Evening Star Variations: Concept and Interpretation

In real-world trading, variations of the evening star that may not perfectly align with the ideal form can still be valid, given certain market conditions.

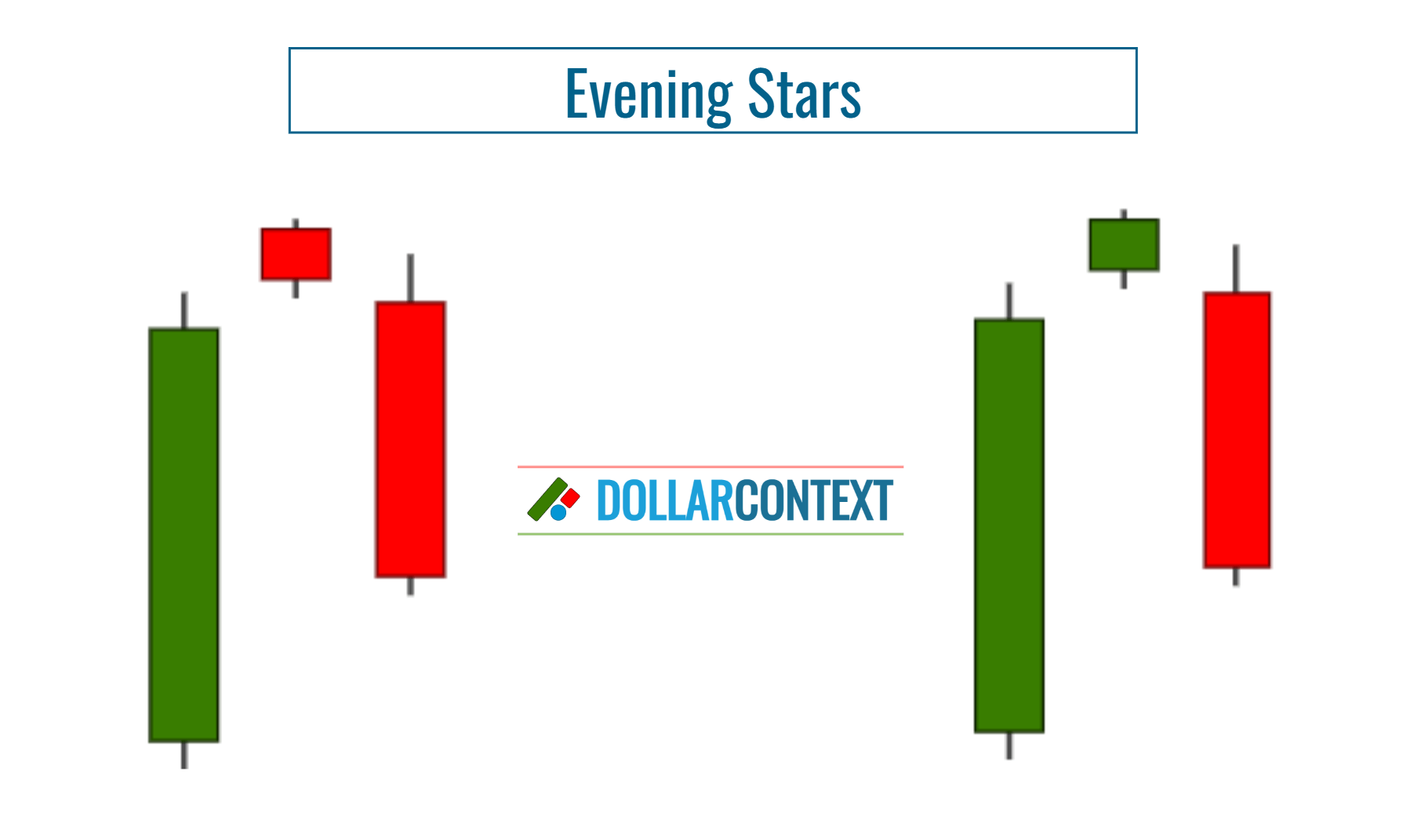

