Shape of an Engulfing Pattern

In this article, we'll explore the different shapes of an engulfing pattern and how to identify this candlestick indicator.

In this article, we'll explore the different shapes of an engulfing pattern, and how to identify this candlestick indicator.

Basic Shape of an Engulfing Pattern

The engulfing pattern is a crucial two-candle formation within the domain of the Japanese candlestick analysis. It is used to identify potential trend reversals.

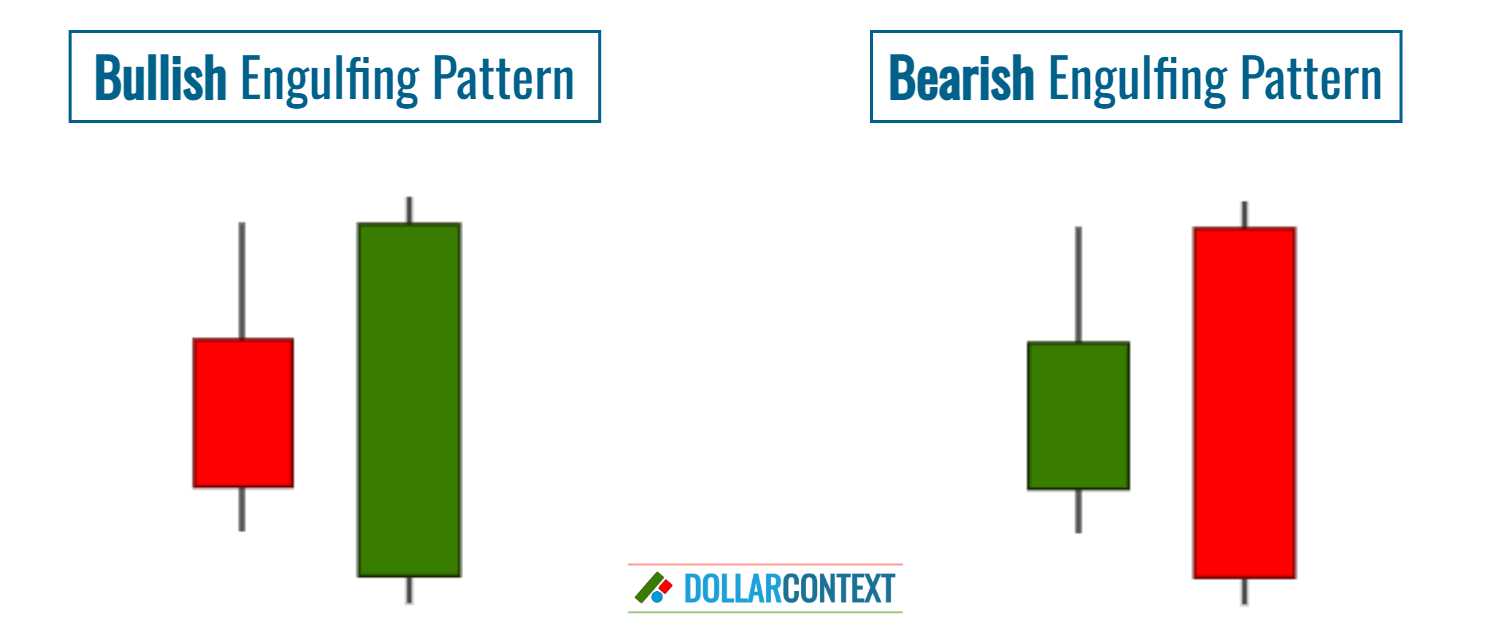

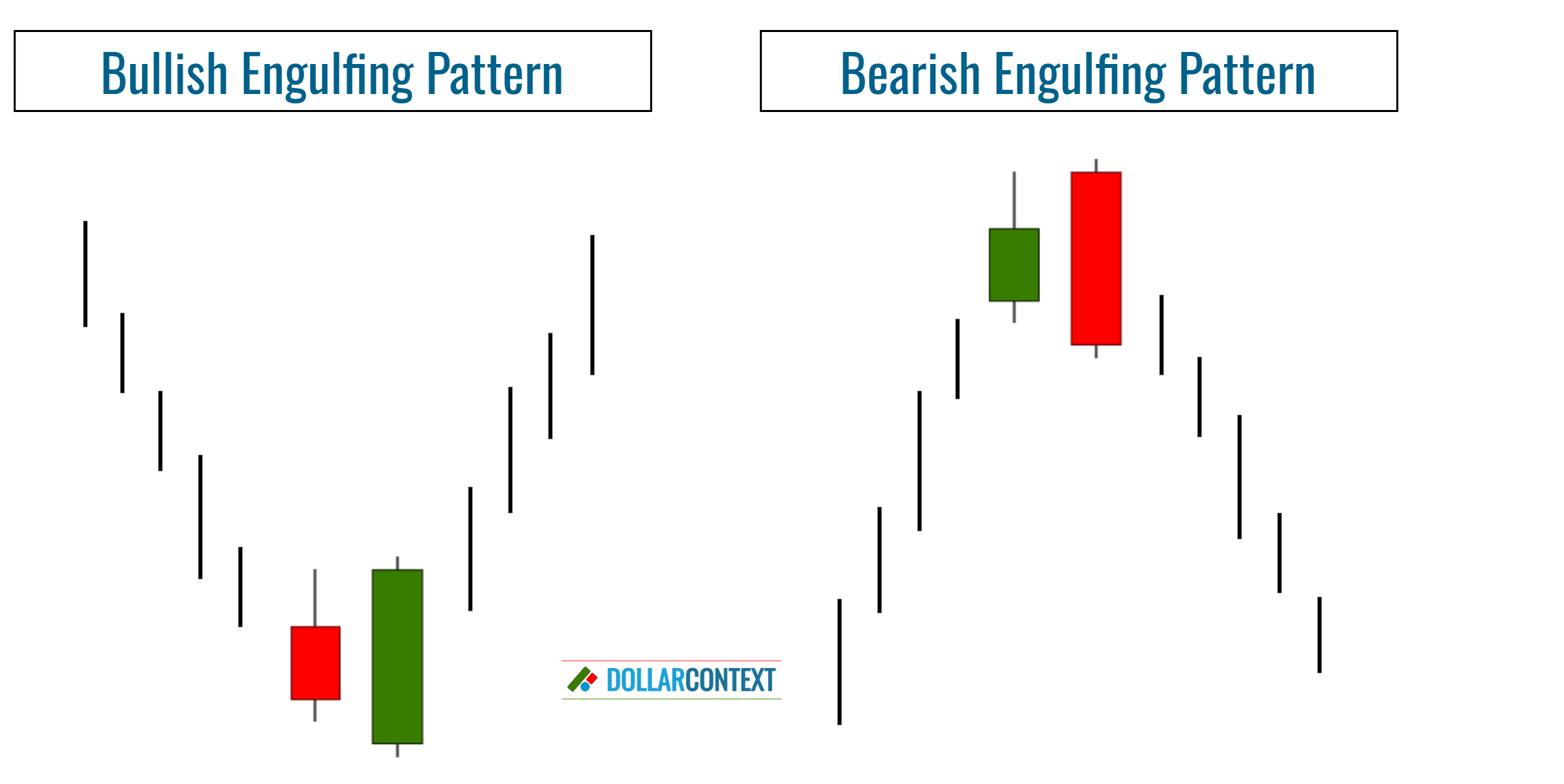

There are two main types of engulfing patterns:

- Bullish Engulfing Pattern: It appears after a downtrend. The first candlestick is usually a small bearish (red or black) one, followed by a larger bullish (green or white) real body that "engulfs" the entire body of the previous candlestick.

- Bearish Engulfing Pattern: It appears after an uptrend. The first candlestick is typically a small bullish (green or white) one, followed by a larger bearish (red or black) real body that "engulfs" the entire body of the previous candlestick.

For a pattern to be classified as an engulfing pattern, it must meet the following three criteria:

- Previous Trend: The market should be in a defined uptrend or downtrend, even if it's over a short timeframe.

- Engulfing Bodies: The body of the second candlestick must cover or "engulf" the body of the preceding one, though it doesn't necessarily need to engulf the wicks or shadows.

- Opposite Color: The color of the second candlestick's body should contrast with the first one. However, there's an exception: if the first candlestick's body is minuscule, almost resembling a doji (or is indeed a doji), then after a significant uptrend, a small red body followed by a much larger red body can indicate a bearish reversal. The opposite is true following an extended downtrend.

