Engulfing Pattern: Implications in Different Market Scenarios

We discuss the significance of an engulfing pattern in different market scenarios, such as uptrends, downtrends, and trading ranges.

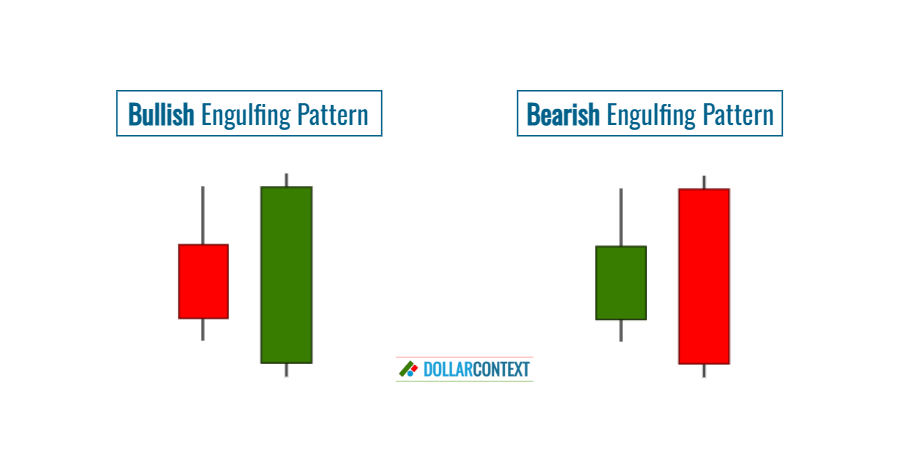

In the realm of Japanese candlestick charting, the engulfing pattern stands out as a key indicator of trend reversal. It is characterized by two contrasting candlesticks.

There are two main variants of this pattern:

- Bullish Engulfing Pattern: This often initiates with a slight bearish (typically red or black) candle, overshadowed by a subsequent, more prominent bullish (commonly green or white) candle. It suggests a potential shift to an upward trajectory.

- Bearish Engulfing Pattern: Typically, this pattern starts with a modest bullish (often green or white) candle, which is then fully encapsulated by a larger bearish (red or black) candle, hinting at a likely transition to a downward trend.

