Visual Characteristics of the Evening Star Pattern

In this article, we'll explore the layout of an evening star pattern in Japanese candlestick analysis and how to identify this reversal indicator.

This article is part of the Evening Star candlestick pattern tutorial series. For the complete guide, see the Evening Star Candlestick Pattern — Complete Guide.

In this article, we'll explore the layout of the evening star pattern in Japanese candlestick analysis and how to identify this reversal indicator.

The Basic Shape of an Evening Star

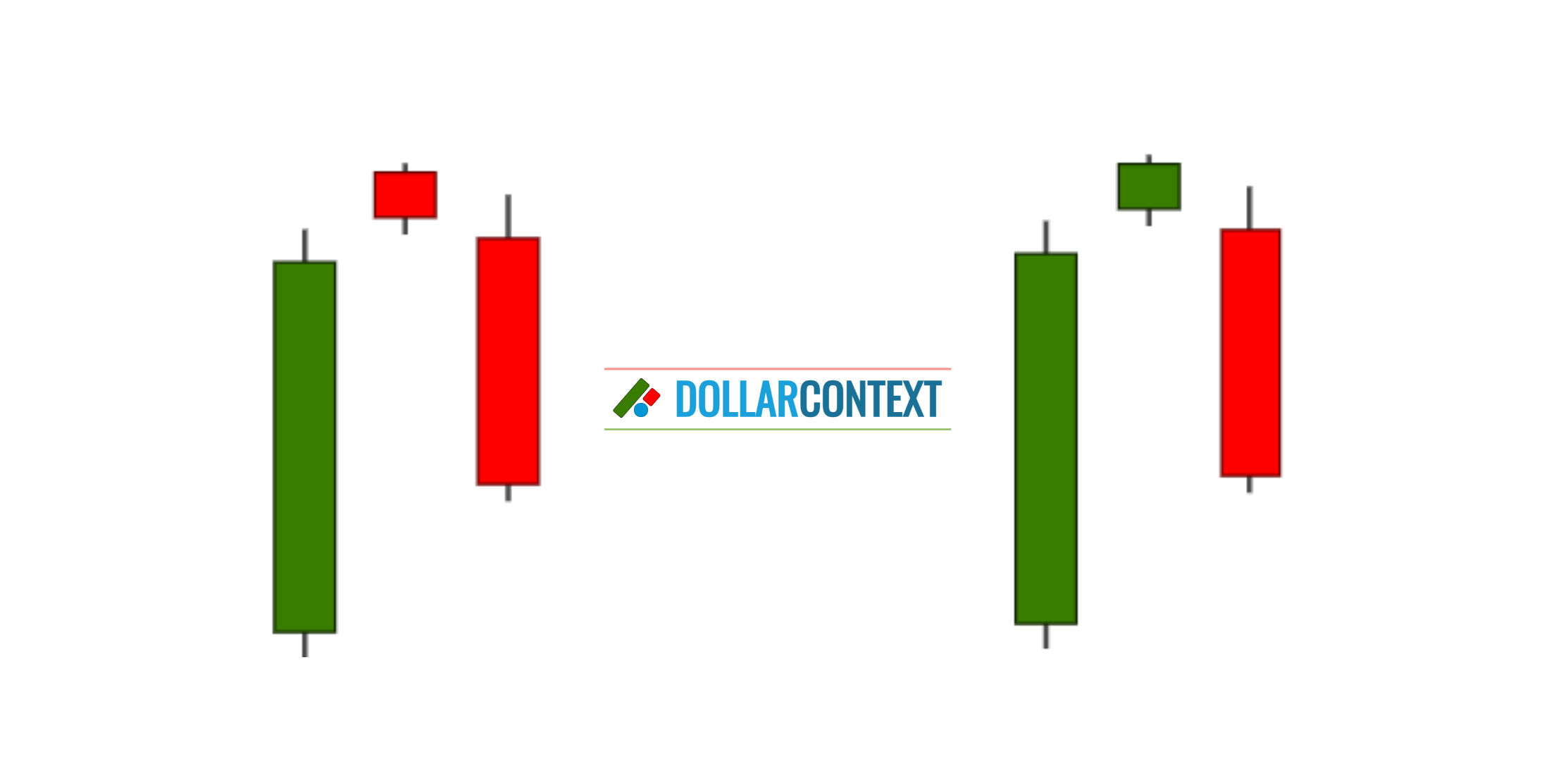

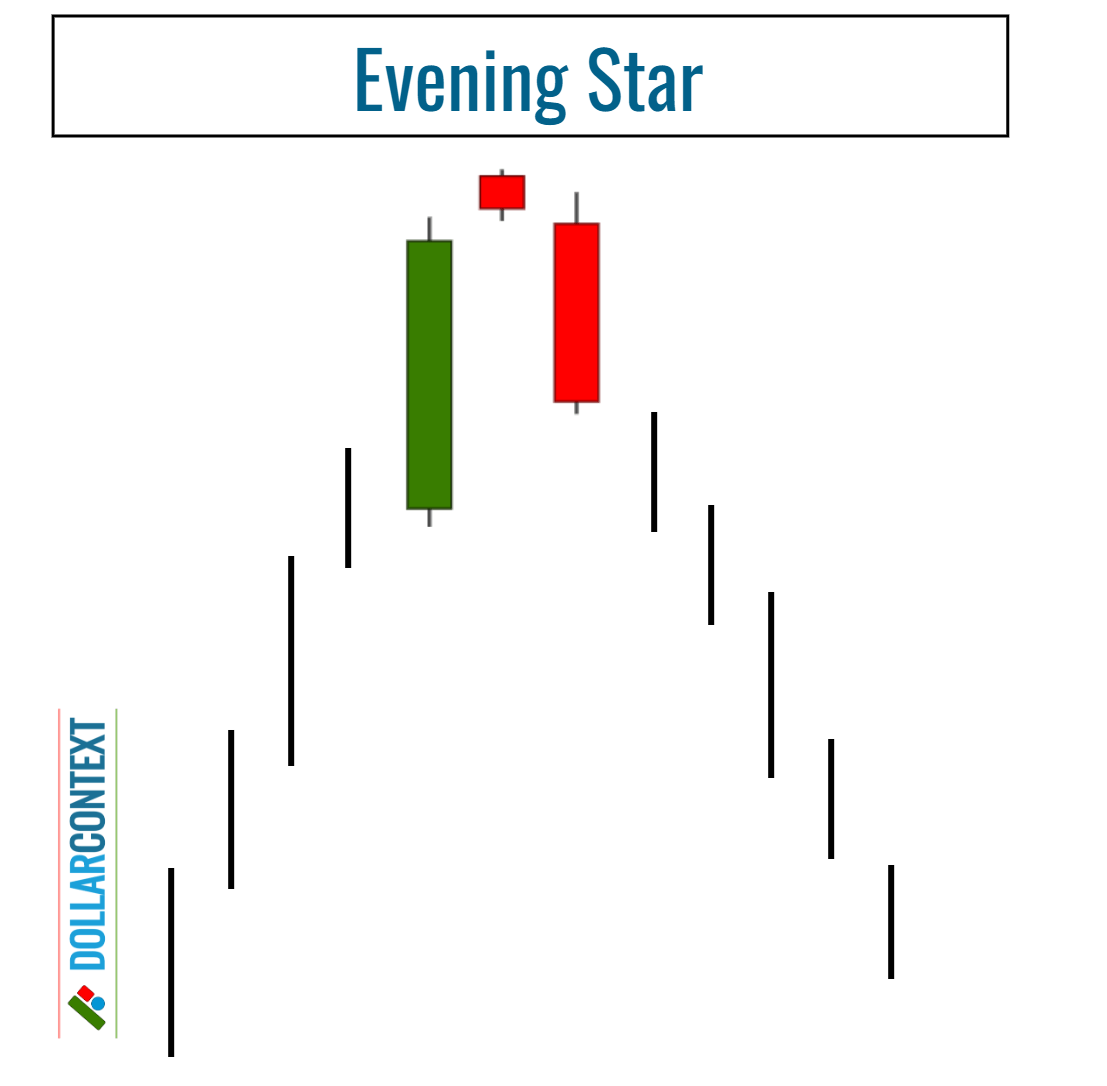

The evening star is a bearish reversal pattern that typically occurs at the end of an uptrend. It consists of three candles:

- First Candle: A long bullish (green) candlestick that signifies a continuation of the existing uptrend.

- Second Candle: A small-bodied candle (also called a "star"), often resembling a doji or a spinning top. This candle gaps up from the close of the first candle, indicating indecision and a potential change in market sentiment.

- Third Candle: A strong bearish (red) candlestick that closes well into the body of the first candle, ideally more than halfway. This candle signifies the reversal and the beginning of a new downtrend.

The overall shape of the pattern resembles a peak or a pinnacle, with the first candle forming the ascent, the second candle forming the peak, and the third candle signifying the descent. The pattern effectively captures the shift from bullish to bearish sentiment and is considered a reliable indicator of an impending downtrend.

The star (the second candlestick of the formation) can be green or red.

