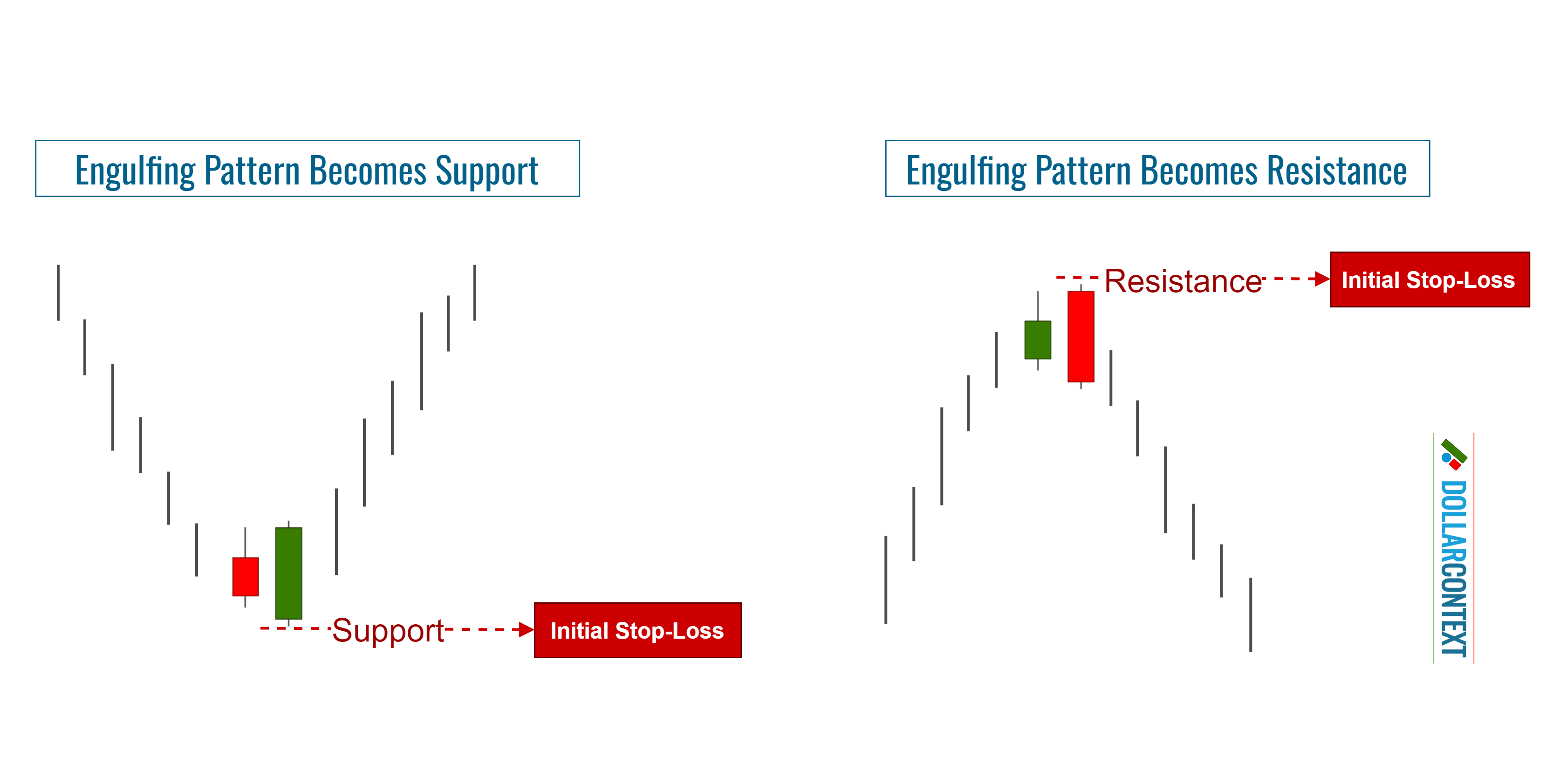

Engulfing Pattern to Identify Support or Resistance

After an uptrend, the price range associated with a bearish engulfing pattern becomes resistance. The same applies in reverse.