Engulfing Pattern: Significance in Different Scenarios

1. Trend-Driven Market vs. Sideways Action

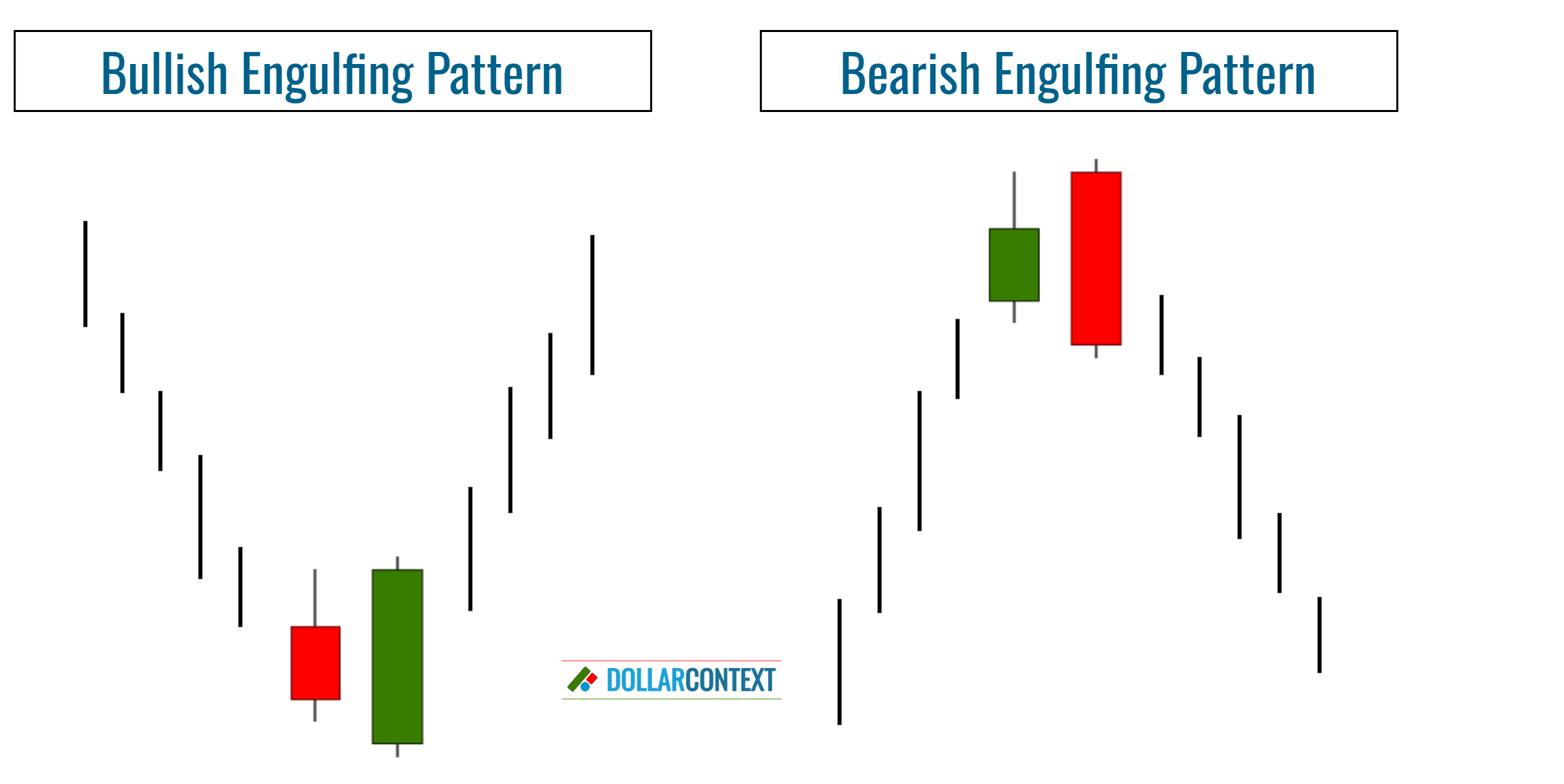

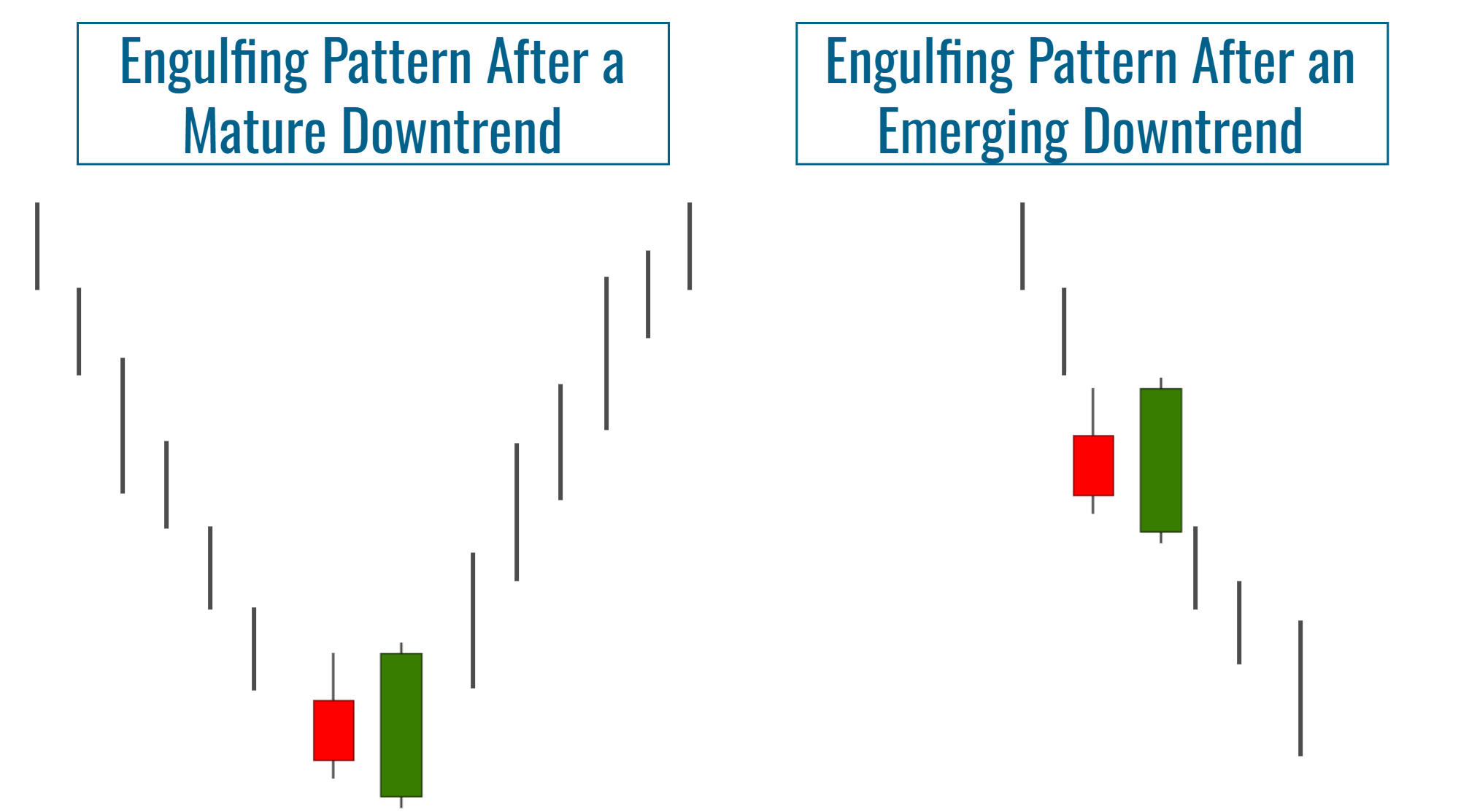

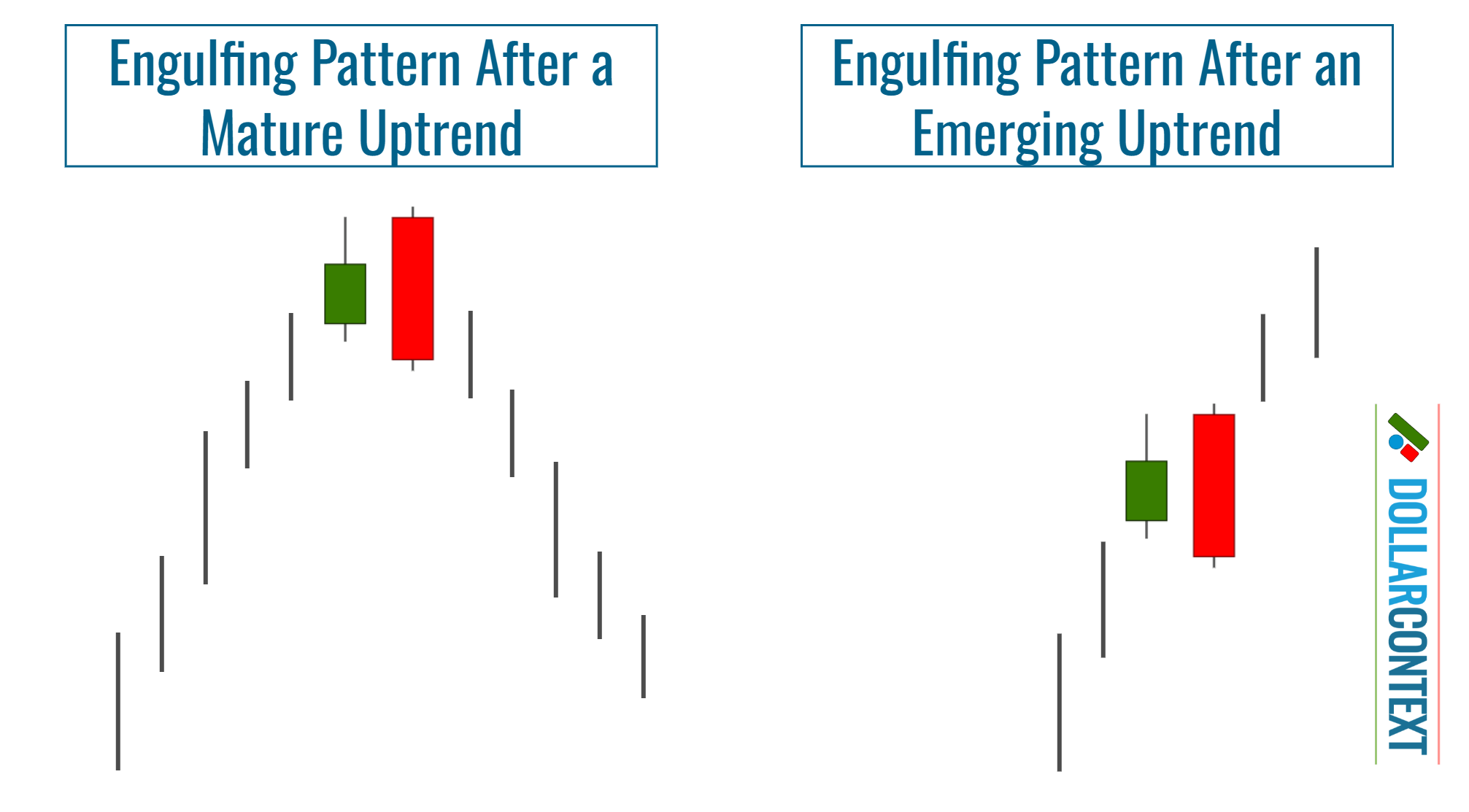

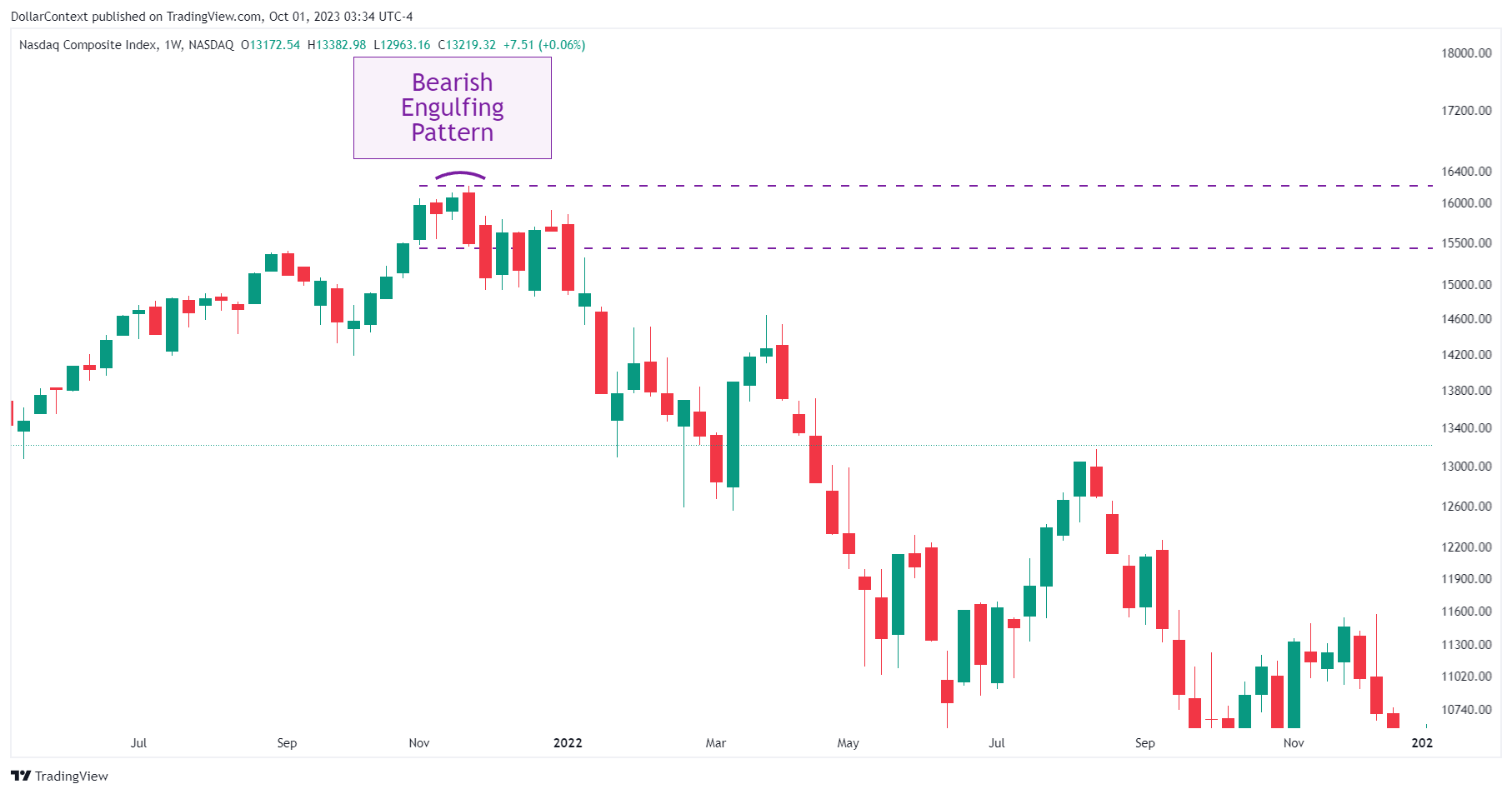

An engulfing pattern appearing after the mature phase of an uptrend or a downtrend is indicative of a potential market turn.

While a bullish engulfing pattern is expected to manifest following the advanced stage of a downtrend, a bearish engulfing pattern should emerge after the developed phase of an uptrend.

A crucial element in understanding an engulfing pattern is identifying its position within a trend. The accompanying image demonstrates this, highlighting that a bullish engulfing pattern following a significant drop could signal a market low. However, if the market is in the early stages of a decline, the chances of it being at its lowest point are diminished.

Follow the same logic to determine the significance of a bearish engulfing pattern within an uptrend.

