What Is an Engulfing Pattern Variation?

Not all engulfing patterns are equally relevant. They can be presented in different configurations or variations.

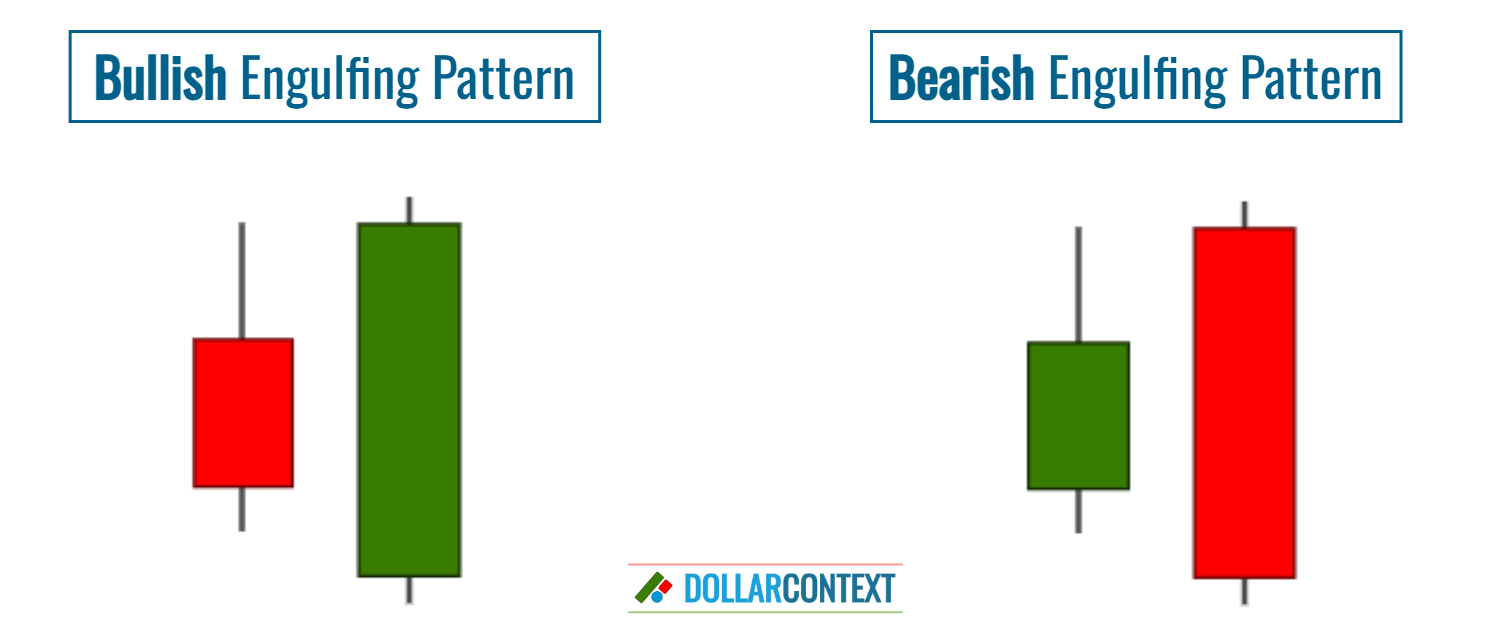

In Japanese candlestick charting, the foundational structure of an engulfing pattern is represented by two opposing candlesticks:

- Bullish Engulfing Pattern: It usually starts with a minor bearish (typically red or black) candle, which is then completely enveloped by a larger bullish (usually green or white) candle, indicating a possible shift towards an upward trend.

- Bearish Engulfing Pattern: This pattern generally begins with a small bullish (commonly green or white) candle. It is then followed by a dominant bearish (red or black) candle that encompasses the preceding one, pointing towards a potential downward trend change.