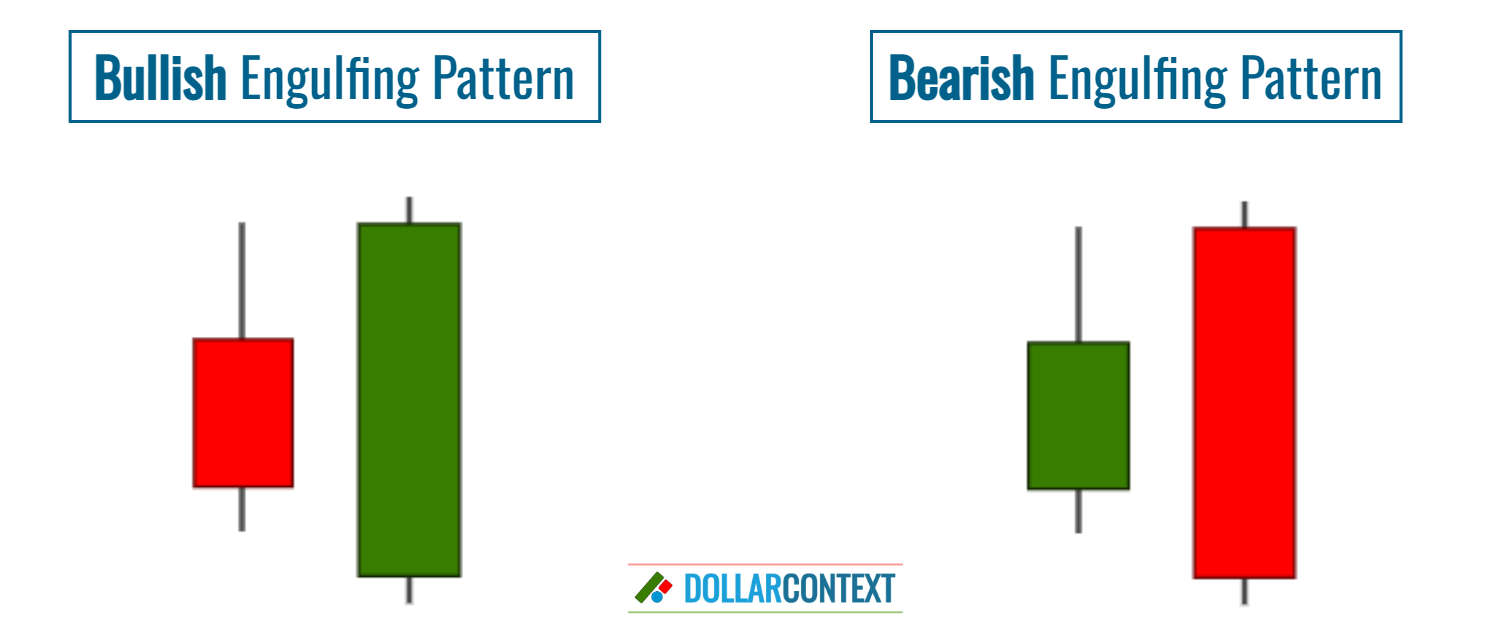

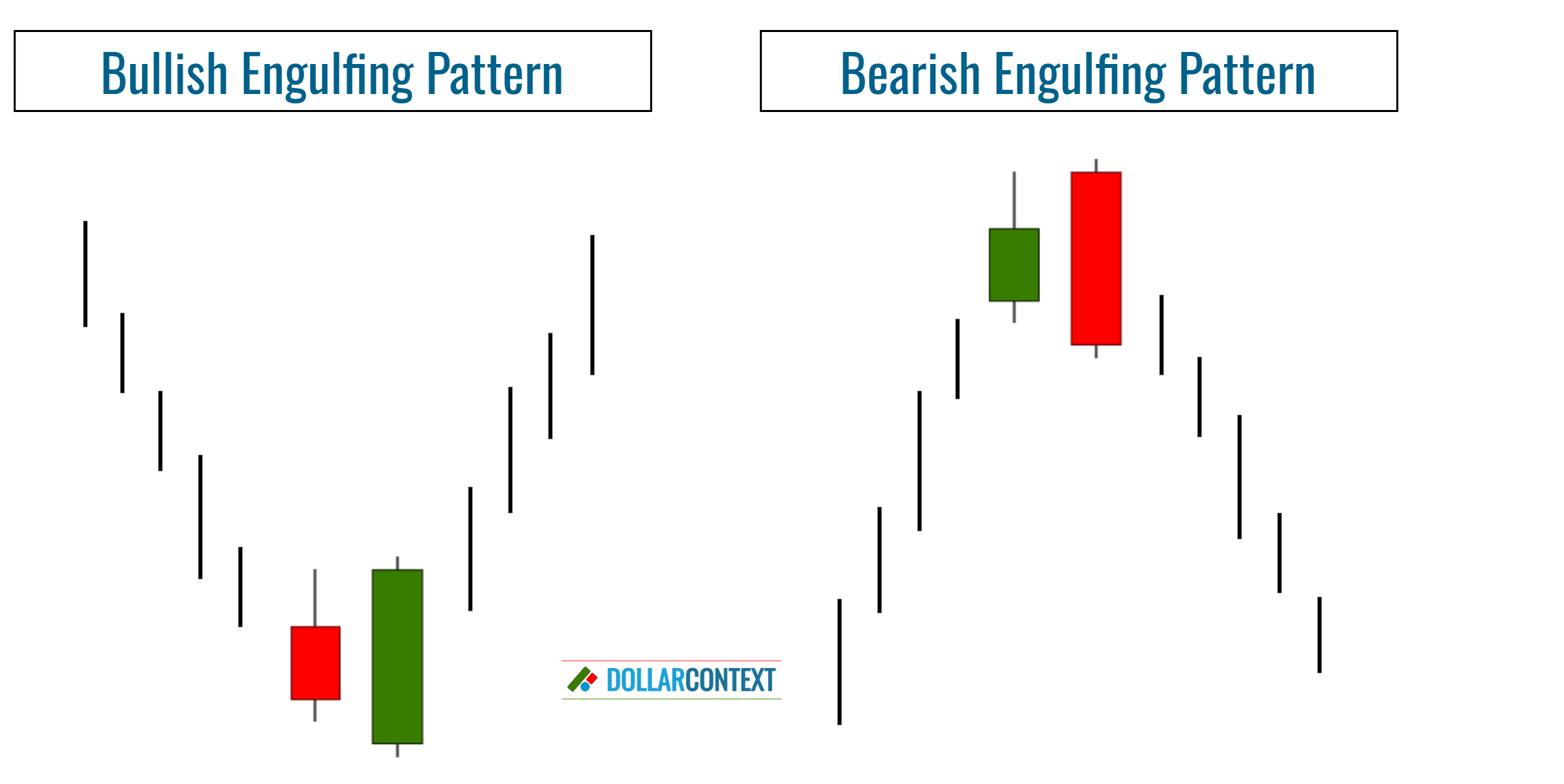

The engulfing pattern is a key formation in Japanese candlestick charting that hints at a possible shift in market direction. This pattern is composed of two distinct candlesticks:

- Bullish Engulfing Pattern: It typically begins with a minor bearish (often red or black) candle, which is then completely overshadowed by a subsequent larger bullish (usually green or white) candle. This suggests a potential trend change to the upside.

- Bearish Engulfing Pattern: This pattern frequently starts with a small bullish (typically green or white) candle, followed by a dominant bearish (red or black) candle that fully encompasses the first one, signaling a possible bearish turnaround.