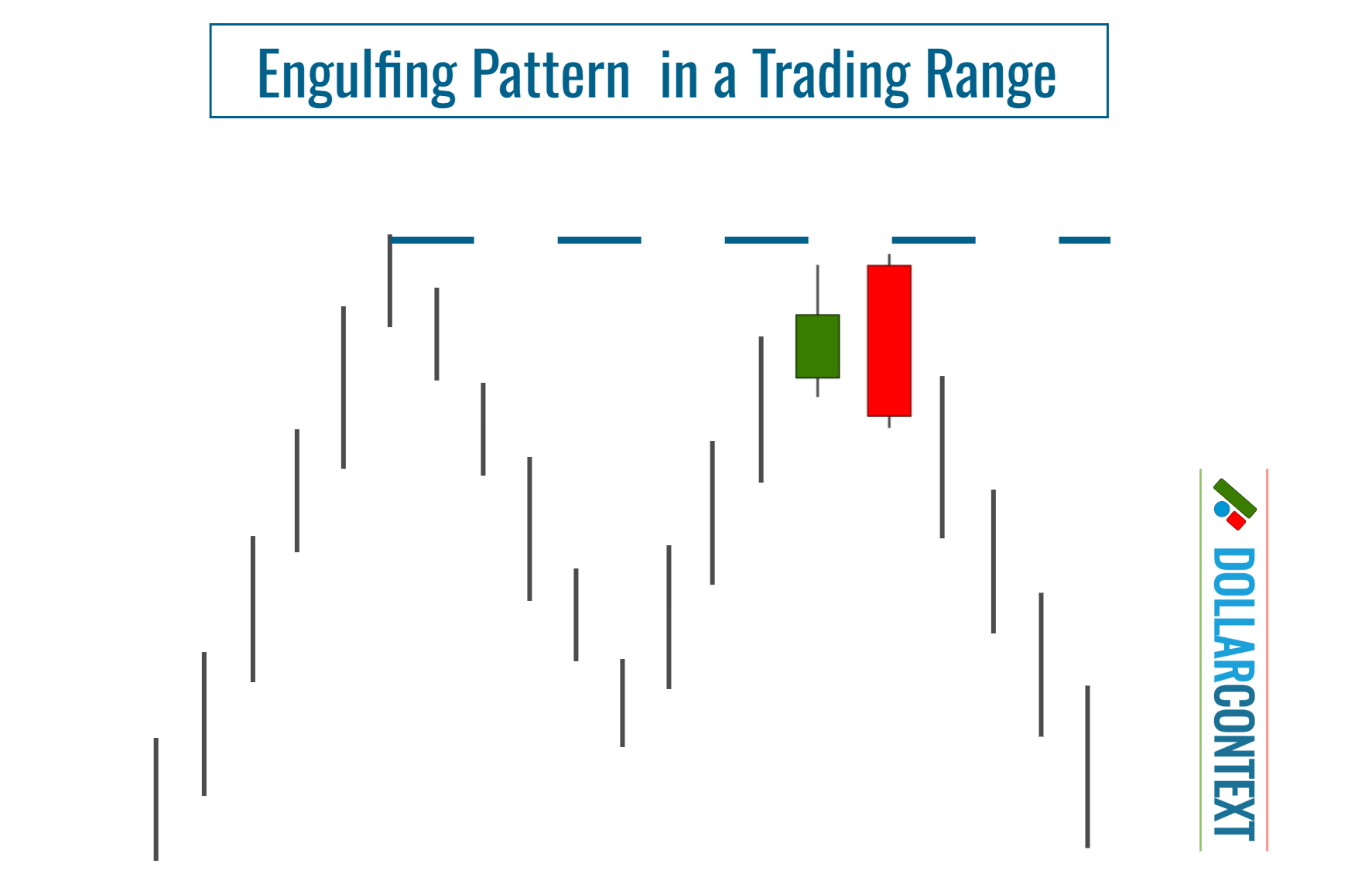

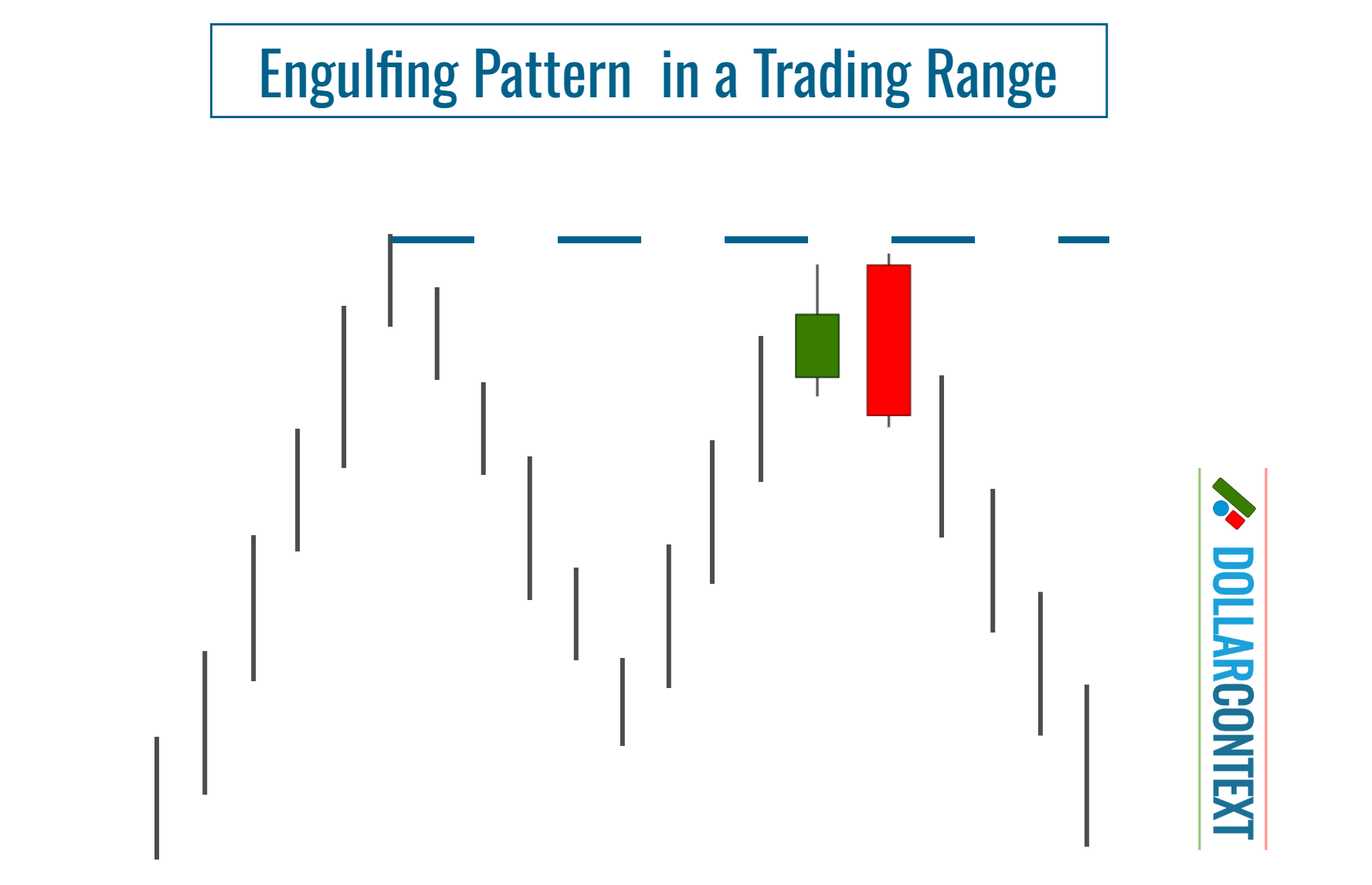

In lateral trading situations, an engulfing pattern typically holds no significance. However, when it arises close to the upper or lower limit of a broad range, it might signal a movement back to the opposite end of that range.