Evening Doji Star and Abandoned Baby

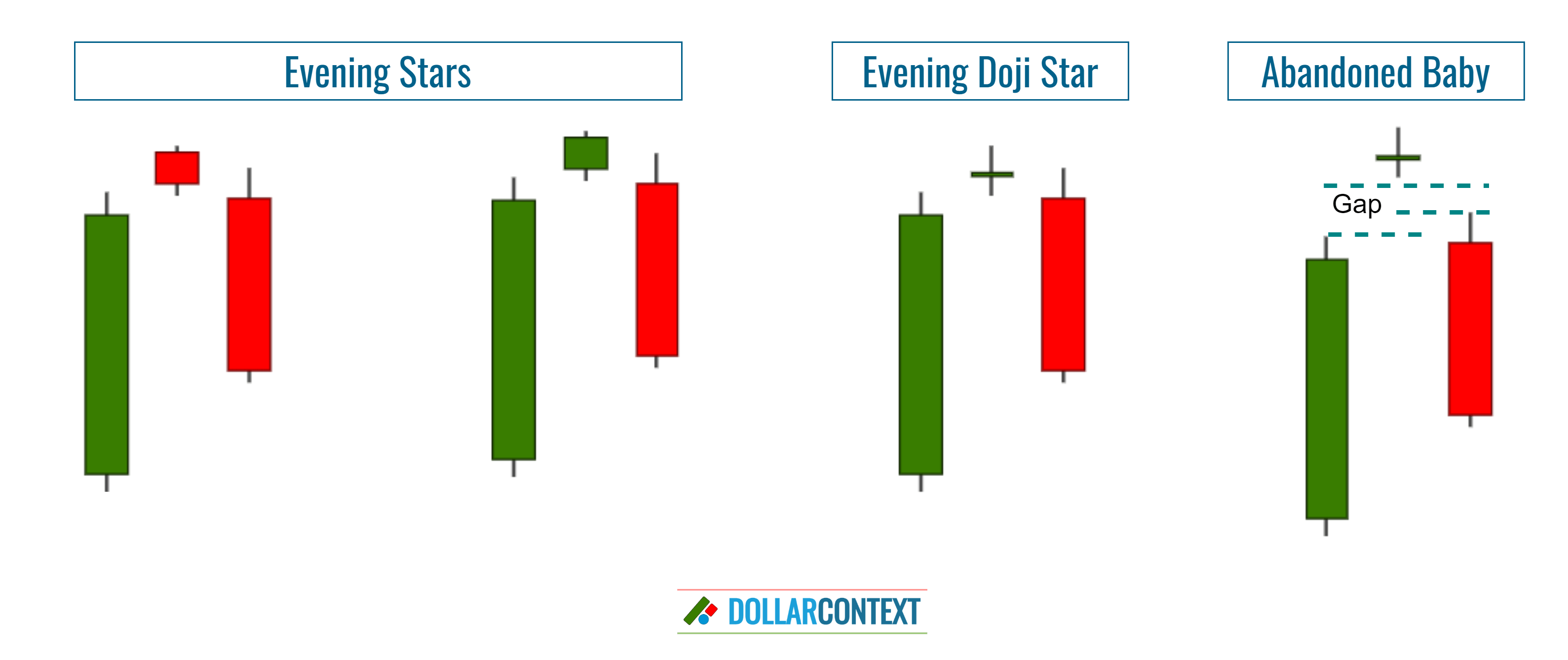

There are three basic subtypes of the evening star pattern: the standard evening star, the evening doji star, and the abandoned baby.

Evening Doji Star: If the second candle of the evening star is a doji instead of a small real body, then the pattern is specifically referred to as an "evening doji star."

Abandoned Baby Top: If a doji with an upward gap (meaning the shadows don't overlap) is followed by a downward-gapping black candlestick whose shadows also don't touch, this formation is recognized as a significant top reversal signal, commonly known as "abandoned baby top."

Factors that Increase the Likelihood of a Reversal

Other factors that increase the likelihood of an evening star acting as a strong reversal signal are:

- Sizes of the First and Third Candles: If the evening star pattern starts with a conspicuously long green real body and the third candlestick delves deep into the real body of the first, it suggests that the momentum of the preceding trend is diminishing.

- Preceding Market Trend: When an evening star appears following a prolonged or steep market trend, it suggests the market is overstretched and ripe for profit-taking.

- Resistance Area: If the pattern materializes within a key resistance region, the odds of a market reversal increase.

- Forming an Upthrust: An upthrust occurs when the price of an asset temporarily breaks above a resistance level, leading traders to believe a breakout is in progress. However, the price quickly reverses and moves back below the resistance level. When the sessions that include the upthrust form an evening star, the likelihood of a market reversal increases significantly.

- Subsequent Candlestick Patterns: The presence of additional reversal patterns in proximity to the price range of the morning star enhances the likelihood of a market turnaround.