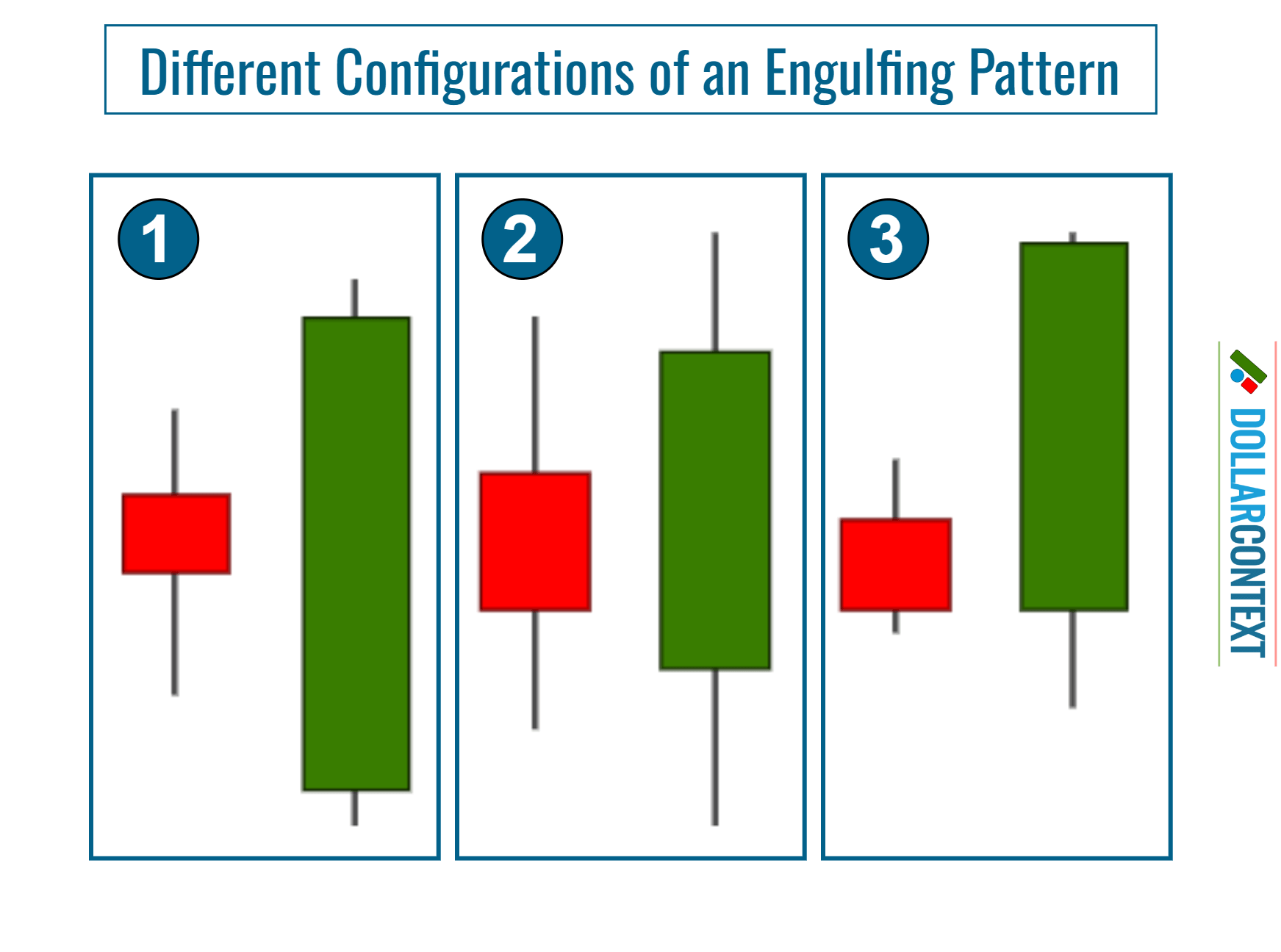

A fundamental characteristic of an engulfing pattern is that the second candlestick's body must completely cover the first one of an opposite color.

After an uptrend, the price range associated with a bearish engulfing pattern generally evolves into a resistance area. The same concept applies inversely. After a downtrend, the price range linked to a bullish engulfing pattern becomes support.

Within this framework, we can differentiate two different scenarios:

- If an engulfing pattern emerges within a previously established support/resistance zone, the engulfing pattern reinforces or confirms this support or resistance.

- If an engulfing pattern surfaces at a new low or at a new high, it creates a new support or resistance zone.