2. Variations and Body Size Contrast

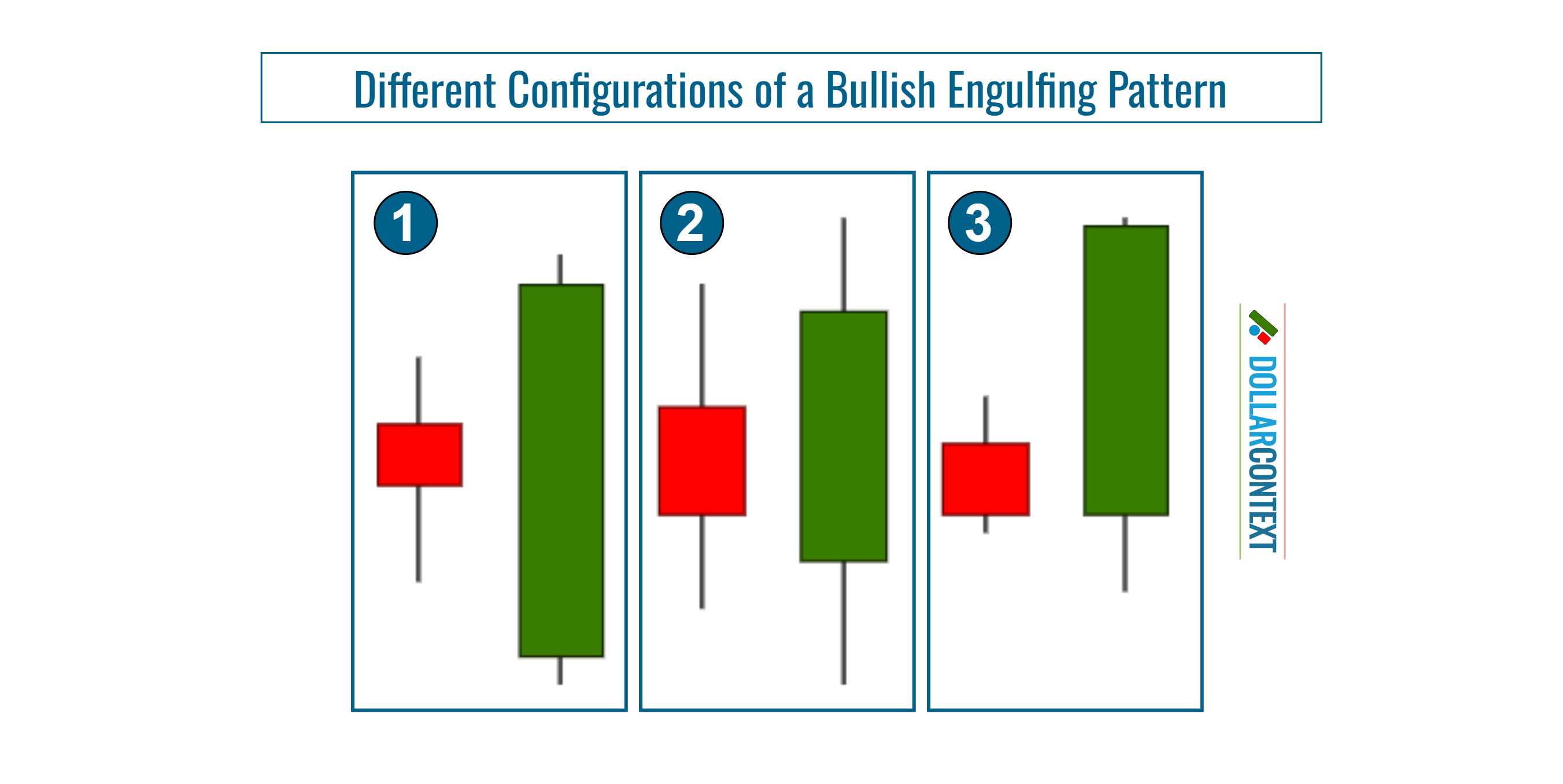

The significance of the engulfing pattern increases when the first body is smaller and the second body is larger. If the two candles forming the engulfing pattern are nearly the same size, the market might transition into a sideways trend instead of reversing.

