Hammer: How to Set Your Stop loss

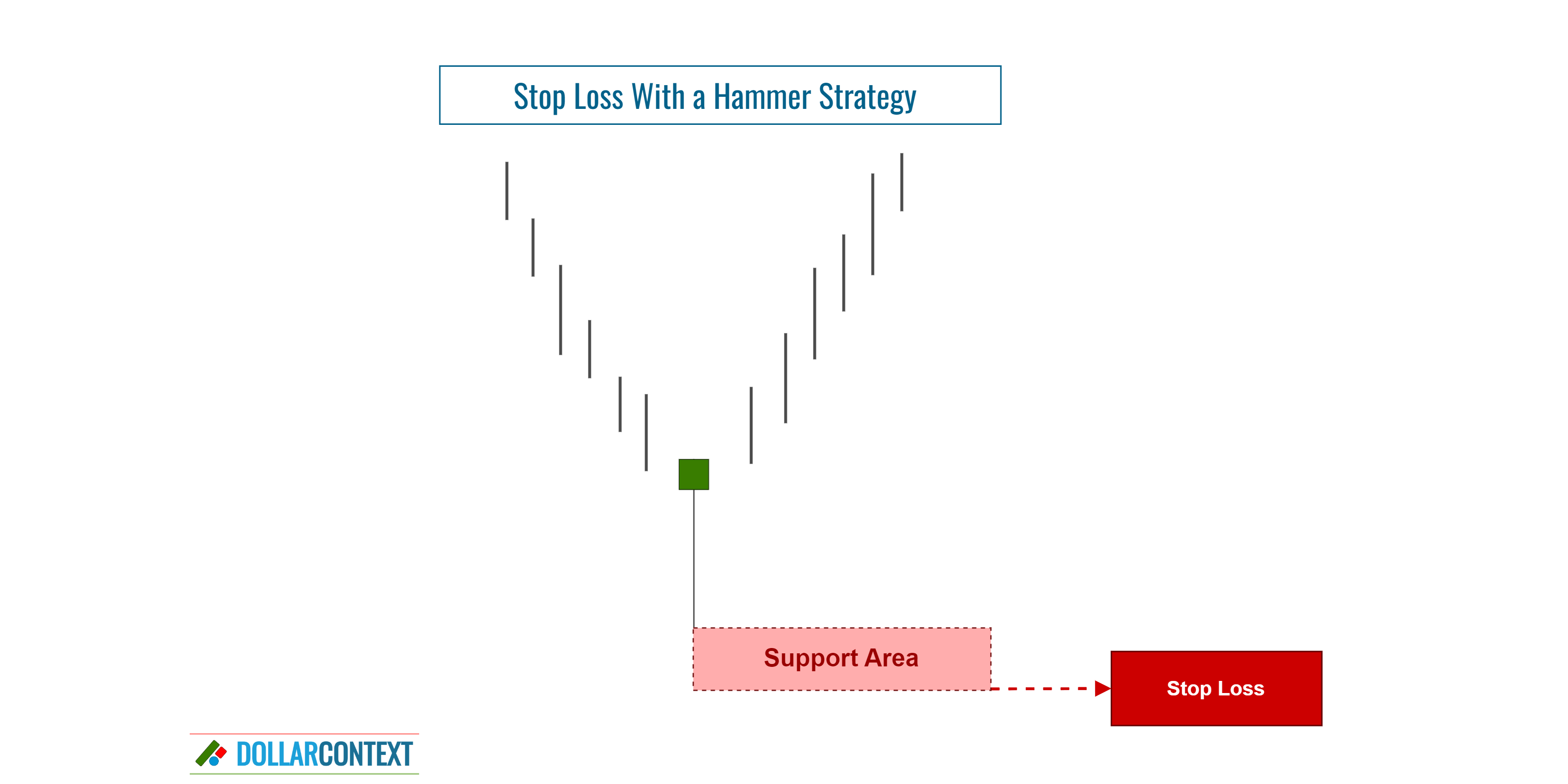

Set the stop-loss level below the low of the hammer pattern to protect against potential downside risk.

Setting a stop-loss level is a crucial aspect of trading, and it becomes especially important when considering the implementation of a hammer strategy. A hammer is a candlestick pattern that typically indicates a potential reversal in a downtrend.

In this post, we'll explain how you can effectively set a stop-loss when using the hammer pattern in your trading strategy.