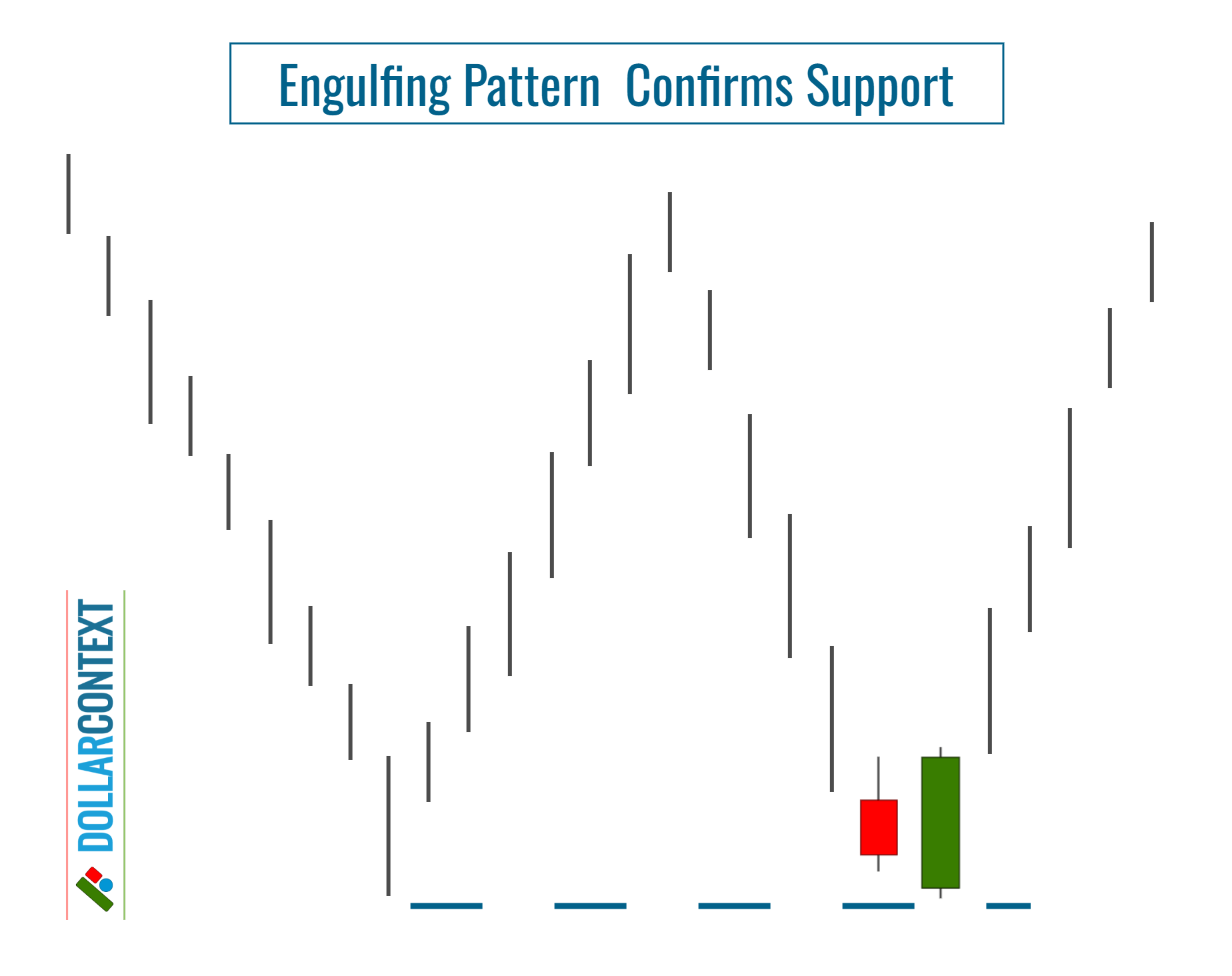

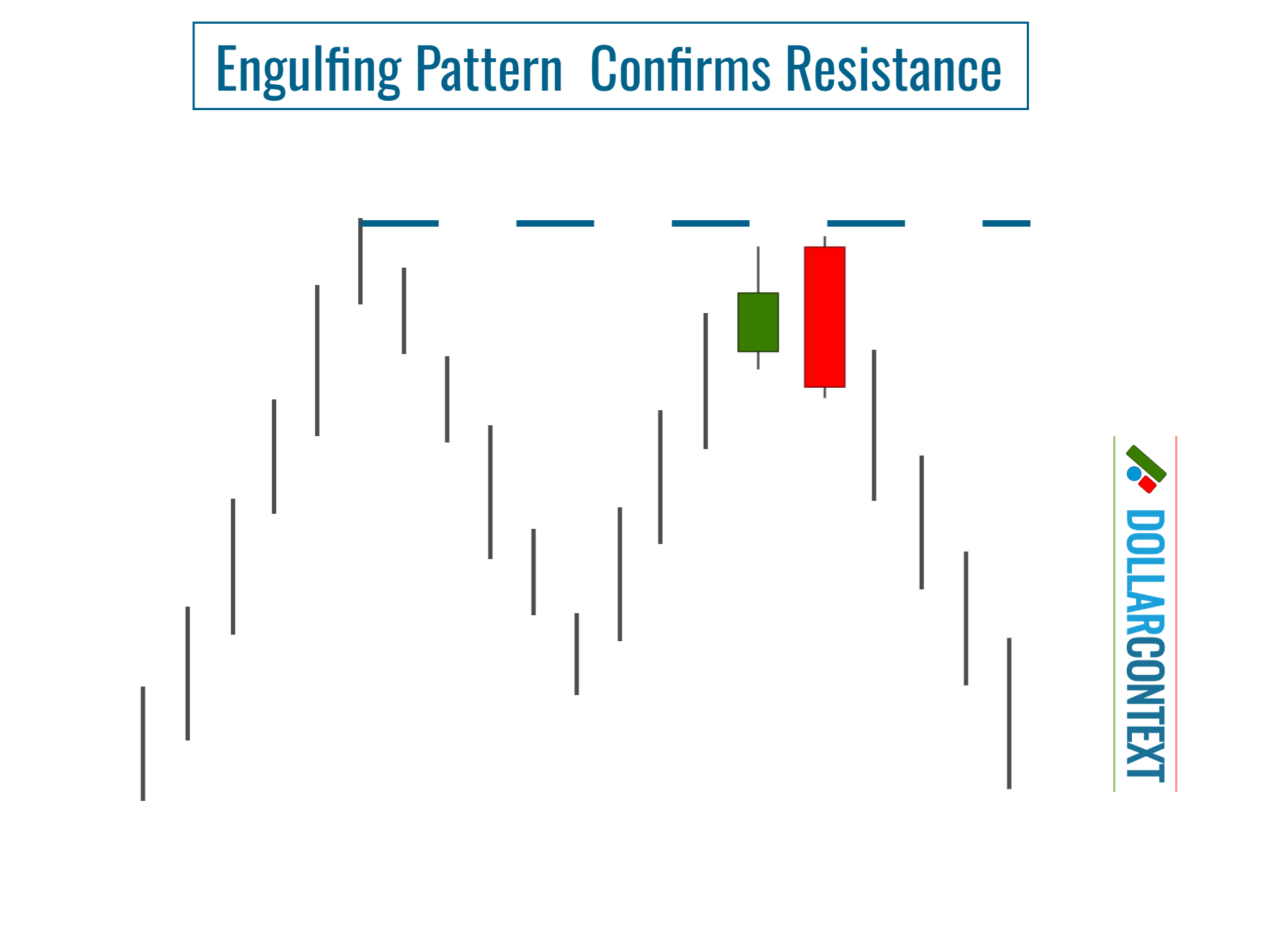

1. Engulfing Pattern Validates Support or Resistance

When a bullish engulfing pattern appears within a previously defined support zone, it reinforces the credibility of that support, increasing the probability of a bullish trend reversal.

Following the same logic, if the engulfing pattern arises near a pre-established resistance zone, it confirms the resistance.

