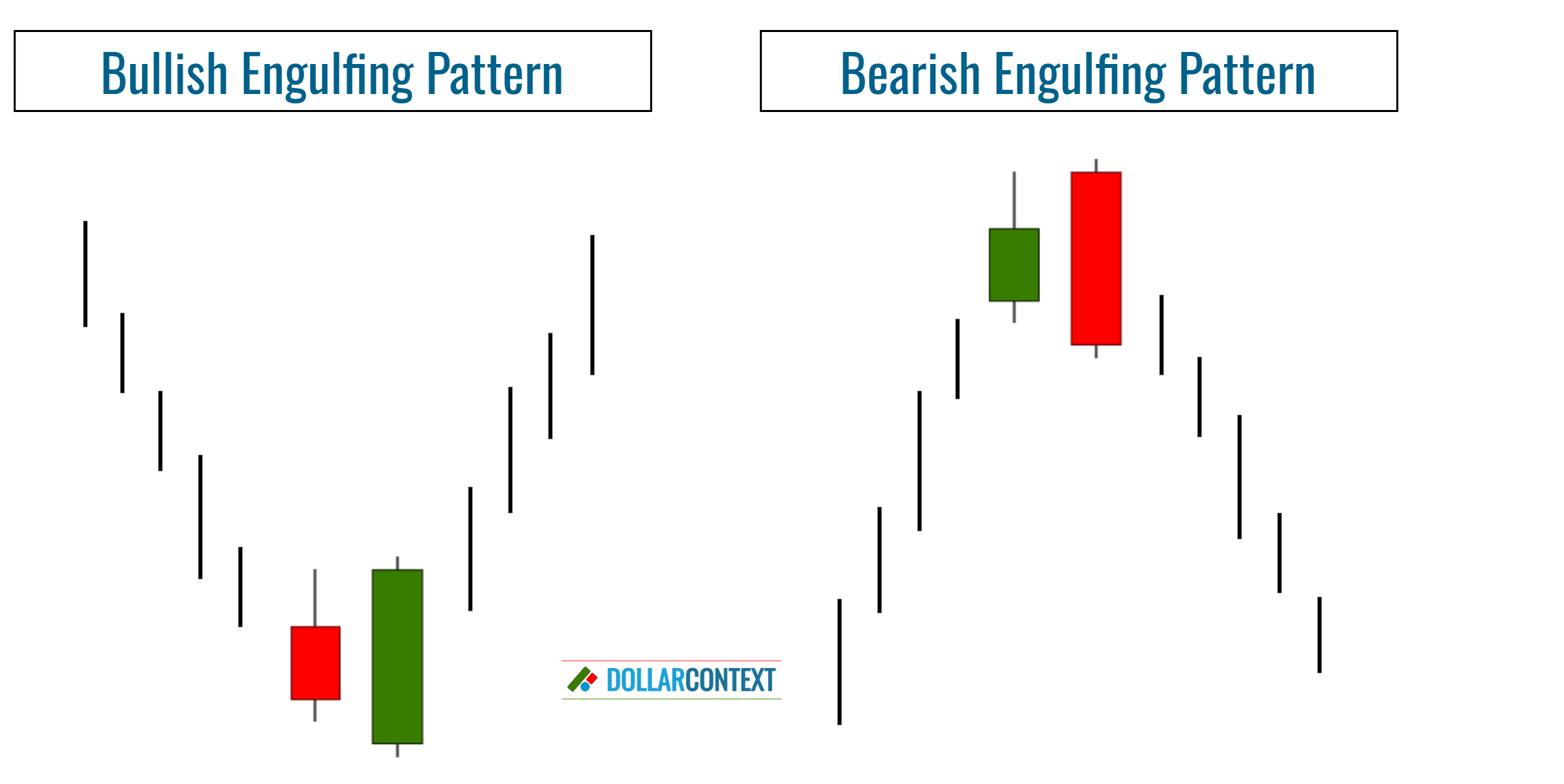

The two primary engulfing patterns are:

- Bullish Engulfing: This emerges after a downtrend. It starts with a small bearish candlestick, overshadowed by a subsequent larger bullish one, which "covers" the entire body of its predecessor.

- Bearish Engulfing: Found after an uptrend, it begins with a small bullish candlestick, which is then "covered" by a succeeding larger bearish body.

In both cases, the sudden change in sentiment is what makes the engulfing pattern significant in predicting potential reversals. However, traders typically look for additional confirmation before making trading decisions based on this pattern.

Psychology Behind a Bullish Engulfing Pattern

In a bullish engulfing pattern, the market gives a bullish reversal signal. This is evident from the distinctive two-candle formation and the context in which it appears.

- Previous Trend: There's typically a downtrend in place before a bullish engulfing pattern emerges. This means sellers have been in control, and the sentiment is negative.

- First Candle: The downtrend continues with a small red candle, reinforcing the bearish sentiment.

- Second Candle: The next day, despite opening lower, buyers step in and push the price up, causing the day to close higher than the previous day's opening. This large green candle completely engulfs the previous day's candle, indicating a sudden and strong shift in sentiment.

- Psychology: The sudden dominance of buyers over sellers indicates that sentiment might be changing. Those who were previously bearish may reconsider their positions, while new buyers might see it as an opportunity to enter.

Psychology Behind a Bearish Engulfing Pattern

In a bearish engulfing pattern, the market signals a bearish reversal, as evidenced by the unique two-candle combination and the circumstances surrounding its emergence.

- Previous Trend: A bullish trend usually precedes a bearish engulfing pattern, indicating that buyers have been in control and the sentiment has been positive.

- First Candle: The uptrend continues with a small green candle, reinforcing the bullish sentiment.

- Second Candle: The next day, despite opening higher, sellers dominate and drive the prices down, causing the day to close below the previous day's opening. This large red candle completely engulfs the previous day's candle.

- Psychology: The sudden control of sellers over buyers suggests that sentiment is changing. Those who were bullish might start taking profits or reconsidering their positions, while potential sellers might see it as a sign to enter.

Other Psychological Aspects of an Engulfing Pattern

By understanding these psychological aspects, traders can better anticipate the potential market's response to an engulfing pattern and adjust their strategies accordingly.

Market Sentiment Shift

- Represents a sudden and decisive shift in market sentiment.

- The pattern indicates that either buyers or sellers have taken control, signaling a potential change in trend direction.

Previous Trend Check

- An engulfing pattern is more significant if it follows a clear trend.

- It demonstrates the exhaustion of the prior trend and the strong presence of the opposing force.

Traders' Reaction to News or Events

- Engulfing patterns can often form after major news events or data releases.

- They demonstrate the market's aggregate reaction, capturing the change in traders' perceptions and sentiment.

Contrasting Strength

- The engulfing candle's size (larger than the previous candle) signifies the strength and dominance of one group over another (buyers over sellers, or vice versa).

Confirmation and Validation

- Many traders seek additional validation following an engulfing pattern to confirm the psychological shift.

Overconfidence and Complacency

- If the market has been trending in one direction for a while, traders might become complacent.

- An engulfing pattern can be a reality check, shaking out overconfident traders and bringing in traders who have been waiting on the sidelines.