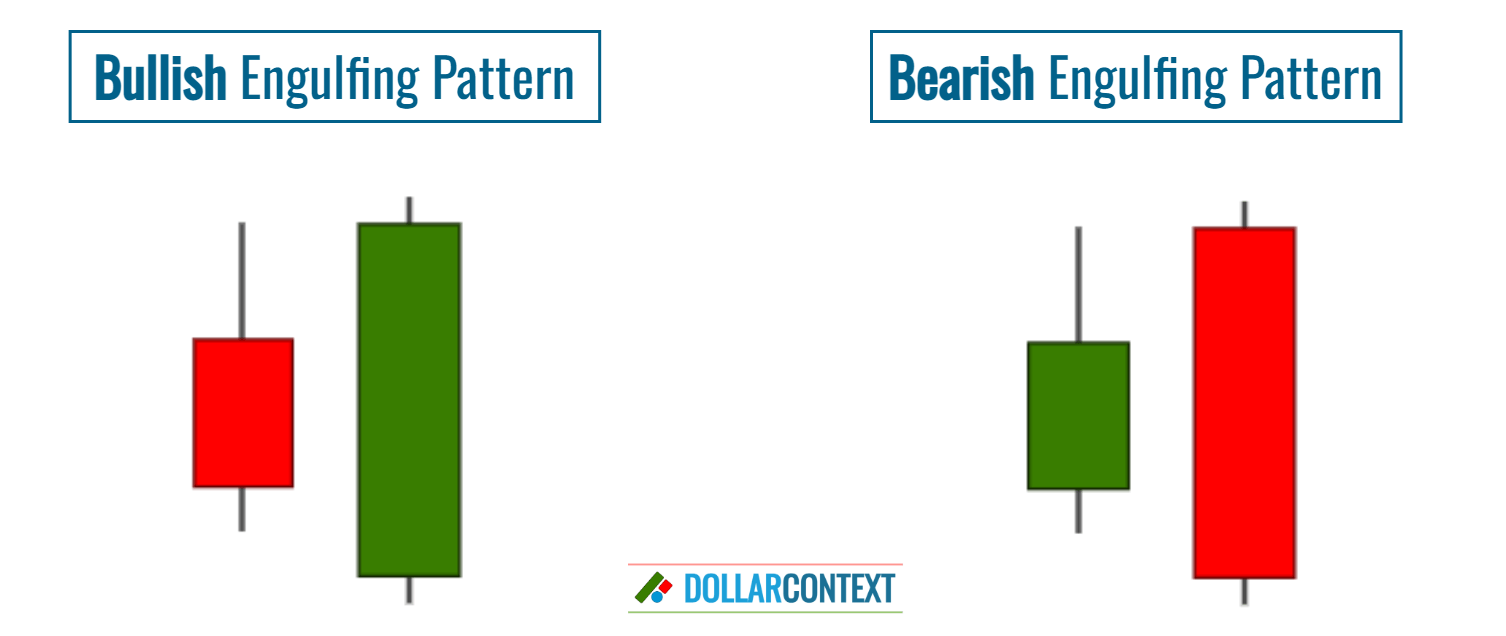

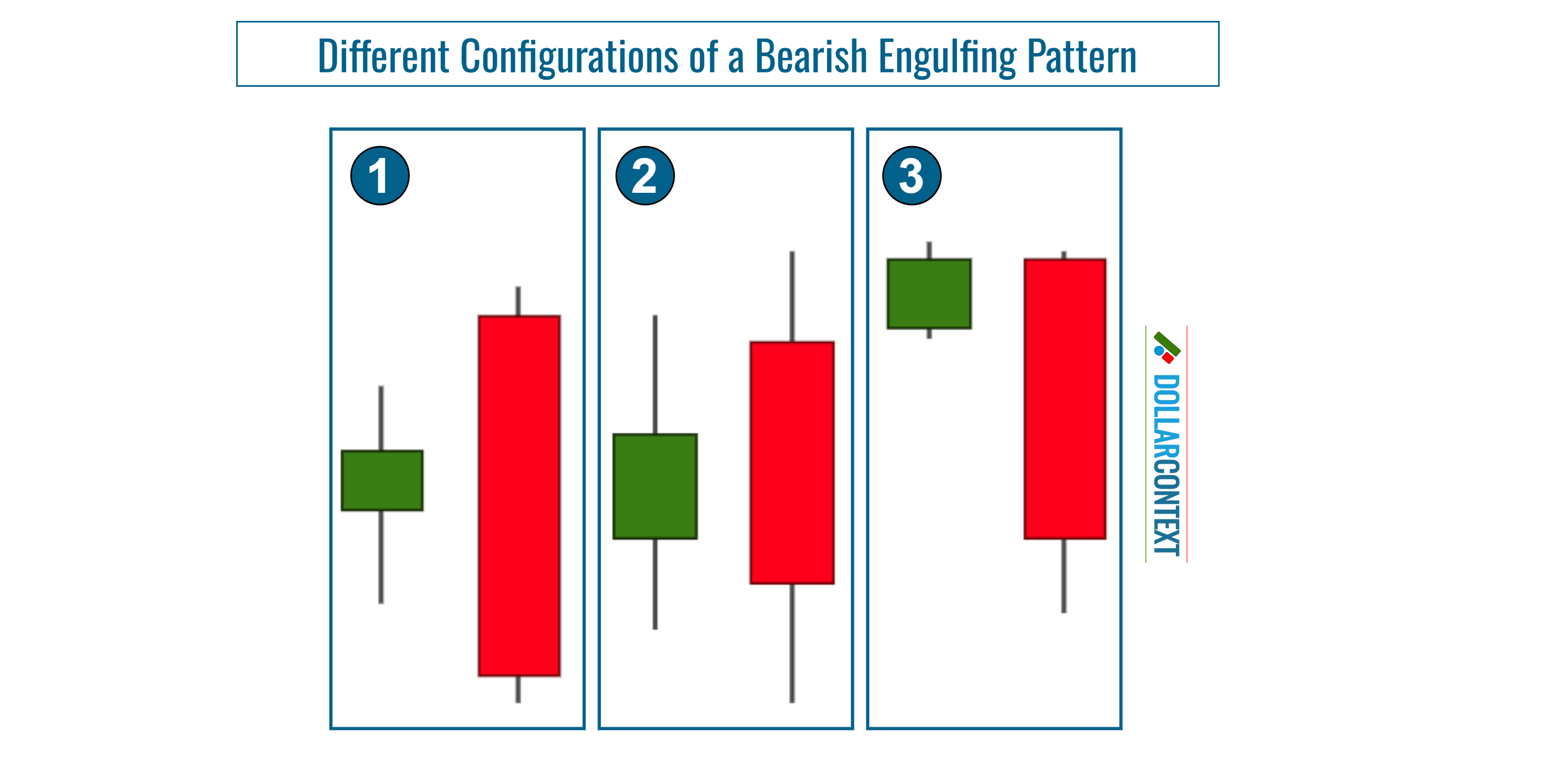

The fundamental principle of an engulfing pattern dictates that the real body of the second candle should cover the real body of the prior candle, which contrasts in color.

However, the importance of engulfing patterns can vary according to the relative size of the real bodies and the relationship between the shadows. Thus, we can identify the following variations of engulfing patterns.

- The quintessential bullish engulfing pattern displays a small initial candle succeeded by a notably larger second candle that wholly overshadows the first, shadows included (pattern "1" in the image below).

- A significant variation emerges when the shadows of the second candle stretch beyond the first candle's, indicating both a higher peak and a deeper trough on the second day of the pattern (pattern "2").

- For less volatile markets or shorter timeframes, like minutes or hours, a more flexible definition for engulfing patterns is generally adopted. In such cases, if the opening of the second session mirrors the closing of the first, it's considered an engulfing pattern. In these instances, seeking additional confirmatory signs to gauge the prospect of a reversal is prudent (pattern "3").

The same differentiation can be established for bearish engulfing patterns.

3. Engulfing Multiple Sessions

An engulfing pattern is considered more meaningful or significant if it engulfs the real bodies of multiple prior sessions. The rationale behind this is that the strength required to overshadow several sessions reflects a powerful shift in market sentiment.

By covering more than just the immediate preceding session, it suggests that the prevailing momentum has not only overcome the most recent sentiment but has also negated the sentiments of multiple previous sessions. This makes the reversal signal provided by the engulfing pattern more robust. The following example illustrates this.