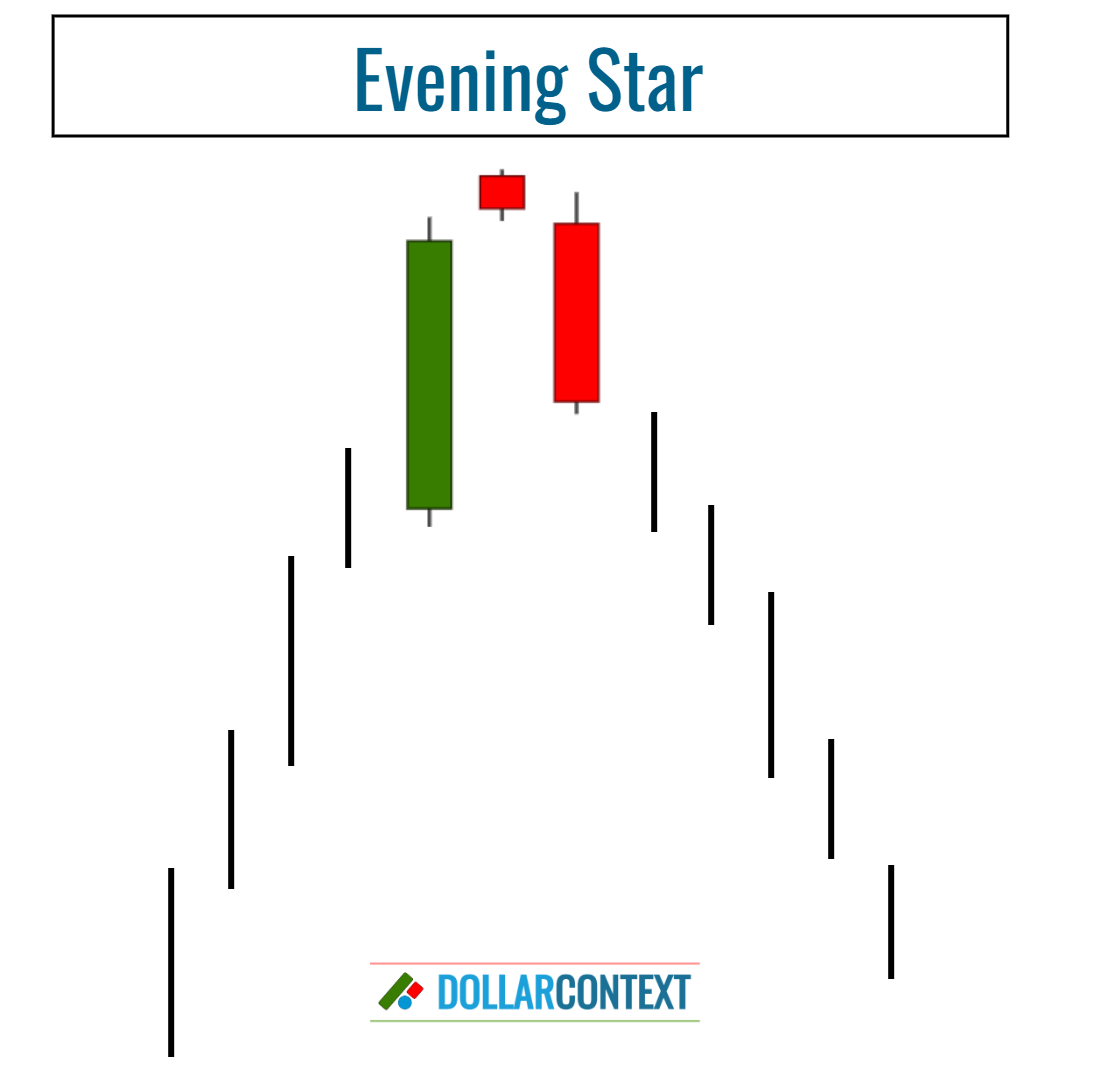

In Japanese candlestick charting, the ideal structure of an evening star pattern is represented by three candlesticks:

- The first candle has a long green body and a small or non-existent upper wick, signifying strong buying pressure.