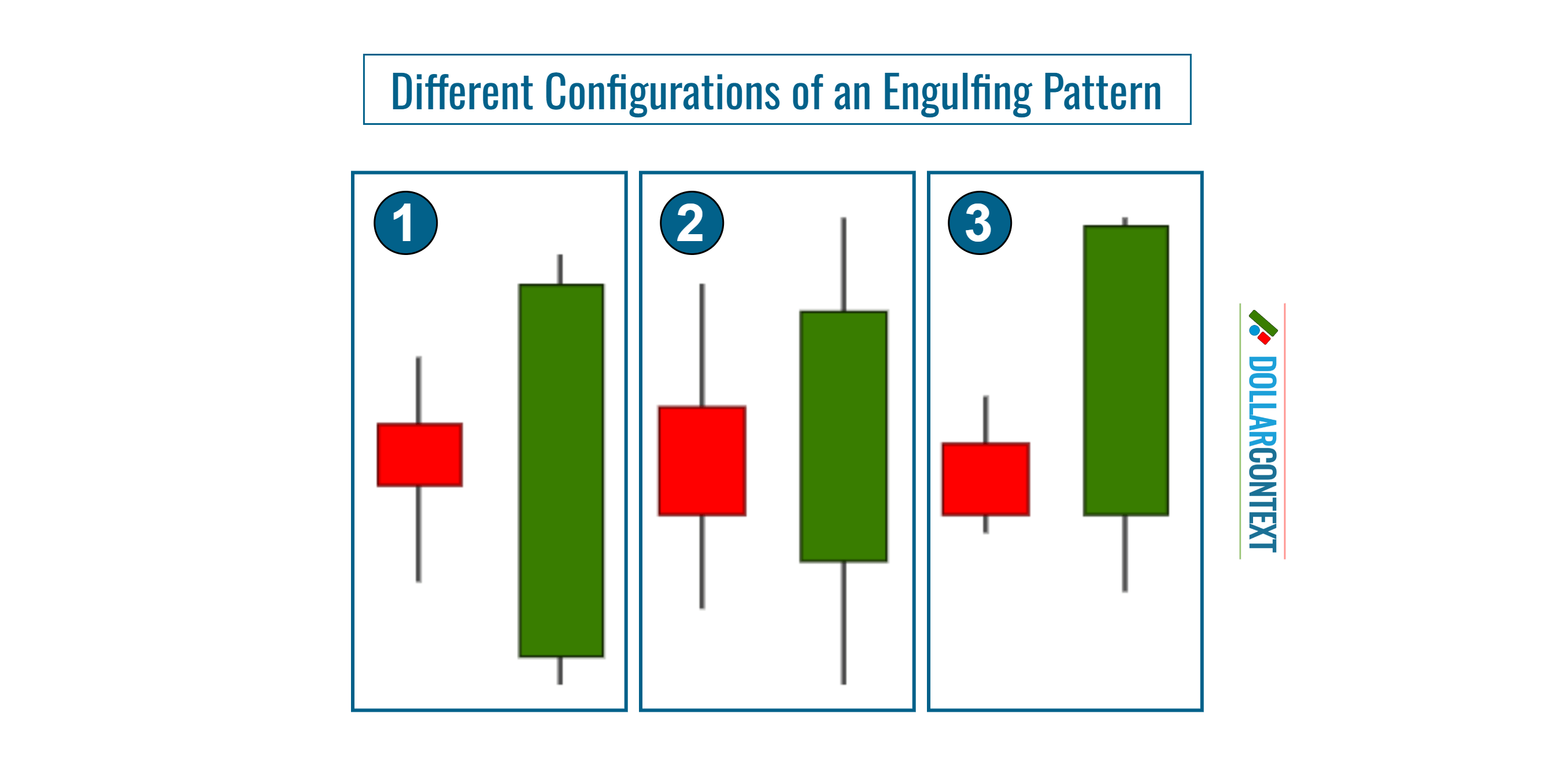

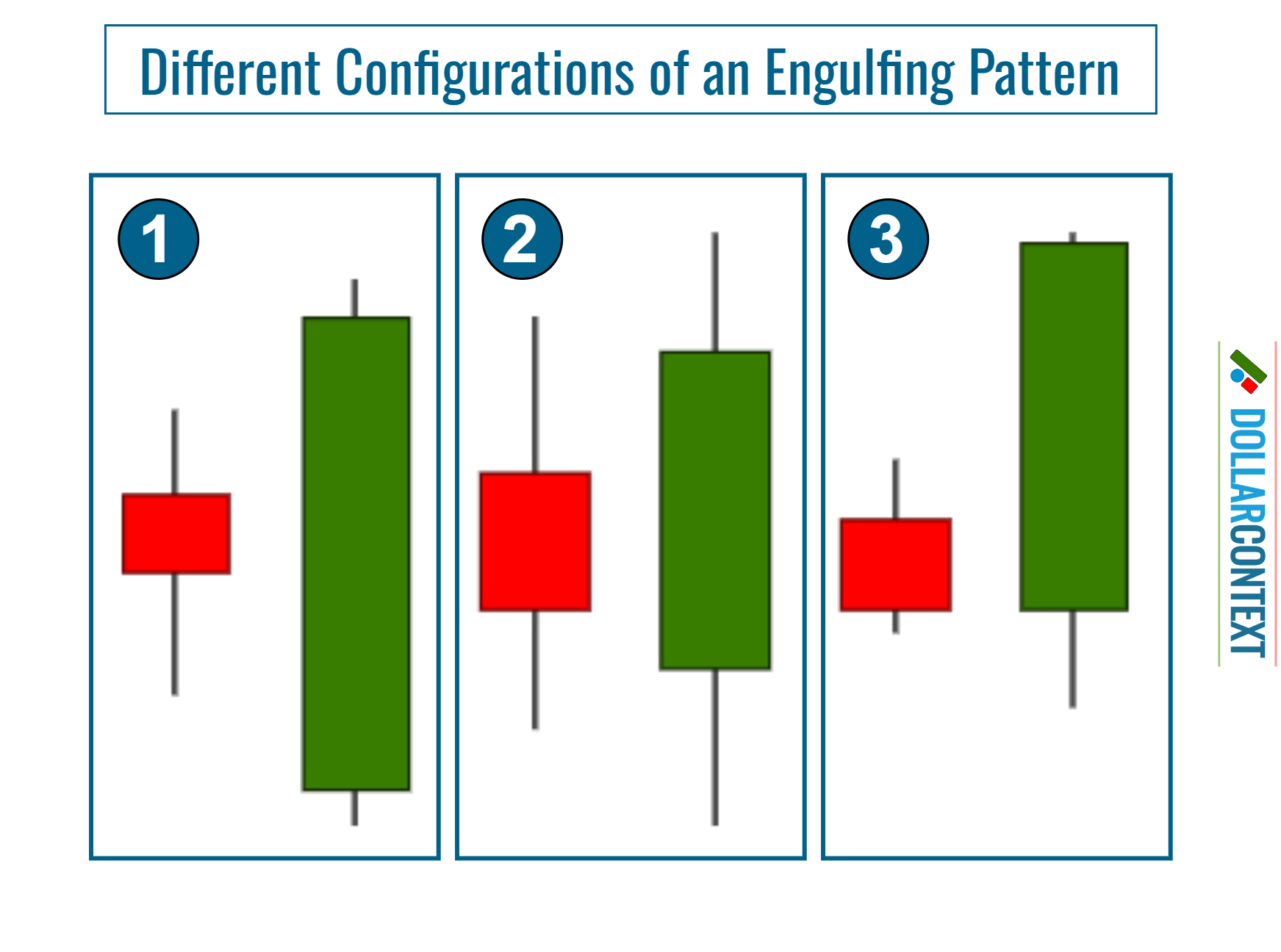

Different Configurations of an Engulfing Pattern

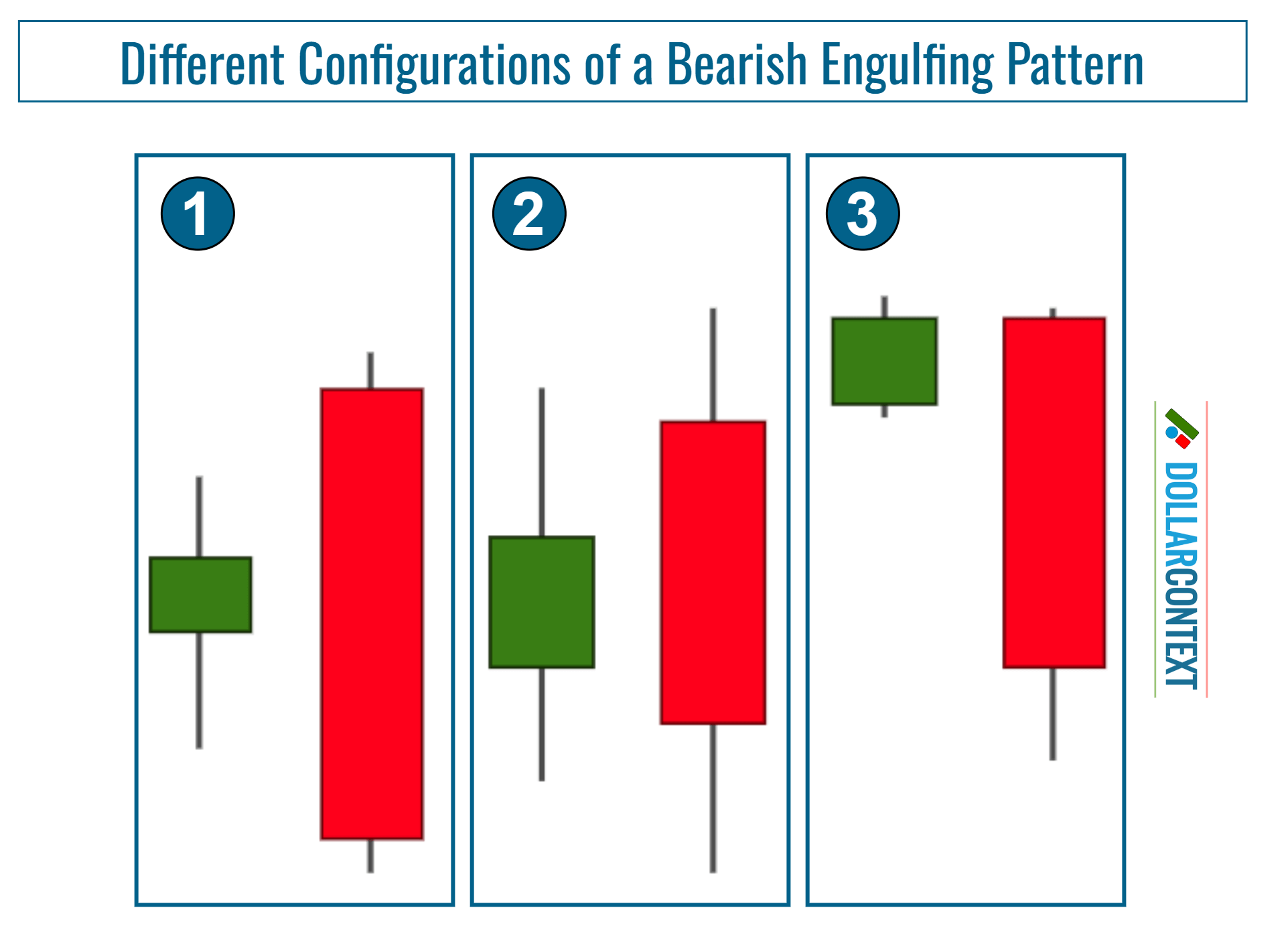

Not all engulfing patterns are equally significant. Their importance hinges on the size of the real bodies, how the shadows relate to each other, and other contextual elements.

A perfect engulfing pattern would have the first candle being small, with the second one substantially larger, such that the second candle's body completely envelops the entirety of the first candle, shadows included—see engulfing pattern labeled as "1" in the image below.

The next ideal shape would be if the shadows of the second candle surpass those of the first, meaning that on the second day of the engulfing pattern, the market registers both a higher high and a lower low (see pattern "2" below).