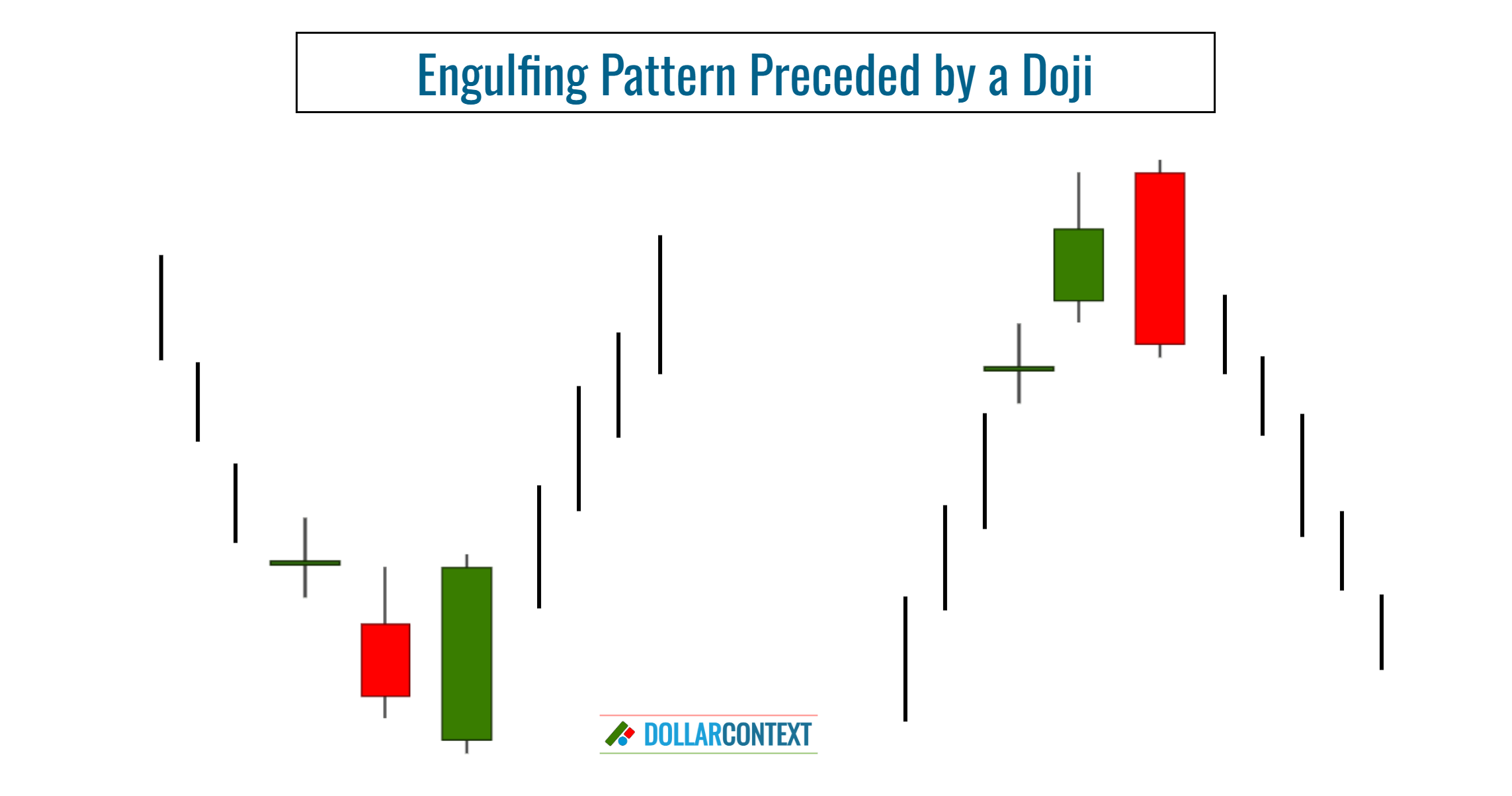

4. Engulfing Pattern Preceded by a Doji

An engulfing pattern that is preceded by a doji can be considered more meaningful and should be taken seriously, especially after a downtrend. Here's why:

- The Doji's Implication: A doji represents indecision in the market. It's a candlestick where the opening and closing prices are virtually the same, implying that neither the bulls nor the bears could gain a decisive advantage during that session.

- Increased Significance with Engulfing: If a doji, which signifies indecision, is immediately followed by an engulfing pattern, it indicates that the market has moved from a state of indecision to a state of decisiveness. The engulfing pattern "resolves" the indecision suggested by the doji.

- Reinforcement of the Reversal Signal: The combination of a doji followed by an engulfing pattern can strengthen the reversal signal, especially if it's in line with other technical indicators or market contexts.

