Engulfing Pattern: How to Set Your Stop-Loss

In this post, we'll explore effective strategies to set a stop-loss when using an engulfing pattern to open a market position.

This article is part of the Engulfing Pattern tutorial series. For the complete guide, see the Engulfing Pattern — Complete Guide.

The engulfing pattern is a prominent figure in Japanese candlestick charting that indicates a potential shift in market trajectory.

In this post, we'll explore effective strategies to set a stop-loss when using an engulfing pattern to open a market position.

1. Correct Identification

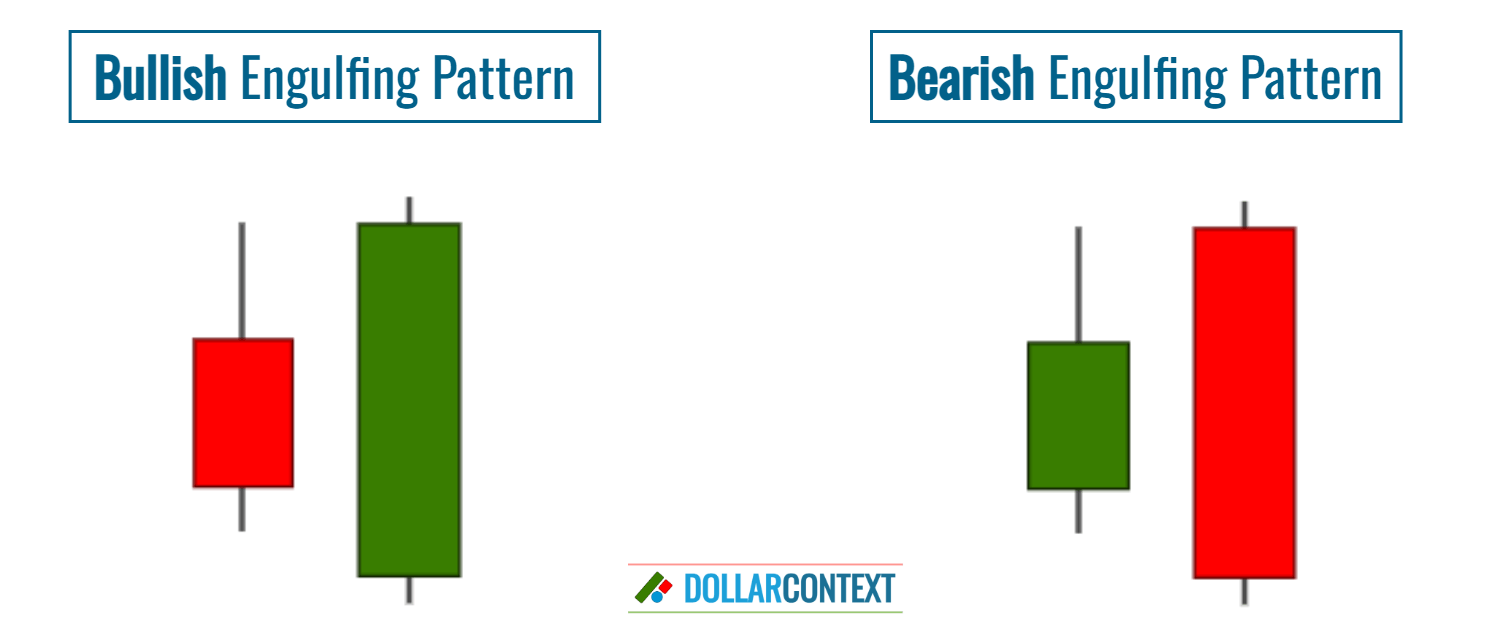

Ensure that you correctly identify the engulfing pattern on your chart. The basic form of this pattern consists of two contrasting candlesticks:

- Bullish Engulfing Pattern: This often begins with a slight bearish (usually red or black) candle, which is then entirely overshadowed by a subsequent, more pronounced bullish (commonly green or white) candle. This hints at a likely upward trend shift.

- Bearish Engulfing Pattern: This pattern typically starts with a modest bullish (often green or white) candle, followed by a more significant bearish (red or black) candle that fully engulfs the initial one, suggesting a potential downward trend reversal.

Although engulfing patterns vary in type, they all possess a core feature: the body of the second candlestick must entirely overshadow the preceding one of an opposite color.