1. Correct Identification

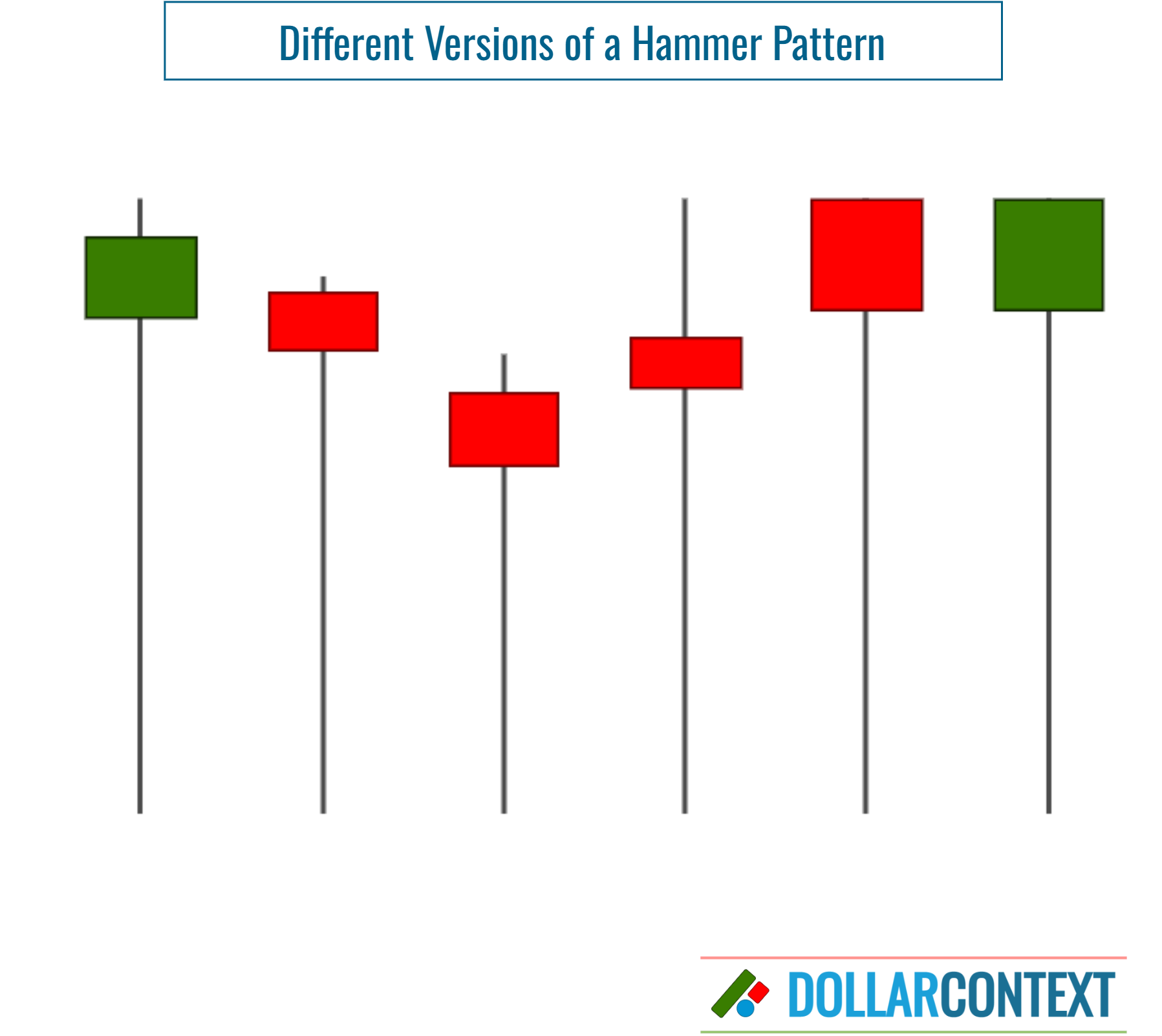

Make sure you correctly recognize the hammer pattern on your chart. This is a single-candle pattern characterized by:

- a small real body at the higher end of the candle,

- an elongated lower shadow, and

- a very short (or nonexistent) upper shadow.