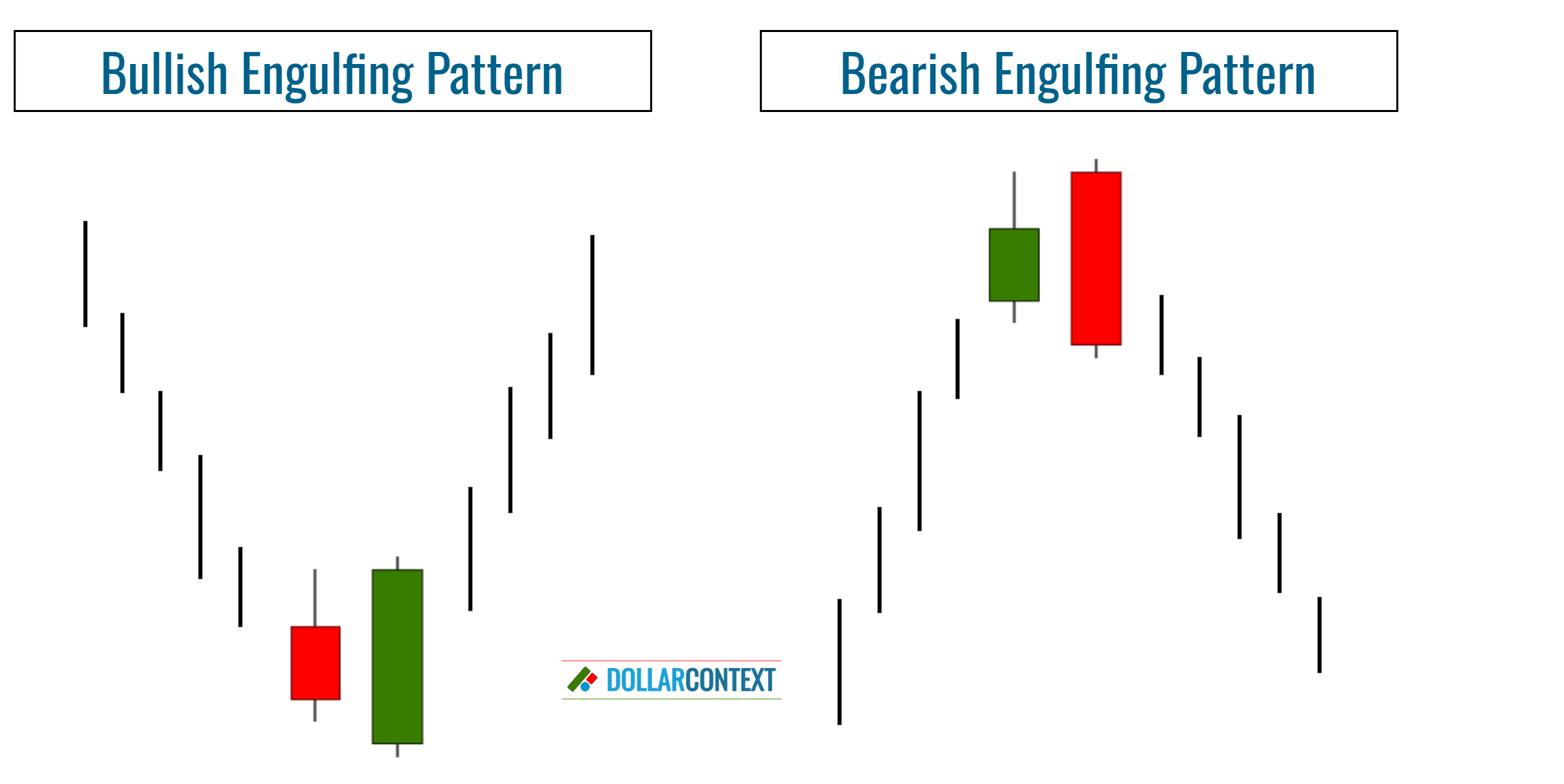

The engulfing pattern is a reversal indicator that, to hold significance, should be preceded by a trending market.

What Is an Engulfing Pattern Variation?

The basic concept of an engulfing pattern establishes that the real body of the second candle must encompass the real body of the preceding candle, which is of an opposite color. However, not all engulfing patterns are equally relevant.