- The second candle has a small body and should gap above the close of the first candlestick, indicating a continuation of the uptrend but with decreasing momentum. The real body of the second candle can be red or green.

- The third candle is a bearish one, with a long body and little to no upper wick. Ideally, this candle should open below the close of the second candlestick and close well into the body of the first candlestick, confirming a potential reversal in trend.

Since the evening star pattern is considered a bearish reversal pattern, it should appear after an uptrend. Traders often use this technique as a sell signal.

What Is an Evening Star Variation?

The criteria outlined above depict the ideal or textbook version of the evening star pattern. However, in real-world trading, variations that may not perfectly align with the ideal form can still be valid, given certain market conditions.

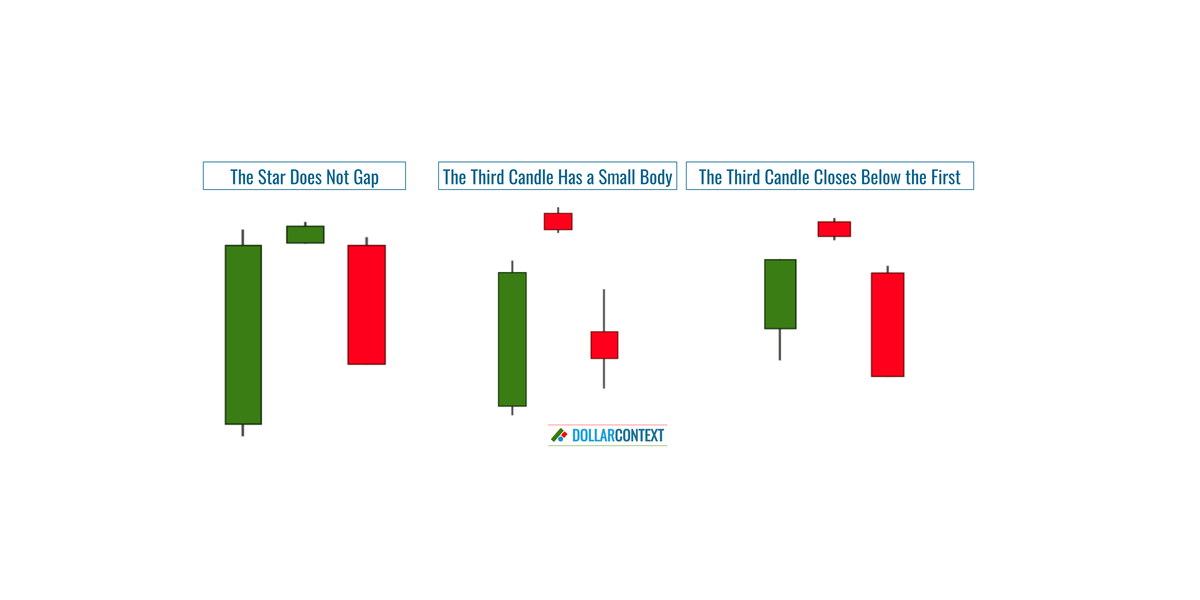

These are the most common variations of an evening star pattern:

- The Second Candle (Star) Does Not Gap

- The Third Candle Has a Small Red/Black Body

- The Third Candle Closes Below the First

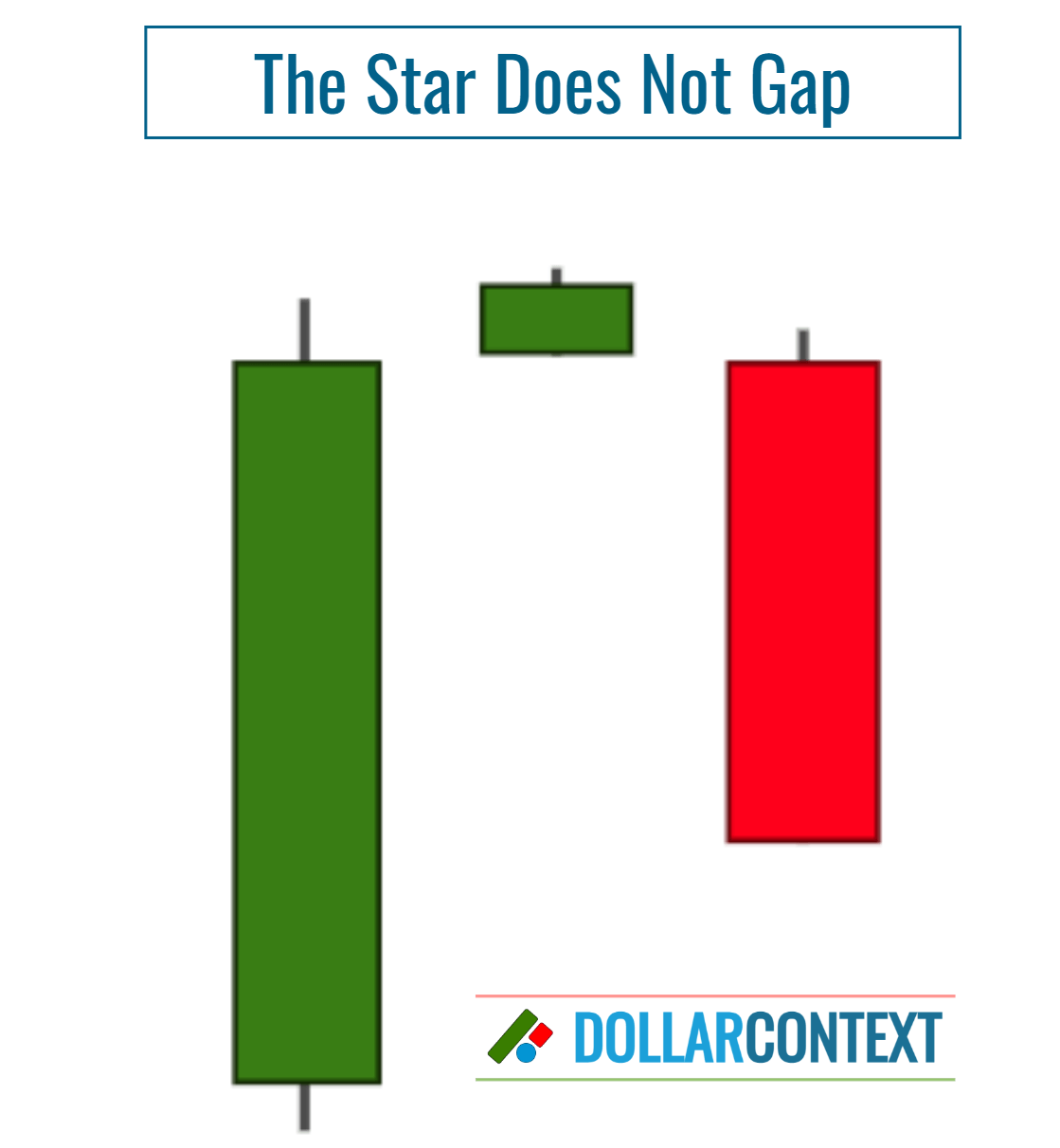

1. The Second Candle (Star) Does Not Gap

Those variations include instances where the second body, typically referred to as the star, does not gap above the close of the first candlestick. This situation is pretty common in low volatile markets or when using lower charting timeframes, such as minutes or hours.