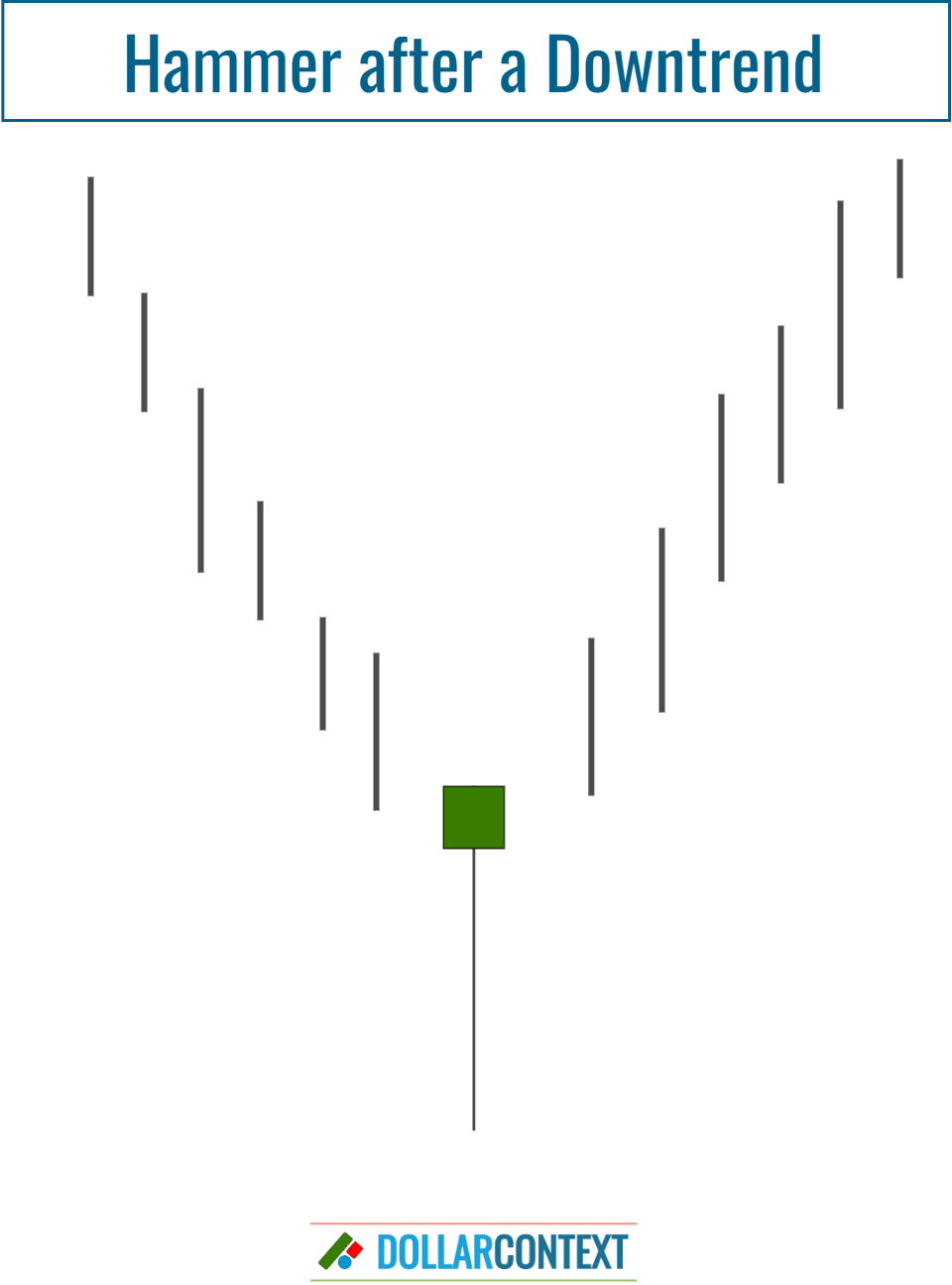

2. Verify the Preceding Trajectory

Psychologically, a hammer indicates a change in market sentiment. The market transitions from a bear to a bull trend; and as a reversal indicator, it requires a previous downward trend to reverse.

When the market is either confined within a narrow range or undergoing an uptrend, a hammer generally lacks meaningful significance.

