Evening Star Pattern: Criteria to Qualify

This article covers the criteria and conditions to qualify an evening star pattern as a reversal indicator.

This article is part of the Evening Star candlestick pattern tutorial series. For the complete guide, see the Evening Star Candlestick Pattern — Complete Guide.

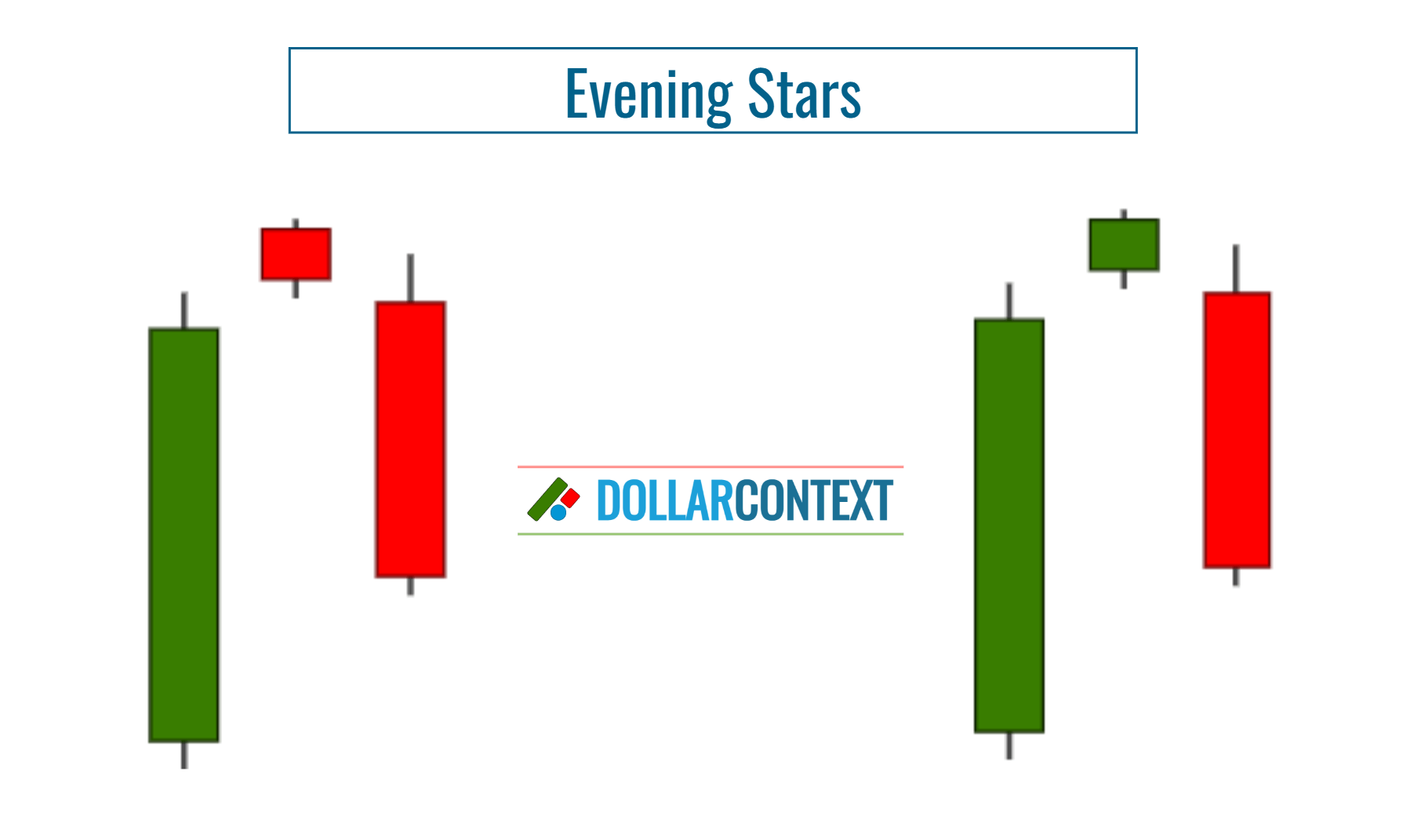

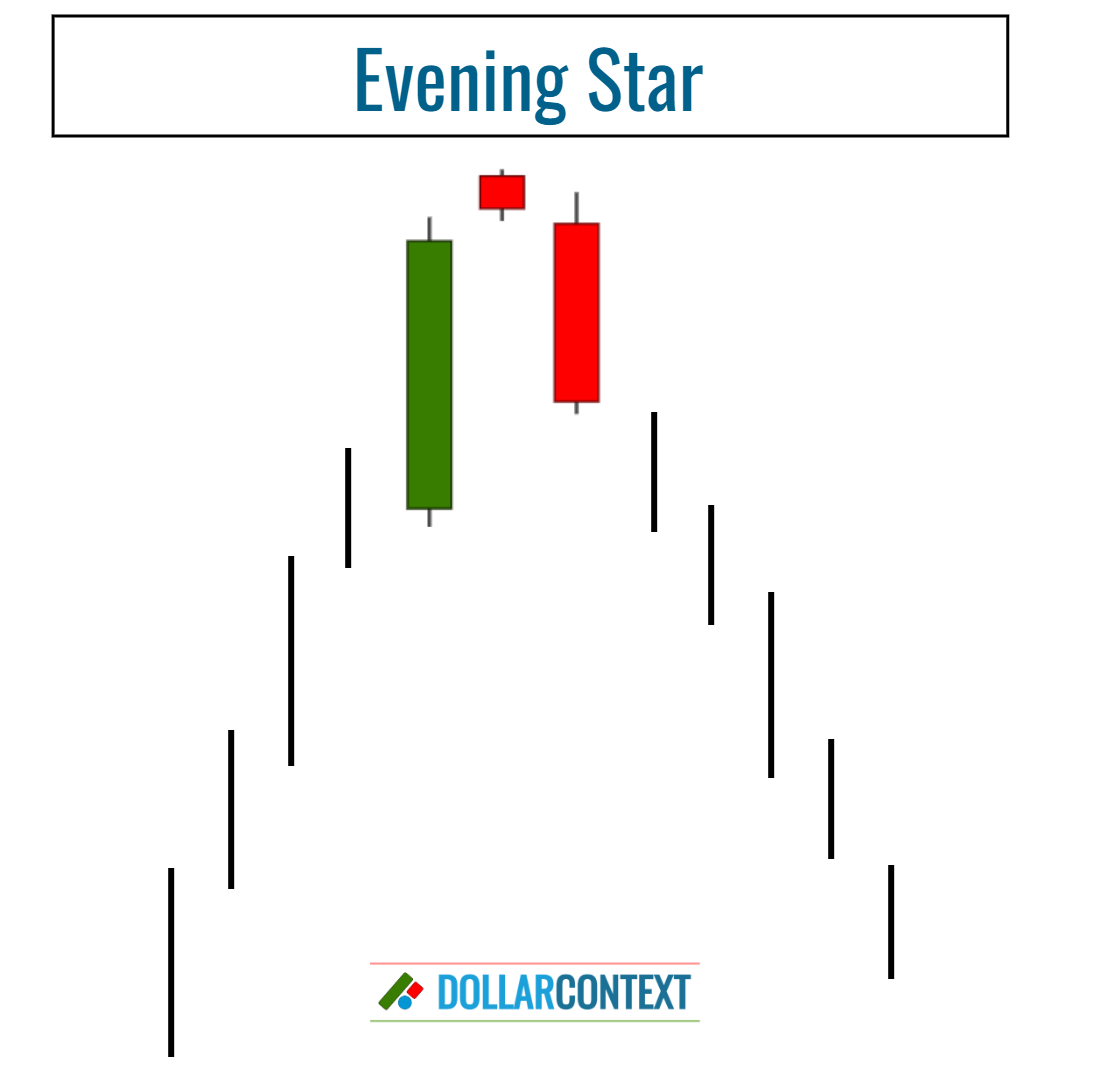

The evening star is a three-candle bearish reversal pattern that appears at the end of an uptrend.

Basic Criteria

Four basic conditions must be met for a pattern to be classified as an evening star:

- Uptrend Precedence: The pattern must form after an established uptrend in price. The longer the uptrend and the more overbought the market, the more reliable the signal of this pattern becomes.