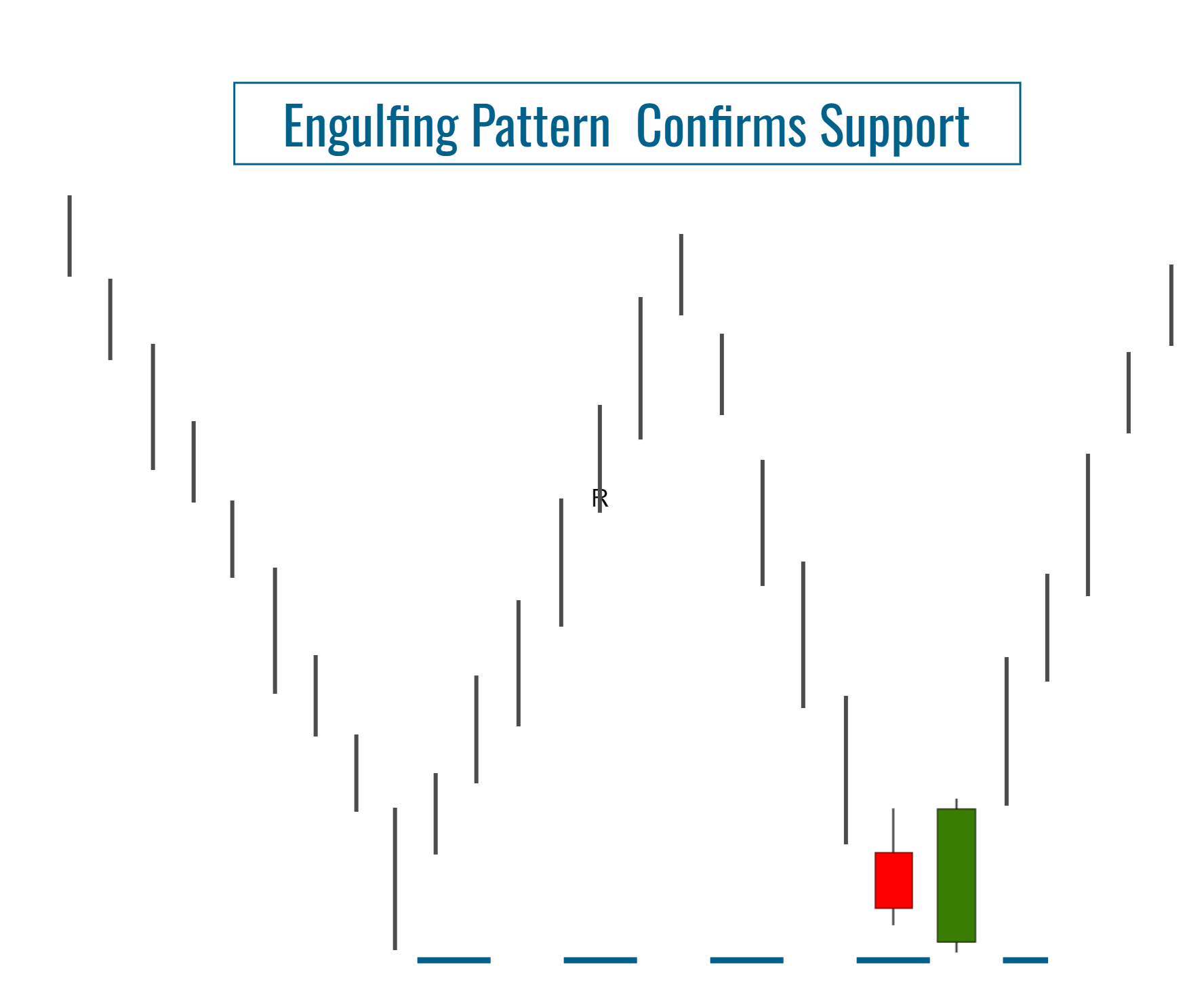

5 Support/Resistance Zones

An engulfing pattern that forms in a support or resistance zone carries added weight for several reasons:

- Validation of Key Levels: Support and resistance zones are areas where the price has historically had difficulty moving below (support) or above (resistance). An engulfing pattern near those levels can validate their significance.

- Enhanced Reversal Signal: When a bullish engulfing pattern appears at a support level, it can signal a strong rejection of lower prices and the potential for a bullish reversal. Conversely, a bearish engulfing pattern at a resistance level can indicate a rejection of higher prices and a bearish reversal possibility.

In other words, a bullish engulfing pattern validates or reinforces a support zone.

Similarly, a bearish engulfing pattern consolidates a resistance area.

Be also aware that the engulfing pattern creates a support or resistance zone.

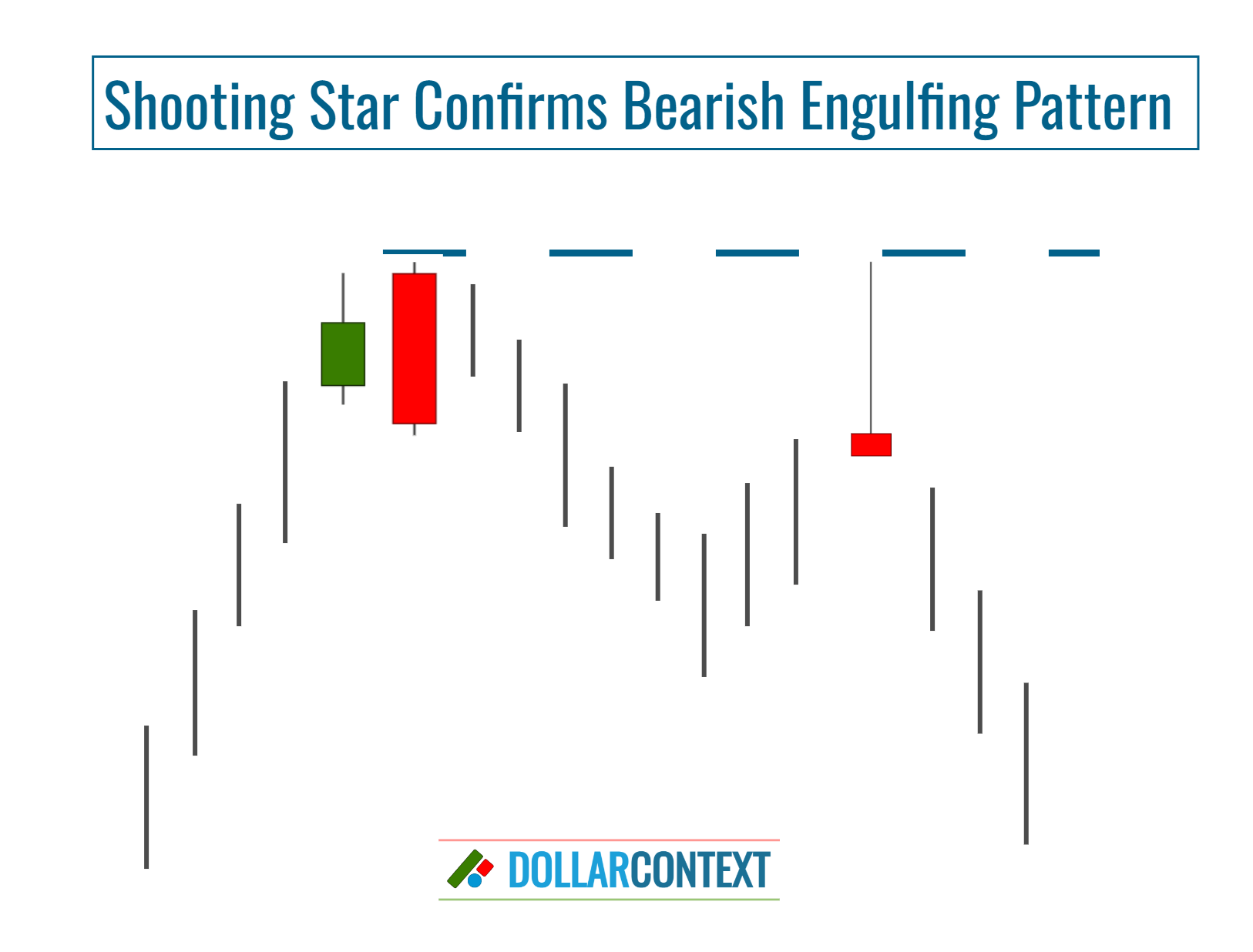

6. Additional Candlestick Patterns

When evaluating the strength and reliability of reversal patterns in technical analysis, confluence—or the alignment of multiple signals—is often sought by traders to bolster their decision-making confidence.

If other reversal patterns are identified around the same price range as an engulfing pattern, this confluence can provide a stronger indication of a potential price reversal.