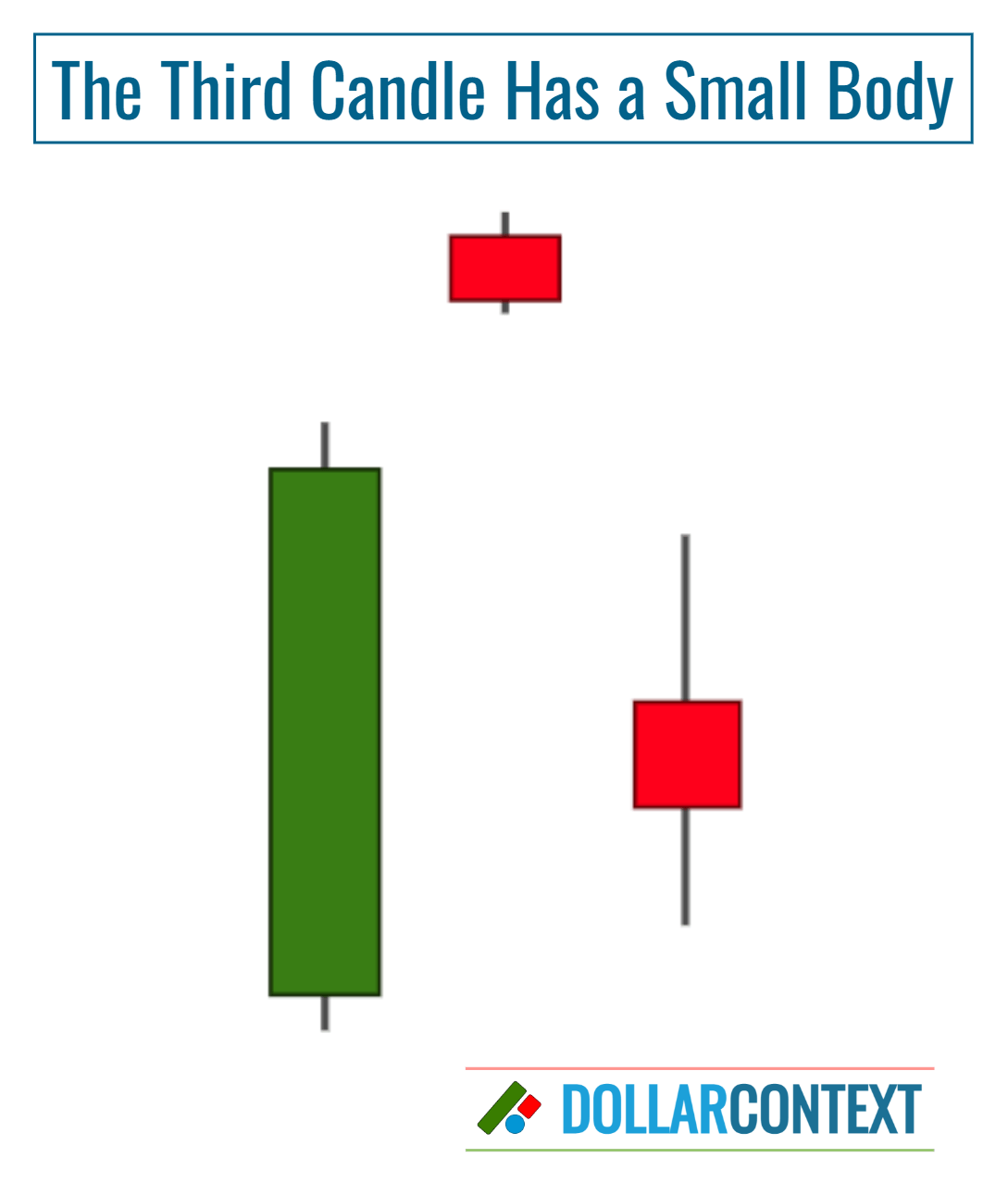

2. The Third Candle Has a Small Red/Black Body

The evening star illustrated below is different from the more traditional evening star in that the third body of this formation is a small red body rather than a long red one. However, under certain conditions, this variation can carry all the bearish implications of the more traditional evening star. This is because the third candle of this evening star, although not a tall red candle, it reflects the strength of the bears by the fact that they were able to pull the prices deep into the first real body of the pattern.