- First Candle: The first candle should be a relatively large bullish candle (green or white).

- Second Candle (Star): This is a small-bodied candlestick (which could be bullish or bearish). Ideally, it should gap above the close of the previous candle. The star represents market indecision and a potential change in trend.

- Third Candle: The formation concludes with a large bearish (red or black) candle that opens below or at the close of the second candle and almost always closes at least halfway down the body of the first candle, showing a shift towards selling pressure.

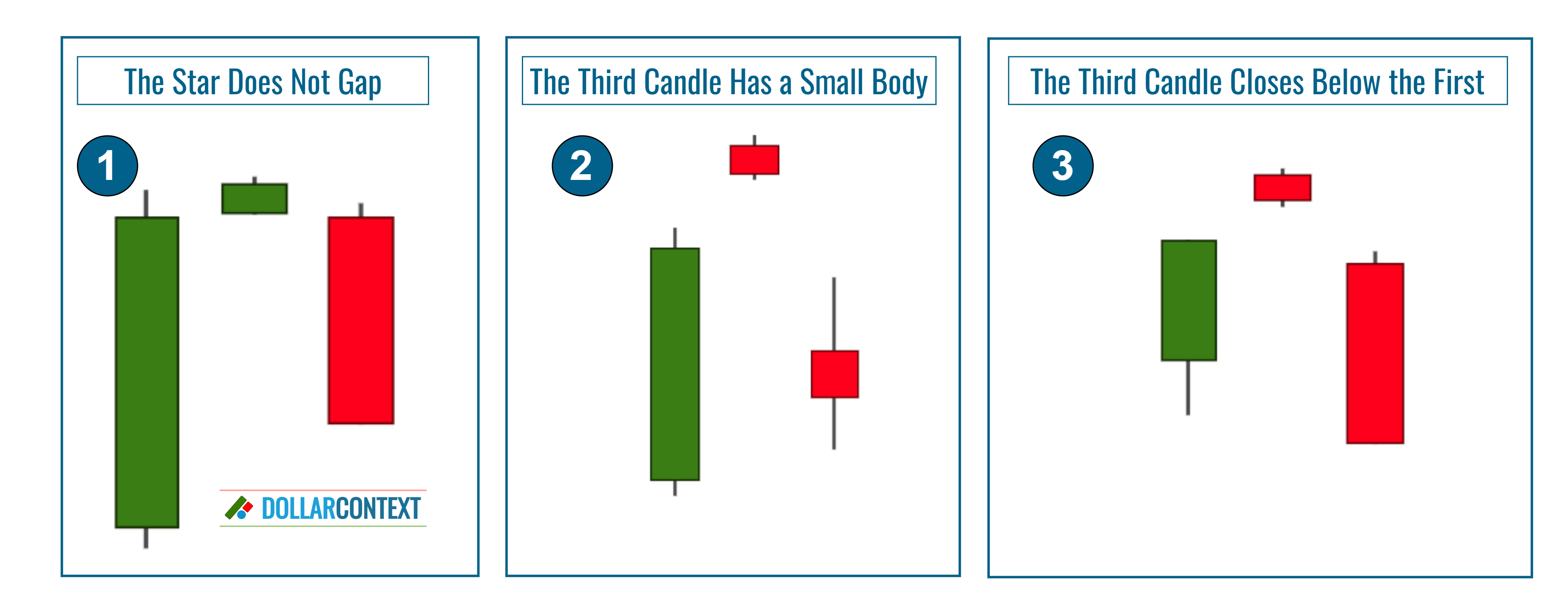

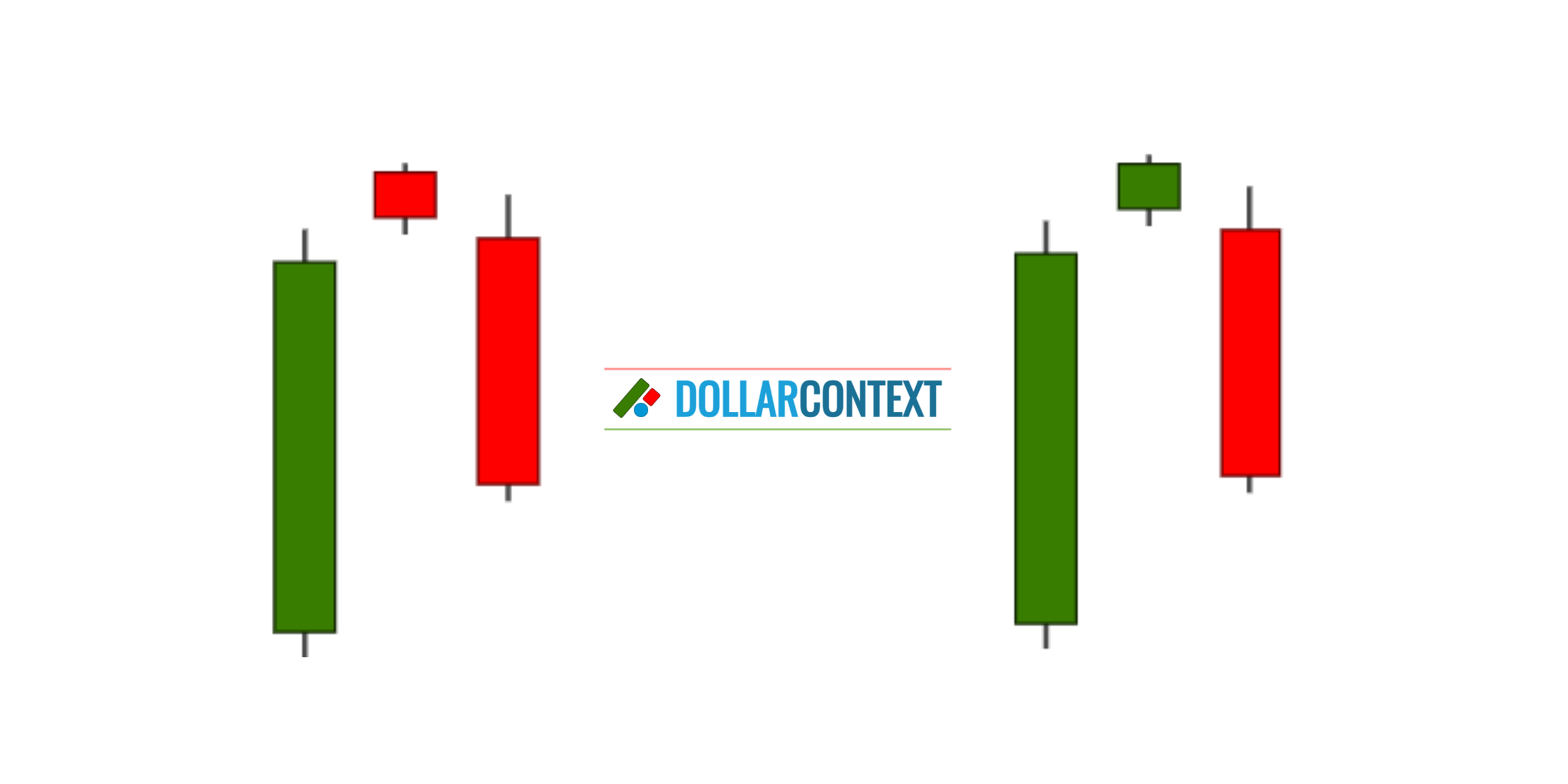

Variations

While the checklist detailed above provides the classical definition of an evening star pattern, real-world applications might see slight variations still accepted by traders as valid evening stars, provided the essential characteristics of the trend reversal are present.

Here are the common variants of the evening star pattern you might encounter:

- Non-Gapping Star: This is often seen in markets with lower volatility or on shorter timeframes, where the star candle may not exhibit a gap. In these scenarios, traders are usually advised to seek further bearish confirmation before engaging.

- Modestly Sized Third Candle: In such a scenario, it's essential that the third candle penetrates deeply into the terrain of the first. A shallow close calls for additional corroborative signals before considering a bearish entry.

- The Third Candle Closes Below the First: This configuration suggests a strong bearish conviction. A third candle closing beneath the first's opening underscores a robust sentiment shift, possibly prefacing a bear market inception.