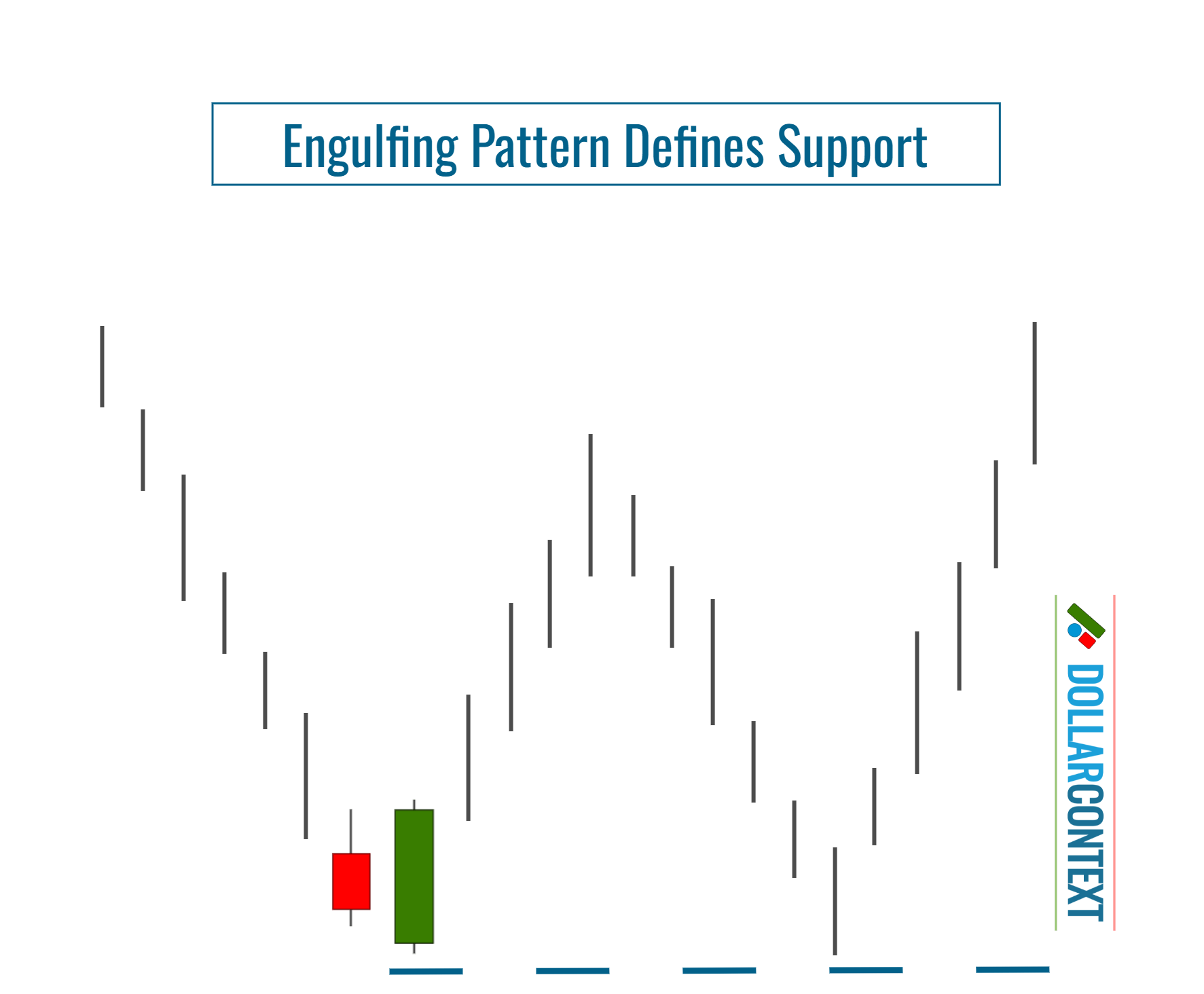

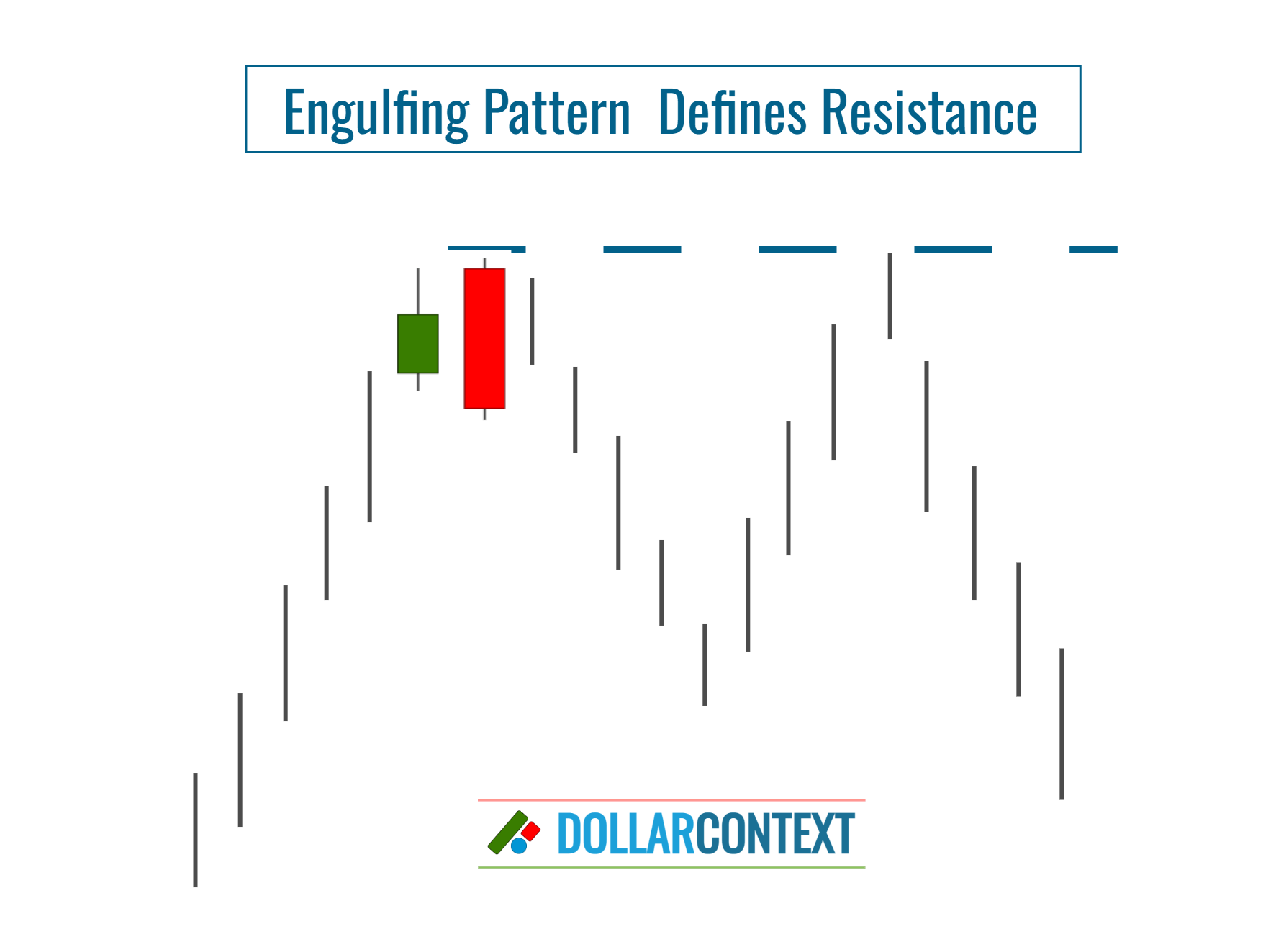

2. Engulfing Pattern Defines New Support or Resistance

When a bullish engulfing pattern defines a new low, it sets up a fresh support zone that may be tested in the future.

This rule is valid in the inverse scenario as well. After establishing a new high, the bearish engulfing pattern creates a new resistance area, which might face a test in the future.

3. Breakout of the Support/Resistance Area

When initiating a position based on the engulfing pattern, it's essential to set a specific price point at which you should reconsider your initial plan. This designated price can serve as the starting stop-loss for the engulfing pattern strategy.

If a session distinctly closes below the support or exceeds the resistance established by the engulfing pattern, the market is likely to persist in its preceding trend. However, as detailed in the following section, there are exceptions.