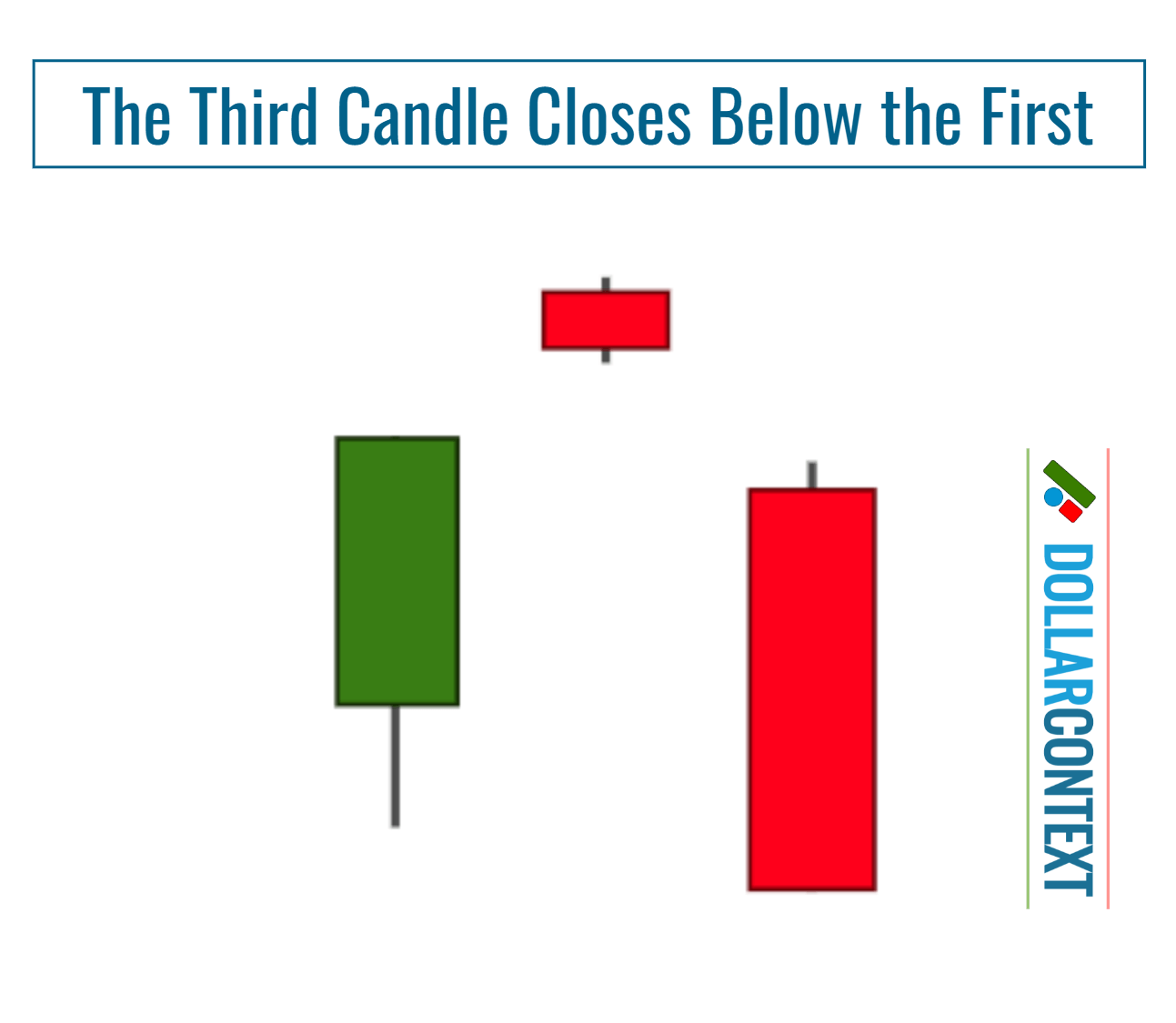

3. The Third Candle Closes Below the First

A third variation of the evening star occurs when the third candlestick closes below the opening of the first candle. In this configuration, the length of the third red candle reflects the strength of the sellers.

Should You Trade From an Evening Star Variation?

How do you determine if you should trade from a less than ideal evening star pattern? We offer these guidelines for your consideration:

- Wait for More Confirmation: Specifically, observe the market behavior in the session following the evening star variation to determine if it continues to show weakness.

- Previous Market Trend: The more overbought the market and the more advanced the preceding uptrend, the greater the likelihood that a variation of the evening star will serve as a top reversal.

- Major Support/Resistance Zones: Variations that occur within key support or resistance areas are more likely to be followed by market turns.

- Additional Reversal Patterns: The presence of additional candlestick patterns near the price range of the evening star variation further suggests a potential reversal.