In low volatile markets or when analyzing shorter timeframes, like minutes or hours, a more flexible approach is recommended when identifying an engulfing pattern. Specifically, many traders consider it an engulfing pattern if the opening of the second session is the same as the close of the first candle. In such scenarios, it's prudent to seek additional confirmation signals to validate the potential for a reversal. Further details are provided in the next section.

The following image illustrates the different configurations for a bearish engulfing pattern:

Additional Factors that Increase the Likelihood of a Reversal

Factors that enhance the probability of an engulfing pattern serving as a significant reversal indicator include:

- The importance of contrasting the sizes of the two real bodies: If the first session of the engulfing pattern features a notably small real body and the second day presents a significantly extended real body, it indicates a waning momentum of the previous trend.

- Previous Market Trend: An engulfing pattern after an extended market trend or a rapid market movement leaves it overstretched and susceptible to profit-taking.

- Preceding Sessions: If the second candle of the engulfing pattern encompasses more than one real body, the probability of a reversal increases.

- Support or Resistance Zone: When the pattern emerges in a major support or resistance zone, the likelihood of a reversal rises.

- After a Doji: If a doji is followed by an engulfing pattern, this pairing is considered especially relevant.

- Additional Candlestick Patterns: If one or more other reversal patterns surface near the price range of the engulfing pattern, the reversal is more likely.