4. False Breakouts

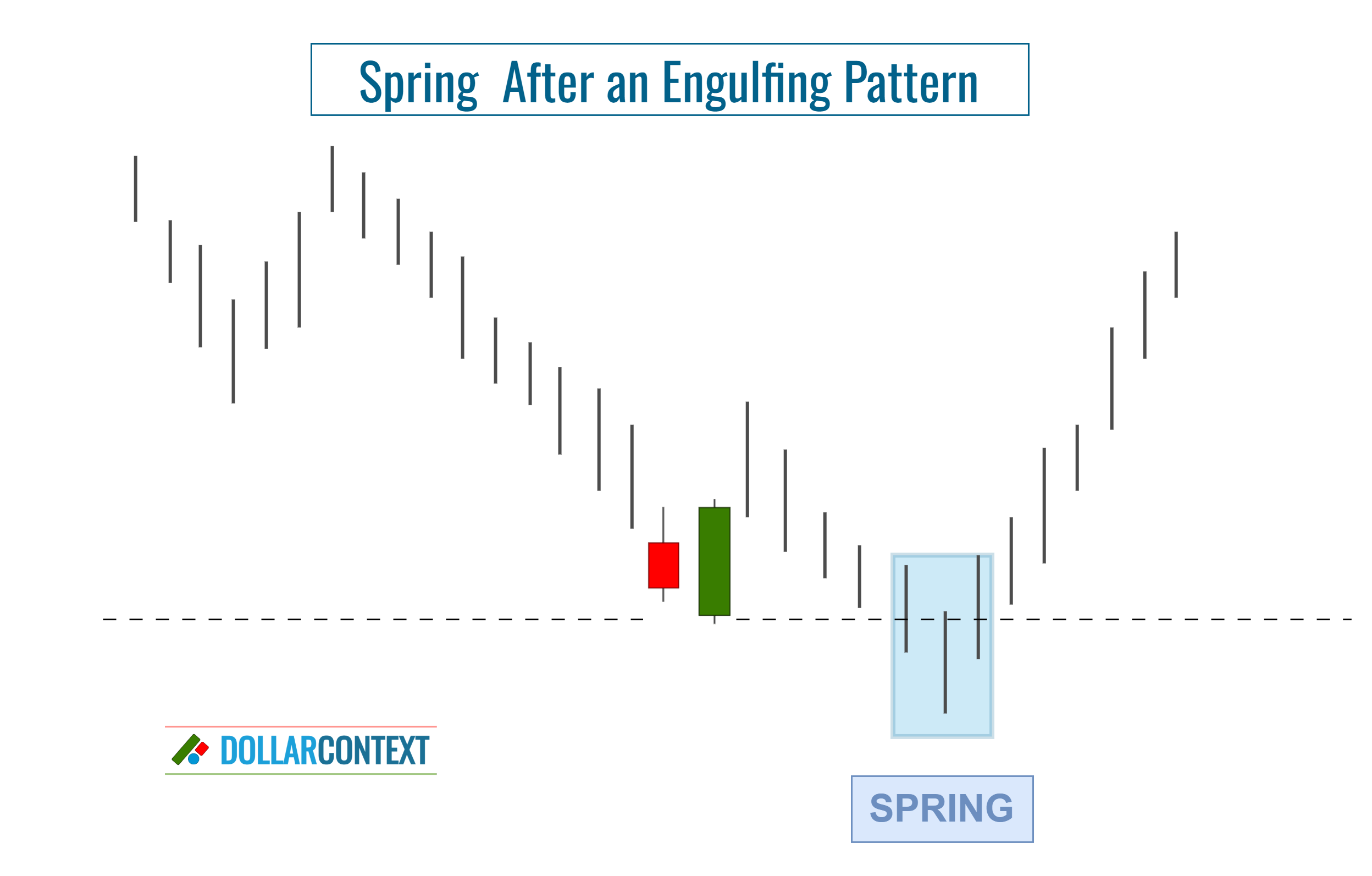

When a support level is broken, many traders interpret it as a potential indicator that the price may further move in the direction of the breakout. However, markets sometimes act against these expectations. Instead of sustaining the trend, they could reverse, reverting to their prior range. This phenomenon is commonly known as "false breakout" or "spring". The same principle applies when a resistance level is exceeded.

To mitigate the risk of a false breakout, consider these recommendations:

- Set your stop-loss based on the session's closing price, rather than getting swayed by intra-session price movements.

- Contemplate adding a buffer to your designated stop-loss point.

- When subsequent bullish candlestick patterns confirm the support set by the bullish engulfing pattern, the probability of a successful breakout decreases notably. The converse is true when additional bearish candlestick patterns appear close to the resistance marked by a bearish engulfing pattern.