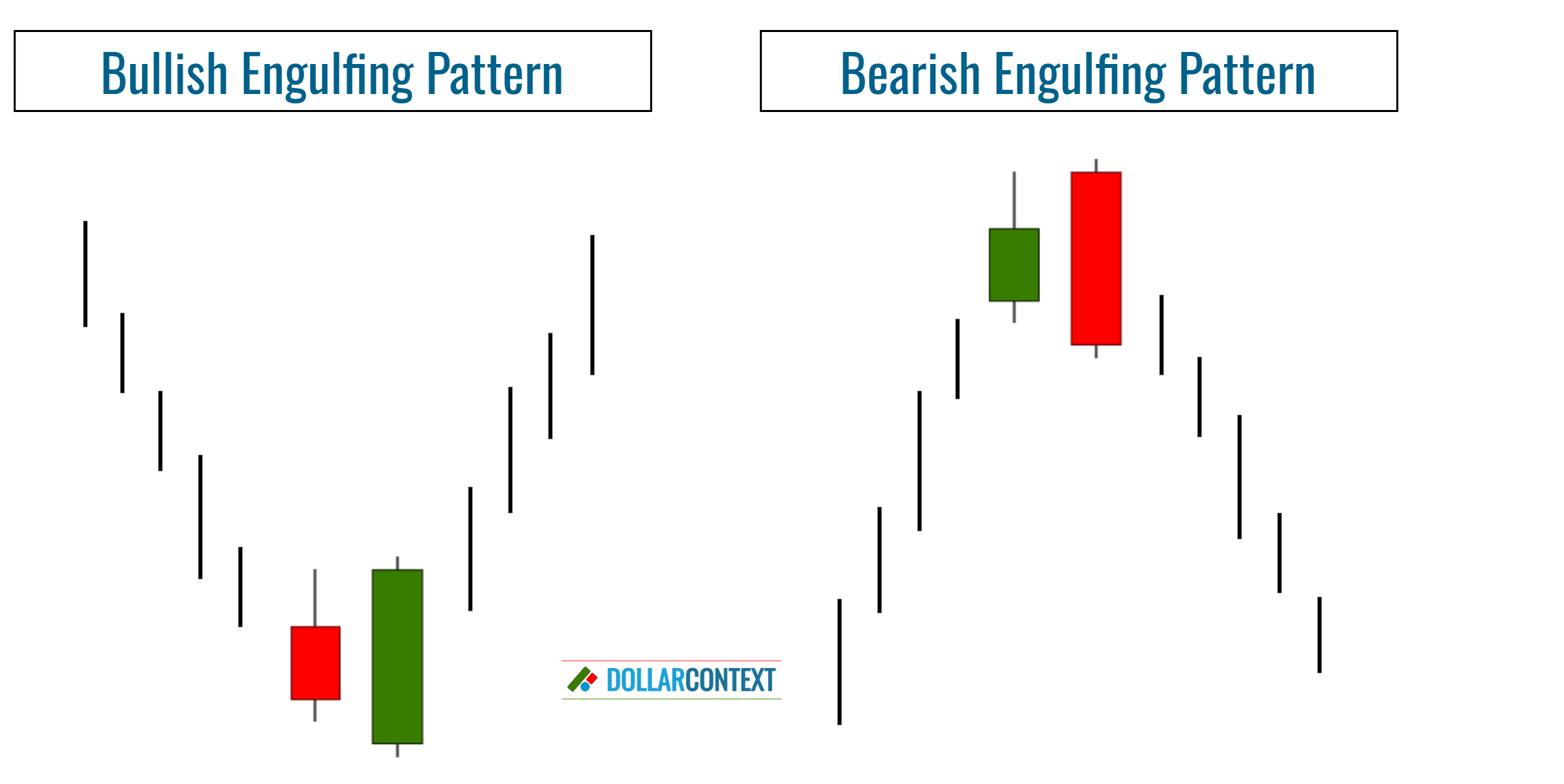

2. Verify the Previous trend

Psychologically, an engulfing pattern indicates a potential shift in market sentiment. However, for a trend reversal to take place, a distinct upward or downward trend must precede the engulfing pattern.

In a market with limited fluctuation or a mild trend, an engulfing pattern typically lacks relevance.