3. Determine the Support Threshold

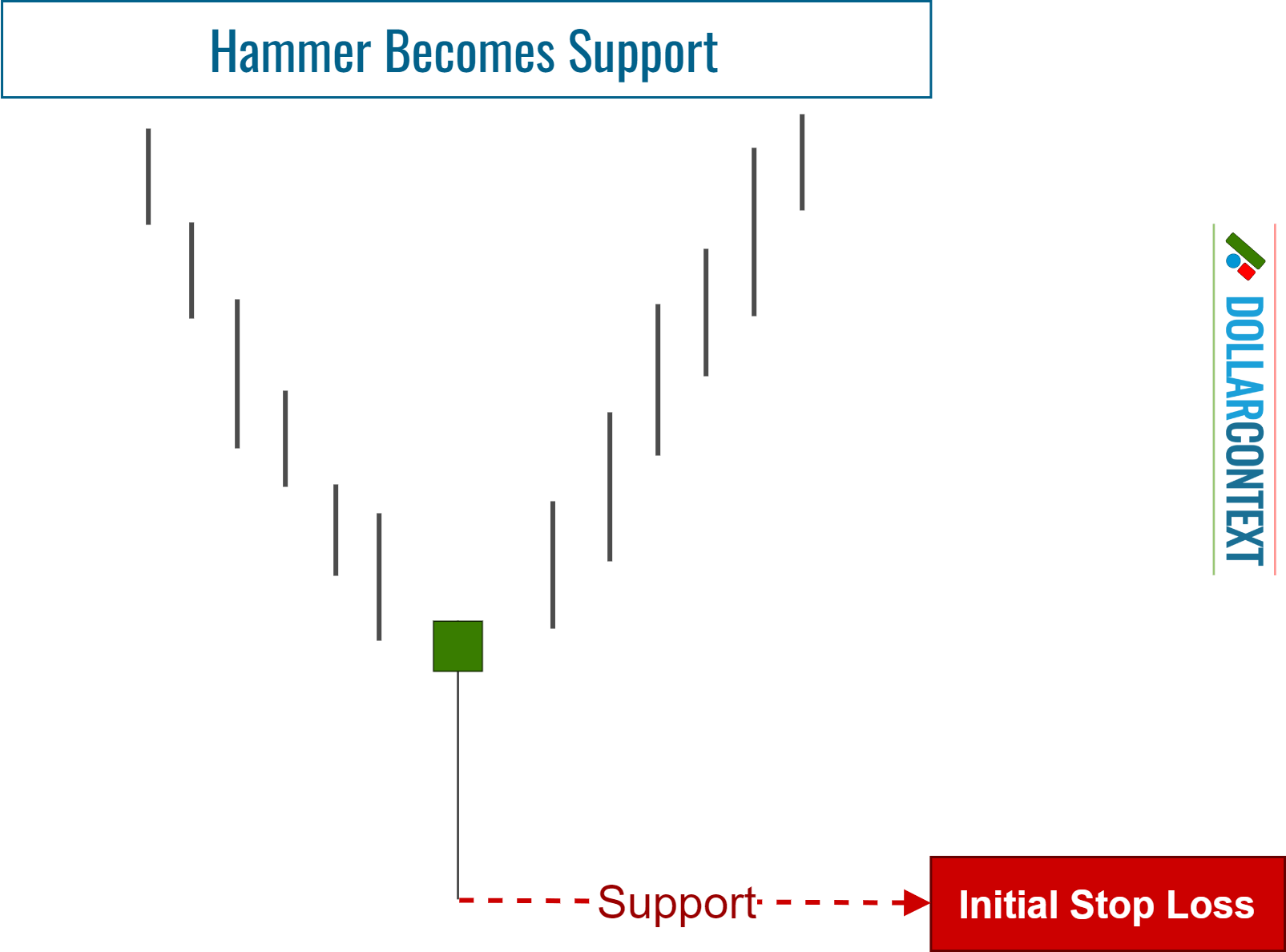

The price range of a hammer becomes support. Specifically, the low of the session represents a support level that you can use as your initial stop loss point.