The importance of an engulfing pattern is determined by:

- The relative size of the real bodies

- The relationship between the shadows

- Other contextual factors

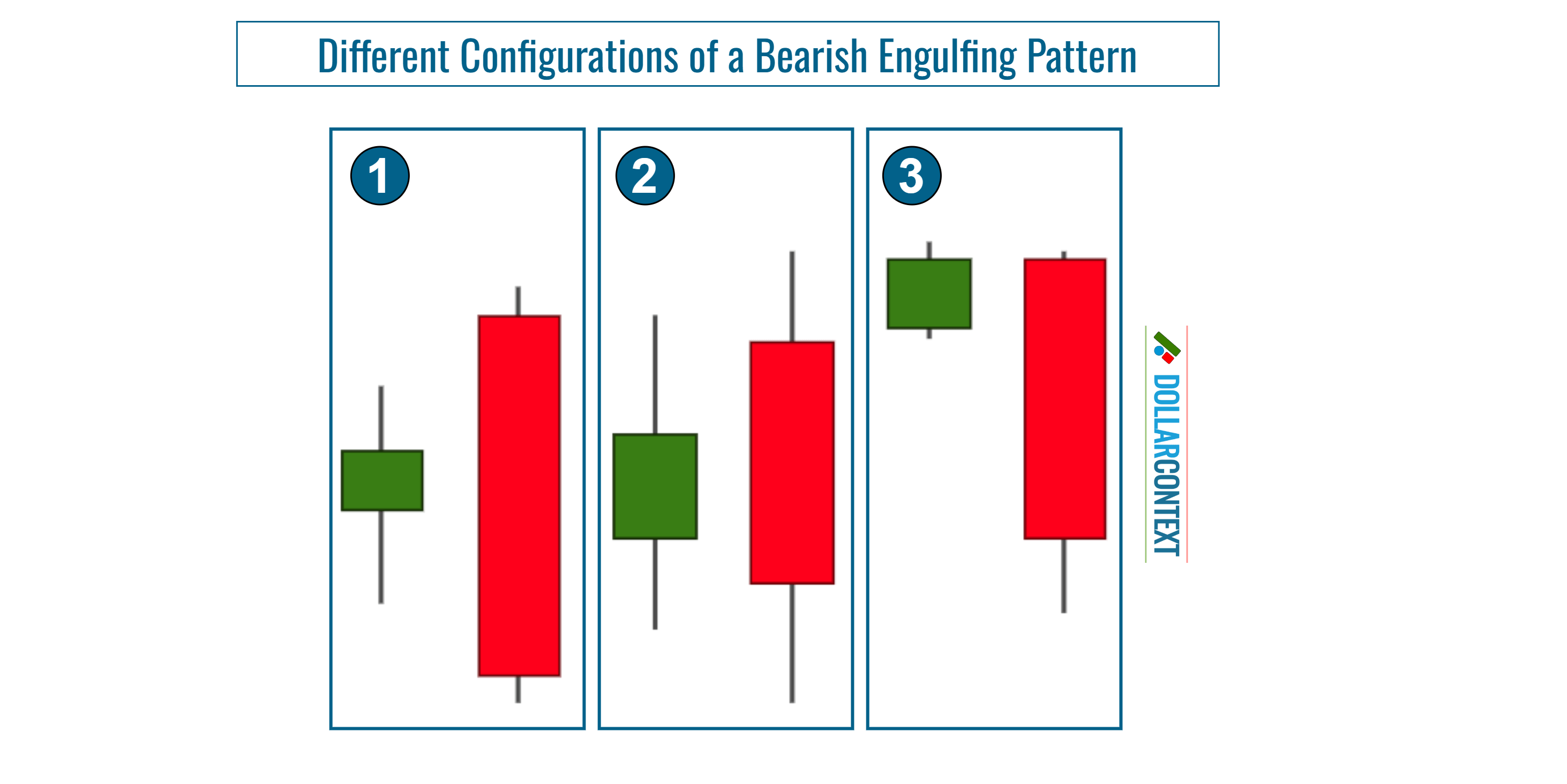

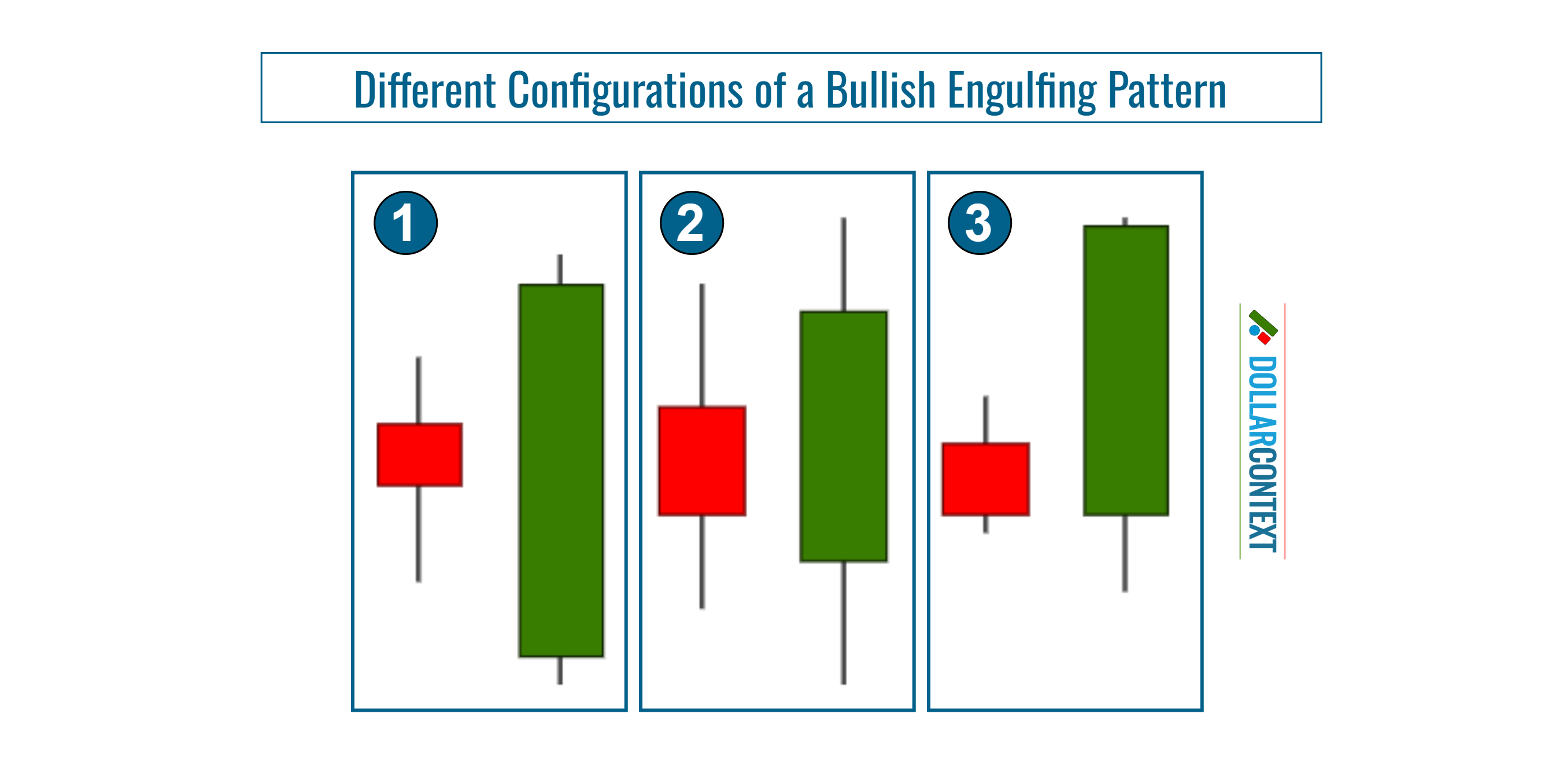

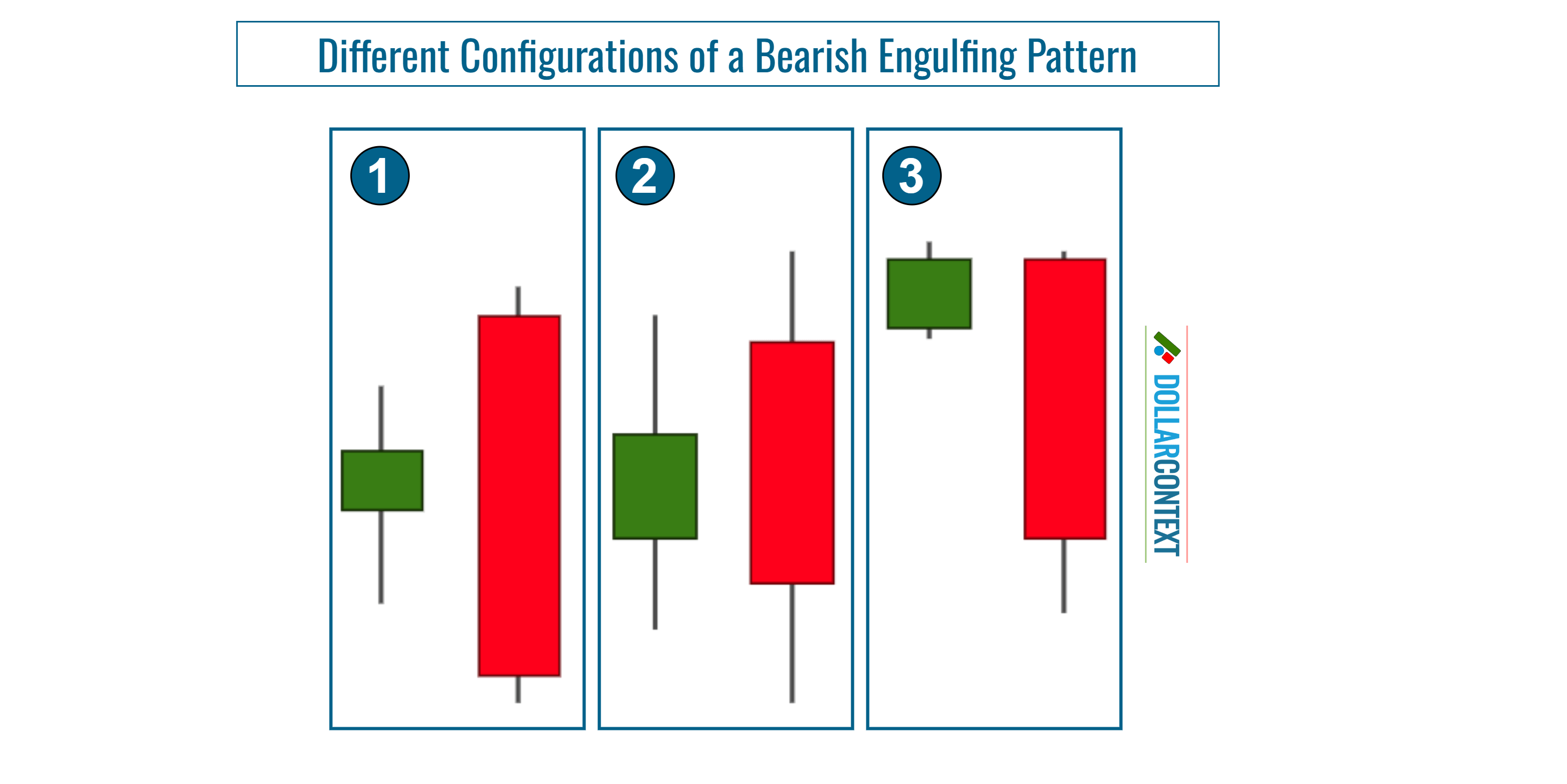

They can be presented in different configurations or variations:

- The ideal bullish engulfing pattern features a small initial candle, followed by a considerably larger second candle, with its body fully encapsulating the first candle, including the shadows (engulfing pattern marked as "1" in the image below).

- Another notable configuration arises when the second candle's shadows extend beyond those of the first, signifying that the market experienced both a higher high and a lower low on the engulfing pattern's second day (pattern "2" in the image).

- In markets with low volatility or when examining shorter timeframes, such as minutes or hours, a more adaptive criterion is suggested for identifying engulfing patterns. For instance, many analysts deem it an engulfing pattern if the second session's opening aligns with the first candle's close. In these situations, it's wise to look for supplementary confirmation indicators to determine the likelihood of a reversal. More insights on this are shared in the subsequent section.

The same principle applies in the opposite direction.

Determining the Importance of an Engulfing Pattern Variation by Context

While the specific variation of an engulfing pattern is important, considering the contextual factors in which the pattern emerges are equally significant. These are detailed below.

- Contrast of Real Body Sizes: A small real body on the first session and an extended one on the second indicates the previous trend's diminishing momentum.

- Previous Market Trend: Engulfing patterns after long trends or swift movements indicate markets are ripe for profit-taking.

- Engulfing Multiple Sessions: If the engulfing pattern's second candle covers multiple real bodies, a reversal is more probable.

- Major Support/Resistance Zones: Patterns within these zones heighten the reversal chances.

- Post-Doji Appearance: An engulfing pattern following a doji amplifies its significance.

- Other Reversal Patterns: Concurring patterns near the engulfing pattern's price range further hint at a potential reversal.