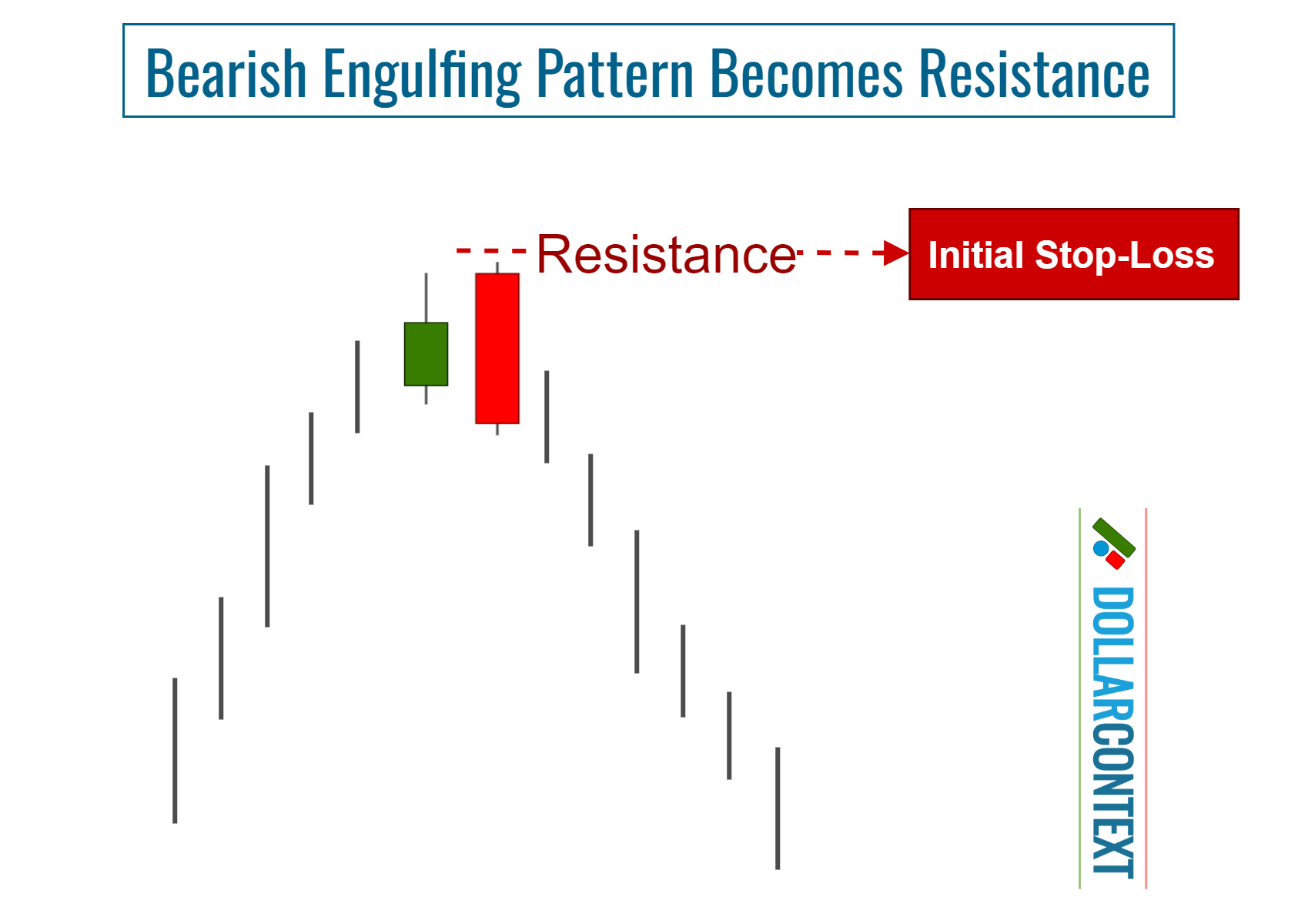

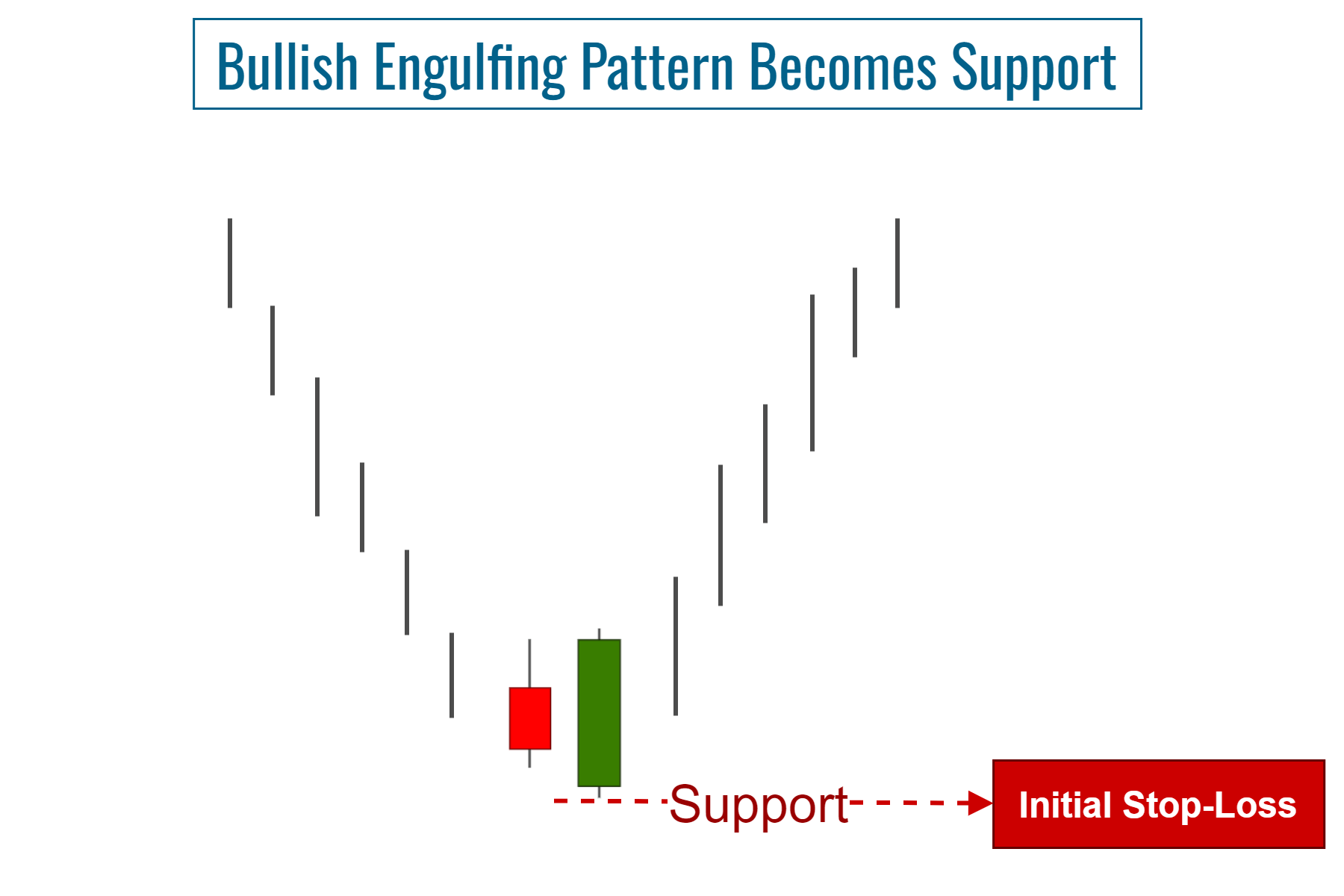

3. Identify the Support or Resistance Zone

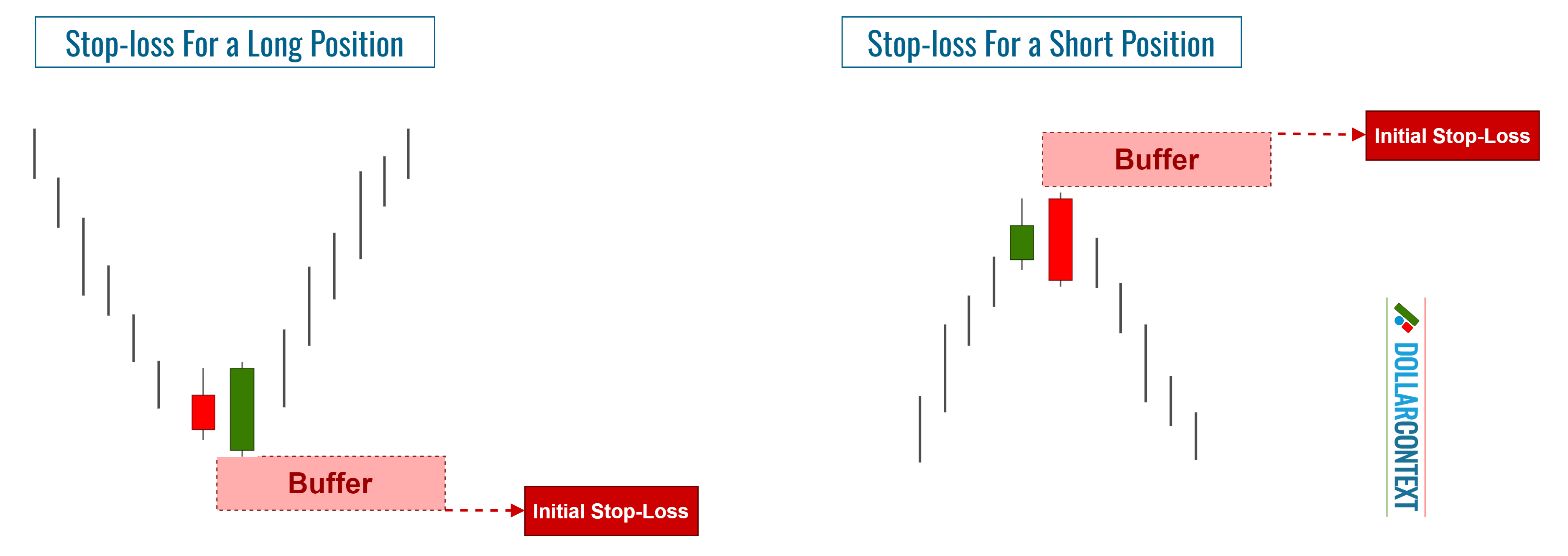

After an uptrend, the price range linked to a bearish engulfing pattern acts as resistance. The highs of this range can be used as a benchmark to set your initial stop-loss when initiating a short position.

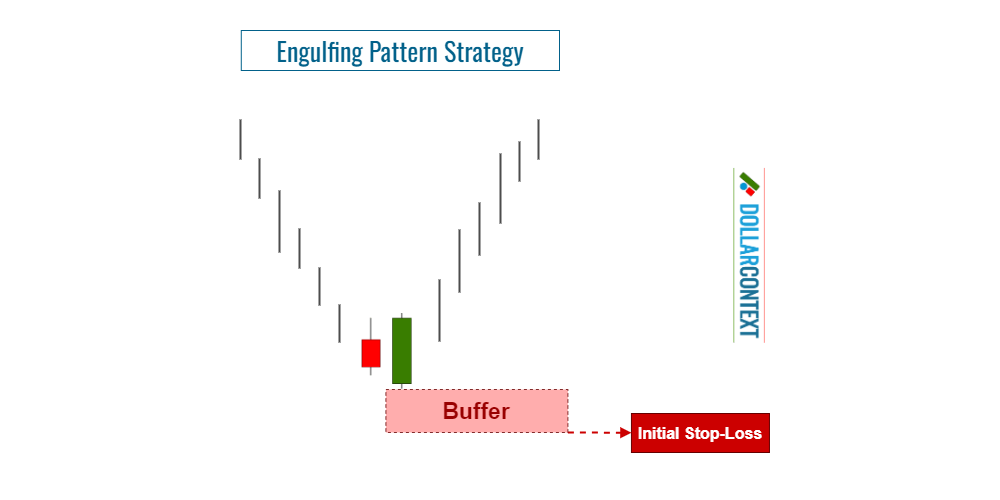

Likewise, following a downtrend, the bullish engulfing pattern becomes support, and the initial stop-loss should be placed at the lowest point of the pattern.

4. Consider Adding a Safety Margin

After taking into account factors like risk management and market volatility, you might consider adding a buffer to your initial stop-loss. This additional safeguard can effectively protect you from false breakouts.

5. Determine If Your Stop-Loss Is Based on a Closing Price

A stop activated at close is initiated when the session's closing price surpasses the stop-loss threshold, rather than solely relying on intraday price fluctuations.

In Japanese candlestick analysis, it's commonly advised to place a stop at the closing mark, particularly when leveraging an engulfing pattern to open your position.

6. Monitor the Trade

Consistently evaluate the market and your position to ensure alignment with your engulfing pattern strategy. Specifically:

- Reassess and modify your stop-loss when necessary. As markets continually shift, new candlestick formations might emerge during your trade's progression. When such developments arise, think about adjusting your stop-loss to accommodate the evolving scenario. For example, if a fresh candlestick pattern surfaces near the price range of the engulfing pattern, strengthening the reversal hypothesis, it would be prudent to adjust your stop accordingly.

- When the price progresses in your direction, consider employing a trailing stop-loss to protect gains and manage risks efficiently.

- Uphold discipline. Avoid decisions driven by emotions, irrespective of market movements.