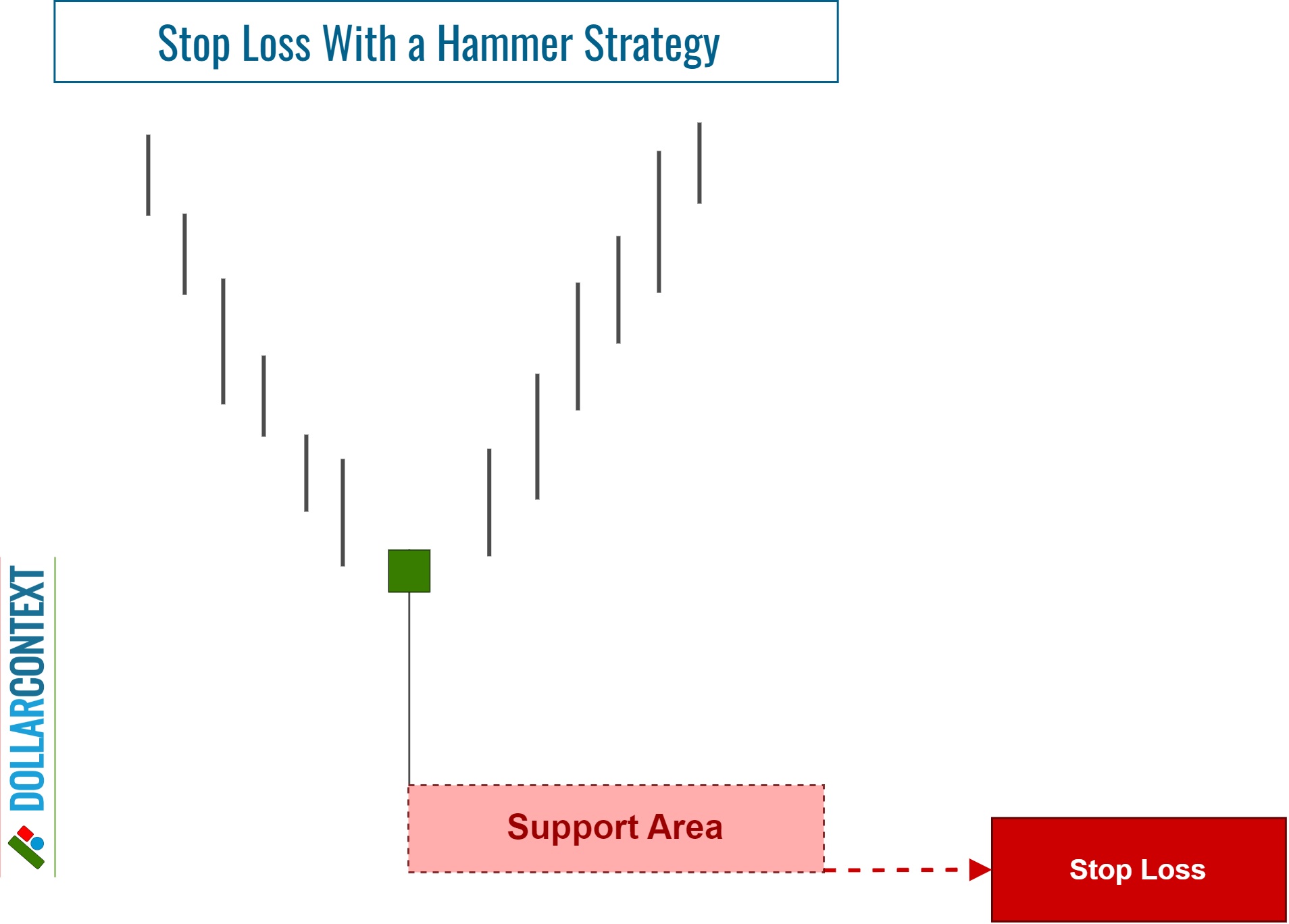

4. Consider Adding a Buffer

After evaluating factors like market volatility, risk management strategies, and various market conditions, it may be prudent to incorporate a buffer into your initial stop-loss level. This extra layer of protection can effectively help shield you from the consequences of false breakouts.

5. Is Your Stop Based on the Close?

A stop activated upon closing takes place when the closing price of a trading session exceeds the stop-loss limit, instead of merely depending on intra-session price movements.

It is generally recommended to set a stop at a close when working with candlestick charts, especially if you're using a hammer pattern to initiate your position.

6. Monitor the Trade

Continuously observe the market and your position to ensure they remain in harmony with your hammer strategy:

- Adjust your stop-loss level as needed. The market is ever-changing, and new candlestick patterns may develop as your trade unfolds. In such cases, consider fine-tuning your stop-loss point to align with the evolving conditions. For instance, if a new candlestick pattern forms around the same level as your hammer, it would be wise to adjust your stop to the lowest point of both patterns.

- When the price movement is favorable, contemplate implementing a trailing stop-loss to safeguard profits and effectively manage risk.

- Maintain discipline. Steer clear of emotion-driven decisions, regardless of market volatility.

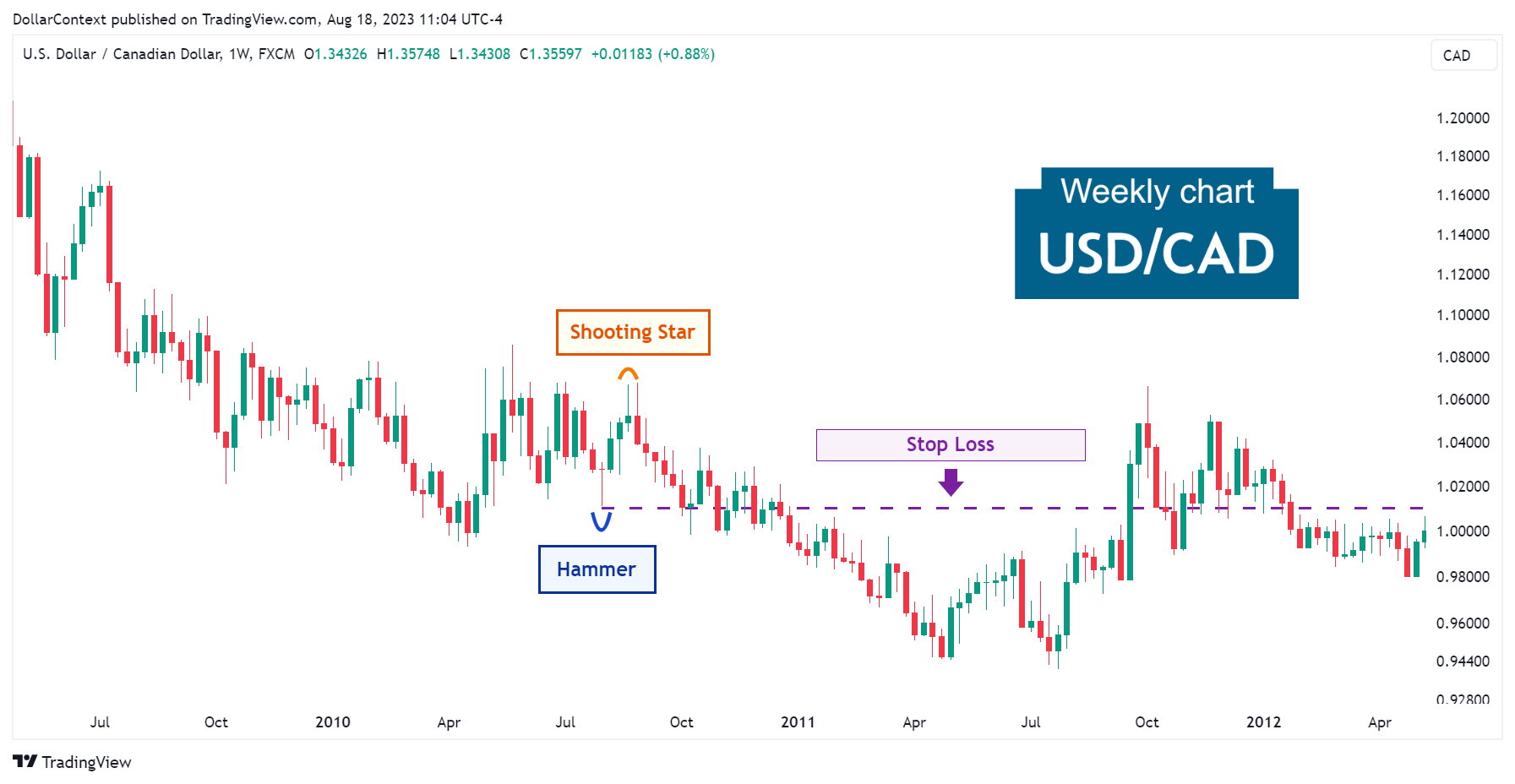

The USD/CAD chart below illustrates the importance of using a stop-loss strategy and maintaining a cautious stance regarding bullish predictions after the appearance of a hammer pattern.

In the first week of August 2010, the USD/CAD chart revealed a hammer pattern, which initiated a minor rally. The emergence of a shooting star candle just three sessions after the rally sent out a warning that the bullish momentum could be countered by prevailing bearish forces.